Transcription

Gold Coast Health PlanIts Reimbursements to Pharmacies Are Reasonable,but Its Pharmacy Benefits Manager Did Not AlwaysProcess Claims CorrectlyAugust 2019REPORT 2018‑124

CALIFORNIA STATE AUDITOR621 Capitol Mall, Suite 1200 Sacramento CA 95814916.445.0255 TTY 916.445.0033For complaints of state employee misconduct,contact us through the Whistleblower Hotline:1.800.952.5665Don’t want to miss any of our reports? Subscribe to our email list atauditor.ca.govFor questions regarding the contents of this report, please contact Margarita Fernández, Chief of Public Affairs, at 916.445.0255This report is also available online at www.auditor.ca.gov Alternative format reports available upon request Permission is granted to reproduce reports

Elaine M. Howle State AuditorAugust 15, 20192018‑124The Governor of CaliforniaPresident pro Tempore of the SenateSpeaker of the AssemblyState CapitolSacramento, California 95814Dear Governor and Legislative Leaders:As directed by the Joint Legislative Audit Committee, my office conducted an audit of Gold Coast HealthPlan's (Gold Coast) oversight of OptumRx, Inc. (OptumRx), the contractor that Gold Coast chose to serveas its pharmacy benefits manager (PBM). A PBM processes prescription drug claims on behalf of a healthplan. This report concludes that Gold Coast could have taken earlier action to address errors made byOptumRx when processing pharmacies’ prescription reimbursement claims. Further, although Gold Coast’sreimbursements may be lower than those of other comparable health plans, they are reasonable and alignwith the Department of Health Care Services’ (DHCS) encouragement to health plans that they achieveefficient and reasonable pharmacy benefits costs.OptumRx became Gold Coast’s PBM after Gold Coast issued a July 2015 request for proposals and conducteda thorough review of the proposals it received. Based on that review, Gold Coast recommended a PBM to theVentura County Medi‑Cal Managed Care Commission (commission), which created and oversees Gold Coast.However, the commission instead chose to award the contract to the lowest‑scoring vendor, OptumRx. Thecommission’s decision was largely because OptumRx offered the lowest cost, but the commission did notstate publicly its reason for making this decision, which made its selection process lack transparency.During its first year as Gold Coast’s PBM, OptumRx made three errors in its processing of pharmacies’prescription reimbursement claims, resulting in its overpayment of thousands of claims by a total of more than 6 million. Although Gold Coast took steps to understand the cause of the errors, it could have taken formalaction earlier to address the first error, which may have prevented subsequent errors from occurring.After OptumRx began providing services, independent pharmacies complained that its reimbursements weretoo low. We did find that OptumRx’s reimbursements were often significantly less than other comparablehealth plans; however, these lower amounts align with DHCS’ encouragement to Gold Coast to achieveefficient and reasonable pharmacy benefits costs. Gold Coast also contracted with a consultant to assessOptumRx’s reimbursements, and the consultant found that OptumRx’s reimbursements were within marketvalue of health plans in California and nationwide. Finally, Gold Coast has maintained a network of pharmaciesthat provide its beneficiaries with access to pharmacy services within 10 miles or 30 minutes from their placesof residence, as required by state law. Taking these factors into consideration, we conclude that OptumRx’sreimbursements were reasonable for the period we reviewed.Respectfully submitted,ELAINE M. HOWLE, CPACalifornia State Auditor621 Capitol Mall, Suite 1200 Sacramento, CA 95814 916.445.0255 916.327.0019 fax w w w. a u d i t o r. c a . g o v

ivReport 2018-124 C ALIFO R N IA S TAT E AUD I TO RAugust 2019Selected Abbreviations Used in This ReportCOHSCounty Organized Health SystemcommissionVentura County Medi-Cal Managed Care CommissionDHCSDepartment of Health Care ServicesGold CoastGold Coast Health PlanPBMpharmacy benefits managerPSAOPharmacy Services Administrative OrganizationRFPrequest for proposal

