Transcription

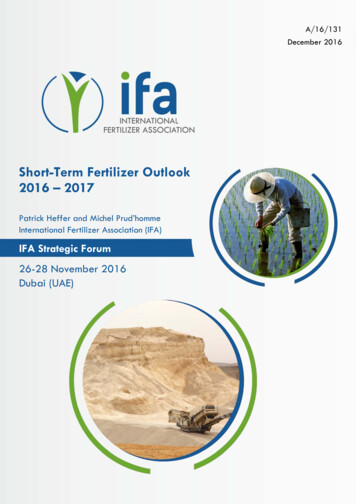

A/16/131December 2016Short-Term Fertilizer Outlook2016 – 2017Patrick Heffer and Michel Prud’hommeInternational Fertilizer Association (IFA)IFA Strategic Forum26-28 November 2016Dubai (UAE)IFA Strategic Forum, Dubai, 26‐28 November 2016“Short‐Term Fertilizer Outlook 2016‐2017” P. Heffer and M. Prud’homme, IFA1

This Public Summary was prepared by Patrick Heffer, Senior Director of the IFA Agriculture Committee,and Michel Prud’homme, Senior Director of the IFA Production & International Trade Committee, on theoccasion of the IFA Strategic Forum held in Dubai (UAE) in November 2016. It draws on two reportsthat were prepared for the IFA Strategic Forum; these detailed reports are restricted to IFA membersonly: the IFA report “Short-Term Prospects for World Agriculture and Fertilizer Demand: 2015/162017/18” and the IFA report “Global Fertilizer Supply and Trade: 2016-2017”.The authors would like to thank their colleagues at the IFA Secretariat for their assistance in preparingthis Public Summary: Agriculture Service: Armelle Gruère and Guillaume PeyroutouProduction & International Trade Service: José de Sousa, Virginie Couturier, Olivier Rousseauand Sylvie Marcel-MonnierCopyright 2016 International Fertilizer Association - All Rights ReservedDisclaimer of Liability for IFA Reports/PresentationsIFA endeavours to base its reports and presentations on accurate information, to the extent reasonablypossible under the circumstances. However, neither IFA nor its members warrant or guarantee anyinformation IFA publishes or presents, and they disclaim any liability for any consequences, direct orindirect, arising from the use of or reliance upon IFA publications or presentations by any person at anytime.

ECONOMIC AND POLICYCONTEXTSeveral largely unexpected events occurred in2016: the United Kingdom (UK) voted to leavethe European Union, a coup d’état was attemptedagainst the Turkish government, and DonaldTrump was elected 45th President of the UnitedStates. All these events could have political andeconomic consequences that increase the levelof uncertainty inherent in this outlook.Global growth in 2016 is projected to remainmodest at 3.1%, slightly weaker than projectedby the International Monetary Fund (IMF) in April.This is mostly due to activity below expectationsin advanced economies through the secondquarter of 2016. A projected increase in globalgrowth to 3.4% in 2017 would mainly besupported by higher growth rates in emergingand developing economies. Increased activity incountries that were in recession in 2016, such asBrazil, Nigeria and Russia, is expected tooutbalance the slowdown in China.Policies in developed countries put increasingemphasis on environmental stewardship ingeneral, and on nutrient use efficiency nsalsoinfluencenutrientmanagement in emerging economies. China’sdecision to limit growth in fertilizer consumptionto 1% per year between 2015 and 2020 with zerogrowth in consumption thereafter is one of themost notable examples. 2016 was the first yearunder India’s mandate to coat all subsidized ureawith neem oil to improve urea use efficiency.WORLD AGRICULTURELow prices and unfavourable weather impactedthe 2015/16 cereal campaign, with globalproduction estimated to be less than the 2014/15record crop.Global cereal output should rebound in 2016/17as a result of favourable weather in majorproduction areas. Coarse grains, rice and wheatare all expected to reach new production records.Despite low prices, output of coarse grains isforecast to be up from 2015/16 due to higherrelative returns, compared with competing crops,and good yields. Low prices at planting timepushed the global wheat area slightly down in2016/17, but favourable weather almosteverywhere boosted the average yield to a newrecord. A recovery in global rice production isvery likely following the strong El Niño event of2015/16, which ended in mid-2016. Global use ofcereals could increase slightly faster than in theprevious season, as the wide availability ofattractively priced maize and low-quality wheatwould encourage feed use. Demand for cerealsis not projected to exceed production.Expectations therefore point to continued stockaccumulation in 2016/17. These prospects willcontinue to depress cereal prices. Soybeanprices could also remain under pressure as abumper crop is expected in 2016/17. However,prices are trending higher for palm oil, sugar andcotton (under the influence of contracting stocks)as well as for dairy products, reflecting tightersupplies.FERTILIZER DEMANDGlobal fertilizer demand remained virtuallyunchanged in 2015/16. The prospects for2016/17 are more positive, reflecting reboundingsugar, vegetable oil, cotton and dairy prices andan anticipated return to average weatherconditions in the southern hemisphere followingthe strong 2015/16 El Niño event. Hence, worlddemand is expected to rise by 2.1% to 187.6 Mt,led by a strong rebound in nitrogen (N) demand.Phosphorous (P) demand is forecast to continuegrowing firmly for the second consecutive year,following three years of stagnation. Potassium(K) demand is seen as regaining momentum afterbelow-average growth during the previouscampaign.IFA Strategic Forum, Dubai, 26‐28 November 2016“Short‐Term Fertilizer Outlook 2016 ‐ 2017” P. Heffer and M. Prud’homme, IFA1

