Transcription

chartermarkettheAIN special report by Charles Alcock and Meredith SainiDemand for aircraft charter is risingworldwide, with more businesses andprivate individuals willing and able tostart taking this increasingly attractivealternative to scheduled airline services.Avoiding the growing inconvenienceFor many charteroperationsdemand is nowoutpacing supplyand inflexibility of the scheduled airlinenetwork seems to be the main driverof this increasing demand, and thesefactors are brought into even sharperfocus for consumers during times ofhigh security alert.AIN has surveyed charter operators inNorth America, Europe, the Middle Eastand Asia to gauge the current state of themarket, understand the factors that driveit and anticipate how it might unfoldin the future. We have also spoken toexperts and analysts to get an impartialoverview of the situation.While demand for charter is undoubtedly growing, so too are costs, especiallythe price of fuel. What is less clear is theextent to which this is reflected in charterrates and the degree of transparencywith which the industry passes on itscosts to consumers.This AIN special report also looksat the rating systems that are availableto assess the quality and capability ofcharter operators. Additionally, it considersmoves to change the regulatory oversightof charter and the debate over access tointernational charter markets.In this new age of heightened security awareness, air charter serviceproviders are flourishing as more business travelers shun the airlines and theimpersonal passenger terminals theyinhabit. What’s more, industry expertssay, this increased demand for privateair travel in the face of therelative insecurity and inconvenience of the airlinesCharter operators report that recent terrorhas created a self-feedingthreats have boosted demand for chartergrowth mechanism.aircraft, as individuals seek more privacy“There’s been a lot of disand security than the airlines can provide.cussion about the effects of9/11 and most recently thefoiled terrorist attacks inLondon. I think that’s had some impact to a few years ago. What that’s done ison the growth of charter, but the pri- open up the market to a lot of people.”mary reason for the growth is that there“I’ve been in the charter businessare lots of different options out there,” for almost 20 years and it has evolvedsaid Joe Moeggenberg, president of from a romantic, sexy type of industryCincinnati-based Aviation Research where people had Learjets and GulfGroup (ARG/US), which gathers and streams and they went to Vegas and itpublishes safety information and re- was all about perception. Now it’s beports for the charter industry.coming a working tool for business,”“I’ve never seen it this busy. As far said Joanne Fothergill, senior viceas we can tell, the industry is up about president of client services for The20 or 25 percent over last year. Overall, Air Group, a charter company basedthe charter industry has been doing in Van Nuys, Calif. “It provides an invery well. We think the primary reason credible amount of security, especiallyis that there are so many different prod- in today’s unsettled world.”ucts that are available. People can charFlightWorks president Scott Bealeter a whole airplane, or they can charter told AIN that the Kennesaw, Ga.-baseda one-way, or buy a card or a fractional operator’s revenues were up more thanshare. There are dozens of different 35 percent in the first half of this yearways to buy charter services compared compared with the same period lastyear. “We were able to meet the continuing demand for charter services byincreasing the number of jets in ouraircraft management and aircraft charter programs,” he said. FlightWorksoperates a fleet of about 25 charter aircraft, including a Bell 407.“It’s been a progressive process forquite a while. We’re seeing more andmore people who hadn’t chartered inthe past who are recognizing goodvalue in it. We’re seeing a higher levelSome charter companies areplanning to include VLJs, such asthe Adam A700, in their fleets.26aaAviation International News November 2006 www.ainonline.comFAA Tightens Oversight on CharterIn recent months the FAA has been crackingdown on what has become known as “piggybacking”charter arrangements, under which a company holdsitself out to the public as a charter provider eventhough it is really using another company’s aircraftand Part 135 certificate.“I don’t think that what they’re doing is creatingnew law, but certain FSDOs have been playing footloose and fancy free with the guidelines,” said JimBetlyon, founder and president of CharterX. “Now [theagency is] clarifying and providing examples of what’slegitimate and what’s not.”In a special seminar held earlier this year for charter industry representatives, the FAA attempted to outline what sorts of charter activity are considered out ofbounds, and how Part 135 operators, their staff andcrew must conduct themselves to comply with the letter of the law. For example, the agency advised that anaircraft owner or management company that listsitself as “doing business as” an air carrier in thecarrier’s operational specifications does not authorizethe aircraft owner or management company to conductbusiness as the air carrier. In other words, the nameof the operational specifications holder must be thelegal name of the certificate holder.Walter Lamon, president and founder of Wyvern,said that his company’s standard naturally weeds outsuch arrangements. “We have a set of structured rulesand procedures for our people to follow to ensurethat, if an operator has aircraft located around thecountry, the proper oversight is consistent throughoutthe fleet,” he said.“The charter brokerage part of this business is likethe Wild West; if you have a cellphone you’re in business,” said Joe Moeggenberg, president of ARG/US.“We’re seeing some shady characters getting into thisbusiness. I think the whole industry needs to take aclose look at the individuals it’s attracting. The FAA’sgoal, and it’s not going to happen for a while, is to getthe 135 operators as close to the 121s as possible.The FAA just doesn’t have the manpower to overseethe 135 business.”–M.S.

