Transcription

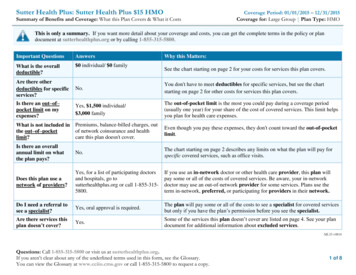

Sutter Health Plus: Sutter Health Plus 15 HMOSummary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Large Group Plan Type: HMOThis is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plandocument at sutterhealthplus.org or by calling 1-855-315-5800.Important QuestionsAnswersWhat is the overalldeductible? 0 individual/ 0 familyWhy this Matters:See the chart starting on page 2 for your costs for services this plan covers.Are there otherdeductibles for specificservices?No.You don't have to meet deductibles for specific services, but see the chartstarting on page 2 for other costs for services this plan covers.Is there an out–of–pocket limit on myexpenses?Yes, 1,500 individual/ 3,000 familyThe out-of-pocket limit is the most you could pay during a coverage period(usually one year) for your share of the cost of covered services. This limit helpsyou plan for health care expenses.What is not included inthe out–of–pocketlimit?Premiums, balance-billed charges, outof network coinsurance and healthcare this plan doesn't cover.Even though you pay these expenses, they don't count toward the out-of-pocketlimit.Is there an overallannual limit on whatthe plan pays?No.The chart starting on page 2 describes any limits on what the plan will pay forspecific covered services, such as office visits.Does this plan use anetwork of providers?Yes, for a list of participating doctorsand hospitals, go tosutterhealthplus.org or call 1-855-3155800.If you use an in-network doctor or other health care provider, this plan willpay some or all of the costs of covered services. Be aware, your in-networkdoctor may use an out-of-network provider for some services. Plans use theterm in-network, preferred, or participating for providers in their network.Do I need a referral tosee a specialist?Yes, oral approval is required.The plan will pay some or all of the costs to see a specialist for covered servicesbut only if you have the plan’s permission before you see the specialist.Are there services thisplan doesn’t cover?Yes.Some of the services this plan doesn’t cover are listed on page 4. See your plandocument for additional information about excluded services.ML33 v0814Questions: Call 1-855-315-5800 or visit us at sutterhealthplus.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-855-315-5800 to request a copy.1 of 8

Sutter Health Plus: Sutter Health Plus 15 HMOCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Large Group Plan Type: HMOSummary of Benefits and Coverage: What this Plan Covers & What it Costs Copayments are fixed dollar amounts (for example, 15) you pay for covered health care, usually when you receive the service. Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example,if the plan’s allowed amount for an overnight hospital stay is 1,000, your coinsurance payment of 20% would be 200. This maychange if you haven’t met your deductible. The amount the plan pays for covered services is based on the allowed amount. If an out-of-network provider charges more than theallowed amount, you may have to pay the difference. For example, if an out-of-network hospital charges 1,500 for an overnight stayand the allowed amount is 1,000, you may have to pay the 500 difference. (This is called balance billing.) This plan may encourage you to use in-network providers by charging you lower deductibles, copayments and coinsurance amounts.Your Cost If You Use anCommonMedical EventServices You May NeedPrimary care visit to treat an injuryor illnessSpecialist visitIf you visit a healthcare provider’soffice or clinicIf you have a testIf you need drugs totreat your illness orconditionMore informationabout prescriptionOther practitioner office visitOut-ofnetworkProviderLimitations & Exceptions 15 per visitNot covered---None--- 15 per visitNot covered 10 per visit for acupuncture 10 per visit for chiropracticcareNot covered---None--Offered and Contracted ThroughACN Group of California.Acupuncture: up to 30 visits perPlan Year.Chiropractic care: up to 30visits per Plan Year.In-network ProviderPreventiveNo Chargecare/screening/immunizationDiagnostic test (x-ray, blood work) No ChargeImaging (CT/PET scans, MRIs) 15 per visitRetail: 10 copayGeneric drugsMail Order: 20 copayRetail: 20 copayPreferred brand drugsMail Order: 40 copayRetail: 35 copayNon-preferred brand drugsMail Order: 70 copayQuestions: Call 1-855-315-5800 or visit us at sutterhealthplus.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-855-315-5800 to request a copy.Not covered---None---Not coveredNot covered---None-----None--Retail: 30-day supplyMail Order: 90-day supplyRetail: 30-day supplyMail Order: 90-day supplyRetail: 30-day supplyMail Order: 90-day supplyNot coveredNot coveredNot covered2 of 8

