Transcription

Separation from Employment: Important Benefits InformationSeparation fromEmployment:Important BenefitsInformationMay, 2018

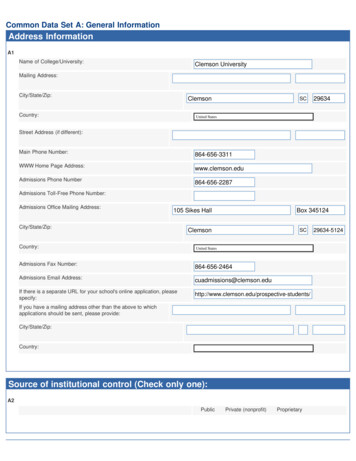

Separation from Employment: Important Benefits InformationTable of ContentsKey Deadlines . 3Insurance, Leave and Other Benefits . 4Medical. 5Dental and Vision . 5Life Insurance . 5Long-Term Disability (LTD) . 6Aflac . 6Metlife/Brighthouse Financial . 6MoneyPlus Medical Spending Account (MSA) . 6Money Plus Dependent Care Spending Account (DCSA) . 7MoneyPlus Health Savings Account (HSA) . 7Annual Leave – FTE with 20 or more standard hours; 12 month positions . 7Annual Leave – TLP with 20 or more standard hours; 12 month positions . 7Sick Leave - FTE with 20 or more standard hours; 12 and 9-month positions . 8Sick Leave - TLP with 20 or more standard hours; 12 and 9-month positions . 8Grant Personal Leave - Temporary Grant positions only . 8Compensatory Time . 8Holiday Compensatory Time . 8CIGNA Life Insurance . 8Employee Tuition Assistance Program (ETAP) . 9PerksCard . 9TicketsatWork . 9Employee Assistance Program (EAP) . 9Contact Information . 10State Retirement Plans and Supplemental Retirement Programs . 12South Carolina Retirement System (SCRS) Plan and Police Officers RetirementSystem (PORS) Plan. 12State Optional Retirement Program (State ORP) . 13Supplemental Retirement Programs (SRP) . 13Contact Information . 14Page 2

Separation from Employment: Important Benefits InformationKey DeadlinesAs soon as employees know they will beseparating from employment: Contact the Office of Human Resourcesat (864) 656-2000 to begin theseparation process.Within 31 days after Clemson Universityactive employee Cigna life insurancecoverage ends: Apply to convert to an individualpolicy, if applicable.By the last day of employment: Notify the Office of Human Resourcesof how to process annual leave and/orcompensatory time payout.Within 31 days after an active employee’slong-term disability coverage ends: Apply to convert to an individualpolicy, if applicable.Within 60 days from the date employeeslose active employee medical, dental orvision coverage: Apply for COBRA continuationcoverage, if applicable.Soon after the separating employee’s lastday on payroll: If an employee has an outstanding401(k), 403(b) or 457 loan, arrange tomake monthly payments or repay theoutstanding amount in full.Within 31 days after an active employee’smedical coverage ends, or 63 days afterCOBRA medical coverage ends: Apply for an individual policy throughthe Federal Health InsuranceMarketplace, if applicable.Within 31 days after an active employee’slife insurance ends: Apply to convert to an individualpolicy, if applicable.Questions?If you still have questions afterreviewing the information here, pleasecontact the Office of Human Resourcesat (864) 656-2000 for assistance.Within 90 days after an employeeseparates from Clemson Universityemployment: File any claims for reimbursement withMoney Plus Medical Spending Accountand Dependent Care SpendingAccount, if applicable. (Otherwisemoney left in account will beforfeited).Page 3