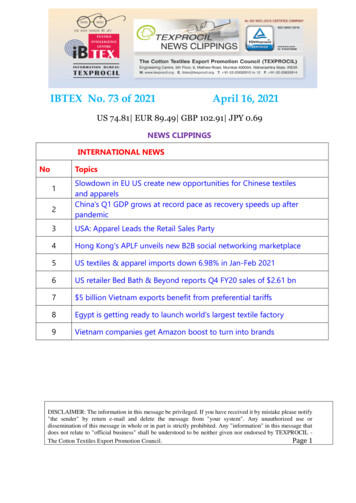

Understanding Charter RatingsWhile DayJet does not define itselfas a charter operator, the per-seat,on-demand service using Eclipse 500smight provide a model for a new typeof charter operation.of performance in the industry and therecord is getting better when you lookat losses,” said Walter Lamon, president and founder of Wyvern Consulting, one of the leading providers ofsafety information and reports for thecharter industry. “There’s less anecdotal buying being done than there isdue diligence.”for West Coast Charters in Santa Ana,Calif., said her company expects toincrease the size of its fleet next year,focusing on small and midsize jets,especially Citations and Learjets. “Weconsistently seek newer aircraft withstate-of-the-art avionics and amenities.managed charter aircraft. Add to thisa backlog of manufacturing ordersand it might become increasingly difficult for charter operators to satisfyconsumer demand. “I think the industry is very busy right now, which isnot necessarily great because theyhave a shortage of airplanes,” saidFred Gevalt III, president and founderApproximate Average Hourly Charter Ratesof The Air Charter Guide.of Benchmark AircraftFuel prices continue to be a domi(in U.S. )nant factor affecting the charter industry, although operators have respondedto price hikes in various ways. “WhileModel20062005Percent Changesome operators have chosen to raise 755 7037.4%Bell 206their base rates, others have held theirKing Air B200 1,156 1,1015%base rates steady while raising theirLearjet 35 1,889 1,8581.7%fuel surcharges to a rate higher thanHawker 800 2,872 2,7982.6%current fuel prices would warrant,”Falcon 50 3,607 3,5222.4%said Brandon Greene, marketing diGulfstream III 4,317 4,2202.3%rector for Delta AirElite Business Jetsin Cincinnati. “Others have done neiSources: AIN’s 2005 Charter Special Report and the Spring 2006 editionther but have chosen to add ramp/faof The Air Charter Guide.cility/FBO or landing fees as new lineAIN interviewed six U.S. charter companies to better understand the charter market initems to their invoices.”the U.S. The average rates shown support the operators’ reports that charter rates haveRobert Seidel, senior vice presidentincreased in the first half of this year versus the same period last year.of charter for Jet Aviation, told AINthat his company’s hourly charter rates“Buyers are becoming more savvy In addition, we have a client base that have remained virtually flat since 2000,about getting up-to-date information,” prefers the flexibility and reliability of “which is really astounding to me besaid Jim Betlyon, founder and presi- the Beechcraft King Airs.” She said cause the cost of operating aircraft, indent of Portland, Ore.-based CharterX. that the company is continually seek- cluding salaries for crew, insurance,In June, the online charter market- ing to bolster its King Air fleet, which parts and labor, has gone through theroof. The pricing for air charter servicesplace host acquired Wyvern, creating today numbers about 15 aircraft.However, most of the opall inclusive ofa venue for consumers to research infuel surcharges Iformation on more than 15,000 char- erators AIN interviewed indiexpect will trackter aircraft and the companies that cated that demand continuesThe charter market is alsoto outpace supply, as charterwith fuel pricing.operate them.experiencing an increasecustomers compete for flightIf oil stabilizes inin demand for helicopterFleet Expansions Likelyoperations, in aircrafthours with the owners ofthe 60 to 70such as the Bell 407.Most of the operators AIN interper barrel rangeviewed indicated that they plan to inand fuel pricescrease the size of their fleets this yearstay in the 4 toand into next year. 5 [per gallon]“I think our fleet will grow over therange, I would expect pricing for thenext 12 months a measured growth.remainder of the year to be flat.”It’s not going to be we’re taking everyOperators Seeaircraft that goes our way,” said JeffBigRole for VLJsCropper, vice president of charterCharter operators identified severalservices for Executive Jet Managekey factors that will continue to drivement, the aircraft