Transcription

AIB CarInsurancePolicy Summaryfor customers who use aapp to save money ontheir car insuranceFrom 1 August 2017

a summary of our carinsurance policy forcustomers who use aapp tosave money on theircar insuranceImportant information In purchasing car insurance with a drivesavediscount, you accept the terms and conditionsof Drivesave, including the means by whichyour data is stored and reviewed. You must download your drivesave app to yourmobile phone and begin recording your tripswithin 7 days of inception. Please ensure yourecord all of your trips on your app.Warning: In the event that the terms andconditions for mobile phone app use are notadhered to, or if AXA considers your drivingbehaviour to be unsatisfactory, AXA has theright to cancel your policy or remove yourdrivesave discounts which will result in anincrease in your premium.First things firstPrivate car insurance providesthree levels of cover tochoose from:¡ comprehensive;¡ third party fire and theft; or¡ third party.You can buy optional extracover for an extra premium.Please see your statement offact or policy schedule for thecover you have chosen.This document is a summary of your motor insurance policy.If you would like to look over the full terms and conditions,these are in your policy document. If there’s anything youdon’t understand, please phone us on 1890 247 365,call into your nearest branch or log onto www.axa.ieIf you need to make a claim or needbreakdown assistance please call our24-hour claims helpline on 1850 27 26 25.

Extra cover for a higherpremium. Please ask us forrelevant chargesAny extra cover you have bought will be shown onyour statement of fact, proposal form, statement offact or on your policy schedule.Protecting your no claims discountIf you buy no claims discount protection, you canmake one claim without losing your no claimsdiscount.To qualify, you must be earning the maximum noclaims discount and you must not have made aclaim for the past three years.Car & Key Rescue*24 hour breakdown assistance in Ireland, the UK,the Channel Islands and the Isle of Man (excludingislands off the coast). Our trained recovery technicianwill get you going following mechanical problems,a flat battery or even just a puncture. And if youcan’t complete your journey, we’ll arrange localtowing and help to get you home or make alternativearrangements. And we also offer lost, damaged orstolen car keys and fob insurance. We give you upto 1,500 toward replacing keys or fobs as well asup to 40 per day for up to three days car hire if youdon’t have a spare set. Claims won’t affect your noclaims-discount.Glass breakage* (if you are not insured forcomprehensive).You can add glass breakage cover to your thirdparty, fire & theft insurance. If you use an AXAapproved supplier, cover will be unlimited. If you useyour own supplier, cover will be limited to 250 perclaim for replacement glass and 50 for a repair.Legal expenses*If you are the victim of a miscarriage of justice or anuninsured driver, legal expenses cover will enableyou to pursue damages.Replacement Car PlusIf your car is out of use due to loss or damage byaccident fire or theft we will hope to provide you witha courtesy car, usually a class-A or economy classone litre car OR we may pay towards you hiring a carup to 22 a day including VAT.Injury to driver coverThe cover includes a benefit of 10,000 if you or anamed driver are seriously injured in a road accidentand a 30,000 death benefit if you or any drivernamed on the policy is killed as a result of a motoraccident involving your car. It also includes hospitaland temporary disability benefits for you.*A claim under these optional benefits willnot affect your no claims discount.Significant generalexceptions and policyconditions. Applies to allsections of the policy.People covered to driveWe will not be liable for any injury, loss or damagewhile your vehicle is being driven by a person notcovered by the certificate of motor insurance.Using your carWe will not be liable for any injury, loss or damagewhile your vehicle is being used for any purpose notcovered by the certificate of motor insurance.Driving licenceThere is no cover for anyone who is disqualifiedfrom driving, has never held a driving licence or whois not meeting the conditions of his/her licence/Learner permit. This includes conditions relating tothe class of vehicle being driven, the requirementto be accompanied when driving under a learnerpermit or any other restriction or condition thatmay apply.Claims procedureYou must, as soon as reasonably possible, give usnotice of any injury, loss or damage which may giverise to a claim under the policy.Looking after your vehicleYou must take all reasonable precautions to keepyour car secure from theft and in a roadworthycondition.You must tell us:If there have been any changes to your information,whether about your vehicle, including modifications,yourself or any named driver on your policy.If you are in any doubt whether certain facts areimportant, please ask us.

