Transcription

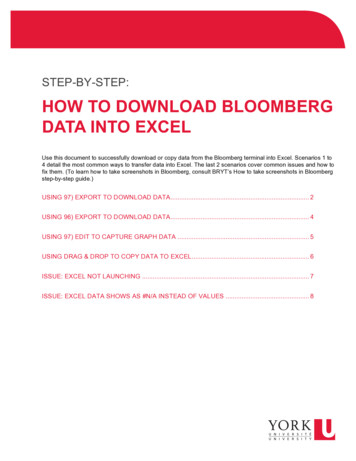

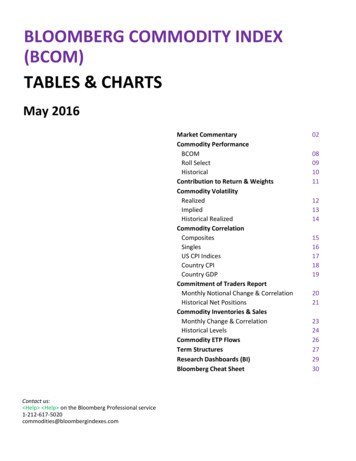

BLOOMBERG COMMODITY INDEX(BCOM)TABLES & CHARTSMay 2016Market CommentaryCommodity PerformanceBCOMRoll SelectHistoricalContribution to Return & WeightsCommodity VolatilityRealizedImpliedHistorical RealizedCommodity CorrelationCompositesSinglesUS CPI IndicesCountry CPICountry GDPCommitment of Traders ReportMonthly Notional Change & CorrelationHistorical Net PositionsCommodity Inventories & SalesMonthly Change & CorrelationHistorical LevelsCommodity ETP FlowsTerm StructuresResearch Dashboards (BI)Bloomberg Cheat SheetContact us: Help Help on the Bloomberg Professional com020809101112131415161718192021232426272930

Energy (34.3 % of BCOM; May performance 3.08%)Oil had the longest run of monthly gains in five years - rising for four consecutive months - as militant attacks cut Nigerian supply tothe lowest level in more than two decades while Canadian output fell amid wildfires, reducing supply. Oil has surged more than 87%since slumping to a 12-year low in February on signs the worldwide surplus is easing amid declining production.With intraday prices reaching 50 a barrel, a long-anticipated barrier, the question for the oil industry is what comes next? It maytake a rise to at least the mid- 50s with signs the rally has staying power before oil explorers start feeling secure again. The world’s50 biggest publicly traded oil companies need an average price of 53 a barrel to stop bleeding cash, according to industryconsultant Wood Mackenzie. For U.S. shale producers, oil may need to rise into the mid- 50s before drillers respond with asignificant ramp-up in well completions, Bloomberg Intelligence analysts said. After shaving billions of dollars off capital budgets thisyear, those companies have a backlog of thousands of wells that have been partially completed but not yet tapped.Low crude prices may finally be taking their toll on U.S. production. For the first four months of the year, U.S. output has fallenalmost 5%. The latest Department of Energy figures show output at 8.8 million barrels a day compared with 9.2 million at thebeginning of January. Saudi Arabia and Russia meanwhile have managed to keep output relatively unchanged.Senior people in the industry including Patrick Pouyanne, chief executive officer of French giant Total SA, and Fatih Birol, theexecutive director of the International Energy Agency, have warned repeatedly that investment cuts triggered by the current slumpcould lead to a production shortfall in the future. Wood Mackenzie estimated that explorers have canceled or delayed investmentsworth nearly 400 billion since prices started their slide in late 2014. Price movements don’t suggest investors are heeding thesecalls though as the market is still pricing the "lower-for-longer" mantra. While front-month futures for WTI have risen 32% this year,the recovery looks very different if you focus on the longer term. The five-year-forward WTI contract is only up 4% over the sameperiod reflecting the view that shale oil production could rebound as prices recover, capping any rally.Oil discoveries have fallen to a six-decade low as explorers cut billions of dollars of spending to ride out the biggest market slump ina generation. About 12.1 billion barrels of oil reserves were found in 2015, marking a fifth consecutive year of decline and thesmallest volume since 1952, according to Rystad Energy. Still, global climate targets are likely to curb oil consumption, and,according to Morgan Stanley, citing the IEA's base-case scenario, the gap between demand and supply would remain “small” and forthe next two decades “further exploration is required but only modestly so”.The world’s biggest oil companies are borrowing record amounts of money to cope with a slump in crude prices. Exxon Mobil Corp.,Royal Dutch Shell Plc, Chevron Corp., Total SA, BP Plc and Eni SpA have together sold the equivalent of 37 billion of bonds this year,about double the amount issued in the period before oil prices plunged, according to data compiled by Bloomberg. While this isstretching their balance sheets and even resulting in credit-rating downgrades, the lowest debt costs in a year are softening the blow.2

