Transcription

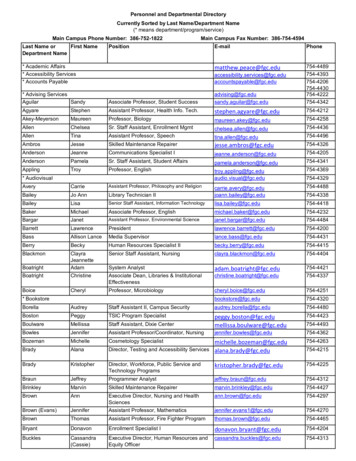

Presenting a live 110‐minute teleconference with interactive Q&ASection 754 and Basis Adjustmentsfor Partnership and LLC InterestsNavigating Complexities in Federal Tax Treatment of Distributions and Sales of InterestsTUESDAY, SEPTEMBER 13, 20111pm Eastern 12pm Central 11am Mountain 10am PacificToday’s faculty features:Janice Eiseman,Eiseman PrincipalPrincipal, Cummings & Lockwood,Lockwood Stamford,Stamford ConnConn.Craig Taylor, Director, Carruthers & Roth, Greensboro, N.C.Craig Gerson, Principal, National Tax Services, PricewaterhouseCoopers, Washington, D.C.For this program, attendees must listen to the audio over the telephone.Please refer to the instructions emailed to the registrant for the dial-in information.Attendees can still view the presentation slides online. If you have any questions, pleasecontact Customer Service at1-800-926-7926 ext. 10.

Conference MaterialsIf you have not printed the conference materials for this program, pleasecomplete the following steps: Click on the sign next to “Conference Materials” in the middle of the lefthand column on your screen.screen Click on the tab labeled “Handouts” that appears, and there you will see aPDF of the slides for today's program. Double click on the PDF and a separate page will open. Print the slides by clicking on the printer icon.

Continuing Education CreditsFOR LIVE EVENT ONLYAttendees must listen to the audio over the telephone. Attendees can still viewthe presentation slides online but there is no online audio for this program.Please refer to the instructions emailed to the registrant for additionalinformation. If you have any questions, please contact Customer Serviceat 11-800-926-7926800 926 7926 ext. 10.

Tips for Optimal QualitySSoundd QualityQ litFor this program, you must listen via the telephone by dialing 1-866-873-1442and entering your PIN when prompted. There will be no sound over the webco ect o .connection.If you dialed in and have any difficulties during the call, press *0 for assistance.You may also send us a chat or e-mail sound@straffordpub.com immediately sowe can address the problem.Viewing QualityTo maximize your screen, press the F11 key on your keyboard. To exit full screen,press the F11 key again.again

SectionSti 754 anddBBasisi AdjustmentsAdj tt forfPartnership and LLC Interests SeminarSept. 13, 2011Janice Eiseman, Cummings & Lockwoodjeisem@cl-law.comCraig Gerson, ig Taylor, Carruthers & Rothcat@crlaw.com

Today’s ProgramIntroduction To Key Concepts[Janice Eiseman]Slide 7 – Slide 11Sect. 754 Elections[Craig Taylor]Slide 12 – Slide 19Sect. 743(b) Adjustments On Transfer Of Partnership Interests[Janice Eiseman]Slide 20 – Slide 37Sect. 734(b) Adjustments On Distributions From Partnerships[Craig Taylor]Slide 38 – Slide 50Collected Issues And Nuances Of Partnership Basis Adjustments[Craig Gerson]Slide 51 – Slide 70

