Transcription

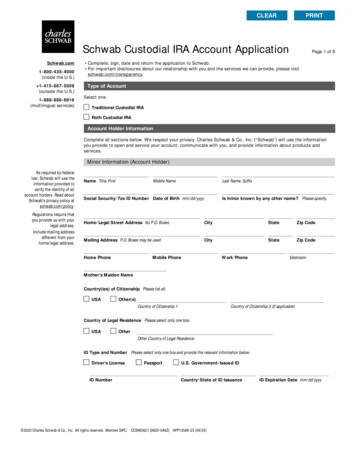

CLEARPRINTSchwab Custodial IRA Account ApplicationSchwab.com1-800-435-4000(inside the U.S.) 1-415-667-5009(outside the U.S.)1-888-686-6916(multilingual services)Page 1 of 8 Complete, sign, date and return the application to Schwab. For important disclosures about our relationship with you and the services we can provide, please visitschwab.com/transparency.Type of AccountSelect one.Traditional Custodial IRARoth Custodial IRAAccount Holder InformationComplete all sections below. We respect your privacy. Charles Schwab & Co., Inc. (“Schwab”) will use the informationyou provide to open and service your account, communicate with you, and provide information about products andservices.Minor Information (Account Holder)As required by federallaw, Schwab will use theinformation provided toverify the identity of allaccount holders. Read aboutSchwab's privacy policy atschwab.com/policy.Regulations require thatyou provide us with yourlegal address.Include mailing addressdifferent from yourhome/legal address.Name Title, FirstMiddle NameLast Name, SuffixSocial Security/Tax ID Number Date of Birth mm/dd/yyyyIs minor known by any other name? Please specify.Home/Legal Street Address No P.O. BoxesCityStateZip CodeMailing Address P.O. Boxes may be usedCityStateZip CodeHome PhoneMobile PhoneWork PhoneExtensionMother's Maiden NameCountry(ies) of Citizenship Please list all.USAOther(s)Country of Citizenship 1Country of Citizenship 2 (if applicable)Country of Legal Residence Please select only one box.USAOtherOther Country of Legal ResidenceID Type and Number Please select only one box and provide the relevant information below.Driver's LicenseID NumberPassportU.S. Government-Issued IDCountry/State of ID Issuance 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)ID Expiration Date mm/dd/yyyy

Page 2 of 8Schwab Custodial IRA Account ApplicationMarital StatusSingleMarriedDivorcedWidowedNumber of DependentsSecurities industry regulations require that we collect this information.Employment InformationPlease select only one t EmployedEmployer Name/Business NameOccupationIf you selected “Employed” or“Self-Employed,” pleaseselect one option that bestdescribes your occupation.Business Owner/Self-EmployedExecutive/Senior ManagementMedical ProfessionalLegal ProfessionalAccounting ProfessionalFinancial Services/Banking ProfessionalInformation Technology ProfessionalOther ProfessionalU.S. Government Employee (Federal/State/Local)Foreign Government Employee (Non-U.S.)MilitaryEducatorClerical/Administrative ServicesTrade/Service Career sultantOther Please Specify:Business Street Address No P.O. BoxesCityStateZip CodeThe next two questions are required.You must answerthis question.Are you affiliated with or employed by a stock exchange or member firm of an exchange or FINRA, or a municipalsecurities broker-dealer?NoYesIf yes, you must attach a letter from your employer approving the establishment of your account whensubmitting this Application.You must answerthis question.Are you a director, 10% shareholder or policy-making officer of a publicly held company?NoYesIf yes, please list all companies below.Company NameTrading SymbolAnnual IncomeUnder 15,000 15,000- 24,999 25,000- 49,999 50,000- 99,999 100,000 or more 25,000- 49,999 50,000- 99,999 100,000- 249,999 250,000 or moreLiquid Net WorthUnder 25,000 Specify dollar amount if 250,000 or more 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)

