Transcription

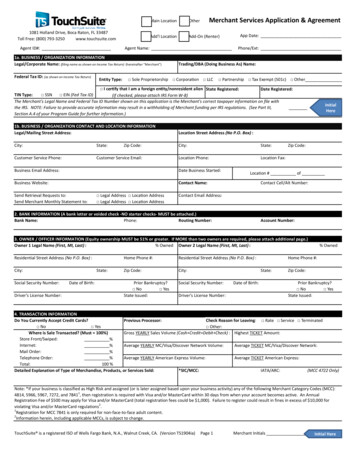

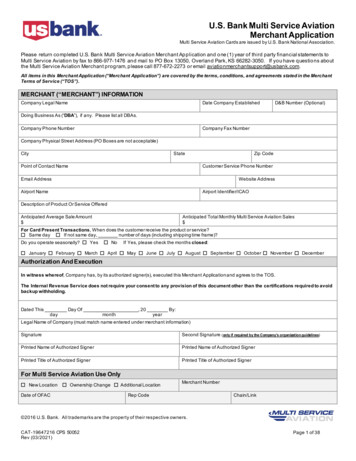

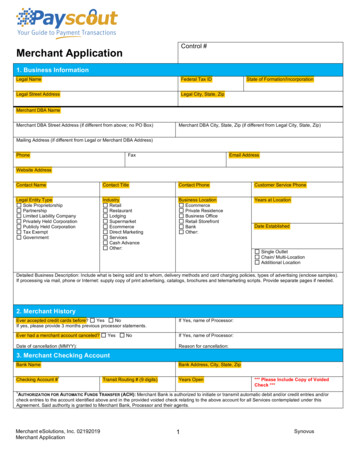

Control #Merchant Application1. Business InformationLegal NameFederal Tax IDLegal Street AddressLegal City, State, ZipState of Formation/IncorporationMerchant DBA NameMerchant DBA Street Address (if different from above; no PO Box)Merchant DBA City, State, Zip (if different from Legal City, State, Zip)Mailing Address (if different from Legal or Merchant DBA Address)PhoneFaxEmail AddressWebsite AddressContact NameContact TitleContact PhoneCustomer Service PhoneLegal Entity TypeSole ProprietorshipPartnershipLimited Liability CompanyPrivately Held CorporationPublicly Held CorporationTax ermarketEcommerceDirect MarketingServicesCash AdvanceOther:Business LocationEcommercePrivate ResidenceBusiness OfficeRetail StorefrontBankOther:Years at LocationDate EstablishedSingle OutletChain/ Multi-LocationAdditional LocationDetailed Business Description: Include what is being sold and to whom, delivery methods and card charging policies, types of advertising (enclose samples).If processing via mail, phone or Internet: supply copy of print advertising, catalogs, brochures and telemarketing scripts. Provide separate pages if needed.2. Merchant HistoryEver accepted credit cards before?YesNoIf yes, please provide 3 months previous processor statements.If Yes, name of Processor:Ever had a merchant account canceled?If Yes, name of Processor:YesNoDate of cancellation (MMYY):Reason for cancellation:3. Merchant Checking AccountBank NameChecking Account #Bank Address, City, State, Zip1Transit Routing # (9 digits)Years Open*** Please Include Copy of VoidedCheck ***1AUTHORIZATION FOR AUTOMATIC FUNDS TRANSFER (ACH): Merchant Bank is authorized to initiate or transmit automatic debit and/or credit entries and/orcheck entries to the account identified above and in the provided voided check relating to the above account for all Services contemplated under thisAgreement. Said authority is granted to Merchant Bank, Processor and their agents.Merchant eSolutions, Inc. 02192019Merchant Application1Synovus

