Transcription

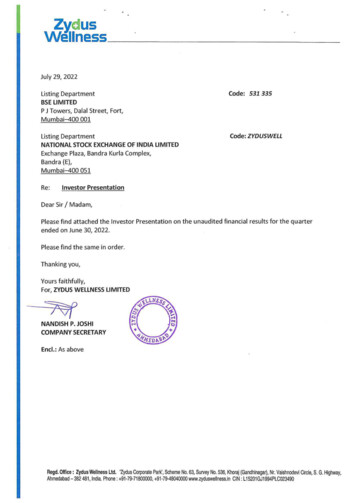

ZydusWellnessJuly 29, 2022Listing DepartmentBSE LIMITEDP J Towers, Dalal Street, Fort,Mumbai-400 001Code: 531 335Listing DepartmentNATIONAL STOCK EXCHANGE OF INDIA LIMITEDExchange Plaza, Bandra Kurla Complex,Bandra (E),Mumbai-400 051Code: ZYDUSWELLRe:Investor PresentationDear Sir/ Madam,Please find attached the Investor Presentation on the unaudited financial results for the quarterended on June 30, 2022.Please find the same in order.Thanking you,Yours faithfully,For, ZYDUS WELLNESS LIMITED i,\.\.NE ::,QNANDISH P. JOSHICOMPANY SECRETARY,,,.,-j -h:IbN :"1,y¾EDP."r Encl.: As aboveRegd. Office: Zydus Wellness Ltd. 'Zydus Corporate Park', Scheme No. 63, Survey No. 536, Khoraj (Gandhinagar), Nr. Vaishnodevi Circle, S. G. Highway,Ahmedabad - 382 481 , India. Phone: 91-79-71800000, 91 -79-48040000 www.zyduswellness.in CIN: L15201GJ1994PLC023490

Q1 FY23Earnings PresentationJuly 29, 2022

Safe Harbour StatementThis presentation contains certain forward-looking statements including those describing Zydus Wellness’sstrategies, strategic direction, objectives, future prospects, estimates etc. Investors are cautioned that“forward looking statements” are based on certain expectations, assumptions, anticipated developments andother factors over which Zydus Wellness exercises no control. Hence, there is no representation, guarantee orwarranty as to their accuracy, fairness or completeness of any information or opinion contained therein. ZydusWellness undertakes no obligation to publicly update or revise any forward-looking statement. Thesestatements involve a number of risks, uncertainties and other factors that could cause actual results orpositions to differ materially from those that may be projected or implied by these forward-lookingstatements. Such risks and uncertainties include, but are not limited to: growth, competition, domestic andinternational economic conditions affecting demand, supply and price conditions in the various businesses inZydus Wellness’s portfolio, changes in Government regulations, tax regimes and other statutes. This documentis a presentation and is not intended to be a prospectus or offer for sale of securities. ZydusWellness2

AgendaFinancial performance – Q1FY23Zydus Wellness :A leadingBusiness, Brand performanceConsumer WellnessCompany in IndiaThe Road aheadGlucon-D,Instant Energy ( Sugar\ Free N teeverY.f.tJ ./ ZydusWellness3

Q1 FY23 PerformanceINR MillionQ1 FY22Q1 FY23YoY Growth %2-Yr CAGRNet Sales5,8826,93017.8%13.7%Total Income from Operations5,9766,96816.6%13.9%Gross 5%10.0%Reported PAT1,3081,3704.7%23.9%Adjusted PAT1,3081,3997.0%25.2% Strong growth in summer season brands along with strong distribution and marketing efforts across brand portfolio resultedin the net sales growth of 17.8% (volume growth 10.3%) in the first quarter Gross margin sequentially improved by 352bps on the back of price increase, cost improvement measures and product mix.The gross margins declined by 70 bps YoY, due to inflationary pressures Incurred one-off expenditure of Rs.29 million on account of cessation of Sitarganj plant operations ZydusWellness4

