Transcription

UC Retiree Medical Plans—Presented by Guerren Solbach—

—Agenda— Your Options Making Changes Medicare and UC Plan Overviews Conclusion2

—Your Options—3

—Your options— UC offers a menu of medical planoptions HMO plans PPO plansAvailability determined by zipcode/county HMOs not available outside urban CA ucnet.universityofcalifornia.edu/oe (seeHMO Service Area chart)4

—UC medical plans— HMOs Health Net Blue & Gold/Seniority PlusKaiser Permanente/Senior AdvantageWestern HealthAdvantage PPOs Core Medical UC Care UC High Option UC Medicare PPO UC Medicare PPO w/oPrescription Drugs5

—Medical plan premiums—100% of UC contribution: see rate chartGraduated Eligibility: During OE, Log on to At Your Service Online(password)Or, use Retiree Premium Estimator (Excel) on HCFProgram site (year round)Or, call Customer Service at 1-800-888-UCOP% of UC contribution is printed aboveaddress stamp85IMA RETIREE1 SHIELDS AVEDAVIS CA 95616-99996

—Medical plan premiums— Retirees age 65 not eligible forMedicare Rates linked to employee ratesMedicare Part B reimbursement Will you have a net premium to pay?7

AYSO: Benefit Income8

—About UC medical plans— Preventive care generally provided at no costMedical benefits can be separate fromMental Health benefits and PharmacybenefitsFor details, see Plan Booklets (Evidence ofCoverage documents) ucnet.universityofcalifornia.edu/oe9

—Making Changes—10

—Making changes— Open Enrollment Changes effective January 1 Move outside plan service area Adding newly eligible family member No pre-existing conditions exclusions11

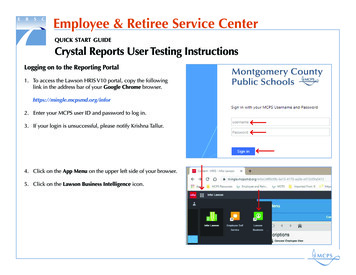

—Open Enrollment for 2018— Changes made on At Your Service Online:ucnet.universityofcalifornia.eduNo online access? Locked out of the website?Call the Retirement Administration ServiceCenter at 1-800-888-UCOPAdditional paperwork may be required ifMedicare-eligibleRemember to get a Confirmation Number12

If you like what you have do nothing except read your Open Enrollment booklet!This includes WHA members who will be 65 next year13

—Medicare and UC—14

—Medicare and UC— Medicare is the federal health insuranceprogram for those over 65 and some disabled Part A: Hospital insurance (premium-free for most) Part B: Medical insurance 134/month if newly enrolled in 2017 (? in 2018) 109/month for those getting SS incomeCosts more if MAGI 85K/year ( 170K for couples)15

—UC’s Medicare requirements— Retirees and their family members must enroll inMedicare Part B: If they are enrolled in medical insurance If they are eligible for Part A free of charge Failure to comply may result in the loss of UC coverage Exceptions: Retirees who reside outside of the U.S.; Those who retired prior to July 1, 199116

—Medicare and HMOs— Medicare Advantage plans If you have Medicare A & B, and you are enrolled in anHMO, you must sign over your Medicare benefits tothe HMO (by form)Medicare pays a flat monthly fee to theinsurance companyMedicare cannot be used separately from theMedicare Advantage plan17

—Medicare and Anthem Blue Cross—1.2. Medicare primaryAnthem Blue Cross plans are secondaryMedicare providers must be used Exception: behavioral health providers 96% of U.S. physicians participate in MedicareAsk if accepting new Medicare patientsProviders that do not accept “assignment” can charge up to15% more18

—Medicare Part D— Subsidizes medical planpremiums UC Part D plans: no“doughnut hole” Form required ifchoosing a new plan19

—More on Part D— Duplicate Part D coverage not allowed Enrollment in a non-UC Part D plan mayresult in loss of coverage Exception: UC Medicare PPO without Rx20

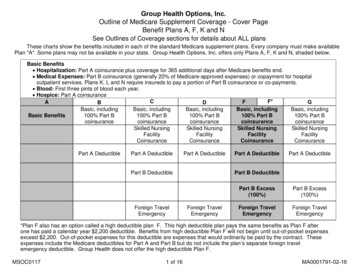

—Mixed Medicare families—Non-Medicare family membersFamily members with MedicareCore Medical UC Medicare PPOHealth Net Blue & Gold HMO Health Net Seniority PlusKaiser Permanente Kaiser Permanente Senior AdvantageUC Care UC Medicare PPO21

