Transcription

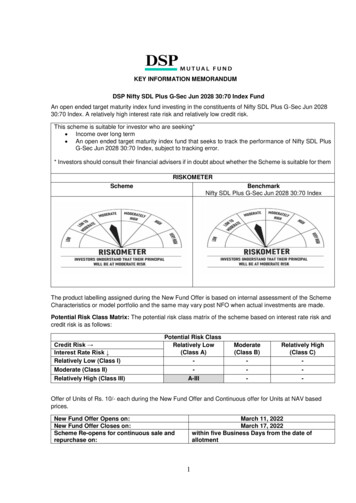

KEY INFORMATION MEMORANDUMDSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index FundAn open ended target maturity index fund investing in the constituents of Nifty SDL Plus G-Sec Jun 202830:70 Index. A relatively high interest rate risk and relatively low credit risk.This scheme is suitable for investor who are seeking* Income over long term An open ended target maturity index fund that seeks to track the performance of Nifty SDL PlusG-Sec Jun 2028 30:70 Index, subject to tracking error.* Investors should consult their financial advisers if in doubt about whether the Scheme is suitable for themRISKOMETERSchemeBenchmarkNifty SDL Plus G-Sec Jun 2028 30:70 IndexThe product labelling assigned during the New Fund Offer is based on internal assessment of the SchemeCharacteristics or model portfolio and the same may vary post NFO when actual investments are made.Potential Risk Class Matrix: The potential risk class matrix of the scheme based on interest rate risk andcredit risk is as follows:Credit Risk Interest Rate Risk Relatively Low (Class I)Moderate (Class II)Relatively High (Class III)Potential Risk ClassRelatively Low(Class A)A-IIIModerate(Class B)-Relatively High(Class C)-Offer of Units of Rs. 10/- each during the New Fund Offer and Continuous offer for Units at NAV basedprices.New Fund Offer Opens on:New Fund Offer Closes on:Scheme Re-opens for continuous sale andrepurchase on:March 11, 2022March 17, 2022within five Business Days from the date ofallotment1

Name of Mutual FundName of Asset Management CompanyName of Trustee CompanyAddresses of the entitiesWebsiteDSP Mutual FundDSP Investment Managers Private LimitedDSP Trustee Private LimitedMafatlal Centre, 10th Floor, Nariman Point, Mumbai400021www.dspim.comThis Key Information Memorandum (KIM) sets forth the information, which a prospective investorought to know before investing. For further details of the Schemes/Mutual Fund, due diligencecertificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pendinglitigations, associate transactions etc. investors should, before investment, refer to the relevantScheme Information Document (SID) and Statement of Additional Information (SAI) available free ofcost at any of the Investor Service Centres or distributors or from the website www.dspim.comThe Schemes’ particulars have been prepared in accordance with the Securities and Exchange Boardof India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities andExchange Board of India (SEBI). The Units being offered for public subscription have not beenapproved or disapproved by SEBI, nor has SEBI certified the accuracy or adequacy of this KIM.This KIM is dated February 28, 2022.2

