Transcription

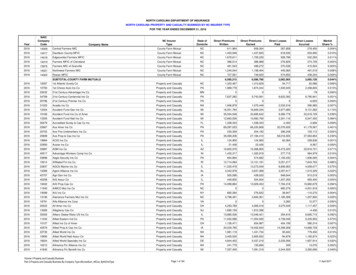

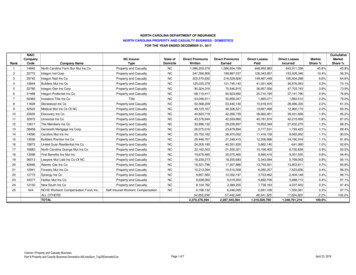

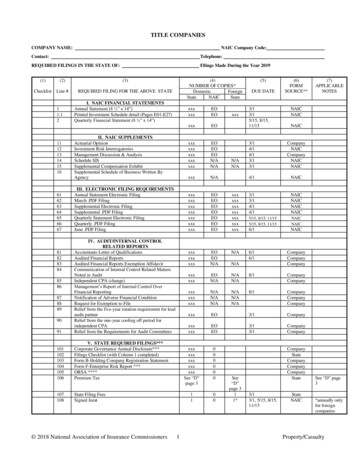

TITLE COMPANIESCOMPANY NAME:NAIC Company Code:Contact:Telephone:REQUIRED FILINGS IN THE STATE OF:Filings Made During the Year 2019(1)(2)(3)ChecklistLine #REQUIRED FILING FOR THE ABOVE STATE11.1211121314151661626364656667I. NAIC FINANCIAL STATEMENTSAnnual Statement (8 ½” x 14”)Printed Investment Schedule detail (Pages E01-E27)Quarterly Financial Statement (8 ½” x 14”)II. NAIC SUPPLEMENTSActuarial OpinionInvestment Risk InterrogatoriesManagement Discussion & AnalysisSchedule SISSupplemental Compensation ExhibitSupplemental Schedule of Business Written ByAgencyIII. ELECTRONIC FILING REQUIREMENTSAnnual Statement Electronic FilingMarch .PDF FilingSupplemental Electronic FilingSupplemental .PDF FilingQuarterly Statement Electronic FilingQuarterly .PDF FilingJune .PDF Filing91IV. AUDIT/INTERNAL CONTROLRELATED REPORTSAccountants Letter of QualificationsAudited Financial ReportsAudited Financial Reports Exemption AffidavitCommunication of Internal Control Related MattersNoted in AuditIndependent CPA (change)Management’s Report of Internal Control OverFinancial ReportingNotification of Adverse Financial ConditionRequest for Exemption to FileRelief from the five-year rotation requirement for leadaudit partnerRelief from the one-year cooling off period forindependent CPARelief from the Requirements for Audit Committees101102103104105106V. STATE REQUIRED FILINGS***Corporate Governance Annual Disclosure***Filings Checklist (with Column 1 completed)Form B-Holding Company Registration StatementForm F-Enterprise Risk Report ***ORSA ****Premium Tax107108State Filing FeesSigned Jurat81828384858687888990(4)NUMBER OF COPIES*DomesticForeignStateNAICState 2018 National Association of Insurance Commissioners1(5)DUE DATE(6)FORMSOURCE**xxxxxxEOEOxxxEO3/13/15/15, 3/14/14/1NAICNAICNAICNAIC5/15, 8/15, 11/155/15, 8/15, xxxxxxxxxxxSee “D”page 30000001100xxxN/AN/AN/ASee“D”page tate3/13/1, 5/15, 8/15,11/15(7)APPLICABLENOTESStateNAICSee “D” page3*annually onlyfor foreigncompaniesProperty/Casualty

(1)(2)(3)ChecklistLine #REQUIRED FILING FOR THE ABOVE STATE109Certificate of Compliance110111Certificate of Deposit112113114115116117(4)NUMBER OF OURCE**(7)APPLICABLENOTES3/1, 5/15, 8/15,11/15State*required forforeigncompanies ifdeposit held inKYStateStateDUE DATE100010Affidavit Covering Finance CommitteeSchedule of Miscellaneous Investments (Form 460 and 470)000000Reconciliation and Summary of Assets and ReserveRequirements (Form 480)Direct Business Page (State Page)Direct Economic Impact of KY Captive During CurrentReporting Year (Form Cl-150) Captive RRGs OnlyCertificate of Advertising (Form 440)0003/13/1, 5/15, 8/15,11/153/13/1, 5/15, 8/15,11/153/1KY EOKY EO10003/13/1NAICState1013/1StateDetail Listing of Securities Held Under Safekeeping (Form143)StateStateState*If XXX appears in this column, this state does not require this filing, if hard copy is filed with the state of domicile and if the data is filed electronicallywith the NAIC. If N/A appears in this column, the filing is required with the domiciliary state. EO (electronic only filing).**If Form Source is NAIC, the form should be obtained from the appropriate vendor.***For those states that have adopted the NAIC Corporate Governance Annual Disclosure Model Act, an annual disclosure is required of all insurersor insurance groups by June 1. The Corporate Governance Annual Disclosure is a state filing only and should not be submitted by the company tothe NAIC. Note however that this filing is intended to be submitted to the lead state if filed at the insurance group level. For more information onlead states, see the following NAIC URL: http://www.naic.org/public lead state report.htm.****For those states that have adopted the NAIC updated Holding Company Model Act, a Form F Filing is required annually by holding companygroups. Consistent with the Form B filing requirements, the Form F is a state filing only and should not be submitted by the company to the NAIC.Note however that this filing is intended to be submitted to the lead state. For more information on lead states, see the following NAIC URL:http://www.naic.org/public lead state report.htm*****For those states that have adopted the NAIC Risk Management and Own Risk and Solvency Assessment Model Act, a summary report isrequired annually by insurers and insurance groups above a specified premium threshold. The ORSA Summary Report is a state filing only andshould not be submitted by the company to the NAIC. Note however that this filing is intended to be submitted to the lead state if filed at the insurancegroup level. For more information on lead states, see the following NAIC URL: http://www.naic.org/public lead state report.htm2

