Transcription

Ground RulesLibertyQ US Equity Index Seriesv1.4The LibertyQ US Equity Index Series is not, and is not intended to be, used by supervised entities in theEuropean Union or the United Kingdom and accordingly, the European Benchmark Regulation* and the UKBenchmark Regulation# does not apply to the index series. Consequently, supervised entities within theEuropean Union and the United Kingdom are not permitted to use any of the indices within the index seriesas a benchmark as set out in article 3(1)(7) of the European Benchmark Regulation.For the avoidance of doubt, neither FTSE International Limited nor any other member of the London StockExchange Group plc group of companies, is the benchmark administrator (as defined in article 3(1)(6) of theEuropean Benchmark Regulation) of the index series.*Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices usedas benchmarks in financial instruments and financial contracts or to measure the performance of investmentfunds# TheBenchmarks (Amendment and Transitional Provision) (EU Exit) Regulations 2019 (which amends theEuropean benchmark regulation in the United Kingdom)ftserussell.comAn LSEG BusinessFebruary 2022

Ground RulesContents1.0Introduction . 32.0Management Responsibilities. 53.0Queries and Complaints . 64.0Eligible Securities . 75.0Factor Construction . 86.0Index Construction . 157.0Periodic Review of Constituents . 188.0Changes to Constituent Companies . 199.0Corporate Actions and Events. 2010.0 Indices Algorithm and Calculation Method . 21Appendix A: Index Opening and Closing Hours . 23Appendix B: Status of Index . 24Appendix C: Further Information . 25ftserussell.comAn LSEG BusinessFebruary 2022

Section 1Introduction1.0Introduction1.1This document sets out the Ground Rules for the construction and management of the LibertyQ USEquity Index Series. Copies of the Ground Rules are available from www.ftserussell.com.1.2The LibertyQ US Equity Index Series is designed to reflect the performance of stocks representing aspecific set of factor characteristics.1.3These Ground Rules should be read in conjunction with the Corporate Actions and Events Guide forNon Market Cap Weighted Indices and the Russell U.S. Equity Indices Construction andMethodology which are available at www.ftserussell.com. Unless stated in these Ground Rules, theLibertyQ US Equity Index Series will follow the same process as the Russell U.S. Equity IndexSeries.1.3.1The LibertyQ US Equity Index does not take account of ESG factors in its design.1.4Price and Total Return Indices will be calculated on an end of day basis.Total return indices include income based on ex dividend adjustments. All dividends are applied asdeclared in the FTSE Total Return Index.1.5The indices may be calculated in real time (See Appendix A).1.6FTSE RussellFTSE Russell is a trading name of FTSE International Limited, Frank Russell Company, FTSEGlobal Debt Capital Markets Limited (and its subsidiaries FTSE Global Debt Capital Markets Inc.and FTSE Fixed Income Europe Limited), FTSE Fixed Income LLC, The Yield Book Inc and BeyondRatings.1.7Statement of Principles for FTSE Russell Non Market Capitalisation Weighted Equity Indices(the Statement of Principles)Indices need to keep abreast of changing markets and the Ground Rules cannot anticipate everyeventuality. Where the Ground Rules do not fully cover a specific event or development, FTSERussell will determine the appropriate treatment by reference to the Statement of Principles whichsummarizes the ethos underlying FTSE Russell’s approach to index construction. The Statement ofPrinciples is reviewed annually and any changes proposed by FTSE Russell are presented to theFTSE Russell Policy Advisory Board for discussion before approval by FTSE Russell’s IndexGovernance Board.FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 20223 of 25