NSE Indices Limited Disclaimer:The Product(s) are not sponsored, endorsed, sold or promoted by NSE Indices Limited (formerly known asIndia Index Services & Products Limited ("IISL")). NSE Indices Ltd does not make any representation orwarranty, express or implied, to the owners of the Product(s) or any member of the public regarding theadvisability of investing in securities generally or in the Product(s) particularly or the ability of the Nifty SDLPlus G-Sec Jun 2028 30:70 Index to track general stock market performance in India. The relationship ofNSE Indices Ltd to the Issuer is only in respect of the licensing of the Indices and certain trademarks and tradenames associated with such Indices which is determined, composed and calculated by NSE Indices Ltd withoutregard to the Issuer or the Product(s). NSE Indices Ltd does not have any obligation to take the needs of theIssuer or the owners of the Product(s) into consideration in determining, composing or calculating the NiftySDL Plus G-Sec Jun 2028 30:70 Index. NSE Indices Ltd is not responsible for or has participated in thedetermination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination orcalculation of the equation by which the Product(s) is to be converted into cash. NSE Indices Ltd has noobligation or liability in connection with the administration, marketing or trading of the Product(s).NSE Indices Limited do not guarantee the accuracy and/or the completeness of the Nifty SDL Plus G-Sec Jun2028 30:70 Index or any data included therein and NSE Indices Limited shall have not have any responsibilityor liability for any errors, omissions, or interruptions therein. NSE Indices Limited does not make any warranty,express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person orentity from the use of the Nifty SDL Plus G-Sec Jun 2028 30:70 Index or any data included therein. NSEIndices Limited makes no express or implied warranties, and expressly disclaims all warranties ofmerchantability or fitness for a particular purpose or use with respect to the index or any data included therein.Without limiting any of the foregoing, NSE Indices Limited expressly disclaim any and all liability for any claims,damages or losses arising out of or related to the Products, including any and all direct, special, punitive,indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.An investor, by subscribing or purchasing an interest in the Product(s), will be regarded as havingacknowledged, understood and accepted the disclaimer referred to in Clauses above and will be bound by it.3

Investment ObjectiveThe investment objective of the scheme is to track the Nifty SDL Plus G-Sec Jun 202830:70 Index by investing in Government Securities (G-Sec) and SDLs, maturing on orbefore June 2028 and seeks to generate returns that are commensurate (before fees andexpenses) with the performance of the underlying Index, subject to tracking error.However, there is no assurance that the objective of the Scheme will be achieved.The Scheme does not assure or guarantee any returns.AssetAllocation Under normal circumstances, it is anticipated that the asset allocation of the SchemePattern of the scheme shall be as follows:Indicative allocations(% of total ent Securities forming part ofthe G-Secportion of Nifty SDL Plus G-Sec JunLow to2028 30:70 Index95%100%Medium# State Development Loans (SDLs)forming part of the SDL portion Nifty SDLPlus G-Sec Jun 2028 30:70 Index*Money Market Instruments including0%5%Lowcash and cash equivalents*Money Market Instruments will include Triparty REPO (TREPS), Commercial Paper,Certificates of Deposit, Treasury Bills, Bills Rediscounting, Repos, short-termGovernment securities and any other such short-term instruments as permitted by SEBI/ RBI from time to time, including schemes of mutual funds.#Pursuant to SEBI Circular no. SEBI/HO/IMD/DF3/CIR/P/2019/147 dated November 29,2019, replication of the Index by the Scheme shall be as follows:a) The Scheme shall replicate the index completely.b) In the event, if the condition laid down in para (a) above is not feasible due to nonavailability of issuances of the issuer forming part of the index, the Scheme mayinvest in other issuances issued by the same issuer having deviation of /- 10% fromthe weighted average duration of issuances forming part of the index, subject tosingle issuer limit of 15%. Further, at aggregate portfolio level, the duration of theScheme shall not deviate /- 5% from the duration of the index.c) In the event, if the conditions laid down in para (a) and para (b) above are notfeasible, the Scheme shall invest in issuances of other issuer(s) within the indexhaving duration, yield and credit rating in line with that of the non-available issuancesof the issuer(s) forming part of the index, subject to single issuer limit of 15%. Theduration of the Scheme shall not deviate /- 5% from the duration of the index.d) In the event, if the conditions laid down in para (a), para (b) and para (c) above arenot feasible, the Scheme shall invest in issuances of issuer(s) not forming part of theindex with duration, yield and credit rating in line with that of the non-availableissuances of issuer(s) forming part of the index. Such investment in issuances ofissuer(s) not forming part of the index shall be maximum of 20% of the aggregateportfolio of the Scheme.e) The rationale for any deviation from para (a) above shall be recorded.f) In an event where the credit rating of an issuance falls below the investment gradeor rating mandated in the index methodology, rebalancing by the Scheme shall bedone within a period of 5 working days.The Scheme shall not invest in ADR/GDR/overseas securities. The Scheme will notinvest in foreign securities. The Scheme will not invest in Securitized Debt. The Schemewill not invest in derivatives & short selling of securities. The Scheme may however invest4