Page 3 of 8Schwab Custodial IRA Account ApplicationCustodian InformationAs required by federal law,Schwab will use theinformation provided to verifyyour identity.Regulations require thatyou provide us with yourlegal address.Include mailing address ifdifferent from yourhome/legal address.Name Title, FirstMiddle NameLast Name, SuffixSocial Security NumberDate of Birth mm/dd/yyyyAre you known by another name? Please specify.Home/Legal Street AddressMailing AddressNo P.O. BoxesP.O. Boxes may be usedHome PhoneCityStateZip CodeCityStateZip CodeMobile PhoneWork PhoneExtensionPlease provide your email address if you would like to access your accounts online. By providing your email address, youconsent to receiving email from Schwab.Email AddressMother's Maiden NameCountry(ies) of Citizenship Please list all.USAOther(s)Country of Citizenship 1Country of Citizenship 2, if applicableCountry of Legal Residence Please select only one box.USAOtherOther Country of Legal ResidenceID Type and Number Please select only one box and provide the relevant information below.Driver's LicensePassportID NumberU.S. Government-Issued IDCountry/State of ID IssuanceID Expiration Date mm/dd/yyyyMarital StatusSingleMarriedDivorcedWidowedNumber of DependentsSecurities industry regulations require that we collect this information.Employment InformationPlease select only one box.EmployedSelf-EmployedRetiredEmployer Name/Business Name 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)HomemakerStudentNot Employed

Page 4 of 8Schwab Custodial IRA Account ApplicationOccupationIf you selected “Employed” or“Self-Employed,” pleaseselect one option that bestdescribes your occupation.Business Owner/Self-EmployedExecutive/Senior ManagementMedical ProfessionalLegal ProfessionalAccounting ProfessionalFinancial Services/Banking ProfessionalInformation Technology ProfessionalOther ProfessionalU.S. Government Employee (Federal/State/Local)Foreign Government Employee (Non-U.S.)MilitaryEducatorClerical/Administrative ServicesTrade/Service Career sultantOther Please Specify:Business Street Address No P.O. BoxesCityStateZip CodeThe next two questions are required.You must answerthis question.Are you affiliated with or employed by a stock exchange or member firm of an exchange or FINRA, or a municipalsecurities broker-dealer?NoYesIf yes, you must attach a letter from your employer approving the establishment of your account whensubmitting this Application.You must answerthis question.Are you a director, 10% shareholder or policy-making officer of a publicly held company?NoYesIf yes, please list all companies below.Company NameTrading SymbolInvestment ExperiencePlease select only one box.This is required for Minorswho are residents of statesgoverned by either theUniform Gifts to Minors Act orthe Uniform Transfers toMinors Act (UGMA or UTMA).NoneLimitedGoodExtensivePlease indicate the age for termination of custodianship and the state law under which this Custodial account will begoverned.Age of TerminationGoverning State LawThe age of custodianship termination varies by state, although many states set the maximum age for termination at 21. Ifyou do not indicate a termination age, the account will be set up using the default age for termination in the Custodian’sstate of residence. If the termination age selected is different from the state’s default age, the Custodian agrees andacknowledges that he or she is responsible under UGMA or UTMA for determining the proper termination age and thatSchwab is not responsible for doing so. If you have questions about the termination age, please consult your legal or taxadvisor. Schwab may restrict the Custodian’s access to the account and register the assets in the beneficiary’s nameupon the beneficiary reaching the age of termination.You understand that by electing to extend custodianship to age 25, if applicable, you may lose your annual exclusion fromfederal gift tax. You should consult with an attorney or tax advisor before making this election. (Note: Only certain statesallow the custodianship to be extended to the Minor’s 25th birthday. This election may be exercised only in those statesthat specifically provide for it.) 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)