C ALIFO R N IA S TAT E AUD I TO R Report 2018-124August 2019CONTENTSSummary1Introduction3The Commission Chose Its Current PBM Primarily to AddressGold Coast’s High Pharmacy Benefits Costs7Gold Coast Could Have Addressed Errors Made by OptumRx Earlier13Although OptumRx’s Reimbursements May Be Lower ThanThose of Some Comparable Health Plans, They Are Reasonable21Other Areas We Reviewed28AppendixScope and Methodology31Responses to the AuditDepartment of Health Care Services35Gold Coast Health Plan37California State Auditor’s Comment on the Response FromGold Coast Health Plan39v

viReport 2018-124 C ALIFO R N IA S TAT E AUD I TO RAugust 2019Blank page inserted for reproduction purposes only.

C ALIFO R N IA S TAT E AUD I TO R Report 2018-124August 2019SUMMARYGold Coast Health Plan (Gold Coast) oversees the provision of health care servicesto Medi‑Cal beneficiaries in Ventura County, including the provision of pharmacyprescription services. In 2015 Gold Coast developed a request for proposals (RFP)for a new contractor to negotiate with pharmacies and process their prescriptionreimbursement claims—known as a pharmacy benefits manager (PBM). Gold Coast dida thorough evaluation of the vendors’ responses to this RFP and accurately shared itsresults with the Ventura County Medi‑Cal Managed Care Commission (commission),which created and governs Gold Coast. However, rather than selecting the applicantthat Gold Coast recommended, the commission instead chose OptumRx, Inc.(OptumRx), largely because its prices were lowest. In its first year, OptumRx made someerrors that resulted in it overpaying pharmacies, and some independent pharmacieshave complained about OptumRx’s low reimbursements. However, we found thatthe reimbursements align with the State’s goals to achieve efficient and reasonableprescription benefits costs and an independent consultant’s determination that thereimbursements are reasonable. Our audit came to the following conclusions:The Commission Chose Its Current PBM Primarily to AddressGold Coast’s High Pharmacy Benefits CostsPage 7Gold Coast initiated its RFP process for a new PBM in response to theDepartment of Health Care Services’ (DHCS) identifying the potentialfor Gold Coast to achieve reductions in its pharmacy benefits costsin future years based on its assessments of historical costs. Accordingto DHCS, it encourages health plans such as Gold Coast to achieveefficient and reasonable pharmacy benefits costs. Commissioners whovoted to award OptumRx the PBM contract believed that OptumRx’sproposal would lower Gold Coast’s pharmacy benefits costs. However,because the commission did not make clear why it chose to award thePBM contract to OptumRx rather than the vendor that Gold Coastrecommended, the commission’s selection process lacked transparency.Gold Coast Could Have Addressed Errors Made by OptumRx EarlierDuring its first year as the PBM for Gold Coast, OptumRx madethree errors in its processing of pharmacies’ prescription reimbursementclaims. These errors resulted in OptumRx overpaying thousandsof claims by a total of more than 6 million. Although Gold Coasttook steps to better understand the cause of the errors, it delayedformally notifying OptumRx that its performance did not complywith contractual requirements and that it must address the source ofthe errors. Had Gold Coast taken prompt, formal action to address thefirst error, it might have prevented the subsequent errors from occurring.Page 131

