Transcription

SPECIAL reportCharter Market Report 2018by James WynbrandtConsolidations cap a growth yearStrong growth in charter flight activity outpaced gains in Part 91 and nominally advancing fractional operations in the U.S. over thepast year. Global charter ops also increased asa surge of consolidation among major providers redefined the marketspace. Technologywas the driving and enabling force behindmuch of the industry news, and a primaryfocus among providers seeking to maximizeefficiencies and opportunities—that is, virtually all of them.U.S. Charter ActivityPart 135 flight activity grew 4.5 percentduring the first half of 2018 comparedwith 2017, to just over 550,000 flights,levels not seen for a decade, while Part91 activity rose 1.3 percent and the fractional fleet gained 0.4 percent, accordingto Argus International.“I think we are back where we were prerecession,” said Joe Moeggenberg, Arguspresident and CEO. “The good news is business is very good. The bad news is the industry is experiencing some issues with lift andhaving a hard time finding newer aircraftwith all the amenities to meet the demand.That’s exactly where we were in the 2008–09time frame.”Major operators far outpaced theindustry’s 4.5 percent growth rate, withtotal hours for the top 25 rising fromabout 467,000 in 2017 to 535,000 in 2018,or 14.6 percent.“The top operators aren’t adding a lot ofnew airplanes, but they’re running a lot moreefficiently,” said Moeggenberg. “Everybodyhas figured out how to fill up a lot of theseempty legs. Operators have done a really goodjob of optimizing their fleets.”Indeed, the combined charter fleets ofthe top 25 operators grew only 2 percent—from 1,023 to 1,044 aircraft from mid 2017to mid 2018.Though Part 135 activity continues to 2018 AIN Publications. All Rights Reserved. For Reprints go to www.ainonline.comFlight Display ClaySystemsLacy