Separation from Employment: Important Benefits InformationInsurance, Leave andOther BenefitsIn most situations, an employee’sparticipation in Clemson Universitybenefits will end when they separate fromemployment. In some cases, if anemployee needs to continue certainbenefits, there are options for doing so.If an employee is leaving ClemsonUniversity due to a medical reason, theemployee should contact the Office ofHuman Resources (OHR) immediately.OHR can help determine eligibility fordisability, retirement and other possiblebenefits.Employees may also want to explore theiroptions through the health insurancemarketplace established under theAffordable Care Act (ACA). Learn more byvisiting www.healthcare.gov.The table on pages 5–9 summarizesoptions for continuing employee benefits.If an employee is retiring, the employeeshould contact OHR. This document willnot offer all the information needed and aone-on-one session with a retirementspecialist is recommended.Using COBRA, separating employees maycontinue some Clemson Universitybenefits – both for themselves and theirspouse, domestic partner or eligibledependents. This program may allowemployees to continue medical, dental,vision and medical spending accountbenefits for up to 18 months. Coverageunder COBRA is identical to the PEBAsponsored coverage that employees andtheir dependents had just beforeseparation of employment. PEBA, thePublic Employee Benefit Authority,handles COBRA administrative services.Once Clemson University notifies PEBAthat an employee is separatingemployment, the Office of HumanResources will send the employee aCOBRA information packet. Enrollmentforms and premiums should be sentdirectly to PEBA.For more details about COBRA, pleasevisit www.peba.sc.gov.Tip:You may be eligible for unemploymentinsurance. You can get details and apply forbenefits at the local South Carolina office, oronline at http://dew.sc.gov.Page 4

Separation from Employment: Important Benefits InformationINSURANCE, LEAVE AND OTHER BENEFITS – OPTIONS FOR CONTINUING BENEFITSBenefitMedicalDental andVisionLife InsuranceWhen CoverageEndsLast date of themonth in whichseparation fromemployment occursand premiums arepaid.ContinuationOptionsCOBRA*Last date of themonth in whichseparation fromemployment occursand premiums arepaid.COBRA*Last date of themonth in whichseparation fromemployment occursand premiums arepaid.You may apply toconvert yourcoverage to anindividual whole lifepolicy withoutproviding evidence ofinsurability.*Note: As analternative to COBRA,please visitwww.HealthCare.govfor informationregarding coveragethrough the federalhealth insurancemarketplace.*Note: As analternative to COBRA,please visitwww.HealthCare.govfor informationregarding coveragethrough the federalhealth insurancemarketplace.What You Need toDoApply for COBRAcontinuation no laterthan 60 days from thedate you lose coverageor the date you receivenotice of yourcontinuation rights(whichever is later).Information will bemailed to you from theOffice of HumanResources.What You Need toKnowThe COBRA periodallows you to continueyour coverage for up to18 months due toseparation ofemployment. After that,you and/or your eligiblefamily members may beable to extend yourcoverageif you aredeemed disabled or asecond qualifying eventoccurs. You must notifyPEBA within certaintimeframes of adisability or a secondqualifying event.Apply for COBRAcontinuation no laterthan 60 days from thedate you lose coverageor the date you receivenotice of yourcontinuation rights(whichever is later).Information will bemailed to you from theOffice of HumanResources.The COBRA periodallows you to continueyour coverage for up to18 months due toseparation ofemployment. After that,you and/or your eligiblefamily members may beable to extend yourcoverage if you aredeemed disabled or asecond qualifying eventoccurs. You must notifyPEBA within certaintimeframes of adisability or a secondqualifying event.To apply for anindividual conversionpolicy, complete theinformation provided toyou by MetLife.Information will bemailed to your homeaddress from MetLifeshortly after yourseparation from theUniversity.You may only apply forcoverage equal to whatwas in place at the timeof your separation fromemployment. Your newconversion policypremium will be set atMetLife’s standard ratefor the amount ofcoverage that you wishto convert and yourage. Forms must bereceived by MetLifewithin 31 days from thedate coverage ends.Page 5