in Repo in Government Securities, Reverse Repos and any other similar overnightinstruments as may be provided by RBI and approved by SEBI. The scheme will notparticipate in Debt instruments having special features. The Scheme will not participatein repo of money market and corporate debt securities. The Scheme will not invest inCredit Default Swaps. The scheme will not invest in debt instruments having creditenhancements & structured obligations.The net assets of the scheme will be invested in securities constituting the Nifty SDL PlusG-Sec Jun 2028 30:70 Index subject to compliance with SEBI circular no.SEBI/HO/IMD/DF3/CIR/P/2019/147 dated November 29, 2019 for Norms for DebtExchange Traded Funds (ETFs)/Index Funds. A small portion of the net assets will beinvested in TREPS / money market instruments permitted by SEBI / RBI.It may be noted that after the closure of the NFO Period, for pending deployment of thefunds of the Scheme, the Scheme may park the funds in short term deposits subject tothe following conditions issued by SEBI vide its circular SEBI/IMD/CIR No. 1/91171 /07dated April 16, 2007, SEBI/HO/IMD/DF4/CIR/P/2019/093 dated August 16, 2019 andSEBI/HO/IMD/DF2/CIR/P/2019/101 dated September 20, 2019.The scheme will not lend and borrow securities.The cumulative gross exposure through debt & other permitted securities/assets andsuch other securities/assets as may be permitted by the Board from time to time shouldnot exceed 100% of the net assets of the scheme subject to regulatory approvals if any.Maturity Date of the Scheme:The Scheme will mature on June 30, 2028. If such a Maturity Date is a non-BusinessDay, the subsequent Business Day shall be considered as the Maturity Date for theScheme.Change in Asset Allocation and Portfolio Rebalancing:Subject to the Regulations and below mentioned rebalance timelines, the asset allocationpattern indicated above may deviate depending on factors as follows:1. After the launch of the Scheme and until full deployment is achieved.2. In case if the Scheme is planning to participate in the primary issue on the EBPPlatform3. In case of the process of rebalancing of the portfolio in the following events:a. Event of credit rating changes,b. Corporate events,c. Generating liquidity for redemption proceeds/ IDCW pay-outIn the event that the asset allocation of the Scheme should deviate from the ranges asnoted in the asset allocation table above, then the Fund Manager will rebalance theportfolio of the Scheme to the position indicated in the asset allocation table above withina period of 7 days. Such changes in the asset allocation will be for short term anddefensive considerations. However, in case of deviation in the asset allocation beyond 7Days, the justification for the same shall be provided by the Fund Manager of the Schemeto the Investment Committee and the reason for the same shall be recorded in writing. Inthe interest of investors, the AMC reserves the right to change the above asset allocationpattern due to corporate action activity undertaken in the underlying securities. It may benoted that no prior intimation/indication will be given to investors when thecomposition/asset allocation pattern under the Scheme undergoes changes within thepermitted band as indicated above.5

