Transcription

Communications Review / April 2015Insights for telecom, cable, satellite, and Internet executivesAre Wi-Fi and 4G LTE on acollision course?v.s.4GLTEWithout Wi-Fi, data services and content wouldn’t be consumed atthe levels they are today. Wi-Fi technology has moved from insecure,point access to full-featured, ‘carrier-grade’ network capabilitiesapproaching those of traditional mobile operators. As interoperabilitybetween Wi-Fi and LTE gains traction, the notion of mobility is beingredefined, and the lines between mobile operators and cable providersare blurring. The result is a need for participants across the mobileecosystem to rethink business strategies and operating models.www.pwc.com/communicationsreview

The emergence of carrier-grade Wi-Fi offers the industryan opportunity to differentiate this Wi-Fi service.The way Wi-Fi technology has grownover the last two decades is nothingshort of phenomenal. What began asa simple way to wirelessly networkisolated clusters of home or businessinfrastructure within a limited areahas become an essential componentof wireless communications.From the days of ‘warchalking’,1when users identified open Wi-Fiaccess points (a.k.a. hotspots), totoday’s active advertising of WiFi availability, consumers havegrown to expect a Wi-Fi signalnearly everywhere they go. Theyexpect not only ubiquitous but,frequently, also free Wi-Fi access.Once, considered a threat to networksecurity, enterprises often shunnedthe technology. But the needs ofworkforce mobility, cloud computingand virtual desktop applications havemade high-performance, secure Wi-Finetworks indispensable.Mobile devices have evolved ina similar manner. From cellularnetwork, voice-only devices,they have become multi-modesmartphones that support highdefinition streaming video, Voiceover IP, Internet browsing andinteractive gaming. The arrival ofWi-Fi capability in these devices alittle over a decade ago 2 heraldedthe age of explosive growth in dataconsumption – one where WiFi would complement the macrocellular network for connectivity andthroughput.Today, two trends in Wi-Fi technologyare setting a direct collision coursewith cellular technologies such asLTE. The first is the advent of ‘carrier-grade’ Wi-Fi. What has been untiltoday ‘best-effort’ Wi-Fi now has theattributes of cellular technology, suchas security, transparent registration,higher availability and improvedquality of service. The second is thedevelopment of interoperability.Cellular and Wi-Fi are now capable ofhanding over call and data sessionsseamlessly as well as authenticatingand automatically billing customers.The evolution of Wi-Fi technologyhas implications — strategic andoperational — across the industry,for both mobile and cable operators.Strategically, cable operators areusing Wi-Fi as a way to enter themobile space. Cablevision’s January2015 announcement of Freewheel,3a mobile-phone service based onWi-Fi, is one example of a cableoperator’s challenge to mobileoperators. Similarly, Comcast andLiberty Global formed a global Wi-Firoaming agreement 4 that’s akin toroaming agreements between mobileoperators.Such agreements likely will take abite out of mobile operators’ roamingrevenue streams. Mobile operators,though, are beginning to think aboutWi-Fi as more than just a tool foroffloading data traffic. T-MobileUSA’s Wi-Fi calling capability isan example of Wi-Fi going beyondoffloading data and extendingfarther into the full suite of mobilityservices. And, Sprint offers Wi-Ficalling from overseas locations as away to lure customers who incur highinternational roaming charges.5Operationally, the implications ofWi-Fi’s evolution include rethinkingAre Wi-Fi and 4G LTE on a collision course?both the commercial and thetechnical areas. On the commercialside, considerations include productsand services offered, pricing plans,the customer experience on Wi-Fi vs.cellular and strategy for supportingconsumers across multiple networks.On the technical side, elementsinclude coordinating the buildingof the Wi-Fi and cellular network,managing and operating thenetworks and developing an overalltechnology road map.Spectrum strategy is another areawith myriad implications. Evaluatingthe need for licensed spectrum isinfluenced by the increasingly strongcapabilities of Wi-Fi because of howmuch spectrum an operator willbuy as opposed to using techniquesfor offloading onto ‘free’ spectrum.Furthering the debate is the potentialuse of unlicensed Wi-Fi spectrum forLTE service, sometimes called LTE-Uor Licence Assisted Access (LAA).6The debate is pitting the Wi-Fistandards bodies against the cellularstandards bodies.Wi-Fi continues to pose one challengeto all those that deploy, manage andrely on it: how to make money on it.Other than pay-per-use models incaptive hospitality and transportationsettings, the willingness to payfor best-effort Wi-Fi has been lowbecause, perceiving its quality andreliability to be low, consumersexpect the service to be availablefor free. The emergence of carriergrade Wi-Fi offers the industry anopportunity to differentiate this Wi-Fiservice from its predecessor andclaim value for the improvementsit brings.Communications Review 1