Separation from Employment: Important Benefits InformationBenefitLong-TermDisability(LTD)When CoverageEndsLast date of themonth in whichseparation fromemployment occursand premiums arepaid.AflacCoverage end dateswill depend onseparation pendingAccount(MSA)ContinuationOptionsBasic LTD coveragemay not beconverted; however,you may apply toconvert yoursupplemental LTDinsurance if you meetcertain criteria, suchas:1. Your insuranceends for a reasonother than termination oramendment of thegroup policy, yourfailure to pay arequired premium, oryour retirement.2. You were insuredfor at least one yearas of the date yourinsurance ends.3. You are notdisabled on the dateyour insurance ends.4. You are a citizen orresident of the US orCanada.5. You apply inwriting and pay thefirst premium within31 days after yourinsurance ends.Contact Aflac directlyfor options tocontinue this benefit.What You Need toDoTo apply forsupplemental LTDconversationinsurance, contact TheStandard, thesupplemental LTDadministrator in writingand pay the firstpremium forsupplemental LTDconversion insurancewithin 31 days of thedate your insuranceends. Information willbe mailed to you fromthe Office of HumanResources.What You Need toKnowThe contact informationfor The Standard is 1800-378-4668. You willneed to know the GroupName, which is thestate of South Carolinaand the Group Number,which is 621144.Contact Aflac for moreinformation on whenyour coverage will endand if your policy iseligible to be extended.Aflac premiums arepayroll deducted amonth in advance,which may affect yourpolicy end date.Last date of themonth in whichseparation fromemployment occursand premiums arepaid.Contact MetLifedirectly for options tocontinue this benefit.Contact MetLife toconfirm your policy iseligible for continuationor conversion.MetLife premiums arepayroll deducted amonth in advance,which may affect yourpolicy end date.Contributions endwhen you separateemployment. If youhave a myFBMCcard, it will becancelled upon yourseparation fromemployment.COBRA coverage willbe offered only if youhave remaining fundsin your account.If you do not electCOBRA, you have 90days from your lastday worked to submiteligible MSA expensesincurred before yourseparation fromemployment. Anyfunds still in youraccount will beforfeited.Wage Works, the thirdparty processor, willcontact you regardingcontinuation ofcoverage, if applicable.You will be charged a 2percent administrativefee to continue theCOBRA coverage.Page 6

Separation from Employment: Important Benefits InformationBenefitMoney lthSavingsAccount(HSA)Annual Leave– FTE with 20or morestandardhours; 12monthpositionsAnnual Leave– TLP with 20or morestandardhours; 12monthpositionsWhen CoverageEndsContinuationOptionsWhat You Need toDoWhat You Need toKnowContributions endwhen you separateemployment.None available.You may requestreimbursement foreligible expenses whileyou were employed,until you exhaust youraccount or the planyear ends.If you do not submityour claims by thedeadline, you will forfeitany money left in youraccount. You may beable to reduce yourtaxes by claimingchildcare expenses onyour federal tax returnthrough the Child andDependent Care Credit.Please consult your taxadvisor for details.Contributions endwhen you separateemployment.If you separate fromemployment, you cantake your HSA withyou and continue touse it for qualifiedmedical expenses.Continue to requestreimbursement forqualified medicalexpenses if fundsremain in the account.To close the Optum HSAAccount, contactCustomer Service at 1866-234-8913. You canonly contribute to anHSA account if you areenrolled in a highdeductible health plan.Benefit ends at thepoint of separation ofemployment.Employees must bescheduled to workone half of themonth to accrueleave. You may beeligible for an annualleave payout of anyremaining balance,not to exceed 45days.Not applicable.If transferring toanother South Carolinastate agency into anFTE position, contactOHR to transfer anyleave balances. If youwould like to deferyour Annual LeavePayout (ALP) to aSupplementalRetirement Account(SRP), contact theOffice of HumanResources.Only a portion of theALP may be deferred toan SRP. Contact theOffice of HumanResources for moredetails.Benefit ends at thepoint of separation ofemployment.Employees must bescheduled to workone half of themonth to accrueleave. You may beeligible for an annualleave payout of anyremaining balance,not to exceed 45days.Not applicable.If you would like todefer your AnnualLeave Payout (ALP) toa SupplementalRetirement Account(SRP), contact theOffice of HumanResources.This position is noteligible to transferunused annual leave.Only a portion of theALP may be deferred toan SRP. Contact theOffice of HumanResources for moredetails.Page 7