Leaders in 5 out of 6 categoriesIncreased Penetration and InnovationsStrengthen “Energy” credential with new launches Category leading brand with 99% plus brand recall Surpassed 60%* market share milestone for the first time inmany yearsStrengthening core through Relaunch of the Brand Focused on scientifically proven claims on memory andconcentration and enhanced chocolate taste 1 lakh stores added since acquisitionReplacing sugar in all forms of ConsumptionsDoubling each year after launch India’s first low calorie sugar substitute with more than 95%market share Potential to be amongst top 3 global brands “Healthier Sugar” which is completely natural with 50% lesscalories than regular sugar Could be the next sizeable brand in sweeteners portfolioGrowing Faster than MarketA Leader getting stronger Growing faster than overall facial cleansing category Scrub Volume market share from 34.8% in 2018 to 42.7%* New launches in previous years – Body lotions and Aloe Gel Market leading brand with heritage of over 65 years Strengthening leadership with Volume market share from29.6% in 2018 to 37.6%*Building ‘Dairy Spread’ portfolio Leveraged milk sourcing to expand dairy segment withDoodhshakti Ghee in retail and institutional channels andPro-biotic Butter*As per MAT June 2022 Nielsen report ZydusWellness5

Brands Market Share update /( SugarNutraliteFree··#i¾&ihdiil./- - - - ---- - - ---- - - ---- - - ---- - - - CategoryDDDDDDDDDDMkt. RankMkt.Share %- ---- - - ---- - - ---- - 76.0NANAMarket share source: MAT June 2022 report as per Nielsen and IQVIA.*Everyuth market rank 5 is at Total Facial cleansing segment which includes Face wash, Scrub, Peel-off,face masks# Market rank as per company estimate ZydusWellness6

Quarterly - Brand performance update – HFD, Glucose PowderGlucon-D Strengthening core through Relaunch ofthe BrandCompton·Try Complan for1--------------------- -------- ------------------------ -------- -----------------II Continued slow down in the Health Foods Drink category compounded bydown-trading to LUP’s and lower priced ----------------------------------1I Key packs holding segment share. Focused interventions on increasing play insachet and pouches along with activations to drive distribution.I The brand’s market share stood at 4.8% in the Health Food Drink (HFD)category as per MAT June 2022 report of Nielsen The brand witnessed double digit growth led by revival in the marketdemand, which was absent during last two consecutive summers due tothe pandemic, and further supported by brand campaigns with celebrityPankaj Tripathi and consumer activations Launched 20 gm sachet for Glucon-D to drive consumer consumption andalso a new variant of “Kaccha Mango” in ImmunoVolt “Pack Palto, Farak Dekho” campaign highlights the superiority of protein overcompetition and has witnessed positive overall response in persuasion andconsideration scores. Strengthen “Energy” credential with newlaunchesIII Glucon-D maintained No. 1 position with a market share of 60.4%* in theGlucose powder category , 203bps over the same period last -----------------------ZydusWellness*As per MAT June 2022 Nielsen report7

Quarterly - Brand performance update – Personal CareGrowing Faster than MarketA Leader getting stronger' ---------------------------------- -------- -------- -------- - - - -,II Strong double-digit growth witnessed during the quarter. The brand wassupported by TV and digital campaigns for its sub-segments like face wash,scrubs and peel-offs1----------------I Everyuth Scrub maintained No. 1 position with a market share of 41.8% in thefacial scrub category, 511bps over the same period last yearr- ------- -------- ------------------------ -------- ---------------------- With the good onset of summer season, the Nycil brand witnessed astrong comeback and registered double-digit growth Supported with aggressive TV campaigns and on ground activation todrive the demand Nycil maintained No. 1 position with a market share of 34.2%* in thePrickly heat powder category with a volume market share of 37.6%* Everyuth Peel off maintained No.1 position with a market share of 76.0% inthe Peel off category1IL--- ---- -IIII---·II Everyuth brand is at No. 5 position with market share of 6.6% at overall facialIIcleansing segment level- ,I----IIIIIIMarket share source: MAT June 2022 report as per Nielsen. ZydusWellness8