In many respects, the relationship between Wi-Fi and cellularhas been symbiotic.Consuming mobile data —the cellular/Wi-Fi synergyGlobally, 46% of the total mobiledata traffic was offloaded ontoWi-Fi networks in 2014. Thatnumber is expected to rise to 54% forsmartphones and to 70% for tablets by2019 7 (see Figure 1).Figure 1: Projected moving of data traffic from cellular to Wi-Fi networks,2014-2019Cellular traffic vs. offload traffic, exabytes/month2014-201953.5To date, mobile operators havefollowed a ‘mobile first, Wi-Fi next’strategy in designing their networks:devices connect predominantly to anoperator’s network, with Wi-Fi usedto enhance capacity and coverage incongested and indoor locations suchas stadiums and shopping malls. Evenwith such a paradigm currently inplace, end users have adopted Wi-Fi asa high-bandwidth, lower-cost (oftenfree) alternative, leading to impressivelevels of use.In many respects, the relationshipbetween Wi-Fi and cellular hasbeen symbiotic. Without Wi-Fi, themobile industry likely wouldn’t haveexperienced such spectacular growthin data usage. On the contrary, theindustry might have been saddledwith enormous capital expendituresto keep up with the demand. Withoutcellular and in particular 4G LTE,consumers wouldn’t have an industryecosystem as rich as it is today withthe diversity of devices, almost allembedded with Wi-Fi capability. Andevidence 8 shows that where both4G and Wi-Fi access is good, trafficover networks increases. Use on onestimulates use on the other — creatingsynergy between the two and a betteroverall experience for the end user.With more than half of mobiledata consumed over Wi-Fi, it’s28.924.62.671.21.520142019Offload traffic from mobile devicesCellular traffic from mobile devicesNote: 1 exabyte 1000 6 bytes of 10 9 bytesimperative that mobile operatorssee the technology as more thanjust an option for offloading data.They need to include Wi-Fi as part oftheir network portfolio and considerWi-Fi in their continuum of serviceexperience.Mobile operators typically face seriouschallenges in deep indoor coverage.Their solutions reflect an increasedemphasis on heterogeneous networks,including pico, femto and microcells, as well as distributed antennasystems – all of which have a manageddeployment aspect to them. But WiFi technology has become a viablesolution to this coverage challenge.Are Wi-Fi and 4G LTE on a collision course?T-Mobile USA 9 has beendemonstrating the benefits of Wi-Ficalling by showcasing customers in thebasements of their homes making WiFi calls. To complement their existingservices, Verizon and AT&T plan tolaunch Wi-Fi calling in mid-2015.10Vodafone and EE in the UK plan tooffer voice services over Wi-Fi as wellin the summer of 2015.11Another example of a strategy notbased on offloading was Sprint’slaunch of Wi-Fi calling and messagingon two Android phones in 2013.12Operators are already recognising thatWi-Fi needs to be an integral part oftheir access strategy and architecture.Communications Review 2

