Transcription

Tata Consultancy Services Ltd

BuyAxis Annual AnalysisMindtree LtdTarget Price16th Sep 2021IT Services4,600ANOTHER ROBUST YEAR; STRONG OUTLOOK(CMP as of Sep 15, 2021)Summary Deal wins for FY21 stood at 1,382 Mn with 270 active clients and 35 strong partnershipsand alliances, showcasing the highest ever growth of 12% YoY in the history of Mindtree. The company delivered superior Operating Margins on account of higher offshoring,CMP (Rs)4,115Upside /Downside (%)12%High/Low (Rs)4,160/1,219Market cap (Cr)67,812Avg. daily vol. (6m) Shrs.efficient utilization, lower attrition, and superior service mix. Mindtree continues to invest in employee addition to ramp up new deal wins won in theprevious quarter and adhere to project delivery timelines. In the long run, this will aid inNo. of shares (Cr) Financial Review: Revenue for FY21 stood at Rs 7,968 Cr, up 2.6% demonstratingstability even during the challenging times led by the COVID-19 pandemic. OperatingMargins, too, exhibited steady growth and expanded by 130bps to 25.9%. The growth wassupported by higher offshoring, higher utilization, lower attrition, and a favourable currencymix.369.90Shareholding (%)achieving sustainable growth.Key 1.061.0FIIs13.313.913.7MFs / UTI7.57.68.7Banks / FIs0.30.30.3Others17.917.116.3Financial & Valuations Operational Review: Mindtree has a strong and geographically diversified presence inY/E Mar (Rs bn)FY22EFY23EFY24ENet Sales9,75811,31912,890EBITDA1,9582,2922,611Net Profit1,4411,6812,114revenue, BFSI 18.2%, Retail CPG and Manufacturing contributed 13.3% each. During FY21,EPS (Rs)87.5102.1128.3the majority of the verticals and geographies exhibited strong and broad-based demand.PER (x)28.524.419.4EV/EBITDA (x)201714P/BV (x)976ROE (%)32%31%32%terms of revenue distribution. While the US and Europe contributed 76% and 16.2% of therevenue respectively, APAC contributed 7.2%. The HI tech & MediaI contributed 45% of the Strategies Implemented: (i) Focus on strategic clients to provide long-term sustainablegrowth (ii) Investment in research and innovations (iii) Expanding footprint (iv) Launch ofcloud platform and allied products. Key Competitive Strengths: (i) Robust 4x4x4 strategy to drive a broad-based growth overESG disclosure Score**the long-term (ii) Increasing investments by the HI-Tech vertical on automation, and (iii)Environmental Disclosure Score44Robust strategy of ‘Simplify, Differentiate, and Change’ to deliver agile integrated solutions.Social Disclosure Score65Governance Disclosure Score54Total ESG Disclosure Score51 Key growth drivers: (i) Robust demand for digital transformations and other services, (ii)Significant investment in automation in the next two years by the BFSI vertical, (iii) Robustdemand scenario across geographies, and (iv) Higher offshoring and strong volume growthto aid margin expansion.Source: Bloomberg, Scale: 0.1-100**Note: This score measures the amount of ESG data a companyreports publicly and does not measure the company's performanceon any data point. All scores are based on 2020 disclosuresRelative performanceOutlook & RecommendationThe management has guided double-digit growth in FY22 in the backdrop of robust deal wins.Additionally, higher offshoring, better utilization, and lower attrition are likely to expand OperatingMargins in the near term. We recommend a BUY rating on the stock and assign a 36x P/Emultiple to its FY24E earnings of Rs 128.3/share to arrive at a TP of Rs 4600/share,implying an upside of 12% from CMP.Key Financials (Consolidated)525MindtreeBSE Sensex42532522512525Jan-20(Rs Cr)FY21FY22EFY23EFY24ENet 611Net Profit1,1111,4411,6812,114EPS (Rs)67.487.5102.1128.3PER (x)37.028.524.419.4EV/EBITDA (x)24201714P/BV (x)11976ROE (%)30%32%31%32%Source: Company, Axis Research1May-20Aug-20Dec-20Source: Capitaline, Axis SecuritiesOmkar TanksaleResearch AnalystCall: 9819327371email: omkar.tanksale@axissecurities.inApr-21Aug-21

