Transcription

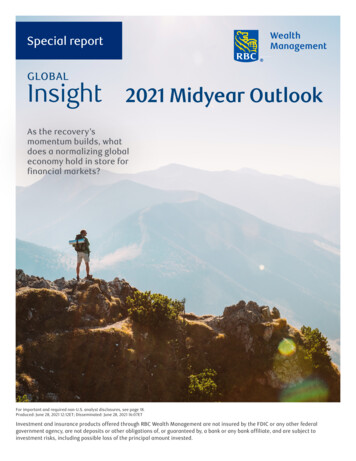

Special reportGLOBALInsight2021 Midyear OutlookAs the recovery’smomentum builds, whatdoes a normalizing globaleconomy hold in store forfinancial markets?For important and required non-U.S. analyst disclosures, see page 18.Produced: June 28, 2021 12:12ET; Disseminated: June 28, 2021 16:07ETInvestment and insurance products offered through RBC Wealth Management are not insured by the FDIC or any other federalgovernment agency, are not deposits or other obligations of, or guaranteed by, a bank or any bank affiliate, and are subject toinvestment risks, including possible loss of the principal amount invested.

GLOBALInsight2021 Midyear OutlookCONTENTS3Global equity: Green light for economy and marketsAs we enter H2 2021, all signs point to a continued economic improvement andno recession in the immediate future. Although a correction is always possible,we don’t view one as inevitable.9Global fixed income: The event horizonThe prospect of the Federal Reserve tightening monetary policy has swungback into view, prompting market volatility and raising concerns about supportfor the global recovery. Will the Fed’s policy moves encourage global centralbanks to follow suit?IN THE MARKETSAll values in U.S. dollars and priced asof market close, June 24, 2021, unlessotherwise stated.3Global equity6Regional equity9Global fixed income12Regional fixed income15Commodities16Currencies

Page 3 of 20Global Insight 2021 Midyear OutlookGLOBALEquityJim AllworthVancouver, Canadajim.allworth@rbc.comGreen light for economy andmarketsIn our view, nothing that hastranspired in the past six monthshas fundamentally changed ouroutlook for the remainder of 2021or for 2022. We expect all of thedeveloped economies, led by the U.S.,will post above-average GDP growthcompared to last year’s slump. Absenta vigorous return of the pandemic,the momentum provided by repeatedapplications of fiscal stimulusfrom governments—supportedby entrenched accommodativemonetary policies—should keep mosteconomies powering on through nextyear and probably beyond. Robustgrowth this year followed by slower,but still above-average growth nextyear looks to be the likely outcome.For the all-important U.S. economy,this view is supported by oureconomic recession scorecard. All sixof the leading indicators of recessionwe track are giving the economy adecisive green light, and are strongenough to suggest that even an “earlywarning” phase lies a long way off.Looking at just one of theseindicators, we note that the fedfunds rate has almost always risenabove the nominal growth rate ofthe economy (i.e., the rate beforeadjusting for inflation) before arecession gets underway. The yearover-year nominal growth rate ofthe U.S. economy was 2.7% as of Q1,is rising sharply, and should be inthe 9% neighbourhood by year end,slowing to 6% by the end of 2022. Inorder for the fed funds rate to riseabove that 6% level, and risk inducinga recession, the Fed would need toraise rates a by one-quarter point24 times—a nearly inconceivablescenario, in our view, especiallybecause the Fed sees no rateincreases before 2023.In our view, the next recession, whenit eventually arrives, will likely betriggered the good old-fashionedway—by a tightening of creditconditions sufficient to make interestrates prohibitively expensive andbanks more cautious about lending.However, no tightening of thatmagnitude appears nearby.No recession on the horizonRecessions are the enemy of theequity investor, as they have alwaysformed the economic backdropassociated with bear markets. SoU.S. recession scorecardStatusIndicatorYield curve (10-year to 1-year Treasuries)Unemployment claimsUnemployment rateConference Board Leading IndexISM New Orders minus InventoriesFed funds rate vs. nominal GDP growthSource - RBC Wealth ManagementExpansion NeutralRecessionary