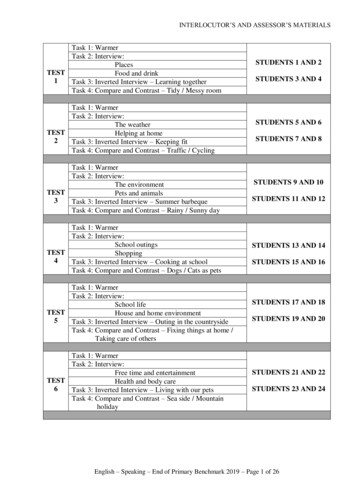

management capabilities (seeUnderstanding consumers— and the promise of carrier- Figure 2).grade Wi-FiOther than seeing less demand onIntroducing the globalstandards bodiesSeparate standards bodies defineand shape cellular and Wi-Fitechnologies. With carrier Wi-Fi,greater collaboration has resultedbetween the bodies.3GPP (3rd Generation PartnershipProject): Group dedicated to definingstandards and specifications forcellular radio-access networks suchas GSM, UMTS and LTE.IEEE (Institute of Electrical andElectronics Engineers): Definespecifications related to Wi-Fi accesstechnologies (e.g., 802.11 standard).WBA (Wireless BroadbandAlliance): Consortium of cableand mobile operators as well asinfrastructure vendors createdto deploy ubiquitous wirelessbroadband services through nextgeneration Wi-Fi.WFA (Wi-Fi Alliance): Nonprofitorganisation that certifies productsindicating they have met industryagreed standards for interoperability,security and other applicationspecific protocols.Legacy Wi-Fi generally isn’t trusted,is considered a best-effort accesstechnology, and lacks sufficientmethods to transport data trafficsecurely. Its access points typicallywere set up by end users in theirhomes, by Internet service providersas public hotspots, as a courtesyservice in certain venues or byenterprises for employees andvisitors. Carrier-grade Wi-Fi is a setof capabilities that improve on besteffort Wi-Fi with dramatically bettersecurity, authentication, availabilityand quality of service.The Wireless Broadband Alliance,one of Wi-Fi’s standards-settingbodies, has created a set ofrequirements that Wi-Fi networksneed to meet in order to be branded‘carrier-grade’. The standards requirea carrier Wi-Fi network to providethree core attributes: a consistentuser experience; a fully integrated,end-to-end network; and networktheir own networks, mobile operatorstoday have little insight into thetraffic that has been offloaded fromtheir network. They don’t knowabout users’ behaviour, the quality ofservice or other performance issuesof the offloaded traffic. As they vieto have more control over what usersexperience, carriers need to developa better understanding of Wi-Fi datatraffic by gaining more intelligenceabout how these networks perform.The introduction of carrier-gradeWi-Fi equipment capable of beingintegrated into mobile networkspromises increased visibility into theuser’s experience.As part of their natural technologylife-cycle process, mobile and cableoperators alike are implementingcarrier-grade technology as the nextgeneration of Wi-Fi technology.They’ll get security advantages aswell as help improve their users’experience.Figure 2: Wi-Fi features compared — best effort & carrier grade 13FeaturesCarrier-grade Wi-FiBest-effort Wi-FiDynamic networkdiscovery/ selectionAbility to discover and selectthe network and access pointLimited ability; user needs tobe proactive in discovering andselecting access pointAuthentication &securityStrong admission controlbased on authentication; canbe SIM or non-SIM basedAdmission control is localisedand often weakService experienceService experienceconfigurable by device or byuser and managed by operatorLimited service experiencecapability by individual/device;typically localised controlArchitectureCapabilities to allow multipleinterfaces, roaming - IPv6among othersMuch more localisedarchitecture and lessdistributed in nature; lessprescriptive in designEnd-to-end serviceprovisioningSubscriber provisioning andenforcementLocalised roaming withinexisting networkNetwork qualityHigh reliability and availability;dynamic load sharingAvailability and reliability notguaranteedNetwork securityStrong detecting andpreventing of intrusionLimited detecting of intrusionNetworkmanageabilityStandards-based provisioningof devicesLess management of thenetwork from a centralisedserviceAre Wi-Fi and 4G LTE on a collision course?Communications Review 3

Getting Wi-Fi ready forcarriersThe current surge in Wi-Fi activities isgeared towards making Wi-Fi carrierfriendly.Hotspot 2.0: A Wi-Fi Alliance(WFA) initiative that has accesspoints certified for Wi-Fi and thataims to allow seamless and secureauthentication at hotspots.NextGen Hotspot (NGH): Aninitiative closely linked to Hotspot2.0, run by Wireless BroadbandAlliance (WBA) and that aims fordeeper integration with cellularnetworks, such as transporting Wi-Fivia mobile core.Cable operators are leading thedeployment of carrier-grade Wi-Fiaccess points. In the US, an exampleis the effort of the Cable Wi-FiAlliance, a consortium of five cableoperators: Bright House, Cablevision,Comcast, Cox and Time WarnerCable. The consortium created anationwide Wi-Fi roaming networkconsisting of more than 6 millionaccess points, 300,000 of which aredeemed carrier grade.14 Around theworld, deploying carrier Wi-Fi isgaining traction (see Figures 3 and4). And the carrier Wi-Fi equipmentmarket is projected to be worthUS 3bn in revenue by 2018.15Figure 3: Growth of carrier-grade Wi-Fi hotspots, 2012-2018Depoyment of new carrier-grade Wi-Fi hotspots by mobile operatorsMillion, 2012-201810.59.66.5I-WLAN: Based on 3GPP; aims toconnect a device on Wi-Fi back intoan operator’s core network via a VPNtunnel.7.97.112.4%CAGR8.35.2Passpoint: Developed to allowautomatic authentication and accessto Wi-Fi networks.ANDSF (Access Network Discoveryand Selection Function): Developedby 3GPP; part of the new EvolvedPacket Core (EPC) specifications forcellular networks; lets mobile devicesdiscover and connect with Wi-Finetworks and enforce policy controls.Mobile operators are noticing theopportunity carrier-grade Wi-Fipresents and are beginning to makemoves to capitalise on it. The WirelessBroadband Alliance announced 16significant carrier-grade Wi-Fideployments, including multipleoperators from the US (Boingo,Towerstream, Time Warner Cable),Asia (KT, NTT DOCOMO, SKT,Telkom Indonesia), Europe (Orange),South America (Linktel) and theMiddle East (Mobily).2012201320142015201620172018Sources: SNL Kagan; PwC’s analysis.Figure 4: Deployment of carrier-grade Wi-Fi, 2014-2018Carrier grade Wi-Fi deployments as a % of total Wi-Fi deployments%72%EAP (Extensible AuthenticationProtocol): Developed to enhanceauthentication for Wi-Fi hotspots.14%20142018Sources: Survey — Commissioned by Amdocs and conducted by Real Wirelessand Rethink Technology Research, 2014Are Wi-Fi and 4G LTE on a collision course?Communications Review 4