Sutter Health Plus: Sutter Health Plus 15 HMOCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Large Group Plan Type: HMOSummary of Benefits and Coverage: What this Plan Covers & What it CostsYour Cost If You Use anCommonMedical EventServices You May NeedIn-network ProviderOut-ofnetworkProviderdrug coverage isavailable atoptumrx.com or call1-888-574-7417Retail: 20% coinsuranceMail Order: 20% coinsuranceNot coveredRetail: 30-day supplyMail Order: 30-day supplyShare of cost will not exceed 100 per 30-day supply for eachspecialty drug dispensed, exceptfor sexual dysfunctionmedications; which are 50% ofcost, 8 doses per 30-day supplyand infertility medications whichare 50% of cost 15 per visitNot covered---None---No ChargeNot coveredEmergency room services 35 per visit 35 per visitEmergency medical transportationUrgent careFacility fee (e.g., hospital room)Physician/surgeon feeMental/Behavioral healthoutpatient servicesMental/Behavioral health inpatientservicesSubstance use disorder outpatientservicesSubstance use disorder inpatientservicesPrenatal and postnatal careNo Charge 15 per visitNo ChargeNo ChargeNo Charge 15 per visitNot coveredNot covered---None--Does not apply if admitteddirectly to the hospital as aninpatient for covered services.---None-----None-----None-----None--- 15 Individual/ 7 Group per visitNot covered---None---No ChargeNot covered---None--- 15 Individual/ 5 Group per visitNot covered---None---No ChargeNot covered---None---No ChargeNot covered---None---Specialty drugsIf you haveoutpatient surgeryIf you needimmediate medicalattentionIf you have ahospital stayIf you have mentalhealth, behavioralhealth, or substanceabuse needsIf you are pregnantLimitations & ExceptionsFacility fee (e.g., ambulatorysurgery center)Physician/surgeon feesQuestions: Call 1-855-315-5800 or visit us at sutterhealthplus.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-855-315-5800 to request a copy.3 of 8

Sutter Health Plus: Sutter Health Plus 15 HMOCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Large Group Plan Type: HMOSummary of Benefits and Coverage: What this Plan Covers & What it CostsYour Cost If You Use anCommonMedical EventIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careServices You May NeedIn-network ProviderDelivery and all inpatient servicesHome health careRehabilitation servicesHabilitation servicesSkilled nursing careDurable medical equipmentHospice serviceNo ChargeNo Charge 15 per visit 15 per visitNo ChargeNo ChargeNo ChargeEye examNo ChargeGlassesDental check-upNot CoveredNot CoveredOut-ofnetworkProviderNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredUp to 45 maxreimbursementNot coveredNot coveredLimitations & Exceptions---None--Up to 100 visits per plan year---None-----None--Up to 100 days per benefit --Excluded Services & Other Covered Services:Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.) Cosmetic surgery Dental care Hearing aids Non-emergency care when traveling outsidethe U.S. Private-duty nursingQuestions: Call 1-855-315-5800 or visit us at sutterhealthplus.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-855-315-5800 to request a copy. Routine foot care Weight loss programs4 of 8

Sutter Health Plus: Sutter Health Plus 15 HMOSummary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Large Group Plan Type: HMOOther Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services and your costs for theseservices.) Acupuncture Infertility treatment Routine eye exam Bariatric surgery Laboratory tests Routine hearing tests Chiropractic careYour Rights to Continue Coverage:If you lose coverage under the plan, then, depending upon the circumstances, Federal and State laws may provide protections that allow you to keephealth coverage. Any such rights may be limited in duration and require you to pay a premium, which may be significantly higher than the premiumyou pay while covered under the plan. Other limitations on your right to continue coverage may also apply.For more information on your rights to continue coverage, contact the plan at 1-855-315-5800. You may also contact your state insurancedepartment, the U.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S.Department of Health and Human Services at 1-877-267-2323 EXT 61565 or www.cciio.cms.gov.Your Grievance and Appeals Rights:If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. Forquestions about your rights, this notice, or assistance, you can contact Sutter Health Plus at 1-855-315-5800 or TTY/TDD: 1-855 830 3500 or visitwww.sutterhealthplus.org.If this coverage is subject to ERISA, you may contact Sutter Health Plus at 1-855-315-5800 or the Department of Labor’s Employee BenefitsSecurity Administration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform, and the California Department of Insurance at 1-800-927HELP (4357) or www.insurance.ca.gov.Additionally, a consumer assistance program can help you file your appeal:Contact Department of Managed Health Care Help Center, 980 9th Street, Suite 500, Sacramento, CA 95814(888) 466-2219 or TTY/TDD: 1-877-688-9891 http://www.healthhelp.ca.gov helpline@dmhc.ca.govDoes this Coverage Provide Minimum Essential Coverage?The Affordable Care Act requires most people to have health care coverage that qualifies as “minimum essential coverage.” This plan or policydoes provide minimum essential coverage.Questions: Call 1-855-315-5800 or visit us at sutterhealthplus.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-855-315-5800 to request a copy.5 of 8

