Transcription

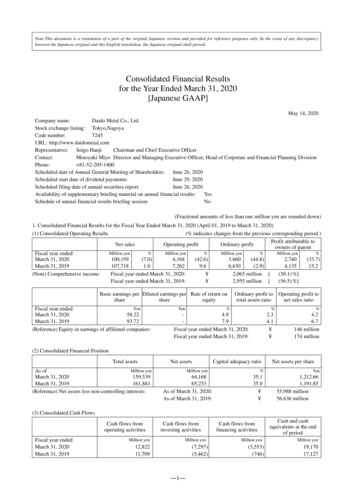

Note:This document is a translation of a part of the original Japanese version and provided for reference purposes only. In the event of any discrepancybetween the Japanese original and this English translation, the Japanese original shall prevail.Consolidated Financial Resultsfor the Year Ended March 31, 2020[Japanese GAAP]May 14, 2020Company name:Daido Metal Co., Ltd.Stock exchange listing: Tokyo,NagoyaCode number:7245URL: http://www.daidometal.comRepresentative: Seigo HanjiChairman and Chief Executive OfficerContact:Motoyuki Miyo Director and Managing Executive Officer, Head of Corporate and Financial Planning DivisionPhone: 81-52-205-1400Scheduled date of Annual General Meeting of Shareholders: June 26, 2020Scheduled start date of dividend payments:June 29, 2020Scheduled filing date of annual securities report:June 26, 2020Availability of supplementary briefing material on annual financial results:YesSchedule of annual financial results briefing session:No(Fractional amounts of less than one million yen are rounded down)1. Consolidated Financial Results for the Fiscal Year Ended March 31, 2020 (April 01, 2019 to March 31, 2020)(1) Consolidated Operating Results(% indicates changes from the previous corresponding period.)Profit attributable toNet salesOperating profitOrdinary profitowners of parentMillion yen%Million yen%Million yen%Million yen%Fiscal year endedMarch 31, arch 31, 2019107,7181.07,2629.66,630(2.9)4,13515.2(Note) Comprehensive income:Fiscal year ended March 31, 2020: 2,065 million [(30.1) %]Fiscal year ended March 31, 2019: 2,955 million [(56.5) %]Basic earnings per Diluted earnings per Rate of return onshareshareequityYenFiscal year endedMarch 31, 202058.22March 31, 201993.72(Reference) Equity in earnings of affiliated companies:YenOrdinary profit tototal assets ratio%Operating profit tonet sales ratio%4.97.9Fiscal year ended March 31, 2020:Fiscal year ended March 31, 2019:2.34.1 %4.26.7146 million174 million(2) Consolidated Financial PositionTotal assetsMillion yenAs ofMarch 31, 2020159,539March 31, 2019161,881(Reference) Net assets less non-controlling interests:Net assetsCapital adequacy ratioMillion yen64,16865,253As of March 31, 2020:As of March 31, 2019:Net assets per share%Yen35.135.0 1,212.661,191.8555,988 million56,636 million(3) Consolidated Cash FlowsCash flows fromoperating activitiesFiscal year endedMarch 31, 2020March 31, 2019Million yenCash flows frominvesting activitiesMillion yen12,82211,709(7,297)(5,462)―1―Cash flows fromfinancing activitiesMillion yen(3,553)(746)Cash and cashequivalents at the endof periodMillion yen19,17017,127

