Transcription

OLD DOMINION UNIVERSITYREPORT ON AUDITFOR THE YEAR ENDEDJUNE 30, 2007

AUDIT SUMMARYOur audit of Old Dominion University for the year ended June 30, 2007, found: the financial statements are presented fairly, in all material respects, inaccordance with generally accepted accounting principles; no internal control matters that we consider to be material weaknesses; and one instance of noncomplianceGovernment Auditing Standards.requiredtobereportedunder

-TABLE OF CONTENTSPagesAUDIT SUMMARYCOMPLIANCE FINDING AND RECOMMENDATIONMANAGEMENT’S DISCUSSION AND ANALYSIS12-6FINANCIAL STATEMENTS:Statement of Net Assets8-9Statement of Revenues, Expenses, and Changes in Net Assets10-11Statement of Cash Flows12-13Notes to Financial Statements16-39INDEPENDENT AUDITOR’S REPORTReport on Financial Statements40-41Report on Internal Control over Financial Reporting andon Compliance and Other Matters41-42UNIVERSITY RESPONSE43-44UNIVERSITY OFFICIALS45

COMPLIANCE FINDING AND RECOMMENDATIONImprove Employment Eligibility Verification ProcessThe University is not having employees properly complete Employment Eligibility Verification forms(I-9) in accordance with guidance issued by the U.S. Citizenship and Immigration Services of the U.S.Department of Homeland Security. The guidance requires the employee to complete, sign, and date the formon the first day of employment. Additionally, the employer or designated representative must complete, sign,and date Section 2 of the form within three business days of employment.In our sample of ten I-9 forms completed, we found one or more errors on seven of the forms asfollows: One employee did not sign and date the form before or on their first day ofemployment; On four of the forms, the documentation required in Section 2 of the form was notreviewed and verified within three business days of employee’s first day of work;and On five forms, the reviewer failed to properly fill out the information regarding theverification documents, such as document title, issuing authority, documentnumber, and expiration date.We recommend that the Human Resources Department review the process to complete the I-9 forms,train staff on the requirements of completing these forms, and develop procedures to continuously review allor a sample of forms for compliance with federal regulations. The federal government has increased itsenforcement efforts requiring employers to ensure all new employees are legally entitled to work in theUnited States. Their increased enforcement makes having a good process in place to complete I-9 forms evenmore important.1

MANAGEMENT’S DISCUSSION AND ANALYSIS(unaudited)The following Management’s Discussion and Analysis (MD&A) is required supplementalinformation under the Governmental Accounting Standards Board (GASB) reporting model. It is designed toassist readers in understanding the accompanying financial statements and provides an objective, easilyreadable analysis of the University’s financial activities based on currently known facts, decisions, andconditions. This discussion includes an analysis of the University’s financial condition and results ofoperations for the fiscal year ended June 30, 2007. Comparative numbers, where presented, are for the fiscalyear ended June 30, 2006. Since this presentation includes highly summarized data, it should be read inconjunction with the accompanying Financial Statements, and Notes to Financial Statements. Universitymanagement is responsible for all of the financial information presented, including this discussion andanalysis.Institutional ProfileOld Dominion University promotes the advancement of knowledge locally, nationally, andinternationally. It develops in students a respect for critical reasoning and a genuine desire for learning. Itfosters the extension of the boundaries of knowledge through research and scholarship and is committed tothe preservation and dissemination of a rich cultural heritage. Old Dominion University is old enough tovalue tradition yet young enough to facilitate change. In a spirit of creative experimentation, innovation,research, and technology, the University is ready to meet the challenges of the twenty-first century.More than 21,600 undergraduate and graduate students comprise the Old Dominion Universitystudent body. Students currently choose from 68 baccalaureate programs, 60 master’s programs, 2 educationspecialist programs, and 35 doctoral programs. With over 12,500 full time and over 9,100 part time students,the University’s scheduling is flexible enough to address the varied needs of individual students includingthose participating in the distance learning program and a worldwide military population.Statement of Net AssetsThe Statement of Net Assets presents the University’s assets, liabilities, and net assets as of the end ofthe fiscal year. The purpose of this statement is to present to the financial statement readers a snapshot of theUniversity’s financial position at year-end. From the data presented, readers of the Statement of Net Assetsare able to determine the assets available to continue the University’s operations. They are also able todetermine how much the University owes vendors and creditors.2

