Transcription

June 24, 2022StockTALESStock Tales are concise, holistic stock reports across wider spectrum ofsectors. Updates will not be periodical but based on significant events orchange in price.

Newgen Software (NEWSOF)CMP: 355Target: 440 (24%)BUYTarget Period: 12 monthsJune 24, 2022Resilient business model in place development platform company. It is an established player in the market ofenterprise content management (ECM), business process management (BPM) &customer communications management (CCM). P a rticula rAnnuity based revenues (SaaS ATS/AMC Support) comprises 59% ofrevenue mix while license & others form 20.7% revenue mix eachStrong logo addition and increasing annuity mix (recurring business) fromexisting clients would aid revenue growth as we baked in 17.2% CAGRrevenue growth over FY22-24. We expect the company to return tohistorical 70-80 logo additions/year as travel opens up. This coupled withsubscription (SaaS ATS/AMC) growth of 31% CAGR over FY22-24 isexpected to drive annuity (SaaS ATS/AMC Support) revenues, which areexpected to grow at 21.8% CAGR in the same period and forms 63% of therevenue mixThe company is working on 70-80 cases as far as GSI opportunity isconcerned. Depending on the scenario analysis we did, it has anincremental revenue opportunity of 79-131 crore in the next two yearsover and above its normal revenue run rate Strong focus on R&D investments to stay competitive. Newgen now has 23patent grants across India and US out of 43 patents filed so far. Its R&D teamhas grown to about 580 employees in FY22 (vs 250 in FY18) and R&Dinvestments as percentage of sales is 10.2% in FY22 vs. 7.2% in FY18. Thecompany also acquired recently ‘Number Theory’ to strengthen its platformwith AI/ML modelling and data analytics capability-Cash and Invest ( Crore)Vertical wise BFSI comprises 66% of revenue mix while geographical splithas been largely equal between India, US, EMEA & APAC 2,470Total DebtKey triggers for future price performance: AmountMarket Cap ( Crore)368EV ( Crore)2,10252 week H/L754/320Equity capital69.5Face value10.0Shareholding patternJun-21 Sep-21 Dec-21 II7.57.27.67.516.819.219.821.7PublicPrice ChartWhat should investors do? Newgen’s share price has grown 1.5x since listing inJanuary 2018. Key risksWe initiate coverage under Stock Tales format with a BUY rating and a targetprice of 440Target Price and Valuation: We value Newgen at 14x FY24 EPS to arrive at a targetprice of 440 per shareKey Fina GSI opportunity does notmaterialise as per expectations gResearch Analyst SaaS driven BFSI focused product company BUY with a target price of 810Key FinSameer te Stock Idea: Apart from Newgen, in our IT coverage we also like Intellect.Key Financial SummarysF Y19F Y20F Y21F Y225 Ye a r C AGR(F Y17- 22)F Y23EF Y24E2 Ye a r C AGR(F Y22- 24E)Net 522.622826817.320.615.828.525.025.025.0 C roreEBITDA Margins (%)Net Profit10273126164189218EPS ( .3RoNW (%)20.613.219.020.219.318.5RoCE (%)23.915.826.423.723.022.2Source: Company, ICICI Direct Research26.2ICICI Securities – Retail Equity Research ParticularsStock TalesAbout the stock: Incorporated in 1992, Newgen is a low code application15.3