2. DividendsAnnual dividends1st2nd3rdquarter-end quarter-end quarter-endFiscal year endedYear-endPayoutTotalratiodividends (consolidated)TotalDividendsto netassets(consolidated)YenYenYenYenYenMillion yen%%March 31, 2019-15.00-15.0030.001,42532.02.5March 31, 2020-20.00-15.0035.001,66360.12.9-----Fiscal year endingMarch 31, 2021-(Forecast)(Note) 1. Breakdown of the interim dividend for the fiscal year ending March 31, 2020:Regular dividend15 yenCommemorative dividend5 yen2. The forecast of dividends for the fiscal year ending March 31, 2021 is not available at this moment.3. Consolidated Financial Results Forecast for the Fiscal Year Ending March 31, 2021 (April 01, 2020 to March 31, 2021)As for Consolidated Financial Results for full year, forecast is not available at this moment due to uncertain circumstances causedby the worldwide spread of the new coronavirus (COVID-19). Consolidated Financial Results Forecast for full year will beannounced when more detailed information is available.* Notes:(1) Changes in significant subsidiaries during the period under review (changes in specified subsidiaries resulting in changes inscope of consolidation): NoNew(Company name:)Exclusion:(Company name:)(2) Changes in accounting policies, changes in accounting estimates and retrospective restatement1) Changes in accounting policies due to the revision of accounting standards:Yes2) Changes in accounting policies other than 1) above:Yes3) Changes in accounting estimates:No4) Retrospective restatement:NoFor details, please refer to page 16, “Notes to Consolidated Financial Statements, Changes in accounting policy”.(3) Total number of issued shares (common shares)1) Total number of issued shares at the end of the period (including treasury shares):March 31, 2020:47,520,253 sharesMarch 31, 2019:47,520,253 shares2) Total number of treasury shares at the end of the period:March 31, 2020:March 31, 2019:3) Average number of shares during the period:Fiscal Year ended March 31, 2020:Fiscal Year ended March 31, 2019:1,350,633 shares324 shares47,067,351 shares44,129,723 sharesNote: From the current period, the Company introduced an E-Ship Trust-Type Employee Stock Purchase Incentive Plan and aperformance-linked stock-based remuneration for Directors and Executive Officers. For the calculation of total number of treasuryshares at the end of the period and average number of shares during the period, Company shares held in the trusts are included intreasury shares to be deducted.―2―

(Reference) Summary of Non-consolidated Financial Results1. Non-consolidated Financial Results for the Fiscal Year Ended March 31, 2020 (April 01, 2019 to March 31, 2020)(1) Non-consolidated Operating Results(% indicates changes from the previous corresponding period.)Net salesFiscal year endedMarch 31, 2020March 31, 2019Operating profitMillion yen%62,86067,732(7.2)2.0Million yenOrdinary profit%1,4322,789Million yen(48.7)50.02,6534,026Net income%(34.1)15.6Million yen3,9053,365%16.155.4Basic earnings per share Diluted earnings per shareFiscal year endedMarch 31, 2020March 31, 2019YenYen82.9776.25--(2) Non-consolidated Financial PositionTotal assetsAs ofMarch 31, 2020March 31, 2019(Reference) Equity:Net assetsMillion yenMillion yen105,178106,465As of March 31, 2020:As of March 31, 2019:Capital adequacy ratio 51,16250,37451,162 million50,374 millionNet assets per share%Yen48.647.31,108.131,060.06* Numbers in parentheses denote negative numbers.* This financial result is not required to be audited by certificated public accountants or audit firm.* Explanation of appropriate use of earnings projections, other explanatory notesAs for Consolidated Financial Results for the fiscal year ending March 31, 2021, forecast is not available at this moment due touncertain circumstances caused by the worldwide spread of the new coronavirus (COVID-19). Consolidated Financial ResultsForecast for full year will be announced when more detailed information is available.―3―

Consolidated Financial StatementsConsolidated Balance Sheets(Million yen)As of March 31,2019As of March 31,2020AssetsCurrent assetsCash and depositsNotes and accounts receivable - tradeElectronically recorded monetary claims operatingMerchandise and finished 89,5086,5789,0396,889OtherAllowance for doubtful accounts2,382(1,303)2,613(445)Total current dings and structures, net16,69015,822Machinery, equipment and vehicles92,90095,940(66,783)(71,312)Work in processRaw materials and suppliesNon-current assetsProperty, plant and equipmentBuildings and structuresAccumulated depreciationAccumulated depreciation26,11624,628LandMachinery, equipment and vehicles, net10,79110,405Leased assetsAccumulated depreciation6,284(1,729)6,695(1,876)Leased assets, net4,5554,819Construction in umulated depreciationOther, netTotal property, plant and equipment99190562,04360,974Intangible assetsGoodwill7,1476,193Leased assetsOther605,383466,07712,59112,317Investment securitiesLong-term loans receivable4,8322734,064230Retirement benefit assetDeferred tax assets962,7563651,794OtherAllowance for doubtful accounts1,195(50)1,067(56)Total investments and other assets9,1037,465Total intangible assetsInvestments and other assetsTotal non-current assetsTotal assets―4―83,73980,758161,881159,539