Page 4 of 20Global Insight 2021 Midyear OutlookGLOBAL EQUITYseeing a recession coming aheadof time is extremely useful from aportfolio-management perspective.We believe, as yet, and probably forsome time, no recession appears onthe horizon.While a bear market-inducingrecession may not be in the offinganytime soon, there is always thepotential for fears arising from agrowth slowdown to induce a marketcorrection. In several bull marketsover the past 70 years, such worrieshave led to a correction 12–18 monthsafter the start of the new economicadvance. However, these werealways eventually superseded byanother substantial leg up for theeconomy, corporate profits, and theequity market.History lessonsAnother way to plot the pathahead is suggested by Eric Savoie,investment strategist at RBC GlobalAsset Management Inc. He pointsout that in the U.S. there havebeen 17 Federal Reserve tighteningcycles since 1954, with eight of themproducing enough credit tighteningto bring on a recession.in each cycle, Savoie notes that themedian return for the S&P 500 overthat stretch was 16.8%. Switching tolook at what the market does in theyear after the first rate hike revealsa median return of an above-average9%.So, the year before the first rate hikeand the year after are both generallypretty good for the stock market. Ifthe Fed tightening cycle is going tocause trouble for the stock market,that trouble usually arrives a waysdown the road from the first ratehike, if it arrives at all, keeping inmind that nine Fed tightening cyclesproduced no recession or any equitybear market.The Fed, while always reserving theright to change its mind, has told usthere will be no rate hike before early2023. Counting backward one year,the historical probabilities wouldsuggest the stock market will deliverpositive, probably above-averagereturns for two consecutive yearsstarting in early 2022.Correction always possible,but not a givenOf course, even years that featureabove-average stock marketreturns can contain within themrocky periods of correction andLooking at equity marketperformance over the 12 monthsleading up to the first Fed rate hikeDon’t fear the rate hike; stocks can still rally as long as hikesdon’t trigger recessionsMedian S&P 500 level before and after first rate hikeNormalized, with level at first hike 1001401301201101009080706050-12 -10 -8 -6 -4 -202468 10 12 14 16 18 20 22 24Months prior to and following first Fed rate hikeNo recession cycles (9)Median of all cycles (17)Recession cycles (8)Worst (1973)Source - RBC Global Asset Management, RBC Wealth Management; data range: 1954-2018

Page 5 of 20Global Insight 2021 Midyear OutlookGLOBAL EQUITYconsolidation. It’s always possiblethat one lies just around the corner.As usual, there is a long list ofthings investors are worried about,including inflation, the pandemic,geopolitics, and severe weather(ranging from heavy rains to droughtconditions). In one sense, investorsare right to expect a correction,because they are not uncommon. Butthey rarely announce their arrival(or conclusion) in a timely enoughfashion to allow even a nimbleinvestor to wring much advantageout of that knowledge.Germany, France, and Canada, andimproving in the UK and Japan; Corporate bond yields remain verylow and access to credit plentiful;and Capital spending is extremelystrong, which is good news forproductivity and inflation.There are also plenty of factors thatwould argue against a correctionoccurring:It’s worth remembering that should amarket correction occur without anaccompanying downturn in economicactivity and corporate profits, theneven though share prices are fallingfor a few months, the intrinsic,underlying value of most businessesgoes on compounding upward at arate driven by earnings growth. Most economies are reopening asthe vaccine rollout diminishes theimpact of the pandemic;Global equities likely toadvance Earnings are very strong (GDPbased U.S. corporate profits arealready above their pre-pandemicpeak) and forward-year earningsestimates have been revisedsharply higher over the past sixmonths (S&P 500 by 15% and TSXby 13%); CEO confidence, as measured byThe Conference Board, is nearan 18-year high, while businessconfidence is high and rising inWe are left with a constructiveoutlook for global equities for thecoming 12 months. We expect theimpact of the pandemic will continueto subside over the remainder ofthis year and through 2022. Theforecast rising tide of GDP andearnings should permit broad marketindexes to advance further fromtoday’s levels. We recommend aglobal balanced portfolio remainmoderately Overweight equities.

