Transcription

Good practiceawareness guidelinesfor helping consumers withmental health conditions and debtMoney Advice Liaison GroupThird edition, 2015

2Money Advice Liaison GroupendorsementsAlastair CampbellStrategist and communications expert, Alastair Campbell is MindChampion of the Year and supports these Good Practice Guidelines.“One in four of us will directly experience mental illness in any oneyear. For many, those problems are exacerbated by financial problems,sometimes in part caused by these mental health conditions. It cannot beentirely coincidental that the word depression has an economic as wellas a health meaning. According to The Money Charity, personal debt inthe UK stands at 1,459 trillion. These updated Guidelines will providea clearer focus for all creditors, advisers and all professionals workingwith consumers who are experiencing mental health conditions wherethese conditions affect their ability to manage their money. They will goa considerable way to assisting all the relevant organisations to worktogether to ensure that both mental health and financial difficulties areidentified so appropriate support can be provided.”STEPHEN FRYComedian and writer Stephen Fry applauds the 3rd edition ofthe MALG Mental Health Good Practices Guidelines.“My own bipolar condition has caused me to go on many giddy spendingsprees so I have first hand experience of the difficulties of debt broughton by poor mental health. I fully support the work being undertaken bythe Money Advice Liaison Group in this complex and sensitive area andbelieve this has the potential to be a very beneficial resource for creditors,debt collection companies and advisers attempting to assist the individualsuffering serious mental health problems.”

Good Practice Awareness GuidelinescontentsForewordAnthony Sharp, Chair of the Money Advice Liaison Group4ForewordJoanna Elson, Chief Executive of the Money Advice Trust5Introduction6The Guidelines12113Treating consumers with mental health conditions fairly2 Staff training143Joined-up working154Data protection procedures165 Referral mechanisms196 Procedures when creditors outsource debts207How much evidence is needed228Time to collect evidence of mental health239Who should provide evidence2410How to deal with charging for evidence2611Using a common financial tool2712How to treat benefits when assessing disposable income2813When to consider ‘writing off’ debts3014Taking court action as a last resort31Appendices1A selected glossary of terms used when describing mental health conditions332Different types of health and social care professionals353Membership of the MALG Mental Health Working Party and Working Team364 Items tabled by the MALG Mental Health Working Party for further discussionand potential exploration5A list of mental health organisations that have endorsed these Guidelinestogether with the two financial sponsorsBibliographyA pdf version of these guidelines is available at www.malg.org.uk,www.moneyadvicetrust.org and www.rcpsych.ac.uk/debtPaper copies are available on request from the Secretary to MALG: info@malg.org.uk3738393

4Money Advice Liaison GroupforewordANTHONY SHARPChair of the Money Advice Liaison GroupThe Money Advice Liaison Group is delightedto publish this edition of the Good PracticeAwareness Guidelines for Helping Consumerswith Mental Health Conditions and Debt. The firstedition was published in 2007; the second in 2009.A Working Party of creditors, advisers andrepresentatives from consumer policy expertsand the Royal College of Psychiatrists has createdthe document. It has received the approval ofthe Information Commissioner’s Office and hasbeen shared with The Financial Conduct Authority(FCA). Although the Guidelines are voluntary, theyare acknowledged within the FCA’s ConsumerCredit Sourcebook (CONC) setting out its rulesand guidance for consumer credit.I wish to acknowledge the enormous support andassistance given by everyone working under theumbrella of the MALG Mental Health WorkingParty in producing this document. Last, but verymuch not least, the wholehearted support andadvice given by the Royal College of Psychiatristsat every stage has been invaluable.It is important to realise that this is not a newdocument but an updated version of an existingdocument. Its sole purpose is to assist creditors,local authorities, debt collection companies,enforcement agents, advisers and all peopleworking with individuals who are genuinely andparticularly experiencing mental health conditionsand debt, where their condition affects theirability to manage money.I commend these valuable Guidelines to you alland sincerely hope they will continue to improveunderstanding and communication amongstall parties involved with individuals who areexperiencing mental health conditions and debt.I would like to acknowledge the generosity ofdebt collection companies dlc and 1st Credit Ltdfor contributing towards the production costs ofthese updated Guidelines. MALG is very gratefulto both sponsors.