Control #Merchant Application (cont.)4. Merchant Ownership and Management Information (Processor’s Privacy Policy can be found at www.merchante-solutions.com/privacy-policy)A. The following information must be provided for Sole Proprietors or each individual, if any, who directly or indirectly owns twenty-five percent (25%) or moreof the equity interests of the Legal Entity listed in Section 1. For purposes of this Section, Legal Entity includes a corporation, limited liability company orother entity that is formed by a filing of a public document with a Secretary of State or similar office, a general partnership, and any similar business entityformed in the United States. If no individuals meet this definition, please check “Beneficial Owner Not Applicable” below and proceed to Section 4.B.Beneficial Owner Not ApplicableSole Proprietor or Beneficial Owner #1 Legal Name% of Legal Entity OwnershipDate of BirthIndividual Street Address (No P.O. Box)City, State, ZipIndividual has a SSN or ITIN issued by the U.S. GovernmentYesNoSocial Security Number (SSN)/Individual Taxpayer Identification Number (ITIN)Control Prong? (See Control Prong definition in 4.B below)YesNoTitleBeneficial Owner #2 Legal Name% of Legal Entity OwnershipDate of BirthIndividual Street Address (No P.O. Box)City, State, ZipIndividual has a SSN or ITIN issued by the U.S. GovernmentYesNoSocial Security Number (SSN)/Individual Taxpayer Identification Number (ITIN)Control Prong?YesNoTitleBeneficial Owner #3 Legal Name% of Legal Entity OwnershipDate of BirthIndividual Street Address (No P.O. Box)City, State, ZipIndividual has a SSN or ITIN issued by the U.S. GovernmentYesNoSocial Security Number (SSN)/Individual Taxpayer Identification Number (ITIN)Control Prong?YesNoTitleBeneficial Owner #4 Legal Name% of Legal Entity OwnershipDate of BirthIndividual Street Address (No P.O. Box)City, State, ZipIndividual has a SSN or ITIN issued by the U.S. GovernmentYesNoSocial Security Number (SSN)/Individual Taxpayer Identification Number (ITIN)Control Prong?YesNoTitleB. The following information must be provided for one individual with significant responsibility for managing the Legal Entity listed in Section 1, a “ControlProng.” Examples of a Control Prong include, but are not limited to: Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, ManagingMember, General Partner, President, Vice President or Treasurer. If a Control Prong has already provided their information in Section 4.A above, then thereis no need to complete this Section 4.B.Individual Legal NameTitleDate of BirthIndividual Street Address (No P.O. Box)City, State, ZipIndividual has a SSN or ITIN issued by the U.S. GovernmentYesNoSocial Security Number (SSN)/Individual Taxpayer Identification Number (ITIN)Merchant eSolutions, Inc. 02192019Merchant Application2Synovus

Control #Merchant Application (cont.)5. Transaction InformationAverage Monthly Processing VolumeHigh Monthly Processing VolumeHigh TicketAverage TicketVisa/MC/Discover VolumeSeasonal Months of OperationJanFebMarAprMayJunJulCard Acceptance Method (must add up to 100%)% Mail Order/Telephone Order (CNP):% Internet (CNP):% Swiped (CP):% Manually Keyed/Mobile (CP):Advanced Payments?YesAugSepOctNovDecRefund PolicyNo Refunds or ExchangesExchanges OnlyRefunds in 30 days or lessRefund-CreditRefund MerchandiseNoCustomer Type (must add up to 100%)%B2B Sales:% B2C Sales:Days to Ship/DeliverImmediate1 to 78 to 1415 to 30Over 30% of Processing Volume that is for Advanced Payments?6. Payment OptionsVisa/Master Card22Discover, Diners, JCB, CUP (MeS Settlement)Debit with PinEBTDiscover Settlement / Existing Merchant #:2ACH2Check Authorization2,5FCS #:2Name of Provider:Merchant #:Check %:7. Product Selection2POS TerminalMeS Virtual TerminalAdmin Email:MeS Virtual Terminal LimitedAdmin Email:Level 3MultiMerchantURL Address:Name of Certified Shopping Cart:MeS Payment GatewayAdministrator Email:MeS Hosted CheckoutMeS Card Present and Card Not PresentMeS Tele-PayPay-by-Phone: Transaction authorization and capture by telephone.Other SolutionName of Other Solution:MeS e-CommerceSolution Version #:Electronic Commerce Merchants, please provide the following regarding any digital certifications that have been issued for your website.Name of the digital certificate issuer:Digital certificate number(s):Digital certificate expiration date(s):Ownership status of your digital certificate(s):IndividualShared25Merchant Bank does not provide such services and has no responsibility or liability therefor.Third party product requires a separate written agreement with the third party. Processor handles billing.Merchant eSolutions, Inc. 02192019Merchant Application3Synovus