—Medicare retirees outside CA— Medicare Exchange Sells local Medicare supplement plans inside U.S.A. All covered family members must have Medicare Does not affect Dental/Vision/Legal coverage22

UC provides premium support Health Reimbursement Account (HRA) 3,000 per covered person Subject to graduated eligibilityUse HRA money to buy Medigap or MedicareAdvantage plans, pay for Medicare Parts B/DCatastrophic Coverage Special Payments for Rx23

—HMO Plan Overview—24

—About HMOs— The insurance company prepays a monthly, per capita rate(capitation) to each Medical Group Primary Medical Group is responsible for your care that month Each family member can have a different PCP/groupYou choose a Primary Care Physician (PCP) who acts as yourgatekeeper to care through the Medical Group Exception: emergencies covered anywhere; call 911 or go to the nearesthospital. Let PCP know ASAP.PCP must be within 30 miles of homeTo change PCPs, call plan25

—HMO coverage: Copayments— Physician office visit: 20 ER: 75 (Medicare: 65) Emergencies covered worldwide Outpatient surgery: 100 Inpatient hospitalization: 250 Behavioral health outpatient: 20 Behavioral health inpatient: 25026

—HMO behavioral health— UC has “carved out” behavioral services for mostof our non-Medicare plans to Optum (UnitedBehavioral Health)Separate behavioral health plan manages careCall Optum directly for mental health/substanceabuse treatmentFirst 3 outpatient visits free27

—HMO behavioral health—Medical PlanBehavioral Health PlanHealth Net Blue & GoldOptumHealth Net Seniority PlusMHN: Managed Health NetworkNew for 2018: Sutter patients use MHNKaiser PermanenteGo through PCP and/orOptumKaiser Senior AdvantageGo through PCPWestern Health AdvantageOptum28

—Non-Medicare HMO Rx—Health NetBlue & GoldKaiserPermanenteWHATier 1(generic, formulary) 5 5 5Tier 2(brand name, formulary) 25 25 25Tier 3(non-formulary) 40Not covered 40Rx 30-day supplies Some meds require prior authorization New for non-Medicare plans: Copayments waivedfor low- to moderate-dose statins29

—HMO Rx 90-day supplies for 2 copays— UC pharmacies Mail-order Does not apply to KaiserKaiser: 100-day supplySome local retail pharmacies Health Net Blue & Gold: CVS WHA: Costco, CVS, Walgreens, and others30

—HMO copayment maximums—Out-of-pocket maximumIncludes medical, mental health, RxHealth NetBlue & GoldKaiserPermanente*WHA 1,000/person 1,500/person 1,000/person 3,000/family 3,000/family 3,000/family* Kaiser maximum does not include Optum copayments31

—HMO Rx: Medicare Part D—Health NetSeniority PlusKaiser SeniorAdvantage 5 5Tier 2(brand name, formulary) 25 25Tier 3(non-formulary) 40Not covered 2,000 5,000Rx 30-day suppliesTier 1(generic, formulary)Rx Out-of-Pocket Max32

—HMO Rx: Part D 90-day supplies— Retail pharmacies: 3 copayments UC pharmacies: 2 copayments Does not apply to KaiserMail order: 2 copayments Kaiser: 100-day supplies33

—Medicare HMO copay limits—Out-of-pocket maximum*Includes medical & mental healthHealth NetSeniority PlusKaiser PermanenteSenior Advantage 1,500/person 1,500/person 3,000/family* Maximums do not include Rx copayments34

—Health Net Blue & Gold/Seniority Plus— Large provider network Special directory for UC Davis Medical GroupAvailable in most of urban CaliforniaDecision Power: Track your health issues/knowledge baseHealth coach (nurse, respiratory therapist, dietitian)24-hour nurse line, case managers, healthy discounts35

—Health Net Blue & Gold/Seniority Plus— Disease Management programsOmada Health weight loss and management program(for those with diabetes and heart risks)Welvie surgery decision programQuit for Life program: Smoking cessation phonebased behavioral coachingTelemedicine consults 24/7 through MDLIVE No copay virtual urgent care visit; less than 1 hour wait36