Sutter Health Plus: Sutter Health Plus 15 HMOSummary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Large Group Plan Type: HMODoes this Coverage Meet the Minimum Value Standard?The Affordable Care Act establishes a minimum value standard of benefits of a health plan. The minimum value standard is 60% (actuarial value).This health coverage does meet the minimum value standard for the benefits it provides.Language Access ServicesSpanish (Español): Para obtener asistencia en Español, llame al 1-855-315-5800.Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-855-315-5800.Chinese (中文): � 1-855-315-5800.Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' �––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next ––Questions: Call 1-855-315-5800 or visit us at sutterhealthplus.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-855-315-5800 to request a copy.6 of 8

Sutter Health Plus: Sutter Health Plus 15 HMOCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Large Group Plan Type: HMOCoverage ExamplesAbout these Coverage Examples:These examples show how this plan mightcover medical care in given situations. Usethese examples to see, in general, how muchfinancial protection a sample patient might getif they are covered under different plans.This isnot a costestimator.Don’t use these examples toestimate your actual costsunder this plan. The actualcare you receive will bedifferent from theseexamples, and the cost ofthat care will also bedifferent.See the next page forimportant information aboutthese examples.Having a babyManaging type 2 diabetes(normal delivery)(routine maintenance ofa well-controlled condition) Amount owed to providers: 7,540 Plan pays 7,090 Patient pays 450Sample care costs:Hospital charges (mother)Routine obstetric careHospital charges (baby)AnesthesiaLaboratory testsPrescriptionsRadiologyVaccines, other preventiveTotalPatient pays:DeductiblesCopaysCoinsuranceLimits or exclusionsTotalQuestions: Call 1-855-315-5800 or visit us at sutterhealthplus.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-855-315-5800 to request a copy. Amount owed to providers: 5,400 Plan pays 4,640 Patient pays 760 2,700 2,100 900 900 500 200 200 40 7,540 0 300 0 150 450Sample care costs:PrescriptionsMedical Equipment and SuppliesOffice Visits and ProceduresEducationLaboratory testsVaccines, other preventiveTotalPatient pays:DeductiblesCopaysCoinsuranceLimits or exclusionsTotal 2,900 1,300 700 300 100 100 5,400 0 680 0 80 7607 of 8

Sutter Health Plus: Sutter Health Plus 15 HMOCoverage ExamplesCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Large Group Plan Type: HMOQuestions and answers about the Coverage Examples:What are some of the assumptions behindthe Coverage Examples? Costs don’t include premiums.Sample care costs are based on nationalaverages supplied by the U.S.Department of Health and HumanServices, and aren’t specific to aparticular geographic area or healthplan.The patient’s condition was not anexcluded or preexisting condition.All services and treatments started andended in the same coverage period.There are no other medical expenses forany member covered under this plan.Out-of-pocket expenses are based onlyon treating the condition in theexample.The patient received all care from innetwork providers. If the patient hadreceived care from out-of-networkproviders, costs would have beenhigher.What does a Coverage Example show?For each treatment situation, the CoverageExample helps you see how deductibles,copayments, and coinsurance can add up.It also helps you see what expenses might beleft up to you to pay because the service ortreatment isn’t covered or payment islimited.Does the Coverage Example predict myown care needs? No. Treatments shown are just examples.The care you would receive for thiscondition could be different based onyour doctor’s advice, your age, howserious your condition is, and many otherfactors.Does the Coverage Example predict myfuture expenses? No. Coverage Examplesare not cost estimators. You can’t use theexamples to estimate costs for an actualcondition. They are for comparativepurposes only. Your own costs will bedifferent depending on the care you receive,the prices your providers charge, and thereimbursement your health plan allows. Yes. When you look at the Summary ofBenefits and Coverage for other plans,you’ll find the same Coverage Examples.When you compare plans, check the“Patient Pays” box in each example. Thesmaller that number, the more coveragethe plan provides.Are there other costs I should considerwhen comparing plans? Yes. An important cost is the premiumyou pay. Generally, the lower yourpremium, the more you’ll pay in out-ofpocket costs, such as copayments,deductibles, and coinsurance. Youshould also consider contributions toaccounts such as health savings accounts(HSAs), flexible spending arrangements(FSAs) or health reimbursement accounts(HRAs) that help you pay out-of-pocketexpenses.Can I use Coverage Examples to compareplans?Questions: Call 1-855-315-5800 or visit us at sutterhealthplus.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-855-315-5800 to request a copy.8 of 8

1 of 8 Sutter Health Plus: Sutter Health Plus 15 HMO Coverage Period: 01/01/2015 - 12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Large Group Plan Type: HMO Questions: Call 1-855-315-5800 or visit us at sutterhealthplus.org. If you aren't clear about any of the underlined terms used in this form, see the Glossary.