Separation from Employment: Important Benefits InformationBenefitWhen CoverageEndsContinuationOptionsWhat You Need toDoWhat You Need toKnowBenefit ends at thepoint of separation ofemployment.Employees must bescheduled to workone half of themonth to accrue sickleave.Not applicable.If transferring toanother South Carolinastate agency into anFTE position, contactOHR to transfer anyleave balances.You will not be paid outfor unused sick leavebenefits.Benefit ends at thepoint of separation ofemployment.Employee's must bescheduled to workone half of themonth to accrue sickleave.Not applicable.No action needed.This position is noteligible to transferunused sick leave.Not applicable.GrantPersonalLeave TemporaryGrantpositions onlyBenefit ends at thepoint of separation ofemployment.Employee's mustwork one half of themonth to accruegrant personal leave.You may be eligiblefor a payout of anyremaining balance.If you would like todefer your GrantPersonal Leave Payoutto a SupplementalRetirement Account(SRP), contact theOffice of HumanResources.Only a portion of thebenefit payout may bedeferred to an SRP.Contact the Office ofHuman Resources formore details.CompensatoryTimeBenefit ends at thepoint of separation ofemployment.Not applicable.No action required.Any remaining balanceis paid out tononexempt positionsonly.Benefit ends at thepoint of separation ofemployment.Not applicable.No action required.Paid out to nonexemptpositions only; Exemptemployees will notreceive payment forholiday compensatorytime not taken.End of the month inwhich separationfrom employmentoccurs.You may apply toconvert yourcoverage to anindividual policy.OHR will sendinformation to eligibleemployees regardingconversion options.Employees shouldcontact CIGNA direct at1-800-732-1603 within31 days of separationto apply to converttheir policy.Sick Leave FTE with 20or morestandardhours; 12 and9-monthpositionsSick Leave TLP with 20or morestandardhours; 12 and9-monthpositionsHolidayCompensatoryTimeCIGNA LifeInsuranceYou will not be paid outfor unused sick leave.Page 8

Separation from Employment: Important Benefits ram(EAP)When CoverageEndsContinuationOptionsWhat You Need toDoWhat You Need toKnowEnd of the semesterin which employee isenrolled.Not applicable.Contact StudentFinancial Services forinformation oncontinuing classeswithout the ETAPbenefit.Employment does notaffect programparticipation only theability to utilize thetuition waiver benefit.Date of separation ofemployment.Not applicable.For customer serviceassistance on existingorders, contactPerksCard at 1-877253-7100.The PERKS Cardprogram requires anactive ClemsonEmployee ID toparticipate.Date of separation ofemployment.Not applicable.For customer serviceassistance on existingorders, contact Ticketsat Work at 1-800-3316483.The Tickets at Workprogram requires anactive ClemsonEmployee ID toparticipate.End of the month inwhich separationfrom employmentoccurs.Not applicable.No action required.Page 9

Separation from Employment: Important Benefits InformationInsurance and OtherBenefitsContact InformationS.C. Public EmployeeBenefit Authority (PEBA)Insurance BenefitsStreet Address:202 Arbor Lake Drive Columbia, SC 29223Mailing Address:P.O. Box 11661Columbia, SC 29211-1661Customer ross BlueShield of SouthCarolina (BCBSSC)SHP Standard Plan,Savings Plan,Medicare Supplemental PlanP.O. Box 100605 Columbia, SC 29260Customer State Dental Plan, Dental PlusBlueCross BlueShield of SCP.O. Box 100300 Columbia, SC 292023300Customer Service:888-214-6230Fax: 803-264-7739StateSC.SouthCarolinaBlues.comSelman & CompanyTRICARE Supplement Plan6110 Parkland Blvd.Cleveland, OH 44124Customer Service:866-637-9911, option 1Claims Fax: l Health Insurance Marketplacewww.healthcare.govEyeMed Vision CareState Vision Plan Claims Address:ClaimsP.O. Box 8504Mason, OH 45040-7111Customer Care Center:877-735-9314Group Number: 9925991www.eyemedvisioncare.comMetLifeBasic Life, Optional Life, DependentLifeMetLife Recordkeeping and EnrollmentServicesP.O. Box 14401Lexington, KY 40512-4401Fax: 866-545-7517Evidence of insurability:800-638-6420, option 1Claims: 800-638-6420Continuation or conversion:866-492-6983 (continuation)877-275-6387 (conversion)Policy Number: 200879-1-GStandard Insurance Company (TheStandard)Basic Long Term Disability,Supplemental Long Term DisabilityP.O. Box 2800Portland, OR 97208-2800General Information and Claims: 800628-9696Fax: 800-437-0961Medical Evidence of Good Health: 800843-7979 Group Number: e 10

Separation from Employment: Important Benefits InformationAflacAlison HluchotaDistrict Sales ManagerPhone/Fax:Ph: 864 312.3960Fx: 864 312.3961E-mail:alison hluchota@us.aflac.comMETLIFE/Brighthouse FinancialRepresentative:Bert Campbell, CLU ChFC CFP Blake ial.netAddress:154 Exchange StreetPendleton, SC comWageWorksMoneyPlusP.O. Box 1840Tallahassee, FL 32302-1840Customer Care Center: 800-342-8017Automated Information: 800-865-3262Claims Fax: 888-800-5217www.myFBMC.comCigna Life Insurance Co.Of North AmericaCustomer Service:1-800-732-1603PerksCardCustomer Service:1-877-253-7100Mailing Address:2561 Territorial RoadSt. Paul, MN 55114TicketsAtWorkCustomer satwork.comPage 11

