Transcription

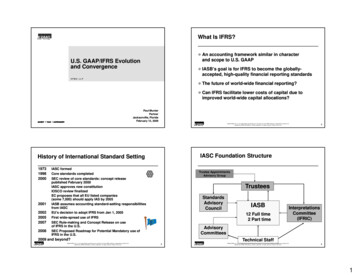

What Is IFRS?An accounting framework similar in characterand scope to U.S. GAAPU S GAAP/IFRS EvolutionU.S.and ConvergenceIASB’s goal is for IFRS to become the globallygloballyaccepted, highhigh-quality financial reporting standardsKPMG LLPThe future of worldworld-wide financial reporting?pCan IFRS facilitate lower costs of capitaldue toimproved worldworld--wide capital allocations?Paul MunterPartnerJacksonville, FloridaFebruary 12, 2009 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.IASC Foundation StructureHistory of International Standard Setting19731998200020012002200520072008IASC formedCore standards completedSEC review of core standards: concept releasepublished February 2000IASC approves new constitutionIOSCO review finalizedEC proposes that all EU listed companies(some 7,000) should apply IAS by 2005IASB assumes accounting standardstandard--setting responsibilitiesfrom IASCEU’s decision to adoptp IFRS from Jan 1,, 2005First widewide-spread use of IFRSSEC RuleRule-making and Concept Release on useof IFRS in the U.S.SEC Proposed Roadmap for Potential Mandatory use ofIFRS in the U.S.Trustee AppointmentsAdvisory GroupTrusteesStandardsAdvisoryCouncilIASB12 Full time2 Part ees2009 and beyond? 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.2Technical Staff3 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.41

Terminology of the StandardsPreviously:IASC—InternationalIAS 1 thru IAS 41Accounting StandardsCommitteeSICs (11 of 33 are still ineffect – many others havebeen incorporated intostandards)—SIC StandingInterpretations CommitteeNow:IASB—InternationalAccounting Standards Board—IFRIC InternationalFinancial ReportingInterpretations CommitteeCompliance with IFRSCompliance with IFRS includes following:All active standards ((IASs and IFRSs))All active interpretations (SICs and IFRICs)IFRS requires presentation of comparative periodMust make explicit and unreserved statement ofcomplianceill ini effect)ff )(29 are stillIASC and SICstandardst d d carriedi dforward, plus:IFRS 1 thru IFRS 8IFRIC 1 thru IFRIC 18 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.5 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.6IFRS Implementation Around the World(2004)Who Uses IFRS?Over 130 countries currently require the use of or havea policy of convergence with IFRSIncreased globalization of capital and trade marketshave led to increased pressures to converge/adoptCompanies with an international footprint are findingIFRS to be preferable or necessary in many instancesMany public U.S. companies are beginning to thinkabout IFRS, and the impact it could have on theirorganizations in the coming years 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.7IFRS or fixed date for implementationU.S. GAAP and/or convergence intendedConvergence plansNo/unknown convergence plans 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.82

IFRS Implementation Around the World(2008)IFRS or fixed date for implementationU.S. GAAP and/or convergence intendedConvergence plansNo/unknown convergence plans 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.“Wave II” is Coming9How Does IFRS Differ from U.S. GAAP?2011: IFRS mandatory for listedbusinesses – 2009: IFRS permittedpJapanGoal of full convergence by 2011ChinaAlign Chinese GAAP with IFRS by 2011IsraelRequired for public companies from 2008IndiaConvergence with IFRS for public companiesfor 2011BrazilBanks to be required to use IFRS startingfrom 2010CanadaTimeframe set – 2011: Reporting underIFRS for publicly accountable entities 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.10Some Key DifferencesIFRS is a less extensive body of literature than isU.S. GAAPInventoriesShare--based PaymentShareImpairmentRevenue RecognitionConsolidationInvestmentProvisionsIncome TaxesPensionsR&DDisclosure Content and ExtentIn many instances, IFRS contains similar conceptsbut does not contain the same amount of detailedimplementation guidance as U.S. GAAPBecause of lessless-detailed guidance, there are morecircumstances where application of IFRS willrequire exercise of judgmentJudgment will need to be supported bycontemporaneous analysisClear, transparent disclosures of criticalaccounting policies and estimates 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.Korea11 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.123

U.S. GAAP – IFRS ConvergenceConvergence PlanNorwalk Agreement (September 2002)FASB and IASB pledged to make their existingfinancial reportingandpg standards fullyy compatiblepcoordinate future work programs to ensurecompatibility is maintainedThe FASB and IASB have objective of convergenceof U.S. GAAP and IFRSTo be achieved through:Formal liaison relationships between FASB and IASBMonitoring FASB and IASB’s major projectsShort--term convergence projectsShortj((e.g.,g revenue recognition,ggJoint pprojectsleasing,liabilities and equity, consolidation, conceptualframework, financial statement presentation) 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.Memorandum of Understanding between FASBand IASB (February 2006)Commitment to achieve convergenceSets guidelines on how to approach the taskggPresents standard settinggoals to beaccomplished by the end of 2008Memorandum of Understanding Updated(September 2008)Identifies nine projects for completion by June20111314Goals by 2008: Topics for Short-TermConvergenceMoU II ProjectsTo be examined by the FASBFAS 159 issuedFair value optionpImpairment (jointly with theIASB)Income tax (jointly with theIASB)Investment propertiesResearch and developmentSubsequent eventsConsolidationsDerecognitionFair value measurement guidanceFinancial instrumentsDebt/equity classificationFinancial statement presentationLeasesPost--employment benefitsPostRevenue recognitionAND, while not part of MoU II – Conceptual Framework 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A. 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.To be examined by the IASBBorrowing costsIAS 23 amendedImpairment (jointly with theFASB)Income tax (jointly with theFASB)Government grantsJoint venturesIFRS 8 issuedSegment reporting––––––Topics above per the Memorandum of Understanding datedFebruary 27, 200615 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.164