Janice Eiseman, Cummings & LockwoodINTRODUCTION TO KEYCONCEPTS

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISOOverviewiA.Subchapter K: In parts of Subchapter K, the subchapter governing the taxation ofpartnershipshi andd partners, a partnershiphi isi treatedd as a separate entity,i whichhi h isi distinctdi ifrom its partners. In other parts of Subchapter K, a partnership is treated as an aggregateof individuals, each of whom owns an undivided interest in partnership assets.B.Outside basis: “Outside basis” refers to a partner’s tax basis in the partnership interestitself. The partnership is treated as an entity separate from its partners and thepartnership interest as an intangible asset that is separate and distinct from partnershipassets. This is similar to a shareholder’s tax basis in a share of stock.C.Inside basis: “Inside basis” refers to the partner’s share of the basis in the assets held bythe partnership. Because the partnership is not a separate taxable entity, its income isallocated and taxed to its partners,partners treating them like owners of undivided interests in theassets and business of the partnership, i.e., as an aggregate of individuals. This does nothave a direct analog in the Subchapter C or Subchapter S world, because corporationsare treated as separate entities.88 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISOverview (Cont.)(Cont )D.Sect. 754 election: Purpose of making a Sect. 754 election is to equalize the “outside basis” and the“inside basis,” to the extent allowed. A Sect. 754 election activates both Sect. 743(b), which applies tocertain transfers of partnership interests, and Sect. 734(b), which applies to certain distributions ofproperty by the partnership to a partner.1.If a Sect. 754 election is not made, there is no change to the inside basis of partnership assets; thatis, there is no adjustment to a transferee’s “inside basis” no adjustment to the tax basis ofpartnership assets because of a distribution of property by the partnership to a partner. For example, Sect.743(a), which treats the partnership as an entity, provides that the basis ofpartnership property is not adjusted as a result of a sale, or exchange, or the death of apartner unless an election has been made under Sect. 754 or unless the partnership has a“substantial built-in loss.” If a Sect.S t 754 electionl ti isi made,d thenth Sect.S t 743(b) isi operative.ti A Sect.S t 743(b) adjustmentdj ttimplements an aggregate approach by adjusting the tax consequences allocable to atransferee partner so as to provide the transferee with an approximation of a cost basis in anundivided interest in the partnership property. The legislative history of the 1954 Code statesthat the ppurposepof Sect. 743(b)( ) is to ensure that a transferee’s distributive share of income,,gain, loss, deduction or credit is the same “as though the partnership had dissolved and beenreformed, with the transferee of the interest a member of the partnership.” H.R. Rep. No.1337, 83rd Cong., 2d Sess. 70 (1954). In other words, the function of a Sect. 743(b)adjustment is to offset gain or loss that accrued prior to the transferee becoming a partner.22.AAssumingi thath thereh isi a basisb i adjustment,djtheh amount off theh adjustmentdjisi determineddi d underd Sect.S743(b) in the case of a transfer and Sect. 734(b) in the case of a distribution.99 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISOOverviewi(Cont.)(C t )E.Sect. 755: How the adjustment determined under Sect. 743(b) or Sect.734(b) is allocated to partnership assets is determined under Sect. 755.F.Mandatory adjustment under Sect. 743: If there is a transfer of apartnership interest, and immediately after such transfer the adjustedtax basis of all of the partnership assets exceeds the fair market value ofthe partnership assets by more than 250,000 (“substantial built-inloss”), then the partnership must make a Sect. 743(b) adjustment as ifan election under Sect. 754 were in effect. I.R.C. § 743(d).EExceptionsiforf electingl i investmentipartnershipshi (e.g.,(buyoutbfunds,f dventure capital funds and fund of funds) and securitizationpartnerships. I.R.C. §§ 743(e) & (f)1010 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISOOverviewi(Cont.)(C t )G.Mandatory adjustment under Sect. 734: If there is a distribution ofpartnershipthi propertyt ini liquidationli id ti off a partner’st ’ interest,i tt andd theth differencediffbetween the sum of (i) the basis of the distributed property to the partner,which equals the value of his partnership interest in the partnership under Sect.732(b), and the tax basis of the distributed property to the partnership; and (ii)the loss recognized by the liquidating partner exceeds 250,000, then the taxbasis of partnership property must be decreased as if a Sect. 754 election werein effect. I.R.C. § 734(d). There is an exception for securitization partnerships.I R C § 734(e).I.R.C.734(e)H.Summary: Under sections 734(a) and 743(a), the partnership is treated as anentity, ii.e.,e , no adjustments to basis of partnership property unless mandatoryadjustments are required. If a Sect. 754 election is made, then adjustments canbe made to the basis of partnership property (the “inside basis”) under sections734(b) and 743(b). How the amount of the adjustment is allocated amongpartnershiphi assets isi determineddi d underd Sect.S755.7551111 Cummings & Lockwood LLC 2011

Craig Taylor, Carruthers & RothSECT 754 ELECTIONSSECT.

