Transcription

MAXIMISING SBENCHMARKS:Top Global Financial Information Providers, Who, Why & Future TrendsDataCompliance LLC/Keiren Harris1

Global Top Financial Information ProvidersThe Market Place: Vendor StrategiesDifferent Vendors, Different Revenue ModelsBy Revenue, since 2010 the most successful providers of financial information and market data services are those whose corebusiness services are providing proprietary data, such as Evaluated Pricing, Financial Benchmarks, Indices, Credit Marketsand Analytics. This financial information providers group includes ICE Data, IHS Markit, Moody’s, MSCI, plus S&P GMI.During this period these vendors combined revenues grew from US 8,798M to US 17,225 in 2017, or 95.79%.In contrast, vendors with a product suite built upon an aggregated model such as Bloomberg, Factset, Morningstar, andThomson Reuters have seen significantly lower revenue growth. In fact TR’s revenues declined over the period.By comparison these vendors combined revenues grew from US 21,166M to US 22,866M in 2017, or 8.03%.It is no accident that during this period all vendors have invested in developing proprietary services either organically, orthrough M&A in each of the market segments listed above. ICE Data is the classic example of a financial information providerthat is successfully transitioning its strategy from aggregation to proprietary data services. This strategic shift from relianceupon aggregated data services also encompasses, Transaction Services, Risk & Compliance services, and RegTech.Each vendor is identifying individual market growth niches, but unsurprisingly strategic focus varies amongst the 9 competitors.2DataCompliance LLC/Keiren Harris

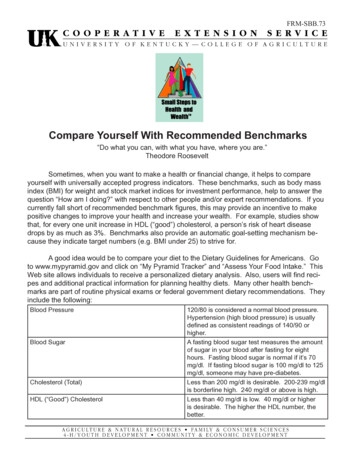

Global Top Financial Information ProvidersGlobal Market Data Industry RevenuesTOP 9 MARKET DATA VENDORS REVENUE US M16,000Revenue growth has been driven byproprietary and specialist data 0102011Bloomberg2012FactsetMorningstarMSCI2013ICE Data2014S&P GMISource: Annual ReportsRevenue for all business activities per company.Top 9 Revenue US MBloombergFactsetICE DataIHS-MarkitMoodysMorningstarMSCIS&P GMIThomson ReutersTOTALS US 91% his is a result of market saturation in thesupply of pure price data, and increasingdemand for value added services, analytics,financial benchmarks and the need to meetregulatory and client reporting.Thomson Reuters123Top 9 vendors revenue in 2010 was US 29,964M in 2017 US 40,091MMarket Growth Rate was 33.80%Only Thomson Reuters revenues declined during the periodFastest growing vendors services are based on proprietary dataM&A activity has generated the creation of price data micro-monopoliesThis creates high margin services which are hard to replicate, or displaceVendors whose main business is data aggregation performed worseThe terminal business faces long term decline as DMA growsBloomberg and TR have diversified to different degrees on aggregationDataCompliance LLC/Keiren Harris3

Global Top Financial Information ProvidersUnlocked ValueGLOBAL MARKET DATA VENDORS MARKET CAP US MMarket Data once ingested into systems which requirestreaming access becomes remarkably ‘sticky’ and hardto dislodge.60,00050,00040,000This places a premium on incumbency and proprietarydata that cannot be replicated, therefore guaranteesrevenue flow.30,00020,00010,0000BloombergFactsetIHS MarkitMoodysMorningstarMSCIS&P GMIMDV PRICE/SALES RATIOMSCI1S&P mson Reuters0.002.004.006.008.0010.00Price/Sales Ratio is the Market Cap at close 04/05/2018 dividedby 2017 Earnings.Bloomberg Market Cap is estimated at 5.5X Earnings based onIDC purchase price.ICE Market Cap is excluded as data is not the main business12.003ThomsonReutersInvestors, who are also consumers, recognise this andare valuing financial information providers accordingly.Total Market Capitalisation of top 8 VendorsAverage Market CapitalisationAverage Price/Sales RatioUS 215,467 MillionUS 26,933 Million6.55Market Cap of 4 Proprietary Data VendorsMarket Cap of 4 Aggregated Data VendorsAverage difference in Market CapUS 115,482 MillionUS 99,985 MillionUS 3,874 MillionAll the financial information providers have valuable data assetsConsolidation amongst these 8 vendors is unlikely, except MorningstarHow attractive are these vendors to outside parties wanting content?DataCompliance LLC/Keiren Harris4