ICICI Direct ResearchStock Tales Newgen Software TechnologiesSoftware products pie expected to grow from current 5.8% to8.6% in FY26As per Nasscom, the Indian technology industry crossed the US 200 billion (bn)revenue mark and is now at US 227 bn in FY22. If we break it down into variouscomponents, then IT services forms a major chunk i.e. US 116 bn (51.3% mix). It isfollowed by Business Process Management (BPM), ER&D, Hardware, which forms19.5%, 15.9%, 7.5% of the revenue mix, respectively. Software products form 5.8% of the revenue mix i.e. US 13 bn.Historically, from FY1990 to FY22, software products revenue grew at 21.3% CAGRi.e. from US 40 mn to US 13 bn now. As per Nasscom, software products revenueis expected to reach US 30 bn by FY26 i.e. 23.3% growth over FY22-26. At the sametime, the Indian technology industry is expected to reach US 350 bn by FY26 i.e.11% CAGR over FY22-26E. Subsequently, the software products pie is expected toreach 8.6% in FY26 from 5.8% in FY22.Exhibit 1: Indian IT industry at US 227 bn in FY22140Exhibit 2: Software products forms 5.8% of pieSoftware products,5.8116120100Hardware, 7.580604436401713HardwareSoftwareproducts20ER&D, 15.9BPM, 19.50IT ServicesBPMER&DIT Services,51.3US bnSource: Nasscom, ICICI Direct ResearchSource: Nasscom, ICICI Direct ResearchExhibit 3: Software products grow 21.3% over FY90-2213.0014.00Exhibit 4: Expected to grow 23.3% over venue (US bn) -Software productsRevenue (US bn) -Software productsSource: Nasscom, ICICI Direct ResearchSource: Nasscom, ICICI Direct ResearchExhibit 5: IT industry to grow 11.4%Exhibit 6: Resulting software products pie to reach 4.02.0FY22FY26Revenue (US bn) -Indian IT industrySource: Company, ICICI Direct ResearchICICI Securities Retail ResearchFY22FY26Mix of software products in overall IT spending (%)Source: Company, ICICI Direct Research2

Stock Tales Newgen Software TechnologiesICICI Direct ResearchLandscape of India software product sectorThe Indian software market has evolved over the years from a US 30-40 mn marketin 1990s to US 10 bn market in 2019-22. The Journey of products sector in Indiacan be bifurcated into four stages from 1990 to 2022, namely early stage, stabilitystage, growth stage and acceleration stage. As per Nasscom, we are currently in theacceleration stage where the revenues are expected to grow 23.3% over the nextfour to five years. Number of companies grew 10x from 200 to 2000 currentlyduring 1990-2022.Exhibit 7: Evolution of software products market in IndiaSource: Nasscom, ICICI Direct ResearchThe following slide depicts software product market in India. The current landscapesuggests 2000 companies, US 13 bn revenues with employment of 160,000headcounts across the industry. The market consists of companies like VYMO, Vsoftwhich are at the lower end of the pyramid ( US 5 mn revenues) while Newgen,which reported 779 crore in FY22 revenue competes with players like Ramco,RateGain, Zeta, etc, in the US 10-100 mn annual revenue run rate bracket. There arelarge IT companies like TCS, Infosys, HCL Tech, which also have product portfolioand revenue of that unit is US 1bn.Exhibit 8: Current landscape of software products sector in India ( figures in US denotes revenue)Source: Nasscom, ICICI Direct ResearchAs per Nasscom, US 13 bn market is can be bifurcated into horizontal and verticalsoftware product market in the ratio of 70:30. The top five horizontal focus areaconsists of Enterprise customer relationship management software, Cloud enterpriseplanning, etc (earlier ERP), enterprise cybersecurity software, etc. As per Nasscom.ICICI Securities Retail Research3

ICICI Direct ResearchStock Tales Newgen Software TechnologiesBFSI and Hi-tech remained focus areas vertically as 45% and 20% of revenue,respectively is coming from these verticals. As per Nasscom, US 9.2 bn was spenton enterprise software in 2021, growing at 16.9% while spent on cloud services wasof US 7.3 bn, which is growing 30%.Exhibit 9: Top five horizontal focus areaExhibit 10: BFSI remains focus area verticallyOthers, 20.0BFSI, 45.0Retail, 7.0Manufacturing,8.0Source: Nasscom, ICICI Direct ResearchHi-Tech, 20.0Source: Nasscom, ICICI Direct ResearchWhat is driving growth?The software product market has evolved substantially over the last few years.Following factors are driving the growth of software products As per Nasscom, global enterprises are embracing software products likeSoftware as a Service (SaaS) with 80% of buyers in mid- size BFSI, Retail,Travel/Tourism and Pharma/Healthcare Total 30% spending by large and mid- size enterprises towards digitalacceleration aiding the penetration of software products Also, 50% adoption, 30% of revenue growth in horizontal products likecybersecurity, CRM and niche products like Low Code No Code (LCNC), etc Verticalisation - An area of increased focus for companies to developvertically focused solutions will help them to tap into 15 billionopportunities e.g. Entertainment, Energy & utilities, TMT, sports, etcExhibit 11: Global enterprises embracing software productsSource: Nasscom, ICICI Direct ResearchICICI Securities Retail Research4