Page 5 of 8Schwab Custodial IRA Account ApplicationTrusted Contact DesignationA Trusted Contact Person (“Trusted Contact”)* is a resource Schwab, and your advisor (if you have one), may contact onyour behalf, if necessary, to attempt to address concerns regarding potential financial exploitation, or in communicatingwith you regarding issues related to your account(s). A Trusted Contact will not be able to view your account information,execute transactions in your account(s), or inquire about account activity, unless that person has that authority throughanother role on the account(s), such as a trustee or power of attorney. Providing Schwab with Trusted Contactinformation is voluntary. We encourage you to provide two Trusted Contacts in the event that one is not reachable in thefuture. Schwab suggests that your Trusted Contact(s) be someone other than your financial consultant or investment advisor. You may name up to two Trusted Contacts. The person(s) you name as Trusted Contact(s) will be the Trusted Contact(s) on all of your Schwab accounts, asprovided for in your account agreement. For multiple-party accounts, each party can name separate Trusted Contacts. The Trusted Contact(s) must be at least 18 years old.Trusted Contact InformationTrusted Contact information provided on this form will replace all Trusted Contact information currently on file.Person 1If you have no changes to yourexisting Trusted Contact,please skip this section.Name Title, FirstMiddle NameLast Name, SuffixRelationshipPlease select only one.Please provide at least onemethod of contact for eachTrusted Contact g Address No P.O. BoxesCityState or Province CountryPostal or Zip CodeHome PhoneMobile PhoneEmail AddressMiddle NameLast Name, SuffixOtherPerson 2If you have no changes to yourexisting Trusted Contact,please skip this section.Name Title, FirstRelationshipPlease select only one.Please provide at least onemethod of contact for eachTrusted Contact g Address No P.O. BoxesCityState or Province CountryPostal or Zip CodeHome PhoneMobile PhoneOtherEmail Address* If you provide a Trusted Contact Person(s) to Schwab, you understand that you have authorized Schwab and youradvisor (if you have one) to contact the Trusted Contact Person(s) at their discretion and to disclose information aboutyour account to address possible activities that might indicate financial exploitation of you; to confirm the specifics ofyour current contact information, health status (including physical or mental capacity), or the identity of any legalguardian, executor, trustee, or holder of a power of attorney on your account(s); or as otherwise permitted by FINRArules or state law. For more information, please see your Schwab Account Agreement, which is available atschwab.com/accountagreement. 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)

Schwab Custodial IRA Account ApplicationPage 6 of 8Overall Investment Objective of AccountPlease select all boxesthat apply.Capital PreservationIncomeGrowthSpeculationAccount FeaturesYour Consent to Enroll in Schwab’s Cash Features ProgramThe Cash Features Program is a service that offers the Bank Sweep feature (a “Cash Feature”) to permit your uninvestedcash (the “Free Credit Balance”) to earn income while you decide how those funds should be invested longer term.You understand that additional information about the Cash Features Program and each Cash Feature is available in theCash Features Disclosure Statement.By signing this Application, you consent to having the Free Credit Balance in your brokerage account included in the CashFeatures Program, as described in the Cash Features Disclosure Statement.The Bank Sweep feature is designated as the Cash Feature for brokerage accounts of account holders residing in the U.S.Through the Bank Sweep feature, Schwab automatically makes deposits to and withdrawals from deposit accounts at oneor more banks affiliated with Schwab (“Sweep Banks”). Your deposits at each Sweep Bank are insured by the FederalDeposit Insurance Corporation (FDIC) up to 250,000 (including principal and accrued interest) when aggregated with allother deposits held by you in the same insurable capacity at that bank. Your funds may be placed in a Sweep Bank inexcess of the FDIC insurance limit. In certain limited circumstances, Schwab may place your funds in a sweep moneymarket fund. Please see the Cash Features Disclosure Statement for additional information.You understand and agree that Schwab can (1) make changes to the terms and conditions of the Cash Features Program;(2) make changes to the terms and conditions of any Cash Feature; (3) change, add, or discontinue any Cash Feature; (4)change your investment from one Cash Feature to another if you become ineligible for your current Cash Feature or yourcurrent Cash Feature is discontinued; and (5) make any other changes to the Cash Features Program or Cash Feature asallowed by law. Schwab will notify you in writing of changes to the terms of the Cash Features, changes to the CashFeatures we make available, or changes to the Cash Features Program prior to the effective date of the proposed change.Paperless Document EnrollmentHere’s how paperless works: You will receive account statements, trade confirmations, shareholder materials, accountagreements and related disclosures, and other regulatory documents, if available in paperless form, by email. For certaindocuments, including account statements, you will receive an email notification with a link to log on to our secure websiteto access your documents. For complete information, please see Important Information About Your Informed Consent toReceive Paperless Documents in the Appendix to this application.To opt for Paperless Documents, simply provide your email address in the "Account Holder Information" section of thisform. The completion of your enrollment will depend on one of the following scenarios.Scenario 1:If you already have an account enrolled in Paperless Documents using the email address provided on this form, havelogged on to Schwab.com in the past six months, and agree to the following, your paperless enrollment will be completeonce your account is opened. I have read and understood the Important Information About Your Informed Consent to Receive Paperless Documents inthe Appendix to this application and consent to enrolling this account in Paperless Documents. I understand that I will receive an email with my new account agreement and related disclosures.OrScenario 2:If you do not have an existing account enrolled in Paperless Documents, are using a different email address, or have notlogged on to Schwab.com in the past six months, we will send you an email after the account is opened. To completeenrollment, you will need to click the “I Consent” button in that email and/or follow the instructions to accessSchwab.com. If you do not click the “I Consent” button, this account will not be enrolled in Paperless Documents and wewill send your account agreement and related disclosures, as well as future regulatory documents, by postal mail.If you do not want to participate in Paperless Documents, please check the box below.No, do not enroll my account in Paperless Documents. Please send my regulatory documents via postal mail. 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)

