Transcription

Temporary DisabilityInsurance Lawsin the United Statesby ALFREDFour out of the five temporary disability insurance programsestablished by law in this country are State systems; thefifth is anational system for railroad workers. These five programs havediflerent provisions for coverage, financing,eligibility,benefits,The complexitiesthus introduced haveand administration.pointed up the continuingneed for bringing together information on legislative, administrative,and statistical developmentsin the field. The following article--the.@stin a series on theseprograms-summarizesthe major substantive provisions of theexisting State temporary disability insurance laws and the Federal law for railroad workers.OUR States have systems of temporary disabilityinsurance providing partialwage-loss compensation for limited periods to wageearners incapacitatedfor work because of nonoccupationalillness orRhode Island initiatedthisinjury.type of social insurance program in1942; Californiaestablished its program in 1946, New Jersey in 1948,and New York in 1949. In addition,Congress extended the Railroad Unemployment Insurance Act in 1946 toprovidecash sickness benefits toworkers covered by that law. Thesetemporarydisabilityinsurance systems are summarized here.1FLegislative BackgroundUnlike most other countries, whichstarted their social insuranceprograms with measures to provide cashbenefits and medical care to workerswho fall sick or are disabled, theUnited States began its national social insurance program in 1935 withunemploymentinsurance and old-ageinsurance.The severe depression ofthe thirties was undoubtedlyresponsible for the break in the pattern. Tothe wage earners of this time, inability to find jobs because of adverseeconomicconditionsor advancingl Divisionof Research and Statistics,Office of the Commissioner.lFor a tabular summary of disabilityinsurance laws, see Cornpurismof Ten porary DisabilityInsurance Laws,April1952, Departmentof Labor, Bureau ofEmploymentSecurity.Bulletin,October 1952age constituted a more serious threatto their economic security than sickness or disability.Providingprotection against costs of sickness thatare more or less recurring regardlessof economic conditions did not seemto have the same urgency as providing protection against cyclical unemployment and old-age dependency.Although the adoption of compulsory disabilityinsurancehas beenslow in this country, interest in suchlegislationgoes back many years.The introductionin 1910-20 of Stateworkmen’scompensationprograms,with their provisions for cash benefitsand medical care for covered wageearners who meet with certain workconnectedinjuries,stimulatedtheearly movement for a social insurance system to cover the costs of nonoccupational illness and injury. During the period 1915-20, 11 States appointed special commissions of inquiry.Six of the commissions foundthat there was a fundamentalneedfor compulsorycash sickness insurance as well as for medical care inBills providingfor suchsurance.programs were introducedin some20 States, but none was passed byboth houses of any legislature.After1921 and until the depression, interestin the subject waned.The need for social insurance tomeet the costs of sickness was oneof the subjects emphasized by theCommittee onEconomic Security, appointed by the President in 1934 toM.SKOLNIK*formulatea national social securityplan. The Committee suggested thatcash paymentsfor temporarydisabilitymight be linkedwith theadministrationof unemploymentinsurance benefits.With the passagein 1935 of the Social Security Act,there was a quickeningof publicinterest in the possibility of providinglegislative protection against the riskof income loss caused by non-workconnected illnesses and accidents. In1939 the presidentiallyappointedInterdepartmentalCommittee to Coordinate Health and Welfare Activities reaffirmed the desirabilityof atemporarydisabilityinsurance program and called attentionto thepossibilityof its developmentalonglines analogousto unemploymentinsurance.During the subsequent years theidea of an integrated temporary disability and unemployment.insuranceprogram gained favor among Stateadministrators,employers,and employees affected by the unemploymentinsurance program.Several influences of a practical nature