Transcription

New Coverage &New Choices forMedicare-eligibleRetireesYakima, WAOctober 2010

What We Will Cover Today Welcome What is changing and why. How this affects you. Get to know Extend Health and the services and healthplans available to you. A look at the Medicare marketplace. Going forward.what to expect. Questions and answers.

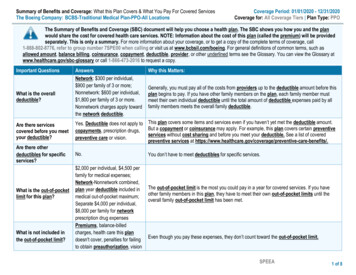

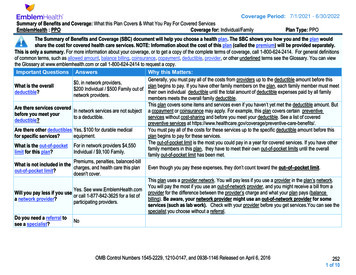

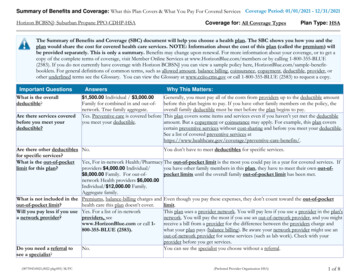

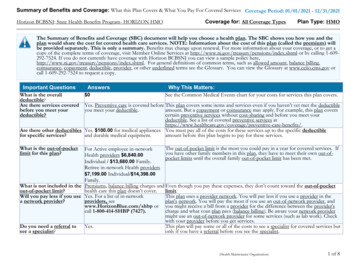

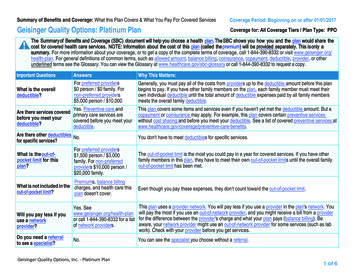

How This Affects YouWhat’schanging HEWT sponsored coverage will end December 31, 2010.What youpay It may change – depending on what coverage you choose.How youenrollYoursupport You will select and enroll in plans available through Extend Health. Individuals currently enrolled must elect 2011 coverage throughExtend Health to continue to receive the HEWT plan subsidy. If you enroll through Extend Health in 2011, HEWT will subsidizeyour coverage through an HRA. You will work with Extend Health to enroll in a plan that meets yourmedical and prescription needs. They will also help you set up yourHRA. Extend Health advisors will help you understand the costsassociated with your coverage – premiums, copayments,deductibles and all other costs.

What’s Driving This Change? The change is necessary to: Maintain retiree health care coverage viability. Maintain or reduce long term liability. Reduce or eliminate self-insured financial risk. Reduce expense of administering the plan. New approach provides: Plan choice for retirees. Financial flexibility for retirees. Plan education and selection expertise.

IntroducingExtend Health

Who is Extend Health? Independent company, dedicated to serving Medicareeligible retirees. Partner with 65 health plan carriers to provide youcoverage to fit your individual needs. Objective and Trusted US based benefit advisors. Focused on helping each participant make an informedand confident decision.6

Why Extend Health We are experienced in helping people just like you –having helped nearly 250,000 people in the last fiveyears. Our services are provided at no cost to eligibleHanford Employee Welfare Trust retirees, spouses,surviving spouses, and dependents.7

8

Plans & PartnersAll Medicare Plan Types Medicare Advantage Medigap Prescription Drug (Part D)Sample of InsuranceCompany PartnersVisionDental9

The ProcessEducateEvaluate/EnrollManage10

EducationGetting Started Guide. Gather information (prescriptions,doctors). Preexisting conditions- except endstage renal disease, will not limityour plan selection Schedule an evaluation andenrollment appointment. Give us a call www.ExtendHealth.com/hewt11

EducationEnrollment Guide Prepare you for enrollmentdiscussion Review Medicare basics Appointment confirmationreminder12

Evaluate and EnrollHours of OperationMonday – Friday6 a.m. – 6 p.m. PTLicensed Benefit Advisor Salt Lake City Your objective advocate Single point of contact Well trained13

Decision Support Tools Help Me Choose Prescription Profiler14

Enrollment Process Benefit Advisors candiscuss coverage optionswith anyone – need tospeak to the participant tocomplete the enrollment. Once you have made acoverage selection,enrollment is conducted viatelephone. 100% of calls are recorded.15

Medicare & You16

Your Future CoveragePrimary CoverageMedicare A & BAdditional Coverage (Your Choice)Medicare Advantage withPrescription Drug (MAPD)Medigap Prescription DrugOptional Coverage (your choice)Dental and Vision17