FY21 Performance Round-upMindtree Ltd – a part of the L&T group, is one of India’s leading IT services and specialized digital solutions providers based inBengaluru. It provides industry-wide solutions including next-gen services such as Cloud computing, digital transformations, IoT,and Machine learning, among others. The company also has expertise in providing solutions in HI-Tech, Manufacturing, Bankingand Financial Services. A few of the key highlights of FY21: FY21 proved to be a boon for IT services as it witnessed an unprecedented demand for the services such as DigitalTransformations, Machine Learning, IoT Analytics, and Embedded Services, to name a few. Capitalizing on the trend, thecompany continued to achieve sectoral growth through efficient execution and strong deal wins. FY21 Revenue for the company stood at Rs 7,967.8 Cr, delivering a growth of 2.6% YoY. The operating margins also exhibited asturdy growth and expanded by 670bps to 20.6%, aided by higher offshoring, higher utilization, lower attrition, and a favourablecurrency mix. Net profit stood at Rs 1,110 Cr and a net margin at 13.9%. Cash conversion continues to be very strong with a cashconversion ratio reaching 116.2%. Free cash flow stood at Rs 35,663 Cr, growing 21.8% over the prior year. The Board recommended a final dividend of Rs 15/share, bringing the total dividend for FY21 to Rs 38/share. Consistent with itsshareholder-friendly capital-allocation policy, the company has paid out Rs 33,873 Cr in dividends. The order book signed every quarter was higher than the corresponding quarter of the prior year. Mindtree closed the year with anall-time high TCV of 1,382 Mn for FY21. The company has also its highest number of active clients of 270 and 35 strongpartnerships and alliances for FY21.Segment-wise Performance Revenue by Vertical: Mindtree has a different vertical split as compared to its Indian peers which help it efficiently monitorindustry specific-risk better than its peers. The Hitech & Media ( 45.4% of revenue) remained a top contributor to the revenue,followed by the BFSI vertical (18% of the revenue), Travel & Hospitality (13% of the revenue), Retail CPG & Manufacturing (22%of revenue). All the verticals witness robust demand for digitalization and cloudification. Mindress’s deal wins for FY21 camemajorly broad-based and sees strong recovery after the COVID-19 outbreak.Exhibit 1: Revenue by vertical8.1%20.6%51.0%20.3%Hi- Tech & MediaBFSIRetail CPG & ManufacturingSource: Company, Axis Securities2Travel and Hospitality

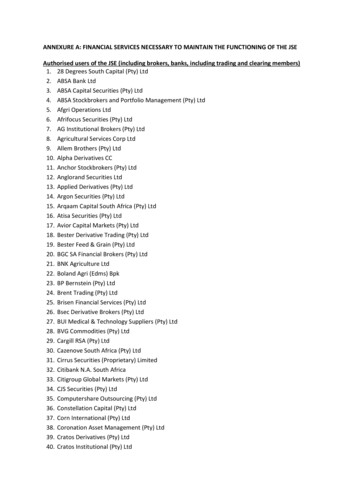

Revenue by Geography: Mindtree won deals across geographies leveraging healthy demand across the globe and therebyreduced market concentration risk. North America is still contributing the majority of the revenue (76.6% of the revenue, followedby Europe (16.2% of the revenue), and the APAC region ( 7.2% of the revenue). We believe recent deal wins are likely to furtherreduce concentration risk going ahead.Exhibit 2: Revenue by Geography3.8%4.1%13.0%79.0%AmericaContinental EuropeUK & IrelandAPAC & Middle EastSource: Company, Axis Securities Increasing client base: Mindtree won many deal wins during the year which will further strengthen its client bucket. B2B nature ofthe business increases the dependency of the client as loss of one client may materially hamper the company’s top line. However,adding to the client list helps Mindtree reduce this client-concentration risk to a large extent.Exhibit 3: Decreasing Client 02100240-2600 1 mnClientQ1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21Number of Active ClientsNew Clients AddedQ1 FY20Source: Company, Axis Securities3 5 mnClientQ2 FY20 10 mnClient 25 mnClientQ3 FY20 50 mnClientQ4 FY20 100 mnClientQ1 FY21

