Transcription

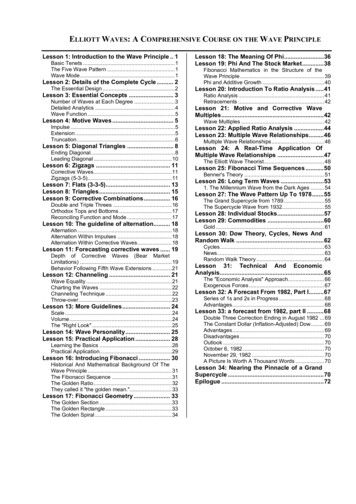

ELLIOTT WAVES: A COMPREHENSIVE COURSE ON THE WAVE PRINCIPLELesson 1: Introduction to the Wave Principle . 1Basic Tenets .1The Five Wave Pattern .1Wave Mode.1Lesson 18: The Meaning Of Phi.36Lesson 19: Phi And The Stock Market.38Lesson 2: Details of the Complete Cycle . 2Fibonacci Mathematics in the Structure of theWave Principle. 39Phi and Additive Growth . 40The Essential Design .2Lesson 20: Introduction To Ratio Analysis .41Lesson 3: Essential Concepts . 3Number of Waves at Each Degree .3Detailed Analytics .4Wave Function .5Lesson 4: Motive Waves . 5Ratio Analysis . 41Retracements . 42Lesson 21: Motive and Corrective WaveMultiples.42Wave Multiples . 42Impulse .5Extension .5Truncation.6Lesson 22: Applied Ratio Analysis .44Lesson 23: Multiple Wave Relationships.46Lesson 5: Diagonal Triangles . 8Lesson 24: A Real-Time Application OfMultiple Wave Relationships .47Ending Diagonal.8Leading Diagonal .10Lesson 6: Zigzags . 11Corrective Waves.11Zigzags (5-3-5).11Lesson 7: Flats (3-3-5). 13Lesson 8: Triangles. 15Lesson 9: Corrective Combinations. 16Double and Triple Threes .16Orthodox Tops and Bottoms .17Reconciling Function and Mode.17Lesson 10: The guideline of alternation. 18Alternation.18Alternation Within Impulses .18Alternation Within Corrective Waves.18Lesson 11: Forecasting corrective waves . 19Depth of Corrective Waves (Bear MarketLimitations) .19Behavior Following Fifth Wave Extensions .21Lesson 12: Channeling . 21Wave Equality .21Charting the Waves .22Channeling Technique .22Throw-over.23Lesson 13: More Guidelines. 24Scale.24Volume.24The "Right Look" .25Lesson 14: Wave Personality. 25Lesson 15: Practical Application . 28Learning the Basics .28Practical Application.29Lesson 16: Introducing Fibonacci . 30Historical And Mathematical Background Of TheWave Principle .31The Fibonacci Sequence .31The Golden Ratio.32They called it "the golden mean.".33Lesson 17: Fibonacci Geometry . 33The Golden Section .33The Golden Rectangle .33The Golden Spiral .34Multiple Wave Relationships. 46The Elliott Wave Theorist. 48Lesson 25: Fibonacci Time Sequences .50Benner's Theory . 51Lesson 26: Long Term Waves .531. The Millennium Wave from the Dark Ages . 54Lesson 27: The Wave Pattern Up To 1978.55The Grand Supercycle from 1789. 55The Supercycle Wave from 1932. 55Lesson 28: Individual Stocks.57Lesson 29: Commodities .60Gold . 61Lesson 30: Dow Theory, Cycles, News AndRandom Walk .62Cycles. 63News. 63Random Walk Theory . 64Lesson 31: Technical And EconomicAnalysis.65The "Economic Analysis" Approach. 66Exogenous Forces. 67Lesson 32: A Forecast From 1982, Part I.67Series of 1s and 2s in Progress . 68Advantages.68Lesson 33: a forecast from 1982, part II .68Double Three Correction Ending in August 1982 . 69The Constant Dollar (Inflation-Adjusted) Dow. 69Advantages.69Disadvantages . 70Outlook . 70October 6, 1982 . 70November 29, 1982 . 70A Picture Is Worth A Thousand Words . 70Lesson 34: Nearing the Pinnacle of a GrandSupercycle .70Epilogue .72