Quarterly - Brand performance update – Dairy & Spreads, SweetenersNutralite·,&UM Wil-- SugarBuilding ‘Dairy Spread’ portfolioFree ---------------------------1II The brand registered yet another strong double-digit growth during thequarter on a year-on-year basisII Nutralite Mayonnaise and chocolate spreads continue to build wellIII Nutralite DoodhShakti dairy portfolio is also gaining good traction as weexpand presence of Ghee in institutional channel through NutraliteDoodhShakti Professional rangeIIIIIIIIIIII --- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- -- IReplacing sugar in all forms of -------------------------------- - --- I Due to high last year’s base of COVID wave which led to high diabeticconsumption, the brand did not see growth during the first quarter. However,the brand witnessed healthy growth in distribution expanding to 4.97 lakhoutlets as reported by Nielsen Focus on category development, to promote the stevia-based Sugar FreeGreen variant through thematic communication of “Fitness Ka Pehla Kadam”with celebrity ‘Katrina Kaif’ Sugar Free brand continues to maintain leadership position with market sharestood at 95.5%* “Sugar Badlo, Health Badlo” campaign supported the Sugarlite brand whichregistered a double-digit growth during the quarter*Market share source: MAT June 2022 report of IQVIA ---------------------------------1ZydusWellness9

Brands campaigns during the quarter - MediaComplan - Superior Nutrition Campaignco63%Glucon D - Campaign with Pankaj TripathiSugar Free - Endorsement with Katrina KaifFitness kaPehla KadamA mnge of Low Calorie Sweetnc,rs.tMt odd all the swootness you doslreIn r doss.rts/bevorngos,with Zero Sugar Calories!)'Fitness KaPehla Kadam withSugar FreeGreen· SugarFree0ye,enZydusWellness10

Brands campaigns during the quarter - DigitalEveryuth - Active Instagram PresenceNutralite - Endorsement with Shilpa ShettySugar Free - Influencer driven testimonialsThis simplechange hasmade aremarkabledifference inmy weightand energylevels. JJeveryuthnaturals TA 19tJ 11i,,,eler the J-11i,,,without thetan I "This simplechange hasmade aremarkabledifference inmy weightand energylevels ."ZydusWellness11

International Business – Presence in more than 25 countriesUAE, Bahrain, Qatar, Kuwait,Kingdom of Saudi Arabia,Oman, Lebanon Sugar Free franchise and Complanconstitute 93% of the overall business Top 5 markets constitute 80% of theMyanmar, Malaysia, Taiwan,Pakistan, Sri Lanka, Bangladesh,Nepal, Bhutan, Maldives, HongKongbusiness Entered new geographies like Hongkong,Lebanon, Zimbabwe, Muscat, Ethiopia andAustralia in FY22 Launched new extensions to Sugar free -0Sugar Free D’lite Cookies and Sugar FreeD’lite Chocolate spread - in internationalmarkets during FY22 Uganda, Tanzania, Kenya,Nigeria, South Africa,Mauritius, Zimbabwe,EthiopiaAustralia, New Zealandom2lamplete Meal in a D Targeting 8-10% of revenuesin next 4 to 5 yearsZydusWellness12

Headwinds in FY22 continuing into FY23Key Raw Materials% Increase in Rs/KgJun 19 vs. Q1 FY 23% Increase in Rs/KgQ1 FY 23 vs. Q1 FY 22[Milk) [RPO*DDDD30% 150% 20% 25% FMCG Industry continues to face same headwindsinflationary pressure more in rural vs. urban Gross Margin impact across top companies ranges from 100-400 bps) [Diesel]DDDD75% 40% 55% 5% Calibrated price increases in FY 22impact Gross Margins across companies Muted volume growth driven by inflationary pressure. Impact ofAspartameZWL actions to mitigate gross margin hit Inflation in key raw material and packing materials prices continues to Rupee Dollar depreciation also impacting the input costs) [ Cost reduction programs Control over discretionary spends Long-term supply contracts Build-up of RM inventory at opportune timefor FY 2022*RPO- Refined Palm Oil ZydusWellness13