Key Operational ActivitiesUnprecedented demand The company demand was driven by the confluence of two big trends. First, with consumers preferring contactless and digitaltransactions, enterprises were forced to rely more on their digital channels, and in some cases, switch entirely to online-onlymodes, triggering a lot of investment. This was not just in front-end transformations and personalization of the customerexperience but also at the backend to simplify and digitize processes, reduce turnaround times for customer service requests, andenhance the end-to-end customer journey releasing huge demand for digitalization services. Second, the pandemic intensified the downsides of carrying technology debt and the need for greater resilience and agility withinenterprises. This resulted in several core transformation engagements around building a lean, secure, and adaptive digital core,encompassing operations, digital workplaces, applications, data, and the underlying infrastructure and cybersecurity. This decision triggered many engagements around cloud migration, application modernization, and data modernization. As aprecursor to the core transformation and cloud migration, many customers are revisiting their current operations to look foropportunities for optimization and to free up resources to support their core transformation.4

Research & Development ActivitiesMindtree Research and Innovation (R&I) With its purpose-driven worldview, R&I teams were engaged in 72 COVID-19 related initiatives around the world, working withlocal, national, and international bodies, adopting multiple approaches to aleviate the challenges created by the pandemic. It worked on leveraging Mindtree IP, collaborating with partners, and offering individual consultative inputs across many areassuch as drug candidate molecule discovery, COVID data management, diagnostic kits, epidemiological study, and management.Mindtree continues to expand its foundational research Expands in core computing areas and the intersections with other sciences. New areas of focus include DNA computing, AI forprotein design, cognitive robotics, metamaterials, quantum computing, and sensing. Research and Innovation teams worked with cross-functional teams across the Company on strategic initiatives such as Patents,Products & Platforms (3P), Technology Change Management, 5G, Cloud, and Cyber Security.The future course of actions Mindtree will continue to scale the Patents, Products, and Platforms strategy across the organization, harnessing the collectiveknowledge and creativity of internal teams and partners to deliver innovative solutions in support of the Company’s pursuit ofgrowth and transformation opportunity and longer-term sustainability goals.Research costs are expensed as incurred. Development costs are expensed as incurred unless technical and commercialfeasibility of the project is demonstrated, future economic benefits are probable, the Company has an intention and ability tocomplete and use or sell the software and the costs can be measured reliably.Mindtree has spent Rs. 33.8 Cr on research anddevelopment during the FY 2020-21 as against Rs 37.3 Cr for the FY 2019-20.5

Key Competitive Strengths Robust deal wins: Mindtree witnessed robust deal wins during FY21 which stood highest in the history at 1,382 Mn, a growth of17.1% YoY. Ramp-up on the deal wins will enable the company to achieve higher billing and deliver sustainable growth. Competent and dedicated human capital: Mindtree continues to invest in human resources to build strong capabilities to fulfil itsclient requirements. It has also invested in cloud transformations and other technologies to help the company fulfil its clients'demands on time and desired quality. Focus on strategic clients to provide long-term sustainable growth: Mindtree has specialized services in cloud computing,digitizations, and business analytics, among many others, and has leadership in Enterprise software, Consumer Software, andInnovation Services. The company’s experienced management team is sharply focused on increasing the wallet share of itsexisting clients. It continues to witness good traction from the top client in adopting collaboration tools, cloud, and digitization.Considering Top clients’ high IT spending momentum and concentration, the company aims to reduce concentration risk. Stabledelivery capabilities coupled with strong deal wins are expected to accelerate growth momentum in the forthcoming quarters.Diversified and strong presence across Geographies: Mindtree has a strong presence across geographies and across verticalswhich helps it reduce geographical dependency and limit the impact of any locational economic downturn on the overall business. Well-spread across multiple verticles: Mindtree considers industry verticals as its go-to-market business segments and has aunique vertical presence vis-à-vis its Indian peers. The four key vertical clusters are Banking, Financial Services, and Insurance(BFSI), Hi-Tech & Media, Retail CPG & Manufacturing, and Travel & Hospitality. Almost all the verticals witness strong recoveryand deal wins for cloudification of data. We believe that unprecedented demand will persist in the near term across verticals andgeographies well-balanced and spread between the verticals also help to reduce the dependence.6