—Health Net Blue & Gold/Seniority Plus— Hearing aids: 2 aids every 36 months; 2,000benefit maxAllergy shots: 20Pharmacy Benefit Manager: CVS/CaremarkBe sure to specify a PCP when choosingeither plan37

—Health Net Blue & Gold vs. Seniority Plus—Health Net Blue & Gold Does not offer local Suttergroups 75 ER copay 1,000 per person out ofpocket limit for medical,mental health and RxSeniority Plus Does offer Sutter groups 65 ER copay 1,500 per person out ofpocket limit for medical &mental health 2,000 Rx OOP limit38

—Health Net Blue & Gold vs. Seniority Plus—Health Net Blue & Gold 90-day supplies @ localCVS pharmaciesSeniority Plus Acupuncture/chiropractic24 visit limitMental health: Optum Chiropractic (20 visit limit)Eye glasses: 100 frameallowance; lenses coveredin full; every 24 monthsSilver & Fit fitness clubsMental health: MHN39

—Kaiser Permanente/Senior Advantage— Kaiser Foundation Health Plan contracts withone large group, the Permanente Medical GroupAvailable in most of urban CaliforniaAdvanced electronic medical records, onlinetools, My Health Manager mobile appClinics tend to offer pharmacies, imaging,laboratories, urgent care all at one location40

—Kaiser Permanente/Senior Advantage— Classes, pamphlets, videos on a wide variety ofhealth topics Disease Management programs Rx: 30-/60-/100-day supplies at 1x/2x/3x copays Must use Kaiser pharmacies Mail order: 100-day supply for 2x copays41

—Kaiser Permanente vs.Senior Advantage—Kaiser Permanente 1,500 out of pocket limitincludes Rx Hearing aids: 1,000 allowanceper aid per ear, every 36 months Allergy shots: 5 Optum behavioral health Acupuncture/chiropractic 24visit limitSenior Advantage Rx out of pocket limit: 5,000 Hearing aids: 2,500allowance per aid per ear,every 36 months 150 allowance for eye glassframes and lenses every 24months Chiropractic Allergy shots: 342

—Western Health Advantage— Local health plan, only available incertain Northern CA countiesOwned in part by UC Davis Health,Mercy and NorthBay hospitalsYes, UC employees/retirees canchoose UC Davis Medical GroupAdvantage: “Advantage Referrals”Travel insurance: Assist America43

—More about WHA— Pharmacy Benefit Manager: Express Scripts Allergy shots: 5Chiropractic/acupuncture: 20 (self-refer to Landmarkproviders) Rx 90-day supplies @ local UC Davis, Costco, CVS,Walgreens, and other pharmacies for 2 copayments24 visits/person/year combinedDiscounts on gym membershipsBe sure to specify a PCP when choosing this plan44

—PPO Plan Overview—45

Large Preferred Provider network: In California: 60,000 Blue Cross network AnthemPreferred providers (87% of doctors) including 400 network hospitals (90% of facilities)More than 96% of hospitals and 92% of physiciansacross the country are Blue Cross/Blue Shield(BlueCard) providersPreferred providers in 200 foreign countriesNew website: ucppoplans.com46

UC-dedicated customer service Anthem Health Guides24/7 nurse line & behavioral health resource centerVariety of online tools & mobile app Castlight personalized cost estimatorLiveHealth Online medical and psychology care (non-Medicare) New for 2018: PsychiatrymyStrength behavioral health siteNew for non-Medicare plans: Copayments waived forlow- to moderate-dose statins47

—Core Medical—48

—Core Medical— Custom PPO for UC No cost preventive care For everything else:“Catastrophic” coverage49

—Core coverage— Anthem PreferredProviders1. 3,000 deductible 2.3. Out-of-networkproviders1.Per person per year20% coinsurance 6,350 out-of-pocketlimit 3,000 deductible 2.3.Per person, per year 12,700 per family20% coinsurance 6,350 out-of-pocketlimit Per person, per yearPer person, per year 12,700 per familyBalance billing50

—Core coverage—Self Only Coverage1: Deductible2: Coinsurance3: Out-of-Pocket LimitPreferredProvidersOut-of-NetworkProviders 3,000 3,00020% 6,35020% balance 6,350 balance51