2

1Lesson 1: Introduction to the Wave PrincipleIn The Elliott Wave Principle — A Critical Appraisal, Hamilton Bolton made this opening statement:As we have advanced through some of the most unpredictable economic climate imaginable, coveringdepression, major war, and postwar reconstruction and boom, I have noted how well Elliott's Wave Principle has fittedinto the facts of life as they have developed, and have accordingly gained more confidence that this Principle has a goodquotient of basic value."The Wave Principle" is Ralph Nelson Elliott's discovery that social, or crowd, behavior trends and reverses inrecognizable patterns. Using stock market data as his main research tool, Elliott discovered that the ever-changing pathof stock market prices reveals a structural design that in turn reflects a basic harmony found in nature. From thisdiscovery, he developed a rational system of market analysis. Elliott isolated thirteen patterns of movement, or "waves,"that recur in market price data and are repetitive in form, but are not necessarily repetitive in time or amplitude. Henamed, defined and illustrated the patterns. He then described how these structures link together to form larger versionsof those same patterns, how they in turn link to form identical patterns of the next larger size, and so on. In a nutshell,then, the Wave Principle is a catalog of price patterns and an explanation of where these forms are likely to occur in theoverall path of market development. Elliott's descriptions constitute a set of empirically derived rules and guidelines forinterpreting market action. Elliott claimed predictive value for The Wave Principle, which now bears the name, "The ElliottWave Principle." Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecastingtool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amountof knowledge about the market's position within the behavioral continuum and therefore about its probable ensuing path.The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both abasis for disciplined thinking and a perspective on the market's general position and outlook. At times, its accuracy inidentifying, and even anticipating, changes in direction is almost unbelievable. Many areas of mass human activity followthe Wave Principle, but the stock market is where it is most popularly applied. Indeed, the stock market considered aloneis far more important than it seems to casual observers. The level of aggregate stock prices is a direct and immediatemeasure of the popular valuation of man's total productive capability. That this valuation has form is a fact of profoundimplications that will ultimately revolutionize the social sciences. That, however, is a discussion for another time.R.N. Elliott's genius consisted of a wonderfully disciplined mental process, suited to studying charts of the DowJones Industrial Average and its predecessors with such thoroughness and precision that he could construct a networkof principles that covered all market action known to him up to the mid-1940s. At that time, with the Dow in the 100s,Elliott predicted a great bull market for the next several decades that would exceed all expectations at a time when mostinvestors felt it impossible that the Dow could even better its 1929 peak. As we shall see, phenomenal stock marketforecasts, some of pinpoint accuracy years in advance, have accompanied the history of the application of the ElliottWave approach.Elliott had theories regarding the origin and meaning of the patterns he discovered, which we will present andexpand upon in Lessons 16-19. Until then, suffice it to say that the patterns described in Lessons 1-15 have stood thetest of time.Often one will hear several different interpretations of the market's Elliott Wave status, especially when cursory,off-the-cuff studies of the averages are made by latter day experts.However, most uncertainties can be avoided by keeping charts on both arithmetic and semilogarithmic scale andby taking care to follow the rules and guidelines as laid down in this course. Welcome to the world of Elliott.Basic TenetsUnder the Wave Principle, every market decision is both produced by meaningful information and producesmeaningful information. Each transaction, while at once an effect, enters the fabric of the market and, by communicatingtransactional data to investors, joins the chain of causes of others' behavior. This feedback loop is governed by man'ssocial nature, and since he has such a nature, the process generates forms. As the forms are repetitive, they havepredictive value.Sometimes the market appears to reflect outside conditions and events, but at other times it is entirely detachedfrom what most people assume are causal conditions. The reason is that the market has a law of its own. It is notpropelled by the linear causality to which one becomes accustomed in the everyday experiences of life. Nor is the marketthe cyclically rhythmic machine that some declare it to be. Nevertheless, its movement reflects a structured formalprogression.That progression unfolds in waves. Waves are patterns of directional movement. More specifically, a wave is anyone of the patterns that naturally occur under the Wave Principle, as described in Lessons 1-9 of this course.The Five Wave PatternIn markets, progress ultimately takes the form of five waves of a specific structure. Three of these waves, whichare labeled 1, 3 and 5, actually effect the directional movement. They are separated by two countertrend interruptions,which are labeled 2 and 4, as shown in Figure 1-1. The two interruptions are apparently a requisite for overall directionalmovement to occur.R.N. Elliott did not specifically state that there is only one overriding form, the "five wave" pattern, but that isundeniably the case. At any time, the market may be identified as being somewhere in the basic five wave pattern at thelargest degree of trend. Because the five wave pattern is the overriding form of market progress, all other patterns aresubsumed by it.Wave ModeThere are two modes of wave development: motive and corrective. Motive waves have a five wave structure,while corrective waves have a three wave structure or a variation thereof. Motive mode is employed by both the fivewave pattern of Figure 1-1 and its same-directional components, i.e., waves 1, 3 and 5. Their structures are called

2"motive" because they powerfully impel the market. Corrective mode is employed by all countertrend interruptions, whichinclude waves 2 and 4 in Figure 1-1. Their structures are called "corrective" because they can accomplish only a partialretracement, or "correction," of the progress achieved by any preceding motive wave. Thus, the two modes arefundamentally different, both in their roles and in their construction, as will be detailed throughout this course.53142Figure 1-1Lesson 2: Details of the Complete CycleIn his 1938 book, The Wave Princi

In The Elliott Wave Principle — A Critical Appraisal, Hamilton Bolton made this opening statement: As we have advanced through some of the most unpredictable economic climate imaginable, covering depression, major war, and postwar reconstruction and boom, I have noted how well Elliott's Wave Principle has fitted into the facts of life as they have developed, and have accordingly gained more .File Size: 2MBPage Count: 74Explore furtherElliott Wave Principle - Rules & Guidelines.pdf DocDroidwww.docdroid.netAdvanced Elliott wave Analysis Trading Strategy - Patterns .bullwaves.orgThe most understandable explanation of the Elliott Wave .trendlizard.comElliot Wave Cheat Sheet - Elevate Your Tradingwww.elevateyourtrading.comThe Elliott Wave Theory Technical Analysis Essential .financestrategysystem.comRecommended to you based on what's popular Feedback