Key Growth Drivers Robust demand for Digital Services will help to accelerate revenue generation: The company's Digital business revenue iscontinuously growing and ‘Digital’ continues to be an important part of Mindtree’s future growth strategy. Digital revenuecontribution to the total revenue has grown meaningfully from 14% in Q1FY17 to 42% in Q2FY21. The management foreseesstrong traction in digital transformation demand where customers are looking at a custom-built development on newer technology.It targets overall double-digit revenue growth for FY22E given healthy traction in the Digital business, especially in Healthcare andBFSI. The company’s strategy is to focus on IP-led offerings, digital transformation, software-based offerings, and large enterpriseaccounts for its future growth. BFSI vertical witnessing a strong demand for digital transformation through Cloudification: The BFSI sector is Mindtree’sone of the key verticals which contribute 18.2% to its revenues. It stands as the fastest-growing vertical having robust demandacross geographies. The global digital transformation in the BFSI market is expected to reach US 122 Bn by 2025. The microfactors that are driving the growth further are the increasing adoption of smartphones and smart devices, growing digital payments,the introduction of digital currencies, and the use of big data tools to analyze a large amount of financial data. The collaborationbetween the technologically advanced companies including Google, IBM, and Amazon and BFSI companies such as JPMorganChase & Co., BNP Paribas, and Wells Fargo & Co. is giving a new growth direction to this industry. Additionally, thesepartnerships and collaborations are helping in reducing operational costs in the overall value chain, thereby improving the profitmargin for the companies as well. Mindtree is well-placed globally to capitalise on these opportunities.7

Key Strategies Moving Forward Aligning closer to industries, service lines, and geographies: The guiding principles of Mindtree’s strategy continue to be theability to ‘Simplify’, ‘Differentiate’ and ‘Change’. The company’s 4x4x4 approach helps it build on its strengths, sharpen focus,create differentiated end-to-end solutions, and accelerate clients’ digital transformation journeys. We believe this strategy enablesthe company to effectively engage with clients and maximize opportunities for seamless cross-selling as well as upselling. Investment in research & innovations: Mindtree’s strategy is to invest in innovation and technologies that enable it to unlocklucrative opportunities across verticals and increase customer engagement as well. Cybersecurity and IoT are the two areas whereMindtree has strong orientations and is likely to invest in forthcoming years as well. Increase the Wallet share of the existing clients: The company’s experienced management team is sharply focused onincreasing the wallet share of its existing clients. While it continues to witness good traction from its top client in adoptingcollaboration tools, cloud, and digitization, the company is aiming to reduce concentration risk in light of the Top client’s high ITspending momentum and concentration in the company's overall revenues. Creating location-independent Agile, machine-first delivery model, and Intellectual Property: After the Covid -19 outbreakand global lockdown, accessing data from remote places and data integrity became a need of an hour. Creating locationindependent model help it to generate a sustainable model. Expanding footprints and reduce client dependency: Mindtree is keen on expanding its footprints across verticals. Thisexpansion will enable it to reduce client dependency and aid in generating more consistent revenue growth in the long run. Merger & acquisitions Mindtree has embarked on a targeted M&A program aligned to its 4x4x4 strategy. The company targetsacquisitions having access to new markets, new capabilities, domain expertise, or help the company achieve quick scale in thechosen geographies.8

Exhibit 4: Robust 4x4x4 strategy to capitalize DemandSource: Company, Axis SecuritiesMindtree management identified 4 sectors to focus namely BFSI, Retail CPG and Manufacturing, Communications Media & Technology,and Travel & Hospitality. The company is investing in newer technologies and skillsets and will develop expertise in the next-generationservices.Mindtree is likely to focus on the four service lines including Customer Success, Data & Intelligence, Enterprise IT, and Cloud services.The realignment is based on exhaustive discussions with clients and reflects both the current buying patterns as well as areas of emergingneeds for end-to-end digital transformation initiatives, creating a win-win situation for both Mindtree and clients.The company's geographical focus areas will be North America, UK & Ireland, APAC & Middle East, and Continental Europe. Mindtreegarner maximum revenue from these geographies and also has a strategy to penetrate these markets.9