M ki ThMakingThe SSect. 754 ElectionEl i Partnership may make the Sect. 754 election at any time – doesnot require the occurrence of a triggering event. Election must besigned by a partner. ElectionEl ti isi filedfil d withith a timelyti l filfiledd partnershipthi returnt(including(i l diextensions). Once made, the Sect. 754 election is: In effect for the tax year of the partnership returncontaining the election; and In effect for all future tax years of the partnership,partnership unlessrevoked. Revocation requires a special application to the IRS and will begrantedd onlyl iff therehare substantialbl changeshto theh bbusiness orassets of the partners. Sect. 1.754-1(c).13

When To Consider The Sect. 754 Election Distributions of property other than cash,cash especially where taxbasis of property is different from fair market value (whetherappreciated or depreciated) Any distributions of cash or property that are disproportionate topartnership interestspto recognizeg Distributions of cash that will cause the recipientgain Liquidating distributions of cash or property SalesS l or exchangeshoff interestsi tt iin ththe partnershipthi Death of a partnery , “good”gfor all Sect. 754 elections are often,, but not always,partners and all partnerships. Each situation should be evaluatedcarefully.14

EffEffectsOf TheTh Sect.S754 ElectionEl iEXAMPLE 1: Purchase of a partnership interestA and B form a 50/50 partnership. Each contributes 150,000 in cash. The ABPartnership buys Asset for 300,000. 300 000 Asset appreciates to 400,000. 400 000C buys a 50% interest in the AB Partnership for 200,000, and the ABC Partnershipsells Asset for 400,000 – a gain of 100,000. If no Sect. 754 election is in place:Partner C’s outside basis:C’s 50% share of gain:C’ss share of cash distributed:C 200,000 50,000( 200,000)Partner C’s remaining basis: 50,00015

Effects Of The Sect. 754 Election (Cont.)EXAMPLE 1: Purchase of a partnership interest (Cont.) Partner C cannot use the 50,000 in remaining basis until it sells theinterest (unlikely)( l k l ) or theh partnershiph is lliquidated.d d If Partner C recognizes a loss, it will be a capital loss. If Asset is a non-capital asset, the 50,000 income allocated to Partner Cwillill beb ordinarydiiincome, butb tPPartnertC’sC’ lloss willill beb a “mismatched”“ it h d”capital loss. If Asset is sold in 2011, but ABC Partnership doesn’t liquidate until 2012,Partner CC’ss loss will be delayed and “mismatched”mismatched to the 2011 incomeincome. If a Sect. 754 election is made for the year of the sale, or is already inplace, both of these bad outcomes are avoided.16

Effects Of The Sect. 754 Election (Cont.)EXAMPLE 2: Non-liquidating distributions to partners propertyPartner D has an outside basis of 40,000 in the DEF Partnership.Partner D receives a distribution of land that has a fair marketvalue (FMV) of 75,000 and an inside basis of 50,000. If no Sect. 754 election is in place, Partner D will hold the landwith a basis of 40 40,000.000 The remaining 10 10,000000 of basis is “lost”lost . If a Sect. 754 election is in place, the DEF Partnership wouldincrease its basis in its remaining assets by 10,000 10 000 under Sect.Sect734(b).17

Effects Of The Sect. 754 Election (Cont.)EXAMPLE 3: Non-liquidating distributions to partners – cash andpropertyPartner D has an outside basis of 40,000 in the DEF Partnership. PartnerD receives a distributiondboff cashh off 50,000 andd a distributiondboff llandd thathhas a fair market value (FMV) of 75,000 and an inside basis of 50,000. Partner D recognizes a gain of 10,000 from the distribution of cash (Sect.731) andd itsit outsidet id basisb i isi reduceddd tot 0. 0 If no Sect.S t 754 electionl ti isi iniplace, Partner D will hold the land with a basis of 0. 50,000 of basis is“lost.” If a SectSect. 754 election is in placeplace, the DEF Partnership would increase itsbasis in its remaining assets by 60,000 under Sect. 734(b) – the sum of 10,000 in gain recognized by Partner D and 50,000 of “lost basis.”18

