Transcription

Cyprus Real EstateMarket Report The Insights10th editionAnnual report outlining the key trendsand major drivers of the Real EstateMarket for 2018April 2019kpmg.com.cy

Cyprus Real Estate Market Report - The Insights April 2019Dear Reader,The real estate sector continues to play a pivotal role inthe Cypriot economy, therefore we are pleased to presentour newest KPMG Cyprus Real Estate Market Report – TheInsights. This is the 10th edition of our report, which providesinsightful leads into the Cypriot economy and the local realestate market.This report provides an overview of the Cypriot economy andan assessment of the performance of the real estate sectorduring 2018.Overcoming the challenges of recent years, the Cyprioteconomy continued to exhibit a solid growth and hasmaintained its status as one of the fastest growingeconomies in Europe. Given the significance of the realestate sector for the Cypriot economy, we continuepublishing our expert sectoral report. This edition delves intothe key economic conditions and provides invaluable insightsinto demand and supply, key trends and notable sectoraldevelopments.We hope that you will find our report enlightening and usefulin supporting your future business decisions related to thereal estate sector. Kindly feel free to contact us for furtherinquiries. KPMG’s “one-stop-shop” real estate service offeringcovers advisory, audit and tax related matters, customisedto provide real added value to your specific needs andenvironment.Christos V. VasiliouManaging DirectorKPMG in Cyprus

Cyprus Real Estate Market Report - The Insights April 201910 th edition - coming soonPositive economic growth hascontinued in 2018 for Cyprus, withGDP exhibiting an annual 3,9%increase (considerably higher than theEU average).Source: Ministry of FinanceSource: CyStatSource: CyStat*R.E. Real Estate & Construction activitiesThe Real Estate sector (includingconstruction activities) hascontributed c. 38,5% of the annualgrowth rate and 16% of the Cyprioteconomy Gross Value Added.The issuance of Building Permitscontinued its upward trend in 2018,both in terms of volume ( 12%year-on-year) and value ( 20%year-on-year).Famagusta district exhibited thebiggest annual increase in terms ofvolume (36%) and in terms of value(77%).Transactions activity remained strong,with the number of Contracts of Saleexhibiting an annual increase of 6%.Source: CyStatTransactions ActivityLimassol had the highest share (37%)of the market for 2018, same as in2017, and Nicosia exhibited thelargest year-on-year increase ( 10%)in sales.Non-nationals contributed 47% oftotal transactions activity.Notable Real Estate Matters include: An annual increase of 27% in thevolume of transactions for highvalue residential properties ( 1million) in 2018 New Building Permits for hotelshave exhibited a growth of 122%in terms of m2 during 2018, whencompared to 2017 Bookings through Airbnb showedan annual increase of 71% in 2018.Source: Department of Land and Surveys (DLS)Source: DLSSource: CyStatSource: AirDNA.co

4Cyprus Real Estate Market Report - The Insights April 2019

Cyprus Real Estate Market Report - The Insights April 2019Table of contentsCyprus at a glance2Economic overview4Real Estate sector12Notable Real Estate matters21Topics of interest29KPMG services321

2Cyprus Real Estate Market Report - The Insights April 2019Cyprus ata glance

Cyprus Real Estate Market Report - The Insights April 2019Currency:Euro ( )since epublicArea Under Turkish Occupation (1)Memberships:EU membersince lity &Infrastructure:2 InternationalAirports(Larnaca & Paphos)Limassol2 deepsea ports(Limassol & Larnaca)1 Not included in this report. All information in this report refers to the areas controlled by the Republic of Cyprus.2 Source: CyStat (end-2017)Key Benefits3

4Cyprus Real Estate Market Report - The Insights April 2019Economicoverview

Cyprus Real Estate Market Report - The Insights April 20195GDP growth, inflation and unemployment rate Source: CyStat, IMF projections (World Economic Outlook Database, 2019), KPMG analysisPositive growth in 2018 at 3,9%(y-o-y)Cyprus’ annual GDP growthis starting to stabilise atapproximately twice the EUaverageIMF is forecasting a growth rateof 3,5% in 2019 and then mildergrowth rates in the next 5 yearsThe largest growth driver in2018 was construction andreal estate activities, closelyfollowed by tourism, wholesaleand retail trade2018 growth driversConstruction1,4%Real estate activities0,1%Tourism, wholesaleand retail trade1,2%Financial and in suranceactivities-0,5%Professional scientific andtechnical activities0,5%Other1r1,2%Source: Eurostat (March 2019), KPMG analysis Source: Cy Stat, Eurostat, IMF projections (World Economic Outlook Database, 2019), KPMG analysisInflation in 2018 was 0,8%,significantly lower than theEuro Area. Private consumptioncontinued to expand, supportedby rising employment andgradually increasing wagesThe unemployment rate ofCyprus is on a decreasing trendsince 2013. The latest Eurostatfigures show a drop to 8,4%,almost equal to the Euro Areaaverage of 8,3%, for the year2018