The overall communications value chain will be affected — everyonefrom consumers to original manufacturers of infrastructure anddevices to network providers and content providers.Mapping a Wi-Fi strategyWith Wi-Fi connectivity beingwidely available, cable operatorshave been able to venture intomobile phone services. Cablevision’sannouncement of Freewheel, a lowcost phone service based entirelyon Wi-Fi, has opened the door to apossible future of cable-led mobileinitiatives. Comcast has been buildingits own Wi-Fi network aggressivelyby also relying on a crowd-sourcedapproach that turns customers’ Wi-Firouters into Xfinity access points.17As mobile phone use moves moretowards data services, a whole newset of players could be offering Wi-Fionly or Wi-Fi first mobile servicessoon.18On the mobile operator side, theability to initiate and pass a callor a data session back and forthbetween Wi-Fi and LTE is nowavailable commercially. Operatorslike T-Mobile USA19 have embracedthis technology. As mobile operatorsfinish rolling out Voice over LTE(VoLTE) on their networks, andestablish VoLTE interoperabilityacross networks,20 they likely willturn their attention to making wi-fiinteroperable.Figure 5: Operational implications of carrier-grade Wi-Fi for cableand mobile operatorsFor cable operatorsFor mobile operatorsCommercial offerings The possible need todeploy, and charge more for,Hotspot 2.0 devices and inhome routers The ability to get morebusiness from mobileoperators for wirelesscommunications The ability to use the Wi-Finetwork to provide additionalcoverage (potentially with adegree of monetisation anddifferentiation) Commercial agreementsand pricing for Hotspot 2.0accessCustomer experience The ability to offer anoutstanding experienceoutdoors, consistent with thespeeds provided indoors The ability to offera seamless mobilityexperience in high-trafficand indoor locations wherespeed and coverage havealways been a concernCare operations The need to respond to issues related to a completely differenttechnology and across disparate networks The need for a new set of technical skills and capabilitiesTechnical operations The need to plan andmanage a wireless footprintand manage cellularinteroperability Regulatory implications ofsupporting E911, call tracingetc. The need to integratefrequency planning onWi-Fi as well as cellularinfrastructure and,potentially, share spectrumthrough Licence AssistedAccess The need to managecall control over multiplenetworks for prepaidservicesTechnology road map Deploy technology thatallows handing off to cellular Deploy high-bandwidth Wi-Fiaccess technology, such as802.11ac Choose between cellulartechnologies and Wi-Fi Focus on technologies thatallow handing off seamlesslyto Wi-FiThe interoperability of carrier-gradeWi-Fi and cellular Wi-Fi serves onlyto further disrupt the industry statusquo with broadly ranging operationalimpacts and new capabilities. Theoverall communications value chainwill be affected – everyone fromconsumers to original manufacturersof infrastructure and devices tonetwork providers and contentproviders (see Figure 5).Are Wi-Fi and 4G LTE on a collision course?Communications Review 5