—Core Rx— No flat copays; coveredlike medical Drug expenses applytoward yourdeductible/OOP limit52

—Core mental health— Behavioral health covered the same waymedical and pharmacy are covered Coverage not “carved out”53

—Advantages of Core — No monthly premium No PCP, self-refer to specialists Large, national preferred provider network Out-of-network/world-wide coverage LiveHealth Online 24/7 telemedicine54

—Limits of Core — High deductible per person & per familyHigh out-of-pocket limit per person & per familyNo coverage for hearing aidsOut-of-network coverage severely limited Outpatient surgery @ surgery center: 80% of 350Hospital: 80% of 600/dayChiropractic/acupuncture 24 visit limitPreauthorization required for imaging, inpatient services,in-office injections, bariatric surgery, transplants & more55

—Core: Family members w/ Medicare— Partner plan: UC Medicare PPO Retirees who enroll in Core won’t see “UCMedicare PPO” as an option on At YourService Online56

—UC Care—57

—UC Care— Custom plan for UCLike a standard PPO, but with two levels of in-networkproviders Choose regular Anthem Preferred providers and pay 20%Or, access a special UC Select provider network for lowcopayments58

—UC Care coverage—Anthem Preferred 250 deductible 1. 2.3. 1.Per person per year 750 for 3 or more20% coinsurance 6,600 out-of-pocketlimit (includes Rx) Out-of-Network 500 deductible 2.3.Per person, per year 13,200 per family50% coinsurance 8,600 out-of-pocket limit(includes Rx) Per person, per year 1,500 for 3 or morePer person, per year 19,200 for 3 or moreBalance billing59

—UC Care: UC Select providers— All UC medical centers and select other providerslocated near UC campuses (CA only)Certain services for flat copayments: Physician office visit: 20New: Urgent Care 30 (not just UC Select)ER (not just UC Select), ambulance: 200Outpatient surgery: 100Inpatient hospitalization: 250LiveHealth Online 24/7 telemedicine: 2060

—UC Care coverage—UC SelectAnthemPreferredOut-ofNetwork1: DeductibleNone 250 5002: CoinsuranceFlatcopayments20% 5,100 6,600Self only coverage3: Out-of-Pocket Limit50% balance 8,600 balance61

—UC Care Rx—1.Generic: 5/30-day supply2.Brand name: 25/30-daysupply3.Non-formulary: 40/30-daysupply 90-day supplies for 2 copays: UC pharmacies Costco, Safeway/Vons,Walgreens, New: CVS Mail order: Express Scripts4.Specialty Rx: 30% up to 150/script (UC pharmacies orAccredo)62

—UC Care mental health coverage— Use Anthem Preferred providers Outpatient visits 1-3, no copay; additionalvisits 2063

—Advantages of UC Care — Low copays for care from UC Select providers,network urgent care providers, and LiveHealth Online Low deductible for Anthem Preferred providers No PCP, self-refer to medical providers Large, national preferred provider network Out-of-network/world-wide coverage Low copayments for Rx compared to other PPOs64

—Limits of UC Care — Highest out of pocket limits per person & per familyMany services not available at UC Select level of coverageUC Select tier: Multiple copayments can apply per serviceAcupuncture/chiropractic limited to 24 visits combinedOut-of-network coverage severely limited Outpatient surgery @ surgery center: 50% of 350Hospital: 50% of 600/dayPreauthorization required for imaging, inpatient services, in-officeinjections, bariatric surgery, transplants & moreSpecialty drugs have especially high copays65

—UC Care: Family w/ Medicare— Partner plan: UC Medicare PPO Retirees who enroll in UC Care won’t see “UCMedicare PPO” as an option on At YourService Online66

—UC Medicare PPO—67

—About UC Medicare PPO— Medicare pays first for covered services Anthem Blue Cross pays second You pay the balance 4% if covered by Medicare (20% of the 20% Medicaredidn’t pay) 20% after 100 deductible if not covered by Medicare68

—UC Medicare PPO coverage— Medicare-coveredservices1.2.3.Deductible N/A4% (20% of the 20%balance left afterMedicare pays first) 1,500 out-of-pocketlimit Per person, per year Services not coveredby Medicare1. 100 deductible 2.3.Per person, per year20% coinsurance 1,500 out-of-pocketlimit Per person, per year69