Stock Tales Newgen Software TechnologiesICICI Direct ResearchExhibit 12: Digital acceleration among Indian enterprises aiding penetration of software productsSource: Nasscom, ICICI Direct ResearchExhibit 13: Verticalisation – US 15 bn opportunitySource: Nasscom, ICICI Direct ResearchICICI Securities Retail Research5

Stock Tales Newgen Software TechnologiesICICI Direct ResearchCompany backgroundNewgen Software, founded in 1992, is a software products company offering aplatform that enables organisations to rapidly develop powerful applicationsaddressing their strategic business needs. The applications created on its platformenable organisations to drive digital transformation and competitive differentiation.This may include automation of routine business functions making them faster,easier and more accurate and increasing the channels or devices through whichthese functions can be performed.The three core products of Newgen Digital Automation Platform are EnterpriseContent Services (ECM), Low Code Business Process Automation (BPM) andCustomer Communication Management (CCM).One of the examples, which we could explain these three products is loan processwherein customer has to submit various documents like salary slips, identificationdocuments along with loan application form. These contents are captured throughECM. Managing the workflow around the content like checking eligibility criteria ofthe applier before approval/rejection of the loan to disbursal is captured throughBPM. Communication to the customer regarding statements regarding debit ofprincipal/interest from the account to various channels of sms, email, etc, is capturedthrough CCM.ECM: Enterprise Content Management platform allows digitisation of enterprisecontent and information. This platform provides smart tools for enterprises tocapture and extract information from various sources, classify, store, archive,retrieve as well as dispose of any content and documents required in day-to-daybusiness operations. It provides the flexibility to access or deliver content overmobile and cloud, creating a highly connected and digital workplace. All the standarddocument management features are available including audit trails, search,navigation, content classification & reporting.BPM: Business Process Management is managing the workflow around the content.It is an integrated system, which allows enterprises to manage a complete range ofbusiness processes, including designing and modelling flow of work, executing theflow of work through the workflow engine and monitoring the flow of work for futureimprovement. Work flow management is critical tool as content have to pass throughchain of employees for authorisation, approval before the objective met for whichthe process has been designed. (e.g. loan disbursal).CCM: Customer communication management is dissemination of the content acrossmultiple channels such as email, web, SMS, print, fax, etc.Exhibit 14: Newgen 3 core platforms provides end to end digital transformationSource: Nasscom, ICICI Direct ResearchICICI Securities Retail Research6

ICICI Direct ResearchStock Tales Newgen Software TechnologiesKey historical numbersExhibit 15: Revenues grow at 14.4% CAGR over FY17-221,00025.023.280021.120.020.060015.8 15.040010.01.8FY17FY18FY19FY20FY21Revenue ( crore)7796736615126216.5427200Exhibit 16: Revenue mix ( 7154118130161FY22FY17FY18FY19License fees ( crore)Sale of Services ( crore)Growth (%)FY20FY21FY22Annuity based Revenue ( crore)Source: Company, ICICI Direct ResearchSource: Company, ICICI Direct ResearchExhibit 17: Annuity grows at 21.7% CAGR over FY17-22 Exhibit 18: Resulting into 59% of revenue mix in .06.63.05.020.010.0License feesAnnuity based RevenueFY17Sale of ServicesFY19License feesCAGR FY17-22 (%)FY20FY21Annuity based RevenueFY22Sale of ServicesSource: Company, ICICI Direct ResearchSource: Company, ICICI Direct ResearchExhibit 19: Banking grows 20.6% CAGR over FY17-22 BankingExhibit 20: Resulting in 66% of vertical mix in FY22Others534652475448FY17FY18FY19Banking (%)CAGR FY17-22 (%)434034576066FY20FY21FY22Others (%)Source: Company, ICICI Direct ResearchSource: Company, ICICI Direct ResearchExhibit 21: EMEA grows at 15.9% CAGR over FY17-22Exhibit 22: Resulting in 31.3% of vertical mix in 9.529.327.5FY17FY18FY19FY20FY21FY22-IndiaEMEACAGR FY17-22 (%)Source: Company, ICICI Direct ResearchICICI Securities Retail ResearchAPACUSAIndiaEMEAAPACUSASource: Company, ICICI Direct Research7