2Report 2018-124 C ALIFO R N IA S TAT E AUD I TO RAugust 2019Page 21Although OptumRx’s Reimbursements May Be Lower Than Those ofSome Comparable Health Plans, They Are ReasonableShortly after OptumRx began providing services, a number of representativesof independent pharmacies in Gold Coast’s network expressed concernsabout the low reimbursements they were receiving for prescriptions theydispensed to Gold Coast beneficiaries. Some pharmacies reported that theselow reimbursements were causing them financial hardship, which couldlead them to close their businesses. We found that OptumRx generallyreimbursed pharmacies significantly less than comparable plans for a selectionof medications; however, this result aligns with DHCS’ encouragement ofGold Coast to achieve efficient and reasonable pharmacy benefits costs.Further, when Gold Coast contracted with a consultant to assess OptumRx’sreimbursements, the consultant concluded that OptumRx’s reimbursementswere within market value of the reimbursements for health plans in Californiaand nationwide. Although two pharmacies in Gold Coast’s network have closedsince OptumRx began providing services, Gold Coast’s beneficiaries havecontinued to have access to pharmacies within the time and distance standardsset in state law. Taking all of these factors into consideration, we conclude thatOptumRx’s reimbursements for the period we reviewed were reasonable.Other Areas We ReviewedWe assessed potential conflicts of interest associated with Gold Coast’s RFPprocess for selecting a new PBM and the extent to which Gold Coast consideredthe best interests of pharmacies during its RFP process. We did not identifyany conflicts of interest. Further, although neither federal nor state law requiredGold Coast to consider pharmacies’ business and financial interests during the RFPprocess, Gold Coast stated that it considered pharmacy interests in some instances.Specifically, Gold Coast required vendors to describe their processes for addressingpharmacy complaints and appeals related to prescription reimbursements.Summary of RecommendationsTo ensure that the public clearly understands the commission’s decisions, thecommission should report its reasoning for awarding contracts or the legalbasis, if any, for choosing not to do so.To ensure that it addresses any significant performance issues by its contractorsin a timely manner, Gold Coast should establish a process to immediatelyrequire contractors to take necessary corrective action to resolve issues andensure that they do not recur.Agency CommentsGold Coast did not agree with our first recommendation, asserting that thecommission is under no legal obligation to provide more information about itscontracting decisions, but it did agree to implement our second recommendation.

C ALIFO R N IA S TAT E AUD I TO R Report 2018-124August 2019INTRODUCTIONBackgroundThe Centers for Medicare & Medicaid Services administers the federal Medicaidprogram that provides medical assistance to certain low‑income individuals andfamilies who meet federal and state eligibility requirements. California participatesin the federal Medicaid program through its California Medical Assistance Program,known as Medi‑Cal, and the Department of Health Care Services (DHCS) is thesingle state agency responsible for administering Medi‑Cal. Medi‑Cal providesbeneficiaries with a safety net of health care services, including prescription drugs,hospitalization, emergency care, and mental health treatment. As of November 2018,the Medi‑Cal program provided services to about 13 million beneficiaries—nearlyone‑third of Californians. During fiscal year 2018–19, the Governor’s budget allottedDHCS more than 102 billion, of which over 21 billion came from the State’sGeneral Fund.Medi‑Cal Managed Care ModelsThe State provides Medi‑Cal benefits through one of two delivery systems:fee‑for‑service or managed care. Under fee‑for‑service, medical providers bill DHCSdirectly for approved services they provide to Medi‑Cal beneficiaries. UnderMedi‑Cal managed care, DHCS contracts with Medi‑Cal managed care health plans(health plans) and pays each a monthly capitation rate (premium)—an amount perperson covered—to provide health care to the Medi‑Cal beneficiaries who areenrolled in the health plan. Managed care is considered a cost‑effective system thatemphasizes primary and preventive care. DHCS estimates that more than 80 percentof Medi‑Cal beneficiaries receive services under the managed care delivery system,while the remaining beneficiaries receive care under fee‑for‑service. The State’ssignificant use of managed care is a result of itsfocus on shifting beneficiaries out of fee‑for‑serviceMedi-Cal Managed Care Modelsand into a lower‑cost system.Available in CaliforniaThe health plan options available to a beneficiarydepend on the county in which the beneficiary resides.Each county participates in one of six Medi‑Calmanaged care models, which the text box describes:County Organized Health System (COHS),Geographic Managed Care, Two‑Plan, Regional,Imperial, and San Benito. Although DHCS hasoverall responsibility for Medi‑Cal, state lawidentifies counties as the entities responsible forlocal administration of Medi‑Cal. Ventura Countyparticipates in Medi‑Cal through a COHS Model.Specifically, DHCS contracts with the Gold CoastHealth Plan (Gold Coast), which the VenturaCounty Medi‑Cal Managed Care Commission(commission) created.COHS—DHCS contracts with a health plan created by thecounty board of supervisors.Regional—DHCS contracts with two commercial plans.Two-Plan—DHCS contracts with a county-organized planand a commercial plan.Geographic Managed Care—DHCS contracts with severalcommercial plans.Imperial—DHCS contracts with two commercial plansin Imperial County, one with county oversight.San Benito—DHCS contracts with one commercial planin San Benito County.Source: DHCS’ Medi-Cal Managed Care Program Fact Sheet.3

