Transcription

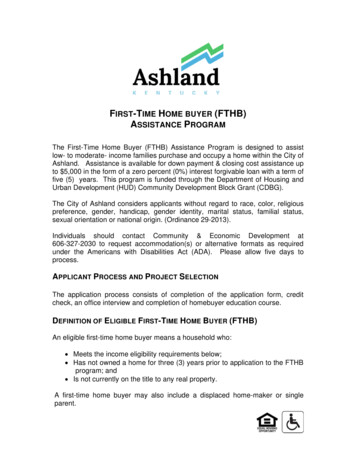

FIRST-TIME HOME BUYER (FTHB)ASSISTANCE PROGRAMThe First-Time Home Buyer (FTHB) Assistance Program is designed to assistlow- to moderate- income families purchase and occupy a home within the City ofAshland. Assistance is available for down payment & closing cost assistance upto 5,000 in the form of a zero percent (0%) interest forgivable loan with a term offive (5) years. This program is funded through the Department of Housing andUrban Development (HUD) Community Development Block Grant (CDBG).The City of Ashland considers applicants without regard to race, color, religiouspreference, gender, handicap, gender identity, marital status, familial status,sexual orientation or national origin. (Ordinance 29-2013).Individuals should contact Community & Economic Development at606-327-2030 to request accommodation(s) or alternative formats as requiredunder the Americans with Disabilities Act (ADA). Please allow five days toprocess.APPLICANT PROCESS AND PROJECT SELECTIONThe application process consists of completion of the application form, creditcheck, an office interview and completion of homebuyer education course.DEFINITION OF ELIGIBLE FIRST-TIME HOME BUYER (FTHB)An eligible first-time home buyer means a household who: Meets the income eligibility requirements below; Has not owned a home for three (3) years prior to application to the FTHBprogram; and Is not currently on the title to any real property.A first-time home buyer may also include a displaced home-maker or singleparent.

Displace home-maker is defined as an adult who has not worked fulltime,full year in labor force for a number of years, but during such yearsworked primarily to care for his/her home and family, and who isunemployed and experiencing difficulty in obtaining or upgradingemployment. Single Parent is defined as an individual who is unmarried or legallyseparated from a spouse and who has one or more minor children in theircare and custody, or who is pregnant.ACCEPTANCE GUIDELINES ARE BASED ON THE FOLLOWING CRITERIA None of the applicants have owned real estate in the past three years; Applicants demonstrate an ability to pay with a two-year history of stableemployment; An acceptable credit history which includes a good record of paying rentand utilities; Bankruptcies must have been discharged for at least 2 years; None of the applicants owes Federal, state or local tax debts; and Total taxable gross household income cannot exceed the Federal incomelimits (taxable gross income is defined as income from all taxable sources,before deductions, projected forward for the next 12 months for allhousehold members 18 and older).FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM2

2018 Maximum Income GuidelinesPersons inMaximumHouseholdHousehold Income1 30,7502 35,1503 39,5504 43,9005 47,4506 50,9507 54,4508 57,950(***subject to change each program year***)FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM3

APPLICANT REQUIREMENTSTo be eligible for participation in the First Time Home Buyer Assistance Program,applicants must meet and/or comply with all of the following Program criteria:APPLICANT INVESTMENTApplicants must have a minimum cash investment of 500 of the downpayment required.HOME BUYER EDUCATION COURSEApplicant(s) must complete a pre-purchase counseling program approved by theCity prior to submitting an application.The homebuyer education class may cover such topics as the following:preparing for homeownership; available financing; credit analysis; loan closing;homeownership responsibilities; home maintenance; and loan servicing.Only graduates of a completed home buyer education course are eligible for theFTHB.LENDER PRE-APPROVALApplicants must furnish a pre-approval letter from the lender. Lender must be registered with the City and adhere to City policies andprocedures, as outlined in this chapter.INTEREST RATEThe rate of interest shall be fixed (not an adjustable rate mortgage- ARM) andshall not exceed 2.1% above the current market rate.POST COUNSELINGApplicants are strongly encouraged to complete a post counseling session afterpurchasing their home with a HUD approved housing counseling agency of theirchoice.FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM4