Global Top Financial Information ProvidersEmbracing a Changing WorldGROWTH OFMICRO-MONOPOLIES By stealth vendors are creating micromonopolies, through incremental M&AS&P is focused on Indices, CreditRatings, LEIs and premium levelmarket data setsICE purchased Super Derivatives foranalytics and valuations, IDC forevaluations and S&P’s fixed incomeevaluated pricingIHS Markit leads the credit space inindices, evaluated prices & analyticsThey have created portfolios of uniquedata which cannot be replicated exactlyOnce ingested into client systems, orused as benchmarks, they become‘sticky’ and difficult to displaceCORPORATEFLEXIBILITY The provision of financial information isincredibly disparate, and that isreflected in the product suites and thecontents of those suitesIn the financial information industry thelower the level of product and contentintegration the harder it is formanagement to generate adequatereturnsNew technologies require newstrategies, the greater the number oflegacy systems the harder futuretransition will beAggregators face the greater challengeto manage the change requiredDataCompliance LLC/Keiren HarrisNEW TECHNOLOGY FOR OLD Amongst the main challenges facing allthe vendors is how to manage newtechnologyLegacy technology is infrastructureheavy and resource inefficientTechnology change requiressubstantial investment in time, money,and resourcesThere is also no guarantee that anystrategy adopted today will be the rightone in 5 years given pace of changeHowever for all the vendors, newentrants with new cheaper moreflexible technologies pose a threatTechnology offers disintermediation5

Global Top Financial Information ProvidersThe Crown JewelsAggregated DataServices1.2.3.Quality is king but coverage has its own quality, Bloomberg & TR are universal aggregatorsFinancial institutions are saturated, but growth is in mass markets, HNWI & retailThe pie is growing, but in new markets clients willingness to pay top dollar dropsEvaluated Pricing1.2.3.An increasingly important data market as OTC markets need to be priced accuratelyMethodology and quality are core attributesICE Data, IHS Markit are the segment leaders ahead of Bloomberg and TRFinancialBenchmarks &Original Works1.2.3.IOSCO Principles have driven index providers consolidationFinancial Benchmarks and Indices are set for growth as OTC benchmarking expands rapidlyThe Credit Rating Agencies have a de facto oligopolyAnalytics1.2.3.Emphasis switch from simple access to price data to analytics as decision making toolsAccess to The Cloud is creating third party facilitators of analytical services to banksProgress in access to unstructured data, and realisation of the promise of ‘Big Data’1.Risk & Compliance 2.3.RegTech & Data1.2.3.The requirement for risk data is driven by regulatory compliance and client reportingData for transaction monitoring and surveillance analyticsReporting standards places an emphasis on actual data source, not the distributorDriving increased automation of regulatory workflow activities, i.e. MiFID2, FRTB & PSD2Development of compliance, monitoring and reporting tools as revenue generatorsProvision of database services utilising machine learning to stay current with regulations6DataCompliance LLC/Keiren Harris