The Statement of Principles can be accessed using the following link:Statement of Principles Non-Market Cap Equity Indices.pdf1.8FTSE Russell hereby notifies users of the index series that it is possible that circumstances,including external events beyond the control of FTSE Russell, may necessitate changes to, or thecessation of, the index series and therefore, any financial contracts or other financial instrumentsthat reference the index series should be able to withstand, or otherwise address the possibility ofchanges to, or cessation of, the index series.1.9Index users who choose to follow this index series or to buy products that claim to follow this indexseries should assess the merits of the index series rules-based methodology and take independentinvestment advice before investing their own or client funds. No liability whether as a result ofnegligence or otherwise is accepted by FTSE Russell (or any person concerned with the preparationor publication of these Ground Rules) for any losses, damages, claims and expenses suffered byany person as a result of: any reliance on these Ground Rules, and/orany errors or inaccuracies in these Ground Rules, and/orany non-application or misapplication of the policies or procedures described in these GroundRules, and/orany errors or inaccuracies in the compilation of the index series or any constituent data.FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 20224 of 25

Section 2Management Responsibilities2.0Management Responsibilities2.1FTSE International Limited (FTSE)2.1.1FTSE1 is responsible for the daily calculation, production and operation of the Index Series and will: maintain records of the index weightings of all constituents; make changes to the constituents and their weightings in accordance with the Ground Rules; carry out periodic index reviews of the Index Series and apply the changes resulting from thereviews as required by the Ground Rules; publish changes to the constituent weightings resulting from their ongoing maintenance andthe periodic reviews; disseminate the indices.2.2Amendments to These Ground Rules2.2.1These Ground Rules shall be subject to regular review by FTSE Russell to ensure that they continueto best reflect the aims of the index series. Any proposals for significant amendments to theseGround Rules will be subject to consultation with FTSE Russell advisory committees and otherstakeholders if appropriate. The feedback from these consultations will be considered by the FTSERussell Index Governance Board before approval is granted.2.2.2Where FTSE Russell determines that the Ground Rules are silent or do not specifically andunambiguously apply to the subject matter of any decision, any decision shall be based as far aspractical on the Statement of Principles. After making any such determination, FTSE Russell shalladvise the market of its decision at the earliest opportunity. Any such treatment will not beconsidered as an exception or change to the Ground Rules, or to set a precedent for future action,but FTSE Russell will consider whether the Ground Rules should subsequently be updated toprovide greater clarity.1FTSE is not the benchmark administrator of the Index Series as the term administrator is defined in the IOSCO Principles for FinancialBenchmarks and Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices used asbenchmarks in financial instruments and financial contracts or to measure the performance of investment funds (the EuropeanBenchmark Regulation) and The Benchmarks (Amendment and Transitional Provision) (EU Exit) Regulations 2019 (the UK BenchmarkRegulation).FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 20225 of 25

Section 3Queries and Complaints3.0Queries and ComplaintsFTSE Russell’s complaints procedure can be accessed using the following link:Queries and Complaints Policy.pdfFTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 20226 of 25

Section 4Eligible Securities4.0Eligible Securities4.1.1Constituent securities as defined by the underlying benchmark indices are eligible for inclusion in theLibertyQ US Equity Index Series.4.1.2Benchmark indices of the LibertyQ US Equity Index Series:Underlying IndexRussell 1000 IndexRussell Midcap IndexRussell 2000 Index4.1.3LibertyQ IndexLibertyQ US Large Cap IndexLibertyQ US Mid Cap IndexLibertyQ US Small Cap IndexAt the quarterly review securities that are affiliated with Franklin Resources by either a direct orindirect aggregate shareholding of greater than 20% will be excluded from the underlying index.FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 20227 of 25

Section 5Factor Construction5.0Factor ConstructionThe data cut-off date for the calculation of all factor data is the close of business on the last businessday of the month prior to the review month.5.1Factor Normalisation and Missing Data Treatment5.1.1The z-score for a factor is computed by combining the relative z-scores of the individual descriptorsdefined for each factor.5.1.2The z-score for a descriptor for each security is calculated as described below:LibertyQ US Large Cap Index:j ̅jj Di -DiZi jσ(Di )Where:Z i,jis the individual descriptor z-score for stock i for descriptor jD i,jis the descriptor value of stock i for descriptor j̅ jiDσ(Dji )is the equal weighted mean of the descriptor values for descriptor j of all thesecurities included in the underlying Index within same ICB industryis the equal weighted standard deviation of the descriptor values for descriptor j ofall the securities included in the underlying Index within same ICB industryThe Z-scores are winsorized at /-3 (i.e., the z-scores above 3 are capped at 3 and z-scores below 3 are floored at -3).LibertyQ US Mid Cap Index/LibertyQ US Small Cap Index:jZi jj̅iDi -Djσ(Di )Where:Z i,jis the individual descriptor z-score for stock i for descriptor jFTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 20228 of 25

