Transcription

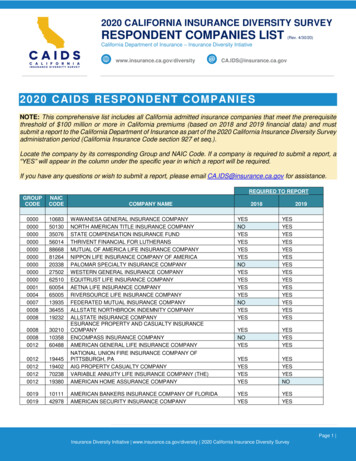

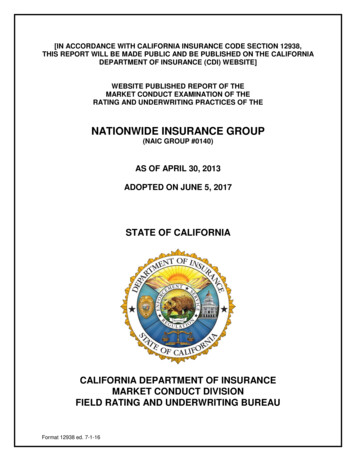

[IN ACCORDANCE WITH CALIFORNIA INSURANCE CODE SECTION 12938,THIS REPORT WILL BE MADE PUBLIC AND BE PUBLISHED ON THE CALIFORNIADEPARTMENT OF INSURANCE (CDI) WEBSITE]WEBSITE PUBLISHED REPORT OF THEMARKET CONDUCT EXAMINATION OF THERATING AND UNDERWRITING PRACTICES OF THENATIONWIDE INSURANCE GROUP(NAIC GROUP #0140)AS OF APRIL 30, 2013ADOPTED ON JUNE 5, 2017STATE OF CALIFORNIACALIFORNIA DEPARTMENT OF INSURANCEMARKET CONDUCT DIVISIONFIELD RATING AND UNDERWRITING BUREAUFormat 12938 ed. 7-1-16

NOTICEThe provisions of Section 735.5(a), (b), and (c) of the CaliforniaInsurance Code describe the Commissioner's authority and exerciseof discretion in the use and/or publication of any final or preliminaryexamination report or other associated documents. The followingexamination report is a report that is made public pursuant toCalifornia Insurance Code Section 12938(b)(1) which requires thepublication of every report on an examination of unfair or deceptivepractices in the business of insurance as defined in Section 790.03that is adopted as filed, or as modified or corrected, by theCommissioner pursuant to Section 734.1.Format 12938 ed. 7-1-16

TABLE OF CONTENTSPAGEFOREWORD1SCOPE OF THE EXAMINATION2EXECUTIVE SUMMARY5METHOD OF DOING BUSINESS6AUTHORIZED CLASSES OF BUSINESS7PREMIUM AND LOSS EXPERIENCE STUDY9LINES OF BUSINESS REVIEWED21HOMEOWNERS21PRIVATE PASSENGER AUTOMOBILE22COMMERCIAL AUTOMOBILE23COMMERCIAL MULTIPLE PERIL24DETAILS OF THE CURRENT EXAMINATION26SUMMARY OF POLICY SAMPLE REVIEWED26SUMMARY OF RELEVANT LAWS29SUMMARY OF EXAMINATION RESULTSFormat 12938 ed. 7-1-1630

FOREWORDThis report is written in a “report by exception” format. This report does notpresent a comprehensive overview of the subject insurer’s practices. The reportcontains only a summary of pertinent information about the lines of business examinedand of the non-compliant or problematic activities or results that were discovered duringthe course of the examination, along with the insurer’s proposals for correcting thedeficiencies.This report contains alleged violations of CIC § 790.03 and its implementingregulations that were identified during the examination. While this report containsalleged violations of law that were cited by the examiner, additional violations of CIC §790.03 or other laws not cited in this report may also apply to any or all of the noncompliant or problematic activities that are described herein. All unacceptable or noncompliant activities may not have been discovered. Failure to identify, comment on, orcriticize non-compliant activities in this state or other jurisdictions does not constituteacceptance of such practices.Alleged violations identified in this report, any criticisms of practices, and theCompanies' responses, if any, have not undergone a formal administrative or judicialprocess.This report is made available for public inspection and is published on theCalifornia Department of Insurance website (www.insurance.ca.gov) pursuant toCalifornia Insurance Code Section 12938(b)(1).1