were responsible for the growing preferencefor coordinatingthe two programsinstead of settingup a separatetemporarydisabilityinsurance system.With the establishmentof unemploymentinsurance systems in allthe States, the covered worker foundhimself protected against part of hiswage loss when he was able to workbut could not get a job, but unprotected against a precisely similar losswhen he was unable to work.Theexperiencesof many wage earnerswho were denied unemploymentinsurance benefits or whose unemployment insurance checks were stoppedbecause of sickness brought home therealizationthat it was illogicalandinequitable to provide benefits againstunemploymentdue to lack of workbut to makeemploymentfinancialno provisionsagainst undue to disabilitywhenneeds may be even greater.11

Six States 2 attempted to rectify someof the inconsistencyby amendingtheir unemploymentinsurance eligibility requirementsso that a claimantbecoming ill after filing his claimand registering for work would continue to draw unemploymentinsurance benefits so long as no suitablejob was offered him.Financialconsiderationswere another factor responsible for the growing interest in placing temporary disability insurance within the framework of the unemploymentinsurancesystem. Several States, among themCalifornia,New Jersey, and RhodeIsland, financed their unemploymentinsurance benefits through a tax onemployees as well as through contributionsfrom employers.With thedecline of unemploymentin the boomperiod of the early forties, employeetaxes were found in most instancesto be unnecessary for unemploymentinsurance purposes and contributedonly to the buildingup of reservesin the unemploymentinsurance trustaccounts. As a result, these Stateshad availablea source of incomethat could conceivablybe divertedfor cash sickness benefits without requiring any additionalcontributionsfrom employers,employees, or theState.Moreover, the closely related objectives of unemploymentand disability insurance, the potential identical coverage of both programs, andthe similaritythat exists in most ofthe functionsnecessaryfor theiroperationheld out the promise ofconsiderablesavings in administrative costs if the two programs wereintegrated.All these factors contributedto a tendencyto modeltemporarydisabilityinsurance afterunemploymentinsurance.Cash sickness benefits for nonwork-connecteddisabilitywere firstpaid in the United States when RhodeIsland’s program for workers coveredby its unemploymentinsurance lawbecame effective on April 1, 1943.Administeredby the State employment security agency, this programis closely allied with unemploymentinsurance in both substantive provisions and administrativearrange2 Idaho, Maryland,Montana,Tennessee, and Vermont.12Nevada,ments. The same groups of workersare covered, the same types of qualifying conditions are used, and thesame wage reports and credits serveas a basis for contributionsand benefits under the two programs.Justas in unemploymentinsurance,allcontributionsare paid to the Stateand all benefits are paid by the State.A similar pattern was followed byCongress when it established a program of cash sickness benefits, effective July 1, 1947, for the Nation’srailroadworkers.Temporarydisability benefits are provided throughan exclusive,Government-operatedfund, closely integratedin administration with railroad unemploymentinsurance.The next State to provide insuranceprotectionagainst off-the-jobdisability was California,which passedthe necessary legislation in 1946. Theprogram, while tied in with unemployment insurance and administeredby the same agency that administersunemploymentinsurance,differsfrom the Rhode Island system andfrom the basic pattern of unemployment insurance in that approved private*insuranceplans can be substituted for the State-operatedplanas the medium through which benefitsare payable.Immediatelyfollowing the passageof the Californialaw,Congressamended the Social Security Act topermit the nine States 3 that had atsome time collected employee contributionsfor unemploymentinsurance purposesto draw on theseamounts deposited to their accountsin the Federal unemploymenttrustfund to finance cash sickness benefits,exclusive of the expenses of administration. This legislation(the Knowland amendment)enabled Californiato