Transcription

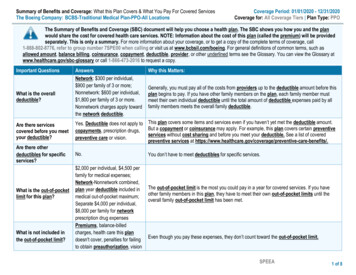

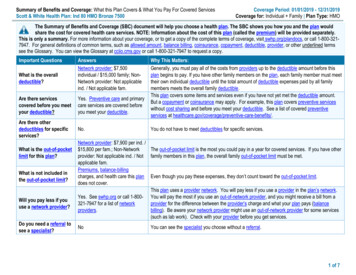

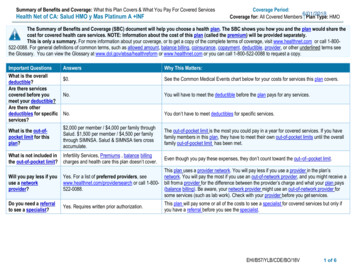

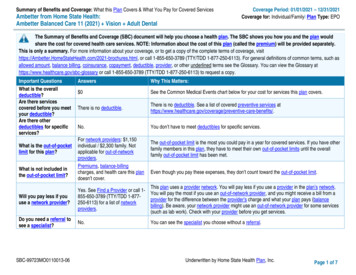

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered ServicesAmbetter from Home State Health:Ambetter Balanced Care 11 (2021) Vision Adult DentalCoverage Period: 01/01/2021 – 12/31/2021Coverage for: Individual/Family Plan Type: EPOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan wouldshare the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, chures.html, or call 1-855-650-3789 (TTY/TDD 1-877-250-6113). For general definitions of common terms, such asallowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary. You can view the Glossary athttps://www.healthcare.gov/sbc-glossary or call 1-855-650-3789 (TTY/TDD 1-877-250-6113) to request a copy.Important QuestionsWhat is the overalldeductible?Are there servicescovered before you meetyour deductible?Are there otherdeductibles for specificservices?What is the out-of-pocketlimit for this plan?What is not included inthe out-of-pocket limit?AnswersWhy This Matters: 0See the Common Medical Events chart below for your cost for services this plan covers.There is no deductible.There is no deductible. See a list of covered preventive services are-benefits/.No.You don’t have to meet deductibles for specific services.For network providers: 1,150individual / 2,300 family. Notapplicable for out-of-networkproviders.Premiums, balance-billingcharges, and health care this plandoesn’t cover.The out-of-pocket limit is the most you could pay in a year for covered services. If you have otherfamily members in this plan, they have to meet their own out-of-pocket limits until the overallfamily out-of-pocket limit has been met.Even though you pay these expenses, they don’t count toward the out-of-pocket limit.Will you pay less if youuse a network provider?Yes. See Find a Provider or call 1855-650-3789 (TTY/TDD 1-877250-6113) for a list of networkproviders.Do you need a referral tosee a specialist?This plan uses a provider network. You will pay less if you use a provider in the plan’s network.You will pay the most if you use an out-of-network provider, and you might receive a bill from aprovider for the difference between the provider’s charge and what your plan pays (balancebilling). Be aware, your network provider might use an out-of-network provider for some services(such as lab work). Check with your provider before you get services.No.You can see the specialist you choose without a referral.SBC-99723MO0110013-06Underwritten by Home State Health Plan, Inc.Page 1 of 7

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventIf you visit a healthcare provider’s officeor clinicIf you have a testIf you need drugs totreat your illness orconditionMore information aboutprescription drugcoverage is available atPreferred Drug List.If you have outpatientsurgeryIf you need immediatemedical attentionServices You May NeedPrimary care visit to treat aninjury or illnessSpecialist visitWhat You Will PayNetwork ProviderOut-of-Network Provider(You will pay the least)(You will pay the most)No chargeNot covered 5 Copay / visitNot coveredPreventive care/screening/immunizationNo chargeNot coveredDiagnostic test (x-ray, bloodwork)No charge for laboratoryoutpatient & professionalservices; 25%Not coveredCoinsurance for x-ray anddiagnostic imagingImaging (CT/PET scans, MRIs)25% CoinsuranceNot coveredGeneric drugs (Tier 1)Retail: No chargeNot coveredPreferred brand drugs (Tier 2)Retail: 25 Copay /prescriptionNot coveredNon-preferred brand drugs(Tier 3)Retail: 35% CoinsuranceNot coveredSpecialty drugs (Tier 4)Retail: 35% CoinsuranceNot coveredFacility fee (e.g., ambulatorysurgery center)25% CoinsuranceNot coveredPhysician/surgeon fees25% CoinsuranceNot coveredEmergency room care25% Coinsurance25% Coinsurance;deductible does not applyLimitations, Exceptions, & Other ImportantInformationVirtual Visits from Ambetter Health covered at 0, providers covered in full.----None---You may have to pay for services that aren’tpreventive. Ask your provider if the servicesneeded are preventive. Then check what yourplan will pay for.Prior authorization may be required. CoveredNo Limit. Failure to obtain prior authorizationfor any service that requires prior authorizationmay result in reduction of benefits. See yourpolicy for more details.Prior authorization may be required. CoveredNo Limit.Prescription drugs are provided up to 30 daysretail and up to 90 days through mail order.Mail orders are subject to 2.5x retail costsharing amount.Prior authorization may be required.Prescription drugs are provided up to 30 daysretail and up to 90 days through mail order.Mail orders are subject to 2.5x retail costsharing amount.Prior authorization may be required.Prescription drugs are provided up to 30 daysretail and up to 30 days through mail order.Prior authorization may be required. CoveredNo Limit.Prior authorization may be required. CoveredNo Limit.-----None-----*For more information about limitations and exceptions, see plan or policy document at ge 2 of 7