Regionally, demand is seen as dropping inWestern & Central Europe and North Americaand rising elsewhere. The strongest year-on-yearchanges in relative terms are expected inOceania, Latin America, South Asia and Africa,while the main volume increases are forecast inSouth Asia, Latin America and East Asia.Demand in 2017/18 is expected to be influencedby prospects for slightly tightening agriculturalcommodity markets; better economic prospectsin the US, Brazil and Russia, which would morethan offset the slowdown in China; and growingpolitical and policy uncertainty in some importantfertilizer-consuming markets. World fertilizerdemand is anticipated to increase by 1.6% in2017/18 to 190.6 Mt, assuming that no majorweather-related shock significantly alters theagricultural outlook and that progressive changeoccurs in fertilizer- and nutrient-related policies inthe main markets. K demand would grow mostrapidly, driven by strong requirements in China,India, Brazil and Indonesia. P demand wouldincreasemoremodestly,boostedbyrequirements in India, Brazil and Argentina.N demand growth would drop back to theaverage medium-term trend, with India aloneaccounting for half the year-on-year increase.Fertilizer demand is forecast to contract in WestAsia and Oceania; it is seen as virtuallyunchanged in North America, while it wouldslightly rebound in Western & Central Europe.Demand would expand in the rest of the world,with the lowest growth rate in East Asia and thehighest in Africa. The largest changes in volumeare anticipated in South Asia, Latin America andEast Asia.Global Fertilizer Demand (Mt 14/15110.141.632.4184.12015/16 (e)109.042.132.6183.8Change-0.9% 1.4% 0.6%-0.1%2016/17 (f)111.642.833.2187.6Change 2.4% 1.6% 1.8% 2.1%2017/18 (f)113.043.534.1190.6Change 1.3% 1.5% 2.6% 1.6%2The forecast is subject to several uncertainties,in particular the evolution of the world economicand geopolitical context; weather-related cropshortfalls; the evolution of agricultural commodityprices and fertilizer prices relative to crop prices;the evolution of biofuel mandates and fertilizersubsidy schemes; and new policies aimed atimproving nutrient management performance,restricting and/or taxing fertilizer use, andincreasing recycling of organic nutrient sources.FERTILIZER SUPPLYIn 2016 the fertilizer industry has been confrontedby weak global nutrient demand, soft economicprospects, depressed crop prices, rising marketcompetition and volatile energy prices. Yet,global fertilizer production and import levels haveremained unexpectedly resilient, and in somecases, have even reached record amounts.World nutrient production in 2016 was estimatedat 250 Mt nutrients, while world nutrient saleswere also steady at 251 Mt nutrients. Fertilizersales, which accounted for 75% of total sales,were estimated at 187 Mt nutrients, expandingby 2.2% over 2015.Prospects for 2017World fertilizer demand is seen expandingmoderately in 2017. Global nutrient demand forall uses is estimated to grow by 1.8% to253 Mt nutrients. Close to 100 new productionunits and expansion projects are expected tocome on stream in 2016 and 2017, adding19 Mt nutrients in incremental capacity forprimary products (ammonia, phosphoric acid andpotash).Nitrogen OutlookGlobal ammonia production has remained staticin 2016, but ammonia output in China dropped5%. The global nitrogen balance in 2016 showsan accelerating potential surplus due tosubstantial supply increases and modestdemand growth.IFA Strategic Forum, Dubai, 26‐28 November 2016“Short‐Term Fertilizer Outlook 2016 ‐ 2017” P. Heffer and M. Prud’homme, IFA