4Report 2018-124 C ALIFO R N IA S TAT E AUD I TO RAugust 2019The Commission and Gold CoastDesignated Commission Members: Two private hospital/health care system representatives. Three practicing physician representatives, withone nominated by Clinicas Del Camino Real, an organizationproviding health care services to underserved populations. Ventura County Medical Center HealthSystem representative. County of Ventura representative. Ventura County Board of Supervisors representative. Clinicas Del Camino Real representative. Ventura County Health Care Agency representative. Medi-Cal beneficiary representative.Source: County ordinance.In 2009 the Ventura County Board of Supervisors(board) created the commission. In 2011DHCS began contracting with the commissionto administer health care benefits to the200,000 Medi‑Cal beneficiaries who live inVentura County. As the text box indicates, thecommission is a public body of 11 members,including representatives from local health careproviders. The commission holds regular publicmeetings at which it discusses issues such ascontractual relationships, employee appointments,and grants.In 2010 the commission created Gold Coast, apublic entity, to oversee the Medi‑Cal programin Ventura County and to provide health careservices to Medi‑Cal beneficiaries. Gold Coastprovides many services, including primary care and pharmacyservices. Gold Coast manages these services through its staff andtwo administrative contractors. One contractor oversees Gold Coast’sadministrative services, which include processing claims receivedfrom medical providers and responding to beneficiary concerns.The other contractor is responsible for administering Gold Coast’spharmacy benefits. Specifically, Gold Coast provides prescriptiondrugs and associated services to its beneficiaries by contracting witha pharmacy benefits manager (PBM).Pharmacy Benefits Management at Gold CoastUnder the terms of its contract with Gold Coast, the current PBM,OptumRx, Inc. (OptumRx), processes prescription claims on behalfof Gold Coast, which is a standard practice for both commercialand public health plans. OptumRx manages the administrative andlogistical services that make the transactions possible whenpharmacies fill prescriptions for beneficiaries. For example,OptumRx establishes contractual relationships with pharmaciesand pharmacy services administrative organizations (PSAOs) toset reimbursements for specific medications. When a beneficiaryattempts to obtain a medication, the pharmacy submits a claimto OptumRx. If OptumRx verifies that the beneficiary is eligibleand the medication is covered by Gold Coast, then OptumRxreimburses the pharmacy for the medication and pays a dispensingfee. Twice each month, Gold Coast reimburses OptumRx for theamount it pays the pharmacies. In part, health plans contract withPBMs because administering pharmacy benefits can be complexand resource‑intensive.