Good Practice Awareness Guidelinesforewordjoanna elsonChief Executive of the Money Advice TrustExperts indicate that one in four adults willexperience a mental health issue in any oneyear and that over 10 million people in the UKexperience some form of mental illness. It istherefore not surprising that a proportion ofthose in debt come from this group – in fact itwould be surprising if they didn’t.I was asked back in 2006 to take over as chairof the MALG Mental Health Working Party todevelop guidelines for creditors and the advicesector regarding debt and mental health, and weare now pleased to publish the 3rd edition, whichincludes updated guidance on the use of the Debtand Mental Health Evidence Form.It also includes information on the type of trainingthat is available and that should be undertaken byadvisers and creditors. Partnership is very much theapproach that works here; the Trust has partneredwith the Royal College of Psychiatrists, as wellas mental health charity Rethink Mental Illness,to develop training as part of our Wiseradviserprogramme for recovery staff, enabling them toapply the practical steps in the Guidelines.We are delighted that the Guidelines havebeen acknowledged in the Financial ConductAuthority’s Consumer Credit Sourcebook, aswell as in the Lending Codes of the LendingStandards Board and the Finance & LeasingAssociation, and that they are used in a practicalway across industry as part of best practice andtraining processes.I am indebted to the Working Party, drawn fromcreditors, the advice world and the mental healthprofession for their continued sterling work.5

Money Advice Liaison Groupintroduction6Florence Nightingale(1820-1910) heard voicesand experienced anumber of severedepressive episodesin her teens and early20s – symptomsconsistent with theonset of bipolar disorderCharles Darwin (1809-1882)experienced anxiety,panic attacks and mentaltorment that often lefthim in floods of tearsAdam Smith (1723-1790)began to suffer shakingfits while studying atOxford, now thoughtto be symptoms ofa nervous breakdown.

Good Practice Awareness Guidelines7INTRODUCTIONPurposeMALG is a non-policy making body and, as such,these Guidelines are voluntary. However theyare referred to in the Financial Conduct Authority(FCA)’s Consumer Credit Sourcebook1 and inindustry codes, reflecting their importance. Webelieve that the Guidelines indicate good practicein the treatment of consumers with mental healthconditions, particularly where that mental healthcondition affects the consumer’s ability to managemoney. We hope that they will result in a greaterawareness of the difficulties such people face.The Guidelines demonstrate good practice inthe management of debt when a consumerwith a mental health condition is in financialdifficulty. They cover: business procedures; stafftraining; collaboration between creditors, adviceagencies and health and social care professionals;outsourcing of debt collection; court action;writing off debts; taking account of disabilitybenefits in repayment plans; and the use of healthevidence and a common financial tool to showincome and expenditure.Mental health, financial difficultiesand debtThe extent and impact of mental healthconditionsBased on research conducted in 2007, onein four adults in England experiences at leastone diagnosable mental health condition inany one year2.The most common conditions are anxiety anddepression, which affect almost one in tenadults. Rarer mental health conditions suchas schizophrenia and bipolar condition occurin around one in every 100 people. Someconditions tend to affect particular social groupsdisproportionately – dementia, for example,affects 6% of people over 65, and 20% of thoseover 80. We should also note that consumers mayhave more than one mental health condition.Financial difficulty, debt, and mental health.This third edition of the Guidelines is a generalupdating of the document which includes:In these Guidelines, unless otherwise specified,the term ‘consumer’ is used to refer to aconsumer who is in debt. The financial difficulties3experienced by consumers with mental healthconditions can be caused by a range of factors,including: Changing the order of some Guidelines;Lack of money management skills Incorporating benefit and debt enforcementchanges Reliance on benefit income Fluctuations in income or an inability to work Applying the context of the new FCA regime Unmet housing, care or treatment needs Giving a clearer focus for creditors, advisersand all professionals working with consumerswith mental health conditions where thoseconditions affect their ability to manage money. Difficulties with communication Relationship breakdown Health problems affecting themselves or theirfamily, including terminal illness.1FCA CONC 7.2.32NHS Information Centre for health and social care, 2009 (Adult Psychiatric Morbidity in England - 2007,Results of a household survey). www.hscic.gov.uk/pubs/psychiatricmorbidity073See Life on the Edge, StepChange 2014, gereport.pdf