Page 6 of 20Global Insight 2021 Midyear OutlookREGIONALEquityKelly BogdanovaSan Francisco, United Stateskelly.bogdanova@rbc.comSunny Singh, CFAToronto, Canadasunny.singh@rbc.comFrédérique CarrierLondon, United Kingdomfrederique.carrier@rbc.comJasmine DuanHong Kong, Chinajasmine.duan@rbc.comNicholas Gwee, CFASingaporenicholas.gwee@rbc.comUnited Statesn The S&P 500’s 90% surge fromthe deep COVID-19 crisis lows ofMarch 2020 through late-June is thestrongest post-trough rally of allrecovery periods that took placeduring similar time frames goingback to the 1960s. Now we thinkthe market is entering a transitionperiod—from that of a robust rallyphase to a two steps forward, onestep back phase that commonlytranspires when economic recoveriescome off of their initial boil.With the market’s “easy” gainslikely in the rearview mirror, we thinkfour interrelated issues will set thetone in the second half of this yearand into 2022: (1) inflation rateseasing down from high to less loftylevels, but remaining above-average;(2) the progression toward lessaccommodative Fed policies with thestart of the central bank’s taperingof asset purchases; (3) continuedabove-trend GDP growth, but at aslower pace; and (4) the shift fromultra-high earnings growth to morenormal growth rates.nn Uncertainties or periodic datacontradictions related to any one ofthese issues could create marketvolatility or pullbacks, but we thinkall four are manageable and will nothinder worthwhile market gains overthe next six to 12 months. Theearnings transition will come intofocus sooner rather than later, as wethink the upcoming Q2 2021 reportingseason will represent “peak growth,”or the high water mark of year-overyear earnings growth for thisbusiness cycle. But by no means dowe think it will mark the peakabsolute level of the S&P 500earnings—profits should marchhigher over the next year, at least. Wewould continue to hold modestlyOverweight positions in U.S. equitiesand still favor value sectors.Canadan Amidst recovery from lastyear’s recession, we expectabove-trend economic growthto disproportionately benefitthe traditionally economicallysensitive (cyclical) sectors withinequity markets. This view supportsa constructive stance towardsthe Canadian market given itscyclical orientation including largebenchmark weights in Financials(31%), Materials (13%), and Energy(12%). Moreover, the S&P/TSXComposite continues to trade ata significant discount relative tothe S&P 500. Discounts of similarmagnitude have historically resultedin positive relative returns for theCanadian equity market.n We maintain a positive view onCanadian banks in a benign creditenvironment. Last year’s provisionsU.S. earnings growth rate forecast to peak in 2021S&P 500 earnings growth y/y % change, 2021–2023 data is consensus 3.9%2019 2020 2021E 2022E 2023E-0.2%2014201520172018Source - RBC Wealth Management, FactSet; data through 6/25/21