.ANOTES AND INSTRUCTIONS (A-K APPLY TO ALLFILINGS)Required Filings Contact Person:Kentucky Department of InsuranceFinancial Standards and Examination Division215 West Main Street, P.O. Box 517Frankfort, KY 40601Phone Number: 502-564-6082Division e-mail: DOI.FinancialStandardsMail@ky.govBCMailing Address for KY ELECTRONIC, Hand orOvernight delivery:Kentucky Department of Insurance215 West Main St.Frankfort, KY 40601Attn. Financial Standards & Examination DivisionContacts:Primary: Rodney HugleRodney.Hugle@ky.govSecondary: Sandra BattsSandra. Batts@ky.govPhone Number: 502-564-6082Division e-mailDOI.FinancialStandardsMail@ky.govMailing Address for Regular Mail:Kentucky Department of InsuranceP.O. Box 517Frankfort, KY 40602- 0517Attn. Financial Standards & ExaminationDivisionDivision e-mailDOI.FinancialStandardsMail@ky.govDivision e-mailDOI.FinancialStandardsMail@ky.govMailing Address for Filing Fees: RENEWAL FEESPAID ONLINERenewal fees paid online.Other fees mailed to the address above.To pay online, click on Eservices on the DOI website(http://insurance.ky.gov/). Your Annual Statementcontact person should have the appropriate“USERNAME”and “PASSWORD” to process the payment.DMailing Address for Premium Tax Payments: (seebelow)Premium tax forms can be accessed on the Dept. ofRevenue’s website (http://revenue.ky.gov/forms)Click on “Current Year Forms.”NOTE:Please DO NOT SubmitPREMIUM TAX payments to the KY Departmentof Insurance.Post Office Box:Department of RevenueP.O. Box 1303Frankfort, KY 40602-1303ORPhysical Address:Department of Revenue501 High StreetFrankfort, KY 40601Phone Number: 502-564-4810EDelivery Instructions: PAY ATTENTION TO YOURDEADLINES3ALL filings must be postmarked no later thanthe indicated due date, regardless of the duedate falling on a weekend or holiday.

FLate Filings: FINES FOR LATE FILINGSGOriginal Signatures: REQUIRED FOR DOMESTICCOMPANIESCompanies will be fined 100 per day forALL late filings, even in situations where arequest for extension has been received inwriting and approved. For all late filingsreceived WITHOUT extension approval, andadditional civil penalty of 1,000 may beassessed.Original signatures are required on ALLfilings from domestic companies.Foreign companies should follow the NAICAnnual Statement Instructions ication:REQUIRED BY KENTUCKY STATUTEPer KRS 304.3-240(1)-shall be verified byoaths of a least two (2) of the insurers’principal officers.IAmended Filings: APPLIES TO DOMESTICCOMPANIES ONLYFor domestic companies, amended items mustbe filed within ten (10) days of theamendment, along with an explanation of theamendment. Same applies for original filingswhere signatures are required.JExceptions from normal filings:Domestic companies should apply for anexemption or extension at least thirty (30)days prior to the filing due date.Foreign companies MUST supply a writtencopy of any exemption or extension, receivedby their state of domicile, at least ten (10)days prior to their filing due date to receiveapproval of an exemption or extension fromthe Kentucky Department of Insurance.KBar Codes (State or NAIC):REFER TO http://insurance.ky.gov/Please follow the NAIC Annual StatementInstructions provided on the KentuckyDepartment of Insurance website.LSigned Jurat:Kentucky REQUIRES Foreign companies tofile a copy of aSigned Jurat Page by March 1 as part of theirAnnual Statement Filings.MNONE Filings:Please follow the NAIC Annual StatementInstructions provided on the KentuckyDepartment of Insurance website.REFER TO http://insurance.ky.gov/NFilings new, discontinued or modified materially sincelast year:4For ALL companies, please see “Note P” and“Note Q” below. Domestics, please refer to“Note R.”