SCOPE OF THE EXAMINATIONUnder the authority granted under the California Insurance Code (CIC) Part 2,Chapter 1, Article 4, Sections 730, 733, and 736 and Article 6.5, Section 790.04; andChapter 9, Article 6, Sections 1857.2, 1857.3, and 1857.4; an examination wasconducted of the rating and underwriting practices and procedures in California of theNATIONWIDE INSURANCE GROUP (NAIC Group #0140), comprised in California ofthe:ALLIED PROPERTY & CASUALTY INSURANCE COMPANY(NAIC #42579, CDI #2982-7),AMCO INSURANCE COMPANY (NAIC #19100, CDI #2192-3),CRESTBROOK INSURANCE COMPANY (NAIC #18961, CDI# 3016-3),DEPOSITORS INSURANCE COMPANY (NAIC #42587, CDI #3114-6),FARMLAND MUTUAL INSURANCE COMPANY (NAIC #13838, CDI#4598-9),HARLEYSVILLE INSURANCE COMPANY (NAIC #23582, CDI#3033-8),NATIONWIDE AGRIBUSINESS INSURANCE COMPANY(NAIC# 28223, CDI# 4599-7),NATIONWIDE GENERAL INSURANCE COMPANY (NAIC#23760, CDI#4422-2),NATIONWIDE INSURANCE COMPANY OF AMERICA (NAIC #25453, CDI #1628-7),NATIONWIDE MUTUAL FIRE INSURANCE COMPANY (NAIC #23779, CDI #1804-4),NATIONWIDE MUTUAL INSURANCE COMPANY (NAIC #23787, CDI #1805-1),NATIONWIDE PROPERTY & CASUALTY INSURANCE COMPANY(NAIC #37877, CDI #2820-9),TITAN INDEMNITY COMPANY (NAIC #13242, CDI #3574-1),andVICTORIA FIRE & CASUALTY COMPANY (NAIC #42889, CDI #4845-4)2

Hereinafter, these companies will be referred to individually as Allied (APCIC),AMCO (AIC), Crestbrook (CB), Depositors (DIC), Farmland (FMIC), Harleysville (HAR),Nationwide Agribusiness (NWAG), Nationwide General (NGIC), Nationwide Insurance(NICOA), Nationwide Mutual Fire (NMFIC), Nationwide Mutual Insurance (NMIC),Nationwide Property & Casualty (NPCIC), Titan (TIC), and Victoria Fire (VFCC), orcollectively, as Nationwide, the Companies, or the Group. The California Department ofInsurance will be referred to as the Department.The examination covered the rating and underwriting practices of theaforementioned Companies in the homeowners, private passenger automobile,commercial automobile, and commercial multiple peril lines of business during theperiod from April 1, 2013 through June 30, 2013. The examination was made todiscover, in general, if these and other operating procedures of the Companies conformto provisions of the California Insurance Code (CIC), the California Code of Regulations(CCR), and other applicable insurance law.To accomplish the foregoing, the examination included:1.A review of the rates, rating plans, and underwriting rules made oradopted by the Companies for use in California, including a review ofrecords of data, statistics, or information maintained by the Companies insupport of or relating to such rates and rules.2.A review of the application of such rates and rules by means of anexamination of policy files and related records, including forms, toevaluate rating, underwriting, and risk selection practices.3.A review of the Group’s advertising materials, which consisted of printadvertisements distributed through direct mail, product brochures that areavailable in the offices of Nationwide’s appointed agents, and theCompanies’ internet sites at www.nationwide.com,www.alliedinsurance.com and www.titansurance.com.4.A review of the Department's market analysis results, a review of anyconsumer complaints and inquiries received by the Department aboutthese Companies in the year prior to the start of the examination, a review3

of prior market conduct examination reports on these Companies, and areview of any prior enforcement actions by the Department regardingthese Companies.The examination was conducted at Nationwide’s regional office in Sacramento,California.4

EXECUTIVE SUMMARYThis examination included a review of policies that were issued, renewed,cancelled, non-renewed, or declined during the period of February 1, 2013 through April30, 2013, referred to as the “review period,” and a review of the Companies’ generalpractices and procedures related to rating, underwriting, advertising and marketing, andrisk selection. The examiners reviewed 590 in-force policies and 390 terminated anddeclined policies.Within the scope of this report, one general practice was alleged to be inviolation of CIC § 790.03 and its implementing regulations. Nationwide’s homeownersreplacement cost notification form implied that the homeowners coverage contractfailed to include coverage for demolition and debris removal costs as part of thereplacement cost calculation. Details regarding the examination results are provided inthe final section of this report.5