Page 7 of 20Global Insight 2021 Midyear OutlookREGIONAL EQUITYEquity viewsRegionCurrentGlobal United States Canada Continental Europe United Kingdom Asia (ex Japan) Japan Overweight; Market Weight; – UnderweightSource - RBC Wealth Managementfor potential loan losses appear tohave been overly conservative in thewake of massive government supportand the ensuing rapid economicrecovery. We believe investorfocus over the next year will be onimproving consumer loan growthand margin trends as the domesticvaccination campaign advancesfurther, arguably justifying greaterliberalization of virus containmentmeasures.n WTI crude oil prices toppedUS 70 per barrel in June. Therise has outpaced RBC CapitalMarkets’ already bullish viewon the commodity heading into2021, resulting in an increase inits forecast for average prices toUS 72.27 per barrel in 2022 fromUS 63 per barrel previously. Webelieve that valuations for Canadianoil producers, particularly thosewith integrated operations, remainattractive given their impressivefree cash flow generation potentialamid a supportive commodity pricebackdrop.n The key risks to the thesis onCanadian equities include, but arenot limited to, the potential for afourth COVID-19 wave on the backof increasing variant cases and/or slowdown in vaccinations, anappreciating U.S. dollar in thecontext of its potentially negativeimpact on commodity prices, and agreater-than-expected slowdown inthe Canadian real estate market.Europe & UKWe recently upgraded Europeanequities to Overweight, suggestinginvestors have an above benchmarkposition in the region. The EuropeanCommission’s efforts towards debtmutualisation—or sharing—via the 750 billion rescue package and theissuance of EU bonds to support therecovery should reduce systemic riskfor the region.nn Beyond this, the economy ispredictably bouncing back after along winter of lockdowns. The ECB’scommitment to a continued loosemonetary policy even as the Fedmoves toward tapering its bondbuying program in early 2022 willlikely cap gains in the euro currency,providing a tailwind to corporateearnings. Moreover, Europeanequities typically outperform wheneconomic activity is improvingdue to their comparatively highexposure to economically-sensitive(cyclical) sectors such as Financials,Industrials, Consumer Discretionary,and Materials.n The MSCI Europe ex UK Indextrades at a more than 20% discountto the S&P 500, but comes roughlyin line with it on a sector-adjustedbasis. We continue to favourthe Industrials and ConsumerDiscretionary sectors as we believethey are well-positioned to benefitfrom both an improving globaleconomy and long-term seculartrends.n The UK is also enjoying a robusteconomic rebound as the bulk ofCOVID-19 restrictions are being lifted.We advocate a Market Weight, orup to benchmark, position in UKequities. The FTSE All-Share’s priceto-earnings valuation is relativelycheap versus its historical average,and the index offers a dividend yieldof over 3%. In the medium term, UKeconomic growth might be cappedby a chancellor eager to balancethe nation’s books, and increasingtensions with the EU in regardsto the Northern Ireland protocol,a consequence of the Brexit dealpassed by the UK parliament.We would take a balancedapproach to UK equities bymaintaining exposure to qualityUK international companies thattrade at what we perceive as anunduly large valuation discount tooverseas-listed peers; and by holdingpositions in the beneficiaries of adomestic economic recovery, suchas Financials and consumer-focuseddomestic stocks, the latter of whichare underpinned by pent-up demandmeeting high levels of consumersavings.n

Page 8 of 20Global Insight 2021 Midyear OutlookAsia-PacificREGIONAL EQUITYn We expect China equities to staylargely range-bound in H2 2021.Policy normalization could capmarket upside in the near term as,historically, equity uptrends usuallyhave been accompanied by crediteasing cycles. We expect broadcredit growth will continue to slowdown in Q3 2021 and may stabilize inQ4. Tensions in U.S.-China relations,tighter-than-expected policy movesby authorities, and/or news relatedto antitrust investigations could addvolatility to the market.Company earnings reports arelikely to remain solid, which shouldprovide downside support for themarket. Sentiment may improveas the H1 2021 earnings seasonapproaches. For the second half ofthe year, we expect MSCI China toreport high-teens earnings growth.nn Despite some short-termheadwinds, we remain constructiveon China equities as we seeattractive longer-term secularopportunities that should coincidewith the economic reopening andtransition. We prefer quality valuestocks such as leading banks andindustrial companies. We also likeleading consumer staples playersand recovery beneficiaries. Inaddition, we think this is a goodopportunity to accumulate qualitynew economy stocks.n Japan equities underperformeddeveloped markets in Q2. In thenear term, we believe the marketcould play catch-up as economicactivity rebounds on the back offaster vaccination rates. Also,valuations are less stretched thanbefore, earnings revisions remain inpositive territory, and we see scopefor upside surprises to forwardearnings estimates. But for a timeframe beyond three months, we thinkJapan equities could be stuck in arange as growth in the global moneysupply starts to slow as centralbanks’ monetary easing graduallyloses momentum, which couldlead to a higher risk premium forJapanese stocks. Meanwhile, USD/JPYmovement may also dampen foreigninvestors’ appetite.Asian equity markets, year to datePerformance indexed to r-21May-21MSCI Asia Pacific, ex JapanSource - RBC Wealth Management, FactSet; data through 6/25/21Jun-21MSCI China