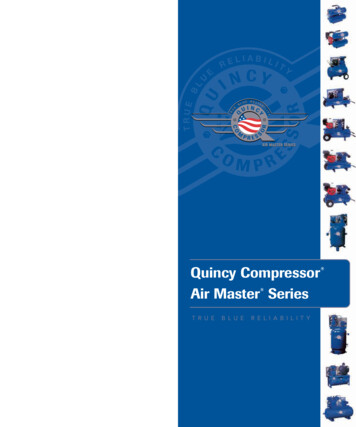

SPECIAL reportVistaJetRankOperator2018 Hours2017 Hours2018 Fleet Size1GAMA AVIATION72,88561,6511172EXECUTIVE JET A PRIVATE JETS40,23936,665695JET LINX AVIATION32,56828,956816SOLAIRUS AVIATION26,78422,466547TRAVEL MANAGEMENT COMPANY24,41636,702428JET EDGE21,64318,025469JET AVIATION21,61215,0604810CLAY LACY AVIATION17,58514,1526411CORPORATE FLIGHT MANAGEMENT17,44616,2042812EXCLUSIVE JETS15,9407,0923013JETSUITE AIR13,82916,4581614ENCOMPASS AVIATION13,0952,611815MOUNTAIN AVIATION13,0769,2092716LANDMARK AVIATION12,91812,2254217AERO AIR11,79610,7022518RED WING AEROPLANE CO10,0598,3021319JET SELECT9,7257,1902720WORLDWIDE JET CHARTER8,8647,8481421SC AVIATION8,8487,4691922MERIDIAN AIR CHARTER8,8018,4922323TALON AIR8,7859,4082424LJ ASSOCIATES8,4607,5722325BERRY AVIATION8,2185,54925*Note- 2018 Fleet Size based on DO85 dated July 2, 2018*Note- 2017 Fleet Size based on DO85 dated July 3, 2017*Note- Excludes Medical Operators 2018 AIN Publications. All Rights Reserved. For Reprints go to www.ainonline.comTop U.S. Part 135 Operators in 2018Source: Argussee positive growth, the rate has slowedrecently, posting in June the first year-overyear (YOY) decline in activity in 25 months.Gama Aviation, which operates WheelsUp’s Citation Excel/XLS and King Air 350iaircraft, in addition to its managed fleet,retained the top spot in charter flight timewith 72,885 flight hours. The 18 percent riseover the prior year was in line with the 18percent growth in its charter fleet from 99to 117 aircraft. More information from providers and news of the past year follows.The consensus in the charter communityhas for some time been that the industryis ripe for consolidation, but the rollupscontemplated usually involved one operator or broker acquiring another. The recentamalgams, however, are modeled as holdingcompanies, acquiring and offering a spectrum of access options for customers andgrowth opportunities for the organization,rather than simply more aircraft and economies of scale.A one-two consolidation punch came fromThomas Flohr’s Vista brand, with the establishment of Vista Global Holding (VGH) inlate August followed by the new entity’s September purchase of XOJet, owner/operator ofthe third-largest U.S. charter operator (basedon flight hours). VGH, headquartered inDubai, aims to “consolidate the fragmentedbusiness aviation market,” according to thecompany, and offer a spectrum of “asset-lite”services: the flagship VistaJet fleet providesguaranteed access for customers who buyblock hours; VistaJet’s app provides accessto on-demand charter for customers whoseempty-leg purchases have allowed VistaJetto eliminate repositioning fees for its blockhour customers; VGH also offers leasing forcustomers who want a dedicated aircraft attheir disposal. With California-based XOJet,VGH gets a U.S. charter operator, broker, andsubscription-service provider that dominatesthe mid/super-mid cabin charter market.The VGH launch comes with a 200million investment from longtime privateequity firm backer Rhône Group.VistaJet’s fleet access app notwithstanding, an element absent from VGH isa digital division to tap into the nascentglobal shared-access charter space. Interestingly, XOJet’s exclusive online salesagent is JetSmarter, the membership charter broker, which has also been developinga mobile booking app for the company. InAugust, CEO Brad Stewart said the app wasvirtually complete, but “there’s a little bit of

SPECIAL reporthesitation to launch until we have an outcome on the sales process,” to give XOJet’sbuyer a say in any decision. (XOJet ownersTPG Capital and Mubadala put the for-salesign out a year ago.)But with the stamp of approval thatcomes with its purchase, why back awayfrom a technology developer that revivedthe per-seat market? That’s the kind of capability VGH might like in its portfolio.In the midst of the Vista activity, in September OneSky, a Ken Ricci Directional Aviation Capital (DAC) company, solidified itsdigital underpinnings, acquiring UK-basedonline charter broker PrivateFly. OneSky’saccess portfolio includes fractional providerVacation tours by chartered jetCustom luxury vacation tours by private jetfeaturing unique experiences and access toexclusive events are trending. UK full-service provider Air Charter Services offerscustomized tours designed around eventslike European Fashion Week and the SuperBowl, and China’s Deer Jet this year offereda weeklong Cannes Film Festival tour on itsGulfstream G550 that included red-carpetinvites to the opening-night gala.“People are increasingly starting tovalue experiences over things, meaningthat they are putting a higher priority ontravel and looking for unique experiences,”said Elisabeth Nelson, managing directorfor private travel, TCS World Travel, whichoffers customized tours in partnershipwith veteran U.S.-based luxury tour organizer Travcoa.Abercrombie & Kent (A&K), whichhelped launch the trend with its roundthe-world tours aboard all-first-class airliners, now offers customized tours viabizjet for up to 16 travelers. A&K spokesperson Jean Fawcett said many customersactually have their own aircraft but “thelogistics of trying to do it on their own canbe overwhelming.”Last fall NetJets teamed with FourSeasons Resorts to offer custom vacations linking the hospitality company’sproperties by the NetJets’ fleet.nFlexjet, jet card provider Sentient Jet, andon-demand charter provider Skyjet. OneSkyhas been enhancing operations at Skyjet, its“current digital on-demand charter broker,”and recently gave Andrew Collins, Sentientpresident and CEO, oversight of the brand.OneSky will now harness PrivateFly’s technology with Skyjet to amplify the latter’sdigital signal.In January Clive Jackson, founder of UKonline charter portal Victor, announced theformation of Alyssum Group, which aims to“pursue a long-term acquisitive plan withingeneral and business aviation which willhelp raise business standards across thesector, encourage innovation, and boostgrowth,” Jackson said. An additional 18million investment in Victor, Alyssum’s primary asset, will jumpstart the acquisitions.In February Alyssum bought longtime vendorRocketRoute, which provides flight-planning,fuel, and concierge services through its MarketPlace and FlightPlan platforms. Jackson isCEO of Alyssum Group and Joe Cohen hasassumed his vacated CEO spot at Victor.The Digital Frontier“A Facebook presence sells charter, it cannow be confirmed,” declared Adam Twidell, 2018 AIN Publications. All Rights Reserved. For Reprints go to www.ainonline.comGama Aviation

