Transcription

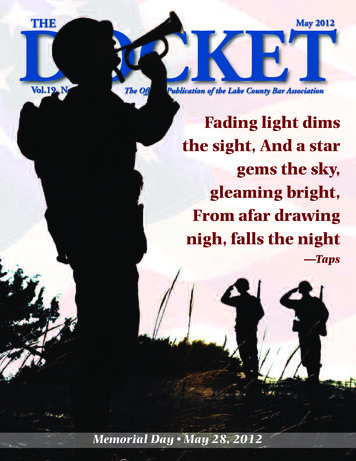

THEMay 2012DOCKETVol.19, No.5The Official Publication of the Lake County Bar AssociationFading light dimsthe sight, And a stargems the sky,gleaming bright,From afar drawingnigh, falls the night—TapsMemorial Day May 28, 2012

Inside this issue.In the Director’s Chair: Take Me Out to the Ballparkby Christopher2 Boadt,Executive DirectorPresident’s Page3 Theby Perry S. Smith, Jr.Chief Judge’s Page: 2012: Changes and Challenges5 byTheChiefJudge Fred Foreman7A publication of theSecurities Regulators Issue Risk Alert for Brokerage Firms toConduct Effective Branch Office Supervisionby James J. EcclestonRestoration: Clean Waters Act Muddys the Waters11 byWatershedDaniel Sean Patrick Lacy & Kari Giles Lacy14 2012 LCBA Golf Championship17Collateral Damage: The Unintended Consequences of a CriminalConvictionby David J. Winer19Jurisdictional Disputes in Adult Guardianship Cases Under theUniform Adult Guardianship Protected Persons Jurisdiction Actby Charles T. Newland20 Liberty Bell Award Recipients24 Calendar of EventsMinutes: March 201225 Meetingby Keith Grant29 Grapevine30 LCBA Bulletin Board & Monthly Committee Meetings31 Proposed By-Laws AmendmentsAdvertisers2621Back7226199189ADR SystemsAppraisal Solutions Group, Inc.Attorneys Title Guaranty Fund, Inc.David L. Gates & AssociatesDeposition ReportersISBA Mutual InsuranceJoseph Modica & Associates, Ltd.Kagen & Co.L & L Reporting Services, Inc.Lakeside Investigations22Front261272116/2922Legal Process Services, Inc.McDonald Hopkins LLCNeil H. GoodPrairie State Legal ServicesRichard Klein PhotographyT&T Reproduction & SuppliesThe Gordon Financial Group of WellsFargoVahl Reporting Service300 Grand Avenue, Suite AWaukegan, Illinois 60085Phone: (847) 244-3143Fax: (847) 244-8259www.lakebar.orginfo@lakebar.org2011-2012 Officers & DirectorsPerry S. Smith, Jr., PresidentMarjorie Sher, First Vice-PresidentSteven P. McCollum, Second Vice-PresidentMichael J. Conway, TreasurerKeith Grant, SecretaryElizabeth M. Rochford, Immediate Past PresidentJoann M. FratianniMichael J. OriGary SchlesingerMark A. Van DonselaarHon. Daniel B. ShanesDonald J. MorrisonEditorial BoardMichael S. Strauss, Co-editorRebecca J. Whitcombe, Co-editorAnn Buche ConroyHon. Michael J. FuszDeborah L. GoldbergHon. Mitchell HoffmanDaniel L. JasicaDaniel Sean Patrick LacyHon. Raymond J. McKoskiStephen J. RiceNeal A. SimonHon. James K. SimonianHon. Daniel B. ShanesTimothy J. StormStaffChristopher T. Boadt, Executive DirectorVirginia Elliott, Program Administrator