Separation from Employment: Important Benefits InformationState Retirement Plans andSupplemental RetirementProgramsWhen you leave employment, you haveseveral options about what to do withyour retirement savings.If you are leaving Clemson University dueto a medical reason, please contact theOffice of Human Resources (OHR)immediately. OHR can help determineeligibility for disability, retirement andother possible benefits.If you are retiring, please contact OHR.This document will not offer all theinformation needed and a one-on-onesession with a retirement specialist isrecommended.South Carolina Retirement System(SCRS) Plan and Police OfficersRetirement System (PORS) PlanIf you separate from employment beforeyou are eligible to retire, you have twooptions concerning your contributions.Leave Funds on DepositWhen you leave your money in yourSCRS/PORS account, you retain youryears of service credit, which may beadded to any future service you mayaccrue should you later become employedin a position covered by one of thecorrelated retirement systemsadministered by PEBA. Your account willcontinue to earn interest until it becomesinactive. An account is considered inactivewhen no contributions have been made tothe account in the preceding fiscal yearand no other active, correlated system orState ORP account exists. You may applyfor a refund at a later date or apply for aservice retirement annuity upon reachingeligibility. No action is required if you wishto retain your membership and leave yourfunds on deposit, but it is yourresponsibility to keep PEBA informed ofyour current address as well as any nameor beneficiary changes.Requesting a RefundIf you have separated from employmentand wish to receive a refund of youraccumulated employee contributions plusthe interest earned on your account, youmust complete a Refund Request andreturn it to PEBA. You may submit yourrefund request immediately uponseparation; however, by law, there is aminimum 90-day waiting period to amaximum of six months from your dateseparation until a refund can be made. Ifyou are working for two or more coveredemployers and/or contributing to morethan one retirement account (i.e., workingtwo jobs and paying into an SCRS and aPORS account), you must stop working inall correlated systems to request a refundfrom any account. If you receive a refund,you forfeit your rights to any futureservice retirement or disability annuity.Employer contributions are not refunded.Instead of having the refund paid directlyto you, you may choose to roll over thefunds into an IRA, a 401(k) plan, a 401(a)eligible plan, a 403(a) plan, a 403(b) plan,or some 457 plans. The South CarolinaDeferred Compensation Program’s 457retirement plan does not accept rolloversfrom your SCRS account.PEBA is required to withhold federal taxesof 20 percent on the taxable portion ofany refund that is eligible for a rolloverbut is not transferred directly into anotherqualified retirement plan. If you do nottake advantage of a rollover as indicatedabove and are under the age of 59 ½ atthe time of distribution, your distributionPage 12

Separation from Employment: Important Benefits Informationwill be subject to regular income tax inthe year you receive the payment, plusthere may be a 10 percent penalty tax onthe taxable portion of your distribution,unless certain exceptions apply.See Special Tax Rules in IRS Publication575 and IRS Form 5329 for moreinformation on this tax penalty and theexceptions to the penalty.Be sure to check with an accountant or atax advisor about your tax liability, or visitthe IRS’s website at www.irs.gov and thewebsite for the tax agency in the state inwhich you reside. In South Carolina, visitthe South Carolina Department ofRevenue’s website at https://dor.sc.gov/.Supplemental RetirementPrograms (SRP)Supplemental retirement programsinclude 401(k), 457, and 403(b) accounts.You have several options regarding yourretirement account upon separation fromemployment, which could include leavingyour funds in the account, rolling overfunds into another investment vehicle, orwithdrawing some or all of yourretirement funds. It is stronglyrecommended that you contact yourretirement account vendor directly as wellas speak with a tax advisor to understandthe implications of your choice, such astaxes, possible penalties, etc.State Optional RetirementProgram (State ORP)When you separate from employment orreach age 59 ½, you have immediaterights to your entire account balance,including employee and employercontributions. Your State ORP assetsremain in the investment options youselect unless you request that they betransferred to another eligible retirementplan, or unless an investment option is nolonger offered.You have several options regarding yourretirement account upon separation fromemployment, which could include leavingyour funds in the account, rolling-overfunds into another investment vehicle, orwithdrawing some or all of yourretirement funds. It is stronglyrecommended that you contact your StateORP vendor directly as well as speak witha tax advisor to understand theimplications of your choice, such as taxes,possible penalties, etc.Page 13