Effects Of The Sect. 754 Election (Cont.)EXAMPLE 4: Liquidating distributions to partnersPartner D has an outside basis of 40,000 in the DEF Partnership. PartnerD receives a liquidatinglddistributiondboff landl d thath hash a fairf marketk valuel(FMV) of 75,000 and an inside basis of 25,000. If no Sect.S t 754 electionl ti isi ini place,lPPartnertA willill holdh ld ththe landl d withith abasis of 40,000, and there will be no impact on Partnership DEF’s otherassets. If a Sect. 754 election is in place, Partner A will hold the land with a basisof 40,000, but the DEF Partnership would be required to decrease itsbasis in its remaining assets by 15,000 under Sect. 734(b).19

Janice Eiseman, Cummings & LockwoodSECT. 743(B) ADJUSTMENTS ONSECTTRANSFER OF PARTNERSHIPINTERESTS

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISAbilit ToAbilityT MakeM k A Sect.S t 754 ElElectiontiDue To A TransferA.Sect. 743(b): Election may be made when there is a sale orexchange of a partnership interest or upon the death of a partner.If a triggering event has not occurred, no Sect. 754 election can bemade, and, therefore there will be no change to the tax basis ofpartnership assets with regard to the transferee unless themandatory rule for basis adjustment applies.1. Sales or exchanges: This includes a carryover basis exchange,such as under Sect. 351. Transfers by gift do not trigger aSect. 754 election, because transfers by gift are not sales orexchanges under Sect. 743(b).2121 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISAbility ToAbilitT MakeM k A Sect.S t 754 ElElectiontiDue To A Transfer (Cont.)2.Distribution of partnership interest: Note that Sect. 761(e)(2) providesthat for purposes of Sect. 743, any distribution of an interest in apartnership (not otherwise treated as an exchange) shall be treated as anexchange. Thus, if there is a “constructive termination” under Sect.708(b)(1)(B), i.e. sale or exchange of 50% or more of the total interestin partnership capital and profits within a period of 12 consecutivemonths, then the deemed distribution of an interest in the newpartnership by a terminating partnership is treated as an exchange of theinterest in the new partnership for interest in the terminatingpartnership,thi forf purposes off Sect.743.S t 743 ThisThi allowslltheth new partnershipthito make a Sect. 754 election because the exchange requirement of Sect.743(b) is satisfied.2222 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISWhat Happens Under Sect.Sect 743(b) When ASect. 754 Election Is Made?AA.The actual amount of the Sect.Sect 743(b) adjustment: Sect.Sect 743(b) states that theadjustment to the basis of partnership property to the transferee equals the differencebetween the (i) transferee’s tax basis in his partnership interest (i.e., the purchase price ofthe interest or its fair market value at date of death plus his share of partnershipliabilities) and (ii) the transfereeliabilities),transferee’ss “proportionateproportionate share of the adjusted basis ofpartnership property.” Treasury Reg. §1.743-1 flushes out how to determine thetransferee’s “proportionate share of the adjusted basis of partnership property.” Tounderstand the regulations, it is important to always remember what the Sect. 743(b)adjustment is designed to do; namely,namely to prevent the transferee from recognizing gain orloss already accounted for in the purchase price of the partnership interest.1.Treasury Reg. §1.743-1(d) provides that the transferee’s “share of the adjustedb i to thebasish partnershiphi off partnershiphi property”” isi equall to theh sum off thehtransferee’s interest as a partner in the partnership’s “previously taxed capital” plushis share of partnership liabilities. The transferee’s share of “previously taxedcapital” is defined to be the amount of cash the transferee would receive if thepartnershipthi were liquidatedli id t d byb sellinglli itsit assetst att fairf i marketk t value.l2323 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISWhat Happens Under Sect.Sect 743(b) When ASect. 