—UC Medicare PPO coverage— Medicare primary, Medicare PPO secondary Caution: must use Medicare providers (exception: mental healthproviders) unless not covered by Medicare Deductible only applies if not covered by Medicare (but covered byplan)Self only coverageNot covered byMedicare*1: Deductible 1002: Coinsurance20%3: Out-of-Pocket LimitExamples:* Acupuncture* Hearing aids* MFTs* Services outside U.S.A. 1,50070

—UC Medicare PPO Rx—1.Generic: 10/30-day supply2.Brand name: 30/30-day supply3.Non-formulary: 45/30-day supply 90-day supplies available for 2 copays: UC pharmacies Costco, CVS, Safeway/Vons, Walgreens Mail order: New: Express Scripts Some meds require prior authorization Out-of-pocket limit: 5,000 New: Select Generics: 071

—UC Medicare PPO mental health— Behavioral health coverage not “carved out” Use Medicare providers for better coverage Or, use non-Medicare providers (pay 20%)72

—Advantages of UC Medicare PPO — Use any Medicare provider for Medicare-coveredservices Use any licensed provider for behavioral health services Low, 4% coinsurance Comprehensive, world-wide coverage Chiropractic/acupuncture coverage Hearing aid coverage at 80%73

—Limits of UC Medicare PPO — Acupuncture visits limited to 24 visits per year Must use Medicare providers for non-behavioralhealth services 5,000 Rx out-of-pocket max too high to help Local Sutter primary care physicians (notspecialists) not accepting new Medicare patients74

—UC High Option—75

—About UC High Option— For most services, plan pays 100% of balance afterMedicare; you pay nothing 50 annual deductible, 20% coinsurance applies only toservices not covered by Medicare Example: Acupuncture76

—UC High Option coverage— Medicare primary, High Option secondary Caution: must use Medicare providers unless not covered byMedicare (exception: mental health providers) Deductible only applies if not covered by Medicare (but covered byplan)Self only coverageNot covered byMedicare*1: Deductible 502: Coinsurance20%3: Out-of-Pocket LimitExamples:* Acupuncture* Hearing aids* MFTs* Services outside U.S.A. 1,05077

—UC High Option behavioral health— Behavioral health coverage not “carved out” No coinsurance for services covered byMedicare Use Medicare providers for better coverage Or, use non-Medicare providers (pay 20%)78

—UC High Option Rx—1.2.3. Generic: 10/30-day supplyBrand name: 30/30-day supplyNon-formulary: 45/30-day supply90-day supplies available for 2copays: UC pharmaciesCostco, CVS, Safeway/Vons, WalgreensMail order: New: Express ScriptsSome meds require priorauthorizationOut-of-pocket limit: 1,000 New: Select Generics: 079

—Advantages of UC High Option — Pay nothing for most servicesUse any Medicare providerUse any licensed provider for behavioral healthservicesHearing aid coverage at 80%Chiropractic/acupuncture coverageLowest Rx out-of-pocket limit ( 1,000)80

—Limits of UC High Option — Highest monthly premium Must use Medicare providers for non-behavioralhealth services 24-visit annual limit on acupuncture Local Sutter primary care physicians (notspecialists) not accepting new Medicare patients81

—Conclusion—82

—Choosing a plan— Every plan has a different drug formulary Match your priorities with the services available Do a cost/benefit analysis based on planpremiums and your expected medical,behavioral and pharmacy needs Review the Plan Booklets (Evidence of Coverage) UCnet Open Enrollment83

—Making a change— Open Enrollment is online until 5 p.m. on 11/21 You can request a form or make changes over the phoneby calling 1-800-888-UCOP (8267) Remember to get a confirmation number Medicare members may have additional paperwork Remember, you can always change again during thenext Open Enrollment 84

—Help is available—Health Care Facilitator Program Guerren Solbach: (530) 752-4264Erika Castillo: (530) 752-7840http://hr.ucdavis.edu/hcf85

UC Retiree Medical Plans—Presented by Guerren Solbach—

—Health Net Blue & Gold vs. Seniority Plus— Health Net Blue & Gold Does not offer local Sutter groups 75 ER copay 1,000 per person out of pocket limit for medical, mental health and R x Seniority Plus Does offer Sutter groups 65 ER copay 1,500 per person out of pocket limit for medical &am