Control #Merchant Application (cont.)8. POS Terminal FeaturesTerminal Application:RetailRestaurantLodgingCash AdvanceCommunication TypeAccess Code # to dial out:Auto Batch CloseReceipt Header Line 4:Receipt Header Line 5:Receipt Footer:AVS OnClerk/Server Prompt OnInvoice Prompt OnEquipment Shipping Address:Legal AddressIPWirelessHR:Min:Tip Option OnPhone training for merchantMerchant DBA AddressDialYesNoOtherOther Shipping Address (No P.O. Box):9. Fee ScheduleVisa, Mastercard and Discover2 Per Occurance Fees2Acceptance Options:Debit/Prepaid CardsChargeback Fee 15.00Retrieval Fee 15.00Credit/Business CardsBothConvenience Fee Monthly Fees2Monthly Minimum Fee 39.95Equipment Fees2Type ofEquipmentMake andModelRent, Buy er Item ( )QuantityTotal ( )# Months Per Month10. Third-Party DisclosureNames of third parties who provide services to, or are otherwise associated with, Merchant and who have access to Transaction data orCardholder Information. Failure to disclose this information can result in account cancellationNameNameNameNameMerchant eSolutions, Inc. 02192019Merchant Application4Synovus

Control #Merchant Application (cont.)11. Merchant and Guarantor SignaturesAgreement Signature: “Authorized Signer” means a person listed in Section 4 of this Application, under either the Beneficial Owner or Control Prong sub-section, andis signing below on behalf of the Merchant. Each Authorized Signer certifies that he/she is authorized to open accounts for Merchant at financial institutions, that allinformation set forth in this completed Application is true and correct, and that Merchant has received a copy of the Merchant Agreement, which is part of this Application,and by this reference incorporated herein. Without limiting the generality of the foregoing, each Authorized Signer by his/her signature below hereby certifies, to the bestof his/her knowledge, that all the information provided in Section 4 of this Application (and in the accompanying “Patriot Act Notification” form) on all individuals listedtherein is complete and correct. By signing below, each Authorized Signer and Guarantor authorizes Merchant Bank or Processor, their affiliates, third partysubcontractors, or any credit bureau or credit reporting agency employed by Merchant Bank or Processor, to make whatever inquiries the Merchant Bank or Processordeems appropriate to investigate, verify or research references, statements or data obtained from Merchant for the purpose of processing Merchant’s accountapplication or for any other purpose permitted by law, including requesting reports from consumer reporting agencies on persons signing below as an AuthorizedSigner or as a Guarantor (if such person asks Merchant Bank or Processor whether or not a consumer report was requested, Merchant Bank or Processor willtell such person, and if Merchant Bank or Processor received a report, Merchant Bank or Processor will give such person the name and address of the agencythat furnished it). If the Application is approved, each Authorized Signer and each Guarantor also authorizes Merchant Bank or Processor, their affiliates, thirdparty subcontractors, or any credit bureau or any credit reporting agency employed by Merchant Bank or Processor to obtain subsequent consumer reports andother information from other sources, including bank references, in connection with the review, maintenance, updating, renewal or extension of the Agreementor for any other purpose permitted by law. Each Authorized Signer and each Guarantor authorizes Merchant Bank or Processor to give information to othersincluding other creditors and credit reporting agencies, concerning the Merchant Bank or Processor’s experience with Merchant as permitted by law, includingany information received from all references, banks and credit reporting agencies. Each Authorized Signer and each Guarantor authorizes Processor to shareinformation provided in this Application to third parties to establish a service or product selected herein provided by a third party.Unless otherwise notified by Processor, if Discover network Card acceptance is selected above, Merchant understands the terms and conditions of the MerchantAgreement will apply to Discover network Card Transactions. If Discover network Card acceptance is selected above, Merchant understands that the terms andconditions for Discover Card Acceptance (“Discover Card Terms and Conditions”) will be sent to Merchant by Discover Financial Services LLC (“Discover”) uponapproval by Discover for Merchant to accept the Discover Card. In such instances, by accepting the Discover Card for the purchase of goods and/or services,Merchant agrees to be bound by the Discover Card Terms and Conditions. Whenever the terms of the Merchant Agreement apply to Discover networkTransactions as described above, Merchant's existing Discover network merchant account, if any, will terminate.25By checking this box, Merchant opts out of receiving future commercial marketing communications from Processor. Please note that you may continue to receivemarketing communications while Processor, as applicable, updates its records to reflect your choice. Opting out of commercial marketing communications will notpreclude you from receiving important transactional or relationship messages from Processor or Merchant Bank.Merchant Bank does not provide such services and has no responsibility or liability therefor.Third party product requires a separate written agreement with the third party. Processor handles billing.Merchant eSolutions, Inc. 02192019Merchant Application5Synovus