Page 9 of 20Global Insight 2021 Midyear OutlookGLOBALFixed incomeThomas Garretson, CFAMinneapolis, United Statestom.garretson@rbc.comThe event horizonOnce beyond view for investors,the prospect of the Federal Reservetightening monetary policy has nowswung back across the market’s eventhorizon and into the observableuniverse, reintroducing volatility tomarkets and raising concerns aboutcentral bank support for the globaleconomic recovery. On top of that,will the Fed’s looming policy movesset the stage for other global centralbanks to follow suit?projection of the 18 members of theFederal Open Market Committee(FOMC) now indicating the potentialfor two rate hikes in 2023, up fromzero previously. Markets took thosetwo developments together as a signFed policymakers may seeinflationary pressures as likely toprove more persistent than they hadpreviously let on. Not surprisingly, theunexpectedly hawkish signals fromthe meeting reintroduced somevolatility into the market.Summer surpriseWe think that volatility will be alasting feature during the back half ofthe year, with markets likely to enterinto a game of “will they, won’t they”as they digest the Fed’s response toeach incoming data point on inflationand the labor market.At the halfway point of the year, theFed’s June meeting marked a pivotalpoint for policymakers as they beganformal discussion of plans to taperasset purchases. Progress towardemployment and inflation goalsappears to be sufficient for the Fed tobegin entertaining the idea of pullingback on the policy reins following thehistoric policy response to the globalpandemic.While the onset of the taperingprocess had been generally expectedto occur at some point this summer,what was less expected was that itwould be paired with a faster ratehike forecast, with the medianThat’s because the Fed has set somelofty goals in its effort to achieve“substantial further progress”on its inflation and employmenttargets. As of the June meeting, theFed’s projections are looking foran unemployment rate of 4.5% byyear’s end, from 5.8% currently, andfor headline PCE inflation to stillbe running at a 3.4% clip, roughlyunchanged from the 3.6% year-over-Central bank projections continue to show temporary inflationary pressuresU.S. PCE inflation y/y and euro area HICP inflation Dec-182% targetDec-19Dec-20Dec-21Euro area HICP inflation y/yDec-22Dec-23U.S. PCE inflation y/yNote: Dashed lines show central bank median forecastsSource - RBC Wealth Management, Bloomberg, Federal Reserve, European Central Bank