Page 7 of 8Schwab Custodial IRA Account ApplicationFund the AccountA. Check or Money Order. Make payable to Charles Schwab & Co., Inc.Select one.New contribution. Indicate the year for which you are contributing on front of check. If no year is indicated, thecontribution will be credited for the current year.Rollover from another Custodial IRA held at another institution that you have withdrawn in the past 60 days.B.Transfer of Account. Complete and attach a Transfer Your Account form.Nominate a Successsor Custodian (Optional)Use this section to designate aSuccessor Custodian to act onbehalf of this account in theevent of your incapacity,death, resignation or removalas Custodian.This is a nomination only. To activate the role of a Successor Custodian, the account registration must be changed.I hereby nominate as Successor Custodian of the account:Name of Successor CustodianThis designation shall take effect as to this account in the event of my incapacity, death, resignation or removal asCustodian.In Witness Thereof, I have executed this Designation of Successor Custodian option on:mm/dd/yyyyWitness (The witness may NOT be the individual designated as the Successor Custodian or Custodian and must be atleast 18 years of age.)signer1 SignHeresigner1 DateSignedToday’s Date mm/dd/yyyysigner1 DocuSignFullNamePrint NameToday’s Date mm/dd/yyyyPrint NameBeneficiary DesignationThe Minor Account Holder of this Custodial IRA may not designate his/her own beneficiaries until he/she reaches the ageof majority (usually 18 or 21, depending upon the state in which the Minor lives). Upon the Minor attaining the age oftermination, the Custodian must terminate custodianship of this account, at which time the Account Holder may assumecontrol of the IRA assets by completing a standard Schwab IRA Application. The Account Holder may designate his/herbeneficiaries at that time. In the event the Minor should die before attaining the age of majority or age for termination, ordies thereafter without having designated any beneficiaries, the account will be distributed to the Minor’s estate. 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)

Page 8 of 8Schwab Custodial IRA Account ApplicationOffer/Referral Code (Optional, up to three offer/referral code entries.)This section is optional.If you have an offer or referralcode, enter it here.You may enter up to threecodes. Your code(s) maybe shorter than thespace provided.Terms and conditions may apply. Any taxes related to an offer are your responsibility. You should consult with your tax orlegal advisor regarding any tax implications and the appropriate tax treatment of an offer. For more information regardingan offer, please call 1-866-469-7017.Offer/Referral Code 1Offer/Referral Code 2Offer/Referral Code 3Authorization to Open AccountPlease read and sign below.By signing this Application, you hereby adopt the Individual Retirement Plan that names Charles Schwab & Co., Inc. asCustodian of this Account, as further explained in the Charles Schwab & Co., Inc. Individual Retirement Plan.You acknowledge that you have received and read the attached “Application Agreement,” which contains a pre-disputearbitration provision. You acknowledge that your signature signifies and constitutes your agreement that this account andyour relationship with Schwab will be governed by the Application Agreement and all incorporated agreements and disclosures, including, but not limited to, the Charles Schwab & Co., Inc. Individual Retirement Plan and Disclosure Statement,the Schwab IRA and ESA Account Agreement and the Charles Schwab Pricing Guide, each as amended from time to time(the “Agreement and Disclosures”). You understand there are fees associated with establishing, maintaining, engaging intransactions and transferring assets out of this account.This account is established and effective when you receive your account number. You have the right to cancel the accountwithin seven days from the date the account is established. The revocation will be reported to the Internal Revenue Serviceas a distribution.You also acknowledge that the securities products purchased or sold in a transaction with Schwab (i) are not insured bythe Federal Deposit Insurance Corporation (“FDIC”); (ii) are not deposits or other obligations of Schwab and are notguaranteed by Schwab Bank; and (iii) are subject to investment risks, including possible loss of the principal invested.For purposes of this Account Application and the attached Application Agreement, the terms “you,” “your” and “AccountHolder” refer to each person who signs this Account Application and apply with respect to both a person’s individualcapacity as well as any applicable representative or fiduciary capacity. The terms “we,” “us,” “our” and “Schwab” refer toCharles Schwab & Co., Inc.I certify, under penalty of perjury, that (1) the number shown on this Application is the correct TaxpayerIdentification Number; (2) I am not subject to backup withholding due to a failure to report interest and dividendincome; (3) I am a U.S. person (a U.S. citizen or U.S. resident alien); and (4) I am exempt from Foreign Account TaxCompliance Act (FATCA) reporting. I understand that if I have been notified by the IRS that I am subject to backupwithholding as a result of dividend or interest underreporting and I have not received a notice from the IRS advisingme that backup withholding is terminated, I must cross out item 2 above.The Internal Revenue Service does not require yourconsent to any provision of this document other thanthe certifications required to avoid backup withholding.signer1 SignHereThe Agreement with Schwab includes a predisputearbitration clause. You acknowledge receipt of thepredispute arbitration clause contained in Section 10,page 2, of the Application Agreement.signer1 DateSignedToday’s Date mm/dd/yyyysigner1 DocuSignFullNamePrint NamePRINT 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)