advance the effective date for payment of benefits from May 1947 toDecember1946 and gave furtherimpetus to the movement for integrating tempo&ydisabilityinsurance with unemploymentinsurance.In 1948, New Jersey enacted a3 Rhode Island, California,New Jersey,Alabama, Indiana, Kentucky,Louisiana,Massachusetts, and New Hampshire.Atthe beginning of 1946, only the first fourStates were still collecting contributionsfrom employees for unemploymentinsurance.temporarydisabilityinsurance lawunder which benefits became payablein January 1949. Like California, NewJersey provided for “contractingout”of the State fund under approvedprivate plans in a program coordinated with unemploymentinsurance.The passage in 1949 of temporarydisabilityinsurancelegislationinNew York marked a sharp departurefrom the pattern developed in theotherthreeStates.Therewerestrong pressures in New York forincorporatingdisabilityinsuranceinto its unemploymentinsurance system and for creating a tax-supportedState insurance fund, even thoughthere were no employee contributions under unemploymentinsuranceavailablefor the financingof thedisabilityprogram.These pressureswere outweighed,however, by thedesire to grant privateinsurancecompanies the widest possible opportunity to participatein the program.With New York’s system of workmen’s compensation for occupationalinjuries serving as a guide, a temporary disabilityinsurance system,entirely separate from unemploymentinsurance and administeredby theState workmen’s compensation board,was created; benefits, beginning July1, 1950, were. to be providedprimarily through private plans.The year 1949 also saw enactmentof a temporarydisabilityinsurancelaw. in the State of Washington, but,as the result of an unfavorablevoteon the referendumat the generalelection in November 1950, the legislation never went into effect. Thelaw provided for the integrationoftemporarydisabilityinsurance withunemploymentinsurance, though itpermitted the substitutionof privateplans for the Stak plan.Since 1950, bills to establish temporary disabilityinsurance programshave been introducedin more than15 State legislatures.Special reportscalling for the enactment of compulsory temporarydisabilityinsurancelaws have been made by interimlegislativecommissions in Ohio andMassachusetts. In Connecticut, Michigan, Pennsylvania, and West Virginiathe State legislaturesor governorshave authorizedthe appointmentofcommissions to study the problems oftemporary disability insurance and toSocial Security

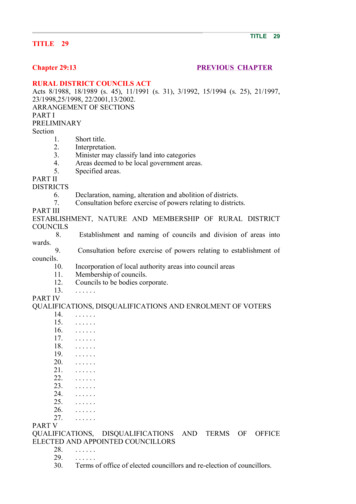

report on the desirablityand feasibility of establishing such a program.CoverageIn the States with coordinated unemploymentand entical for both programs. In general, such occupationalgroups ees,the selfemployed,and employeesof nonprofit organizationsoperated for religious, charitable,and educationalpurposes are excluded.In addition,Rhode Island and New Jersey excludeemployers with fewer than four employees. The California law excludesworkers in firms with a quarterlypayroll of less than 100.In New York, coverageof thedisabilityprogramis more limitedthan that of unemploymentinsurance.Maritime services and State government services are covered by unemploymentinsurancebut not bydisabilityinsurance.Unemploymentinsurance covers employers who havefour or more persons in employmenton each of at least 15’ days in acalendar year, while disabilityinChart L-TemporaryProvision.Rhode Island--TTypes of PlansWhile the State systems of disability insurance make protection ofcoveredworkersmandatory,theyuse different ways of furnishingthisprotection.The development of temporarydisabilityinsurancein theUnited States has been featured bythe establishmentof three differenttypes of plans for the short-terminsuringof covered wage earnersagainst the loss of wages caused bydisability.The first type of plan, which wasadopted by Rhode Island and therailroadsystem, providesthat allcoveredmustinsureemployersthrough an exclusive, publiclyoperated, insurance fund into which allinsurance:Method of insuringCaliforniaNew JerseyAll employers insuredwith exclusive Statefund.Employers insured u-ithState fund unless anduntil agency approval isgiven to private-plan(insured or self-insured).Employers insured withState fund unless anduntil agency approval isgiven