D i,jis the descriptor value of stock i for descriptor j̅ jiDis the equal weighted mean of the descriptor values for descriptor j of all thesecurities included in the Parent Indexσ(Dji )is the equal weighted standard deviation of the descriptor values for descriptor j ofall the securities included in the Parent IndexThe Z-scores are winsorized at /-3 (i.e., the z-scores above 3 are capped at 3 and z-scores below 3 are floored at -3).5.1.3All descriptors with missing data are allocated the universe average z-score for LibertyQ US LargeCap Index, and are allocated the industry average z-score for LibertyQ US Mid Cap Index/LibertyQUS Small Cap Index after the normalisation procedure in Rule 5.1.2.5.1.4For LibertyQ US Mid Cap Index/LibertyQ US Small Cap Index the relative z-score of a descriptor isdefined by standardizing the individual descriptor z-scores within the sector groupsThe three sector groups defined to apply relative z-scores are:a.) Securities belonging to the ICB2 “Financials” Industry (ICB Financials 30), of the IndustryClassification Benchmark (ICB))b.) Securities belonging to the ICB “Real Estate Investment Trusts” Sector of the IndustryClassification Benchmark (ICB) (Real Estate Investment Trusts 351020 and Mortgage RealEstate Investment Trusts 302030))c.) Securities belonging to all other ICB industries except the “Financials” Industry (ICB Financials30) and Real Estate Investment Trusts Sector (Real Estate Investment Trusts 351020 andMortgage Real Estate Investment Trusts 302030)The relative z-scores within each sector group are calculated as described below:jZreli j ̅jZi -Zijσ(Zi )Where:Zrel i,jis the relative z-score for stock i for descriptor jZ i,jis the descriptor z-score of stock i for descriptor j within a sector group̅jiZis the equal weighted mean of the descriptor z-scores for descriptor j of all thesecurities included in a sector groupσ(Zji )is the equal weighted standard deviation of the descriptor z-scores for descriptor j ofall the securities included in a sector groupThe relative z-scores for each sector group universe are winsorized at /-3.5.2Volatility5.2.1The volatility descriptor defined as the slope coefficient β in a time-series regression of local stocktotal returns against the local total returns of the benchmark index:ri α βR ewhere ri is the weekly local total return from Wednesday to Wednesday of stock i over the trailing104 weeks of the cut-off date, and R is the weekly local total return from Wednesday to Wednesdayof the benchmark index over the trailing 104 weeks of the cut-off date.2FTSE indices migrated to the new ICB classification system in March 2021.FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 20229 of 25