Stock Tales Newgen Software TechnologiesICICI Direct ResearchNewgen revenue modelThe company generate its revenue from: (i) sale of software products, (ii) annuitybased revenue, and (iii) sale of services.Sale of products (software) includes its revenue from sale of licenses for its softwareproducts. The company enter into licensing agreements with its customers for eachproduct whereby their customers are required to pay licensing fees. The licensingfee constitutes a one-time upfront fee on a per-user basis. Additional license fees arepayable for an increase in the number of users or for purchase of additional products.Annuity based revenue includes: (i) revenue from annual maintenance contracts andtechnical support (ATS/AMC), (ii) revenue from support/development services, and(iii) SaaS revenue. In addition to the licensing agreements, it typically enter intoATS/AMC contracts with the customers, whereby its customers are required to paysupport and maintenance fees annually. The company also provides support anddevelopment services to its customers and charges fees on a periodic basis. SaaSrevenue relates to its customers' use of software functionality in a cloud-basedinfrastructure provided by the company and the customers pay them subscriptionfees on a per user per month (PUPM) model on a monthly, quarterly or an annualbasis.Sale of services includes its revenue from implementation, development anddigitisation services. Implementation refers to the service of installing and integratingits products with the customer’s existing platform or system. The company chargesan implementation fee based on fixed cost or man-month basis for this service.Development refers to work done for customer based on its specific requirements.The company charge a development fee based on fixed cost or man-month basis.Digitisation services refer to scanning of documents and archival to documentmanagement.NewgenONE platformNewgen Software launched (Link)a new, comprehensive digital transformationplatform, NewgenONE in July 2021. It combines existing process automation,content services, and communication management capabilities into one platform. Itis designed to simplify complex business processes, manage unstructuredinformation, and drive customer engagement based on changing demands. Theplatform enables businesses to leverage low-code to develop and deploy complex,content-driven, and customer-engaging business applications in the cloud. Fromcustomer on-boarding to service requests, from lending to underwriting, and manymore, NewgenONE unlocks simplicity with speed and agility.Exhibit 23: Newgen ONE with contextual content services capabilitySource: Nasscom, ICICI Direct ResearchICICI Securities Retail Research8

Stock Tales Newgen Software TechnologiesICICI Direct ResearchExhibit 24: Newgen ONE with low code process automation capabilitySource: Nasscom, ICICI Direct ResearchExhibit 25: Newgen ONE with personalised customer engagement capabilitySource: Nasscom, ICICI Direct ResearchICICI Securities Retail Research9

ICICI Direct ResearchStock Tales Newgen Software TechnologiesBrief on low code platform on which Newgen operatesLow code options allow users to design complex applications, without learningcomplex computer languages. The global lode code development platform marketsize is expected to grow at 28% CAGR from CY20-25 to reach US 45 bn. Some ofthe drivers for rapid adoption of low code development platforms in recent years hasbeen i) Increased operational efficiency and device integration by creating apps formobiles and supporting offline capabilities ii) lower development costs and time, andreduces possible errors caused by manual processes iii) Uses visual, declarativetechniques rather than traditional lines of coding iv) shorter low code developmentcycle i.e. up to two months vs. three to nine months cycle depending on developingbasic app to large app (exhibit 18). Exhibit 19 shows pricing across different low codeplatform, which starts at US 60 per user per month, which is at the lower endindicated by Newgen (US 60-180 per month per user).Exhibit 26: Low code definitionExhibit 27: Industries targeted by low code providersSource: Avendus Low code report, ICICI Direct ResearchSource: Avendus Low code report, ICICI Direct ResearchExhibit 28: Typical application development lifecycleSource: Avendus Low code report, ICICI Direct ResearchExhibit 29: Pricing across different low code platformsSource: Avendus Low code report, ICICI Direct ResearchICICI Securities Retail Research10