to private plan(insured or self-insured).Employee contribution-1% Of first 3,000 ofannual wages (formerly paid for uncmp1oymentinsurance purposes).None . .1% Of first 3,000 of annualwages (formerly paid forunemploymentinsurante purposes).Financing of administrative costs.6% of contributions--.No limit for administntion of State fund. Statecods of supervising Qrivate plans assessedagainst lattor in proportion to taxable wages;limit 0.02% of taxablewages.0.75% of first 3,000 of annual wages out of 1%formerly paid for unemploymentinsuranceDIIrDOSCS.’Siatc-jslan employers payo.!25,goof first 3,000 ofannual wages, modifiedby experience rating.Private-plan employerspay balance of cost.0.08% of taxable wages allotted for administrationof State fund.Statecosts of supervising private plans assessedagainst lattor in proportion to taxable w-ages;limit 0.02% of taxableFinancing of disabilityduring unemploymentAll payments madefrom State fund without distinctionbetween beneEts begin.ning during employment or unemployment.Special extended liabilityaccount in State fundmay assess private plansfor pro rata share of excess of cost over intereston 132 million of initialfund.Assessment limited to 0.03% of taxable wages.Special state unemployment disabilityfundmay assess private plansfor pro rata share of excess of cost over intereston 50 million of initialAssessment lifund.mited to o.02y0 of taxable wages.None for State-plan employers.Private planemployers pay balanceof cost,wages.‘”1 Effective Jan. 1, 1953, employee contribution will be 0.5 percent.Source: Based on Comparison of Temporary Disability Insurance Laws, April 19.52,DepartmentBulletin,October 1952contributionsare paid and fromwhich all benefits are paid. The samebenefit provisions apply to all coveredworkers in like circumst%nces.Noprovisionis made for private cashsickness insuranceplans, althoughany covered employer may providesupplementalbenefits in any mannerhe chooses.The second type of plan providesfor a State-operatedfund, with employers being permitted to “contractout” of the State fund-generallybypurchasing insurance from commercial carriers or by self-insuring.Untila private plan is approved by theState agency as meeting the standards prescribed in the law, workersare automaticallycovered by theState temporarydisabilityinsurancefund. When workers are covered bya private plan, neither they nor theiremployers are required to contributeto the State fund, and no benefits arepayable to such employees from theState fund. Workers’ premiums underprivate plans may not be any greaterthan the contributionthey wouldotherwise be required to pay to theState fund.The Californiaand New Jerseyandfinancialprovisions,Method of insuring-----Emplo %r contribution-’disabilitysurance is compulsoryonly for employers with four or more employeesin at least 30 days.All States with these laws permitindividualswhose religioustenetsprevent them from consulting a physician to “elect out” of the programthat is, on request they may beexemptedfrom contributionsandbecome ineligiblefor benefits underthe disabilityprogram.TJuly I,1952New YorkRailroad programEmployers must arrangefor benefit payments bypurchasing policy froman insurance company,or from the N. Y. StateInsurance Fund, or byself-insurance.0.5% of the first GO ofweekly wages.All employers insured with xc sireGovernmentBalance of cost . . . .Employer tax for unemployment insurance alsofinances disability benefits.Expenses of administeringprogram by workmen’scompensation board financed by assessmentagainst all carriers inproportionto coveredwages: no limit set.Administrativecosts paidfrom unemploymentinswa ce fund; 0.2% oftaxable wages allox-edfor administrationofboth programs.Special State fund administered by workmen’scompensation board andmaintainedby annualassessments against allcarriers without limit.All payments made fromGovernment fund without distinction betweenbcncEts beginning during employment or unemployment.of Labor, Bureau of EmploymentSecurity.13