Subject to the above, any change in the asset allocation affecting the investment profileof the Scheme shall be effected only in accordance with the provisions of sub regulation(15A) of Regulation 18 of the Regulations, as detailed later in this document.Tracking ErrorTracking Error is divergence of the performance (return) of the Fund’s portfolio from thatof the Underlying Index. Based on that the availability of issuances, it is expected that thePortfolio allocation could be different than that of underlying index allocation and couldresult in Tracking Error. That said, the risk parameters of the portfolio of the Scheme andunderlying index could be similar.The Fund will endeavor to keep the tracking error as low as possible. Under normalcircumstances, such tracking error is not expected to exceed 2% per annum.Tracking error could be the result of a variety of factors including but not limited to:a.b.c.d.Delay in the purchase or non- availability of securities which are part of the IndexDelay in liquidation of securities which have been removed by the IndexDue to timing of transactions either on RFQ platforms or in open marketDue to investment in out of index investments such as Repo in Governmentsecurities and TREPSe. Due to over-weight / under-weight investment in bonds of eligible issuers at ISINlevel whichare part of the Indexf. Due to mismatch in the weight of the issuers forming part of the Index and theScheme throughoutlife of the Scheme.g. Change in asset allocation between the Index and the Scheme in the last year ofthe Scheme.h. Difference in valuation of underlying bonds by the Index Provider and AMC’svaluation providers.Investment Strategy1. The Scheme seeks to track the Nifty SDL Plus G-Sec Jun 2028 30:70 Index subjectto tracking errors. Accordingly, the Scheme will invest in G-Secs and SDLs maturingwithin the maturity date of the Scheme. The Scheme is a Target Maturity Date IndexFund. It will mature on 30 June 2028 and will distribute all of its maturity proceeds(Net Assets) to the Unitholders within 10 (Ten) Business days from the date ofmaturity of the Scheme, in line with current regulatory timelines.2. The Scheme will follow Buy & Hold investment strategy in which existing bonds willbe held till maturity unless sold for meeting redemptions, payment of IDCW,rebalancing requirement or optimizing portfolio construction process.3. The portfolio of eligible securities invested by the Scheme is expected to have, inaggregate, fundamental characteristics such as modified duration, weighted averagematurity, aggregate credit ratings, aggregate Yield To Maturity (YTM) etc. along withother liquidity parameters in line with Nifty SDL Plus G-Sec Jun 2028 30:70 Index.The Scheme may or may not hold all of the eligible securities which are part of NiftySDL Plus G-Sec Jun 2028 30:70 Index, in line with SEBI circular no. SEBI/HO/IMD/DF3/CIR/P/2019/147 dated November 29, 2019. The Issuer weight of the Schemewill be in line with the Issuer weights in the Index subject to suitability and availabilityof the eligible G-Secs and SDLs from time to time.4. The Scheme may also participate in new issuances / private placement by the eligibleissuers which are currently not part of the index but will eventually get included in theindex during the next rebalancing period in line with SEBI circular no.SEBI/HO/IMD/DF3/CIR/P/2019/147 dated November 29, 2019. The Scheme mayparticipate in such issuances only if they meet all eligibility criteria as defined by theindex and suitable from asset allocation perspective and other parameters of theScheme.6

5. Further, the norms as indicated in para (1) of SEBI circular no.SEBI/HO/IMD/DF3/CIR/P/2019/147 dated November 29, 2019 reproduced belowshall be adopted for SDL portion of the index –(a) The constituents of the index shall be aggregated at issuer level.(b) The index shall have a minimum of 8 issuers.(c) No single issuer shall have more than 15% weight in the index.(d) The rating of the constituents of the index shall be investment grade.(e) The constituents of the index shall have a defined credit rating and definedmaturity as specified in the index methodology.6. The Scheme’s exposure to money market instruments will be in line with the assetallocation table.Risk Profile of the Mutual Fund Units involve investment risks including the possible loss of principal. Pleaseschemeread the SID carefully for details on risk factors before investment. Scheme specific RiskFactors are summarized below:1. Liquidity and Settlement Risk 2. Credit Risk 3. Term Structure of Interest Rates (TSIR)Risk 4. Re-investment Risk 5. Spread risk 6. Risks associated with the scheme (PassiveInvestments, Tracking Error Risk, Trade Execution Risk on RFQ Platforms) 7. RisksAssociated with exposure in Tri-party Repo 8. Risk Associated with Repo transactionsin Corporate Debt 9. Risks Associated with Transaction in Units Through StockExchange Mechanism 10. Risks associated with segregated portfolio 11. Additional RiskFactors for Foreign Portfolio Investors (Political Risk, Economic Risk, Foreign CurrencyRisk, Convertibility and Transferability Risk)RiskRisk Mitigants / Management strategyMarket RiskThe Scheme, being a Target Maturity Date index fund structure, isexpected to follow a Buy and Hold investment strategy in a passivemanner. Investors who remain invested until the maturity of theScheme are expected to mitigate intermittent market / volatility risk tolarge extent.Liquidity RiskThe Scheme intends to invest predominantly in government securities& SDLs issued by State governments. In general, governmentsecurities enjoy higher level of secondary market liquidity.Credit RiskThe Scheme intends to invest predominantly in government securities& SDLs issued by State governments. As a result the bond issued bythem are considered as relatively safe from a credit perspective. SDLsare issued and serviced by the RBI. SDLs are eligible for SLRinvestments.Term Structure The Scheme being passively managed and a Target Maturity Dateof Interest Rates index fund structure, is expected to follow a Buy and Hold investment(TSIR) Riskstrategy in a passive manner. All investments are within the maturitydate of the Scheme and the underlying Index.Types of instruments The corpus of the Scheme will invest in Securities which are constituents of Nifty SDLin which the Scheme Plus G-Sec Jun 2028 30:70 Index and in Money Market Instruments.shall investSubject to the Regulations, the corpus of the Scheme can be invested in any (but notexclusively) of the following securities:1. Investment in Government Securities: The Scheme would invest in G-Secscomprising part of Nifty SDL Plus G-Sec Jun 2028 30:70 Index and endeavor to trackthe benchmark index.7