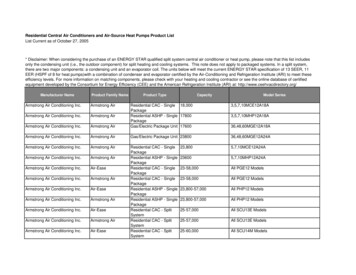

SPECIAL reportBrokerage continues annual growth inexcess of 40 percent, Barros said, and on theoperator side Leviate recently added a Challenger 300 and Learjet 45 to its air operator’scertificate.Jet Aviation has no digital presence, yetits flight hours climbed some 44 percent (to21,612 hours) on fleet growth of just 9 percent (to 48 aircraft). “We don’t have an app orper-seat charter,” said Don Haloburdo, seniorv-p of flight services. However, he added, “Wecertainly recognize that things are moving inthat direction.” So is Jet Aviation thinking ofmoving in that direction? “Yes,” Haloburdosaid, quickly adding, “I can’t elaborate.”Haloburdo also said Jet Aviation wouldlike to offer more lift at the light end ofthe fleet to bring in more customers newto charter but “the hourly rates tend tobe much lower, so it becomes a littleXOJetBUSINESS AVIATION FLIGHT ACTIVITY280K270K260K250K240K230K220K210KPrivateFly started operations 10 years ago betting on thepopularity of digital platforms.The first six months of this year marked growth from last year. The increase is the result of efficiency, not additional equipment. 2018 AIN Publications. All Rights Reserved. For Reprints go to www.ainonline.comCEO of PrivateFly, citing the ability to broker trips from postings on the platform,and signaling social media’s new status as abizav marketing tool.Besides its purchase by DAC, PrivateFly,celebrating its 10th anniversary, last November acquired U.S. broker Bird Dog Jet, folding the Nevada shop’s leadership into theFort Lauderdale, Florida office PrivateFlyestablished in 2016.Twidell noted PrivateFly’s digital platform features the ability for operators tosee one another’s pricing. This enablessmall operators to be “nimble on pricing”and compete with larger players, whilealso allowing all to see when they are ableto increase prices. “I don’t think any otherplatform offers this,” he said.Over the past six months, NetJetsowned Executive Jet Management (EJM)has focused on client-centric technologyimprovements, said Mike Tamkus, seniorv-p for client services and managementsales. “Multiple IT projects are currentlyunder way, leveraging technology solutionsas well as internal systems, to improvecommunication and provide real-time databetween departments and our clients.”EJM has “also increased staffing levels inour safety, training, charter, owner services,maintenance, and finance teams,” Tamkussaid, and earlier this year Brian Hirsh, formerly president of NetJets’ aircraft salesbrokerage arm QS Partners was namedEJM’s president.Last year, Dallas-based charter brokerage Horizon Air Group became an operatorwith its acquisition of Starbase Jet and itsAOC. Shortly after, Alaska Airlines, parentof regional airline Horizon Air, notified thecharter company of concern about possiblebrand confusion, says Luis Barros, CEOof what is now the Leviate Air Group, therenamed full-service provider.

