Transcription

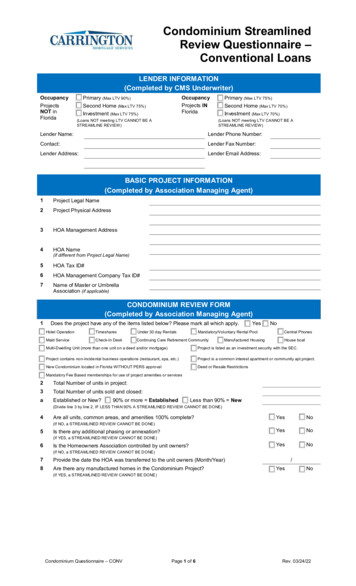

Condominium StreamlinedReview Questionnaire –Conventional LoansLENDER INFORMATION(Completed by CMS Underwriter)Occupancy Primary (Max LTV 90%)ProjectsNOT inFlorida Second Home (Max LTV 75%) Investment (Max LTV 75%)OccupancyProjects INFlorida(Loans NOT meeting LTV CANNOT BE ASTREAMLINE REVIEW) Primary (Max LTV 75%) Second Home (Max LTV 70%) Investment (Max LTV 70%)(Loans NOT meeting LTV CANNOT BE ASTREAMLINE REVIEW)Lender Name:Lender Phone Number:Contact:Lender Fax Number:Lender Address:Lender Email Address:BASIC PROJECT INFORMATION(Completed by Association Managing Agent)1Project Legal Name2Project Physical Address3HOA Management Address4HOA Name5HOA Tax ID#6HOA Management Company Tax ID#7Name of Master or UmbrellaAssociation (if applicable)(if different from Project Legal Name)CONDOMINIUM REVIEW FORM(Completed by Association Managing Agent)1Does the project have any of the items listed below? Please mark all which apply. Hotel Operation Timeshares Under 30 day Rentals Maid Service Check-In Desk Continuing Care Retirement Community Yes No Mandatory/Voluntary Rental Pool Manufactured Housing Central Phones House boat Multi-Dwelling Unit (more than one unit on a deed and/or mortgage) Project is listed as an investment security with the SEC. Project contains non-incidental business operations (restaurant, spa, etc.) Project is a common interest apartment or community apt.project. New Condominium located in Florida WITHOUT PERS approval Deed or Resale Restrictions Mandatory Fee Based memberships for use of project amenities or services2Total Number of units in project:3Total Number of units sold and closed:aEstablished or New? 90% or more Established Less than 90% New(Divide line 3 by line 2, IF LESS THAN 90% A STREAMLINED REVIEW CANNOT BE DONE)4Are all units, common areas, and amenities 100% complete? Yes No Yes No Yes No(If NO, a STREAMLINED REVIEW CANNOT BE DONE)5Is there any additional phasing or annexation?6Is the Homeowners Association controlled by unit owners?(If YES, a STREAMLINED REVIEW CANNOT BE DONE)(If NO, a STREAMLINED REVIEW CANNOT BE DONE)7Provide the date the HOA was transferred to the unit owners (Month/Year)8Are there any manufactured homes in the Condominium Project?/ Yes No(If YES, a STREAMLINED REVIEW CANNOT BE DONE)Condominium Questionnaire – CONVPage 1 of 6Rev. 03/24/22