ONotification of Adverse Financial ConditionNotice of Adverse Financial Condition is duefive (5) business days after receipt of theaccountant’s report and must be sent to theKentucky Department of Insurance EarlyWarning Analyst (EWA):Sandra Batts, EWAKentucky Department of InsuranceP.O. Box 517Frankfort, KY 40602-0517PKentucky Annual Filing Instructions:REFER TO http://insurance.ky.gov/QCompany’s Responsibility to Review/Update theirInformation onFor additional instructions, please see theattached Kentucky Annual Filing Instructionslisted on the Kentucky Department ofInsurance website. The instructions shouldappear directly above the NAIC checklistsprovided for each type of entity.All companies should refer to the KentuckyDepartment of Insurance website under“Company Info” to review and verify theircompany information. If corrections orupdates need to be made, companies shouldnotify the Kentucky Department of Insuranceby submitting the appropriate form(s) on theNAIC UCAA Corporation AmendmentsApplication.Kentucky Department of Insurance website:Please be advised:Website address http://insurance.ky.gov/*the Form 12 – deals with changes to theService of Process*the Form 14 – deals with address changes*Biographical affidavitsshould ONLY be submitted for NEWPresidentsRActuarial Opinion Summary: REQUIRED FROMDOMESTICSSDirect Economic Impact of Kentucky Captive DuringCurrent Reporting Year (Form CI-150): FOR“DOMESTIC” RISK RETENTION GROUPS ONLY5All domestic companies are required to filethe Actuarial Opinion Summary. Only one(1) copy of the summary is needed and stampthe envelope “confidential.”Note S pertains to domestic risk retentiongroups.

General InstructionsFor Companies to Use ChecklistPleaseNote:This state’s instructions for companies to file with the NAIC are included in this Checklist. TheNAIC will not be sending their own checklist this year.Electronic Filing is intended to be filing(s) submitted to the NAIC via the NAIC Internet FilingSite which eliminates the need for a company to submit diskettes or CD-ROM to the NAIC.Companies are not required to file hard copy filings with the NAIC.Column (1)ChecklistCompanies may use the checklist to submit to a state, if the state requests it. Companies should copythe checklist and place an “x” in this column when mailing information to the state.Column (2)Line #Line # refers to a standard filing number used for easy reference. This line number may change fromyear to year.Column (3)Required FilingsName of item or form to be filed.The Annual Statement Electronic Filing includes the annual statement data and all supplements dueMarch 1, per the Annual Statement Instructions. This includes all detail investment schedules andother supplements for which the Annual Statement Instructions exempt printed detail.The March.PDF Filing is the .pdf file for annual statement data, detail for investment schedules andsupplements due March 1.The Risk-Based Capital Electronic Filing includes all risk-based capital data.The Risk-Based Capital.PDF Filing is the .pdf file for risk-based capital data.The Supplemental Electronic Filing includes all supplements due April 1, per the Annual StatementInstructions.The Supplemental.PDF Filing is the .pdf file for all supplemental schedules and exhibits due April 1.The Quarterly Electronic Filing includes the complete quarterly filing and the PDF files for allquarterly data.The Quarterly.PDF Filing is the .pdf file for quarterly statement data.The June.PDF Filing is the .pdf file for the Audited Financial Statements and Accountants Letter ofQualifications.6

Column (4)Number of CopiesIndicates the number of copies that each foreign or domestic company is required to file for each typeof form. The Blanks (EX) Task Force modified the 1999 Annual Statement Instructions to waive paperfilings of certain NAIC supplements and certain investment schedule detail, if such investmentschedule data is available to the states via the NAIC database. The checklists reflect this action takenby the Blanks (EX) Task Force. XXX appears in the “Number of Copies” “Foreign” column for theappropriate schedules and exhibits. Some states have chosen to waive printed quarterly and annualstatements from their foreign insurers and have chosen to rely upon the NAIC database for thesefilings. This waiver could include supplemental annual statement filings. The XXX in thiscolumn might signify that the state has waived the paper filing of the annual statement and allsupplements.Column (5)Due DateIndicates the date on which the company must file the form.Column (6)Form SourceThis column contains one of three words: “NAIC,” “State,” or “Company,” If this column contains“NAIC,” the company must obtain the forms from the appropriate vendor. If this column contains“State,” the state will provide the forms with the filing instructions (generally, on the state web site). Ifthis column contains “Company,” the company, or its representative (e.g., its CPA firm), is expected toprovide the form based upon the appropriate state instructions or the NAIC Annual StatementInstructions.Column (7)Applicable NotesThis column contains references to the Notes to the Instructions that apply to each item listed on thechecklist. The company should carefully read these notes before submitting a filing.7

Noted in Audit xxx EO N/A 8/1 Company 85 Independent CPA (change) xxx N/A N/A Company 86 Management's Report of Internal Control Over Financial Reporting xxx N/A N/A 8/1 Company 87 Notification of Adverse Financial Condition xxx N/A N/A Company 88 Request for Exemption to File xxx N/A N/A Company .