SPECIAL reportchallenging: how much work and effort doyou exert to make sure you have a diversified fleet business model, without focusingtoo much energy on a segment of the market that’s not as profitable?”Lider, Brazil’s oldest bizav firm, has introduced a mobile app providing “a path fromthe market to Lider,” and permitting charter and empty-legs bookings at a discount,said Philipe Figueiredo, aircraft sales director. For customers who prefer the personaltouch, “the telephone will keep working.”Lider also operates a chain of FBOs and isBrazil’s exclusive HondaJet distributor.Expanding Their ReachAfter gaining an East Coast foothold lastyear with the purchase of Oxford, Connecticut-based Key Air, Clay Lacy Aviationthis year added offices at New York’s Westchester Country Airport; Miami-Opa Locka;Portsmouth International in New Hampshire; and Lewis University Airport outsideChicago/Romeoville, Illinois.Hours at Clay Lacy rose 23.6 percent to17,585 hours on 12 percent fleet growth, withsome of that time coming from recipientsof the company’s Gift of Flight cards. Anentertainment company last year gave teammembers 3 million worth of the cards indenominations of 100,000 to 300,000“in gratitude for a job well done,” said VeriarCollins-Jenkins, v-p for charter and managed services.This year, the company retired its loneLearjet 55 and a Learjet 35 from its fleet, “adifficult decision owing to Clay’s history withthem,” said Collins-Jenkins, alluding to theThe Gray Lady gets onboard private aviationIn a sign of private aviation’s mainstreaming, the New York Times this year publishedthree lifestyle articles on private aviation:a New York Times Magazine feature aboutVistaJets’ onboard children’s program; aJanuary piece on the affordability of privatejet travel; and an August article on familycollege tours by private jet offered by XOJet.(Magellan Jets has been selling a 10-hourcollege-tour jet card for several years, butthe XOJet program brings college placement experts into the process).nlongstanding connection between the company’s founder and the Learjet brand. They’llbe replaced with a CJ3, a Phenom 300, and aLearjet 45. Last year, the company said it wouldput more emphasis on looking for lift on theopen market to meet charter requests, ratherthan on its own fleet, and Collins-Jenkins saidthat effort has been “hugely successful.”Focusing on the Northeast, Jet Linx, fifthlargest operator in the U.S., has added basesin Boston (Bedford) and Chicago, with plansto open a Jet Linx terminal at Teterboro Airport in New Jersey by the new year, bringingits facilities count to 17. Jet Linx partners withexisting FBOs and refurbishes their facilitiesand is eyeing additional expansion opportunities, particularly on the West Coast, saidJamie Walker, president and CEO. Jet Linx,which offers only jet cards, saw flight hoursrise 12 percent to 32,568 on a fleet decline of10.9 percent to 81 jets. The company now hassome 1,500 clients, Walker said.Walker sees more aircraft joining the U.S.charter fleet. “Aircraft owners today aremuch more savvy,” he said. “They realize thiscan be a revenue-generating asset when it is[otherwise] idle. We see the trend moving inthat direction and think the [Part] 135 fleetwill continue to grow.”Also adding a terminal to its operations, 2018 AIN Publications. All Rights Reserved. For Reprints go to www.ainonline.comJet Linx