Schwab Custodial IRA AccountApplication AgreementPage 1 of 3Client CopyThis agreement relates to your account and is part of the Account Agreement between each account holder and Charles Schwab & Co., Inc.(“Schwab”). Please read and retain for your records.Section 1: Scope of Agreement.Your agreement with Schwab consists of theterms set forth in this Application Agreementand the terms set forth in the applicableIndividual Retirement Plan and DisclosureStatement, the Schwab IRA and ESA AccountAgreement, which incorporates the CharlesSchwab Pricing Guide and a number of otherimportant disclosures. The applicable IndividualRetirement Plan and Disclosure Statement andthe Schwab IRA and ESA Account Agreementare provided with this Application or at theopening of your Account. You agree to contactSchwab if you do not receive the applicableIndividual Retirement Plan and DisclosureStatement and the Schwab IRA and ESAAccount Agreement.In addition, you may in the future receive fromSchwab supplemental terms or disclosuresthat pertain to certain account types, servicefeatures and benefit packages. These supplemental terms and disclosures, this ApplicationAgreement, the applicable IndividualRetirement Plan and Disclosure Statement, andthe Schwab IRA and ESA Account Agreementare collectively referred to as the “Agreementand Disclosures.” You agree to read theAgreement and Disclosures carefully and retaincopies for your records.Section 2: Acceptance of Agreement andDisclosures.You agree that the Agreement and Disclosuresgovern all aspects of your relationship withSchwab, including all transactions betweenSchwab and you and all products and servicesnow or in the future offered through Schwab.Schwab may rely on your use of Schwab’sproducts and services as evidence of yourcontinued acceptance of the Agreement andDisclosures.Section 3: Your Representations andWarranties.You represent and warrant that: (a) you are oflegal age in the state in which you live and youare authorized to enter into this Agreement; (b)you have supplied accurate information in yourAccount Application; (c) the Minor is a U.S.citizen; (d) you agree that all assets in theAccount belong to the beneficiary and that youwill only use the assets for the beneficiary’sbenefit; (e) you agree to transfer and deliver tothe beneficiary all securities and other propertyheld in this Account promptly upon the beneficiary attaining the age specified by thegoverning state law for termination of thecustodianship;(f) upon the termination of thecustodianship, you agree to provide Schwab,upon request, with the beneficiary’s address,phone number and any other information thatmay assist Schwab in contacting thebeneficiary; (g) you instruct Schwab, withoutfurther notice or instruction, to register theAccount into the beneficiary’s name as soon ascommercially practicable after the terminationof the custodianship; (h) you acknowledge thatSchwab may restrict your access to theaccount upon termination of the custodianship;(i) no additional authorizations from thirdparties are required for you to open theAccount and effect transactions therein;(j) except as you have otherwise indicated onyour Account Application or in writing to us,(1) you are not an employee of or affiliated withany securities exchange or member firm of anyexchange, the Financial Industry RegulatoryAuthority (FINRA), or any securities firm, bank,trust company, or insurance company; and(2) you are not a director, 10% beneficialshareholder, policy-making officer, or otherwisean “affiliate” (as defined in Rule 144 under theSecurities Act of 1933) of a publicly tradedcompany; and (k) this Application Agreement,as amended from time to time, is a legal, validand binding obligation, enforceable against youin accordance with its terms.Section 4: Account Handling.Schwab will automatically hold all of yoursecurities purchased, sales proceeds,dividends and interest. Schwab will alsorelease your name, address and securitiespositions to companies in which we holdsecurities for your Account upon request,unless you notify us otherwise in writing.Section 5: Responsibility for InvestmentDecisions.You agree that you and any agent under apower of attorney or Investment Advisor (if youhave one) are solely responsible for investmentdecisions in your Account