754 Election Is Made? (Cont.)andd (i) increasingii theth amountt off cashh byb theth taxt lossl(including(i l di any remedialdi lallocations under Treasury Reg. §1.704-3(d)) that would be allocated to thetransferee to the extent attributable to the transferred interest, or (ii) decreasing theamount by the amount of tax gain (including any remedial allocations underTTreasuryReg.R §1.704-3(d))§1 704 3(d)) ththatt wouldld bbe allocatedll t d tto ththe ttransfereeftto ththe extentt tattributable to the transferred interest. (Note that non-contingent liabilities do notaffect the amount of the adjustment because they are included in the transferee’stax basis and the computation of the transferee’s share of the adjusted basis ofpartnershipthi property.)t )2.In essence, the tax capital account that the transferee inherits from his transferordetermines the transferee’s share of the partnership basis in its assets. By usingtransferor’s tax capital account as a measure of inside basis, the Treasuryregulations generally ensure that a transferee receives a basis adjustment that takesinto account both pre-contribution gain or loss and post-contribution changes invalue.2424 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISWhat Happens Under Sect. 743(b) When ASect. 754 Election Is Made?3.Example 2 of Treasury Reg. §1.743-1(d)(3) illustrates thecomputation of the Sect. 743(b) adjustment. See Exhibit A.4.As this example shows, if the partnership sells the land for 1,300, the gain from the sale equals 900. Transferee will have 700 of the gain allocated to him, and the other two partners willeach have 100 allocated to them. Because the transferee has a taxbasis of 700 in the land, he will recognize no gain.2525 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISWhat Happens Under Sect.Sect 743(b) When ASect. 754 Election Is Made?B.Note the following with regard to a Sect. 743(b) adjustment:1. The adjustment applies only to the transferee partner. There is no adjustmentto common basis of partnership property. The adjustment essentially operatesoutside the partnership. Treas. Reg. § 1.743-1(j)(1)22.The adjustmentThdj tt hhas no effectff t on theth computationt ti off theth partnership’sthi ’ incomeior loss. Treas. Reg. § 1.743-1(j)(1)3.The adjustment has no effect on the transferee’s capital account. Thetransferee steps into the capital account of the transferor.transferor Treas.Treas Reg.Reg § 1.7431 7431(j)(2)4.The adjustments to the transferee’s distributive share of income or loss mustbe shown on the Form K-1K 1 issued to the transferee.transferee TreasTreas. RegReg.§ 1.743-1(j)(2)5.Where there has been more than one transfer of a partnership interest, atransferee’ss basis adjustment is determined without regard to any priortransfereetransferee’s basis adjustment. Treas. Reg. § 1.743-1(f)2626 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISS t 755 BSect.Basisi AdjAdjustmentsttA.Three sets of rules11.Transfer of partnership interest when assets of partnership do not constitute a trade or business.businessTreas. Reg. § 1.755-1(b)(1)-(b)(4)2.Transfer of partnership interest involving “substituted basis exchanges” (e.g., Sect. 351 and721 exchanges). Treas. Reg. §1.755-1(b)(5). Also, Treasury Reg. §1.755-1(b)(5) applies tobasis adjustments that result from exchanges in which the transferee’stransferee s basis in the partnershipinterest is determined by reference to other property held at any time by the transferee e.g. aconstructive termination under Sect. 708(b)(1)(B) in which the terminated partnership isdeemed to contribute its assets to a new partnership in exchange for an interest in the newpartnership and the terminated partnership is deemed to distribute interests in the newpartnership in liquidation of the partner’s interest in the terminated partnership. Sect. 761(e)provides the “exchange,” meaning the distribution of partnership interests in the newpartnership is an “exchange” for purposes of Sect. 743(b). Because the distribute-partner of theterminated partnership receives its interest in the new partnership in a liquidating distribution,the distributee takes a substituted basis in the new partnership under SectSect.732(b).732(b) A SectSect. 