Since the start of 2015, 130 North American oil and gas producers and service companies have filed for bankruptcy owing almost 44 billion, according to law firm Haynes & Boone. The tally doesn’t include Chaparral Energy Inc., Penn Virginia Corp. and LinnEnergy LLC, which filed for bankruptcy earlier this month owing more than 11 billion combined.Oil producers took advantage of the rebound in crude markets to lock in protection against another slump. They increased their betson falling prices to the highest level in 4 1/2 years. Speculators reduced bets on falling prices to the lowest level in 11 months.Money managers’ short position in U.S. benchmark crude reached the least since June, according to data from the CommodityFutures Trading Commission.Federally mandated ethanol blending is adding extra pressure to the U.S. refiners' profits. The worst crude oil downturn in ageneration, which at first helped profits, has now passed through to the fuel prices. Now, gasoline is cheaper than the ethanol thatrefiners have no choice but to use under the Renewable Fuel Standard program introduced in 2005 under the Energy Policy Act.Ethanol futures on the Chicago Board of Trade averaged 21.5 cents above gasoline contracts on the New York Mercantile Exchangein the quarter, compared with an average 48-cent discount in the same period during the previous five years.American motorists will consume a record amount of gasoline this year as growing employment and low prices spur demand.Consumption will top the previous record reached in 2007 before the Great Recession, according to the EIA. Gasoline demand willaverage 9.32 million barrels a day in 2016, up from 9.29 million barrels projected in April. Consumption is then forecast to slip 0.1%to 9.31 million barrels in 2017. Pump prices tumbled to the lowest level in seven years in February, and while they’re up from theirlows, they still trail the average for this time of year, encouraging vehicle use.U.S. natural gas futures capped the longest monthly winning streak in three years as forecasts showed hot weather making acomeback. The third straight monthly increase was gas’s best bullish run since the period from late 2013. Gas bulls are betting onhot weather to erode a stockpile surplus that’s the biggest since 2006 for this time of year. Without a scorching summer and adecline in gas production from shale formations, inventories will reach a record before the winter, capping price gains. Gas demandfor power plants has advanced 26% from this time last year, data from PointLogic Energy show. Drillers, however, are beatingproduction estimates as the price collapse forced them to become leaner, producing more fuel with the fewest rigs since at least the1980s. Improved drilling technology has made explorers more efficient, boosting output even as they reduce costs. While thenumber of rigs has fallen dramatically, producers are drilling several wells from the same site, cutting longer horizontal segmentsthrough shale rock to yield more gas.3

Grains (23.3% of BCOM; May performance 1.76%)Bad weather across South America is shrinking global supplies of soybeans, helping prices extend a rally to a 2-year high. Floodingdestroyed plants, hurt crop quality and delayed harvesting and impeded shipments in Argentina. Rains also hampered output inUruguay. Dry weather hurt production in Brazil, the world’s largest exporter of the oilseed. South African grain and oilseed pricessurged to records making the country a net buyer of the commodities after a drought damaged local harvests. The supply woes sentsoybean prices into a bull market last month. Hedge funds are expecting more gains, with their bets on a rally rising to the highestsince April 2014. The inventories provide a cushion though as they stand to be second-biggest ever even.China is so hungry for soybeans it has taken a major foray into expanding its control over supplies from Brazil, the world’s topexporter. A unit of China’s Shanghai Pengxin Group Co. bought a controlling stake in Brazil’s soybean trader and biodiesel makerFiagril Ltda for 286 million. The deal would be the first major Chinese acquisition of an agricultural company in Brazil. Almost 78%of Brazil’s soybean shipments went to the China in 2015.The best rally for corn prices in 10 months meant U.S. farmers were frantic to sell from the mountain of grain they’d been hoarding.Growers have been stockpiling supplies following a string of bumper harvests, waiting patiently for a rebound in prices. Their hopeshave finally been answered after dry weather threatened crops in Brazil, sending futures traded in Chicago to their highest in almosta year. South Africa, the continent’s biggest producer of corn, became a net importer of the grain for the first time since 2008 thisyear as the worst drought in more than a century hurt local output. South Africa last year had the least rainfall since records startedin 1904, damaging crops and raising prices. The nation imported 1.96 million metric tons of corn in the marketing year ended April29, that’s the most since 1993.Wheat supplies are forecast to remain ample next season. U.S. reserves will rise to 1.029 billion bushels by May 2017, while worldinventories at the end of the 2016-17 season are estimated to a reach an all-time high. The wheat harvest in Kansas will rebound 19%this year, according to findings from a crop tour organized by the Wheat Quality Council, meaning favorable weather in the largestU.S. grower of the grain will likely exacerbate a global glut. Showers in April revived crop prospects across the state and helpedfarmers avoid a developing drought, while above-normal temperatures warmed soil in February and March to prevent threeseparate freezes from damaging immature plants. Wheat prices are near the lowest since June 2010 after bumper harvests in theEuropean Union, Russia, Ukraine and India pushed global reserves to a five-year high.4