Page 10 of 20Global Insight 2021 Midyear OutlookGLOBAL FIXED INCOMEyear pace in the latest data fromApril. That’s a high bar, in our view, soit’s equally conceivable that recenthawkishness could turn back todovishness should the data not keeppace with expectations.In any event, we still expect the Fedto unveil a formal tapering plan inAugust or September, and to begincutting its monthly 120 billionin Treasury and mortgage bondpurchases in the first quarter of nextyear, with further monthly cuts overthe course of 2022—which ultimately,we think, will prove undisruptive formarkets.Keep an eye on yield curvesWe continue to monitor the shapeof the Treasury yield curve, as wesee it as one of the most reliablebarometers of the U.S. growthoutlook, a gauge of whether monetarypolicy is easy or tight, and a broadindicator of the overall stage of thebusiness cycle.While the yield curve garners themost attention when it inverts,or turns negative, ahead of risingrecession risks, we think the resteepening process at the earlystages of an economic recovery canbe just as important.The slope of the curve between10-year and 2-year Treasury yieldsrecently peaked at around 1.5%. That’sonly about half the slope typicallyachieved in the immediate aftermathof a recession, when 2-year yieldstend to drop along with Fed policyrate cuts while 10-year yields riseon recovering growth and inflationexpectations.Since the Fed’s seemingly hawkishpivot at the June meeting, the10-year/2-year curve has flattenedsignificantly, to just 1.2%, on acombination of higher 2-year yieldsdue to higher rate hike expectations,and lower 10-year yields as thosesame rate hike expectations may beseen as weighing on the economicoutlook. While we think the recentflattening will likely prove temporary,we would interpret further yieldcurve flattening as an indicator thatmarkets believe the Fed to be atrisk of removing monetary policyaccommodation prematurely.We continue to expect thatthe Fed will ultimately remainaccommodative, and believe thatyield curves are still in the process ofsteepening. Accordingly, we maintainour view that the benchmark 10-yearTreasury yield is headed toward arange of 1.75% to 2.00% by the endof the year, and that 2-year Treasuryyields will remain anchored aroundcurrent levels, as we don’t expect anyFed rate hikes until 2023.Central banks go their ownwaysAs the Fed charts its own pathforward, so too do many othermajor central banks as the pace ofvaccinations and economic recoveriesremain on different trajectories.Whereas the Fed appears to benearing the point of withdrawingsupport, the European Central Bank(ECB) has left its accelerated paceof asset purchases unchanged, withfew signs that it could be slowedmeaningfully in the months aheadeven as ECB policymakers have notedan improved economic outlook and areduction in downside risks.And that policy support is likelywarranted, in our view. The keydifference is that where the Fed seesinflation running just above its 2%target through 2023, the ECB stillforecasts inflation to fall well short ofits own 2% target through the sametime horizon. That may keep a lid onthe oft-watched German 10-year Bundyield, which recently came close toreturning above 0% for the first timesince 2019; RBC Capital Markets nowbelieves it will not breach that leveluntil the second quarter of next year.The Bank of Canada (BoC) has beenleading the pack in terms of dialingback policy support, cutting assetpurchases in April and signaling arate hike as early as next year. The

Page 11 of 20Global Insight 2021 Midyear OutlookGLOBAL FIXED INCOMEFed’s hawkish pivot may help easethe cross-border burden of divergentpolicy stances, allowing the BoC toremain on track. Finally, we think theBank of England is the least likely ofthe global central banks to make anymajor policy moves for the balanceof the year, as uncertainty remainsaround the true state of the UK labormarket’s recovery.Portfolio positioningThe action for the rest of 2021 islikely to play out in global sovereignyields as markets reprice centralbank expectations. Credit marketslargely reflect a benign environmentamid a robust economic outlook andvastly improved balance sheets, andvaluations across the board remainon the rich side relative to historicalaverages.In line with our expectation forsovereign yields to move higher,if only modestly, in most regions,we maintain neutral to relativelyshort views in terms of yield curvepositioning. With respect to creditmarkets, we remain comfortableadding some risk exposure in lowerrated credits to pick up incrementalyield, with preferred shares in manyregions still offering fairly attractiverisk-adjusted yields, in our view.Stay the courseAs central banks plot their variousroutes to the exits, we stress thatpolicy support will likely remainaccommodative to a historic degreefor quite some time, and we thinkany reduction in support will beapproached cautiously. There willundoubtedly be hiccups along theway as central bankers fine-tune theirmessages and plans—not to mentionongoing uncertainty around the pathof the global pandemic—but for all ofthe talk around central bank policychanges, we think they will ultimatelybe broadly supportive of markets overany reasonably foreseeable horizon.