SPECIAL reportNew Access ProgramsPriester Aviation is reformatting its Centerline access program “as a traditional jet cardproduct,” a national, hours-based offeringwith guaranteed availability, said Gary Gennari, senior v-p for charter sales. Meanwhile,its expanded brokerage business accountsfor half of Priester’s charter revenue, hesaid. The Wheeling, Illinois–based company has seen a growing demand for midand super-midsize-cabin jets, driven by lowcharter rates for the category, Gennari said.Charter management company SolairusAviation has introduced Altitude bySolairus, offering fixed one-way pricing onselect routes aboard light, mid- and supermidsize-cabin jets. Meanwhile, to spurnear-term bookings, the company featuresits Cleared fleet, aircraft requiring no ownerapproval and ready for quick departures.Solairus features a rotating selection of fourto five Cleared jets on its website, spotlighting aircraft that “have a lot of availability forthe month,” said Paul Class, senior v-p ofcharter sales.Hours and charter fleet at the sixth-largest U.S. operator both grew 12.5 percentover the past year, to 26,784 hours and 54aircraft. But despite the size of its fleet andits California base (Petaluma), Solairusnever had a charter aircraft at the state’s(and nation’s) busiest bizav hub: Van Nuys.This year a VNY-based Falcon 900EX andG450 joined the fleet.Delta Private Jets (DPJ)—jet card, charterand management arm of Delta Airlines—launched its Sky Access online membershipprogram this year, offering unlimited accessto free empty-leg flights and discounts onsome return flights on Delta. (Introductorymemberships cost 8,500; annual renewalsare 6,000.) For potential customers putoff by per-seat charter, “members are ableto book the whole aircraft without sharingit with others,” DPJ emphasizes. Its proprietary AmpliFly technology provides up to30 alternate destinations (e.g., Pittsburgh,Detroit, and Chicago between New York andMilwaukee) and 10 preferred airports on anempty-leg route. Customers can view theoptions in real time online or via an iOS app.A 20 percent discount on select return-tripfares on Delta from empty-leg destinations isIllegal charter and broker regulationsIllegal/gray-market charter is back infocus in the U.S. and Europe. National AirTransportation Association (NATA) members complained about an increase in thepractice, and after discussions with theFAA, in May the organization formed anillegal-charter task force. Europe’s BACA–the Air Charter Association teamed withthe European Business Aviation Association that same month in a complementary action.No reliable data on illegal charter activity exists, but it’s thought to be increasing,spurred by the variety of access schemes andlack of regulatory enforcement. Given thenew, shared models under Part 380, even charter professionals “can’t always tell” whether anovel low-cost offering is legal, said JohnMcGraw, director of regulatory affairs at theNATA. “It’s complicated,” he said.In Europe, scofflaws’ apparent impunityhas legitimate operators questioning thereturn on investment for regulatory compliance. “If we’re just going to accept this isallowed to happen, what’s the point of having an AOC [aircraft operator certificate]?”asked Dave Edwards, BACA’s CEO.Flexing its enforcement powers, in Julythe FAA proposed a civil penalty of 3.3million for a Michigan-based real estatefirm for charging passengers on its Part91 Beechjet 400A and Hawker 900XPflights “more than the expenses allowed”under the FARs.Going forward, the FAA will also provide more follow-up information totipsters who report suspicious activityvia the Air Charter Safety Foundation’savailable. Members also get fixed hourly ratesfor on-demand charter.Card & Membership ProgramsJet card provider Sentient Jet now has “wellnorth” of 6,000 cardholders, said companypresident and CEO Andrew Collins, and morethan one quarter of them book flights via itsmobile app. “We’re booking millions of dollarsthrough that app. It’s a very robust structurethat continues to develop,” he added.But technology can take a back seat tonature, and “large providers have to startbuilding extreme weather into their businessmodels,” said Collins. “Last year we had thetrifecta of the [Hurricane] Harveys of theworld. We have to be on our toes and ready.We guarantee a product to get people out ofplaces [in harm’s way]. We had to overinvestto do that, and we learned a lot.”SkyJet, Sentient’s sister on-demandbrokerage, added its first card program,Explorer, last fall. The 9,500 membershipprovides guaranteed access to four categories of aircraft at fixed hourly rates. Morethan 30 percent of SkyJet’s bookings comethrough digital channels.Sentient Jet is among the many providersburnishing their appeal and membership benefits through partnerships with luxury brandsand signature events. The company was Preferred Private Aviation Partner for the Kentucky Derby and Churchill Downs Racetracklongstanding illegal charter hotline(888-SKY-FLT1; 888-759-3581).Meanwhile, in September the Departmentof Transportation (DOT) released its regulations on charter brokers, titled “Increasing AirCharter Transportation Options,” five yearsafter the NPRM appeared. The rules c

Charter Market Report 2018 . over the prior year was in line with the 18 . help raise business sta