Industrial Metals (15.3% of BCOM; May performance -7.27%)For iron ore, if April was a party then May’s been the aftermath. Benchmark prices capped the biggest monthly loss since August2012 as a rally driven by a speculative frenzy in China reversed into a back-to-reality slump when the fervor faded. Ore with 62%content has lost 24% in May to unwind April’s 23% rally, when prices posted a third monthly gain. The raw material has collapsed 29%since peaking at more than 70 on April 21, and last week dipped below the 50 level. The commodity’s boom turned to a bust asregulators in China moved to prevent the frenzy from getting out of hand and signs emerged of increased supply, including higherport stockpiles. Steel-product prices have also retraced, denting iron ore demand.Metals slumped in May as Federal Reserve officials hinted at higher U.S. interest rates as soon as June, strengthening the dollar andmaking materials more expensive in other currencies. The U.S. currency was lifted to its highest level since March after Fed ChairJanet Yellen said that a rate increase may be in order in coming months. China’s central bank, meanwhile, cut the value of the yuanby the biggest monthly amount since August’s surprise devaluation. Money managers raised their bearish copper bets in the weekended May 24 by 38% to the most in four months, U.S. government data show.Renewable energy and China’s economic shift toward consumer-led growth will be major catalysts for a new wave of copperdemand that’ll accelerate a shortage forecast to develop from 2019, according to BHP Billiton Ltd., the world’s largest miningcompany. By 2040, the share of global electricity generated from renewable energy sources, including solar and wind, will double to46%; and renewable sources will account for two-thirds of an estimated 12.2 trillion of investment in energy over the next 25 years,Bloomberg New Energy forecasts. Wind, solar and hydro-electricity systems need as much as 12 times more copper than traditionalpower generation, according to the Copper Development Association. In China, power generation accounts for almost half of themetal’s usage.China, maker of about half the world’s aluminum, will export less in 2016 as output expands at the slowest pace in five years and aprice rebound fails to spur substantial smelter restarts, according to United Co. Rusal, the biggest producer outside the Asiancountry. The major part of idled capacity is still unprofitable at current levels. China’s aluminum production fell 2% in the first threemonths of the year, while overseas shipments shrank 10% through April, government data show. Demand will grow faster thanproduction this year in China, curbing overseas shipments as smelters find better prices at home, Rusal said. Domestic use alreadyincreased 6% in the first quarter on year, Standard Chartered Plc analysts show. In a sign of tighter supplies, inventories monitoredby the Shanghai Futures Exchange have tumbled about 12% since the middle of March.China is shipping in record volumes of nickel as demand for the metal used in stainless steel surges amid tight domestic supplies.Imports of refined nickel jumped 167% from a year earlier to an all-time high of 48,592 tons, while purchases of the lower-gradeferronickel expanded 43% to 107,161 tons, also the most ever. Demand is rising faster than expected in China and may tip the globalmarket into a shortage this year, pushing nickel toward 10,000 a ton by the end of 2016, according to Macquarie Group Ltd.Demand is set to exceed supply of industrial metals - led by zinc - after supply gluts and three years of declining prices deterredproduction, Glencore Plc said. Refined zinc production will trail consumption by 352,000 tons this year, the International Lead andZinc Study Group said in April,

31.05.2016 · Bloomberg Cheat Sheet. 30. Contact us: Help Help on the Bloomberg Professional service 1-212-617-5020 commodities@bloombergindexes.com . TABLES & CHARTS (BCOM) BLOOMBERG COMMODITY INDEX . Energy (34.3 % of BCOM; May performance 3.08%) Oil had the longest run of monthly gains in five years - rising for four consecutive months - as militant attacks cut