Industry Outlook The global market for IT services continues to be a highly fragmented one with even the largest provider having a mid-single-digitmarket share. Mindtree is among the largest IT services providers globally with a market share of 1.6% and has significantlyoutperformed the market, growing at twice the rate of market growth over the last decade. This may be attributed to market sharegains resulting from Mindtree’s customer-centric strategy and organization structure, focused investments in building superiorcapabilities, better execution resulting in greater customer satisfaction, and steadily expanding participation in customers’ growthand transformation spends. Demand for services around remote connectivity, cybersecurity, collaboration tools, digitized processes, automation, and cloudadoption, progressively strengthened in the year and is expected to continue the growth trend. The pandemic is estimated to have caused a 3.3% contraction of the world output in CY21, with advanced economies contracting4.7%, and many sectors such as Travel, Hospitality, Transportation, Aerospace, Consumer Discretionary, and Small Enterprisesgetting impacted severely across the world. Consequently, global technology spend has declined 3.2% to about 1.4 Tn in 2020.Within this, IT services spending declined more to the tune of 3.9% decline while Business Process Management declined by2.4%. While the spending showed a decline on a full-year basis, technology was centre-stage in enterprises’ response to thepandemic-related lockdowns and thereafter. After the initial contraction due to dislocations, the need for business continuity,operational resilience, and the switch to digital transactions drove strong demand for IT services over the rest of the year and isexpected to increase further moving ahead.Exhibit 5: Surpassing Industry GrowthGlobl maarket ( In Bn)Mindtree ( In lobl maarket ( In Bn)Mindtree ( In Mn)Source: Company, Axis Securities102021

Company outlook & RecommendationWe believe Mindtree is likely to have better growth prospects in the near future either in terms of revenue growth or Operating Marginexpansion. The management has guided for double-digit growth in FY22 backed by robust deal wins. Higher offshoring, better utilization,and lower attrition are likely to result in Operating Margin expansions in the near term. We recommend a BUY rating on the stock andassign a 36x P/E multiple to its FY24E earnings of Rs 128.3/share to arrive at a TP of Rs 4,600/share, implying an upside of 12%from CMP.Exhibit 6: Mindtree 12M Fwd PE BandExhibit 7: Mindtree 1Y Fwd PE ChartMindtree 12M Fwd PE Band4000Mindtree 1Y Fwd PE 7Dec-16Aug-16030xMeanSource: Company, Axis Securities11Mean 1StdevMean-1StdevPE

Risks and Mitigation Disruption and uncertainty in business due to the Covid-19: Mindtree has Secure Borderless WorkSpaces (SBWS)infrastructure enabling its associates to seamlessly work from home and ensure business continuity. Digital communicationchannels and collaboration platforms are set up for them to stay connected with colleagues and customers. Remote workingpractices for managers and employees integrated into the Location Independent Agile delivery method to ensure effectiveness andproductivity. Restrictions on global mobility: Mindtree conducts ongoing monitoring of the global environment, working with advisors,partners, and governments. A material reduction in dependency on work visas through increased hiring of local talent includingfreshers, use of contractors, local mobility, and training in all major markets. Business Model Challenges: The company proactively invests in building scale and differentiated capabilities on emergingtechnologies through large-scale reskilling, external hiring, research and innovation, solution development, and IP asset creationleveraging deep contextual knowledge across a customer-specific domain, technologies and processes to mitigate the risk ofchanging business model. It is also developing capabilities in organization divestiture and integration planning to cater to Merger &Acquisition induced demand for advisory and business consolidation-related services. Currency volatility: Mindtree follows a currency hedging policy aligned with best market practices to limit the impact of exchangevolatility on receivables, forecasted revenue, and other current assets and liabilities. Hedging strategies are decided and monitoredby the Risk Management Committee of the Board which is convened regularly. Cyber-attacks Risks: Cyber attacks are forever a threat on account of their fast-evolving nature. The company invests inautomated prevention and detection solutions, including perimeter security controls with advanced tools, enhanced internalvulnerability detection, data leak prevention tools, defined and tested incident management and recovery process in compliancewith ISO 27001 standard to mitigate cyber risk. Non-compliance to complex and changing global regulations: The company has deployed a comprehensive globalcompliance management framework that enables tracking of changes to applicable laws and regulations across variousjurisdictions and functional areas and managing compliance obligations. This includes those laws and provisions specially enacteddirectly to cater to the pandemic impacts. Intellectual Property (IP) infringement and leakage: Employee confidentiality agreement, training, and awareness for IPprotection and prevention of IP contamination and infringement. Digitized system to enable strict controls around the movement ofpeople and information across TCS’s product teams and customer account teams.12

Progress on SustainabilityThe company has adopted an environmentally sustainable approach by creating green policies, processes, frameworks, andinfrastructure. Business Continuity plans are tested periodically to ensure effectiveness in the event of a disaster. Masscommunication infrastructure has been established to reach targeted set employees and was implemented effectively multipletimes last year driven by the pandemic and extreme weather conditions. Focus on carbon footprint reduction through energy efficiency, use of renewable energy, water management through rainwaterharvesting, recycling, and waste management. Centralized IoT-based Remote Energy Management System across TCS campuses, Roof Top Solar Power Plants in campuses.Driving supply chain sustainability through responsible sourcing. Year-round associate engagement on environmental awareness and sensitizing them towards nature and conservation ofresources.13