2007Assets:Current 68,161,593Capital, net of accumulated depreciation 360,270,734Other non-current75,844,9642006Difference 58,146,943 10,014,650270,780,578 89,490,15679,526,145 1,316180,102,15774,939,15942%Net Assets:Invested in capital assets, net ofrelated 919,476(2,918,908)9%27%(9%)Total net assets 249,235,975Total assetsLiabilities:CurrentNon-currentTotal liabilities 228,351,509 20,884,4669%Total University assets increased 95,823,625 or 23 percent during fiscal year 2007. The growth inassets was a result of an increase in capital and current assets. Capital assets increased 89,490,156 primarilydue to capitalization of buildings relating to new capital leases. The rise in current assets was directly relatedto an increase in prepaid assets for simulation equipment and monies due from the Commonwealth for interestearnings. Total University liabilities increased 74,939,159. The rise in liabilities was a result of additionaldebt for related construction projects and assumption of new capital leases for the University Villageapartments.Statement of Revenues, Expenses and Changes in Net AssetsThe Statement of Revenues, Expenses, and Changes in Net Assets presents a summary of revenue andexpense activity which resulted in the change from beginning to ending net assets. The purpose of thisstatement is to present the University’s operating and non-operating revenues recognized and expensesincurred and any other revenues, expenses, gains, and losses.Generally, operating revenues are received for providing goods and services to students and otherconstituencies of the institution. Operating expenses are those expenses incurred to acquire or produce thegoods and services provided in return for the operating revenues and to carry out the University’s mission.Salaries and fringe benefits for faculty and staff are the largest type of operating expense.3

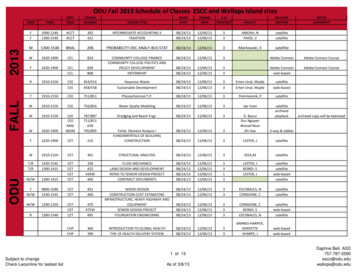

Non-operating revenues are revenues received for which goods and services are not provided. Forexample, the University’s state appropriations are non-operating because they are provided by the statelegislature without the legislature directly receiving commensurate goods and services for those revenues.Operating revenues:Student tuition and fees, net ofscholarship allowancesof 14,170,461 and 12,568,561Federal grants and contractsState, local and nongovernmental grantsAuxiliary enterprises, net ofscholarship allowances of 6,977,655 and 5,368,562Other operating revenuesTotal operating revenuesOperating expenses:InstructionResearchPublic serviceAcademic supportStudent servicesInstitutional supportOperation and maintenanceDepreciationScholarships and fellowshipsAuxiliary activitiesTotal operating expensesOperating lossPercentageDifference20072006 72,205,09315,825,2485,998,121 64,974,56614,883,4856,369,632 25) 2,20020%6,595,5202,795,4753,800,045136%Other revenues18,474,61414,996,7373,477,87723%Increase in net 10,559,29713,606,5447% 249,235,975 228,351,509 20,884,4669%Net nonoperating revenues and expensesIncome before other revenues, gains or lossesNet assets-beginning of year (as restated)Net assets-end of year4

