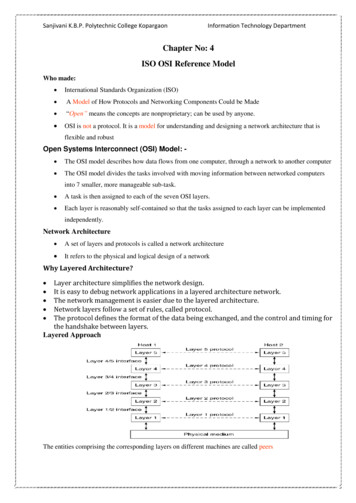

Transcription

ENGINEERING ECONOMICSFactor NameSingle PaymentCompound AmountConvertsSymbolFormulato F given P(F/P, i%, n)(1 i)nSingle PaymentPresent Worthto P given F(P/F, i%, n)(1 i) –nUniform SeriesSinking Fundto A given F(A/F, i%, n)Capital Recoveryto A given P(A/P, i%, n)Uniform SeriesCompound Amountto F given A(F/A, i%, n)(1 i )n 1ni (1 i )(1 i )n 1(1 i )n 1Uniform SeriesPresent Worthto P given A(P/A, i%, n)Uniform GradientPresent Worthto P given G(P/G, i%, n)Uniform Gradient †Future Worthto F given G(F/G, i%, n)Uniform GradientUniform Seriesto A given G(A/G, i%, n)NOMENCLATURE AND DEFINITIONSA Uniform amount per interest periodB BenefitBV Book valueC Costd Inflation adjusted interest rate per interest periodDj Depreciation in year jF Future worth, value, or amountf General inflation rate per interest periodG Uniform gradient amount per interest periodi Interest rate per interest periodie Annual effective interest ratem Number of compounding periods per yearn Number of compounding periods; or the expected lifeof an assetP Present worth, value, or amountr Nominal annual interest rateSn Expected salvage value in year nii(1 i )n 1ni (1 i )(1 i )n 1 nnni 2 (1 i )i (1 i )(1 i )n 1 ni2i1n i (1 i )n 1RiskRisk is the chance of an outcome other than what is planned tooccur or expected in the analysis.NON-ANNUAL COMPOUNDINGmrl - 1ie b1 mBREAK-EVEN ANALYSISBy altering the value of any one of the variables in a situation,holding all of the other values constant, it is possible to find avalue for that variable that makes the two alternatives equallyeconomical. This value is the break-even point.Break-even analysis is used to describe the percentage ofcapacity of operation for a manufacturing plant at whichincome will just cover expenses.The payback period is the period of time required for the profitor other benefits of an investment to equal the cost of theinvestment.Subscriptsj at time jn at time n† F/G (F/A – n)/i (F/A) (A/G)127ENGINEERING ECONOMICS

INFLATIONTo account for inflation, the dollars are deflated by the generalinflation rate per interest period f, and then they are shiftedover the time scale using the interest rate per interest period i.Use an inflation adjusted interest rate per interest period d forcomputing present worth values P.The formula for d is d i f (i f)CAPITALIZED COSTSCapitalized costs are present worth values using an assumedperpetual period of time.Capitalized Costs P AiBONDSBond value equals the present worth of the payments thepurchaser (or holder of the bond) receives during the life ofthe bond at some interest rate i.DEPRECIATIONStraight LineDj Bond yield equals the computed interest rate of the bond valuewhen compared with the bond cost.C - SnnRATE-OF-RETURNThe minimum acceptable rate-of-return (MARR) is thatinterest rate that one is willing to accept, or the rate onedesires to earn on investments. The rate-of-return on aninvestment is the interest rate that makes the benefits and costsequal.Modified Accelerated Cost Recovery System (MACRS)Dj (factor) CA table of MACRS factors is provided below.BOOK VALUEBV initial cost – Σ DjBENEFIT-COST ANALYSISIn a benefit-cost analysis, the benefits B of a project shouldexceed the estimated costs C.TAXATIONIncome taxes are paid at a specific rate on taxable income.Taxable income is total income less depreciation andordinary expenses. Expenses do not include capital items,which should be depreciated.B – C 0, or B/C 1MACRS FACTORSRecovery Period (Years)Year35710Recovery Rate 3.28128ENGINEERING ECONOMICS

32.834739.196144.955063.0289Factor Table - i 740714.126518.835923.462428.006445.3613Factor Table - i G 1.483113.755718.177622.436326.533341.3426

Factor Table - i 340.02860.02540.0194A/GFactor Table - i 5312.2323ENGINEERING 33.9863

5.761916.161416.6175P/GFactor Table - i 4.00%F/PF/AP/GFactor Table - i 290.3359533.12825,638.3681ENGINEERING 96414.790916.3711

Factor Table - i 8350.54030.50020.46320.42890.39710.36

128 ENGINEERING ECONOMICS INFLATION To account for inflation, the dollars are deflated by the general inflation rate per interest period f, and then they are shifted over the time scale using the interest rate per interest period i. Use an inflation adjusted interest rate per interest period d for computing present worth values P. The formula for d is d i f ( f)