management andthe demand for aircraft charter throughcharter division of NetJets. “We don’tnext year, and in particular the waninghave a certain type of aircraft we’reappeal of the airlines. “Charter travel,looking for, though we’re looking foralthough expensive, is perceived asnewer aircraft.”Barbara Hunt, marketing directorContinued on next page uThousands of charter customers each year look toWyvern and ARG/US for information about the flights theyare contemplating. They want to know about the pilots’qualifications, the maintenance history of the aircraft, andwhether the operator carries sufficient insurance, amongother things. The two companies offer similar servicesthat help a passenger decide whether or not the flightmeets industry-recognized safety criteria. Many operatorsmarket the fact that they are rated highly by these consultancies, but what do the ratings actually mean?Wyvern Consulting specializes in performing on-siteaudits of Part 135 charter operators’ aircraft operationsand maintenance practices. Wyvern measures an operator against its in-house standards, developed over theyears in conjunction with many of the same Part 91 flightdepartments and aircraft owners who have, until recently,been required to sponsor an audit of a Part 135 operator.Wyvern also offers what it calls a Wyvern Desk Review, which provides the customer with an overview ofa non-Wyvern recommended charter operator, with emphasis on a particular flight, on a given date and time,and with a specified aircraft and crew. This is similar tothe ARG/US TripCheq Report, which provides information about a particular flight. In both cases, a customeris provided with information to steer the decision aboutwhether to accept or decline a particular charter flight.“Now that we’re working with Jim [Betlyon] andCharterX we’re able to disseminate more informationmore broadly. Our auditors have to do less searchingand digging in different places, and our analysts havemore information at their fingertips,” said WalterLamon, president and founder of Wyvern.While a charter operator is either approved or not approved according to the Wyvern standards, the ARG/USrating system is divided into four categories of acceptability: Platinum, Gold, Silver or Does Not Qualify. “Our auditis a process audit; what we’re looking for is best practices,” said ARG/US president Joe Moeggenberg, notingthat an on-site inspection is done only for those operatorsthat seek the Platinum rating. The highest rating attainablefor operators who choose to forego the on-site inspectionand have their operations manuals and documentationreviewed by ARG/US off-site is a Gold rating.Of the roughly 120 audits ARG/US had slated for thisyear, Moeggenberg said, fewer than 10 companies havereceived the Platinum rating. “We’re looking to see if theoperator has the policies and procedures in place to makesure that they do the right stuff, that they get their trainingon time, that their records are up to date,” he said, notingthat 48 charter operators have received the Platinumrating, while 350 operators hold the Gold rating.“What that means is that those operators haveprovided us with all their pilot and aircraft data and wedo background checks on them annually.”“You can have two airplanes sitting side by side thatboth look great. One airplane is crewed by a professionalATP-rated crew that has simulator training every sixmonths, they are highly qualified, tons of time in type,the airplane and the crew has had no incidents or violations everything is just perfect. Right next to it youhave one that’s crewed by a couple of kids who don’t doany simulator training, the airplane’s insured by somecompany in Ecuador and they’re both selling for theexact same price, say 4,500 an hour. The customerdoesn’t know that one airplane and one flight crew istop-notch and the other one leaves a lot to be desired.”Moeggenberg concluded, “Customers really need toknow what they’re paying for. The charter operator itselfdeserves to make a little better margin on the higherquality airplane. The operation that has done everythingright is a lot more expensive to operate than the one that–M.S.is not doing all the simulator training.”

