Transcription

Colleague Accounts ReceivableRegistration BillingUser GuideRelease 18September 2017

NoticesNotices 2016 - 2017 Ellucian.Contains confidential and proprietary information of Ellucian and its subsidiaries. Use of thesematerials is limited to Ellucian licensees, and is subject to the terms and conditions of one or morewritten license agreements between Ellucian and the licensee in question.In preparing and providing this publication, Ellucian is not rendering legal, accounting, or othersimilar professional services. Ellucian makes no claims that an institution's use of this publicationor the software for which it is provided will guarantee compliance with applicable federal or statelaws, rules, or regulations. Each organization should seek legal, accounting, and other similarprofessional services from competent providers of the organization's own choosing.Ellucian2003 Edmund Halley DriveReston, VA 20191United States of America 2017Ellucian. Confidential & Proprietary2

Revision MemoRevision MemoThis document reflect changes associated with AR Colleague Configurability Enhancements 2017-3(Software Update 017622-1805).DescriptionWhere to LookUpdated information about how the Invoice Date Batch Reg/Meal/Room Billing (BILL) form onfield is used.page 21 2017Ellucian. Confidential & Proprietary3

ContentsContentsRevision Memo.3Registration billing overview.5Course section records are grouped by billing period type. 5Course section records are grouped by billing period.5Correct registration rate table is determined. 6Tuition charges are calculated. 6Other registration charges are calculated.7Other section charges are calculated. 7Static charges are calculated.8Waived charges are calculated.8Total registration charges are calculated. 8Adds, drops, and withdrawals overview. 9Registration process period is determined. 9Add, drop, and withdrawal charges are calculated.10Static charges are calculated.10Registration refunds are calculated. 11Status of a student's registration billing is determined. 11Waivers overview.13Course sections are sorted for calculating waivers. 13Tuition and fees are waived or charged. 13Waivers are calculated based on a maximum number of courses.13Waivers are calculated based on a maximum number of course credits. 14Waivers are calculated based on a maximum tuition amount. 16Bill registration charges. 17Batch registration billing overview.19Batch bill student registration charges.19Batch Reg/Meal/Room Billing (BILL) form. 21Registration billing repair overview. 30Fix or reverse registration billing records. 31Fix or Reverse Reg AR Postings (FRAP) form.32Registration billing adjustments overview. 34Adjust registration charges. 35Section Billing Override (SCBO) form. 36 2017Ellucian. Confidential & Proprietary4

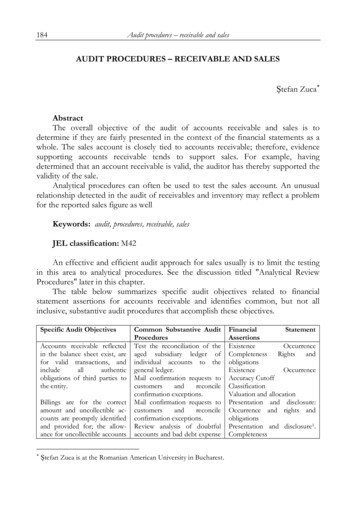

Registration billing overviewRegistration billing overviewRegistration billing overviewThis section provides an overview of Colleague’s registration billing process.The basic steps that Colleague takes to generate registration charges are listed below.1. Group together all the unbilled course section records for a student by the billing period typecode associated with each course section record and, within that code, by table-based orsection-based billing.2. For each group of records, group the course sections by billing period.3. Determine which registration rate table to use for each group of course sections.4. Calculate the tuition charges.5. Calculate other registration charges.6. Calculate section other charges.7. Calculate static charges.8. Calculate waived charges.9. Calculate the total registration charge.Course section records are grouped by billing period typeColleague groups together course section records by billing period type for billing purposes.Billing period type is a code that Colleague uses to group together course sections for billingpurposes and determine the date billing period that Colleague uses for course section enrollment.Term and Reporting Term are the billing period type codes that Colleague uses for registrationbilling.Course section records are grouped by billing periodColleague groups together course section records by billing period for billing purposes.After Colleague groups the unbilled course section records by billing period type, it groups therecords again by billing period. Colleague bases the billing period on either the term or the reportingterm defined for each course section. 2017Ellucian. Confidential & Proprietary5