CommonMedical EventIf you have a hospitalstayIf you need mentalhealth, behavioralhealth, or substanceabuse servicesWhat You Will PayLimitations, Exceptions, & Other ImportantServices You May NeedNetwork ProviderOut-of-Network ProviderInformation(You will pay the least)(You will pay the most)Emergency medical25% Coinsurance;25% Coinsurance-----None----transportationdeductible does not applyUrgent care 10 Copay / visitNot covered-----None----Prior authorization may be required. CoveredFacility fee (e.g., hospital room) 25% CoinsuranceNot coveredNo Limit.Prior authorization may be required. CoveredPhysician/surgeon fees25% CoinsuranceNot coveredNo Limit.Prior authorization may be required. Note:Services (excluding emergency services)rendered by an out-of-network provider are notNo charge / Office Visits;covered under this plan, with the exception ofOutpatient services25% Coinsurance for allNot coveredtwo (2) sessions per year forother outpatient servicesdiagnosis/assessment by a licensed mentalhealth provider. (PCP and other practitionervisits do not require prior authorization).Prior authorization may be required. CoveredInpatient services25% CoinsuranceNot coveredNo Limit.Office visitsNo chargeNot coveredChildbirth/delivery professionalservices25% CoinsuranceNot coveredChildbirth/delivery facilityservices25% CoinsuranceNot coveredIf you are pregnantPrior authorization not required for deliverieswithin the standard timeframe per federalregulation, but may be required for otherservices. Cost-sharing does not apply forpreventive services, such as routine pre-nataland post-natal screenings. Depending on thetype of services, coinsurance, deductible orcopayment may apply. Maternity care mayinclude tests and services describedelsewhere in the SBC (i.e. ultrasound).Prior authorization may be required. Costsharing does not apply for preventive services.Depending on the type of services, copayment,coinsurance or deductible may apply.Maternity care may include tests and servicesdescribed elsewhere in the SBC (i.e.ultrasound).*For more information about limitations and exceptions, see plan or policy document at ge 3 of 7

CommonMedical EventWhat You Will PayNetwork ProviderOut-of-Network Provider(You will pay the least)(You will pay the most)Services You May NeedHome health care25% CoinsuranceNo charge / office visit forphysical and occupationaltherapy; 25%Not coveredCoinsurance for all otherservicesNo charge / office visit forphysical and occupationaltherapy; 25%Not coveredCoinsurance for otherservicesRehabilitation servicesIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careNot coveredHabilitation servicesSkilled nursing care25% CoinsuranceNot coveredDurable medical equipment25% CoinsuranceNot coveredHospice services25% CoinsuranceNot coveredChildren’s eye examChildren’s glassesChildren’s dental check-upNo chargeNo chargeNot coveredNot coveredNot coveredNot coveredLimitations, Exceptions, & Other ImportantInformationPrior authorization may be required. Limited to100 visits per year.Prior authorization may be required. Limited to20 visits per year per therapy (occupationaland physical therapy); no limit applies forspeech therapy or pulmonary therapy; limitedto 36 visits per year for cardiac therapy.Prior authorization may be required. Limited to20 visits per year per therapy (occupationaland physical therapy); no limit applies forspeech therapy or pulmonary therapy; limitedto 36 visits per year for cardiac therapy.Prior authorization may be required. Limited to150 days per year.Prior authorization may be required. CoveredNo Limit.Prior authorization may be required. CoveredNo Limit.Limited to 1 visit per year.Limited to 1 item per year.-----None-----Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Abortion (Except in cases of rape, incest, orwhen the life of the mother is endangered) Acupuncture Bariatric surgery Cosmetic surgery Long-term care Non-emergency care when traveling outside theU.S. Weight loss programs*For more information about limitations and exceptions, see plan or policy document at ge 4 of 7