Control #Merchant Application (cont.)11. Merchant and Guarantor Signatures (cont.)BY SIGNING BELOW, MERCHANT (AND EACH AUTHORIZED SIGNER AND EACH GUARANTOR) ACKNOWLEDGE(S) AND AGREE(S) (i) TO THEAPPLICATION AND MERCHANT AGREEMENT; (ii) TO ACCEPT ELECTRONIC NOTIFICATION OF ANY CHANGES TO THOSE TERMS ANDCONDITIONS; AND (iii) THAT MERCHANT DOES NOT AND WILL NOT PROVIDE, OFFER OR FACILITATE GAMBLING SERVICES, INCLUDINGOFFERING OR FACILITATING INTERNET GAMBLING SERVICES, OR ESTABLISHING QUASI-CASH, CREDITS OR MONETARY VALUE OF ANY TYPETHAT MAY BE USED TO CONDUCT GAMBLING. THE APPLICATION AND MERCHANT AGREEMENT SHALL NOT TAKE EFFECT UNTIL MERCHANTHAS BEEN APPROVED AND THIS AGREEMENT HAS BEEN ACCEPTED BY MERCHANT BANK AND PROCESSOR.To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verifyand record information that identifies each individual or business who opens an account. What this means for you: when you open an account, wewill ask for your name, address, date of birth, and other information that will allows us to identify you. We will also ask to see your driver’s licenseand/or other identifying documents.By signing below, the undersigned Guarantor(s), individually and severally, guarantee the full and faithful performance and payment by the Merchant (identifiedabove in this Application, which Application is incorporated by reference into this Guaranty) of each and all of Merchant’s duties and obligations to MerchantBank and Processor, as further provided in Sectionof the Merchant Agreement.1)Authorized SignerPrint NameDate2)Authorized SignerPrint NameDate3)Authorized SignerPrint NameDate4)Authorized SignerPrint NameDate1)Guarantor SignaturePrint NameDate2)Guarantor SignaturePrint NameDate3)Guarantor SignaturePrint NameDate4)Guarantor SignaturePrint NameDateMerchant eSolutions, Inc. 02192019Merchant Application6Synovus

Patriot Act NotificationTo help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify andrecord information that identifies each individual or business who opens an account. What this means for you: when you open an account, we will askfor your name, address, date of birth, and other information that will allows us to identify you. We will also ask to see your driver’s license and/or otheridentifying documents. Please complete all sections.Merchant Business IdentificationMINIMUM OF ONE BOX MUST BE CHECKED AND COMPLETED, AND SUPPORTING DOCUMENTATION MUST BE PROVIDED.Government IssuedBusiness LicenseTax ReturnIdentification NumberDate of IssuancePlace of IssuanceExpiration DateI.R.S. Employer Identification NumberType of Taxes FiledPlace of IssuanceDate FiledCorporateResolutionPlace of IssuanceDate FiledArticles ofIncorporationPlace of IssuanceArticles of Incorporation File DatePartnershipAgreementName(s) of Who Executed Partnership AgreementPlace of IssuanceDate of AgreementMerchant FinancialStatementsTypeBalance SheetPlace of IssuanceDateIncome StatementStatement of Cash FlowsPersonal IdentificationPERSONAL IDENTIFICATION MUST BE PROVIDED FOR EACH INDIVIDUAL LISTED IN SECTION 4 OF THE MERCHANT APPLICATION.MINIMUM OF ONE BOX MUST BE CHECKED AND COMPLETED, AND SUPPORTING DOCUMENTATION MUST BE PROVIDED. THEPERSONAL IDENTIFICATION FOR U.S. PERSONS SHOULD BE A DRIVER’S LICENSE UNLESS THERE IS NONE, AND FOR FOREIGNPERSONS SHOULD BE RESIDENT ALIEN ID OR PASSPORT OR MEXICAN CONSULATE ID.Sole Proprietor or Beneficial Owner #1 Legal NameDriver’s LicensePassportNumber on IDMexican Consulate IDPlace of IssuanceMilitary IDResident Alien IDDate of ExpirationDate of IssuanceBeneficial Owner #2 Legal NameDriver’s LicensePassportNumber on IDMexican Consulate IDPlace of IssuanceMilitary IDResident Alien IDDate of ExpirationDate of IssuanceBeneficial Owner #3 Legal NameDriver’s LicensePassportNumber on IDMexican Consulate IDPlace of IssuanceMilitary IDResident Alien IDDate of ExpirationDate of IssuanceBeneficial Owner #4 Legal NameDriver’s LicensePassportNumber on IDMexican Consulate IDPlace of IssuanceMilitary IDResident Alien IDDate of ExpirationDate of IssuanceControl Prong Legal nameDriver’s LicenseNumber on IDPassportMexican Consulate IDPlace of IssuanceMilitary IDResident Alien IDDate of ExpirationDate of IssuanceSignaturesMerchant Legal Name and DBA Name (if applicable)Merchant Authorized Signer Signature**Name and Title of Authorized Signer forMerchantDateProcessor or Referral Source RepresentativeSignature**Name of Processor or Referral Source RepDate**BY SIGNING ABOVE, YOU HEREBY CERTIFY AND AGREE THAT THE INFORMATION LISTED HEREIN IS COMPLETE AND CORRECT ANDWAS PERSONALLY OBSERVED ON THE INDICATED DOCUMENTSMerchant eSolutions, Inc. 02192019Merchant Application