Cyprus Real Estate Market Report - The Insights April 20196Government bonds and credit ratingSource: Credit rating agenciesSource: Stock Markets data Since the events of the Cypriot economic crisis in2013 and the downgrade of Cyprus’ sovereign ratingby various international credit rating agencies to “Non– Investment Grade”, the country has significantlyprogressed The positive economic growth has led to a seriesof upgrades of the Cyprus sovereign rating frominternational credit rating agencies A Cypriot 10-year government bond yield issued inmid 2013 (July) was priced c. 3,43% and this has nowdropped to 0,52% in March 2019, signifying the strongfiscal performance of the economy The uncertainty surrounding the troubled Coop Bankhad increased the Cypriot bond yield to c. 2,99% inJuly 2018, but the normal trajectory was re-establishedonce the resolution deal was completed

Cyprus Real Estate Market Report - The Insights April 20197Deposits and Loans breakdownSource: CBC, KPMG analysisSource: CBC, KPMG analysisSource: CBC, KPMG analysis The level of total bank depositsshows aggregate stability over thepast few years, since the events of2013 Local deposits have been relativelystable during the last three years,whereas foreign deposits exhibit asteadily decreasing trend from 2011to 2018 Loans have significantly reducedsince 2011. There was a decrease ofc. 24% between 2017 and 2018 The decline in loans is multi-faceted;it is attributed to the banks’ effortsto de-leverage their balance sheetsvia debt for asset swaps, writeoffs and cash collections, but moreimportantly, particularly in 2018, tothe sale of loan portfolios and therecent transfer of the Coop Bank’sNPL portfolio outside the bankingsystem The loans to deposits ratio hasdecreased significantly during thelast 5 years. Loans have a loweraggregate value in 2018, comparedto deposits for the first time since2011

8Cyprus Real Estate Market Report - The Insights April 2019Interest rates, deposits and loans movementInterest Rates (%):Source: Eurostat, KPMG AnalysisSource: Eurostat, KPMG Analysis Interest rates have been declining since 2013.The decision of the Central Bank of Cyprusin February 2015 to lower the ceiling of itsbase interest rate by 1%, is reflected in thedeclining trend More specifically, new housing and corporateloans interest rates continued their declineand stand at 2,13% and 3,41% respectively,as of December 2018. However, the interestrates for both housing and corporate loansare still significantly higher than Eurozone’saverage The interest rate spread between Loans andDeposits has been reduced in Cyprus for bothHouseholds and Corporates. However, CypriotBanks are still enjoying a bigger spread thanthe Eurozone average

Cyprus Real Estate Market Report - The Insights April 20199Keys pil ars of the economyHOTELTourism, wholesaleand retail trade accountfor the employment of32% of the workingpopulation of CyprusDespite the factthat Real estate andconstruction activitiesemploy only 9% of theworking population, theyaccount for 16% of GVASource: CyStat, KPMG AnalysisReal Estate in the Real EconomyJobsEconomic ContributionNote: Real Estate sector includes Real Estate and Construction activitiesSource: CyStat, KPMG Analysis

10Cyprus Real Estate Market Report - The Insights April 2019Tourism 64% Tourist arrivals have continued their stronggrowth over the past years. Tourist arrivalsin 2018 exhibited an increase of 7,8%,compared to 20172.405Revenue per arrival has a decreasingtrend: from 865,7 in 2013 to 688,2 in2018 (20,5% cumulative decrease). This isa combined result of the decrease in theaverage length of stay and of the averagespend per day. However, these reductionsare compensated by the increasing trend inarrival numbersRevenue per personper arrival(-12% from 2013)9,2 daysRevenue per arrival(-20% from 2013)Source: CyStat, KPMG Analysis 2.082 2.711(2018)(2013)Arrivals (thousand)Revenue (million)1.328 ( 6%)784 (-5%)233 (-11%)189 (0%)154 ( 12%)86 ( 10%)1.065 ( 30%) 980 ( 3%) 523 (-13%) 114 (-25%) 146 (0%) 93 ( 8%) 66 ( 13%) 789 ( 23%)Note: Comparisons between 2018 and 2017Tourist sources UK is still the top market of origin (34%) withRussia in second place (20%) The UK market of origin exhibited a 5,9%(74 thousand arrivals) y-o-y increase in 2018.Revenues from the UK market have increasedby 3,2% ( 31 million) for the same period. Itis noted that the effects of Brexit may haveprofound implications for the local touristindustry in the future The second (Russia) and third (Israel) highesttourist sources recorded decreases in arrivals(5% and 11,2% respectively in 2018) The source markets with the highest increase intourist arrivals in 2018 compared to 2017 werePoland (58%), Ukraine (44,5%) and Romania(35,8%)Average stay(-11% from 2013) 688(2018)(2013)Revenues from tourism hit a double-digitpercentage increase in the previous twoyears (11,9% and 11,7% in 2016 and 2017respectively). The growth was milder in2018 (2,7%) 74,83.939 30%