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Chiropractic care (Limited to 26 visits per year.Visits in excess of 26 require prior authorization.) Dental care (Adult-visit & item limits apply peryear. 1,000 annual dollar limit per year.) Hearing aids (Limited to 1 item per ear per year.) Infertility treatment (Covered Services includediagnostic tests to find the cause of infertility andservices to treat the underlying medicalconditions that cause infertility.)Private-duty nursing (Limited to 82 visits peryear.) Routine eye care (Adult-visit & one item per year.Dollar limits apply.) Routine foot care (Coverage is limited to diabetescare only.)Page 5 of 7

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for thoseagencies is: Ambetter from Home State Health at 1-855-650-3789 (TTY/TDD 1-877-250-6113); Missouri Department of Insurance, PO Box 690, Jefferson City, MO65102-0690, Phone No. 1-573-751-4126. Other coverage options may be available to you too, including buying individual insurance coverage through the HealthInsurance Marketplace. For more information about the Marketplace, visit www.HealthCare.gov or call 1-800-318-2596.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called agrievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents alsoprovide complete information to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance,contact: Missouri Department of Insurance, PO Box 690, Jefferson City, MO 65102-0690, Phone No. 1-573-751-4126. Additionally, a consumer assistance programcan help you file your appeal. Contact 800-726-7390.Does this plan provide Minimum Essential Coverage? Yes.Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid,CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit.Does this plan meet Minimum Value Standards? Yes.If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services:Spanish (Español): Para obtener asistencia en Español, llame al 1-855-650-3789 (TTY/TDD 1-877-250-6113).Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-855-650-3789 (TTY/TDD 1-877-250-6113).Chinese (中文): � 1-855-650-3789 (TTY/TDD 1-877-250-6113).Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-855-650-3789 (TTY/TDD 1-877-250-6113).To see examples of how this plan might cover costs for a sample medical situation, see the next section.Page 6 of 7

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will bedifferent depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharingamounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion ofcosts you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Peg is Having a Baby(9 months of in-network pre-natal care and ahospital delivery) The plan’s overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance 0 525%25%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example CostIn this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay is 12,700 0 0 1,100 60 1,160Managing Joe’s Type 2 DiabetesMia’s Simple Fracture(a year of routine in-network care of a wellcontrolled condition) The plan’s overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance(in-network emergency room visit and follow upcare) 0 525%25%This EXAMPLE event includes services like:Primary care physician office visits (includingdisease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is The plan’s overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance 0 525%25%This EXAMPLE event includes services like:Emergency room care (including medicalsupplies)Diagnostic tests (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy) 5,600 0 300 200 20 520Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay isThe plan would be responsible for the other costs of these EXAMPLE covered services. 2,800 0 20 500 0 520Page 7 of 7

Statement of Non-DiscriminationAmbetter from Home State Health complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, nationalorigin, age, disability, or sex. Ambetter from Home State Health does not exclude people or treat them differently because of race, color, nationalorigin, age, disability, or sex.Ambetter from Home State Health: Provides free aids and services to people with disabilities to communicate effectively with us, such as: Qualified sign language interpretersWritten information in other formats (large print, audio, accessible electronic formats, other formats)Provides free language services to people whose primary language is not English, such as: Qualified interpretersInformation written in other languagesIf you need these services, contact Ambetter from Home State Health at 1-855-650-3789 (TTY: 711).If you believe that Ambetter from Home State Health has failed to provide these services or discriminated in another way on the basis of race,color, national origin, age, disability, or sex, you can file a grievance with: Grievance/Appeals Home State Health, 11720 Borman Drive, MarylandHeights, MO 63146, 1-855-650-3789 (TTY: 711), Fax, 1-855-805-9812. You can file a grievance by mail, fax, or email. If you need help filing agrievance, Ambetter from Home State Health is available to help you. You can also file a civil rights complaint with the U.S. Department of Healthand Human Services, Office for Civil Rights electronically through the Office for Civil Rights Complaint Portal, available athttps://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail or phone at: U.S. Department of Health and Human Services, 200 Independence AvenueSW., Room 509F, HHH Building, Washington, DC 20201, 1-800-368-1019, 800-537-7697 (TDD).Complaint forms are available at 0-MO-C-00189Ambetter from Home State Health is underwritten by Celtic Insurance Company. 2020 Home State Health Plan, Inc. All rights reserved.

Page 1 of 7 Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: 01/01/2021 - 12/31/2021 Ambetter from Home State Health: Coverage for: Individual/Family Plan Type: EPO Ambetter Balanced Care 11 (2021) Vision Adult Dental SBC-99723MO0110013-06 Underwritten by Home State Health Plan, Inc.