ICICI Direct ResearchStock Tales Newgen Software TechnologiesInvestment RationaleIncreasing annuity mix, new logo addition to drive growthNewgen Software has added 53 logos in FY22. Historically, it was adding 70-80 logosin a year but the logo addition has slowed down in the last couple of years due to i)Covid restriction on travel ii) India business impact due to consolidation of banks(66% vertical mix). The company is now looking to scale up the logo additions, goingforward, as travel opens up and indicated that they would like to go back to run rateof 70-80 logo additions in a year, going forward.Newgen is also focusing on increasing mix of annuity based revenues (recurringbusiness) from its existing clients. As customer relationships mature and deepen,Newgen seeks to maximise its revenues and profitability by expanding the scope ofits offerings with the objective of winning more business from customers. Many ofits existing customers typically expand their usage by either purchasing additionalproducts or expanding the usage of the product from one location to additionallocations in which they operate (consequently, increasing number of users).We bake in 17.2% CAGR revenue growth over FY22-24, which would be driven by31% revenue growth in subscription (SaaS ATS/AMC). Subscription revenueswould grow on addition of new logos and mining of existing customer relationship.We estimate 10% CAGR growth in support revenues (which is typically billed onadditional manpower provides for some of its selected large customers), resultingAnnuity (SaaS ATS/AMC Support) revenues to grow 21.8% growth over FY2224 and forms 63% of the revenue mix.80060010.01,071FY22FY23EFY24E5.0-Revenue ( crore)20.014.0ICICI Securities Retail Research254187Support ( crore)231200(6.6)10.0 10.010.021017512.5Source: Company, ICICI Direct ResearchFY22FY23EFY24E-Growth (%)FY22FY23EFY24E(10.0)Growth xhibit 33: Resulting annuity growth of 21.8% CAGR50.02005015.0Source: Company, ICICI Direct Research30010020.018.8Subscription Revenue ( crore)Exhibit 32: While support to grow at 10% CAGR25025.022.9Growth (%)Source: Company, ICICI Direct Research35.030.6 5010050-2461,000Exhibit 31: Driven by subscription growth 31% CAGR20020.01691,200128Exhibit 30: Revenues to grow at 17.2% CAGR over FY22-24FY22FY23EFY24E-5.0-Annuity revenues ( crore)Growth (%)Source: Company, ICICI Direct Research11

ICICI Direct ResearchStock Tales Newgen Software TechnologiesWe believe repeat business is also a function of recognition of the company as astrong performer in Forrester Wave report of digital process automation where thecompany has been recognised in the strong performers category consistently overthe last few years.Exhibit 34: Forrester report Q3 2017Source: Forrecter Wave report for digital process automation, ICICI Direct ResearchExhibit 35: Forrester report Q4 2021Source: Forrecter Wave report for digital process automation, ICICI Direct ResearchSaaS, which has formed only 9% of the revenue still has a long runway for growth,which we can pick up from the data points mentioned As per ESDS RHP document, Global Software as a Service (SaaS) marketgrew at 19.2% CAGR over CY17-20 to reach to US 100 bn. The global SaaSmarket is expected to grow 4x to US 400 bn by CY25. Indian SaaS marketgrew 27% over FY15-20 while it is expected to grow.4% over FY20-25 As per ESDS RHP document, some of the growth drivers for SaaS globallyincludes: i) promotion of SaaS adoption by governments worldwide, ii) datadriven decision making culture, iii) rise in consumption based models andiv) deployment of futuristic technologies in SaaSICICI Securities Retail Research12

