Transcription

New coveragewith newchoicesEffective January 1, 2018, eligible retireeswho retire(d) under the Central LaborAgreement on or after Jan. 10, 2005, theireligible spouses and surviving spouses whoare age 65 or older will transition to theCaterpillar-sponsored Health ReimbursementArrangement (HRA). Retirees who retiredon or after Jan. 10, 2005, but prior to[March 27, 2017] may opt out of the HRAand instead remain in their currenthealthcare coverage by calling309-675-1700 by October 6, 2017.This guide explains the Caterpillar-sponsored HRA for eligible retirees, their eligiblespouses and surviving spouses who are age 65 and older. Unless you opt out of thisHRA coverage, you will receive a guide from OneExchange later this year that willcontain enrollment information.Caterpillar has selected OneExchange to administer the HRA and assist you withenrollment. OneExchange’s licensed benefit advisors will help you find and enroll incoverage that best serves your medical needs and fits your budget.After your guide arrives you must work with OneExchange to complete theenrollment process that will provide you access to your HRA dollars.

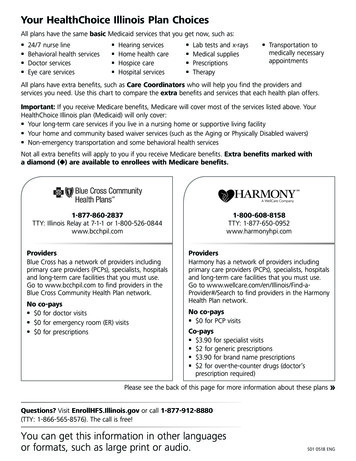

When you enroll in coverage throughOneExchange, you will have accessto several individual health coverageoptions such as Medicare Advantageand Medicare Supplement plans.Caterpillar provides benefit dollars toreimburse you for qualified healthcareexpenses, including Medicare planpremiums. These benefit dollars will beavailable through an HRA.Caterpillar has chosen OneExchangeto assist you with enrollment in theMedicare marketplace. As professionalsin the Medicare market, OneExchange’slicensed benefit advisors will helpyou evaluate your options and enrollin coverage that best fits your budgetand unique medical, dental, vision andprescription drug needs.To learn more about this change,please review this booklet and plan toattend one of the education sessionsthat will be offered by Caterpillar andOneExchange.*For purposes of this brochure, the term “spouse” also includes same-sex domestic partner.2CATERPILLAR RETIREE HEALTH REIMBURSEMENT ARRANGEMENT GUIDEIf your spouse* is not currently age 65 orolder, he or she will not be eligible for theHRA. The materials in this guide do notapply to those under age 65. Please seepage 7 for more information.

IntroducingOneExchangeBE ON THE LOOKOUT!Later this year you will receiveyour guide from OneExchange.The guide will include informationfor you to complete beforecontacting OneExchange to beginthe enrollment process.If you have a spouse who is alsoeligible to enroll in individualcoverage through OneExchange,both of you must enroll incoverage. Neither Medicare norsupplemental insurance coverageis two-party coverage—onlyindividual coverage is available.OneExchange is a leading provider of healthcare solutions. With OneExchange’s assistance,retirees and their eligible spouses gain access to the Medicare marketplace, including a widerange of plan choices from leading national and regional insurance companies.OneExchange will provide you and your eligible spouse with personalized assistance. Anexperienced OneExchange benefit advisor can provide individualized telephone support to helpyou make an informed Medicare enrollment decision. While OneExchange can assist you withenrollment in the Medicare marketplace, OneExchange is not able to assist retirees who retiredon or after Jan. 10, 2005 but prior to [March 27, 2017] with deciding whether to opt out of HRAcoverage.CATERPILLAR RETIREE HEALTH REIMBURSEMENT ARRANGEMENT GUIDE3