ASSETSApplicants may not hold more than 5,000 in non-pension savings, investmentproperty, or any other form of account (i.e. CD, money market, mutual fund,stocks, bonds, etc.). Any amount in excess of 5,000 shall be used by theapplicant to pay down the principal.Gifts from family or friends will also be used 1.00 for 1.00 in reducing City’scontribution, under this Program.CREDITWORTHINESSApplicants must meet the underwriting criteria (i.e. creditworthiness, debt toincome ratios, employment) of the lender that will finance the first lien mortgageto purchase the property.RATIOSThe housing cost ratios shall be no more than 41% of the applicant’s grossmonthly income.This percentage includes PITI (which is the loan principal, interest, property taxesand insurance) plus estimated utility expense of 150.00.The applicant’s total outstanding debt ratio shall not exceed 55% of theirgrossmonthly income. This percentage includes the cost of PITI, utilities and any othermonthly debt.PRINCIPAL RESIDENCEApplicants must agree to occupy the home to be purchased under this Programas their principal residence for the required period of 5 years.REQUIRED DOCUMENTS Recent bank statements for all accounts Proof of all current income for all family members Pre-approval lender qualification letter and proof of completed home buyertraining courseFIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM5

APPRAISAL REQUIREMENTSThe property value will be determined by one or more of the following methodsas established by HUD:ESTIMATES OF VALUE (COMPARABLE SALES)The City may use estimates of value based on sale prices for comparableproperties in the immediate neighborhood (within the prior six months). Projectfiles must contain the estimate of value and document the basis for the valueestimates.APPRAISALSAppraisals, prepared by a state licensed fee appraiser may be used. Project filemust document the appraised value and the appraisal approach used.APPRAISAL GUIDELINES AND PROCUREMENT PROCEDUREAn appraisal that meets either the Urban Redevelopment Authority (URA)appraisal requirements of 49 CFR 24.103 or one of the other appraisal optionsspecified below:Should an appraisal be required the following three options may be used: Option 1An appraisal meeting the URA appraisal requirements of 49 CFR 24.103; Option 2An appraisal meeting the requirements of the Uniform Standards ofProfessional Appraisal Practice (USPAP);FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM6

Option 3An appraisal meeting the requirements of the Federal HousingAdministration (FHA) or a Government-Sponsored Enterprise (GSE)ANTI-DISPLACEMENT/RELOCATION POLICYIt is not anticipated that the implementation of the City’s FTHB Program will resultin the displacement of any persons, households, or families. However, ifrelocation becomes necessary due to lead abatement and/or substantialrehabilitation, the activity will be carried out in compliance with City’s relocationplan.UNIFORM RELOCATION ASSISTANCE (URA)POLICIES ACT OF 1970ANDREAL PROPERTY ACQUISITIONThe Federal Urban Revitalization Act (URA) and Real Property AcquisitionPolicies, as amended by the URA Amendments of 1987, contains requirementsfor carrying out real property acquisition or the displacement of a person,regardless of income status, for a project or SFOO Program for which HUDfinancial assistance (including CDBG and HOME) is provided. Requirementsgoverning real property acquisition are described in Chapter VIII.Theimplementing regulations, 49 CFR Part 24, require developers and owners totake certain steps in regard to tenants of housing to be acquired, rehabbed ordemolished, including tenants who will not be relocated even temporarily.SECTION 104(D) OF THE HOUSING AND COMMUNITY DEVELOPMENT ACT OF 1974Section 104(d) requires each contractor (City), as a condition of receivingassistance under HOME or CDBG, to certify that it is following a residential antidisplacement plan and relocation assistance plan. Section 104(d) also requiresrelocation benefits to be provided to low-income persons who are physicallydisplaced or economically displaced as the result of a HOME or CDBG assistedproject, and requires the replacement of low-income housing, which isdemolished or converted. The implementing regulations for Section 104(d) canbe found in 24 CFR Part 570(a).FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM7

CANCELLATION BY OWNER/GRANTEEAny applicant who cancels an application while it is in process shall not be eligiblefor reconsideration of the application for a two (2) year period.Applications canceled by the housing program due to ineligibility or other reasonsshall not be subject to this provision.The City’s financial commitment under the FTHB Program will be valid for 90consecutive calendar days, starting with the first working day after preliminaryapproval.Applicants who do not have an acceptable earnest money contract with aseller within the 90 consecutive days will be cancelled.CONTRACTOR DEBARMENT & SUSPENSION REQUIREMENTSPursuant to 24 CFR, Part 5, all Federally funded subrecipient/contractors arerequired to verify that they and their principals, or any/all persons, contractors,consultants, businesses, sub-recipients, etc., that are conducting business withthe City are not presently debarred, proposed for debarment, suspended,declared ineligible, or voluntarily excluded from participation in the coveredtransaction or in any proposal submitted in connection with the coveredtransaction. The City must check the Excluded Parties Listing System at sam.gov,print and maintain evidence of the search results. In the event that the searchresults indicate a prior or current debarment or suspension of the contractor,include the printout in the application.The City will not award any Federal housing funds to contractors that arepresently debarred, suspended, proposed for debarment, declared ineligible, orvoluntarily excluded from participation from the covered transaction.DISPUTE RESOLUTION AND APPEALSAny applicant denied assistance from the City’s housing programs has theright to appeal. The appeal must be made in writing to the Director of theCommunity & Economic Development.FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM8