2. Investment in State Development Loans (SDLs): The Scheme would invest inState Development Loans issued by State Governments, comprising part of NiftySDL Plus G-Sec Jun 2028 30:70 Index and endeavor to track the benchmark index.3. Investment in money market instruments: The Scheme may also invest in moneymarket instruments, in compliance with Regulations. Money Market Instruments willinclude Triparty REPO (TREPS), Commercial Paper, Certificates of Deposit,Treasury Bills, Bills Rediscounting, Repos, short-term Government securities andany other such short-term instruments as may be permitted by SEBI / RBI from timeto time.4. Any other securities / instruments as may be permitted by SEBI/ RBI from time totime, subject to regulatory approvals, if any.Investments in the Schemes of Mutual Fund:For the purpose of liquidity, the Scheme may invest in Liquid/Money Market Schemesmanaged by the same AMC or by the AMC of any other Mutual Fund without chargingany fees on such investments, provided that aggregate inter-scheme investment madeby all schemes managed by the same AMC or by the AMC of any other Mutual Fund shallnot exceed 5% of the net asset value of the Fund.Plans & OptionsPlansRegular PlanDirect PlanProcessing of Application Form/Transaction Request: The below table summarizesthe procedures which would be adopted while processing application form/transactionrequest by the AMC.SrNo.12345678AMFI Registration Number(ARN) Code/Direct/Blank asmentionedintheapplicationform/transaction requestNot mentionedNot mentionedNot an as selectedin the applicationform/transactionrequestTransaction shallbe processed andUnitsshallbeallotted underNot mentionedDirectRegularDirectNot MentionedRegularRegularNot MentionedDirect PlanDirect PlanDirect PlanDirect PlanDirect PlanDirect PlanRegular PlanRegular PlanIn cases of wrong/ invalid/ incomplete ARN codes mentioned on the application form,the application shall be processed under Regular Plan. The AMC shall contact andobtain the correct ARN code within 30 calendar days of the receipt of the applicationform from the investor/ distributor. In case, the correct code is not received within 30calendar days, the AMC shall reprocess the transaction under Direct Plan from thedate of application without any exit load.Options (under both the plans) Growth*Income Distribution cum Capital Withdrawal option (IDCW)8