Separation from Employment: Important Benefits InformationState Retirement Plans andSupplemental RetirementProgramsContact InformationSCRS/PORSS.C. Public EmployeeBenefit Authority (PEBA)Retirement BenefitsStreet Address:202 Arbor Lake Drive Columbia, SC 29223Mailing Address:P.O. Box 11960Columbia, SC 29211-1960Customer Service:1-888-260-94308:30 a.m. - 5 p.m., Monday – FridayWebsite:www.peba.sc.govState Optional RetirementProgramMass Mutual (HARTFORD)Representative:Lucretia H. WindomPhone:(803) ert Campbell, CLU ChFC CFP Blake ial.netAddress:154 Exchange StreetPendleton, SC com/scorpTIAARepresentative:Tamara JohnsonEmail:tamjohnson@tiaa.orgAddress:8500 Andrew Carnegie BlvdCharlotte, NC 28262Phone:877-535-3910 ve:Rollie B RobertsFinancial Planning AdvisorEmail:Rollie.Roberts@valic.comAddress:102 Sanderling DriveGreenville, SC 29607Phone:864-275-3048 (cell),800-448-2542 al RetirementProgramsAmerican FundsRepresentative:Charles Baker and Brian BakerThe Baker Financial Group, LLC.Address:PO Box 1974, 208 Frontage Road- Ste 2,Clemson, SC 29633Phone:(864)722-9202, Cell(864) 723-3767Email:Charles@thebakerfg.comPage 14

Separation from Employment: Important Benefits InformationAmerican FundsRepresentative:Deborah Talley, Greenville,Tracy Klukkert, SenecaThe Investment CenterAddress:Charbonneau, PO Box 397 Seneca, SC29679Phone/Fax:Ph: (864) 888-8700Fx: (864) righthouse FinancialRepresentative:Bert Campbell, CLU ChFC CFP Blake CampbellACI cial.netAddress:154 Exchange StreetPendleton, SC m PollockAddress:105-3 Wall St.Clemson, SC 29631Phone:(864) presentative:Chris MillerAXA AdvisorsAddress:1200 Woodruff Road Suite A-3Greenville, SC 29607Phone/Fax:Ph: (864) 250-9033Fx: (866) SPire, IncRepresentative:Jim HillEdward JonesAddress:501 Forest Ln, Suite CClemson, SC 29631Phone/Fax:Ph: (864) 654-5556Ph: 1-800-755-7649Fx: (866) 550-8699Representative:Lee WoodsEdward JonesAddress:402 College Ave, Ste 2Clemson, SC 29631Phone/Fax:Ph: (864) 654-6831, 1-866-654-6831Fx: (866) 584-9244Website:www.edwardjones.comFidelity InvestmentsAddress:PO Box 770002Cincinnati, Ohio .com/atworkNew York LifeRepresentative:Gene AdkinsAddress:717-B W. North 1st StSeneca, SC 29678Phone/Fax:Ph: (864) 885-1492 (office)Ph:(864) 444-0756 (cell)Fx: (864) ww.GeneAdkins.comPage 15

Separation from Employment: Important Benefits InformationT Rowe PriceRetirement Operation GroupAddress:P.O. Box 8900Baltimore, MD ce.comTIAARepresentative:Tamara JohnsonEmail:tamjohnson@tiaa.orgAddress:8500 Andrew Carnegie BlvdCharlotte, NC 28262Phone:877-535-3910 lie B RobertsFinancial Planning AdvisorEmail:Rollie.Roberts@valic.comAddress:102 Sanderling DriveGreenville, SC 29607Phone:864-275-3048 (cell),800-448-2542 rt Campbell, CLU ChFC CFP Blake CampbellACI cial.netAddress:154 Exchange StreetPendleton, SC 29670Phone:864-654-3121Page 16

Metlife/ month in which Brighthouse Financial or conversion. Last date of the separation from employment occurs and premiums are paid. Contact MetLife directly for options to continue this benefit. Contact MetLife to confirm your policy is eligible for continuation MetLife premiums are payroll deducted a month in advance, which may affect your