If the Director disapproves an application pursuant to the authority granted to theDirector, the applicant shall have the right to appeal to City of Ashland Commission.DEFAULT AND FORECLOSUREIn the event that the applicant fails to adhere to the conditions andrestrictions contained within the written agreement between the applicant andthe City of Ashland, the City of Ashland reserves the right to terminate theindividual's participation in the FTHB program and/or demand full repaymentof the loan.DOWN PAYMENT REQUIREMENTSAn applicant must put down at least 50% of the down payment for conventionalfinancing. 3.5% down is required for FHA financing. A minimum of 500 of thedown payment must be from the applicant’s own funds. Beyond that, anyadditional funds over this requirement may be from a relative.DOWN PAYMENTThe minimum amount of cash required from the buyer is 500 of the downpayment.The maximum amount of cash required by the buyer will vary according to theterms of the first mortgage, the price of the home to be purchased, the buyer’sassets, the Lender’s required down payment and the closing costs.ELIGIBLE ACTIVITIESThe following activities are eligible under CDBG: Direct homeownership assistance means: Up to 50% of required downpayment; and/orPayment of reasonable closing costs.FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM9

INELIGIBLE COSTS No taxes shall be paid with Community Development Block Grant funding.HOME RESTRICTIONS The house price will depend on what you can afford, but in no case,can it exceed 128,000;The house must be located in The City of Ashland;The house must pass a City of Ashland housing Inspection; andYou must be able to afford the property as determined by yourcounselor and mortgage lender.The following property types may be included under the program: Traditional single-family housing that is owned fee simple (this housingmay contain one to four dwelling units); or A condominium unitINCOME QUALIFICATION AND VERIFICATION REQUIREMENTSAPPLICATION INTAKEINCOME/SCREENING/DETERMINATION OF HOUSEHOLD ADJUSTEDThe City utilizes the 24 CFR Part V definition of Adjusted Gross Income.In calculating adjusted gross income, the applicant’s income and that of all otherhousehold members at the time of application shall be considered. The incomeof household members under eighteen (18) years of age will be excluded. Theincome of any persons who are paid caregivers of elderly or handicappedindividuals will be excluded.A household member is any person residing in the household at the time ofapplication.Income is defined as follows:FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM10

The full amount before any payroll deductions of wages and salaries,overtime pay, commissions, fees, tips, bonuses, and other compensation forpersonal services; The net income from an operation of a business or profession, as calculatedby averaging the net income as reported in their Federal Income Taxes forthe past three years; Interest, dividends, and other net income of any type from the real orpersonal property (where the family assets are in excess of 50,000,excluding property, adjusted gross income shall include the greater of theactual income derived from all assets or percentage of such assets based onthe current passbook savings rate); The full amount of periodic payments received from social security, annuities,insurance policies, retirements funds, pensions, disability or death benefits,and other similar types of periodic receipts, including a lump-sum paymentfor the delayed start of a periodic payment; Payment in lieu of earnings, such as unemployment, workers' compensation,severance pay, welfare assistance (NOTE: Such payments may be excludedby the lending institutions providing the first mortgage for purposes ofunderwriting, but shall be included in eligibility determinations for thisProgram); Periodic and determinable allowances, such as alimony and child supportpayment, and regular contributions or gifts received from persons notresiding in the dwelling to the extent that such payments are reasonablyexpected to continue; All regular pay, special pay, and allowances of a member of the ArmedForces (whether or not living in the dwelling) who is the head of the family,spouse, or other person whose dependents are residing in the unit; Any earned income tax credit to the extent it exceeds income tax liability; Any other income that must be reported for Federal and State income taxpurposes; andFIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM11