5.2.2Stocks with history of less than 104 weeks will be treated as missing data.5.2.3A relative z-score for the volatility descriptor is created following the procedure detailed in Rule 5.1,and the volatility factor is the relative z-score of the volatility descriptor.5.3Momentum5.3.1The momentum factor contains 2 descriptors: 6-month risk-adjusted price momentum and 12-monthrisk-adjusted price momentum.5.3.26-month risk-adjusted price momentum is defined as the cumulative local daily price return over thetrailing 6 months of the cut-off date divided by the annualized standard deviation of weekly localprice returns (Wednesday to Wednesday) over the trailing 3 years of the cut-off date.5.3.312-month risk-adjusted price momentum is the cumulative local daily price return over the trailing 12months of the cut-off date divided by the annualized standard deviation of weekly local price returns(Wednesday to Wednesday) over the trailing 3 years of the cut-off date.5.3.4If a stock has history of less than 3 years, it will be treated as missing data.5.3.5The relative z-score of individual descriptors is created following the procedure detailed in Rule 5.1,and the momentum factor is the average relative z-scores of 6-month and 12-month risk-adjustedprice momentum.5.4Quality5.4.1The following descriptors are used to build the quality factor:a.Return on Equity𝐿𝑎𝑡𝑒𝑠𝑡 12 𝑚𝑜𝑛𝑡ℎ 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 100𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑆ℎ𝑎𝑟𝑒ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝐸𝑞𝑢𝑖𝑡𝑦Net income is the trailing 12 month net income as of the data cut-off date. Net income isdefined as earnings from continuing operations before preferred dividends and excludingdiscontinued operations and extraordinary items sourced from Refinitiv Worldscope.Shareholders' equity is the average of the most recent and previous fiscal year’s totalshareholders' equity as of the data cut-off date.b.Earnings VariabilityEarnings variability is defined as the standard deviation of the most recent five fiscal yearsannual earnings per share growth.c.Cash ROA𝐿𝑎𝑡𝑒𝑠𝑡 𝐹𝑖𝑠𝑐𝑎𝑙 𝑌𝑒𝑎𝑟 𝑁𝑒𝑡 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐶𝑎𝑠ℎ 𝐹𝑙𝑜𝑤 100𝐿𝑎𝑡𝑒𝑠𝑡 𝐹𝑖𝑠𝑐𝑎𝑙 𝑌𝑒𝑎𝑟 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠Latest fiscal year net operating cash flow and total assets are sourced from RefinitivWorldscope.d.Operating Cash Flow to Sales𝐿𝑎𝑡𝑒𝑠𝑡 12 𝑚𝑜𝑛𝑡ℎ 𝑁𝑒𝑡 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐶𝑎𝑠ℎ 𝐹𝑙𝑜𝑤 100𝐿𝑎𝑡𝑒𝑠𝑡 12 𝑚𝑜𝑛𝑡ℎ 𝑆𝑎𝑙𝑒𝑠Net operating cash flow and sales are the trailing 12 month values as of the data cut-off dateand sourced from Refinitiv Worldscope.e.LeverageThe leverage descriptor value is the average of three components: Market Leverage, BookLeverage, and Debt to Assets ratio, whereFTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 202210 of 25