(Million yen)As of March 31,2019As of March 31,2020LiabilitiesCurrent liabilitiesNotes and accounts payable - tradeElectronically recorded obligations - 2Lease obligationsIncome taxes payable8371,0662,087885Provision for bonusesProvision for bonuses for directors (and otherofficers)Provision for product t-term loans payableCurrent portion of long-term loans payableProvision for environmental measuresElectronically recorded obligations - nonoperatingOtherTotal current 2,3031,90111,680Non-current liabilitiesLong-term loans payableLease obligationsDeferred tax liabilitiesProvision for environmental measuresProvision for share-based remunerationProvision for share-based remuneration fordirectors (and other officers)Provision for loss on guaranteesRetirement benefit liabilityAsset retirement obligationsNegative 48338,74233,55496,62895,370Capital stockCapital surplus8,41313,1148,41313,114Retained earningsTreasury shares36,655(0)37,693(1,016)Total shareholder's equity58,18258,204906361Total non-current liabilitiesTotal liabilitiesNet assetsShareholders' equityAccumulated other comprehensive incomeValuation difference on available-for-salesecuritiesForeign currency translation adjustmentRemeasurements of defined benefit plansTotal accumulated other comprehensive incomeNon-controlling interestsTotal net assetsTotal liabilities and net )8,6178,18065,25364,168161,881159,539

Consolidated Statements of Income and Comprehensive IncomeConsolidated Statements of Income(Million yen)For the fiscal yearended March 31,2019For the fiscal yearended March 31,2020Net salesCost of sales107,71879,596100,15974,702Gross profit28,12125,456Selling, general and administrative expensesFreightage expenses2,4192,091Business consignment expensesProvision of allowance for doubtful accounts1,2253481,263103Remuneration for directors (and other officers)Salaries and allowances5064,8785614,871Provision for bonusesProvision for bonuses for directors (and other officers)602181454105Provision for product compensationRetirement benefit expenses175463185503Welfare expensesDepreciation1,0957911,249860Rent expensesResearch and development expenses1,0731,9821,0722,060OtherTotal selling, general and administrative expensesOperating profitNon-operating incomeInterest incomeDividend incomeForeign exchange �0Amortization of negative goodwillShare of profit of entities accounted for using equitymethodOther0174146429447Total non-operating income779821Interest expensesForeign exchange losses867225869Other318-460Non-operating expensesTotal non-operating expenses1,4111,3306,6303,6603,909Subsidy income-1,000Total extraordinary income1,0003,909-2,051-186Ordinary profitExtraordinary incomeGain on sales of non-current assetsExtraordinary lossesImpairment lossProvision for loss on guarantees--2,237Profit before income taxes7,6305,331Income taxes - currentIncome taxes - deferred2,5571841,855935Total income taxes2,7422,790Profit4,8882,540Total extraordinary losses―6―

(Million yen)For the fiscal yearended March 31,2019Profit (loss) attributable to non-controlling interestsProfit attributable to owners of parent―7―For the fiscal yearended March 31,2020752(199)4,1352,740

Consolidated Statements of Comprehensive Income(Million yen)For the fiscal yearended March 31,2019ProfitOther comprehensive incomeFor the fiscal yearended March 31,20204,8882,540Valuation difference on available-for-sale securitiesForeign currency translation adjustment(500)(1,032)(552)(98)Remeasurements of defined benefit plans, net of taxShare of other comprehensive income of entitiesaccounted for using equity methodTotal other comprehensive income(228)185(170)(9)(1,932)(475)Comprehensive income2,9552,065Comprehensive income attributable toowners of parent2,5322,070423(5)non-controlling interests―8―