Multiple levers to build leaner and efficient organization – Transformation 2.0Building an Efficient Supply ChainReorganizing Manufacturing OperationsRevisited manufacturing footprint focusing on redistributing themanufacturing of same product in different geographies.Digitalization for better demand andsupply planningStrategic long-term partnershipfor key ingredientsBuilding capabilities to manage volatilecommodity pricesUnification of ambient & coldchain warehousesLeveraging combined entity spends forsourcing efficientlyCeased operations of Sitarganj plant with the objective of havingleaner operations closer to the consumersIIReduced operational costsReduced variable cost through automationIDigitization across Value Chain ZydusWellness14

Building Route to market to adapt shifting channel mix Leverage changing shopperbehaviour by investing inbuilding stronger presenceand efficient spends onvisibility and Promotions Plan to reach 1 million storesdirectly in next 3 years Overall availability of ourproducts crossing 2.5 millionstores in Q1-FY23 as reportedby Nielsen, with equal splitbetween urban and ruraldistribution.Building future readycapabilities in S&D E-com continuing goodgrowth, contributing to 6.5%of sales (vs 5.9% prev. year) Direct reach 6 lakh storesexpansion across sub channelsTraditional TradeOrganized Trade Channel mix shift towardsMT Ecom from 14% (FY 21) to18% (FY 22). Potential toincrease to 25% in next fewyears ImplementingIntegratedBusiness Planning (IBP) toolto automate the demandplanning, supply planning andsales & operations planning(S&OP) resulting in betteravailability and reduction ininventory Digitization till last mile sales Reduced cost to servethrough distributordisintermediation in organizedtradeZydusWellness15

Three Pillars to drive growth – staying on courseAccelerate Growth of CoreBrandsBuild International PresenceSignificantly Grow ScaleInnovations to focus on portfoliodiversification and expansion withan aim to recruit new customerBuild scale in internationalbusiness by focusing on SAARC,MEA and SEA and suitableinnovations to grow them furtherOpen to bolt-on acquisitions atthe right timeDifferentiated propositionssupported by strong GTM Growing the customer base withincreased penetrationEnter new markets with relevantofferingZydusWellness16

The building blocksCategory BuildingLeading Route to MarketVolume led focusPlan to enhance distribution infrato 3Mn reach and 1 Mn directcoverage over next 3 yearsRecruit new consumersInnovation to contemporize/differentiate the offeringsBuild online-first portfolio Invest in capabilities; forconverging Offline & Online tradeEngage shoppers at multipletouch pointsDigital backbone to decisionmakingInorganic play for gapfillingDigitizing the whole value chain –Sourcing to fulfillmentProactively look for Bolt-onacquisitionsIn next phase work withdownstream and upstreampartners for data sharingFocus on internationalopportunities in topgeographies of interestBuild capability around predictiveanalysisZydusWellness17

Summary Financials Q1FY23INR MillionNet SalesTotal Operating IncomeGross ContributionHR CostAdvertisement ExpensesOther ExpensesEBITDAPBTExceptional itemsPBT (after Exceptional items)PATAdjusted PAT1Q FY221Q ,399YoY Growth2Y %25.2%*Adjusted PAT PAT Exceptional items. The Company has incurred one-off expenditure of Rs.29 million on account of cessation of Sitarganj plant operations in Q1 FY23. ZydusWellness18

THANK YOUTitle Layout

Doodhshakti Ghee in retail and institutional channels and Pro-biotic Butter Increased Penetration and Innovations *As per MAT June 2022 Nielsen report Zydus Wellness . 6 Brands Market Share update . PAT 1,308 1,370 4.7% 23.9% Adjusted PAT 1,308 1,399 7.0% 25.2%