including whether tobuy or sell a particular security. Unlessrequired by law, or unless Schwab providesadvice to you that is clearly identified as anindividualized recommendation for you, youunderstand that Schwab has no obligation todetermine whether a particular transaction,strategy or purchase or sale of a security is inyour best interest. Your obligation includes anaffirmative duty to monitor and stay informedabout your Account and your investments andrespond to changes as you deem appropriate.Unless we otherwise agree with you in writing,Schwab does not monitor your account(s) orinvestments and has no obligation to update aninvestment recommendation, financial advice,or financial plan we may give you. Suchrecommendation, financial advice, or financial 2020 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC3965621 (0620-0A9Z) APP13589-23 (06/20)plan only applies at the point in time weprovide it to you.You acknowledge that Schwab does notprovide tax or legal advice.Section 6: Payment of Indebtedness.You agree to make payment of anyindebtedness related to your Account,including, but not limited to, any suchindebtedness that results from instructionsprovided to Schwab by you, your agent or anyattorney-in-fact under a power of attorney orInvestment Advisor authorized to maketransactions in your Account. We may electanytime, with or without notice, to make anydebit balance or other obligation related toyour Account immediately due and payable. Wemay report any past-due account to aconsumer and/or securities credit reportingagency. We may also refer your Account to acollection agency.Section 7: Liquidations.Whenever it is necessary, for our protection, tosatisfy a debit in your Account or an obligationowed us with respect to your Account(including the payment of any fees andexpenses relating to your Account that areassessed from your Account), you authorizeand direct Schwab to sell, assign and deliver allor any part of the property in your Account orclose any or all transactions in your Account orrestrict activity in your Account as may benecessary from time to time to satisfy any suchdebit or obligation. You further authorize anddirect us to choose which property to buy orsell, which transactions to close, and thesequence and timing of liquidation. We maytake such actions on whatever exchange ormarket and in whatever manner (includingpublic auction or private sale) that we choosein the exercise of our business judgmentpursuant to this direction. You agree not tohold us liable for the choice of which propertyto buy or sell or which transactions to close, forthe timing or manner of liquidation, or for anytax consequences from such actions pursuantto this direction. This serves as your directionand authorization to us, without any additionalnotice to you. No demand or notice shallimpose on Schwab any obligation to make suchdemand or provide such notice to you in thefuture. Any such notice or demand is herebyexpressly waived, and no specific demand ornotice shall invalidate this waiver.Section 8: Verification.You authorize Schwab to inquire from anysource, including a consumer reporting agency,as to the identity (as required by law),

Schwab Custodial IRA Account Application Agreement - Client Copycreditworthiness and ongoing eligibility for theAccount of the Account Holders, any otherperson referred to on this Application, or anyperson whom Schwab is later notified isassociated with or has an interest in theAccount (as well as such persons’ spouses ifthey live in a community-property jurisdiction)at account opening, at any time throughout thelife of the Account, and thereafter for debtcollection or investigative purposes.Section 9: Required Arbitration Disclosures.Regulatory authorities require that anybrokerage agreement containing a predisputearbitration agreement must disclose that thisagreement contains a predispute arbitrationclause. This Agreement contains a predisputearbitration clause. By signing an arbitration

Schwab suggests that your Trusted Contact(s) be someone other than your financial consultant or investment advisor. You may name up to two Trusted Contacts. The person(s) you name as Trusted Contact(s) will be the Trusted Contact(s) on all of your Schwab accounts, as provided for in your account agreement.