Condominium StreamlinedReview Questionnaire –Conventional LoansFINANCIAL INFORMATION1In the event a lender acquires a unit due to foreclosure or a deed-in-lieu of foreclosure, isthe mortgagee responsible for paying delinquent common expense assessments? Yes No*If Yes, for how long is the mortgagee responsible for paying common expense assessments? (select one) 1 to 6 months2 7 to 12 months more than 12 monthsIs the HOA involved in any active or pending litigation? Yes No*If Yes, attach documentation regarding the litigation from the attorney or the HOA.Provide the attorney’s name and contact information:Name:Phone:OWNERSHIP & OTHER INFORMATION1Complete the following table if more than one unit is owned by the same individual or entity.Developer orSponsor(Yes or No)Individual / Entity Name2Number ofUnits OwnedPercentageOwned of TotalProject Units Yes No% Yes No% Yes No% Yes No%NumberLeased atMarket RentAre any units in the project used for commercial or non-residential purposes?NumberLeased underRent Control Yes No*If Yes, complete the following:Type of Commercial orNon-Residential UseNumber ofUnitsName of Owner or Tenant% Square Footageof Total ProjectSquare FootageSquareFootage%%%%3What is the total square footage of commercial space in the building that is separate from the residential HOA?Include above and below grade space used for commercial purposes, such as public parking facilities, retail space,apartments, commercial offices, and so on.Total square footage of commercial spaceINSURANCE INFORMATION & FINANCIAL CONTROLS1Are units or common elements located in a flood zone? Yes No*If Yes, flood coverage is in force equaling (select only one option below): 100% replacement cost Maximum coverage per condominium available under the National Flood Insurance Program Some other amount (enter amount here)2 Check all of the following that apply regarding HOA financial accounts: HOA maintains separate accounts for operating and reserve funds. Appropriate access controls are in place for each account. The bank sends copies of monthly bank statements directly to the HOA. Two members of the HOA Board of Directors are required to sign any check written on the reserve account. The Management Company maintains separate records and bank accounts for each HOA that uses itsservices. The Management Company does not have the authority to draw checks on, or transfer funds from, the reserveaccount of the HOA.INSURANCE INFORMATIONTypeCarrier or Agent NameCarrier/Agent Phone NumberPolicy NumberHazardLiabilityFidelityFloodCondominium Questionnaire – CONVPage 2 of 6Rev. 03/24/22

Condominium StreamlinedReview Questionnaire –Conventional LoansCondominium Project Questionnaire AddendumThis addendum is applicable to condominium projects and must be completed by an authorized representative of theHOA.Project InformationProject NameProject AddressBuilding Safety Soundness, Structural Integrity, and Habitability1When was the last building inspection by a licensedarchitect, licensed engineer, or any other building inspector?2Did the last inspection have any findings related to thesafety, soundness, structural integrity, or habitability of theproject’s building(s)? Yes No2a Yes NoIf Yes, have recommended repairs/replacements beencompleted?If the repairs/replacements have not been completed:2bWhat repairs/replacements remain to be completed?2cWhen will the repairs/replacements be completed?Provide a copy of the inspection and HOA board meeting minutes to document findings and action plan.34Is the HOA aware of any deficiencies related to the safety,soundness, structural integrity, or habitability of the project’sbuilding(s)?3aIf Yes, what are the deficiencies?3bOf these deficiencies, what repairs/replacementsremain to be completed?3cOf these deficiencies, when will therepairs/replacements be completed?Are there any outstanding violations of jurisdictionalrequirements (zoning ordinances, codes, etc.) related to thesafety, soundness, structural integrity, or habitability of theproject’s building(s)? Yes No Yes No Yes No Yes NoIf Yes, provide notice from the applicable jurisdictional entity.5Is it anticipated the project will, in the future, have suchviolation(s)?If Yes, provide details of the applicable jurisdiction’srequirement and the project’s plan to remediate the violation.6Does the project have a funding plan for its deferredmaintenance components/items to be repaired or replaced?Condominium Questionnaire – CONVPage 3 of 6Rev. 03/24/22

Condominium StreamlinedReview Questionnaire –Conventional LoansBuilding Safety Soundness, Structural Integrity, and Habitability7Does the project have a schedule for the deferredmaintenance components/items to be repaired or replaced? Yes No Yes NoIf Yes, provide the schedule.8Has the HOA had a reserve study completed on the projectwithin the past 3 years?9What is the total of the current reserve account balance(s)?10Are there any current special assessments unit owners areobligated to pay? If Yes:111210aWhat is the total amount of the special assessments?10bWhat are the terms of the special assessments?10cWhat is the purpose of the special assessment(s)?Are there any planned special assessments that unit ownerswill be obligated to pay? If Yes:What will be the total amount of the specialassessments?11bWhat will be the terms of the special assessments?11cWhat will be the purpose of the special assessments?Has the HOA obtained any loans to finance improvements ordeferred maintenance?Amount borrowed?12bTerms of repayment? Yes No Yes No 11a12a Yes No Additional Comments:Condominium Questionnaire – CONVPage 4 of 6Rev. 03/24/22