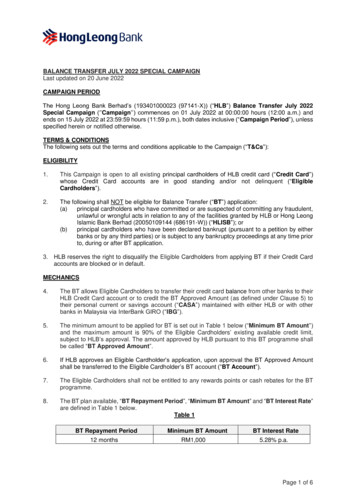

ICICI Direct ResearchStock Tales Newgen Software TechnologiesExhibit 36: Global SaaS industry grows 19.2% over 2-201720182019Exhibit 37: While expected to grow 4x by CY251.2400300200100100CY202020Global SaaS industry US bnGlobal SaaS industry US bnSource: ESDS Software DRHP, ICICI Direct ResearchSource: ESDS Software DRHP, ICICI Direct ResearchExhibit 38: India SaaS grows 27.2% over FY15-20Exhibit 39: Expected to grow 33.4% CAGR over 3010020-FY15FY20FY20Indian SaaS industry bnIndian SaaS industry bnSource: ESDS Software DRHP, ICICI Direct ResearchFY25Source: ESDS Software DRHP, ICICI Direct ResearchGSI provides huge runway for growth, if executed as per plansOnce most software product companies reach a particular size and scale, theirproducts are carried by global system integrators (GSI). It is a worldwidephenomenon. The typical milestone that the product companies follow is revenuetouching US 100 mn. Newgen’s FY22 revenue achieved that milestone. Now it islooking to scale up GSI opportunity to the next level.The company started working with GSIs 18 to 24 months back. It is currently workingwith four to five GSIs. The opportunity funnel has improved significantly as it grewfrom 40 cases in FY21 to 70-80 cases in FY22. The idea here is to capture accountsof Fortune 2000 companies where GSI will already have made inroads and Newgenwill not have direct access due to size and scale. Initially GSI deals were largelylocalised to US geography but Newgen started exploring deals in other territories,which resulted in securing few wins in Australia, APAC and in Europe as well.As per the company, currently the revenue mix from GSI is miniscule i.e. 5% as itis recent initiative. The company is looking to scale up this opportunity in the nextthree to four years. The typical revenue model here is per user per month (PUPM).Hence, customers end up buying this platform and depending on their usage, thepayment happens. E.g. it has contracted for 100 users or 500 users or thousand usersand will charge anywhere between 50 and 60 per user per month to 180depending on the kind of components they are consuming.We have worked on scenario analysis for GSI opportunity. We have made certainassumptions as per indications by the management on the funnel size, winning rateand indicate revenue potential range.ICICI Securities Retail Research13

ICICI Direct ResearchStock Tales Newgen Software TechnologiesExhibit 40: Scenario analysis of GSI opportunitySc ena ri oABCGSI accounts being persuied - A707070Deal Size range (USD mn) - BRema rk500K-3mn 500K-3mn 500K-3mnWinning rate (%) -C152025 As per management indicationNo of accounts can be won - D A*C%111418Max potential revenue opprtunity (USD mn)- E111418 D* USD 1 mnUSD/INR rate757575Ma x p o tenti a l revenue o p p rtuni ty (i n INR c ro re)- F79105131Revenue in FY22 -G779779Revenue in FY24E -H1,0301,0301,030 Assuming 15% CAGR over FY22-24ERevenue in FY24E - I1,1221,1221,122 Assuming 20% CAGR over FY22-24E1,1091,1351,161EBITDA255261267 at 23% margin - lower end of the guidancePAT222227232 Guidance of 20% PAT marginCurrent Mcap2,5062,5062,506P/E(x) - FY24E11.311.010.81,2011,2271,253276261779Ca l c ul a ti o n fo r 15% revenue g ro wth i n FY22- 24ERevenue potential Including GSI - F H - FY24ECa l c ul a ti o n fo r 20% revenue g ro wth i n FY22- 24ERevenue potential Including GSI - F I - FY24EEBITDAPAT267 at 23% margin - lower end of the guidance240245Current Mcap2,5062,5062,506P/E(x) - FY24E10.410.210.0251 Guidance of 20% PAT marginSource: Nasscom, ICICI Direct ResearchOur calculation suggests that depending on the winning rate, GSI could provideincremental revenue opportunity in the range of 79 crore to 131 crore, which isover and above 20% revenue growth guidance given by the management.Strong focus on R&D to remain competitiveNewgen plans to expand the product portfolio through investments in advancedfeatures and technologies. It is constantly engaged in enhancement of R&Dcapabilities, particularly with a view to create solutions in emerging technologies thatenhance the ability to develop tools for enabling entry into new areas and developingproducts that address customers in specific industries. Key focus areas includeartificial intelligence/ machine learning, business intelligence and analytics. Newgencontinues to work with customers in mature markets to build capabilities, both indomain and technology, for enhancing the product offering, strengthening theplatform and expanding the number of features available to customers.Over the years, its products, have been consistently recognised by leading industryanalysts across categories. Its R&D team has grown to about 580 employees as ofFY22 and has been consistently working on strengthening capabilities on itsplatform. The company now has 23 patent grants across India and US out of 43patents filed so far.The company also did small acquisition of ‘Number Theory’ in FY22 for the totalconsideration of 14 crore ( 7.03 crore upfront payment and rest would be paid overthe next 3 years equally. The acquisition is expected to further strengthen Newgen’splatform with AI/ML (artificial intelligence and machine learning) modelling and dataanalytics capabilities. Number Theory is expected to bring domain expertise, alongwith a powerful engine to extract actionable insights in real time. The platformimproves productivity, enhances collaboration, and speeds up AI project executionto accelerate the data to insights journeyICICI Securities Retail Research14