Total operating revenue increased by 16,783,189 or 12 percent from the prior fiscal year. Thegrowth in revenue was expected given the rise in both in state and out of state tuition rates. An increase inauxiliary enterprise revenue was the result of increases in fees and the assumption of the village and theopening of two new dormitories. Non-operating revenue increased by 21,712,200. The largest growth wasthe result of increased state appropriations for base adequacy. The University also experienced an increase ingifts and investment income.Statement of Cash FlowsThe Statement of Cash Flows provides relevant information that aids in the assessment of theUniversity’s ability to generate cash to meet present and future obligations and detailed information reflectingthe University’s sources and uses of cash during the fiscal year. The statement is presented in four definedcategories: operations, non-capital financing, capital financing, and investing activities.Cash flow from operating reflects the sources and uses to support the essential mission of theUniversity. The primary sources are tuition and fees ( 82.8 million) and auxiliary enterprises ( 65.3 million).The primary uses are payments to employees, including salaries, wages, and fringe benefits ( 162.4 million),and payments to vendors ( 56.4 million).Cash flow from non-capital financing reflects non-operating sources and uses of cash. The primarysources are state appropriations ( 121.0 million) and gifts and grants ( 7.5 million). The primary use is tosupport cash requirements of operations.Cash flow from capital financing activities reflects the activities related with the acquisition andconstruction of capital assets including related debt payments. The primary source is proceeds from issuanceof bonds and investment income ( 11.2 million). The primary uses are purchases of capital assets ( 49.7million) and principal paid on capital debt ( 8.8 million).20072006Cash flows from operating activitiesCash flows from non-capital financing activitiesCash flows from capital financing activitiesCash flows from investing activities (90,784,747)128,550,232(36,967,160)(312,012) (91,996,518)107,216,04411,654,5496,145,837Net change in cash 33,019,912486,313Capital Asset and Debt AdministrationOverall, funds invested in capital assets reflect the ongoing campus construction. Major capitalprojects include Quad Student Housing, Athletic Facility, Indoor Tennis Court, Orchid Conservatory, andrenovations to Batten Arts and Letters, Student Housing, Health and Physical Education, Physical Scienceand Technology buildings. Major additions to capitalized assets include buildings ( 108,776,385), andequipment ( 6,943,384).The University’s long-term debt increased ( 63,173,357). The increase is primarily the net result ofthe issuance of note payables for capital projects, capital leases, and payment of existing debt. As calculated,the net investment in plant to plant debt ratio is 1.02.5

Overall, uncompleted construction and other related contractual commitments increased from 22,240,402 at June 30, 2006, to 26,338,282 at June 30, 2007. Further information relating to capital assets,construction, and capital debt is included in the Notes to the Financial Statements in Notes 6, 8, and 9.Economic OutlookThe University budget is consistent with the criteria set forth in the University Strategic Plan and theCode of Virginia higher education institutional performance standards as follows: access, affordability,breadth of academic programs, academic standards, student retention and timely graduation, articulationagreements and dual enrollment, economic development, research, patents and licenses, elementary andsecondary education, the six-year financial plan, financial and administrative efficiency standards, andcampus safety. The University has defined the following priorities to address these diverse needs: Ensure the quality of academic, teaching, and research programs;Enhance direct services for students;Continue implementation of the 2005-2009 Strategic Plan;Build the appropriate infrastructure support especially as it relates toaccomplishing the goals of the strategic plan;Recognize students’ financial capabilities and limitations;Reallocate or redirect resources, where possible, to support academic priorities andraise additional funds;Support research centers/targeted activities;Support educational assessment initiatives, marketing, and student housingstaffing; andMinimize the addition of other user and service fees to students.The University proposed 2007-2008 budget increase of 6.5 percent was due to additional general fundsupport and a tuition and fee increase. The University will advance the institution’s strategic agenda byimproving faculty and staff salaries to retain and recruit a well-qualified workforce. Funding allocations havebeen made to continue the Commonwealth Higher Education Research Initiative for the University’sexpansion of modeling and simulation research and teaching. Also, the Commonwealth added 1.5 millionfor the Virginia Coastal Energy Research Consortium to implement research and development of renewableenergy resources, with an initial focus on offshore winds, waves, and marine biomass.The University addressed the recent five percent general fund budget cut by reducing discretionaryspending, identifying ways to perform processes more efficiently, abolishing several positions, such as theVice President for Student Affairs, and eliminating nonproductive and inefficient programs or services. TheUniversity is committed to protecting its core programs in instruction and research, and keeping tuition costslow to remain accessible and affordable to students. Strategic initiatives are continually evaluated andmodified and those that do not lead to significant measurable results are amended or abolished. TheUniversity is responsive to the rapidly changing higher education environment and follows the objectivesoutlined in the University’s Strategic Plan and the Six-Year Academic and Financial Plans. The Universitywill continue to maintain its solid financial foundation and is well positioned to continue its pursuit ofexcellence in teaching, research, and public service.6

