Transcription

1-888-NCB-FIRST www.jncb.comMerchantRates &ChargesUpdated August 17, 2017

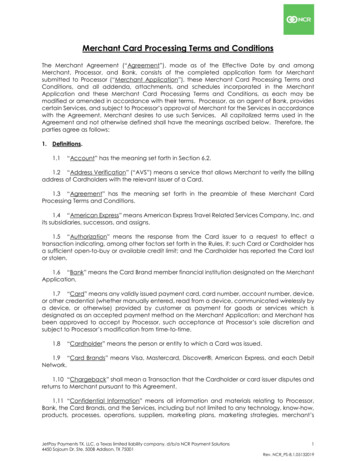

Merchant Rates & ChargesEffective Nov 1, 2016FEE COMPONENTRATECHARGEBACKSChargeback FeeUS 12.00 GCT or the J EquivalentArbitration Fee(losing Merchant pays)US 500.00 GCTBill Payment/TelemidasFile Download Monthly FeeJ 1200.00 GCTECOMMERCEOne Time Setup FeeUS 550.00 GCT or J EquivalentMonthly FeeUS 40 GCT or J EquivalentCommission: Credit Card4.5% GCT (Starting)Per Transaction FeeUS 0.25 or the J EquivalentMANUAL MERCHANT (CREDIT CARDS ONLY)4% GCTCommission:NON-QUALIFIED TRANSACTION FEES(Inclusive of key-entered transactions)Downgraded Transaction Fee(Credit Card)0.50% agreed Commission Rate GCTPAYMENT CARD INDUSTRY (PCI) FEESAnnual PCI Compliance FeeJ 5,000.00 GCTPCI Non-Compliance Fee:POS: After 30 DaysJ 5,000 GCT/MonthPOS: After 90 DaysJ 10,000.00 GCT/MontheCommerce: After 90 DaysJ 5,000 GCT/MontheCommerce: After 365 DaysJ 15,000.00 GCT/MonthPCI Breach Fines:1st BreachUS 50.00 GCT or J Equivalent

Merchant Rates & ChargesEffective Nov 1, 2016FEE COMPONENTRATEPCI Breach Fines (continued):2nd BreachUS 75.00 GCT or J Equivalent3rd BreachUS 100.00 GCT or J EquivalentPOINT OF SALESetup Fee (One time only)J 2,000.00 GCTMonthly Service Charge:Standard/Internet Protocol (IP)MobileJ 1,500.00 GCTJ 3,500.00 GCTDaily Rental Charge:Standard/Internet Protocol (IP)MobileJ 1,000.00 GCTJ 1,800.00 GCTCommission:Credit Card:Debit Card:3.80% GCT (starting) 20 GCT (Effective Oct 9, 2017)RE-ACTIVATION FEEPOSJ 2,000.00 GCTBill PaymentJ 2,000.00 GCTeCommerceUS 50.00 GCT or J equivalentSERVICE/SUPPORT FEESPOS RefundJ 2,446.50 GCT Per Item(Paid on insufficient/over limit balances)Duplicate/Interim MerchantStatementJ 757.25 GCT Per Cycle

Merchant Rates & ChargesEffective Nov 1, 2016QUALIFIED TRANSACTION CONDITIONSA Qualified Transaction is a Credit Card transaction that is processed inaccordance with the rules and standards established by the PaymentSystems. The conditions are as follows: Card is present, full magnetic stripe/chip is read by the terminal andsignature/pin is obtained. One electronic authorization request is made per transaction andtransaction/purchase date is equal to the authorization date. Authorized transaction amount must match settled transactionamount. Incremental electronic authorization requests are permitted (forLodging & Car Rental). Transactions electronically deposited (batch transmitted) no laterthan one day from transaction/purchase date. 3D Secured Compliant for eCommerce Merchants.NON-QUALIFIED/DOWNGRADED TRANSACTION CONDITIONS One or more of the QUALIFIED Conditions above werenot met.CHARGEBACKChargeback is a process that allows Credit cardholders to reversetransactions when there is a dispute or dissatisfaction with the goods orservices they have purchased using their cards.The process is as follows:1. When a Chargeback right applies, the Issuer sends the transaction backto the Acquirer.2. The Acquirer charges back the dollar amount of the disputed sale.

Merchant Rates & ChargesEffective Nov 1, 20163. The Acquirer researches the transaction; if the Chargeback is validthe Acquirer deducts the amount including fees from the Merchant’saccount and informs the Merchant.4.If the Merchant cannot remedy the Chargeback, it will remain on theMerchant’s account.ARBITRATION If the Card Issuer disputes a presentment or pre-arbitration responsefrom the Acquirer, the Card Issuer may file for arbitration with thePayment Systems. In arbitration, the Payment System decides whichparty is responsible for the disputed transaction. In most cases, thePayment System’s decision is final and must be accepted by the CardIssuer, the Acquirer and the merchant. If the decision is against theMerchant, fees will be applied to the Merchant’s account.PCI COMPLIANCEPCI Data Security Standards (PCI DSS) is the global data security standardadopted by the payment card brands (Visa, MasterCard, Discover, AmericanExpress, Amex) for all entities that process, store or transmit cardholder dataand/or sensitive authentication data. It consists of steps that mirror globalsecurity best practices: As a merchant, you are responsible for the security of cardholder dataand must be careful not to store card-related data on your systems orthe systems of your third party service providers. You are also responsible for any damages or liability that may occur asa result of a data security breach or other non-compliance with the PCIData Security Standards. Each merchant is required to become PCI Compliant annually and isrequired to pay fees to maintain compliance. Any data breaches or non–compliance will incur fines.

ElectronicPaymentSolutions:POSNever Miss A SalePOINT OF SALEEMVEasy payment processingCHIP CARDNCB eCommerceNCBM obile MoneyUnleash the power ofyour websiteChat. Text. Quisk.1-888-NCB-FIRST www.jncb.com

Merchant, fees will be applied to the Merchant's account. ARBITRATION PCI Data Security Standards (PCI DSS) is the global data security standard adopted by the payment card brands (Visa, MasterCard, Discover, American Express, Amex) for all entities that process, store or transmit cardholder data and/or sensitive authentication data.