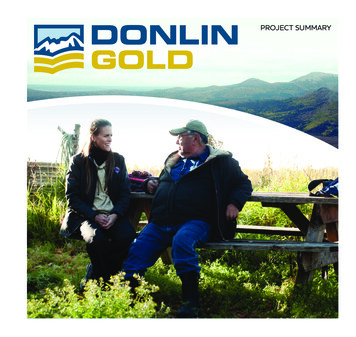

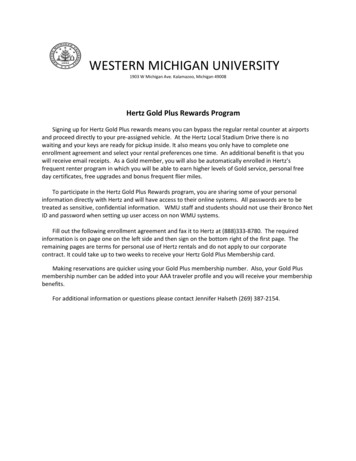

C ALIFO R N IA S TAT E AUD I TO R Report 2018-124August 2019As Gold Coast’s PBM, OptumRx contracts with a variety ofpharmacies and PSAOs across Ventura County. OptumRx overseesall direct relationships with the pharmacies, while Gold Coast hasauthority for overseeing OptumRx and its compliance with contractrequirements. As Figure 1 indicates, OptumRx has establishedrelationships with large chain pharmacies, such as WalMart andCVS, as well as with independent pharmacies that are not a partof such national chains. In Ventura County, the independentpharmacies generally belong to one of four PSAOs, which serve asintermediaries between the member pharmacies and OptumRx.The PSAOs manage contractual relationships and disputes withOptumRx on behalf of their member pharmacies and thereforeare responsible for many of the pharmacies’ financial and businessinterests. In 2018 Gold Coast’s pharmacy network within VenturaCounty included 52 independent pharmacies, or 33 percent of thetotal pharmacies, and 104 chain pharmacies.Gold Coast requires its PBM to establish a network of pharmaciesthat provides prescription services for Medi‑Cal beneficiaries incompliance with state and federal law. Specifically, state law requiresthat health plans must establish a network that includes pharmacieswithin 10 miles or 30 minutes’ driving distance of all beneficiaries.Although this requirement in state law became effective onlyin 2018, federal law and Gold Coast’s contract with DHCS requiredGold Coast to provide adequate access to these services for muchlonger. To demonstrate compliance with this standard, Gold Coastsubmits pharmacy network data to DHCS using information thatOptumRx provides.Governor’s Executive Order Regarding Medi‑Cal Pharmacy ServicesIn January 2019, the Governor issued an executive order regardingthe accessibility and affordability of prescription medications underMedi‑Cal. This executive order aims to generate substantial annualsavings for the State by transitioning Medi‑Cal pharmacy servicesfrom managed care to a system in which the State is the singlepayer for all medications that pharmacies dispense to Medi‑Calbeneficiaries. The goal of the executive order is to leverage theState’s purchasing power to obtain better prices on prescriptionmedications for Medi‑Cal beneficiaries. To this end, the executiveorder directs that by July 2019, DHCS review state purchasinginitiatives and consider options that will increase the State’sbargaining power for the Medi‑Cal program. According to DHCS,it completed this review and submitted it to the Governor. Further,the executive order directs the State to implement bulk purchasingof prescription medications. As a result of this order, the Statewill likely take on the role of PBM for all Medi‑Cal health plans inCalifornia, including Gold Coast’s program.5

6Report 2018-124 C ALIFO R N IA S TAT E AUD I TO RAugust 2019Figure 1Gold Coast Provides Pharmacy Services to Beneficiaries Through OptumRxRCONTCONTRACTACTHEALTH CARE PROVIDERSPBM, PHARMACIES, AND PSAOsMANUFACTURERSAND SUPPLIERSDHCScontracts withGold Coastcontracts withService providers(such as doctorsand hospitals)provide coveredservices tocontracts withOptumRxnegotiatesdiscounts from(PBM)negotiates reimbursementrates withChain pharmacies(such as CVSand WalMart)sell medications tosupplymedications toMedi-CalbeneficiariesPharmaceuticalsuppliersFour PSAOsact on behalf ofprovide pharmacyservices toPharmaceuticaldrug manufacturerssupplymedications toIndependentpharmaciesSource: Contracts between Gold Coast and DHCS and between Gold Coast and OptumRx; interviews with Gold Coast; and the U.S. GovernmentAccountability Office’s report titled Prescription Drugs: The Number, Role, and Ownership of PSAOs, January 2013.