Condominium StreamlinedReview Questionnaire –Conventional LoansSOURCE OF INFORMATION: Acceptable sources include an officer of thecondominium association or a qualified employee of the association’smanagement company.Source of Information:Signature:Title:Date:Phone Number:Email Address:Website Address ofAssociation:COMPLETED BY CMS UNDERWRITERBy signing below, you certify that the above condominium project meets eligibility requirements forStreamlined Review and meets General Condominium Project Requirements in the Freddie Mac Seller/ServicerGuide.Underwriter’s Signature:Print Name:Lender Name:Carrington Mortgage Services, LLC (CMS)Phone Number:Date:INSTRUCTIONS1Have the Association Managing Agent complete the Streamlined Review questionnaire.2If any of the items are marked Yes for line item 1, check the ineligible projects list below to determine if theproject is ineligible.3If the project does not meet any of the streamline review requirements, condition the loan for full projectapproval.4Check Fannie Mae for the Condominium FINAL PERS approval or Fannie Mae’s Condominium ProjectManager (CPM) approval.5Obtain a FULL condominium questionnaire.6InterIsland Mortgage Corp4704 18th Avenue WestBradenton, FL 34209Phone: 941.748.3087Fax: 941.747.9725Email: iisland@tampabay.rr.comThis may require a second condominium FULL questionnaire to be completed by the Association; it will alsorequire fees to be paid for Full project approval.Condominium Questionnaire – CONVPage 5 of 6Rev. 03/24/22

Condominium StreamlinedReview Questionnaire –Conventional LoansINELIGIBLE PROJECTS1All new construction and new conversion projects located in Florida WITHOUT Fannie Mae Condominiumapproval known as PERS. In addition, all new conversion projects that are non-gut rehabs WITHOUT PERSapproval will be ineligible.2Any project that is required to be registered with the U.S. Securities and Exchange Commission or any Statesecurities agency, regardless of the project type will be ineligible.3Condominium Hotels:Hotel operation, timeshares, under 30 day rentals, mandatory and voluntary rental pool, central telephoneand central key systems, maid service, check-in desk, non-incidental business operations (restaurant, spa,etc.)4Multi-dwelling Unit:A project in which an owner may hold a single deed evidencing ownership of more than one dwelling unit.5Project with excessive commercial or non-residential space:No more than 25% of the total square footage of the project can be used for nonresidential purposes.6Tenancy-in Common apartment project:A project in which there is an arrangement under which a purchaser receives an interest in real estate and theright to use a unit or Amenities, or both, for a specified period and on a recurring basis such as the 15th weekof the year, or ownership that is for a limited period such as for the subsequent five years.7Houseboat project8Project that is a legal nonconforming use:A Condominium Project with legal non-conforming use and the jurisdiction in which the project is located doesnot allow the rebuilding of the improvements to current density in the event of their partial or full destruction.This restriction does not apply to Detached Condominium Projects or if the jurisdiction in which the project islocated allows the rebuilding of the improvements to their current density in the event of their partial or fulldestruction.9Project in litigation:A project in which: (1) the HOA is named as a party to pending litigation, or (2) the project sponsor ordeveloper is named as a party to pending litigation that relates to the safety, structural soundness, functionaluse or habitability of the project.The following types of minor litigation are acceptable: the HOA Corporation is the plaintiff in the litigation and upon investigation and analysis the lenderhas reasonably determined the matter is minor and will result in an insignificant impact to thefinancial stability of the project; the reasonably anticipated or known damages and legal expenses are not expected to exceed 10%of the project's funded reserves; the HOA corporation is seeking recovery of funds for issues that have already been remediated,repaired, or replaced and there is no anticipated material adverse impact if funds are not recovered;andlitigation concerning localized damage to a unit in the project that does not impact the overall safety,structural soundness, habitability, or functional use of the project.New Project sold with excessive Seller contributions: 10A New Condominium Project where the builder, developer or property seller is offering financing or salearrangements for Condominium Unit Mortgages. These individual Mortgages have builder/developercontributions that do not comply with the requirements of the Purchase Documents.11No single entity, other than units owned by developer still for sale, may own more than 10% of the units. If aproject consists of 2-4 units, no one can own more than 1 unit, 5-20 unit projects no more than 2 units.12Continuing Care Retirement Community (CCRC)13Manufactured Homes14Timeshare project or project with segmented ownership:A project in which there is an arrangement under which a purchaser receives an interest in real estate and theright to use a unit or Amenities, or both, for a specified period and on a recurring basis such as the 15th weekof the year, or ownership that is for a limited period such as for the subsequent five years.Condominium Questionnaire – CONVPage 6 of 6Rev. 03/24/22

Fidelity Flood . Condominium Streamlined Review Questionnaire - . Provide a copy of the inspection and HOA board meeting minutes to document findings and action plan. 3 Is the HOA aware of any deficiencies related to the safety, . the HOA is named as a party to pending litigation, or (2) the project sponsor or developer is named as a .