Financial Statement AnalsysisKey P&L 5%Better service mix and cost optimization result in margin expansionCost of services64627670394%Declining Cost of sales indicating better management of the operating costand better service mix.Gross Profits92,32297,1385%Operating lesCommentsSource: Company; Axis SecuritiesMindtree has a strong focus on managing its operating expenditure and delivering better operating efficiency with the rising scale. Duringthe year, it focused on higher offshoring thereby reducing the higher onsite cost. This resulted in higher revenue per employee. Betterutilization also helps them to generate higher billing and lower attrition help to reduce the training cost.Strong volume growth and better execution help to gain revenue growth momentum in the forthcoming years. We believe healthy deal winsand better execution will enable Mindtree to deliver double-digit revenue growth in the years FY22E and FY23E.Margins 7647,9683%Revenue growth aided mainly by deal winsCost of services5064.75113.21%Declining Cost of sales indicating better management of the operating costand better service mix.EBITDA1,0821,64352%Better service mix and cost optimization result in margin %Superior execution aids strong executionsPAT630.91110.576%Strong bottom line growth by better executionEPS386776%Source: Company; Axis SecuritiesThe management has also indicated to transform 95% of its employees to work-from-home by 2025. This will result in higher revenue peremployee moving forward. Better utilization also helps it to generate higher billing and lower attrition will help to reduce the training cost.14

Growth 0%59.20%34Better cost managementEBITDAM13.93%20.62%152High off-shoring helps the company in gaining operating margin expansionsPATM8.13%13.94%-27Better service mix and cost optimizationSource: Company; Axis SecuritiesTCS has shown a consistent performance in the year FY21Better deal wins and robust capabilities help TCS to deliver broad-based growth.Growth 167.4376%CommentsAccelerated demand for automation, favorablemacroeconomic environment, better costoptimization, favorable currency mixEfforts help Mindtree to deliver healthy andsustainable growthStrong bottomline growth by better executionSource: Company; Axis SecuritiesFinancial 209Superior execution leads to ROE expansionROCE38%63%2,529Efficient execution leads to ROCE expansionROA18%26%869Return on Invested capital29%48%1,882Higher investment in capital for ram-pup on new deal wins in futureMarginal decline in ROICSource: Company; Axis SecuritiesMindtree delivered robust return ratios by leveraging better execution, cost optimization measures, higher free cash flow generations, andhigher operating efficiency.We believe, with better deal wins, Mindtree has good revenue visibility in FY22E and will likely deliver encouraging return ratios in theforthcoming years.Key Balance Sheet TakeawaysParticularsFY20FY21ChangeShare on of reservesTotal Borrowings1801800%No change in borrowing help them to growFixed Assets340157-54%Working capital1713218928%Current Assets3,2554,22530%Current Liabilities1,324891-33%Cash & ong addition of Current assets indicates rising efficiencySource: Company; Axis Securities15

Mindtree continues to build a robust business structure by increasing its assets, better long-term investments in technologies. Rising currentassets indicate raising efficiency in the business. Thereby gaining the market share. Mindtree continues to be a debt-free and cash-richcompany. This coupled with a rise in scale and volume will accelerate its return ratios moving forward.Working Capital otal assets (x)2.031.73-15%Receivables Days68681%Better management of receivablesCash conversion cycle91943%Better management of cash conversionRising sales with efficiency aided by better service mixSource: Company; Axis SecuritiesMindtree has successfully managed its working capital to improve the operating business efficiency. The cash conversion cycle is reducingwhich implies better management of the working capital. Sales to Total Assets also increasing indicating increasing the price parity.16

Forex AnalysisMovements in currency exchange rates through the year resulted in a positive impact of 5.4% on the reported revenue. The constantcurrency revenue growth fo

Source: Company, Axis Securities 79.0% 13.0% 4.1% 3.8% America Continental Europe UK & Ireland APAC & Middle East-2 4 6 8 10 240 250 260 270 280 290 300 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Number of Active Clients New Clients Added 0 100 200 300 400 500 600 700 1 mn Client 5 mn Client 10 mn Client 25 mn Client 50 mn Client 100 mn .