Understanding the basicsBecoming more familiar with Medicare, Health ReimbursementArrangements, benefit dollars and who is eligible for the HRA willlay the foundation for enrollment through OneExchange.Become familiar with MedicareHow the parts combine to provide you with coverageBefore you enroll, it’s good to become familiar with Medicare. Medicare benefits are broken into several components.To decide how to best meet your medical needs and budget, it helps to understand how these parts work together.Below is a simple outline to help familiarize you with the parts of Medicare and the decisions you must make.WHAT YOU GETPart A and Part BOriginal Medicare consists of Part Aand Part B. You automatically receivePart A from Medicare and becomeeligible for Part B when you becomeMedicare-eligible due to age ordisability.Part AProvides you with inpatient care, andcovers inpatient hospital stays, homehealthcare, stays in skilled nursingfacilities, and hospice care.Part BProvides you with outpatient care andcovers physician fees and other medicalservices not requiring hospitalization.You must choose to enroll in Part B.WHAT YOU CHOOSEYou may choose between threedifferent types of supplemental plansthat add coverage where originalMedicare may have none.Medicare AdvantagePart C is coverage offered by a privateinsurance company to provide yourMedicare Part A and Part B benefitsplus additional benefits. There are twoversions of Part C, also referred to asMedicare Advantage coverage. Withinthese two Medicare Advantage typesthere are three doctor networks: HMO,PPO, and Private Fee-for-Service Plans(PFFS).Medigap is supplemental insurancesold by private insurance companiesto fill “gaps” in original Medicarecoverage.Part DRefers to optional prescription drugcoverage, which is available to allpeople who are eligible for Medicare.Part D coverage is offered throughprivate insurance companies.4CATERPILLAR RETIREE HEALTH REIMBURSEMENT ARRANGEMENT GUIDEHOW TO DECIDEYou may combine the supplementalcoverage to get a package of plans thatcovers your needs. Choosing the bestcombination requires some educationand some comparison of features andcosts.

EXAMPLES OF HRA-ELIGIBLE EXPENSES Premiums for Medicare Part B and Part D Premiums for Medigap or Medicare Advantage coverage (Part C) Dental premiums Vision and dental expenses not covered by insurance Out-of-pocket expenses like deductibles, medical co-pays andyour share of coinsurance For a complete list of HRA-eligible expenses, go towww.irs.gov/publications/p502/index.html or call the IRSat 800-829-3676 and request Publication 502 – Medical andDental ExpensesHow Health Reimbursement Arrangements workA Health Reimbursement Arrangement (HRA) is anemployer-provided health plan. An account is established foreach plan participant and the account is credited with benefitdollars that can be used to pay for eligible healthcare expenses. When you enroll in individual insurance coverage throughOneExchange, Caterpillar will create an HRA for you. You can use the funds in your account to be reimbursedfor premiums and/or your share of eligible healthcareexpenses during the year. You decide how to use thebenefit dollars in your HRA account. If you have an eligible spouse, you and your spouse willhave separate HRA accounts; however, both you and yourspouse may claim eligible expenses from each other’saccount. An annual contribution will be made to the account. Youwill also be able to roll over unused benefit dollars fromyear-to-year, allowing you to accumulate dollars forfuture use.CATERPILLAR’S CONTRIBUTION TO YOUR HRAOnce the eligible retiree/surviving spouse or spouse enrollsin individual coverage through OneExchange, an HRA accountwill be established for each eligible retiree/surviving spouseor spouse. Caterpillar credits each account with 3,000 benefitdollars if the retiree retired prior to January 2, 2019. At thebeginning of each subsequent year Caterpillar credits eachindividual’s HRA with additional benefit dollars.HOW IT WORKSYou enroll in a participating plan with OneExchange and pay thepremiums to the carrier. You can then be reimbursed from yourHRA account. The Enrollment Guide you will receive will coverthe reimbursement process. HRA funds used to reimburse youreligible expenses are not considered taxable income.CATERPILLAR RETIREE HEALTH REIMBURSEMENT ARRANGEMENT GUIDE5

An explanation of the HRA processBeginning in October 2017, you may enroll in individual healthcare coverage offered through OneExchange. In January 2018,after you have enrolled through OneExchange, Caterpillar will credit your HRA account with benefit dollars to use towardeligible healthcare expenses such as premiums, deductibles, medical co-pays, etc. You can then be reimbursed from yourHRA account throughout the year to the extent benefit dollars are available in your HRA account.CREATING YOUR HRA ACCOUNTYou and OneExchange work togetherto evaluate the options and select thecoverage that is right for you.You enroll in individual coverage throughOneExchange in October throughDecember 2017. Your specific enrollmentperiod will be listed in the EnrollmentGuide you receive from OneExchange.If you made an appointment to enrollduring your pre-registration withOneExchange you will enroll on that date.After you enroll, Caterpillar placesbenefit dollars in your HRA accountbeginning January 1, 2018.GETTING REIMBURSED FROM YOUR HRA ACCOUNTYou pay your insurance premiumdirectly to your insurance provider.You submit your claim (premium,co-pay, coinsurance, etc.) toOneExchange.OneExchange reimburses you fromyour HRA account.ESTABLISHING DIRECT DEPOSIT FOR YOUR HRA REIMBURSEMENTSTo receive your reimbursement as quickly as possible, you have the option to establish direct deposit. OneExchange willsend more information about HRAs this fall and will include additional directions for direct deposit. Unless you choose toset up direct deposit, all reimbursements will be made by check and mailed to the address on file with OneExchange.6CATERPILLAR RETIREE HEALTH REIMBURSEMENT ARRANGEMENT GUIDE