Market Leverage 𝐶𝑜𝑚𝑝𝑎𝑛𝑦 𝐼𝑛𝑣𝑒𝑠𝑡𝑎𝑏𝑙𝑒 𝑀𝑎𝑟𝑐𝑘𝑒𝑡 𝐶𝑎𝑝𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝐸𝑞𝑢𝑖𝑡𝑦 𝐿𝑜𝑛𝑔 𝑇𝑒𝑚 𝐷𝑒𝑏𝑡Book Leverage Debt to Assets 𝐶𝑜𝑚𝑝𝑎𝑛𝑦 𝐼𝑛𝑣𝑒𝑠𝑡𝑎𝑏𝑙𝑒 𝑀𝑎𝑟𝑘𝑒𝑡 𝐶𝑎𝑝 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝐸𝑞𝑢𝑖𝑡𝑦 𝐿𝑜𝑛𝑔 𝑇𝑒𝑟𝑚 𝐷𝑒𝑏𝑡𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠Note:a) Company Investable Market Cap is as of the data cut-off dateb) Preferred Equity, Long Term Debt, Book Value, Total Debt, and Total Assets are the mostrecent available data prior to the data cut-off date and are source from RefinitivWorldscope.c) If company investable market cap, preferred equity, or long term debt is missing, theMarket Leverage will be treated as missing datad) If book value, preferred equity, or long term debt is missing, the Book Leverage will betreated as missing datae) If any of the Market Leverage, Book Leverage, or Debt to Assets data is missing, TheLeverage factor will be the average of the available components.f.Gross Profit over Asset𝑳𝒂𝒕𝒆𝒔𝒕 𝑭𝒊𝒔𝒄𝒂𝒍 𝒀𝒆𝒂𝒓 𝑮𝒓𝒐𝒔𝒔 𝑰𝒏𝒄𝒐𝒎𝒆 𝟏𝟎𝟎𝑳𝒂𝒕𝒆𝒔𝒕 𝑭𝒊𝒔𝒄𝒂𝒍 𝒀𝒆𝒂𝒓 𝑻𝒐𝒕𝒂𝒍 𝑨𝒔𝒔𝒆𝒕𝒔Latest fiscal year gross income and total assets are source from Refinitiv Worldscope.g.Gross Margin Sustainability𝑨𝒗𝒆𝒂𝒓𝒈𝒆 𝑮𝒓𝒐𝒔𝒔 𝑴𝒂𝒓𝒈𝒊𝒏 𝒐𝒗𝒆𝒓 𝑳𝒂𝒔𝒕 𝟓 𝑭𝒊𝒔𝒄𝒂𝒍 𝒀𝒆𝒂𝒓𝒔 𝟏𝟎𝟎𝑺𝒕𝒂𝒏𝒅𝒂𝒓𝒅 𝑫𝒆𝒗𝒊𝒂𝒕𝒊𝒐𝒏 𝒐𝒇 𝑮𝒓𝒐𝒔𝒔 𝑴𝒂𝒓𝒈𝒊𝒏 𝒐𝒗𝒆𝒓 𝑳𝒂𝒔𝒕 𝟓 𝑭𝒊𝒔𝒄𝒂𝒍 𝒀𝒆𝒂𝒓𝒔Last 5 fiscal years gross margin is sourced from Refinitiv Worldscope.h.ROA Sustainability𝑨𝒗𝒆𝒓𝒂𝒈𝒆 𝑪𝒂𝒔𝒉 𝑹𝑶𝑨 𝒐𝒗𝒆𝒓 𝑳𝒂𝒔𝒕 𝟓 𝑭𝒊𝒔𝒄𝒂𝒍 𝒀𝒆𝒂𝒓𝒔 𝟏𝟎𝟎𝑺𝒕𝒂𝒏𝒅𝒂𝒓𝒅 𝑫𝒆𝒗𝒊𝒂𝒕𝒊𝒐𝒏 𝒐𝒇 𝑪𝒂𝒔𝒉 𝑹𝑶𝑨 𝒐𝒗𝒆𝒓 𝑳𝒂𝒔𝒕 𝟓 𝑭𝒊𝒔𝒄𝒂𝒍 𝒀𝒆𝒂𝒓𝒔Cash ROA is defined in 5.4.1 ci.Return on Asset𝐿𝑎𝑡𝑒𝑠𝑡 12 𝑚𝑜𝑛𝑡ℎ 𝑛𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 100𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡Net income is the trailing 12 month net income as of the data cut-off date. Net income isdefined as earnings from continuing operations before preferred dividends and excludingdiscontinued operations and extraordinary items sourced from Refinitiv Worldscope. Totalasset is the average of the most recent and previous fiscal year’s total asset as of the datacut-off date.5.4.2The relative z-score of individual descriptors is created following the procedure detailed in 5.1, andquality factor is:LibertyQ US Large Cap Index:A. Average relative z-scores of the Return on Equity, Earnings Variability, and ROA for stocks inthe Financials Industry (ICB Financials 30).FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 202211 of 25