laws follow this basic pattern, although some differencesexist.InCalifornia/ before a private plan canbe substitutedfor the State plan, itmust afford covered employees rightsgreater than those under the Stateplan. This provisionhas been interpreted to mean that the plan mustbe at least as good as the State planin all respects and be more liberalin at least one respect. New Jersey,on the other hand, only requires thatthe rights afforded under the privateplan be at least equal to those underthe State plan.Both States require that a privateplan to which employees contributecannot be substitutedfor the Stateoperated plan without the consent ofthe majorityof workers covered byit. In California,the consent of themajorityis requiredeven if employees do not contribute.The California law permits a worker to electto be covered by the State plan evenwhen his coworkers are participatingin a private plan. In New Jersey,once a majority of workers have approved a private plan, all the workersin the establishmentare automatically covered by that plan.In both States, unemployedclaimants (defined as those who becomedisabled after they have been separated from covered employmentformore than 2 weeks) are paid benefitsby the State disabilityfund, regardless of whether or not they had paidpremiumsto one or more privateplans. In New Jersey, however, a separate system with different eligibilityconditionsand benefit distinctionbetweentheNew Jersey and Californialaws isthat the latter provides for the disapprovalof a privateplan if itrepresents a substantialselection ofrisks adverse to the State fund. Thisprovisionhas been implementedinpractice by the requirementthat atleast 20 percent of the aggregatevoluntaryplan coverage of each pricarriermustbevateinsurancewomen workers. No provisions, however, have been adopted to protectthe State fund against being left withan undue proportionof the poorerrisks representedby older workers,low-paid wage earners, and workers14in hazardous types of employment.The third type of plan, of whichNew York is the only example, provides for the insuring of the coveredwage earner primarilythrough Stateapproved private plans. No funds arecollectedby the State workmen’scompensationboard itself for thepayment of benefits to workers whobecome disabled while employed andno claims from such workersarefiled with or paid by the board. TheNew Yorkboardmaintainsandadministers a special fund, however,to finance benefits when disabilitycommences after the fourth week ofunemploymentor when the employerhas failed to carry the required insurance.The responsibilityrests solely uponthe employer to make his own insurance arrangementsfor the protectionof his employeesagainsttemporarydisability.He can eitherpurchase a group accident and healthpolicyfroma privateinsurancecompany or from the New York StateInsurance Fund, or he can adopt anapproved plan of self-insurance.Thefailure of an employer to take positive action in this directionleaveshim and his employees without protection. The New York State Insurance Fund is solely a State-operatedcarrier that writes insurance on apremium-payingbasis, unliketheCaliforniaand New Jersey Statefunds, which automaticallycover under a payroll tax program those whodo not take steps to obtain privatecoverage.Except for the fact thatit must accept all risks offered it,the New York State Insurance Fundis administeredand treated like anyother private fund, subject to all theregulatoryrequirementsimposed onprivate insurance carriers, includinga premiumandfranchisetax.Actually,therefore,the State fund(which protects less than an estimated 10 percentof the presentcovered labor force in New York)bears little resemblance to the Stateoperated funds in the other temporary disabilityinsurancesystemswith their uniform tax and automaticcoverage provisions.Benefits paid under the voluntaryprivate plans in New York must beat least as favorable as those providedby the statutory formula in the law.This provision has been interpretedby the State workmen’s compensationboard to mean that some features ofthe private plan can be less favorable if other features of the plan aremore favorable.Employers who hadplans in existence at the time thelaw went into effect are, however,relievedof the responsibilityofmeeting the statutoryrequirementsuntil the earliest date on which theyhave the right to discontinuetheprovisions of their own plans. If anexisting cash plan is the result ofcollectivebargaining,the plan maybe extended indefinitely,as long asboth employer and employee concur.The New Jersey law also