Consolidated Statements of Changes in Net AssetsFor the fiscal year ended March 31,2019(Million yen)Shareholders' equityCapital stockBalance at beginningof current periodChanges of itemsduring periodIssuance of newsharesDividends ofsurplusProfit attributable toowners of parentPurchase oftreasury sharesDisposal of treasurysharesNet changes ofitems other thanshareholders' equityTotal changes ofitems during periodBalance at end ofcurrent periodCapital y Accumulated other comprehensive incomeTotalValuationForeign currency Remeasurements accumulated Non-controlling Total net assetsdifference onintereststranslationof definedotheravailable-foradjustmentbenefit plans comprehensivesale securitiesincomeBalance at beginningof current periodChanges of itemsduring periodIssuance of newsharesDividends ofsurplusProfit attributable toowners of parentPurchase oftreasury sharesDisposal of treasurysharesNet changes ofitems other thanshareholders' equityTotal changes ofitems during periodBalance at end ofcurrent 53―9―

For the fiscal year ended March 31,2020(Million yen)Shareholders' equityCapital stockBalance at beginningof current periodCumulative effectsof changes inaccounting policiesRestated balanceChanges of itemsduring periodDividends ofsurplusProfit attributable toowners of parentPurchase oftreasury sharesDisposal of treasurysharesNet changes ofitems other thanshareholders' equityTotal changes ofitems during periodBalance at end ofcurrent period8,413Capital surplus13,114RetainedearningsTreasury ,11437,693(1,016)58,204Accumulated other comprehensive incomeTotalValuationForeign currency Remeasurements accumulated Non-controlling Total net assetsdifference onintereststranslationof definedotheravailable-foradjustmentbenefit plans comprehensivesale securitiesincomeBalance at beginningof current periodCumulative effectsof changes inaccounting policiesRestated balanceChanges of itemsduring periodDividends ofsurplusProfit attributable toowners of parentPurchase oftreasury sharesDisposal of treasurysharesNet changes of itemsother thanshareholders' equityTotal changes ofitems during periodBalance at end ofcurrent )(1,045)361(654)(1,922)(2,216)8,18064,168―10―

Consolidated Statements of Cash Flows(Million yen)For the fiscal yearended March 31,2019Cash flows from operating activitiesProfit before income taxesDepreciationImpairment lossFor the fiscal yearended March ion of goodwillAmortization of negative goodwillShare of loss (profit) of entities accounted for usingequity methodIncrease (decrease) in allowance for doubtful accountsIncrease (decrease) in provision for bonusesIncrease (decrease) in provision for bonuses fordirectors (and other officers)Increase or decrease in net defined benefit asset andliabilityIncrease (decrease) in provision for share-basedremunerationIncrease (decrease) in provision for share-basedremuneration for directors (and other officers)Increase (decrease) in provision for environmentalmeasures(174)Increase (decrease) in provision for loss on guaranteesInterest and dividend incomeSubsidy incomeInterest expensesLoss (gain) on sales of non-current assetsDecrease (increase) in notes and accounts receivable tradeDecrease (increase) in inventoriesIncrease (decrease) in notes and accounts payable tradeIncrease (decrease) in accrued consumption 87)(433)289Interest and dividend income receivedProceeds from dividend income from entitiesaccounted for using equity methodProceeds from subsidy incomeInterest expenses paid(3,909)(405)119Subtotal(146)345163-Increase (decrease) in other liabilitiesOther, ��(873)Income taxes paid(2,825)(1,930)Net cash provided by (used in) operating activities11,70912,822―11―