Page 12 of 20Global Insight 2021 Midyear OutlookREGIONALFixed incomeThomas Garretson, CFAMinneapolis, United Statestom.garretson@rbc.comRyan HarderToronto, Canadaryan.harder@rbc.comRufaro Chiriseri, CFALondon, United Kingdomrufaro.chiriseri@rbc.comUnited Statesn At its June meeting, the FederalReserve formally opened discussionsaround the process of tapering itsongoing 120 billion per month inasset purchases, while now projectingtwo rate hikes by the end of 2023, upfrom zero at its March meeting. Thishawkish pivot surprised markets andre-introduced broad-based volatility,and while it may persist, we thinklittle has changed with respect tothe Fed outlook—policy will remainaccommodative for the economyand for markets for some time. Whiletapering plans will come into focuslater this year, we don’t expect theactual start until early next year,and that the window for rate hikes isunlikely to open before 2023.Though the benchmark 10-yearTreasury yield has fallen sharplyover the past month as the potentialfor tighter Fed policy has weighedon longer-term growth and inflationexpectations, we continue to expectyields to rise modestly through yearend as the Fed’s plans come into view,together with further progress on thefiscal spending front associated withthe various infrastructure plans. The10-year yield will likely head towardthe 1.75%–2.00% range.nCalvin NgHong Kong, Chinacalvin.ng@rbc.comn Credit market valuations continueto rise amid optimism around theeconomic outlook, the demand foryield, and easy credit market accessthat has allowed companies torefinance debt and boost liquidity.Investors in investment-gradecorporate bonds are now being paidjust 0.82% in incremental yield overTreasuries for associated credit risks,near the lowest levels of the past 20years. We continue to see value in thefixed-to-float preferred share marketwhere investors can add yield, whileadding protection via the fixed-tofloating rate coupon structure as theFed edges toward a potential rate hikecycle over the next couple of years.Canadan While preferred shares and highyield bonds have performed wellthis year, the yield premium offeredfor taking credit risk has remainedin a tight range in recent months,particularly for higher-qualityissuers. Those credit spreads havebeen kept unusually tight by veryaccommodative monetary policyand easy financial conditions; on theother hand, they have little room tonarrow further given credit spreadsare already hovering near historiclows. Outside of a significant reversalin the global fight against COVID-19,there is no obvious catalyst currentlythreatening this relatively benigncredit environment.n For this reason, we thinkdevelopments in underlyingInvestment-grade corporate bond, 10Y Treasury spread tightenU.S. investment-grade corporate bond & 10Y Treasury 19951998200120042007201020132016U.S. recessionU.S. investment-grade corporate bond yieldU.S. 10Y Treasury yieldSource - RBC Wealth Management, Bloomberg20190

Page 13 of 20Global Insight 2021 Midyear OutlookREGIONAL FIXED INCOMEFixed income viewsRegionGov’tbondsCorp.creditGlobal 5–7 yrUnitedStates 5–7 yrCanada 5–7 yrContinentalEurope 5–7 yrUnitedKingdom– 3–5 yrDuration Overweight; Market Weight; – UnderweightSource - RBC Wealth ManagementSovereign yield Y20Y10Y-0.5%1Y2Y5Y0.0%UKgovernment rates are likely toremain the key focus for fixedincome investors in the second halfof the year, which puts particularimportance on communication fromBank of Canada (BoC) Governor TiffMacklem going forward. The BoC’sstatements have positioned it asmarginally more aggressive than mostcentral banks; the Bank sees its firstrate hike occurring at some point inH2 2022, compared to 2023 for theFederal Reserve.n Expectations for higher ratesneed not push investors to remainin short-term bonds only. In fact, webelieve markets have already pricedrate hikes into intermediate-termbonds that are more aggressive thanBoC projections, anticipating twofull hikes over the course of H2 2021and H1 2022. These higher rate hikeexpectations provide some bufferto extend term, even in a rising rateenvironment.n With relatively little compensationfor credit risk, and price upsideconstrained in high-yield andpreferred shares, we believe modestlyextending term in government orhigh-quality corporate bonds withina neutral fixed income allocation isappropriate until pockets of valuebegin to reappear.Source - Bloomberg; data through 5/24/21Europe & UKn The European Central Bank (ECB)announced it would maintain thePandemic Emergency PurchaseProgramme (PEPP) at an elevatedpace for the next quarter to keepfinancing conditions favourable. Weexpect the ECB to keep rates on holdthis year, and markets are expectingrates to rise in late 2023—laggingother central banks in raising interestrates as the vaccination rollout andre-opening in

GLOBAL. Insight. 2021 Midyear Outlook. CONTENTS. 3. Global equity: Green light for economy and markets. As we enter H2 2021, all signs point to a continued economic improvement and . no recession in the immediate future. Although a correction is always possible, we don't view one as inevitable. 9. Global fixed income: The event horizon