exemptedplans existing at the time the legislation was passed, but the Californialaw permittedno exceptions to statutory conditions for plans in existence when the law was enacted.The significance of the distinctionbetween private-plancoverage andState-plan or statutory coverage mustbe kept in mind in any discussion ofthe provisionsof the various lawswith regard to financing, eligibilityrequirements,benefit formulas, andconditions under which benefits maybe received.As far as workerscovered by privateplans are concerned, the statutory provisions areintended only as guides to standardsbelow which the privateplans ingeneral cannot fall. Thus, while identical statutory provisions apply to allcovered workersunder the RhodeIsland and under the railroad system,a different situation prevails in theother States, where private plans maydeviate sharply from the statutoryspecifications.At the end of 1951, almost half thecovered workersin Californiaandmore than two-thirdsof those inNew Jersey were under private plansthat for the most part offered a widevariety of formulas and procedures.In addition, about three-fifthsof thecovered workers in New York wereunder plans that differed in somerespect from the statutory scheduleof benefits. For a realistic view ofthe type of temporarydisabilityinsurance protectionthat the workersin these States actuallyenjoy, aseparate analysis of the thousands ofprivateplans wouldbe required.Such an analysis would go beyondSocial Security

the scope of this article, but it ispossible to cite here the statutoryprovisionsand some of the areaswherevariationsprobablyoccurunder private plans.FinancingIn Rhode Island and California theemployee contributionsformerlyrequired for unemploymentinsuranceare used to finance the entire cost ofthe State-operatedplans for disabilityinsurance.Until July 1946, RhodeIsland continued to use for unemployment insurance purposes one-third ofthe 1.5-percent employee tax on thefirst 3,000 of annual wages. Sincethat time the entire employeetax(reduced to 1 percent in July 1947)has been diverted to the State disability fund. In California,from thebeginning of the program, all of thel-percentemployeetax has beenused for disabilityinsurance.The railroad workers’ program isfinanced exclusivelyby an employertax that covers both unemploymentinsuranceand temporarydisabilityinsurance.This tax rate, which maynot exceed 3.0 percent of earnings upto 300 a month, is adjusted annually,depending on the balance in the railroad unemploymentinsuranceaccount. Since 1948 the rate has been0.5 percent.The New Jersey and New York lawscall for jointemployer-employeecontributions.In New Jersey, aChart2.-Temporaryworker pays 0.75 percent on wagesup to 3,000 a year (0.25 percent stillgoes to the unemploymentinsurancefund) ,4 Employerswhose workersare not protected by private plansoriginallyadded a contributionof0.25 percent.Since July 1, 1951, theemployer tax has been modified under experience rating, within a rangefrom 0.10 percent of taxable payrollto 0.75 percent.In New York, employees contribute0.5 percent of their wages up to amaximum of 30 cents per week, withemployersbearingany additionalcost that may arise. There is no ceiling on the employer’s liability.Eachbusiness establishmentcarries thecost of its own insurance risk, as thehigher incidencesof disabilityexperienced by women wage earners,older workers, and other groups arereflected in the premium rates fixedby private insurance carriers.The same financial distributionofcosts is followed under the Californiaand New Jersey private plans; afterthe employeehas contributedthestatutory amount, the employer paysthe balance of the cost. In practice,however, employee contributionsinthe two States have been more thansufficient to cover the benefit costs ofmost private plans without additional premium payments by the yRhode Islandtoclaimantswhobecomeandsickis creditedearningson accumulatedreservesbuiltup by some ofthe earlieremployeecontributionstothe unemploymentdeficitresults,trustitpropriationsis madefund.upIf abyap-from the State disabilityfundandbyproportionatementson voluntary-plannot exceeding 0.03 percentplan wages.In New Jerseyfund,ingsdevelopedmorethanassessemployers,of private-a similarfromreserveinterestearn-on employee contributionstransferred