Cyprus Real Estate Market Report - The Insights April 201911Potential growth driversCasino ResortThe development of a luxurious integrated casino resort, a 550million project, has commenced in LimassolThe resort is expected to be completed by 2021. It is estimated thatit will contribute 700 million/year (over 3% of Cyprus’ annual GDP).Satellite Casinos 3 Satellite casinos commenced operations in 2018: Nicosia,Larnaca and LimassolThe remaining 2 are expected to operate in 2019-2020: Paphosand Ayia NapaSource: Melco Cyprus announcementsShipping IndustryEducation Cyprusregistry ranks10th worldwideSource: Deputy Ministryof Shipping3rd largestmerchant fleet inthe EU andamong thelargest merchantfleets worldwideCyprusNewly foundedregistryDeputyranks 10thMinistry ofworldwideShipping 48.172 post-secondaryeducation studentsover the academic year2017/20188,4% growth in 2018Source: Ministry of EducationEnergy Sector Natural gas has already been discovered in Block 12 (Aphroditefield) by Noble EnergyThe second drilling programme, “Glaucus 1”, of Block 10 has beencompleted in February 2019 with positive results. Excellent qualityof natural gas was discovered and the quantities of natural gas inthe Block are estimated between 5 and 8 trillion cubic feet.Source: Ministry of Energy, Commerce and IndustryAlternative Investment FundsNewlegislationgoverningthe AIFsLow setup andoperationcostsFlexiblestructures:UCITS andAIFsSource: Central Bank of Cyprus, Cyprus Securities and ExchangeCommission, KPMG Analysis

12Cyprus Real Estate Market Report - The Insights April 2019Real Estatesector

Cyprus Real Estate Market Report - The Insights April 2019Building permits activity steadily risingThe issuance of new buildingpermits exhibits a steady growth innumbers over the last few years buteven more so in value.Nicosia is the district with thehighest number of buildingpermits (37% of total).In terms of value, Limassol is theleading city (31% of the total),closely followed by Nicosia (29% ofthe total).Source: CyStat, KPMG Analysis13

14Cyprus Real Estate Market Report - The Insights April 2019Building permits issued by type of developmentThe majority of building permits issued in 2018 isrelated to residential developments (70% of totalvolume), with a total value of 1,3 billion (63% oftotal value).Hotels making up 20% of‘big projects’ value8% of the building permitsissued are for projects biggerthan 900 m2 – with a value of 1,2 billion (52% of the totalbuilding permits value).Source: CyStat, KPMG Analysis

Cyprus Real Estate Market Report - The Insights April 201915Construction price index & cost per building permitConstruction Price IndexThe construction sector wasone of the sectors which wasaffected severely, as a result ofthe economic crisis of 2013.The 2018 index reflects a y-o-ygrowth, following years of noor negative growth, indicativeof the increased constructionactivity on the island.Source: CyStat, KPMG AnalysisConstruction cost perBuilding PermitThe average construction costper building permit issuedvaries between regions,implying moderately higherscale developments in certaingeographical areas. One suchexample is Famagusta, which ismainly touristic-oriented and a bigpercentage of construction activityis attributed to hotels; for 2018demonstrates by far the highestaverage construction cost perbuilding permit.Source: CyStat, KPMG Analysis

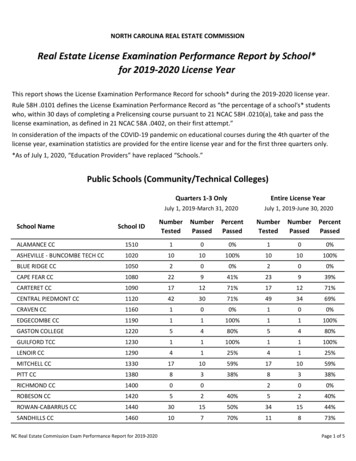

16Cyprus Real Estate Market Report - The Insights April 2019Increased sales activity annually since 2014Following the 2004-2008 rise in transactions, the marketexperienced a sharp drop in 2009 through to 2013 whenit reached a trough. The market is gradually rebounding,with continuous increases every year since 2014. Thela

Cyprus Real Estate Market Report - The Insights April 2019 9 Keys pillars of the economy Economic Contribution Real Estate in the Real Economy Jobs Source: CyStat, KPMG Analysis Note: Real Estate sector includes Real Estate and Construction activities Source: CyStat, KPMG Analysis HOTEL Tourism, wholesale and retail trade account for the employment of 32% of the working population of Cyprus .