METHOD OF DOING BUSINESSNationwide uses marketing channels to distribute the programs offered in itsvarious companies. NICOA is used as the direct and exclusive marketing channel onthe personal lines side. The independent marketing channel includes APCIC andAMCO, and is marketed by licensed individual producers who represent theindependent marketing channel companies in addition to other insurance companies orgroups. Commercial products are marketed through a combination of variouscompanies and utilize both the independent and direct marketing channels.The Group’s world headquarters are located in Columbus, Ohio, which providesinsurance services, including policy processing, underwriting, claims handling andbilling for personal and commercial lines. The Group also has service centers inCalifornia, Iowa, Nebraska and Texas. These centers underwrite, issue, and processpolicies and serve as call centers for both agent and policyholder questions.Titan Indemnity Company distributes its non-standard commercial auto productsthrough 4,280 independent agents and five employee associates at the companyowned Titan Insurance Agency.Victoria Fire and Casualty Company distributes its non-standard privatepassenger auto products through 4,281 independent agents and four employeeassociates at the company owned Titan Indemnity Agency and via the internet.Managing General AgentsNationwide does not use Managing General Agents for any of its business unitsin California.6

AUTHORIZED CLASSES OF BUSINESSThe Companies are authorized to transact the following classes of business inCalifornia:ClasNo.s1.Class Of e eam and VehicleAutomobileMortgageAircraftMortgage GuarantyLegal InsuranceMiscellaneous24.Financial XXFMICXXXXXXXX

ClassNo. Class Of ate GlassLiabilityWorkers’CompensationCommon CarrierLiabilityBoiler and MachineryBurglaryCreditSprinklerTeam and VehicleAutomobileMortgageAircraftMortgage GuarantyLegal InsuranceMiscellaneous24.Financial XXXXXXXXXXXXXXXXXXXX

PREMIUM AND LOSS EXPERIENCE STUDYThe following tables show the California premium and loss experience for eachNationwide company by line of business for calendar year 2013, based on data fromthe Statutory Page 14 of the Annual Statement filed with the Department. The“Nationwide Insurance Group, Consolidated” table includes combined Californiapremium and loss experience for all companies. The loss ratio for each line iscalculated by dividing Direct Losses Incurred by Direct Premiums Earned. (Figures withno meaning due to division by zero are indicated as “NM,” as are calculations includinga negative premium earned. All ratios are capped at 999%.) Nationwide GeneralInsurance Company and Harleysville Insurance Company did not have any premiumwritings for 2013.9

Nationwide Insurance Group, ConsolidatedCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirect PremiumsPremiumsDirect LossesLossWrittenEarnedIncurredRatio( )( )( )(%)Fire57,688,14655,870,07818,069,21927%Allied lines29,286,62825,272,82125,567,777101%Federal flood4,136,9873,869,67327,0001%Farmowners multiple peril100,795,145100,306,24936,143,86836%Homeowners multiple 28145,293,30967,137,95846%(liability portion)99,581,20995,495,82127,366,93029%Inland 588,2522,466,556(2,979)0%Workers’ er liability - 112,257(11,274)(10)%Products liability12,665,48512,725,38219,094,575150%Private passenger auto rcial auto e pass auto physical al auto physical ine Of CoverageCommercial multiple peril(non-liability portion)Commercial multiple perilOther liability – claims madeBurglary and TheftBoiler and MachineryTOTALS10

Allied Property and Casualty Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirectPremiumsPremiumsDirect LossesLossWrittenEarnedIncurredRatio( )( )( )(%)Fire12,258,68912,073,3913,361,15428%Allied lines5,557,8455,529,5365,214,23294%Homeowners multiple peril65,138,94164,113,45837,003,55758%Inland Marine1,781,2471,787,806586,98533%Other liability4,715,9694,626,7962,448,38153%Private pass auto liability67,299,68966,475,44837,012,84956%Private pass auto physical ,38056%Line Of CoverageSuretyBoiler and machineryTOTALS11

AMCO Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirect PremiumsPremiumsDirect LossesLossWrittenEarnedIncurredRatio( )( )( )(%)Fire35,459,30034,889,59810,387,56630%Allied lines16,622,01613,375,31414,921,856112%Farmowners multiple peril00(30,731)NMHomeowners multiple 4125,436,02934%Inland (1)0%00(14)NMOther liability20,585,13219,745,83712,551,09564%Products 0,028,59094,609,51468%Commercial auto liability1,498,001707,756526,45974%Private pass auto physical damage93,086,32692,061,58957,664,37263%Commercial auto physical 3%Line Of CoverageCommercial multiple peril(non-liability portion)Commercial multiple peril (liabilityEarthquakeWorkers’ compensationPrivate passenger auto liabilityBurglary and TheftBoiler and MachineryTOTALS12