The Docket2May 2012In theDirector’s ChairbyChristopher T. BoadtAdvertising RatesOneIssueSixTwelveIssues IssuesEighth Page 65 60 55Quarter Page 115 105 95Half Page 170 155 140Full Page 290 265 240Inside Front Cover . . . . . . . . 750 per issueInside Back Cover . . . . . . . . . 750 per issueBack Cover . . . . . . . . . . . . . . . 600 per issueBar Bulletin BoardStandard TextRate for LCBA Member . . 1.75 per wordRate for Non-Member . . . 2.75 per wordBold TextRate for LCBA Member . . 3.50 per wordRate for Non-Member . . . 4.50 per wordClassified Advertisement may contain as manywords, numbers, symbols and boldface type.To place an ad or for information on advertising rates, call (847) 244-3143. Submission deadline: first day of month precedingthe month of publication. All submissionsmust be made in electronic format (highresolution PDF or JPG format at a resolution of 300 pixels per inch or more.) Seewww.lakebar.org/html/docketRates.asp.The Docket is the official publication of theLake County Bar Association, 300 GrandAvenue, Suite A, Waukegan, Illinois60085 (847) 244-3143, and is publishedmonthly. Subscriptions for non-membersare 45.00 per year.Take Me Outto the Ballpark:Cubs vs. Brewers!he Lake County Bar Foundation is hosting an excitingspring fundraiser on Friday, May 11, 2012 at Miller Parkin Milwaukee. The Foundation has secured seats on theprivate Dew Deck of Miller Park for this sure to be sold-out game.Tickets are only 99. Seats in this highly sought after area arenot available for sale to the general public.TThe Dew Deck, which includes an all-you-can-eat buffet and aview of the game from one of the most popular party areas inMiller Park. Tickets include a pre-game buffet, which beginswhen the Miller Park gates open and ends one hour after the firstpitch. The buffet includes: bratwursts smothered in sauerkrautwith secret stadium sauce on the side, BBQ chicken sandwiches,Klement’s hot dogs, grilled sirloin hamburgers, Wisconsin mac &cheese, corn on the cob, red wine vinaigrette coleslaw, assortedcookies, soft drinks and two beers per adult.Bring your entire family! Don’t miss the opportunity to spend anevening at the ballpark with your fellow LCBA members.TICKETS ARE LIMITED CALL TODAY 847-244-3143.vs.Reproduction in whole or part without permission is prohibited. The opinions and positions stated in signed material are thoseof the authors and not necessarily those ofthe Association or its members.All submitted manuscripts are consideredby the Editorial Board. All letters to the editor and articles are subject to editing. Publications of advertisements is not to beconsidered as an endorsement of any product or service advertised unless otherwisestated.How to write for The DocketThe Editorial Board of The Docket is always looking for fresh and relevant articles to feature every month. Feature articles shouldbe a minimum of 1,500 words and a maximum of 3,500. The deadline for submissions is the first day of the month precedingpublication. Articles should be submitted electronically in Word or WordPerfect. The Editorial Board reserves the right to edit articles as they see fit to meet the needs of the publication. Please send submissions to info@lakebar.org or call (847) 244-3143with questions.

May 2012The Docket3ThePresident’s PagebyPerry S. Smith, Jr.know this is a horrible segue, but, thenight of April 14, 1912 has been referred to as “A Night to Remember.”For very different reasons, the last year(OK, it’s only been 10 months, but theway things work, this is my last Docket article) has been a year to remember for me.Unlike the Captain of the Titanic, withwhom I share a last name, neither theLCBA nor I are sinking.IBy the time you read this article we willhave voted on some proposed amendmentsto our association by-laws. For the mostpart those amendments cleaned up a fewmatters. However, the big item in thoseamendments dealt with our committeestructure. With regard to the committeeswhich deal with substantive law issues, theamendments proposed a leadership structure bringing in more people, but placing aterm limit on chairmanship of a committee. The amendment also would requireeach committee to do what many have already been doing, by requiring minutes tobe taken and submitted to the Associationfor record keeping purposes. Simply put, acommittee chair would be limited to notmore than four consecutive years. Afterthat time, the chair would be required tostep down. If a chair serves only for oneyear and is replaced by the next associationpresident, they can be reappointed to thatchairmanship at any point in time. However, if a chair serves for 2, 3 or 4 years,they would have to “sit-out” for at leasttwo years before they could be reappointedas chair.There was a lot of debate among the executive officers and board of directors regarding this particular amendment andover the course of the last year it wentthrough a few changes before it got to theform which was presented to you. Our ultimate goal for the amendment was to create a committee structure which wouldbring more people into leadership roles forthe Lake County Bar Association.One of the questions that is frequently a whole, and get on board by joining us.asked about our Association is “What do Iget out of the Association, besides this I would like to take a moment to thank themagazine, for the dues I pay each year?” Executive Officers and Board of DirectorsAnother is “That’s a lot of money for those members with whom I have had the opdues, can I really afford it?” Let me try to portunity to serve, not only this year, butanswer those questions for you. For the in my prior four years on the board aslast few years we have had a mandatory well. We are divergent personalities withContinuing Legal Education requirement, differing thoughts on many matters. Yet,and the hours required each year has we have always managed to work togetherbeen increasing. The Illinois State Bar Asand work through our differences to try tosociation, which charges more than theLCBA does for dues, has recently an- do what we believe is in the best interestnounced that it will be providing a pro- of the Association and its members.gram which will give its members an Please give Marjorie Sher the same supopportunity to get some free CLE’s. Hey, as port and encouragement that you havea member of the ISBA Assembly, I say given to me, and those who preceded me.that’s great. But, we’ve been doing that foryears, going back to before there was a Lastly, I want to give special thanks toCLE requirement. During calendar year Chris Boadt, Virginia Elliott, Pricilla2011, between Brown Bags, committee Copeland and Maxie Norman. I think thatmeetings and other no-cost events, we it is fair to say that we have one of the bestprovided up to 26.5 hours of free CLE to staffs for any local bar association in theour members. Additionally, when I at- state. The time and effort they put in is intended the joint Doctor-Lawyer dinner, I credible. Their work day, like ours is a farspoke with one of the officers from the cry from 9:00 to 5:00. Without them andLake County Medical Society. She told metheir efforts, we would be hearing the orthat she had gone to our web site andchestra playing either “Nearer My God tofound it far superior to theirs. She also toldThee”or “Autumn” as we wait for theme that their dues were a flat rate ofCarpathiato arrive. 900.00 per year,regardless of howlong the memberhad been in practiceand without anyfreecontinuingmedical educationopportunities. So,do me a favor. Sinceyou are already aAttorney Membersmember of theLCBA and reapingJohnathan B. KamanDrake W. Shunnesonthese benefits, giveyour copy of theAssociate MembersDocket to a colBobbie CalleseJodi Kueflerleague who isn’t amember, tell themTudor AncasJordan Kaganto read this articleand the magazine asWelcomeNew LCBA Members

