Transcription

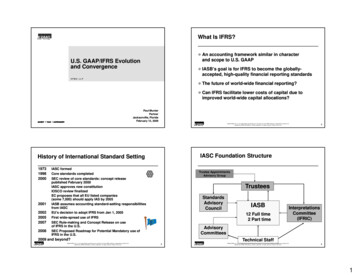

technicalThis article summarises some of the key changes to group accountingwhich have been affected by the convergence process, mainly the newrequirements of IFRS 3 (Revised). Additionally, the related topic of first-timeadoption of IFRS has also been included.01convergenceifrs and usRELEVANT to ACCA QUAlification paper P2IFRS and US GAAP convergenceis a topic which has beenperiodically examined inPaper P2 exams. It is ofcontinuing importance, both asa potential exam topic and alsoin a commercial context wherecompanies may be affected bythis process.The topic is worthy of reviewas there have been developmentsin recent times, and the PaperP2 syllabus includes currentissues with specific reference toconvergence between nationaland international reportingstandards. Typically, one of thequestions available in Section Bof the exam paper has a currentissues focus, and will be basedon recent developments.This article also summarisessome of the key changes togroup accounting which havebeen affected by the convergenceprocess, mainly the newrequirements of IFRS 3 (Revised).Additionally, the related topic offirst-time adoption of IFRS hasalso been included.BACKGROUND TO CONVERGENCEIn September 2002, theInternational AccountingStandards Board (IASB) andthe Financial AccountingStandards Board (FASB) signedthe Norwalk Agreement as thestarting point for a project toconverge their respective sets offinancial reporting standards.Both IASB and FASB stated theircommitment to the developmentof high quality, compatibleaccounting standards that aresuitable for both domestic andcross-border financial reporting.The agreement identified twokey objectives: to make existing accountingstandards compatible as soonas practicable to maintain compatibilityonce convergence hadbeen achieved.MEMORANDUMOF UNDERSTANDINGIn February 2006, the IASB andFASB agreed and published aMemorandum of Understanding(MoU), also called the Roadmap,identifying short-term andlong-term convergence projects.This was based on the followingthree principles: Convergence of accountingstandards can best be achievedthrough the developmentof high quality, commonstandards over time. Trying to eliminate differencesbetween two standards thatare in need of significantimprovement is not the bestuse of the FASB’s and theIASB’s resources. Instead, anew common standard shouldbe developed that improves thefinancial information reportedto investors. Serving the needs of investorsmeans that the boardsshould seek convergence byreplacing standards in needof improvement with jointlydeveloped new standards.

student accountant 11/2009Studying Paper P2?Performance objectives 10 and 11 are linked02As a consequence of agreeingthe MoU, priorities andmilestones were established,including short-termconvergence topics which wereidentified either as high priorityfor convergence or whereconvergence could be easilyachieved, including the following: IAS 23 permitted borrowingcosts on the construction of anasset to be either capitalisedor written off, whereas USGAAP required such costs tobe capitalised. IAS 23 wasamended in March 2007 and isnow in line with US GAAP; from1 January 2009, entities havebeen required to capitaliseborrowing costs wherespecified criteria are met. IAS 14 has been supersededby IFRS 8, which deals withsegmental reporting. IFRS 8identifies reportable segmentsbased on a ‘managerialapproach’, which is consistentwith the approach adoptedunder US GAAP, rather thanthe ‘risk and returns’ approachadopted by IAS 14.IFRS and US GAAP convergence is a topic which has beenperiodically examined in Paper P2 exams. It is of continuingimportance, as a potential exam topic and in a commercialcontext where companies may be affected by this process.betweengaap IAS 1 was revised in September2007, with the balance sheetrenamed as the ‘statement offinancial position’. The incomestatement was renamed as the‘statement of comprehensiveincome’, and now includesitems of income and expensethat are not recognised inprofit or loss but were directlyrecognised in equity, such asrevaluation gains. IAS 27 and IFRS 3 wereamended in January 2008.The new standards changethe calculation of goodwilland also the treatment ofpiecemeal acquisitions. Alongwith changes to US GAAP,these amendments bringthe accounting treatment forgoodwill into line, althoughsome differences still exist,such as the definition ofcontrol and fair value. Areview is scheduled for 2012,by which date the revisedstandards would have beenapplied for two years.The main changes arising fromrevision of IAS 27 and IFRS 3are summarised in Table 1 onpage 5.Given that many of themore recently issued reportingstandards eliminate or narrowdown the range of permittedaccounting treatments, it ispossible that, in future, theaccounting policy choice formeasurement and recognitionof goodwill may be narroweddown by: requiring entities to adopt aconsistent accounting policy forall acquisitions where control isacquired, rather than goodwillaccounting policy beingdecided on an acquisition byacquisition basis, or moving towards a singleaccounting policy ofaccounting for goodwill atfair value.Note that where goodwill onacquisition has been accountedfor on a gross or fair valuebasis, and is subsequentlyfound to be impaired, theimpairment is allocated betweenthe group and NCI based upontheir respective shareholdings inthe subsidiary.