C ALIFO R N IA S TAT E AUD I TO R Report 2018-124August 2019The Commission Chose Its Current PBM Primarilyto Address Gold Coast’s High PharmacyBenefits CostsKey Points DHCS encouraged Gold Coast to achieve efficiencies in its pharmacy benefitscosts, which contributed to Gold Coast seeking a new PBM that could offermore cost‑effective services. Although Gold Coast implemented a thorough request for proposal (RFP)process to solicit a new PBM, the commission did not choose the vendorthat Gold Coast recommended; instead, it selected the lowest‑scoring vendorprimarily because this vendor offered the lowest costs. The commission did notpublicly disclose the reasons for its decision, thereby limiting its transparency.Gold Coast Was Justified in Seeking a New PBM to Reduce CostsAs part of its oversight of health plans, DHCS contracts with an actuary to setthe premiums it will pay to those health plans. To assist with setting a health plan’sfuture premiums, the actuary conducts annual assessments of the plan’s historicalpharmacy benefits costs to identify any future reductions in costs the health plancould realize with generic medications. In other words, the actuary uses the actualpharmacy benefits costs that a plan paid in a previous year to identify areas wherethat plan could pay less for pharmacy benefits in a future year, given the expectedchanges in generic medication costs. The assessment compares the health plan’spharmacy costs for generic medications to national benchmark prices. Accordingto DHCS, it has historically applied these assessments to generic medications ratherthan to brand name medications because the focus of the national benchmarkshas been on generic medications and because more price variation tends to existbetween generic medications. Health plans can monitor these price variations toachieve pharmacy cost efficiencies, when possible.Through its annual reviews of Gold Coast’s costs, DHCS identified potentialreductions in costs that Gold Coast could achieve in the future related to pharmacybenefits. According to DHCS, it encourages health plans, such as Gold Coast, toachieve efficient and reasonable pharmacy benefits costs through its annual processof setting premiums. During DHCS’ annual assessments of costs in calendaryears 2012 through 2016, its actuary identified the potential for Gold Coast to achievereductions in cost in future years based on its assessment of historical costs. Thisperiod coincided with management of Gold Coast’s pharmacy benefits by its formerPBM, Script Care, Ltd. (Script Care). DHCS’ actuary used the potential reductions itidentified during these annual reviews in setting Gold Coast’s annual premiums for7

8Report 2018-124 C ALIFO R N IA S TAT E AUD I TO RAugust 2019fiscal years 2014–15 through 2018–19.1 According to Gold Coast’sestimates, DHCS’ actuarial assessments resulted in it receivingnearly 11 million less in premiums than it otherwise would haveover these five fiscal years.In response to the effect that DHCS’ assessments had onits premiums, Gold Coast proposed to the commission inNovember 2014 that it start a competitive RFP process for anew PBM to ensure that its pharmacy costs were in line withmarket rates. In its presentation to the commission about its RFP,Gold Coast explained that its contract with Script Care wouldterminate in June 2016. It also noted that its increased pharmacybenefits costs as a portion of its total health care costs hadresulted in increased oversight by DHCS. In addition, Gold Coastspecified in its RFP that it was seeking a PBM that would workcollaboratively with it to continuously improve beneficiaries’customer service experience and health status while offeringcost‑effective solutions related to pharmacy benefits.The Commission Chose the Lowest‑Scoring PBM Rather Than theVendor That Gold Coast RecommendedTo obtain more competitive pricing for its pharmacy benefits,Gold Coast issued an RFP in July 2015 to solicit proposals fromPBMs. The RFP reflected Gold Coast’s intention to identifycost‑effective solutions for its pharmacy benefits. For instance,the RFP included certain aspects of pricing accountability, suchas requiring the vendors to agree to disclose the definition andclassification of medications for which Gold Coast would receivethe value of the PBM’s negotiated discounts, rebates, credits, orother financial benefits. The RFP also required the vendors to agreeto contract terms that specified expectations for performance.Gold Coast conducted a thorough review of the proposalsit received in response to its RFP and included appropriatecategories in its review. Gold Coast received responses fromthree vendors: Magellan Health, Inc. (Magellan); OptumRx; andits then‑current PBM, Script Care. Several Gold Coast staff withspecialized industry knowledge of pharmacy benefits servicesand other health care fields were responsible for scoring theproposals. For example, Gold Coast’s director of pharmacy, aregistered pharmacist, scored several categories related to the1The actuary’s annual assessment includes a review of historical calendar year data to determinepremiums for the future fiscal years. For example, the actuary used calendar year 2015 data toassess whether Gold Coast could achieve any potential pharmacy benefits cost savings in fiscalyear 2017–18. As of May 2019, the actuary had not certified its assessment of calendar year 2017data for fiscal year 2019–20 premiums.