(Million yen)For the fiscal yearended March 31,2019Cash flows from investing activitiesPayments into time depositsFor the fiscal yearended March 31,2020(2,484)(3,335)Proceeds from withdrawal of time depositsPurchase of investment securities1,842(885)2,711(25)Proceeds from sales of investment securitiesPurchase of property, plant and )124(150)111Fair value adjustment of contingent considerationOther, net1,850(1)-112Net cash provided by (used in) investing 2,009(6,760)-(1,089)361(1,372)Proceeds from issuance of common sharesPurchase of treasury shares2,259(0)-(1,122)Proceeds from disposal of treasury sharesCash dividends paid4,574(1,307)105(1,659)Proceeds from sales of property, plant and equipmentPurchase of intangible assetsPayments of loans receivableCollection of loans receivableCash flows from financing activitiesNet increase (decrease) in short-term loans payableProceeds from long-term loans payableRepayments of long-term loans payableProceeds from sale and leaseback transactionsRepayments of finance lease obligationsDividends paid to non-controlling interestsNet cash provided by (used in) financing activitiesEffect of exchange rate change on cash and cashequivalentsNet increase (decrease) in cash and cash Cash and cash equivalents at beginning of period11,86617,127Cash and cash equivalents at end of period17,12719,170―12―

Notes to Consolidated Financial Statements(Notes on going concern assumption)Not applicable(Significant matters that form the basis of presenting the consolidated financial statements)1. Scope of consolidation(1) Number of consolidated subsidiaries 33 companiesCompany nameDAIDO LOGITECH CO., LTD.Daido Plain Bearings Co., Ltd.NDC Sales Co., Ltd.Asia Kelmet Co., Ltd.Iino Holding Ltd.ATA Casting Technology Japan Co., Ltd.IINO (Foshan) Technology Co., Ltd.Dong Sung Metal Co., Ltd.ATA Casting Technology Co., Ltd.PT. IINO INDONESIASUPER CUB FINANCIAL CORPORATIONISS America, Inc.Daido Metal Mexico Sales, S.A. de C.V.ISS MEXICO MANUFACTURING S.A. de C.V.Daido Industrial Bearings Europe LimitedDaido Metal Russia LLCDAIDO METAL CZECH s.r.o.DAIDO METAL SALES CO., LTD.NDC Co., Ltd.Daido Industrial Bearings Japan Co., Ltd.DAIDO METAL SAGA CO., LTD.Iino Manufacturing Co., Ltd.Daido Precision Metal (Suzhou) Co., Ltd.Chung Yuan Daido Co., Ltd.Dyna Metal Co., Ltd.DM Casting Technology (Thailand) Co., Ltd.PT. Daido Metal IndonesiaPHILIPPINE IINO CORPORATIONDaido Metal U.S.A. Inc.Daido Metal Mexico, S.A. de C.V.DAIDO METAL KOTOR ADDAIDO METAL EUROPE LIMITEDDaido Metal Europe GmbH(2) Names of unconsolidated subsidiaries 3 companiesCompany nameKorea Dry Bearing Co., Ltd.Chung Yuan Daido (Guangzhou) Co., Ltd.DMS Korea Co., Ltd.Reason for exclusion from scope of consolidationKorea Dry Bearing Co., Ltd., Chung Yuan Daido (Guangzhou) Co., Ltd., and DMS Korea Co., Ltd. have been excluded from thescope of consolidation because these companies are immaterial from the Group’s point of view in terms of total assets, net sales,profit attributable to owners of parent, and retained earnings for the year and do not have a significant impact on the net assets,financial position and results of operations of the Group.2. Application of equity method(1) Number of unconsolidated subsidiaries to which the equity method was applied 1 companyCompany nameKorea Dry Bearing Co., Ltd.(2) Number of associates to which the equity method was applied 3 companiesCompany nameBBL Daido Private LimitedShippo Asahi Moulds (Thailand) Co., Ltd.NPR of Europe GmbH(3) Names of unconsolidated subsidiaries and associates to which the equity method was not appliedChung Yuan Daido (Guangzhou) Co., Ltd.DMS Korea Co., Ltd.―13―