technicalROADMAP 2008A second Roadmap towardsconvergence was agreed inNovember 2008. The objectiveof this roadmap was to enablecompanies to file annualfinancial statements, preparedin accordance with IFRS GAAP,to be accepted by the Securitiesand Exchange Commission(SEC) in the US. This followed onfrom an announcement in 2007that the SEC would no longerrequire IFRS-compliant financialstatements filed with the SECto also include a reconciliationto US GAAP. Based on the 2008Roadmap, a small group ofcompanies will begin to preparetheir financial statements usingIFRS with effect from yearsstarting 15 December 2009onwards. Companies eligiblemust be one of the 20 largestin that industry (measured bymarket capitalisation), andfinancial reporting by those 20major companies must haveIAS GAAP as the major basis forfinancial reporting.This announcement wasfollowed, in January 2009, by anSEC statement that a mandatorytwo-year dual-reporting periodwould begin for most companiesin 2012, with IFRS onlyrequired by 2014. The SEC’sdecision reflects the increasingacceptance of IFRS as a widelyused and high-quality financialreporting language.A further driver towardsconvergence in recent monthshas been the global financialcrisis. While there were alreadyproposals to harmoniseaccounting for financialinstruments, this issue has takenon greater significance andpriority. Amendments to IAS 39and IFRS 7 have been approved,and these will become effectiveduring 2009 dealing withderecognition of financial assetsand related disclosures.However, there are still areaswhere IAS/IFRS differs from USGAAP, and these are summarisedin Table 2 on page 6.There are also a number oflonger-term projects to continuethe harmonisation processbetween IFRS/US GAAP, includingthe following: Fair value measurement –the objective is to clarifythe definition of fair valueand to establish a singlesource of guidance for fairvalue measurement. Post-employment benefits– IASB and FASB intend tomove to a common standardon this topic, but thereare currently significantdifferences between theirrespective positions. Revenue recognition – theobjective is to develop a singlemodel for the recognitionof revenue which can beapplied across industries andgeographical regions. Thiswould improve comparabilityand understanding of financialreporting information.A further driver towards convergence in recent months has been theglobal financial crisis. While there were already proposals to harmoniseaccounting for financial instruments, this issue has taken on greatersignificance and priority.03 Leases – a new standard mayresult in operating leases beingregarded as an asset for theright to use an item, whilealso recognising the liabilityto make rental payments. Astandard on this topic is notexpected until 2011. Earnings per share – thishas involved both IASB andFASB reviewing proposedamendments to the calculationof diluted earnings per share. Conceptual framework – todate, this has focused onthe objectives of financialreporting and the qualitativecharacteristics of financialreporting information.