FINANCIAL STATEMENTS7

OLD DOMINION UNIVERSITYSTATEMENT OF NET ASSETSAs of June 30, 2007Old DominionUniversityComponentUnits 45,132,820 952,064,60916,398,79957,489,950Total noncurrent assets436,115,698265,151,573Total assets504,277,291298,688,785ASSETSCurrent assets:Cash and cash equivalents (Note 3)Accounts receivable (Net of allowance fordoubtful accounts 248,317) (Note 5)Contributions receivable (Net of allowance fordoubtful collections 613,887) (Note 12)Due from the Commonwealth (Note 9)Travel advancesPrepaid expensesInventoryNotes receivable (Net of allowance fordoubtful accounts 21,373)Other assetsTotal current assetsNoncurrent assets:Restricted cash and cash equivalents (Note 3)Endowment investments (Note 3)Investments (Note 12)Other long-term investments (Notes 3 and 12)Contributions receivable (Net of allowance fordoubtful collections 200,462) (Note 12)Notes receivable (Net of allowance fordoubtful accounts 65,012)Unamortized bond issuance expenseNondepreciable capital assets (Notes 6 and 12)Capital assets (Notes 6 and 12)8

Old DominionUniversityComponentUnitsLIABILITIESCurrent liabilities:Accounts payable and accrued expenses (Note 7)Deferred revenueObligations under securities lending (Note 3)Deposits held in custody for othersOther liabilitiesLine of creditLong-term liabilities - current portion (Notes 8 and 28,030,10276,714,8798,887,827 249,235,975 189,255,093Total current liabilitiesNoncurrent liabilities (Notes 8 and 12)Total liabilitiesNET ASSETSInvested in capital assets, net of related debtRestricted for:Nonexpendable:Scholarships and fellowshipsPermanently restrictedExpendable:Scholarships and fellowshipsResearchLoansCapital projectsTemporarily restrictedDepartmental usesUnrestrictedTotal net assetsThe accompanying Notes to Financial Statements are an integral part of this statement.9

OLD DOMINION UNIVERSITYSTATEMENT OF REVENUES, EXPENSES, AND CHANGES IN NET ASSETSFor the Year Ended June 30, 2007Old DominionUniversityOperating revenues:Student tuition and fees (Net ofscholarship allowances of 14,170,461)Gifts and contributionsFederal grants and contractsState grants and contractsIndirect costSponsored researchNongovernmental grants and contractsAuxiliary enterprises (Net ofscholarship allowances of 6,977,655)Other operating revenuesComponentUnits 72,205,093 75,2021,209,509-Total operating expenses278,027,12554,276,197Operating income/(loss)(121,850,025)1,239,643Total operating revenuesOperating expenses (Note10):InstructionResearchPublic serviceAcademic supportStudent servicesInstitutional supportOperation and maintenanceDepreciationStudent aidAuxiliary activities10

Old DominionUniversityNonoperating revenues (expenses):State appropriations (Note 11)GiftsInvestment income (net ofinvestment expenses of 218,277)OtherInterest of capital asset - related debtPayments to Commonwealth from state appropriationsPayments to 13,150)(3,033,719)(1,627)Net nonoperating 594Income before other revenues, expenses, gains, and losses6,595,52020,113,237Capital appropriationsBond issuance expenseContributions from primary governmentCapital giftsContributions to permanent 9,612Total other revenues, expenses, gains, and lossesIncrease in net assetsNet assets - beginning of year, restated (Note 2)Net assets - end of ,841164,322,244 249,235,975 189,255,093The accompanying Notes to Financial Statements are an integral part of this statement.11

OLD DOMINION UNIVERSITYSTATEMENT OF CASH FLOWSFor the Year Ended June 30, 2007Cash flows from operating activities:Student tuition and feesGrants and contractsAuxiliary enterprisesOther receiptsPa

More than 21,600 undergraduate and graduate students comprise the Old Dominion University student body. Students currently choose from 68 baccalaureate programs, 60 master’s programs, 2 education specialist programs