Transcription

DERIVATIVESA Bloomberg Professional Service OfferingBLOOMBERGDERIVATIVESLIBRARYDLIB GO

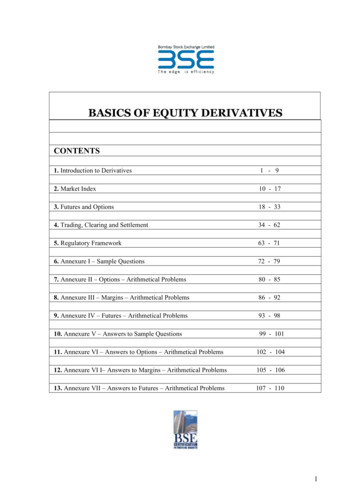

CONTENTS02 BLOOMBERG DERIVATIVES LIBRARY OVERVIEW03 STRUCTURING05 LIFE CYCLE07 PRICING08 CALIBRATION10 RISK & SCENARIO ANALYSIS11 PORTFOLIOS12 API & EXCEL12 INTEGRATION

BLOOMBERGDERIVATIVESLIBRARY OVERVIEWThe Derivatives Library, DLIB GO , is a comprehensive platform to structure, price and risk managederivatives, structured products and dynamic strategies. It has unlimited coverage from the vanilla to themost complex structures. It is not only aimed at the sellers and buyers of structured notes, but also riskmanagers, valuation and treasury groups who need to have an independent sophisticated tool capableof structuring, pricing and risk management of all deals.Part of our Bloomberg Anywhere, the Derivatives PricingLibrary offers cross-asset coverage using both pricing screens(Templates) and a simple yet powerful scripting language(BLAN). DLIB deals can be shared and sent to any of theBloomberg Professional service users.It offers term sheet generation from templates, dual curve andOIS discounting for pricing. Life cycle management with audittrail is also available along with calibration and risk analytics.Users can perform cash flow analysis, scenario analysis andstress testing.Market standard quant models have been integrated into itsMonte Carlo engine. DLIB offers transparency from marketdata to calibration as well as flexibility in overriding modelparameters.DLIB is seamlessly integrated with BPS Data and solutionssuch as Desktop and Server API, Excel, our Multi AssetRisk System MARS GO and BVPM GO our portfoliofunctions that is part of our independent valuation services.Example of BLAN (Bloomberg Language) scriptingFEATURES & BENEFITSCutting-edge Technology» Technology to build pricing templates fast» Flexibility in contract creation using our simplified scriptinglanguage, BLAN» Customized Trade sheet generation from templates» Pricing outputs such as implied probabilities and projectedcash flowsEfficient & Transparent Work Flow» Transparency with regards to market data, calibrationand pricing» Minimal operational risk, leveraging life-cycleautomatic generation» Two-way integration with client data and pricing modelsIntegration with Bloomberg Platforms» Seamless integration with BPS market Data andmarket conventions» Integration with Desktop and Server API, Excel, Multi AssetRisk System MARS GO and Independent Valuationservices for portfolio management BVPM GO » Distribution of Trades and ideas on Bloomberg platformDERIVATIVES // 02

STRUCTURINGWe build a range of templates for our customers that offer maximum coverage thanks to our easy to use generic payoffcomponent. Easy to use templates can be delivered to our customers fast to accompany the growth of their business.Example of a Capital Protected TemplateThanks to our easy to usesimplified scripting language(BLAN), our customers canhave the full flexibility for ideageneration and structuring.Example of BLAN (Bloomberg Language) scriptingDERIVATIVES // 03

STRUCTURINGDLIB platform can alsobe used for two-waycustomisation of deal aspart of the trading process.Clients can incorporatetheir own market data, aswell as underlying models,and use DLIB platform asa trade distribution, sharingmechanism incorporated inthe workflow.Trade sheets can be generatedfor idea generation and furthercommunication with clients.Trade Sheet generated by DLIBDERIVATIVES // 04

LIFE CYCLEBloomberg L.P. generates life cycle events from trade descriptions (Templates and BLAN scripts). Life cycle information thatis generated on the fly is extremely useful to minimise operational risk and time to model trades in DLIB since it helps checkingsome details related to the economics of the trade.We display payment dates,currency, and amount whenknown or formula whereunknown. Finally, we confirmwhether the payment iscertain or not, as well asprobabilities of event. Apayment for instance thatis conditional on a userexercising a Bermudanoption is uncertain.Lifecycle CashflowsWhen appropriate, payoffformula can be generatedfor more transparency andquality assurance in relationto trade economics.Future Lifecycle of Formulaic CashflowsDERIVATIVES // 05

LIFE CYCLEPast fixings are displayed andcan be further customized.Audit trail for life cycle eventsat trade is also provided.Fixings and Corporate ActionsCorporate actions arehandled automatically.Corporate ActionsDERIVATIVES // 06