Due to the drive towards convergence of reporting standards betweenIAS/IFRS and US GAAP, and also national moves to harmonise nationalstandards with IAS/IFRS, many of the historical differences have alreadybeen eliminated.student accountant 11/2009A NATIONAL PERSPECTIVEON HARMONISATION OFREPORTING STANDARDSMany national standardsetting bodies now have apolicy of either convergence orharmonisation with IFRS. TheAccounting Standards Board(ASB) in the UK has long heldthe view that there can be nocase for maintaining differencesbetween the principlesunderlying UK and InternationalAccounting Standards.Typically, when drafting anynew reporting standards for theUK, the ASB will consider anyrelevant international standardsand will incorporate the principalrequirements within the approvedUK standard. This policy hasbeen mirrored by other nationalaccounting standard setters.In addition, listed companieswithin the European Union arealready required to prepare theirannual financial statements inaccordance with IFRS.FIRST-TIME ADOPTION OF IFRSDue to the drive towardsconvergence of reportingstandards between IAS/IFRSand US GAAP, and also nationalmoves to harmonise nationalstandards with IAS/IFRS, manyof the historical differences havealready been eliminated. Wheredifferences remain between IAS/IFRS and a particular set ofnational reporting standards,they are not as significantas they may have been, say,20 years ago. Consequently,the importance of first-timeadoption of IFRS, and theapplication of IFRS 1, may beperceived to be less importantthan it has been in the past.However, it is still of importancefor several reasons: Entities who expect to seeka listing for the first timestill need guidance on howthe adoption process shouldbe managed, accountedfor, and disclosed in thefinancial statements. Entities who have noexpectation of seeking a listingmay choose to adopt IFRS ifthey perceive that IFRS is morerelevant to their situation. Unlisted multinationalcorporate groups may chooseto adopt IAS/IFRS as thebasis for financial reportingthroughout the group. This maysave time and resources in thepreparation of managementinformation throughoutthe group, and streamlinegroup annual financialreporting requirements.04 Entities may believe thatadoption of IFRS could assistin their efforts to raise capital;if potential capital providersare familiar with IFRS, it mayease their evaluation of anycapital investment opportunity. Entities may believe that theyare ‘doing the right thing’ byadopting IFRS as it is alreadyused by other, usually listedand often larger entities.The above commentarydemonstrates the significantprogress to date made bythe IASB and FASB towardsachieve their desired outcomeof producing high quality,compatible accounting standardsthat are suitable for bothdomestic and cross‑borderfinancial reporting. While thereis still some way to go, andnumerous obstacles to benegotiated, there appears to bea momentum which will ensurethat progress continues in thecoming years.Tony Sweetman is a contentspecialist at Kaplan Publishingand is also a tutor at KaplanFinancial in Glasgow

05technicaltable 1: summary of changes arising from revision of IAS 27 and IFRS 3TopicExternal professionalacquisition costsIFRS 3Part of cost of gaining controland capitalisedIFRS 3 (Revised)Now expensed to income statementContingent considerationRecognised if it was probable that itFair value of contingent considerationwould be paid: ie in accordance withnow part of cost of gaining controlIAS 37GoodwillRecognise only parent entity share ofChoice of accounting policy,goodwill in the acquired entitywhich can be made on anaquisition by acquisition basis – either: parent share of goodwill, or fair value of goodwill for theentity as a whole (so parent andnon-controlling interest sharegoodwill, expressed as a single figure)Measure and recognise goodwill only atthe date control is acquired; derecognisegoodwill when control is lostNon-controlling interests (NCI)(previously minority interest)NCI based upon their proportionateDepending on the choice of goodwillinterest in the net assets of theaccounting policy, NCI at the reportingsubsidiary at the reporting datedate may be stated at either: fair value (being fair value atacquisition plus share of post-acquisitiontransactions/profits or losses lessshare of goodwill impairment) or their proportionate interest in the netassets of the subsidiaryTransactions between group and NCI A piecemeal transaction resulted in eitherwithout a change in controlan incremental addition to goodwill, or again or loss arising on partial disposalRegarded as a transaction between equityholders; such transactions do not changegoodwill, but result in an increase ordecrease in the equity of the groupStep acquisitions where control isUse the cost of each purchase to identifyacquired by more than one transaction the cost of gaining controlRe-measure the cost of earlier purchasesof shares at date control is acquired; anygain or loss on re-measurement is takento income and also reflected in the costof gaining control

A second Roadmap towards convergence was agreed in November 2008.The objective of this roadmap was to enable companies to file annual financialstatements, prepared in accordance with IFRS GAAP, to be accepted by theSecurities and Exchange Commission (SEC) in the US.student accountant 11/200906table 2: summary of differences between ifrs/iasTopicInventory valuationIFRS/IAS GAAPLIFO not permittedUS GAAPLIFO permittedDevelopment costsCapitalise when criteria metExpensedNon-current assetsHistorical cost or valuationHistorical costExtraordinary itemsProhibitedPermitted underspecific circumstancesJoint venturesEquity accounting orproportional consolidationEquity accountingFair valueThe value at which an asset orliability can be exchanged in anarm’s length transactionExit or disposal value

once convergence had been achieved. MEMORANDUM OF UNDERSTANDING In February 2006, the IASB and FASB agreed and published a Memorandum of Understanding (MoU), also called the Roadmap, identifying short-term and long-term convergence projects. This was based on the following three principles: Convergence of accounting standards can best be .