B. Average relative z-scores of the Earnings Variability, ROA, and Operating Cash Flow to Salesfor stocks in the Real Estate Industry (ICB Real Estate 35).C. Average relative z-scores of the Return on Equity, Earnings Variability, Cash ROA,andLeverage for stocks in all the other industries.LibertyQ US Mid Cap Index:A. Average relative z-scores of the Cash ROA and ROA Sustainability for Financials.B. Average relative z-scores of the Cash ROA and ROA Sustainability for REITs.C. Average relative z-scores of the Return on Equity, Gross Profit over Asset, and Gross MarginSustainability for Real Estate excluding REITs and all the other industries.LibertyQ US Small Cap Index:A. Average relative z-scores of the Cash ROA and ROA Sustainability for Financials.B. Average relative z-scores of the Cash ROA and ROA Sustainability for REITs.C. Average relative z-scores of the Return on Equity, Gross Profit over Asset, and Gross MarginSustainability for Real Estate excluding REITs and all the other industries.5.5Value5.5.1The following descriptors are used to build the value factor:a.Book to Price𝐿𝑎𝑡𝑒𝑠𝑡 𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 100𝑀𝑎𝑟𝑘𝑒𝑡 ��𝑛Book value is sourced from Refinitiv Worldscope as of the data cut-off date. MarketCapitalisation is the full market Capitalisation as of the data cut-off date.b.Dividend Yield𝐿𝑎𝑡𝑒𝑠𝑡 12 𝑚𝑜𝑛𝑡ℎ 𝑇𝑟𝑎𝑖𝑙𝑖𝑛𝑔 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 100𝑀𝑎𝑟𝑘𝑒𝑡 ��𝑛Latest 12 month trailing dividend is the sum of ordinary and extra dividends from RefinitivWorldscope as of the data cut-off date. Market Capitalisation is the full market capitalisation asof the data cut-off date.c.Earnings Yield𝐿𝑎𝑠𝑒𝑠𝑡 12 𝑚𝑜𝑛𝑡ℎ 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 100𝑀𝑎𝑟𝑘𝑒𝑡 ��𝑛Net income is the trailing 12 month net bottom line as of the data cut-off date. Net incomebottom line is before deduction of preferred dividends and is sourced from RefinitivWorldscope. Market Capitalisation is the full market capitalisation as of the data cut-off date.d.12 Month Forward Earnings Yield(12M FwdEPS) * 100Price12 Month Forward EPS is the time weighted average of the IBES mean FY1 and FY2 EPSestimates, where the weights are determined by the proportion of the current fiscal yearremaining as of the data cut-off date. The Forward Earnings Yield is the 12 Month ForwardEPS divided by price at the data cut-off date.e.EBITDA to Enterprise ValueFTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 202212 of 25

𝑳𝒂𝒕𝒆𝒔𝒕 𝟏𝟐 𝒎𝒐𝒏𝒕𝒉 𝑬𝑩𝑰𝑻𝑫𝑨 �� 𝑽𝒂𝒍𝒖𝒆EBITDA is the trailing 12 month earnings before Interest, Taxes, Depreciation andAmortization as of the data cut-off date. Enterprise Value is the sum of the company fullmarket capitalisation and net debt as of the data cut-off date. EBITDA and net debt aresourced from Refinitiv Worldscope.5.5.2The relative z-score of individual descriptors is created following the procedure detailed in 5.1, andvalue factor is:LibertyQ US Large Cap Index:A. For stocks in the Financials Industry: 2/3 relative z-scores of the Book to Price Ratio 1/3relative z-score of Dividend Yield.B. For stocks in the Real Estate Industry: 2/3 relative z-scores of the Book to Price Ratio 1/3relative z-score of Dividend Yield.C. For stocks in all the other industries: Average relative z-scores of the Dividend Yield, EarningsYield, and 12 Month Forward Earnings Yield.LibertyQ US Mid Cap Index:A.For Financials: 2/3 relative z-scores of the Book to Price Ratio 1/3 relative z-score ofDividend Yield.B.For REITs: 2/3 relative z-scores of the Book to Price Ratio 1/3 relative z-score of DividendYield.C.For Real Estate excluding REITs and all the other industries: Average relative z-scores of theDividend Yield, EBITDA to Enterprise Value Ratio, and 12 Month Forward Earnings Yield.LibertyQ US Small Cap Index:A.For Financials: 2/3 relative z-scores of the Book to Price Ratio 1/3 relative z-score ofDividend Yield.B.For REITs: 2/3 relative z-scores of the Book to Price Ratio 1/3 relative z-score of DividendYield.C.For Real Estate excluding REITs and all the other industries: Average relative z-scores of theDividend Yield, EBITDA to Enterprise Value Ratio, and 12 Month Forward Earnings Yield.5.6Outlier Treatment5.6.1LibertyQ US Large Cap Equity Index:Top and bottom 0.5% values of each descriptor excluding DY and leverage will be defined asoutliers. For DY, only largest 0.5% values will be defined as outlier. For leverage, the outliers will bedefined at the component level, where the largest 0.5% values of Debt to Assets will be defined asoutliers. For the Book Leverage and Market Leverage components of the leverage descriptor, thelargest 0.5% values and all the values less than 1 will be defined as outliers.LibertyQ US Mid Cap Equity Index:Top and bottom 0.5% values of each descriptor excluding DY will be defined as outliers. For DY,only largest 0.5% values will be defined as outlier.LibertyQ US Small Cap Equity Index:Top and bottom 1% values of each descriptor excluding DY will be defined as outliers. For DY, onlylargest 1% values will be defined as outlier.FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 202213 of 25