Registration billing overviewCorrect registration rate table is determinedColleague determines which registration rate table to use for billing purposes.A registration rate table contains the billing information for a unique group of students. Eachregistration rate table is defined based on a general set of billing characteristics. For example, astate college or university may have the following registration rate tables: In-state undergraduates In-state graduates Out-of-state undergraduates Out-of-state graduatesThe billing characteristics define the general billing characteristics that form the basis of each ofthese registration rate tables.In this step of the calculation, Colleague classifies the student according to those characteristics,and then locates the registration rate table that matches the student’s particular billingcharacteristics. Colleague bases its classification of a student on information associated with eachcourse section the student registers for. For example, if a student registers for an undergraduatecourse section and a graduate course section, Colleague may calculate the student’s tuition fromtwo different registration rate tables.Tuition charges are calculatedColleague calculates tuition charges based on billing method.Before Colleague calculates tuition charges, it groups the course sections within a billing periodgroup by billing method code. The billing method code is associated with each course section andindicates whether Colleague uses a tuition rate table (billing method “T”) or the billing informationunique to that course section (billing method “S”) to calculate a student’s tuition charges.Calculating Tuition through a Tuition Rate TableThe Tuition Rate Tables (TRTB) form has two main sections: Policies & Defaults and TuitionCharges. The Policy & Defaults group is where you define the registration refund policies thatColleague uses for calculating refunds for charges generated from this tuition rate table. Theinformation in the Tuition Charges group defines how Colleague calculates tuition for each studentbilled by this tuition rate table.Calculating Tuition From Course Section Billing InformationIf each student who registers for a given course section is to be billed the same rate for that coursesection— regardless of their individual billing characteristics—then define specific tuition informationfor that course section. 2017Ellucian. Confidential & Proprietary6

Registration billing overviewOther registration charges are calculatedColleague calculates other types of charges related to registration.Other registration charges encompass all non-tuition charges and credits that are assessed when astudent registers for class. Examples of registration charges include health services fees, insurance,activities fees, and any fees associated with adding or dropping course sections or withdrawingfrom the institution. Colleague calculates these other registration charges from information in theregistration rate table and associated with individual course sections.Calculating registration term ratesRegistration term rates are charges that are assessed to all students in a given population onetime for each term for which they are registered. Examples of registration term rates include healthservices fee and activity fees.Colleague uses the Term Charges group on the Registration Term Rate Table (RTRT) form tocalculate the registration term charges for an individual.Calculating add, drop, or withdrawal chargesWhen a student’s course section information is changed through the registration process, Colleaguereevaluates the billing information for that course section and, if necessary, adjusts the charges thatit generates. If the change to the student’s course section information included adding, dropping, orwithdrawing from the course section during add/drop registration, Colleague creates a charge forthat add, drop, or withdrawal based on the optional AR add/drop/withdrawal policy associated withthe billing table used to generate the student’s charges. The policies that your institution defines willidentify charges for each type of transaction. Colleague uses your AR add/drop/withdrawal policywhenever a student adds, drops, or withdraws from a course.Other section charges are calculatedColleague calculates other course section-based charges.If any course section using section-based billing has other charges defined, Colleague calculatesthose charges at this point. For example, a section-billed course section may have additionalcharges associated with it such as special fees. You can define these using specific AR codes andbased on specific credit requirements.You can also override billing information associated with a section-billed course section for anindividual student. When you record any overrides, Colleague calculates the charges based onthese overrides at this time. 2017Ellucian. Confidential & Proprietary7

Registration billing overviewStatic charges are calculatedColleague calculates static charges.Static charges are charges that are assessed one time for each term. Static charges are similar toregistration term charges, but they differ in the manner in which they are refunded. Static chargesare never allocated over the sections for which the student has registered as term charges are,but are instead charged or refunded as an indivisible amount. As a result, unlike term charges,Colleague will never charge a static rate plus some forfeited amount of that same static rate.Colleague uses the Static Rate Table (STRT) form to calculate the static rate charges for anindividual.Waived charges are calculatedColleague calculates registration waived charges.A waiver policy may reduce the tuition and other registration charges assessed as part of theregistration billing process. If a student’s registration charges are subject to a waiver policy (if awaiver policy is entered in the registration rate table), Colleague calculates the amount that iswaived after computing the basic registration charges as described in the previous sections.Total registration charges are calculatedColleague calculates the total amount of registration charges.The last step that Colleague performs is to calculate a student’s total registration charge. In this stepColleague adds together the tuition charges, registration term charges, and static charges with anyadd/drop/withdrawal charges and deducts any tuition waivers. Colleague then posts these chargesto the student’s accounts receivable account.Colleague uses the rate tables and any custom subroutine defined on the Registration RateTables (RGRT) form to calculate the registration charges for an individual. 2017Ellucian. Confidential & Proprietary8