Reason for non-application of equity methodChung Yuan Daido (Guangzhou) Co., Ltd. and DMS Korea Co., Ltd. are immaterial from the Group’s point of view in terms ofprofit attributable to owners of parent and retained earnings for the year and do not have a significant impact on the net assets,financial position and results of operations of the Group.(4) For companies consolidated under equity method with closing dates different from the consolidated closing date, financialstatements as of their year-end are used.3. Matters relating to the accounting period of consolidated subsidiariesThe closing date for Daido Metal U.S.A. Inc., DAIDO METAL KOTOR AD, Daido Industrial Bearings Europe Limited, DAIDOMETAL CZECH s.r.o., Dyna Metal Co., Ltd., Chung Yuan Daido Co., PT. Daido Metal Indonesia, Dong Sung Metal Co., Ltd., DaidoPrecision Metal (Suzhou) Co., Ltd., Daido Metal Europe GmbH., DAIDO METAL EUROPE LIMITED, Daido Metal Russia LLC,Daido Metal Mexico, S.A. de C.V., Daido Metal Mexico Sales, S.A. de C.V., PHILIPPINE IINO CORPORATION, IINO (Foshan)Technology Co., Ltd., ISS America, Inc., ISS MEXICO MANUFACTURING S.A. de C.V., PT. IINO INDONESIA, and SUPER CUBFINANCIAL CORPORATION is December 31.Financial statements as of the same date are used in compiling the consolidated financial statements as of March 31, with necessaryadjustment for the effects of significant transactions or events that occur between the date of those financial statements and the date ofthe consolidated financial statements.4. Matters relating to accounting policies(1) Basis and method of valuation of important assets1) SecuritiesOther securitiesSecurities with market valueStated at market value based on the market price at the balance sheet date (Valuation differences are recorded directly in netassets, and the net sales cost is calculated by the moving average method.)Securities without market valueStated at cost using moving average method2) InventoriesBasis of valuation is in accordance with the cost basis (with writing down of the carrying value based on any decreasedprofitability).Merchandise and finished goods pally by weighted average methodWork in ly by weighted average methodRaw materials ···················Principally by weighted average methodSupplies Principally by moving average method3) DerivativesStated at market value(2) Method of depreciation of important depreciable assets1) Property, plant and equipment (excluding leased assets)The Company and six domestic consolidated subsidiaries use the declining balance method (with the exception of buildings(excluding facilities annexed to buildings) acquired on or after April 1, 1998 and facilities annexed to buildings and structuresacquired on or after April 1, 2016, for which the straight-line method is used), while other subsidiaries use the straight-linemethod.―14―

Estimated useful lives of major assets are as follows:Buildings and structures 3-60 yearsMachinery, equipment and vehicles 4-10 years2) Intangible assets (excluding leased assets)Straight-line method is used.3) Leased assetsLeased assets relating to finance lease transactions which transfer the ownership of leased assetsThe same depreciation method as applied to our own assets is used.Leased assets relating to finance lease transactions which do not transfer the ownership of leased assetsStraight-line method based on the depreciation period equal to the lease period and residual value of zero is used.(3) Reserves and Provisions1) Allowance for doubtful accountsIn order to prepare for any losses arising from bad debt receivables, an amount estimated to be unrecoverable is provided. Generalreserve is calculated based on the past loss experience, and specific reserve is calculated by reviewing the probability of recoveryin each individual case where there is concern over claims.2) Provision for bonusesAn amount corresponding to the period out of the estimated amount of bonuses payable to employees is provided.3) Provision for bonuses for directors (and other officers)An estimated amount of bonuses payable is provided.4) Provision for product compensationIn order to prepare for any expenditure for quality claims, an estimated amount required to be paid in future is provided.5) Provision for environmental measuresIn order to prepare for the payment of disposal cost of PCB wastes required as stipulated by the “Act on Special Measuresconcerning Promotion of Proper Treatment of PCB Wastes” and for the payment of cost of soil contamination countermeasures tobe incurred, the estimated disposal cost is provided.6) Provision for loss on guaranteesIn order to prepare for the loss on guarantee balance remains at the end of an Employee Shareholding Incentive Plan (E-Ship )period, an estimated amount of loss is provided.7) Provision for share-based remuneration, Provision for share-based remuneration for directors (and other officers)In order to prepare for the payment of share-based remuneration for directors (and other officers), an estimated share-basedremuneration amounts based on the estimated points to be granted to eligible directors(and other officers) under the Share GrantRule of the Company is provided.(4) Accounting for retirement benefitsIn order to prepare for the payment of retirement benefits to employees (excluding operating officers etc.), an amount estimated tohave occurred at the balance sheet date is provided based on the projected benefit obligation and plan assets at the balance sheet date.When calculating retirement benefit obligations the benefit formula basis is used to allocate to the current period.―15―