DeterminingEligibilityWHEN YOUR HRA COVERAGE BEGINS AND YOUR EXISTING COVERAGE ENDS UNDER THE CATERPILLAR-SPONSOREDGROUP HEALTH PROGRAMAGE 65 OR OLDERRetiree/Surviving Spouse Unless you opt out of participating inthe HRA, coverage under your currentCaterpillar healthcare plan will end onDecember 31, 2017. Once you enroll in individual coveragethrough OneExchange, an HRAaccount will be established for you. Benefit dollars will be placed in theHRA account in January 2018.Your Spouse Unless you opt out, if your spouse isunder age 65, he/she will transition tothe same healthcare benefit plan thatmanagement and executive retireesunder age 65 participate in today(which is different from the HRA),effective January 1, 2018. Unless you opt out, if your spouse isage 65 or older, he/she will transitionto the HRA through OneExchange,effective January 1, 2018. Once your spouse enrolls in acoverage through OneExchange, anHRA account will be established forhim/her. Benefit dollars will be placed in theHRA account in January 2018.Your Dependent(s) Unless you opt out, your dependentchildren will transition to thesame healthcare benefit plan thatmanagement and executive retireesunder age 65 participate in today(which is different from the HRA),effective January 1, 2018, as longas they meet established eligibilitycriteria. Disabled dependent children willtransition to the same healthcarebenefit plan as management andexecutive retirees under age 65(which is different from the HRA),effective January 1, 2018, and canremain in that coverage until age 65.At age 65, they will become ineligiblefor existing coverage but will beeligible for services provided byOneExchange. An HRA account willnot be established for the disableddependent child.CATERPILLAR RETIREE HEALTH REIMBURSEMENT ARRANGEMENT GUIDE7

Steps toward enrollmentBeginning in October, you can begin your enrollment withOneExchange. OneExchange has identified three steps tocomplete this process— Education, Evaluation and Enrollment.You will be fully supported through each of these steps byBenefit Advisors from OneExchange.1EDUCATION»NEED DENTAL OR VISION COVERAGE?Later this year, you will receive anEnrollment Guide from OneExchangewith helpful information on eligibility,coverage options and the detailsyou need to prepare you for the 2018enrollment period. There will also be aWeb site and phone number for you tocontact OneExchange before the actualenrollment period begins so they canbegin collecting information that willimprove your enrollment experience.2EVALUATIONUsing the Enrollment Guide and, if youhave internet access, OneExchange’sonline tools, you can review the optionsavailable to you before speaking witha benefit advisor. If you do not haveinternet access, the Enrollment Guideand your benefit advisor will guide you.When you call, an OneExchange benefitadvisor will spend time learning aboutyour specific needs to assist you withyour enrollment choices.You’ll also find a selection of dental and/or vision plans to choose from.In the event that the content of this document or any representations made by anyperson regarding Caterpillar’s employee benefit plans and programs conflict with or areinconsistent with the provisions of the governing plan documents, the provisions of theplan documents are controlling. You are neither vested in your retiree healthcare benefitsnor does Caterpillar intend to vest you in your retiree healthcare benefits. To the fullestextent permitted by law, Caterpillar has reserved the right to amend, modify, suspend,replace or terminate any of its plans, policies or programs (including the HRA), in whole orin part, at any time and for any reason, by appropriate company action. 2017 Caterpillar. All Rights Reserved. CAT, CATERPILLAR, BUILT FOR IT, their respective logos,“Caterpillar Yellow,” the “Power Edge” trade dress as well as corporate and product identity usedherein, are trademarks of Caterpillar and may not be used without permission.3ENROLLMENTA OneExchange benefit advisor willexpedite the process of enrollment,assisting you with all applications, andhelping you apply for and enroll in theindividual coverage you choose. Duringyour dedicated enrollment period andusing OneExchange’s customized toolsfor enrollment, a benefit advisor willhelp you to make informed enrollmentdecisions and support you throughoutthe entire process.

While OneExchange can assist you with enrollment in the Medicare marketplace, OneExchange is not able to assist retirees who retired on or after Jan. 10, 2005 but prior to [March 27, 2017] with deciding whether to opt out of HRA coverage. Introducing OneExchange Later this year you w