754election by the new partnership will bring into play Treasury Reg. §1.755-1(b)(5).3.Transfer of a partnership interest when the assets of the partnership constitute a trade orbusiness, as described in Reg. §1.1060-1(b)(2)Treas Reg.Treas.Reg §1.755-1(a)(2)-(a)(6)§1 755 1(a)(2) (a)(6)2727 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISS t 755 BSect.Basisi AdjAdjustmentstt (C(Cont.)t)B.Transfer of partnership interest when assets of partnership do not constitute a“tradetrade or business”business1.First, determine the adjusted basis and the fair market value of the partnershipassets immediately after the transfer and determine how much income, gain orloss (including remedial allocations under Treasury Reg. §1.704-3(d)) would beallocated to the transferee-partner, if the partnership were to sell all of its assetsfor cash in a hypothetical sale for an amount equal to their fair market values. If,in fact, the purchase price for the partnership interest equals the fair market valueof the assets, then the adjustment to the basis of partnership property with respectto the transferee-partner is done.Treas. Reg. §1.755-1(b)(1)(ii); Example 1, Treas. Reg. 1.755-1(b)(2)(ii)2.The portion of the transferee-partner’s basis adjustment allocated to ordinaryincome property is equal to the total income gain or loss (including remedialallocations) that would be allocated to the transferee with respect to thehypotheticalypsale of ordinaryy income property.p p y Treas. Reg.g §§1.755-1(b)(2)( )( )2828 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISS t 755 BSect.Basisi AdjAdjustmentstt (C(Cont.)t)3.The portion of the transferee-partner’s basis adjustment allocated to capital gainproperty is equal to the Sect. 743(b) adjustment reduced by the amount allocatedto ordinary income property. If the purchase price of the partnership interest isless than the purchase price based upon fair market value, and there has to be adecrease in capital gain property, the decrease cannot be greater than the“partnership’s basis” in the property or the transferee’s share of any remedial lossunder Treasury Reg. §1.704-3(d). Any excess is applied to reduce the basis ofordinary income property. Treas. Reg. §1.755-1(b)(2) 44.Note that this approach allocates any overpayment or underpayment forthe partnership interest to the basis of capital gain property.AdjustmentsAdjtt can beb maded tot individuali di id l assetst even thoughthh theth totalt t l amountt offbasis adjustment is zero. Treas. Reg. §1.755-1(b)(1)(i) Note that in a substituted basis transaction, no adjustment can be made ifthe total amount of the Sect. 743(b) adjustment is zero.2929 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISS t 755 BSect.Basisi AdjAdjustmentstt (C(Cont.)t)5.Allocations have to be made within the class of ordinaryy income propertyp p y and withinthe class of capital gain property.a.Within the class of ordinary income property, the basis of each property isgenerally adjusted by an amount equal to the income, gain or loss (includingremedial allocations) that would be allocated to the transferee upon a sale ofthe property in the hypothetical transaction.b.Within the class of capital gain property, the basis of such property isgenerally adjusted by (1) the amount of income, gain or loss that would beallocated to the transferee in the hypothetical transaction,transaction minus (2) a portion(based on the market value of a particular property) compared to theaggregate market value of all capital gain property. Treas. Reg. §1.7551(b)(3)c.N t thatNoteth t thereth mustt beb an adjustmentdj tt wheneverhtheth actualt l Sect.S t 743(b)adjustment is either more or less than what it would be if the transferee hadpaid fair market value for each partnership asset.6.See subsequent exhibits B and C for examples of Sect. 755 allocations3030 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISSect 755 Basis Adjustments (Cont.)Sect.(Cont )C.Substituted basis exchanges1.The rules for “substituted basis exchanges” are set forth in Treasury Reg. §1.755-1(b)(5). If thebasis adjustment is positive,positive an adjustment can be made only if the hypothetical sale of thepartnership’s assets results in a net gain to the transferee.a.The increase is allocated between classes of assets (ordinary and capital) in proportion to thenet income or gain of each class allocable to the transferee.bb.Within each class,class increases are first allocated to properties with unrealized appreciation inproportion to the transferee’s share of such unrealized appreciation until the transferee’sshare of the appreciation is eliminated. Any remaining amount is allocated among assets inthe class according to the transferee’s share of the amount realized from the hypothetical saleof each asset in the class.2.Likewise, if