ICICI Direct ResearchStock Tales Newgen Software TechnologiesExhibit 41: Key patents grantedSource: Nasscom, ICICI Direct ResearchExhibit 42: Skilled R&D team of 580 people as on 2,5009.810.29.02,0008.01,5001,000500Exhibit 43: R&D investments now at 10.2% of r of employees (nos)Source: Company, ICICI Direct ResearchICICI Securities Retail ResearchFY20FY21R&D employees (nos)FY22FY18FY19FY20FY21FY22R&D investments as % of revenuesSource: Company, ICICI Direct Research15

ICICI Direct ResearchStock Tales Newgen Software TechnologiesFinancial story in chartsExhibit 36: Revenues trend ( 015.8600661673FY18FY19FY20FY21Revenue ( enues to grow at 17.2% CAGR over FY2224E on the back of better growth from annuitybased revenue, license revenues5.0-FY22FY23E FY24EGrowth (%)Source: Company, ICICI Direct ResearchExhibit 37: EBITDA margin trend over the BITDA margins were elevated in FY21 because ofsavings in travelling expenses, some part of it wasnormalised in FY22, we expect largely similarmargins, which is also as per managementguidance5.0-EBITDA ( crore)FY23E FY24EEBITDA (%)Source: Company, ICICI Direct ResearchExhibit 38: PAT 72.9(28.8)51.350.0100.073.9188.7250.0-PAT expected to grow at 15.2% CAGR over thesame period15.620.0(20.0)(40.0)PAT ( crore)FY23E FY24Egrowth (%)Source: Company, ICICI Direct ResearchICICI Securities Retail Research16

ICICI Direct ResearchStock Tales Newgen Software TechnologiesExhibit 39: RoE & RoCE trend (%)30.025.022.218.520.015.010.05.0FY19FY20FY21RoCE (%)FY22FY23EFY24ERoE(%)Source: Company, ICICI Direct ResearchKey risks and concernsGSI opportunity does not materialise as per expectationNewgen is looking to tap Global system integrators (GSI) like TCS, Infosys, Wipro,HCL Tech for the next stage of growth. The GSI funnel has increased from 40 casesin FY21 to 70-80 cas

time, the Indian technology industry is expected to reach US 350 bn by FY26 i.e. 11% CAGR over FY22-26E. Subsequently, the software products pie is expected to reach 8.6% in FY26 from 5.8% in FY22. Exhibit 1: Indian IT industry at US 227 bn in FY22 Source: Nasscom, ICICI Direct Research 6.00 Exhibit 2: Software products forms 5.8% of pie