5.6.2Median value of the universe excluding null values will be assigned to outliers for all descriptors andthe components except Book Leverage and Market Leverage, where median value is calculatedbased on universe excluding null values and values less than 1.5.7Index Back-Histories5.7.1The availability of factor data prior to the December 2016 launch date of the LibertyQ US Large CapEquity Index is simulated through the application of a three month lag on fundamental data. All indexreviews prior to this date that utilize realized fundamental data incorporate a lag of three months.5.7.2The availability of factor data prior to the March 2017 launch date of the LibertyQ US Mid Cap EquityIndex and the LibertyQ US Small Cap Equity Index is simulated through the application of a threemonth lag on fundamental data. All index reviews prior to this date that utilize realized fundamentaldata incorporate a lag of three months.FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 202214 of 25

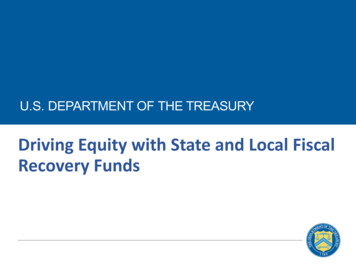

Section 6Index Construction6.0Index Construction6.1Determination of Factor Score6.1.1Calculating the Composite Factor Z-ScoreThe Composite Factor Z-Score is computed from the factor z-scores described below.LibertyQ US Large Cap Index:Zcompi 0.40 Zqualityi 0.30 Zvaluei 0.30 ZmomentumiLibertyQ US Mid Cap Index/LibertyQ US Small Cap Index:Zcompi 0.50 Zqualityi 0.30 Zvaluei 0.10 Zmomentumi 0.10 ZvolatilityiWhere:6.1.2Zcomp iis the composite factor z-score for stock iZquality iis the quality factor z-score of stock iZvalue iis the value factor z-score of stock iZmomentum iis the momentum factor z-score of stock iZvolatility iis the volatility factor z-score of stock iCalculating the Final Factor ScoreComposite factor Z-Scores are mapped to a score Si ϵ (0, 1), using the cumulative normaldistribution with mean zero and standard deviation one.ZiSi CN(Zi ) 2𝑒 𝑥 /2𝑑𝑥 2𝜋(1)Chart 1 illustrates the relationship between Z-Scores and mapped Z-Scores.Chart 1: Mapping Factor Z-Score to S-ScoreFTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 202215 of 25