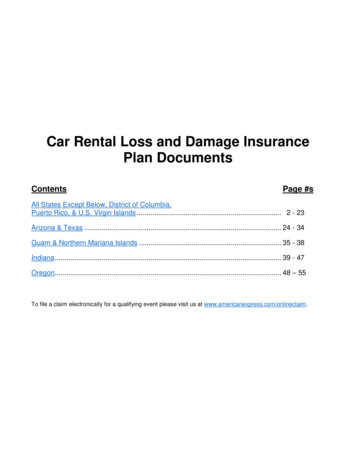

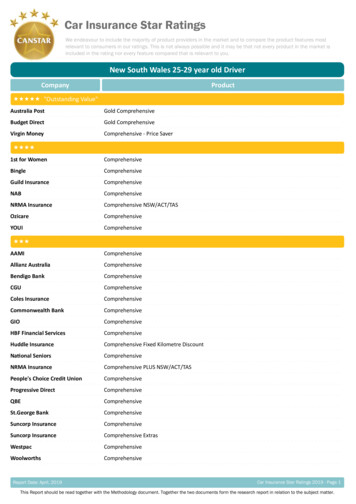

our policy at a glancethis is a summary of policy features and benefitsFeatures and benefitsType of policyComprehensiveThird partyfire and theftWe will pay for loss of or damage to your car and its accessoriesand spare parts while they are in or on the car.4We will cover Personal Belongings up to 500, Fire BrigadeCharges up to 1,000 and Replacement locks up to 750.44We will cover loss of or damage to your car, including glassbreakage, by fire or theft. You will not pay an excess if you make aclaim for fire or theft and it will not affect your no claims discount.44We will replace your car with a new model if you make a claim.44If you have a claim under the policy, we will give you up toseven days, car hire while your car is being repaired. Pleasecontact us for details.44If your car is damaged by an uninsured driver we will pay the costof repair or the market value without any reduction in your noclaims discount.4We will pay the cost of repairing or replacing damaged orbroken glass in the windscreen or windows of your car. If thisis the only damage you claim for, your no claim discount will notbe affected.4The policy applies while your car is towing a caravan or trailer.44We will provide cover for your legal liability for accidental deathor injury to other people as a result of using your car. Cover isunlimited.44We will cover legal liability for damage to other people’s propertydue to an accident as a result of using your car.44You have cover to drive in the European Union and EuropeanUnion-approved countries.44You can earn up to 75% no claims discount.44Fire, Theft or Windscreen claims do not effect your no claimsdiscount.44You have a ‘step back’ facility if you are earning 60% or 75%no claims discount. This means that you will only lose part of yourdiscount if someone makes a claim against you.44

Third partySignificant or unusual limitsand exclusionsWe will not cover any reduction in the market value of your carbecause it has had to be repaired. We will not cover mechanical orelectrical breakdowns.We will not cover loss or damage arising fromputting the wrong fuel or lubricant into your engine. Your excess (thefirst part of a claim you must pay) is shown on your schedule.PolicysectionSection 1Section 14We will not cover loss or damage caused by theft or attempted theft,if the keys (or keyless entry system) are left unsecured or left in or onan unattended car.Section 1Your car must be less than a year old and have damage that costsmore than 60% of its value to repair.Section 1You must use one of our approved repairers to take advantage ofthis benefit.Section 1You must pay any excess. We may reduce your no claims discountwhilst we investigate the circumstances of the claim.Section 1Glass cover will be limited to 250 for replacement glass and 50 for repairs when our approved supplier is not used.We will not pay for more than 2 claims under this section in eachperiod of insurance.Section 2We will not cover loss of or damage to the towed caravan or trailer.Section 4Section 544We will not pay more than 30 million.Section 54Full policy cover applies for trips of up to 31 days in a row during theperiod of insurance. The minimum cover you need in these countriesapplies while the policy is in force.Section 64You may lose this discount if you make a claim.Section 8Section 84The ‘step back’ no claims discount facility will not apply if you areconvicted of dangerous driving or a drink-driving or drugs offenceunder road traffic laws following an accident.Section 8