Adds, drops, and withdrawals overviewAdds, drops, and withdrawals overviewAdds, drops, and withdrawals overviewThis section explains billing for adds, drops, and withdrawals from classes.The basic steps that Colleague takes to process adds, drops, and withdrawals are listed below.1. Determine the registration process period.2. Calculate add, drop, and withdrawal charges.3. Calculate static charges.4. Calculate registration refunds.5. Determine the status of the student's registration billing.Registration process period is determinedBilling is processed differently during the pre-registration and registration periods compared to theadd and drop periods.Each course section is associated with a set of dates that determine the section’s registrationprocess periods. In each of these processing periods—pre-registration, registration, add, and drop—Colleague processes registration transactions differently. For the purpose of billing, it is importantto understand the distinction between pre-registration/ registration and add/drop.Note: Registration transactions refers to the processing of a student’s registration informationand includes registering, adding, deleting, or dropping a course section or withdrawing from theinstitution.Registration transactions recorded during the pre-registration/registration processing periodWhenever a student registers for a class, Colleague records the date, assigns a registration status,and tracks whether or not the student has been billed for the class. During pre-registration andregistration, Colleague assigns a default status of N for New. The default status and status date canbe overridden.Note: If the registration Update AR Immediately parameter is set to “Yes,” then the billingprocessing is run as soon as the registration transactions are recorded.If a student adds more courses during these same processing periods, Colleague adds additionalrecords in the same manner described above and generates additional registration charges for eachcourse section.If a student drops one or more courses from the schedule during these same processing periods,Colleague assigns a status of X for Deleted. Then, when the registration billing process is run, thestudent’s registration charges are recalculated, but the deleted courses are not factored into thecalculation. For example, a student initially registers for five course sections during the registrationprocessing period. When the registration billing is run, the student’s registration charges arebased on five course sections. Then if, also during the registration processing period, the studentdrops one of the courses and does not add a course, when the registration billing process is run, 2017Ellucian. Confidential & Proprietary9

Adds, drops, and withdrawals overviewColleague recalculates the student’s charges based on the four remaining course sections. Theamount of any charge related to a deleted class is always fully refunded.Registration transactions recorded during the add/drop processing periodIf a student adds course section during either the add or drop processing period, Colleague assignsthe section a status of A for Added. Each of these records are given a registration status of “A” andan AR posted status of “No.” When the registration billing process is run, Colleague recalculates thestudent’s registration charges based on all the unbilled courses.If a student drops one or more courses or completely withdraws from the institution during thesesame processing periods, Colleague Modifies the affected STUDENT.COURSE.SEC records. Changes the registration status to D if the course section was dropped or W if the studentwithdrew. Marks the course section as unfilled.When the registration billing process is run, Colleague recalculates the student’s registrationcharges based on all the unbilled courses. However, when Colleague encounters an unbilled coursesection with a registration status of D, it checks for a registration refund policy to determine if anyrefunds should be issued to the student.When Colleague encounters an unbilled course section with a W registration status, it looks for awithdrawal registration refund policy to determine if any refunds should be issued to the student.Add, drop, and withdrawal charges are calculatedColleague uses an add/drop/withdrawal policy to calculate registration charges and refunds.An AR add/drop/withdrawal policy identifies any additional charges that you assess whenever astudent adds or drops a course section or withdraws from the university.Static charges are calculatedColleague uses a static rate table to calculate static rate charges and refunds.A static rate table identifies any charges which apply to a student based on registrationcharacteristics. 2017Ellucian. Confidential & Proprietary10