Gross Self-Employed income as reported on Schedule C, IRS 1040, will beadjusted to reflect deductions for necessary and reasonable businessexpense. The One CPD Income Eligibility Calculator is located at the followinghyperlink: https://www.onecpd.info/incomecalculator/LIMITS OF ASSISTANCEThe First Time Home Buyer Program maximum assistance for down paymentand closing cost assistance is 5,000.00 which will be in the form of a 0%interest forgivable loan with a term of 5 years.Funds will be applied first to eligible closing cost.ALLOWABLE CLOSING COSTSA maximum amount of one (1%) percent origination fee or processing fee (basedon 1% of the loan amount). Only one of these fees will be allowed tobecharged to the buyer.Up to 5,000 in Service Delivery Costs associated with the processing andapproval of the application including, but not limited to: Amortization Schedule feeBuyer’s portion of the attorney’s fee associated with the transactionCredit Report feeCourier feePhotograph feeMortgagee’s title fee/City’s title policyEscrow feesRecording feesHUD Homeownership Counseling application review feesMortgage Insurance Premium feeTREC Re-Inspection feeTitle feesAppraisal feesINELIGIBLE CLOSING COSTFIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM12

Prepaid taxes or any other City, State, Federal TaxRestrictions FeeGood Funds Cost (except if buyer requests table funding)PROHIBITED CLOSING COSTSThese costs may not be charged to the buyer/borrower, by the Lender, under anycircumstances Funding FeesTax Service FeeWarehousing FeeUnderwriting FeeLoan Discount FeeMortgage Broker FeeWire Transfer FeeMortgage Insurance Application FePROHIBITED CLOSINGS (CONTINUED) Assumption FeeCommitment FeeLender’s Rate Lock-In FeeAbstract or Title Search FeeTitle Examination FeeNotary FeeIntangible TaxWholesale Lender’s CostApplicants are not allowed to pay for the Realtor’s sales commission or anyclosing costs required by FHA that the sellers normally pay.Applicants are not allowed to negotiate to pay any amount of the seller’sclosing costsAny other cost not specifically mentioned in Allowable Closing Costs andPrepaid SectionsALLOWABLE PREPAIDFIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM13

(Items to be deposited into the escrow account prior to closing) Interest due on closing dateHazard Insurance for first yearFlood Insurance (when applicable)Escrow items (insurance, etc.) excluding real estate taxesMortgage Insurance payment in escrowDOWN PAYMENTThe minimum amount of cash required from the buyer is 500 of the downpayment cost at closing.The maximum amount of cash required by the buyer will vary according to theterms of the first mortgage, the price of the home to be purchased, the buyer’sassets, the Lender’s required down payment and the closing costs. A first mortgage requirement of a down payment in excess of 5% of thepurchase price of the home is prohibited.LOCATION AND CHARACTERISTICSUNIT TYPESProperty to be purchased must be a single family property located in Ashland,Kentucky.HABITABILITYThe property must comply with Section R304 (Minimum Room Areas)International Residential Code as adopted by the City.of theGenerally accepted HUD occupancy guidelines will determine the number ofbedrooms required for a particular size of qualifying household.CODE REQUIREMENTS ON COMPLETIONFIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM14

The property to be purchased must pass a residential inspection conductedby the City of Ashland Code Enforcement to ensure compliance with CityProperty Codes and Standards at no cost to applicant. Additionally, theapplicant may hire a licensed Real Estate Inspector that is paid for by theapplicant for an optional additional inspection. All required inspections mustbe completed prior to closing.New construction must also comply with the International EnergyConservation Code, as adopted by the City, which meets or exceeds HUD’sModel Energy Code requirements.LOAN TO VALUEThe combined loan-to-value ratio for a City’s First Time Homebuyers Programshall not exceed 105 percent.LONG-TERM AFFORDABILITYUnder the regulations the period of affordability in years for homeownershipassistance is based on the amount of CDBG and HOME funds that are in theproject (unit) and are as follows:CDBG FUNDS PROVIDEDAFFORDABILITY PERIODUp to 5,000HOME FUNDS PROVIDED5 YearsAFFORDABILITY PERIODLess than 15,000.005 Years 15,000 – 40,000.0010 YearsMore than 40,000.0015 YearsLong-term affordability requirements will be reserved as part of a restrictivecovenant running with the deed. Affordability requirements are triggered if thehome is no longer your primary residence, and/or if the home is sold during theaffordability period.FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM15