Depositors Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirect PremiumsPremiumsDirect LossesLossWrittenEarnedIncurredRatio( )( )( )(%)(111)(111)0NM6006006811%Private passenger auto liability2,232,5882,257,0281,841,84382%Private pass auto physical damage1,427,7841,520,568816,44054%Commercial auto 590489,37362%8,715,0918,296,0904,856,29259%Line Of CoverageHomeowners multiple perilOther liabilityCommercial auto physical damageTOTALSCrestbrook Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirect PremiumsPremiumsDirect LossesLossWrittenEarnedIncurredRatio( )( )( eowners3,694,5233,276,2031,473,00345%Inland marine408,319338,12532,61210%Other liability343,024283,18535,11013%Burglary and %Line Of CoverageTOTALS13

Farmland Mutual Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirectDirectPremiumsPremiumsLosses IncurredLossWrittenEarned( )Ratio( )( 2,24027%portion)65,49863,231(5,474)(8%)Workers compensation846,417804,19481,60310%Inland Marine123,77863,24061,98598%Other liability2,350,0111,903,867638,43634%Products liability1,397,8951,175,969226,16919%Commercial auto liability3,438,6452,591,7352,476,04096%Commercial auto physical 2,2874%Burglary and %Line Of CoverageFireAllied lines(%)Commercial multiple peril(non-liability portion)Commercial multiple peril (liabilityTOTALS14

Nationwide Property and Casualty Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirect PremiumsPremiumsDirect LossesLossWrittenEarnedIncurredRatio( )( )( )(%)portion)00(36,749)NMWorkers’ compensation0065NMOther liability00(4,793)NMProducts liability00(14,685)NMPrivate passenger auto liability00841NMPrivate pass auto physical damage00912NM00(54,409)NMLine Of CoverageCommercial multiple peril (liabilityTOTALS15

Nationwide Agribusiness Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirect PremiumsPremiumsDirect LossesLossWrittenEarnedIncurredRatio( )( )( )(%)Fire906,996678,639180,29827%Allied ke15,80012,17200%Workers' compensation316,5651,305,8711,795,356137%Inland Marine119,668118,1802,7892%Other liability24,126,08123,489,21215,926,99368%Products liability6,818,8066,575,6483,291,47950%Commercial auto al auto physical ,579174,53765,95038%Burglary and Theft11,77911,9329,39679%Boiler and 8,13165,991,96254%Line Of CoverageCommercial multiple peril(non-liability portion)Commercial multiple peril (liabilityportion)TOTALS16

Nationwide Mutual Fire Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectDirect PremiumsPremiumsDirect LossesLossWrittenEarnedIncurredRatio( )( )( )(%)Fire308,376302,4057,2452%Allied ,6542%Farmowners multiple peril00(2,758)NMHomeowners multiple 347,171)NMWorkers' compensation18,92119,644(808,888)999%Inland Marine98,238117,28114,84713%00(2,978)NMOther liability – occurrence(390)7,1781,019,775999%Other liability- claims made00(1,613)NMProducts liability00(59,160)NMPrivate passenger auto liability002,892NMPrivate pass auto physical e Of CoverageFederal FloodCommercial multiple peril(non-liability portion)Commercial multiple peril (liabilityportion)EarthquakeTOTALS17

Nationwide Insurance Company of AmericaCalifornia Premium and Loss Experience by Line for the Year 2013Line Of CoverageDirectPremiumsWritten( )DirectPremiumsEarned( )Direct LossesIncurred( d ,89720%Homeowners multiple peril25,864,61724,563,89117,566,62772%Commercial multiple peril(non-liability portion)3,025,7122,829,1451,722,11261%Commercial multiple peril te pass auto physical damage43,234,58942,297,63228,744,27268%Commercial auto physical 62%Farmowners multiple perilInland MarineEarthquakeOther liabilityProducts liabilityPrivate passenger auto liabilityCommercial auto liabilityBurglary and theftBoiler and MachineryTOTALS18

Nationwide Mutual Insurance CompanyCalifornia Premium and Loss Experience by Line for the Year 2013DirectPremiumsWritten( )Line Of CoverageFireDirectPremiumsEarned( )Direct LossesIncurred( 2,522,472(1,153,127)(9)%00(6,905,523)NMInland 9,1981,608,45000%Group accident & health25,34723,3471,279,505999%Other liability e pass auto physical damage00926NMCommercial auto physical 3722%258,579,912244,675,777118,955,34249%Allied linesFederal floodFarmowners

Titan Indemnity Company distributes its non-standard commercial auto products through 4,280 independent agents and five employee associates at the company owned Titan Insurance Agency. Victoria Fire and Casualty Company distributes its non-standard private