the basis adjustment is negative, an adjustment can only be made if thehypothetical sale results in the allocation of a net loss to the transferee.a.The decrease is allocated between asset classes in proportion to the net loss allocable to thetransferee from the hypothetical sale of all assets in each class.bb.Withini hi eachh class,ltheh decreasedisi allocatedlld to propertiesi withi h unrealizedli d depreciationdi i iniproportion to the transferee’s shares of such unrealized depreciation until they are eliminated.Remaining decreases are allocated in proportion to the transferee’s shares of the adjustedbases of all assets in the class until these shares of adjusted bases are reduced to zero, withanyy remainingg downward adjustmentjsuspendedpuntil the partnershippp acquiresqadditionalproperty in that class.3131 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISSect 755 Basis Adjustments (ContSect.(Cont.))D.Sale of business1.2.If the assets of the partnership constitute a trade or business (as described in Treasury Reg.§1.1060-1(b)(2)),§( )( )), the partnershippp must use the residual method to assigng values to thepartnership’s Sect. 197 intangibles. Treas. Reg. §1.755-1(a)(2)Residual method involves the following steps:a.b.c.d.e.First, the partnership must determine the value of its assets other than Sect. 197.Second, the partnership must determine “partnership gross value” under Treasury Reg.§1.755-1(a)(4).Third, the partnership gross value is then compared to the aggregate value of all partnershipproperty other than Sect. 197 intangibles. If there is no residual value, then the value of all Sect.197 intangibles is deemed to be zero. If there is a residual value, then the amount must beSect. 197 intangiblesgin order to assigng a value to them under the rules of Treasuryyallocated to SReg. §1.755-1(a)(5).“Partnership gross value” generally is equal to the amount that, if assigned to all partnershipproperty, would result in a liquidating distribution to the partner equal to the transferee’s basisin the transferred partnership interest immediately following the relevant transfer (reduced bythe amountamount, if anyany, of such basis that is attributable to partnership liabilities)liabilities). TreasTreas. RegReg.§1.755-1(a)(4)(i)(A).Treasury Reg. §1.755-1(a)(5)(i) requires that the residual value be allocated first among Sect.197 intangibles other than goodwill and going concern value, but the value assigned to a Sect.197 intangible (other than goodwill and going concern value) is limited to its actual fair marketvaluel on theh dated off theh relevantltransfer.f AnyA remainingi i residualid l valuel isi thenh allocatedlld togoodwill and going concern value.3232 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISExhibit AExample 2 of Treasury Reg. Sect. 1.743-1(d)(3)TaxLandCashTotalABCFair market value on contribution dateSale of partnership interest for fair market value by A 400 2,000 2,400 1,000 2,000 3,000 1,300 2,000 3,300 400 1,000 1,000 1,000 1,000 1,000 1,100 1,100 1,100Transferee's share of previously taxed capital:Cash received on sale of assets for fair market valueLess: Gain allocated to transfereeShare of previously taxed capital 1,100 700 (Pre-contribution gain & post-contribution gain) 400Section 743(b) adjustment:Outside basis of price paid for partnership interestLess: Share of previous taxed capitalAmount of Section 743(b) adjustment to the basis of the land 1,100 400 7003333 Cummings & Lockwood LLC 2011

PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASISExhibit BExample 2 of Treasury Reg. §1.755-1(b)(3)(iv): T buys A’s partnership interest for 110,000.Capital gain propertyAssett 1AAsset 2Ordinary Income propertyAsset 3Asset 4AdjustedBasisFair Market Valueat time of contribution 25 000 25,000 100,000 50 000 50,000 100,000 75 000 75,000 117,500 192,500 33,604 33604 2,646 36,250 40,000 10,000 175 000 175,000 40,000 10,000 200 000 200,000 45,000 2,500 47 500 47,500 2,500( 3,750)( 1 250)( 1,250) 240,000 35,000TotalBook Capita

entity, i e , no adjustments to basis of partnership property unless mandatory, i.e., no adjustments to basis of partnership property unless mandatory adjustments are required. If a Sect. 754 election is made, then adjustments can be made to the basis of partnership property (the "inside basis") under sections 734(b) and 743(b).