PRICINGDLIB provide its users with many quantitative models used by the industry such as Black & Scholes, Local volatility, Heston,Hull & White 1&2 Factors and LMM with displaced diffusion. Over time, DLIB team will continue to add more models andasset classes.DLIB is fully integratedwith market data. Firms canupload and distribute theirown market data on BPS totheir privileged clients as wellas their staff. This data flowthrough the DLIB platformseamlessly. Users can priceintra-day or using customdata or snapshots.DLIB provides also variousmethods to computecorrelation used in its models.Correlation — Rolling WindowsIn addition to prices and pastrealised cash flows, DLIBprovide additional outputsand projected cash flows tohelp users understand andanalyse the prices of theirdeals. BLAN offer very simpleway to customise theseprojections. For instance,one could have access tothe implied probabilities ofearly redemption, spot abovebarriers etc.Projected CashflowsDERIVATIVES // 07

CALIBRATIONDLIB provides transparency around calibration errors in relation to input data and to the market quotes. Model parameters aredisplayed and can be overridden.CalibrationUsers can customise thelist of market instruments towhich the model is calibrated.Calibration InstrumentsDERIVATIVES // 08

CALIBRATIONCONTINUEDFinally, users can overridemodel parameters.As an idea generation tool,DLIB can solve for specifictrade parameters, such asstrike, or funding level.Model ParametersDERIVATIVES // 09

RISK & SCENARIOANALYSISIn addition to the Greeks provided by DLIB, users can shift market data such as spot and vols for equity and FX as well asrate curves and analyse the impact on price and Greeks.Scenario Analysis — Risk EvaluationUsers can build customStress Scenario usingSHOC GO and then applythem seamlessly on any deal.Bloomberg Stress testingScenarios are also available.Firms can make their ownregulatory Stress Scenariosavailable to be applied witha click on any deal.Scenario Analysis and Stress TestingDERIVATIVES // 10

PORTFOLIOSWhether deals are templates or scripted BLAN deals, users can add them into our Multi Asset Risk System.DLIB is integrated withour independent valuationservice, BVAL Derivativesand users can send dealsto our financial engineers.MARS Multi Asset Risk SystemDERIVATIVES // 11

API & EXCELDLIB is integrated with the Bloomberg Desktop and Server API supported on main platforms and programming Languages asshown on WAPI GO . A suite of simple functions is provided via the Bloomberg Excel Add-In is provided consistently withthe API and the terminal.Fully and Easily Integrated into APIINTEGRATIONUser can integrate DLIB within their work flow and systems both from a desktop and enterprise perspective. Users canleverage DLIB to integrate various components such as trade details, life cycle information, pricing and risk numbersincluding projected cash flows etc.Additionally, we offer to the sell side third party quant libraries to integrate into DLIB platform allowing for instance thebuy side clients to access the sell side proprietary quant models to get indicative and firm trading prices.Portfolio view of DLIB deals in BVAL DerivativesDERIVATIVES // 12

ABOUT THEBLOOMBERGPROFESSIONALSERVICEThe founding vision in 1982 was to create an informationservices, news and media company that provides businessand financial professionals with the tools and data they needon a single, all-inclusive platform. The success of Bloombergis due to the constant innovation of our products, unrivalleddedication to customer service and the unique way in whichwe constantly adapt to an ever-changing marketplace. TheBloomberg Professional service is a powerful and flexibletool for financial professionals–whatever their needs–incash and derivatives markets as diverse as equities,currencies, commodities, money markets, government andmunicipal securities, mortgages, indices, insurance and legalinformation. The Bloomberg Professional service seamlesslyintegrates the very best in real-time data, news and analytics.In addition, Bloomberg users benefit from on-demandmultimedia content, extensive electronic trading capabilitiesand a superior communications platform. Bloombergcustomers include influential decision makers in finance,business and government. Business and financialprofessionals recognize the Bloomberg Professional serviceas the definitive tool for achieving their goals because it offersunparalleled assistance and functionality on a single platformfor a single price.DERIVATIVES // 13

//////////To get more information about Derivatives Library DLIB GO ,please contact your Bloomberg ///////////////////////// BEIJING 86 10 6649 7500FRANKFURT 49 69 9204 1210LONDON 44 20 7330 7500NEW YORK 1 212 318 2000SÃO PAULO 55 11 3048 4500SYDNEY 61 2 9777 8600DUBAI 971 4 364 1000HONG KONG 852 2977 6000MUMBAI 91 22 6120 3600SAN FRANCISCO 1 415 912 2960SINGAPORE 65 6212 1000TOKYO 81 3 3201 8900bloomberg.comThe data included in these materials are for illustrative purposes only. 2014 Bloomberg L.P. All rights reserved. 57542232 DIG 0414

Bloomberg Professional service is a powerful and flexible tool for financial professionals–whatever their needs–in cash and derivatives markets as diverse as equities, currencies, commodities, money markets, government and municipal securities, mortgages, indices, insurance and legal information. The Bloomberg Professional service seamlessly