NON-DISCRIMINATION REQUIREMENTSThe City’s Housing Programs will be implemented in ways consistent with theCity’s commitment to non-discrimination. No person shall be excluded fromparticipation in, denied the benefit of, or be subject to discrimination underany City housing program or activity funded in whole or in part with Federalfunds on the basis of his or her religion or, race, gender identity, familialstatus (children), disability, or national origin.NOTIFICATIONS AND DISCLOSURES REQUIREMENTEach homeowner or homebuyer must be given the necessary disclosures forthe City Housing Program applied for. Each homeowner must have read and signed the Disclosure Statement.PRIORITY MORTGAGE LENDER REQUIREMENTSThe owner(s) may supplement the City loan with private funds in order to make theactivity financially feasible for rehabilitation.If required project funds exceed the program limits, owner(s) may be requiredto obtain a mortgage for the additional amount in order to remain in the City’sprogram. In this case the City will subordinate with an agreement from the lender tonotify the City upon default and allow the City to cure the debt. The priority lien holder must be registered with the City and agree to acceptthe conditions noted in the lender registration form, to include no ARMS,interest-only mortgages, or other non-standard first mortgage productsallowed. Interest rate on first lien may not exceed 2.1% above market rate.PROPERTY VALUE REQUIREMENTSPURCHASE PRICE LIMITFIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM16

The maximum purchase price may not exceed 95% of the Single-FamilyMortgage Limits under Section 203(b) of the National Housing Act (12 U.S.C.1709 (b)).CURRENT PURCHASE PRICE LIMITSThe current maximum purchase price is 128,000.00, which is 67% of theaverage median purchase price for the area. The maximum purchase pricewill be adjusted periodically according to HUD purchase price limits.VERIFICATION REQUIREMENTSVerification of the following items of information relative to the application shall bemade with the appropriate verification procedures: Applicant will provide verification of completion in a home ownershipcounseling course that is acceptable to the City. The applicant’s income and asset information shall be verified as stated inHUD 24 CFR Part 5 Applicant will provide a pre-qualification letter from a lending institutionthat will provide the first mortgage financing. Applicant will provide evidence of savings to pay for the required applicantinvestment.The first mortgage loan obtained by the homebuyer has:HOMEBUYER PROPERTY QUALIFICATIONNET PROCEEDS EXAMPLENet Proceeds ExampleSales Price First Mortgage Pay-off Capital Improvements Cost of Sale Net Sale Proceeds 121,00093,5005008,41518,585FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM17

If the City’s loan balance is less than the net sales proceeds, then theremainder of proceeds sale shall accrue to the FTHB program participant.Net Proceeds w/Remainder ExampleSales Price 121,000First Mortgage Pay-off 93,500Capital Improvements 500Cost of Sale 8,415Net Sale Proceeds 18,585Balance on City Payable Loan 4,200Balance on City Deferred Loan 6,900Balance to Owner 7,485If the owner has made all payments on the loan during the loan term, then at theend of the loan term, the City shall discharge the lien and the balance of thedeferred payment loan, if any, shall be forgiven.Loan terms may extend beyond the required affordability period for the property.In the case of property sales that occur after the affordability period, the City willrequire repayment only of the balance of the payable loan.If the owner(s) dies within the loan term, the City shall forgive the balance of theloan upon presentation by the heirs to the City a valid death certificate.PROPERTY SALE OPTIONSIf the property is sold during five (5) year affordability period, for the deferredpayment loan, there are two repayment options available for the applicants’selection: Option 1Zero percent (0%) interest with shared appreciation or Option 2FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM18

Three percent (3%) interest without shared appreciation for a term up to thirty(30) years. RepaymentIn either case, the outstanding balance on the indebtedness must be repaidto the City if the property is sold, leased, transferred, or it ceases to be theprincipal residence of the borrower(s) within the five (5) year affordabilityperiod.Repayment by the borrower is limited to Net Sale Proceeds less the City’sPayable Loan.In the event there are no Net Sale Proceeds then the balance shall beforgiven.ANNUAL INSURANCE BINDER REQUIREMENTThe City shall receive a copy of the Insurance Binder at the anniversary of theCity’s Loan origination each year. The City shall be named by the owner as a co-insured.SUBSIDY LAYERING REVIEWA Subsidy Layering Analysis is required for any project in which HOME funds arecombined with at least one other public source, including CDBG.The City does not have to perform a subsidy layering analysis if any of thesubsidy layering evaluations listed below has been conducted: Those produced by HUD when another source of funding is provided byHUD, and HUD conducts a subsidy layering review (e.g., the reviewconducted by the Office of Housing for Section 202/811 projects);Those produced by DHCR when tax credits are allocated to a project, andthe state conducts an evaluation to determine whether there are excess taxsubsidies; orThose produced by DHCR in accordance with the guidelines presented inHUD Notice CPD-98-01.FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM19