Past service cost is recorded as an expense by a pro-rated amount by the straight-line method over a period within the averageremaining service years of employees (mainly 14 years) at the time of occurrence thereof.For actuarial differences, an amount prorated by the straight-line method over a period within the average remaining service years ofemployees (mainly 14 years) at the time of occurrence thereof in each consolidated fiscal year is expensed starting from theconsolidated fiscal year that follows the consolidated fiscal year of occurrence.In order to prepare for the payment of retirement benefits to operating officers etc., the amount that would need to be paid if alleligible officers retired at the balance sheet date is provided.(5) Conversion of foreign currency denominated assets and liabilities into Japanese YenForeign currency denominated monetary assets and liabilities are converted into Japanese Yen at the spot exchange rates prevailingat the balance sheet date, and the resulting exchange differences are recorded as gains or losses. Assets and liabilities, income andexpenses of overseas subsidiaries are converted into Japanese Yen at the spot exchange rates prevailing at the balance sheet date, andthe resulting exchange differences are recorded in net assets as foreign currency translation adjustments and non-controllinginterests(6) Amortization of goodwill and the amortization periodGoodwill is amortized by the straight-line method within a period of 14 years based on the estimated period during which thebenefits are expected to arise.(7) Scope of cash and cash equivalents in consolidated statement of cash flowsThe cash and cash equivalents in consolidated statement of cash flows comprise cash on hand, demand deposits, and short-terminvestments with a maturity of three months or less from the date of acquisition that are readily convertible into cash and that aresubject to an insignificant risk of changes in vales.(8) Other significant matters for presentation of consolidated financial statementsAccounting method of consumption taxesConsumption taxes are accounted for by the tax-excluded method.(Changes in accounting policy)(Changes in accounts regarding proceeds from disposal of scraps)The Group previously recorded proceeds from disposal of scraps (scrap metal and waste liquid) as Gain on sales of scraps (NonOperating Income). Effective from the beginning of the fiscal year ended March 31, 2020, the Group records such proceeds asdeduction of manufacturing costs. This is in line with the Group’s revision of cost management method following the increase inscrap disposal proceeds through the improvement in recycling process. The Group applied the changes in the accounting policyretrospectively, and reclassified the consolidated financial statement for the previous period.As a result, Cost of sales for the previous period decreased by 663 million yen, and Gross profit and Operating profit increased bythe same amount. There is no impact on Ordinary profit and Profit before income taxes.Cost of manufacturing is not recalculated for the past periods, as impact is not material. Gain on sales of scraps for each period isdeducted from the Cost of sales. There is no cumulative effect on the opening balance of Net assets of the previous period.(Adoption of IFRS 16, “Leases”)Effective from the beginning of the fiscal year ended March 31, 2020, the Group companies reporting under IFRS for consolidationpurpose adopted IFRS 16, “Leases”. Those who don’t adopt this standard include the Company itself and its domestic subsidiaries(Japanese GAAP), and its US subsidiary (US GAAP). In accordance with the transitional measures under IFRS 16, the cumulativeeffect is recog

Note:This document is a translation of a part of the original Japanese version and provided for reference purposes only. In the event of any discrepancy between the Japanese original and this English translation, the Japanese original shall prevail. Consolidated Financial Results for the Year Ended March 31, 2020 [Japanese GAAP] May 14, 2020