from the unemploymenttrustfund, is used to finance benefits tothe disabled unemployed.In case ofa deficit, an additionaltax of notamountrequirements,New JerseyProvisionmadewhile unemployedwitln the interest0.02percentoftaxablepayrolls may be imposed on all private-plan employers, matched by anJanuary1, 1953, thediscontributionrate for New Jerseywilldrop to 0.5 percent.disabilityer. In the event that benefit costsrise to a point where the premiumrate would require a substantial contributionfrom the employer, he hasthe privilege,after due notice, ofabandoning his private plan and reverting to State-plancoverage.States with private plans assess theplans for part of the cost of payingbenefits to insured workers who become disabled while unemployed.InCaliforniathis assessment is accomplished through the “extended liability account.” The account is chargedwith the amount of benefit paymentsTfromtheStatedisabilityJuly 1, 1952New York-Railroad program1--QuaUfyin wages 30 in base perfod.or employment.Base period--.-.Last 4 calendarquarters preecdlug benefit year.BeneAt year--.-.Individual,beglnulng with validclaim for dieability iu.3umce. 3G4 in base periodand30timesweeklybenefltamount if 75% ofbase-period wagesare wneentratedin 1 quarter.First 4 of last 5 calen.dar quarters preceding benefityear. 8Individual,beginning with validclaim for eitherdisabilityor nnemploy&3nt inemame.26 times weekly hen- 25 times weekly ben- 4 01 more wnseoutive weeks of covefit amount in basee5t amount in bastperiod. 1ered employmen tperiod. 1before commencx !ment of disabilit: rFirst 4 oflest 6 c&nFirst 4 of last 6 calendar quarters predsr quarten preceding commaumceding benefitment of any psriodyea*. 6of dieability. 1None Individual,beginning with validclaim for eitherdieabilityor unemployment insurance.-(9None , Calendarcedingyear.year prebenefitNone .- None .1 Effective Jan. 1,1953,17 weeks of covered cm loyment in base period.2 Elther (1) suffictent base-period wages to qua Pify for unemployment insuranceor (2) earnings of 13 in covered employment in each of 20 out of 30 weeks preceding last day worked in covered employment.8 When bene5t year begins in 5rs.t month of quarter, first 4 of last 6 calendarquarters.Bulletin,October 19524 Effective Jan. 1,1953,62-week period prccadlng commencement of any l%riOdof disability.5 Effective Jan. 1,1953, C&week period preceding bcneflt year.Source: Based on Comparison of Temporary Disability hurancc Laws, April1068, Department of Labor, Bureau of Employment Security.15

fund. In New York the special fundfor the disabled unemployed is maintained by annual assessments againsteach carrierin proportionto hisshare of total covered payroll. Thereis no statutory limit; the assessmentfor the fiscal year ended March 30,1951, came to 0.05 percent of taxablepayroll.”Most of thz systems put a statutorylimit on the amounts that can bespent by the government-operatedfunds for administrativeexpenses.In New Jersey and under the railroadprogram, the limit is expressed interms of taxable wages. In New Jersey the amounts set aside for administrativecosts may not exceed 0.08percent of the taxable payroll covered by the State plan.Under therailroadprogram,0.2 percentoftaxable wages are allowed for theadministrationof both temporarydisabilityinsurance and unemployment insurance.For the fiscal yearended June 30, 1951, the operatingexpenses for railroaddisabilityinsurance alone came to 0.04 percentof taxable wages.6In Rhode Island the limit is expressed as a percent of contributions.This limit has been steadily increasedover the years-from1 percent ofcontributionsin 1942 (before benefitsbecame payable)to 6 percent by1947. California had a statutory limit of 5 percent of contributionsuntil1951, when the law was amended toremove the percentage limit; at present, the sum allotted for administration is determinedannuallyby theState director of finance.Statutorylimits are providedinnone of the States for the administrat

porary disability insurance system, entirely separate from unemployment insurance and administered by the State workmen's compensation board, was created; benefits, beginning July 1, 1950, were. to be provided pri- marily through private plans. The year 1949 also saw enactment of a temporary disability insurance