If any of these analyses have been conducted, PCB staff should obtain a copy ofthe analysis for the project file.If none of these analyses have been conducted, PCB staff must analyze theproject (and consult with the other public program agency) to determine theminimum total public subsidy required to achieve project feasibility. The analysistypically includes at least the following four elements:COST ANALYSIS Is the acquisition cost reasonably related to market value and is it an armslength transaction?Are development costs (construction and soft costs) reasonable?FEE ANALYSIS Is the Builder’s Overhead and Profit reasonable?Are the Developer’s Fee and all other non-arms-length-party fees (e.g., thedeveloper or a subsidiary also receives a marketing fee) reasonable? If tax credits are involved, are the syndication costs and fees reasonable (thisanalysis is usually done by the tax credit agency)?EQUITY ANALYSIS Is the amount of equity committed reasonable (considering loan to value andWorking Capital)?Is the Return on Equity or Return on Investment reasonable?Is the return reasonable after considering any tax benefits?Are there any restrictions on distribution of cash flow to the investors, and arereasonable reserves assured?GAP ANALYSIS Are the total sources of funding, including all public sources and equity,disclosed?Is the amount of public funding proposed reasonable in that it covers the onlygap after adjustments required by the cost and fee analysis above?FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM20

The PJ should ensure that a copy of the evaluation done by the other fundingentity is included in the PJ’s project file.Regulatory reference: 24 CFR 92.250(b); see also CPD-98-01SUBSIDY LIMITSiMinimum HOME investment: The minimum amount of HOME funds is anaverage of 1,000, multiplied by the number of HOME-assisted units in theproject.The minimum only relates to the HOME funds, and not to any other funds thatmight be used for project costs.Maximum HOME investment: The maximum per-unit HOME subsidy limit variesby PJ. HUD determines the maximum amounts, which are based on the PJ'sSection 221(d)(3) program limits for the metropolitan area, each year. Aneconomist in a local HUD field office can provide these limits.100 percent of the dollar limits for a Section 221(d)(3) nonprofit sponsor,elevator-type development, indexed for base PJ high cost areas, and adjusted forthe number of bedrooms.In some instances, the 221(d)(3) limit has already been increased to 210 percentof the base limit. If this is the case, HUD will allow, upon request, an increase inthe per-unit subsidy amount on a program-wide basis. However, the absolutemaximum subsidy limit that HUD will allow is 240 percent of the base 221(d)(3)limits.SUBORDINATION REQUIREMENTThe City’s Housing Programs permit subordination of the City’s loan to a firstmortgage.WAITING LISTThe City maintains a waiting list of all prospective homebuyers who are approvedfor assistance. Grantee may waive this requirement at its sole discretion ifDeveloper demonstrates conclusively that a waiting list serves no purpose,FIRST-TIME HOME BUYER (FTHB) ASSISTANCE PROGRAM21

because the number of homes available for sale exceeds the number of qualifiedbuyers.WAITING LIST PROCEDURESPriority for selecting a completed home will be determined by the date that aclient’s application for assistance was approved (that is, the client with theearlier date of approval shall have priority).WRITTEN AGREEMENTA Written Agreement is required between the City and the Applicant/Homeowner/Home buyer describing terms and conditions of the program/activityrequirements.VERIFICATION REQUIREMENTSVerification of the following items of information relative to the application shall bemade with the appropriate verification procedures A title company in the form of a Commitment shall verify ownership in writtenform for Title Insurance. The applicant’s income and asset information shall be verified as stated inHUD 24 CFR Part 5. Payment of property taxes will be verified thru the City Tax Office. Noapplications will be considered where delinquent property taxes exist. Upon determination that an applicant is eligible for assistance, theapplication will be inactivated until the delinquent taxes have been paid.Eligible exceptions are Tax repayment agreement from the City’s tax office or Verification of an eligible City tax exemption. The applicant must be current with any loans obtained through the HousingPrograms Division.ANNUAL MONITORING OF RESIDENCY REQUIREMENTFIRST-TIM

An eligible first-time home buyer means a household who: Meets the income eligibility requirements below; Has not owned a home for three (3) years prior to application to the FTHB program; and Is not currently on the title to any real property. A first-time home buyer may also include a displaced home-maker or single