XThe DocketMay 2012

May 2012The Docket5TheChief Judge’s PagebyChief JudgeFred Foreman2012: Changes and Challengeshe Lake County Bar Association celebrates 100 years of history in 2012.The article in the March 2012 Docketdiscusses the role the LCBA played in the construction of the Lake County Courthouse dedicated on May 1, 1970. The LCBA also playeda prominent role in the construction and dedication of the Robert H. Babcox Justice Centerdedicated in 1988. The next time you are inthe courthouse, step by the dedication placques in the lobby of each facility. You shouldrecognize not only the names of the public officials in office at the time of the dedication,but also the names of prominent attorneysand judges involved in the planning processand all are LCBA members.TI start my term as Chief Judge on May 1,2012. Over the next two years, our courts, citizens and attorneys will face many changesand challenges. One major change will be theexpansion and enhancement of courthousefacilities. I plan to report monthly on ourprogress.The changes have been in the planning stagesfor several years. Our current space is inadequate and we do not have sufficient courtrooms to conduct our daily business. TheCounty Board and County Administrationhave addressed many of our needs by addingquality branch courts in Mundelein, RoundLake Beach and Park City. We are now engaged in an ongoing planning process to expand the courts on the footprint in downtownWaukegan. The Facilities Committee of theLCBA chaired by retired Judge Skip Toniganhas met with Judge Rossetti and myself several times to provide input for the projects. Inthe next six months you will begin to see thetangible results of our efforts.In addition to these changes, the judges arecommitted to working with the LCBA Technology Committee, the Circuit Court Clerk,and the County to address an upgrade incourt technology and accessibility to courtrecords. With the assistance of the NationalCenter for State Courts and the IllinoisSupreme Court Administrative Office we willimplement E-filing and enhanced remote access to court records.many changes and challenges for the stakeholders in our court system.I will continue to work with our PresidingJudges in the Criminal Division, Civil Division,and Family Division in conjunction withLCBA committees to improve case management and the tracking of cases. Our goal is amore efficient system to deal with complex litigation.On behalf of my colleagues on the bench, wethank Judge Victoria Rossetti for her serviceas Chief Judge. During her term she accomplished many tasks. Among her many successes:One additional challenge facing us this year isthe directive from the Supreme Court to provide access to cameras in the courtroom. TheCircuit Judges are in the process of studyingthe impact of this new rule and how to implement the rule to offer the public a view intothe courtroom while preserving proper decorum. Realigned resources within the Family Division Updated the master facilities plan documenting courtroom and staff space needs Established Veteran’s Court Established the Guardianship and ProbateHelp Desk Worked to open the Family Visitation Center2012 also is an election year. The LCBA andits members continue to play an important We personally want to thank Vicki for being arole in the leadership of the Judiciary and mentor and friend to all of us.County government. State’s Attorney MikeWaller and Circuit Court Clerk Sally Coffelt I thank President Perry Smith for his servicewill be retiring this year. We thank them for this past year and look forward to workingtheir years of dedicated public service. Their with incoming President Marjorie Sher.potential successors, State’s Attorney candi- Thanks to Executive Director Chris Boadt anddates Chris Kennedy and Mike Nerheim and Virginia Elliott for their assistance to the JudiCircuit Court Clerk candidates Cynthia Haran ciary. And to all the members of the LCBA,and Keith Brin are all members of the LCBA. Happy Anniversary!LCBAmembersseeking positions asCircuit Judges include Judges NancyWaites,DanielShanes,LuisThe following attorneys have accepted Pro Bono casesBerronesandthrough Prairie State Legal Services in March 2012.Thomas Schippersand Attorneys PatriKathy Curtincia Fix and JeffreyMari Jo JacquetteBraiman. Our SherDamon ParkKevin Kaneiff Mark Curran,Deborah GoldbergCountyClerkDavid BerlandChris MarderWillard HelanderLenita Sims-SpearsBurr Andersonand County BoardChairman DavidStolman are alsoTo volunteer, please contact Susan Perlmanmembers of theatsperlman@pslegal.org or 847-662-6925.LCBA. There will beTHANK YOU!