Adds, drops, and withdrawals overviewRegistration refunds are calculatedColleague uses a refund policy to calculate registration refunds.A registration refund policy identifies the refund formulas used to define an amount or percentage ofa previously applied registration charge that you return to a student who has dropped one or morecourse sections. Registration refund policies apply to the following types of charges: Tuition charges calculated as either a table-based tuition or section-based tuition. Course section-specific fees established for a course section using table-based tuition billing. Other course section-specific charges. Registration term charges associated with a specific registration rate. Static rate charges associated with a specific static rate.When a student drops course sections or withdraws from your institution, Colleague finds thesource of each affected registration charge and identifies the registration refund policies associatedwith those charges. For example, to refund a tuition charge, Colleague locates the tuition dropor withdrawal registration refund policy from the tuition rate table that was used to calculate theregistration charge. After Colleague identifies the appropriate registration refund policy, it cancalculate the amount of the refund using the associated refund formulas.There are two key parts of the refund formula: the Days Before Start group and the Days Usedgroup. When a student drops a course section before the course started Colleague uses theinformation in the Days Before Start group to determine how much of a refund to apply.When a student drops a course section after the start of classes, Colleague determines the amountof a refund to apply based on the information in the Days After Start group. In this group, you definethe refund method either in terms of the number of days used or as a percentage used. Colleaguecalculates the amount used from the course section start date for the student and the date when thestudent dropped or withdrew from the course section.After Colleague determines the number of days or percent used, it reads the refund formula to findhow much of a refund to calculate.Colleague compares the number of days used to the number of days listed in the refund formula.When it finds a number in the refund formula that is greater than or equal to the number of days thestudent used, it uses the associated refund information to calculate the refund.Status of a student's registration billing is determinedColleague determines how a student's registration billing status affects adds, drops, and withdrawalfrom classes.When a student drops a course section or withdraws from the institution, the status of the billingprocess determines the way that Colleague posts the refund to the student’s account. If a studentdrops or withdraws before being billed for registration (before you have run registration billing),when you run registration billing Colleague computes tuition charges based on any course sections 2017Ellucian. Confidential & Proprietary11

Adds, drops, and withdrawals overviewfor which the student is still registered. If the student is not registered for any course sections, andthere are any fees involved with withdrawing, Colleague posts those fees to the student’s account.If a student drops/withdraws after you have run the billing process, Colleague: Generates an adjusting invoice that reverses the previous charge. Generates a new invoice that reflects the new amount due, which is calculated as the originalbalance less any refunded amount. 2017Ellucian. Confidential & Proprietary12

Waivers overviewWaivers overviewWaivers overviewThis section explains waived registration charges.The basic steps that Colleague takes to process waivers are listed below.1. Sort course sections for calculating waivers.2. Waive or charge tuition and fees.3. Calculate waivers based on a maximum number of courses.4. Calculate waivers based on a maximum number of course credits.5. Calculate waivers based on a maximum tuition amount.Course sections are sorted for calculating waiversColleague sorts course sections before waivers are calculated.Before Colleague can calculate the waiver for any group of course sections, it sorts the student’scourse sections in the order in which the student registered for each course section.Tuition and fees are waived or chargedColleague uses a waiver policy to waive or set a maximum for tuition and fees.You can define a waiver policy to either waive tuition and fees up to a set maximum or to chargetuition and fees up to a set maximum. The Waive or Charge field on the AR Waiver Policies(WAVP) form determines which method is used.Note: For Colleague to waive the tuition portion of any registration charge, the waiver policy mustinclude a tuition AR code.Waivers are calculated based on a maximum number ofcoursesColleague calculates waived registration charges based on a maximum number of courses in whicha student is enrolled.This section describes how Colleague computes the waiver for registration charges when the waiverpolicy is based on a maximum number of courses. The Max Number of Courses is defined on theAR Waiver Policies (WAVP) form. 2017Ellucian. Confidential & Proprietary13