Moving towards the promiseMobile operators are facing athreat to their revenues as a resultof Wi-Fi becoming ubiquitous. Butwith carrier-grade Wi-Fi, they havean opportunity to close coverageproblems and give users a moremanaged experience. All operatorsshould establish a formal Wi-Fistrategy that explicitly incorporatesWi-Fi into their network road maps.The strategy should consider Wi-Fi tobe another network in their portfolio,complete with capital expendituresand operating expenditures managedby a full-fledged, operational WiFi department. Wi-Fi should playan important role in addressingcoverage problems, giving users abetter experience and managingbackhaul and core network expenses.LTE in the unlicensed bands(LTE-U) considers the use of cellulartechnology in the unlicensedspectrum that is today the mainstayfor Wi-Fi. As the 2.4GHz bandgets even more crowded, andwith the growing use of the 5GHzunlicensed band, there’s likely to bemore regulatory review of how theunlicensed bands are fairly used.Mobile operators should begin toanalyse the implications of suchspectrum use across technologies andwhat regulatory scrutiny of that useto expect.Wi-Fi providers - typically the cableoperators - should recognise thatcellular technology can complementtheir strategy to achieve truemobility. As the industry facesconsumers who want mobility ofcontent, the interoperability of WiFi and cellular becomes a criticalmechanism for breaking the tie tothe home cable box and to competingbetter with the growing number ofover-the-top video providers.With carrier-grade Wi-Fi, mobileand cable service providers have anopportunity to distinguish themselvesfrom the, so far, unmanaged Wi-Fiofferings that make no commitmenton security, availability or purposeof use. And, potentially, serviceproviders can charge a premium forcarrier-grade Wi-Fi, an offering thatwill appeal particularly to enterprisecustomers who demand a higher levelof security and availability.By wanting simplicity and flexibilitywhen they consume content how, when, where and what theyconsume - users are creating a clearopportunity ahead for both mobileand cable operators. Carrier-gradeWi-Fi and the interoperability of WiFi and LTE are giving operators theflexibility to deliver on the promiseof ubiquitous coverage: a seamless,great experience and value formoney.Carrier-grade Wi-Fi already is partof the mobile landscape, and itsimpact is increasing. The strategic,operational, technical and regulatoryissues associated with it meritoperators’ attention. As with anydisruptive technology, carrier-gradeWi-Fi holds both promise and threat.Have you formulated a strategy foryour company to follow in navigatinga course through this changingenvironment?Endnotes1 Definition of warchalking — source: html.2 Wi-Fi first in cellphones — source: http://www.theregister.co.uk/2004/10/22/wifi phones certified/.3 Cablevision announcement of Freewheel 26/1/2015 — source: http://cablevision.com/investor/index.jsp.4 Source: t-to-connect-u-sand-european-wi-fi-networks.5 Source: ernational-wi-fi-calls/.6 WFA’s position on LAA — source: lliance-statement-on-license-assisted-access-laa.7 Source: Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update 2014-2019.8 Source: 14/05/Wi-Fi-Offload-Paper.pdf.9 Source: tenders.html.10 Source: 11 Source: -11.12 Source: -to-improve-voice-coverage/.13 Sources: Wireless Broadband Alliance’s Carrier Wi-Fi Guidelines; PwC’s analysis.14 Sources: Comcast, Cox, Time Warner Cable, Bright House Networks, Cablevision, Verizon, FCC.15 Source: Infonetics Research, 2014.16 Source: gh-developments-anddeployments/.17 Xfinity Wi-Fi — source: http://wifi.comcast.com/hotspots.php.18 Source: hes-wi-fi-only-mobile-phone-service/2015-01-26.19 T-Mobile USA website/Wi-Fi calling — source: tenders.html.20 Verizon and AT&T to make VoLTE networks interoperable in 2015 (11/3/2014) — source: -interoperability.html.Are Wi-Fi and 4G LTE on a collision course?Communications Review 6

www.pwc.com/communicationsreviewAbout the authorsGreg ChiassonGreg Chiasson is a Principal in PwC US’sCommunications advisory practice.For more information, contact Gregby phone at 1 847 343 7076 orby email at greg.chiasson@us.pwc.com.Dan HaysDan Hays is a Principal in PwC US’sCommunications advisory practice.For more information, contact Danby phone at 1 202 756 1733 orby email at dan.hays@us.pwc.com.Harish NalinakshanHarish Nalinakshan is a Director in PwC US’sCommunications advisory practice.For more information, contact Harishby phone at 1 703 856 0470 orby email at harish.nalinakshan@us.pwc.com.Srinivas RangannaSrinivas Ranganna is a Senior Associate in PwC US’sCommunications advisory practice.For more information, contact Srinivasby phone at 1 214 754 4879 orby email at srinivas.ranganna@us.pwc.com. 2015 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, eachof which is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for generalinformation purposes only, and should not be used as a substitute for consultation with professional advisors.PwC helps organisations and individuals create the value they’re looking for. We’re a network of firms in 157 countrieswith more than 195,000 people who are committed to delivering quality in assurance, tax and advisory services.Find out more and tell us what matters to you by visiting us at www.pwc.com. MW-15-2119 LL

a mobile-phone service based on Wi-Fi, is one example of a cable operator's challenge to mobile operators. Similarly, Comcast and Liberty Global formed a global Wi-Fi roaming agreement4 that's akin to roaming agreements between mobile operators. Such agreements likely will take a bite out of mobile operators' roaming revenue streams.