thechartermarketuContinued from preceding pageproviding greater value due to on-demand charter operator, Delray Beach, Fla.-basedscheduling flexibility, the closer geographic DayJet is creating a new service model,proximity of general aviation airports to something of a charter-airline hybrid, that itbusiness sectors, increased productivity and calls “per-seat, on-demand air travel servoverall time saving,” said Beale.ices” using the Eclipse 500 very light jet.Mark Reichin, senior vice president of The idea is that customers will pay for thecharter sales for PrivatAir, said he expects to seats they book, not the entire aircraft, andsee an increase in demand for newer, longer- will fly on “individually negotiated” schedrange aircraft as more customers travel ules. DayJet says it will not publish schedinternationally. The Swiss-based company’s ules and that flights will be priced “at afleet of more than 50 aircraft–90 percent of modest premium to equivalent regionalwhich are managed by PrivatAir for their full-fare coach airfares.”owners–includes such big longhaulers as the Boeing Business Jet,the Global 5000 and the GulfstreamARG/US Updates TripCheqIV. However, Reichin said he alsoanticipates a growing market forIn September, ARG/US president Joe Moeggenbergsmaller, shorter-range jets, includingtold AIN that his company planned to unveil a newthe new class of very light jets.version of its online Charter Evaluation and Qualification,“VLJs will increase our charter andor Cheq Report, at the NBAA Convention in Orlandomanagement business,” he predicted.last month. We tested a pre-release version of theSome charter companies are alnew TripCheq system and found it to be fairly userready planning to integrate VLJsfriendly. Kathleen Tyler, director of sales and marketinto their fleets. William Herp, presing for ARG/US, walked us through the program andident of Lexington, Mass.-basedsaid that the new quality rating system will use theLinearAir, said his company has 30same “AAA” nomenclature as bond ratings instead ofEclipse VLJs on order, with plans tothe current green, yellow and red labels. It is possible,put 18 of those aircraft on the linefor example, for a Gold-rated operator to be associnext year. LinearAir owns or leasesated with a “yellow” labeled trip based on the combiits fleet aircraft, which include fournation of flight crew, aircraft and mission profile.Cessna Grand Caravan turboprops,“The educated consumers can make some judgand does not manage any aircraft.mentcalls” depending on the trip conditions, such as“Next year the VLJs will drivethe length of the duty day and the severity of the enhuge demand among current airlineroute weather, Tyler said. “We give them the informatravelers, given their dramaticallytion to help them make the decision. Most of the timeimproved economics over existingif it comes back yellow, the customer won’t go.”–M.S.light jets and turboprops,” Herp said,noting that his company’s bread andbutter is regional trips of less than500 nm. He said the Eclipse is “ideal” forIn June the company announced that fivethis travel profile but because the Caravan Florida cities–Boca Raton, Gainesville,offers greater passenger and payload capa- Lakeland, Pensacola and Tallahassee–wouldbility, the turboprop will remain an impor- be the first to offer the service. The comtant component of their fleet.pany has a five-year agreement with Eclipse“We expect that some of our charter that includes firm orders for 239 aircraftclients might become owners of very light and options on 70 more.jets; however, we do not expect this to sigEclipse president and founder Vernnificantly affect our client base,” said West Raburn received provisional type certifiCoast Charters’ Hunt. “We already had a cation for the Eclipse 500 jet on Julyfew clients interested in having us manage 27 this year at EAA AirVenture inOshkosh, Wis. The FAAand/or charter their lightissued full certificationjets but we are unsureon September 30. –M.S.of the charter market inGrowth in international travel,this category.”operators expect, will fuelThough it is carefulgreater demand for long-haulThe charter market reportcontinues on page 30 unot to define itself as aairplanes such as the BBJ.28aaAviation International News November 2006 www.ainonline.com

thechartermarketSnapshots of Europe’sCharter OperatorsuContinued from page 28European operators reportstrong market, push forrule changes for fair competitionEurope’s executive aircraft chartermarket has enjoyed strong growth during the first half of this year. OperatorsAIN surveyed report average increasesin sales of around 26 percent compared with the same period last year.The August 11 uncovering of aterrorist plot to destroy transatlanticairliners departing London prompteda deluge of new inquiries about charterservices. The incident has undoubtedlyresulted in further increases in business for European charter operators,been driven by the hassle and unpredictability of scheduled airline servicein a situation where security regulations change frequently.“After 9/11 people started lookingaround for alternatives to flying and itseemed that video conferencing wouldbut it remains unclear whether thiswill have a lasting effect on the sizeand shape of the market.Hunt & Palmer booked 11 additional flights on August 11 and eightmore on August 12, according to NeilHarvey, executive aviation managerwith the UK-base

line what sorts of charter activity are considered out of bounds, and how Part 135 operators, their staff and . itself as “