Payout of Income Distribution cum Capital Withdrawal option (IDCW)Reinvestment of Income Distribution cum Capital Withdrawal option(IDCW)* default optionInvestors may note that under Income Distribution cum Capital Withdrawal options theamounts can be distributed out of investor’s capital (Equalization Reserve), which is partof sale price that represents realized gains.Applicable NAV (after Applicable NAV is as follows:the Scheme re-opensfor repurchase and(a) Purchase and Switch-insale)ParticularsApplicable NAVWhere the valid application is received upto cut-off time of 3.00p.m. on a business day at the official point(s) of acceptance andfunds for the entire amount of subscription/purchase areavailable for utilization upto 3.00 p.m. on the same BusinessDay.Closing NAV ofsameBusinessDayshallbeapplicableWhere the valid application is received upto cut-off time of 3.00p.m. on a business day at the official point(s) of acceptance andfunds for the entire amount of subscription/purchase areavailable for utilization after 3.00 p.m. on the same Business Dayor on any subsequent Business DayClosing NAV ofsuch subsequentBusiness Day onwhich the fundsare available forutilization prior to3.00 p.m.Where the valid application is received after cut-off time of 3.00p.m. on a business day at the official point(s) of acceptance andfunds for the entire amount of subscription/purchase areavailable for utilization upto 3.00 p.m. on the same BusinessDay.Closing NAV ofsubsequentBusiness Day shallbe applicable(b) Redemption /Switch-outParticularsApplicable NAVWhere the application is received on any Business Day at the NAV of the sameofficial points of acceptance of transactions upto 3.00 p.m.dayWhere the application is received after 3.00 p.m.NAV of the nextBusiness Day.Transaction through online facilities/ electronic mode: The time of transaction donethrough various online facilities/electronic modes offered by the AMC, for the purpose ofdetermining the applicability of NAV, would be the time when the request ofpurchase/sale/switch of units is received in the servers of AMC/RTA as per terms andconditions of such facilities.With respect to investors who transact through the stock exchange, ApplicableNAV shall be reckoned on the basis of the time stamping as evidenced byconfirmation slip given by stock exchange mechanism.9

Applicable Net Asset Value in case of Multiple applications/transactions receivedunder all open-ended Schemes of the Fund: All transactions as per conditionsmentioned below shall be aggregated and closing NAV of the day on which funds forrespective transaction (irrespective of source of funds) are available for utilization.1. All transactions received on same Business Day (as per cut-off timing and Timestamping rule).2. Aggregation of transactions shall be applicable to the Scheme.3. Transactions shall include purchases, additional purchases and exclude Switches,SIP/STP and trigger transactions.4. Aggregation of transactions shall be done on the basis of investor/s/Unit Holder/sPermanent Account Number (PAN). In case of joint holding in folios, transactionswith similar holding pattern will be aggregated. The principle followed for suchaggregation will be similar as applied for compilation of Consolidated AccountStatement (CAS).5. All transactions will be aggregated where investor holding pattern is same asstated in point no.4 above.6. Only transactions in the same Scheme of the Fund shall be clubbed. It will includetransactions at Plans/Options level (i.e. Regular Plan, Direct Plan, IDCW Option,Growth Option, etc).7. Transactions in the name of minor received through guardian will not beaggregated with the transaction in the name of same guardian. However, two ormore transactions in folios of a minor received through same guardian will beconsidered for aggregation.8. In the case funds are received on separate days and are available for utilization ondifferent business days before the cut off time, the applicable NAV shall be of theBusiness day/s on which the cleared funds are available for utilization for therespective application amount.9. Irrespective the date and time of debit to the customer bank accounts, the dateand time of actual credit in the Scheme’s bank account, which could be differentdue settlement cycle in the banking industry, would be considered for applicabilityof NAV.10. Investors are advised to make use of digital/electronic payment to transfer thefunds to the Scheme’s bank account.Minimum Application Rs. 500/-and any amount thereafterAmount /Number ofUnits (First purchaseandsubsequentpurchase)Minimum installment Rs. 500/forSystematicInvestment Plan (SIP)Minimum installment Rs. nsfer Plan (STP)(Applicable only duringContinuous Offer)Minimum Application N.A.Amount/ Number ofUnits for Repurchase/Redemption10