In 2017 the global nitrogen balance is expectedto show relatively static demand, while supply isseen as increasing much more rapidly.Urea OutlookThere was a net 2% growth in world ureaproduction in 2016, to 178 Mt. However, China’sproduction dropped by 5%, creating significantopportunities for other producing/exportingcountries. Global domestic deliveries in 2016rose for the third consecutive year, to 128 Mt.Global exports grew 2%, to 50 Mt, despite a 28%drop from China.Global urea capacity in 2016 has grownmodestly, to 211.5 Mt, with large additions inAfrica and West Asia. Global urea capacity isprojected to expand by 5% to 223 Mt, with thebulk of the increase occuring in North America(the US) followed by Africa.Global urea supply in 2017 would grow by 4%, to193 Mt, and demand by 2% to 183 Mt, thus theglobal supply/demand imbalance would furtherincrease due to large capacity additions in 201617. Global urea sales in 2017 are projected toexceed 183 Mt, but global urea imports mayweaken and fluctuate around 46-47 Mt.Phosphate OutlookGlobal production of processed phosphates in2016 rose by 2% to 32 Mt P2O5 (67 Mt products).Global trade of processed phosphatesdecreased by 1% to 14 Mt P2O5. (29 Mtproducts). DAP imports were relativelydepressed due to much reduced shipments toIndia, while imports remained soft in other largemarkets.The global supply/demand balance in 2017would show a small increase in the potentialsurplus. Potential regional deficits wouldincrease in South Asia and in Latin America, thusstimulating P-fertilizer imports in 2017.Potash OutlookWorld potash production decreased by 2.8%over 2015, to 62.7 Mt MOP. However, globalpotash sales were firmer than expected,stabilizing at 63.3 Mt MOP, thanks to solid tradelevels in the second half of 2016. Overall, globalannual exports were stable at 48 Mt MOP (76%of total sales), supported by solid import levelsinto Brazil and the US.Global potash capacity in 2016 expanded by4.8%, but global potash supply remained static at44 Mt K2O, when considering the removal ofeffective capacity from operations that were idlein 2016.In 2017 global potash capacity is projected tofurther expand by 4.6%, to 57.6 Mt K2O,representing a net increase of 2.4 Mt K2O withthe main expansions occurring in Canada,Russia, Turkmenistan and China. Global potashsupply in 2017 would increase by 4.5% over2016, and demand by 2.5%. The potentialimbalance would then expand, given thesubstantial supply increment. Global potassiumdeliveries in 2017 are forecast to growing to 6465 Mt MOP. Import demand would improvemoderately, to 49 Mt MOP, supported by firmdemand into Asia, Latin America and, to a lesserextent, Africa.Global phosphoric acid capacity was unchangedin 2016, at 58 Mt P2O5, but would expand in 2017by 5% to 61.3 Mt P2O5. Global processedphosphates capacity (MAP, DAP and TSP)would reach 45.4 Mt P2O5 in 2016 and 48.7 Mt in2017. Capacity increases would essentially occurin only four countries: China, Morocco, Russiaand Saudi Arabia.IFA Strategic Forum, Dubai, 26‐28 November 2016“Short‐Term Fertilizer Outlook 2016 ‐ 2017” P. Heffer and M. Prud’homme, IFA3

IFA Strategic Forum, Dubai, 26‐28 November 2016“Short‐Term Fertilizer Outlook 2016‐2017” P. Heffer and M. Prud’homme, IFA4

"Short‐Term Fertilizer Outlook 2016 ‐ 2017" P. Heffer and M. Prud'homme, IFA In 2017 the global nitrogen balance is expected to show relatively static demand, while supply is seen as increasing much more rapidly. Urea Outlook There was a net 2% growth in world urea production in 2016, to 178 Mt. However, China's