XThe DocketMay 2012

May 2012The Docket7Securities Regulators Issue Risk Alertfor Brokerage Firms to ConductEffective Branch Office SupervisionINRA (the Financial Industry Regulatory Authority) and the SEC (theSecurities and Exchange Commission) recently joined together to issue aNational Exam Risk Alert (the “Alert”).Republished by FINRA as Regulatory Notice 11-54,the Alert provides an excellent overviewof the requirements for abrokeragefirm’s supervision program,including information onBydeveloping effective policiesandproceduresforbranch officeinspections. Noting that the “branch inspection process is a critical component ofa comprehensive risk management program and can help protect investors andthe interests of the firm,” the Alert detailsthe kinds of practices that sound supervisory systems typically employ as well asthe kinds of practices that deficient supervisory systems typically employ. The Alertconcludes with a list of effective supervisory practices that brokerage firms seriously should consider adopting. Let’sexamine the highlights of this most important Alert.FJames J.EcclestonOverview of SupervisionRequirementsPreliminarily, the Alert reminds firms ofits critical supervisory obligations. Sections 15(b)(4)(E) and 15(b)(6)(A) of theExchange Act authorize the Commissionto impose sanctions on a firm or any person that fails to reasonably supervisesomeone that is subject to the supervisionof such firm or person who violates thefederal securities laws. The regulatorshave noted that an effective branch officeinspection program is a vital componentof a supervisory system reasonably designed to oversee activities at remotebranch offices. A number of SEC decisionsset forth principles that can guide firms inconstructing an effective branch office inspection program, and suggest that regular branch office inspections overreasonably short intervals, includingunannounced inspections, are the cornerstone of a well designed branch officeinspection program.In addition, the regulators believe that awell-constructed branch office supervisory program should include: “proceduresfor heightened supervision of remotebranch offices that have associated persons with disciplinary histories; independent verification of the nature andextent of outside business activities; senior management’s involvement in assuring that adequate procedures are in placeand that sufficient resources are devotedto implementing those procedures; periodic reassessment of supervisory responsibilities; adequate delineation ofsupervisory responsibilities; periodic reassessment of supervisory responsibilities;thorough investigation and documentation of customer complaints; and a systemof follow up and review of those and otherred flags.”Finally, the regulators want brokeragefirms to customize their supervisory systems to their particular firms. The Alertreminds firms of FINRA Notice to Members 99-45, which instructs firms “toadopt and implement a supervisory system that is ‘tailored specifically to themember’s business and must address theactivities of all its registered representatives and associated persons.’” Similarly, abrokerage firm’s procedures should instruct the supervisor on the requirementsto be in compliance, including the frequency of reviews, and the fact that thereviews will be on-site.Practices of Firms with EffectiveSupervisory SystemsThe Alert give examples of what brokerage firms have done in adopting an effective supervisory process. Examplesinclude: Tailor the focus of branch exams to thebusiness conducted in that branch andassess the risks specific to that business