1S- Score0.80.60.40.20-3-2-10Z-Score6.2Security Selection and Weighting Scheme6.2.1LibertyQ US Large Cap Index:123The securities with benchmark weight greater or equal to 1% are selected for inclusion to theLibertyQ US Large Cap Index, and the total weights in the final index w a is the sum of theirbenchmark weights.The top 20% of the remaining constituents in the underlying universe with the highest CompositeFactor Z-Score are also selected for inclusion to the LibertyQ US Large Cap Index (subject to Rule6.3), and the total final index weights is 1-wa.LibertyQ US Mid and Small Cap Index:The top 25% of constituents in the Parent Index with the highest Composite Factor Z-Score areselected for inclusion to the LibertyQ US Equity Index ( subject to Rule 6.3).6.2.2The securities included are assigned weights in the proportion of Market Cap Weight x Final FactorScore:̂i WSi *Wi j Sj *Wj(2)where Wi are the underlying eligible universe market capitalisation index weights.6.3Buffer RulesTo reduce turnover and enhance Index stability, buffer rules are applied as follows:6.3.1Security Selection BufferA security selection buffer of 50% is applied at each Index Review.LibertyQ US Large Cap Index:Securities in the underlying universe are ranked by their Composite Factor Z-Score in descendingorder. The securities ranked within top 10% (rounded to the nearest integer) will be included in theIndex. Existing constituents not included in the previous step that rank at or within 30% (rounded tothe nearest integer) are then successively added until the number of securities reaches the 20%target representation. If the number of securities is below the 20% target representation after thisstep, the remaining securities in the underlying Index with the highest Composite Factor Z-Score areadded until the number of securities in the Index reaches the target representation.LibertyQ US Mid and Small Cap Index:Securities in the Parent Index are ranked by their Composite Factor Z-Score in descending order.The securities ranked within top 12.5% (rounded to the nearest integer) will be included in theIndex. Existing constituents not included in the previous step that rank at or within 37.5% (rounded tothe nearest integer) are then successively added until the number of securities reaches the 25%target representation . If the number of securities is below the 25% target representation after thisFTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 202216 of 25

step, the remaining securities in the Parent Index with the highest Composite Factor Z-Score areadded until the number of securities in the Index reaches the target representation.6.3.2Turnover BufferA turnover buffer of 50% is applied at each Index Review. If the ongoing rebalancing results inchanging the weight of a security from x% to y% in the Index, where x% is the security index weightfrom data cut-off date and y% is the indicative security index weight from 6.2, then the effectivechange in weight will be:Effective pro forma constituent weight x (y - x) / 2(3)The turnover buffer is applied to the uncapped weights of existing and pro forma constituents and isnot applied to deletions. Any resulting excess weight will be redistributed amongst the indexconstituents.6.3.3Maximum and Minimum Stock WeightLibertyQ US Large Cap Index:A max weight cap of Minimum of (Benchmark weight 1%, 10 * Benchmark Weight) is appliedacross all the securities, and a min weight floor of Maximum of (Benchmark weight – 1%, 0.1%) isapplied across all securities. Any resulting excess weight will be redistributed amongst the remainingconstituents and may cause breaches to the constraints in Rules 6.3.2.LibertyQ US Mid Cap Index/LibertyQ US Small Cap Index:A maximum issuer level weight cap of 1% is applied to the LibertyQ US Mid Cap Index and LibertyQUS Small Cap Index. Any resulting excess weight will be redistributed amongst the remainingconstituents and may cause breaches to the constraints in Rules 6.3.2.FTSE Russell An LSEG Business LibertyQ US Equity Index Series, v1.4, February 202217 of 25

Section 7Periodic Review of Constituents7.0Periodic Review of Constituents7.1Review Dates7.1.1The LibertyQ US Large Cap Index will be reviewed quarterly in March, June, September, andDecember, based on the data at the close of business on the last trading day of the month prior toreview, using constituents as of Monday following the third Friday of the review month for March,September, and

LibertyQ US Equity Index Series will follow the same process as the Russell U.S. Equity Index Series. 1.3.1 The LibertyQ US Equity Index does not take account of ESG factors in its design. 1.4 Price and Total Return Indices will be calculated on an end of day basis. Total return indices include income based on ex dividend adjustments.