DespatchRepurchase(RedemptionRequest)of The Mutual Fund will endeavor to dispatch redemption proceeds within T 1 BusinessDays from the date of the acceptance of redemption request. However, as per SEBI (MF)Regulations, redemption proceeds shall be dispatched within 10 (ten) Business Daysfrom the date of such acceptance.Benchmark IndexNifty SDL Plus G-Sec Jun 2028 30:70 IndexIDCW PolicyThe Trustee envisages declaring a IDCW under the IDCW Option, and the distributionof IDCW and the frequency thereof are entirely at the discretion of the Trustee.Name of the Fund Mr. Laukik Bagwe- 44 Years. Tenure- -ManagersMr. Vikram Chopra- 43 Years. Tenure- -Name of the TrusteeCompanyDSP Trustee Private LimitedPerformance of the This is a new Scheme being launched and hence, there is no performance track record.SchemeDisclosure as per SEBI circular SEBI/HO/IMD/DF2/CIR/P/2016/42 dated March 18,2016:SCHEME PORTFOLIO HOLDING (TOP 10 HOLDINGS)Top 10 Holdings issuer wise% of SchemeThis being a new Scheme, hence not available.Link to the scheme’s latest monthly portfolio holding: NANote: The portfolio shall be available, once the portfolio has been constructed.SECTOR ALLOCATIONSector wise break upSectorThis being a new Scheme, hence not available.% of SchemePortfolio Turnover Ratio: This being a new Scheme, hence not available.Actual Expenses for Direct Plan: N.A being new scheme2020 -2021Regular Plan: N.A being new schemeExpensesofthe Entry Load – Not ApplicableSchemeExit Load – Nil(i) Load Structure(ii)RecurringExpensesParticularsAs a % of daily net assetsas perRegulation 52(6) (b)On total assets1.00%Notes to Table 1:11Additional TERasperRegulation 52(6A) (b) 0.30%

In addition to expenses as permissible under Regulation 52(6)(a)(ii), the AMC mayalso charge the following to the Scheme of the Fund under Regulation 52 (6A):a. Brokerage and transaction costs which are incurred for the purpose of execution oftrade and is included in the cost of investment, not exceeding 0.12 per cent in caseof cash market transactions.It is clarified that the brokerage and transaction cost incurred for the purpose ofexecution of trade over and above the said 0.12 percent for cash market transactionsmay be charged to the Scheme within the maximum limit of Total Expense Ratio(TER) as prescribed under regulation 52 of the SEBI (Mutual Funds) Regulations,1996.b. Additional expenses up to 0.30 per cent of daily net assets of the concernedSchemes of the Fund if new inflows from such cities as may be specified byRegulations from time to time are at least:i. 30 per cent of gross new inflows from retail investors* in the concerned Scheme,or;ii. 15 per cent of the average assets under management (year to date) of theconcerned Scheme, whichever is higher.Provided that if inflows from such cities is less than the higher of (i) or (ii) mentionedabove, such expenses on daily net assets of the concerned Scheme shall becharged on proportionate basis.* Inflows of amount upto Rs 2,00,000/- per transaction, by individual investors shallbe considered as inflows from “retail investors.The additional expenses charged shall be utilized for distribution expenses incurredfor bringing inflows from such cities. The additional expense charged to the Schemeon account of inflows from such cities shall be credited back to the concernedScheme in case such inflows are redeemed within a period of one year from the dateof investment.GST on investment and advisory fees:1. AMC may charge GST on investment and advisory fees of the Scheme inaddition to the maximum limit of TER as per the Regulation 52(6) and (6A).2. GST on expenses other than investment and advisory fees: AMC may chargeGST on expenses other than investment and advisory fees of the Scheme, if anywithin the maximum limit of TER as per the Regulation under 52(6) and (

DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund An open ended target maturity index fund investing in the constituents of Nifty SDL Plus G-Sec Jun 2028 30:70 Index. A relatively high interest rate risk and relatively low credit risk. This scheme is suitable for investor who are seeking* Income over long term