Global Top Financial Information ProvidersKey TrendsExpansion in Usage1.2.3.Financial institutions see market data as a cost, and constantly look to reduce itHowever, what Banks reduce in one area gets offset by an increases elsewhereVendors need to expand their client footprint, but few have a mass market strategyData Assets & IPRs1.2.3.Revenue premiums will gravitate further to proprietary data and higher quality datasetsData Source Owners will become more aggressive in protecting IPRs in a FinTech worldGlobal vendors will enhance and grow their micro-monopolies and create differentiationTechnology1.2.3.Technology is changing data flows from a linear to omni-directional environmentLegacy infrastructure is creating cost and technology competitive disadvantagesHow global vendors invest in new technology will determine future success levelsDisintermediation1.2.3.Technology providing global access creates new channels to market for data sourcesThis reduces entry barriers, creates fragmentation as well as increased consumer choiceIt reinforces the inherent value of proprietary dataIndustry M&A1.2.3.Integrating different market data vendors has always proven problematicVendors bulking up their product lines through acquisition of competitors’ business unitsFocus now is strategic bolt-ons to existing business rather than wholesale M&AThird Party M&A1.2.3.Will the Blackstone investment in TR F&R set a new trend or be a once-off?Any purchaser of a major financial information provider will require deep pocketsHow attractive, if at all, is an information provider to content drivers such as Google?7DataCompliance LLC/Keiren Harris

Global Top Financial Information ProvidersFuture ChallengesStrategic re-orientationAll of these information providers face new challenges which they are aware need addressing. These include: With the notable exception of Bloomberg, which is increasing its focus on terminals, providers want to reduce their relianceupon aggregated data services, while recognising these services will continue to play an important supporting roleDiversifying vendor strategies towards offering unique proprietary content that is difficult to displace even once thecontractual term has concluded, plus value added services (Though Bloomberg would say this is all in their terminal)Increased cross-pollination between commercial and financial information, witness the IHS and Markit mergerIncreasingly aggressive protection of IPRs through watertight licence agreements, usage policies, and policingAbandoning legacy infrastructure in favour of new lightweight technology where traditional interactions no longer applyWelcoming new third party data facilitators now providing Banks with services previously undertaken inhouseRecognising that future mass growth is going to come from Toyota drivers not Rolls Royce ownersMost importantly, embracing corporate mindsets which recognise the information world is fluid and dynamicAggregated DataServicesEvaluated PricingFinancialBenchmarksOriginal Works,i.e. CRADataCompliance LLC/Keiren HarrisAnalyticsRisk &ComplianceRegTech & Data8

Global Top Financial Information ProvidersCriteria for InclusionWhy these information providers?There are many companies which could justifiably be included in this report, especially as the definitions and criteria for inclusioncan be as wide or as narrow as the writer’s interpretation desires. Equally none of the companies included can be compared on atrue like for like basis, there are crucial differences in structure and service offerings. Here is why we included these providers: Primary business is the supply of information services and market data covering global financial marketsThis includes aggregated data services and/or value added original works such as financial benchmarks, indices and creditratings, i.e. Moody’s & MSCIThe provision of analytics and investment decision toolsTheir clients primary businesses are participating in global financial markets, though HNWI and retail are becoming importantmarket segmentsRevenues greater than US 1,000 Million PA (for all business activities not just market data), or likely to exceed this in the nearfuture, i.e. MorningstarGlobal presence in all major and secondary financial centres with primary services offered including:Aggregated DataServicesEvaluated PricingFinancialBenchmarksOriginal Works,i.e. CRADataCompliance LLC/Keiren HarrisAnalyticsRisk &ComplianceRegTech & Data9

‘Turning Data Into Dollars’Our ConsultingDataCompliance LLC’s consulting is about maximising the efficient use of data as a valuable strategic resource,not merely another cost, from original creation to usage. We ‘Turn Data Into Dollars’.We take the global perspective, advising our clients from building successful market data businesses toeffectively leveraging market data sourced both externally and internally enabling them to participate profitably inthe financial markets.It is about creating data, accessing data, the regulation of data usage, and most importantly the policing andprotection of IPRs and data ownership.Maximising data utility while minimising risk is key to the cost efficiency dollar equation.This is not only about sourcing data externally, but maximising the value of in-house and proprietary data.DataCompliance LLC provides a future view by analysing how market data is being used now, then we lookforward to how innovation and change is creating new industry ruNew York & Hong nce.comNew York & Hong KongDataCompliance LLC/Keiren Harris10

Average Price/Sales Ratio 6.55 Market Cap of 4 Proprietary Data Vendors US 115,482 Million Market Cap of 4 Aggregated Data Vendors US 99,985 Million . Financial Benchmarks and Indices are set for growth as OTC benchmarking expands rapidly 3. The Credit Rating Agencies have a de facto oligopoly 1. Driving increased automation of regulatory .