Recent FASB/IASB Standards Achieving“High-Level” ConvergenceDescriptionFASB IssuancesShare--based paymentsShareFAS 123RIFRS 2Business combinationsFAS 141RIFRS 3 (2008)Goodwill and otherintangible assetsFAS 142IAS 36 and IAS 38Long--lived assets held forLongsale and discontinuedoperationsFAS 144Fair value option andmeasurement guidanceFAS 155, FAS 157 andFAS 159Differences come in all shapes and sizesDifferent levels of detailRevenue recognition e.g. software revenue recognitionIASB IssuancesDifferentDifft approachh tot industryindustryi d t -specificifi guidanceidTypes of entities vs activitiesDifferent concepts/ approachese.g., revaluation of investment propertiesIFRS 5Differences in scopeEmployee share compensation vs all shareshare-based paymentsIAS 39Legacy differences due to effective date and transitionBusiness combinations applied prospectively but from a different dateBeware converged standards – there’s always a difference!Even though the FASB/IASB worked together on these topics, keydifferences still remain! 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.17 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.18Proposed Roadmap for Potential Adoptionof IFRS by all U.S. Public CompaniesApproaches to Adopting IFRS in U.S.Progress toward certain “milestones” would be part of theCommission’s consideration of whether to require adoptionoff IFRSS by all U.S.S public companiesThe “optional” modelThe “convergence” model – improve and adoptMilestones include:Continued improvement in IFRS. In line with the objective ofimproved IFRS, continuing overall progress on convergencebetween IFRS and U.S. GAAPThe “date“date--certain” modelIASB accountability and funding stabilityDevelopment of an IFRS XBRL taxonomy that allowscompanies to file XBRLXBRL--formatted financial statements aseffectively as does the U.S. GAAP XBRL taxonomyEducation and training of investors, preparers, and auditors 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.19 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.205

Proposed Roadmap for Potential Adoption ofIFRS by all U.S. Public Companies (cont’d.)Proposal to Grant Permission to Adopt IFRSto Limited Number of CompaniesProposal would allow a small number of U.S. public companies tobegin preparing financial statements in accordance with IFRS asearly as for years ending on or after December 1515, 2009SEC staff to monitor progress in achieving milestonesmade the staff could recommend thatIf sufficient progress is made,the Commission adopt final rules requiring use of IFRS by allU.S. public companiesCriteria (or “screens”) to qualify:Peer--group companies, as determined by SIC code or anotherPeercommon industryindustry-classification scheme, report financial informationusing IFRS more than any other basis of accounting. PeerPeer-groupdefined as 20 largest companies in the industry based on marketcapitalizationRoadmap proposes Commission consideration in 2011Possible dates for required adoption and phasephase-in period:Large accelerated filers, calendar 2014 financial statementsAccelerated filers, calendar 2015 financial statementsU.S. company is one of the 20 largest companiesRemaining filers, calendar 2016 financial statements 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.The SEC staff estimates that at least 110 U.S. public companieswould meet these requirementsThese companies represent approximately 14 percent ofU.S. market capitalization21What Happens in the Meantime?22Potential Benefits of Adopting IFRSCompanies must:Potential Benefits to Domestic IssuersContinue to respond to changes in UU.S.S GAAP in responseto the FASB/IASB convergence initiativeEli i t dEliminateduall reportingti ffor fforeigni subsidiariesb idi iusing IFRS locallyStart making impact assessments and readinessassessments, and engaging in scoping exercisesComparability of financial information withinternational competitorsBegin developing preliminary project management plans,and identifying key leaders with respect to the company’sconversion effortEasier access to foreign capital marketsPotentially lower cost of capitalDetermine the degree and timing of required educationfor current personnelIncreased flexibility in choosing accounting policiesthat match the economic substance of particulartransactionsStart identifying what additional outside resources maybe required 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A. 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.23 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.246

Potential Challenges When Adopting IFRSTrainingIT system changesAccounting policyselection issuesChanges to policies,procedures, and controlsDivergent management,income tax and interinter--groupreporting basesContractual and legalobligationsCorporate governance issuesDifferent type of professionaljudgmentWhere You Can Get More InformationThe KPMG IFRS Institute is an open forum whereboard and audit committee members,, executives,,management, stakeholders and governmentrepresentatives can share knowledge, gain insightand access thought leadership about the evolvingglobal financial reporting environment. The websiteincludes:Newsfeeds and eventsKPMG BriefingB i fi SheetsSh t / DefiningD fi i IIssuesRegular Webcasts and videocastsConferences and share forumswww.kpmgifrsinstitute.comRisks of shortshort-term financialreporting quality shortfallsCommunicationswith usersIncreased risk ofmisstatement, error,omission, and fraudCompensation plans andperformance measurementA learning curve 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.25 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.26Presenter’s contact detailsPaul MunterKPMG LLP(212) 909909-5567pmunter@kpmg.comwww.kpmg.comThe information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although weendeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continueto be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. 2008 KPMG LLP, a U.S. limited liability partnership and a member firm of the KPMG network of independent member firmsaffiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U.S.A.277

The FASB and IASB have objective of convergence of U.S. GAAP and IFRS To be achieved through: Formal liaison relationships between FASB and IASB Monitoring FASB and IASB's major projects ShortShort--term convergence projectsterm convergence projects Joint projects (e.g., revenue recognition, leasing,