other things you should knowHow long the policy lastsYour policy will run for 12 months from the date and time shown in the schedule. If we agreeto provide cover for less than 12 months, the schedule will show when yourpolicy ends.Cancelling your policyTo cancel your policy, return your certificate of insurance and insurance disc with a writteninstruction to: AXA Insurance dac, Wolfe Tone House, Wolfe Tone Street, Dublin 1,or your local branch.Cooling-off periodIf you cancel within the first 14 days after receiving the policy documents within the firstyear of insurance, we will refund your full premium, providing no claims have been made onyour policy.Cancelling your policy in the first yearIf you cancel at any other time during the first year of insurance, we will work out thepremium after an administration fee has been taken away for the period you were insuredbased on our short period rates as shown below. If you have made a claim or there has beenan incident likely to give rise to a claim, we will not give any refund.Period which your policy is in forcePercentage of premium returnedUp to 1 month2 months3 months4 months5 months6 months7 months8 months9 monthsOver 9 months80%70%60%50%45%35%25%20%10%NilThe premium does not include the charge for Car & Key Rescue or the premium for injury todriver cover and we will not provide a refund for these optional items when you cancelyour policy.

Cancelling your policy at any other timeIn the second and any future years, once you return the certificate and disc of insuranceand you have not claimed or there is no incident that is likely to result in a claim duringthe current period of insurance, we will return the premium after an administration fee hasbeen taken away for the period of insurance still left to run. The premium does not includethe charge for car and key rescue or the premium for injury to driver cover and we will notprovide a refund for these optional items when you cancel your policy.Our rights to cancelIf we have to cancel your policy, we will send you 10 days’ notice by registered letter toyour last known address. As long as you return the certificate and disc of insurance to us,and you have not claimed on your policy or there is no incident that is likely to result in aclaim during the current period of insurance, we will return the premium for the period ofinsurance still left to run. Cancellation may occur if your Drivesave app shows you to be adangerous driver.Your premiumAlthough you may be able to protect your no claims discount, your premium may increase ifyou make claims or you receive motoring convictions.The law and language of the contractBoth you and we can choose the law within the European Union which applies to thecontract. We propose that the law of the Republic of Ireland will apply. The language usedin this policy and in communications relating to it will be English.Terms and conditionsAs with all insurance contracts, certain terms and conditions will apply. We will be happyto discuss your insurance needs. Please phone us on 1850 27 26 25.Important Notice – Statement of SuitabilityThis is an important document which sets out the reasons why theproduct(s) or service(s) offered or recommended is/are consideredsuitable, or the most suitable, for your particular needs, objectivesand circumstances. The cover you have chosen is based on your conversationwith our Staff and the information you have provided to us. The AXA MotorInsurance Policy provides an adequate level of protection and is supported byquality after sales & claims services; all at a reasonable premium. If you have anyquestions regarding the Policy or if you have overlooked information which may beuseful to our assessment of your insurance needs, please contact us.

Call 1850 27 26 25or Drop in to any branch.www.aib.ieAIB-507 08/17 (6659 AD)

AIB Car Insurance Policy Summary for customers who use a app to save money on their car insurance From 1 August 2017. a summary of our car insurance policy for customers who use a app to save money on their car insurance Private car insurance provides three levels of cover to choose from: ¡ comprehensive; ¡ third party fire and theft; or .