Visa and MasterCard DisclosuresProcessor InformationProcessor Name:Processor Address:Customer Service Phone:Customer Service Email:Application Inquiry:SalesMerchant eSolutions, Inc.3475 Lenox Rd, Suite 500, Atlanta, GA 88-2692866-663-6132Merchant Bank (Acquirer) InformationBank (Acquirer) Name:Bank (Acquirer) Address:Phone:Synovus BankP.O. Box 23019, Columbus, GA 31902-3019(706) 649-4900Important Bank (Acquirer) Responsibilities The Bank is the only entity approved to extend acceptance of Visa and MasterCard products directly to aMerchant. The Bank must be a principal party to the Merchant Agreement. The Bank is responsible for educating merchants on pertinent Visa and MasterCard Rules with whichMerchants must comply; but this information may be provided to you by Processor. The Bank is responsible for and must provide Visa and MasterCard settlement funds to the Merchant. The Bank is responsible for all Visa and MasterCard funds held in reserve.Important Merchant Responsibilities Ensure compliance with cardholder data security and storage requirements. Maintain fraud and chargebacks below Card Network thresholds. Review and understand the terms of the Merchant Agreement. Comply with Card Network rules. Retain a signed copy of this Disclosure Page.Merchant Resources You may download “Visa Regulations” from Visa's website ulations-fees.html You may download “MasterCard Rules” from MasterCard's website d/what-we-do/rules.htmlMerchant InformationThe responsibilities above do not replace the terms of the Merchant Agreement and are provided to ensure the Merchantunderstands some important obligations of each party and that the Bank is the ultimate authority should the Merchantexperience any problems.Merchant Legal Name (printed):Merchant Address:Merchant Phone Number:Merchant SignatureMerchant Authorized Signature:Name of Merchant Authorized Signer:Title:Date:Merchant eSolutions, Inc. 02192019Merchant ApplicationSynovus

CARD PROGRAMSERVICESTerms and Conditions(Merchant Agreement)Merchant eSolutions Inc. 08012017Merchant Application9Synovus

MERCHANT SERVICES AGREEMENT FOR SUBMERCHANTSTHIS MERCHANT SERVICES AGREEMENT (this “Agreement”) is entered into by and among Payscout Partners, Inc. d/b/a Payscout(“Partner”), Merchant eSolutions, Inc. (“Processor”), Synovus Bank (“Merchant Bank”), and Merchant referred to within the MerchantApplication (“Merchant”), effective as of the date accepted, signed and dated by Merchant Bank (the “Effective Date”).In consideration of the mutual covenants contained he

5 Synovus Merchant Application (cont.) Control # 11. Merchant and Guarantor Signatures Agreement Signature: “Authorized Signer” means a person listed in Section 4 of this Application, under either the Beneficial Owner or Control Prong sub-section, and is signing below on behalf of the Merchant. Each Authorized Signer certifies that he/she is authori