C ALIFO R N IA S TAT E AUD I TO R Report 2018-124August 2019pharmacy network, while Gold Coast’s procurement officerscored the categories related to contract terms and conditions andthe statement of work. Gold Coast divided its evaluation of theproposals into two components. The first component focused onqualitative factors, including factors concerning network access andbeneficiary services. The second component related to quantitativefactors, including whether the vendor agreed to certain contractterms and conditions, such as a three‑year contract and annualcontract renewal subject to satisfactory performance thereafter.We found that Gold Coast generally used reasonable weightswhen calculating the scores of the proposals and that it accuratelypresented the results of its review to the commission. As Table 1shows, Gold Coast identified Magellan as the highest‑scoringvendor, with a total score of 96.5. Magellan’s score exceeded thatof the lowest‑scoring vendor, OptumRx, by more than 10 points.In September 2016, Gold Coast presented these results to thecommission for its consideration in deciding which vendor wouldreceive the PBM contract. Based on our review of Gold Coast’spresentation of those results, Gold Coast provided relevant andaccurate information to the commissioners for their consideration.Table 1Gold Coast Recommended Awarding the PBM Contract to theHighest‑Scoring ApplicantVENDORS’ SCORESSECTION WEIGHTSMAGELLANSCRIPT CAREOPTUMRxQualitative analysis45%43.5137.7935.82Quantitative analysis55%52.9952.0950.45Overall score100%96.5089.8886.27Source: Gold Coast’s presentation to the commission.Although Gold Coast recommended that the commission awardthe PBM contract to Magellan, the commission awarded thecontract to the lowest‑scoring vendor, OptumRx. After Gold Coastpresented the vendor scores to the commission, each of thethree vendors made formal presentations to the commissionregarding their proposals. Following these presentations andsome discussion, the commission adjourned into a closed sessionto discuss pricing issues; under state law, these pricing issues arenot required to be disclosed to the public. Ultimately, as Figure 2shows, five commission members—each affiliated with Ventura9

10Report 2018-124 C ALIFO R N IA S TAT E AUD I TO RAugust 2019County—voted in September 2016 to award the PBM contract toOptumRx. The remaining four commission members who werepresent, including those representing the private hospital system,voted against the decision. Although state law does not requirepublic disclosure of the commission’s discussion regarding thevendors’ pricing, the commission at least should have disclosedits own overall evaluative process for transparency purposes.Instead, we found that the commission’s meeting minutes and anaudio recording of the meeting did not include reasoning as towhy five of the nine commissioners voted against Gold Coast’srecommendation to award the contract to Magellan.Figure 2County‑Affiliated Commissioners Voted to Award the PBM Provider Contract to OptumRx in September 2016County-affiliated commissionersCounty officialPracticing physician(Ventura County MedicalCenter Health Systemrepresentative)Commissioner votedin favor of OptumRxClinicas DelCamino Realchief of businessdevelopmentPrivate hospitalpresidentCounty of VenturarepresentativeCommissioner votedagainst OptumRxPracticing physician(Clinicas Del CaminoReal representative)Ventura CountyMedical CenterHealth SystemrepresentativeRepresentativefrom County Boardof SupervisorsCommissioner absentfrom votePrivate hospitalpresidentPracticing physicianSource: Commission meeting minutes, selected statements of economic interests, and documentation from Gold Coast.Note: At the time of the vote, the position of Medi-Cal beneficiary representative was vacant. Consequently, we did not include this position in Figure 2.

C ALIFO R N IA S TAT E AUD I TO R Report 2018-124August 2019Because of the limited information available on the commission’sdecision, we interviewed seven of the nine commissioners who werepresent during the vote.2 The commissioners who voted in favorof OptumRx and who respo

Gold Coast Health Plan 37 California State Auditor's Comment on the Response From Gold Coast Health Plan 39. vi Report 2018-124 CALIFORNIA STATE AUDITOR . families who meet federal and state eligibility requirements. California participates in the federal Medicaid program through its California Medical Assistance Program,