Location Specific Plans18

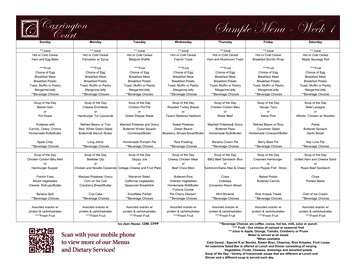

Plan Choices Available in Yakima CountyPlan TypeMedicareAdvantageMedigap/MedicareNumber ofPlansOffered2011 Monthly Premium7 37 - 21216 65- 18514 15 - 119SupplementPart DCompanyArcadian ColumbiaCommunity Care, AsurisNorthwest Health(Regence)Humana,SecureHorizons, AARP,Mutual of Omaha, AsurisNorthwest Health(Regence)AARP, Coventry,Humana, Medco, AsurisNorthwest Health, Aetna,CIGNA19

Plan Choices Available in Yakima CountyPlan TypeNumber ofPlansOffered2011 Monthly PremiumCompany 14 per person per monthVision1Annual Eye Exam: 15Coverage for eye glasses,lenses and frames tooVision Service Plan(VSP) 45Dental1 0 deductibleRenaissance Dental 1600 annual max20

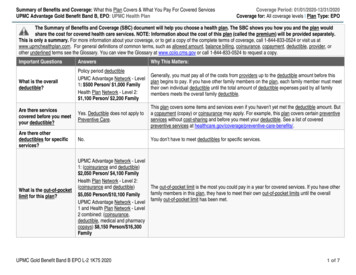

What are some popular coverage options and howmuch do they cost?Humana Choice (PPO) Medicare Advantage––––––––– 52 per monthNetwork: PPODeductible: NoDoctors: 10 copay; Specialist: 25Hospital: 250 copay Days 1 – 5Emergency Room: 50 copay if not admittedRx: 6/ 36/ 80/33%Mail order: (90 day) discountCoverage Gap: Some generic and preferred brand21

What are some popular coverage options and howmuch do they cost?AARP Plan F and Humana Enhanced PDP–––––––––Medical - 156 & PDP - 43Network: Any doctor who accepts MedicareDeductible: NoDoctors copay: 0; Specialist copay 0Hospital: 0 copayER copay: 0Rx: 7 / 45 / 70 /33%Mail Order: 0/ 110/ 200/33%Coverage Gap: Some Generics22

Sample Retiree Out of Pocket AnalysisCost ComponentDetailsPremiumAnnual Retiree PremiumMedical OOPMedical based on utilizationand plan detailsPart D OOPIncludes Donut hole forExtend plan for 40 Rx fills andco-paysHRA SubsidyTotalRetiree SavingsAARP Plan F Humana PDPCurrentHEWT PPOand Rx 2,237 1,134 0 249 829 596Company HRA contribution( 1,800)-Retiree Out of Pocket Costs 1,265 1,979 714

Medicare Prescription Drug CoverageInitial CoverageYou pay*Deductible and Co Pays for your plan*Coverage for the first 2840 in Actual Cost of MedicationsCoverage Gap – Donut HoleYou pay*50% of Brand Drugs and 93% of GenericsUntil out of pocket costs reach 4550Catastrophic CoverageYou pay* 2.50 for generics and 6.30 for BrandOr 5% which ever is greater24

What is an HRA? Tax-advantaged account used to reimburse you for eligiblehealthcare expenses Premiums (including Medicare Part B) Out-of-pocket expenses (e.g., deductibles, medical copays) You receive money from HEWT to pay for your expenses throughthe HRA Account is shared with your spouse Reimbursements are tax free Your funds will be automatically available January 1, 2011, if youenroll in an individual Medicare plan through Extend Health25

How an HRA WorksThe HEWT allocatesbenefit dollars to yourHRA account: 1,800 single retireeYour HRAAccountAdministered byExtend Health 3,600 for coupleYou work with Extend Health toenroll in individual coverageYou arereimbursed foryour health careexpenses usingHRA benefitdollars26

Auto Reimbursement (AR) Available on many of the plans you may select. Eliminates the need for you to file for monthlypremiums. Ask your Benefit Advisor to activate during yourenrollment call.27

Health Reimbursement Account- ReimbursementThe following process will allow you to access your HRA funds.123YouInsuranceCompanyPay your premium directly toyour insurance providerYou /CarrierSubmit your claim to ExtendHealthExtend HealthReimburses you from yourHRA accountPaperExtend HealthAuto-ReimbYou Direct Deposit Receive Check28

Post Enrollment Customer Service Advocacy and support services. Toll Free number to contact Extend Healthrepresentative. Direct support for claims issues, appeals and networkquestions. Renewal process – ability to pick new coverage for futureyears – not locked into this year’s coverage choice. Ongoing enrollment services as retiree or spouse turns age65.29

Next StepsReview Getting Started GuideGather Medicare card,prescriptions, & doctor informationCall Extend Health (888) 864-076430

Questions And Answers31

Plans & Partners All Medicare Plan Types Medicare Advantage Medigap Prescription Drug (Part D) . Medicare Advantage 7 37 - 212 . Northwest Health (Regence) Medigap/ Medicare Supplement 16 65- 185 Humana, SecureHorizons, AARP, Mutual of Omaha, Asuris Northwest Health (Regence) Part D 14 15 - 119