8 Schedule the frequency and intensity ofexams based on underlying risk, ratherthan on an arbitrary cycle, but examinebranch offices at least annually Engage in a significant percentage ofunannounced exams, selected througha combination of risk based analysisand random selection Deploy sufficiently senior branch officeexaminers who understand the business and have the gravitas to challengeassumptions Design procedures to avoid conflicts ofinterest by examiners that may serve toundermine complete and effective inspectionPractices of Firms with DeficientSupervisory SystemsConversely, the Alert details practices ofbrokerage firms “with significant deficiencies in the integrity of their overallbranch inspection process.” Examples include: Utilize generic examination proceduresfor all branch offices, regardless of business mix and underlying risk Try to leverage novice or unseasonedbranch office examiners who do nothave significant depth of experience orunderstanding of the business to challenge assumptions Perform the inspection in a “check thebox” fashion without questioning critically the integrity of underlying controlenvironments and their effect on riskexposure Devote minimal time to each exam andlittle, if any, resources to reviewing theeffectiveness of the branch office examprogram Fail to follow the firm’s own policies andprocedures by not inspecting branch offices as required, announcing examsthat were supposed to be unannounced,or failing to generate a written inspection report that included the testing andverification of the firm’s policies andprocedures, including supervisory policies and procedures Fail to have adequate policies and procedures, particularly in firms that usean independent contractor model andthat allow registered personnel to alsoThe Docketconduct business away from the firm Lack heightened supervision of individuals with disciplinary histories or individuals previously associated with afirm with a disciplinary historyAdmonition to Adopt Risk-Based InspectionsThe Alert states that the “branch officesshould be continuously monitored withrespect to changes in the overall business,products, people and practices.” This “ongoing risk analysis” should lead to moreeffective supervision. The Alert advisesthat “[s]ome areas of high risk to considerare: sales of structured products; sales ofcomplex products, including variable annuities; sales of private or otherwise unregistered offerings of any type; or officesthat associate with individuals with a disciplinary history or that previouslyworked at a firm with a disciplinary history.”May 2012of customer accounts; written supervisory procedures (“WSPs”); new accountreview; suitability of investments;unauthorized trading; churning; allocations of new issues; licensing; andtraining Advertising and other communicationswith the public or with customers (suchas email and other written correspondence) and compliance with approvalprocedures Evidence of unreported outside or otherunauthorized business activities by review of: customer files, written materials on the premises and at any satellitelocations, branch office accountingrecords, appointment books and calendars, phone records, and bank records Procedures for handling of customercomplaints Risk-based reviews of bank accounts ofthe branch and affiliated entities, thirdparty wire transfers, and branch signature guarantee logTips as to What RegulatoryInspections Seek to Reviewand VerifyThe Alert details several areas ripe for regulatory inspection. For example, examiners may review the following: Procedures to uncover use of unauthorized computers or other electronic devices and/or social media Policies and procedures, including supervisory procedures as they pertain tothe supervision of customer accounts,including those serviced by income producing managersReview of Effective PracticesThe Alert concludes with a consolidatedlist of effective practices that brokeragefirms should consider adopting. Examplesinclude: Policies and procedures relating to thehandling of money and securities physically received at the branch Using risk analysis to identify whetherindividual non-supervising branchesshould be inspected more frequentlythan the FINRA-required minimumthree-year cycle, and whether firmsshould conduct “re-audits” Validation of changes in customer addresses and other account informationin accounts serviced by the branch Procedures related to transmittals offunds between customers and third parties, and between customers and registered representatives Firm testing of policies and proceduresrelated to specific retail products, including sales of structured products,private and other unregistered offerings; municipal securities; mutualfunds; and variable annuity sales andexchanges Firm testing in retail sales practiceareas, including: verification of customer account information; supervision Using surveillance reports, employingcurrent technology and techniques asappropriate, to help identify risk and develop a customized approach for thefirm’s compliance program and branchoffice inspections that consider the typeof business conducted at each branch Employing comprehensive checkliststhat incorporate previous inspectionfindings and trends from internal reports such as audit reports Conducting unannounced branch inspections Including in the written report of each