Waivers overviewTuition chargesIf a tuition AR code is identified for the waiver policy and if the waiver policy is based on a maximumnumber of courses, then Colleague computes the tuition waiver as follows.After sorting the course sections, Colleague waives (charges) the tuition for each course sectionuntil the maximum number of course sections is reached. For example, if the waiver policy identifiesa maximum of five course sections, Colleague waives (charges) 100 percent of the tuition chargedfor the first five course sections that the student registered for. If the student registered for six ormore course sections, Colleague charges (waives) that student the tuition for the additional coursesection.Course-based fees and other chargesYou can waive miscellaneous and other charges associated with a specific course section which areeligible to be waived when all of the following conditions are true: The AR code representing the charge is listed in the waiver policy. The same AR code is in the student’s charges. The conditions set in the Max Number of Courses, Max Number of Credits, and Max Tuitionfields on the WAVP form have not been exceeded.When the above conditions are true, then Colleague computes the waived amount by multiplyingthe charge by the waiver percentage defined on the AR Waiver Policies (WAVP) form.Registration Term ChargesColleague waives registration term charges generated based on information set up on theRegistration Term Rate Tables (RTRT) form when the following conditions are true: The AR code representing the charge is listed in the waiver policy. The same AR code is in the student’s charges.Static Rate ChargesColleague waives static rate charges (generated based on information set up on the Static RateTables (STRT) form) when the following conditions are true: The AR code representing the charge is listed in the waiver policy. The same AR code is in the student’s charges.Waivers are calculated based on a maximum number ofcourse creditsColleague calculates waived registration charges based on a maximum number of credits in which astudent is enrolled.This section describes how Colleague computes the waiver for registration charges when the waiverpolicy is based on a maximum number of credits. The Max Number of Credits is defined on the ARWaiver Policies (WAVP) form. 2017Ellucian. Confidential & Proprietary14

Waivers overviewColleague determines which billing credits to use as follows:1. Override billing credits, if entered for the student.2. The default billing credits associated with the course section, if there are no overrides.3. The academic credits associated with the course section, if there are no default billing credits oroverrides.4. The CEUS associated with the course section, if there are no default billing credits, overrides, oracademic credits.Note: Each course section must have either academic credits or CEUs defined.TuitionIf a tuition AR code is identified for the waiver policy and if the waiver policy is based on a maximumnumber of credits, then Colleague computes the tuition waiver as follows. After sorting the coursesections, Colleague waives (charges) the tuition for each course section until the maximum numberof course credits is reached. For example, if a waiver policy identified a maximum of 15 coursecredits, then Colleague waives (charges) 100 percent of the tuition associated with each coursesection up to, but not in excess of, 15 billing credits.Course-based fees and other chargesColleague waives miscellaneous and other charges associated with a specific course section whenall of the following conditions are true: An AR code representing the charge is listed in the waiver policy. The same AR code is in the student’s charges. The Max Number of Courses, Max Number of Credits, and Max Tuition values defined on thewaiver policy are not exceeded.When the above conditions are true, Colleague waives the eligible course-based charges until themaximum number of course credits is reached.Registration term chargesRegistration term charges generated based on information set up on the Registration Term RateTables (RTRT) form are eligible to be waived when the following conditions are true: The AR code representing the charge is listed in the waiver policy. The same AR code is in the student’s charges.Static Rate ChargesColleague waives static rate charges (generated based on information set up on the Static RateTables (STRT) form when the following conditions are true: The AR code representing the charge is listed in the waiver policy. The same AR code is in the student’s charges. 2017Ellucian. Confidential & Proprietary15

Waivers overviewWaivers are calculated based on a maximum tuition amountColleague calculates waived registration charges based on a maximum amount of tuition charged.This section describes how Colleague computes the waiver for course-based registration chargeswhen the waiver policy is based on a maximum tuition amount. The Max Tuition is defined on theAR Waiver Policies (WAVP) form.TuitionIf a tuition AR code is identified for the waiver policy and if the waiver policy is based on a maximumtuition amount, then Colleague computes the tuition waiver as follows. After sorting the coursesections, Colleague waives (charges) the tuition for each course section until the maximum amountof tuition is reached. For example, if the employee waiver policy identified a tuition maximum of 2,500.00, Colleague would waive (charge) 100 percent of tuition charges until it has waived 2,500.00. The student is charged (waived) any tuition incurred in excess of 2,500.00.Course-based fees and other chargesMiscellaneous and other course-based charges associated with a specific course section arewaived when all of the following conditions are true: The AR code representing a course-based registration charge is listed in the waiver policy. The same AR code is in the student’s charges.Registration term chargesRegistration term charges generated based on information set up on

Billing period type is a code that Colleague uses to group together course sections for billing purposes and determine the date billing period that Colleague uses for course section enrollment. Term and Reporting Term are the billing period type codes that Colleague uses for registration billing. Course section records are grouped by billing period