May 2012branch inspection any noted deficiencies and areas of improvement. The report should also outline agreed uponactions, including timelines, to correctthe identified deficiencies Using examiners with sufficient experience to understand the business beingconducted at the particular branchbeing examined and the gravitas tochallenge assumptions Designing procedures to avoid conflictsof interest by examiners that may serveto undermine complete and effective inspection Involving qualified senior personnel inseveral branch office examinations peryear Incorporating findings on results ofbranch office inspections into appropriate management information or riskmanagement systems, as well as usinga compliance database that enablescompliance personnel in various officesto have centralized access to comprehensive information about all of thefirm’s registered representatives andtheir business activitiesThe Docket Providing branch office managers withthe firm’s internal inspection findingsand requiring them to take and document corrective action Tracking corrective action taken byeach branch office manager in responseto branch audit findings Elevating the frequency and/or scope ofbranch inspections where registeredrepresentatives are allowed to conductextraordinary business activities, for example, by selling away from the firm.The regulators state that branch office inspections “must be conducted with vigilance.” While the suggestions contained inthe Alert “are not meant to be exclusive orexhaustive and do not constitute a safe harbor,” they should go a long way in assistingfirms adopt a well-designed branch officeinspection program. Let’s hope that they do!James J. Eccleston leads the Securities group at theChicago law firm of Shaheen, Novoselsky, Staat,Filipowski & Eccleston, P.C., where he representsinvestors in recovering investment losses and financial services professionals in disciplinary, employment, and compliance matters. He has heldnumerous securities licenses and Chicago Bar As-9sociation leadership positions and serves as an arbitrator and mediator. He is a recipient of Martindale-Hubbell’s highest rating (AV) for legal abilityand ethics and is named to the Illinois law.com, 312.621.4400,www.snsfe-law.com, www.financialcounsel.com.

10The DocketMay 2012

May 2012The Docket11Watershed RestorationClean Waters Act Muddys the Watersatershed restoration projectshave become essential due tothe ecological and economicconnection between land and water.1However, despite the resulting improvements to water quality, flood control,watersupplies, and natu r a lresources, wat e r s h e drestorationprojects canbe subjectedto the sametypes of environmentalregulationsBythat were designed for industrialactivities. Regulating waters h e drestorationprojectsisbothironicand necessary.The irony issimple – thesame environmental lawswhich wereByenacted to improve and protecttheenvironmentfrom industrial pollution and other harms are beingapplied to projects whose entire purpose isto improve and protect the environment.However, regulation is necessary in orderto ensure due process for the public andpermittee, as well as to protect an area’sresources.2 Therefore, it is the extremelyWDaniel SeanPatrick LacyKari GilesLacy1important to find a balance that providesreasonable and responsible regulationwithout creating too many hurdles for apermittee of important environmentalprojects.It is because of the American history ofwell-intentioned projects which resultedin extremely devastating environmentalresults, that restoration is regulated in thefirst place. In 1974, the U.S. Congresspassed the National Environmental PolicyAct (NEPA) which requires an environmental impact statement to be conductedfor all projects that may have a potentialimpact on the environment.3 Followingthe federal example, many states, including Illinois, passed their own regulationsfocusing on established environmentalstandards, such as water quality, and established procedures for issuing permitsfor these types of projects.4The environmental permitting process ensures that concerned members of the public are allowed to voice their concernsabout specific projects.5 In certain cases,pursuant to the Illinois AdministrativeProcedures Act, 5 ILCS 100/, a partywhose interests are substantially affectedcan file a petition to administratively challenge a proposed action. When this isdone, the permit applicant and the publicare given the opportunity to questionwhether a regulatory agency, i.e., state Environmental Protection Agency (EPA),has met its burden to issue a permit, andwhether the permit provides “reasonableassurances” – the legal standard typicallyused for environmental permits – that therequirements will be met.6The permitting process provides the permittee with a “permit shield” – an assurance that compliance with the permitconstitutes compliance with the law, thusrelieving the permittee of any worry of future liability as to any pollutants regulatedby that permit.7 The “permit shield” hasbeen formally codified in most states, aswell as in federal environmental laws,namely the Clean Water Act (CITE) andupheld by the Supreme Court.8Obtaining a permit by a watershed shedproject does not mean that all regulatoryhurdles have been cleared. It simply signals the beginning of a new series of regulatory problems. Once the exposure to anAdministrative Procedures Act challengepasses, the next task of complying withexisting permit conditions – sometimes anextraordinarily difficult task – begins.Projects likely will have to receive permitsfrom an agency of the Federal government, such as the Army Corps of Engineers if dredging and filling is needed.This not only slows down a project, butmay make it impossible to even begin aproject since the requirements and testingnecessary for obtaining a federal permitmay either be impossible to fulfill or

private Dew Deck of Miller Park for this sure to be sold-out game. Tick etsar only 9.S eatsin hgly ou f r not available for sale to the general public. The Dew Deck, which includes an all-you-can-eat buffet and a view of the game from one of the most popular party areas in Miller Park. Tickets include a pre-game buffet, which begins