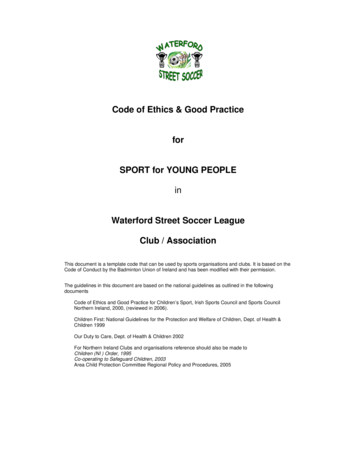

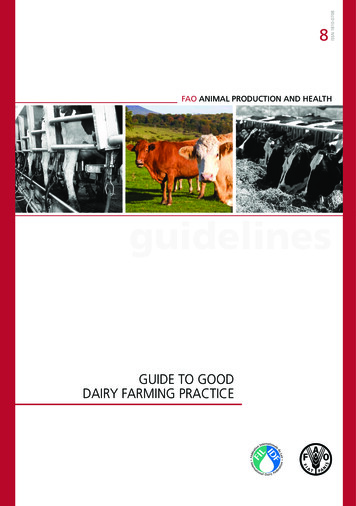

8Money Advice Liaison GroupINTRODUCTIONThere is no one definition of financialdifficulty. However, in this context, it couldbe assessed according to both objective andsubjective measures.There are numerous reasons why consumerswith mental health conditions experience aboveaverage levels of debt and arrears. These include: The fact that consumers with mental healthconditions often live on low incomes andexperience high levels of unemployment.Debt disproportionately affects those on lowincomes. The impact of certain mental healthconditions on a consumer’s condition,perhaps exacerbating spending (eg maniaand spending sprees) or communicationdifficulties/withdrawal, can all contribute topersonal debt.Objective measures might include: A high proportion of income spent onservicing debt Arrears on credit commitments anddomestic bills Variable and/or low income.Subjective measures – as seen from theconsumer’s perspective – might include: Regarding their financial situation asunmanageable or out of control Being unable to fully assess their financialsituation Feeling that their financial situation hasbecome oppressive.Without monitoring or intervention, people withmental health conditions who experience debtare at risk of falling into a problem debt spiral.Furthermore, of significance for its impact onconsumer health, research indicates that debt isassociated with anxiety and stress, depression,self-harm or suicidal thoughts, and relationshipstrain and social isolation. Relatively low levels of awareness andintervention. There are a small number ofspecialist training programmes and otherresources for creditor4 sector staff that coverhow to work effectively with consumers withdebt and mental health conditions, or withthe health and social care professionals whosupport them.The Debt and Mental HealthEvidence Form5A significant number of the recommendationsin these Guidelines deal with collecting evidenceto help demonstrate the impact of a consumer’smental health condition on his or her ability todeal with debt issues.It was agreed by all MALG stakeholdersthat advisers and creditors needed a toolenabling them to request clear, relevant andcomprehensive information in a standard formatfrom health and social care professionals, asappropriate to each given situation.4See definition of ‘creditor’ below under ‘Who should follow the Guidelines’5www.malg.org.uk/dmhef3creditors.html

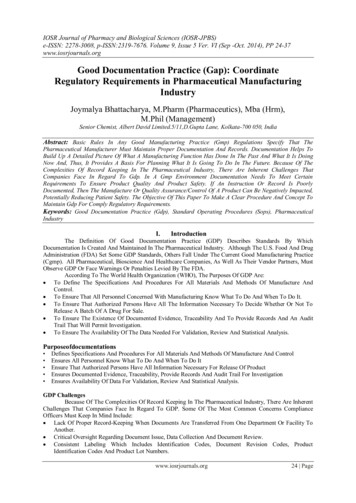

Good Practice Awareness GuidelinesDebt and Mental Health Evidence Form (Version 3)Only a health or social-care professional should fill in this formThis form has been given to you because theperson named opposite:Person’s full name: is in debt to one or more creditors; and has said they have a mental health problem that affectstheir ability to repay.Date of birth:You have been identified by this person as:Address:6 When communicating with the person, arethere any special circumstances that a creditorneeds to take into account?Your evidence could really help the person’shealth and well-beingAdvice/creditor organisationOrganisation:Reference number:Can you help this person? It will take just three steps.Second step:Please sign and stamp the form.First step:Please fill in this form.The information you givewill be shared with theperson named above.Third step:Please return this form inthe envelope provided.Please also enclose the patientConsent Form (you may want tophotocopy this for your files).About the person:Q1: What is your relationship with the person named above? I am working with them as a:r general practitionerr occupational therapistr mental health nurser social workerr psychiatristr clinical psychologistr other (please give details)r I do not know the person (if so, please return this form in the envelope provided.)Q2: Does the person have a mental health problem?r Yes r No4 Does the person have a mental health problemthat affects their ability to manage theirmoney?5 Is the person receiving treatment or supportfor this mental health problem and does thetreatment or support affect their ability tomanage their money? a health or social-care professional who knows them; and a professional who could provide medical evidence abouttheir mental health situation.They have given their written permission for you to fill inthis form (this is enclosed). It will help creditors to take relevant mental healthproblems into account. This could improve the person’s financial situation andmental health.9NoIf you answer ‘No’,please sign, stamp andreturn the form.Q3: What is this mental health problem? If it has a name or diagnosis, what is it?7 What was the approximate date when(a) this mental health problem first started,(b) the first treatment was given, (c) the mostrecent episode took place, and (d) is theepisode on-going?8 Is there anything else we should know aboutthe person?Who should follow the GuidelinesThe DMHEF was developed by the Royal College of Psychiatrists and the Money Advice Liaison Group.It has been approved by The Information Commissioner’s Office as keeping to the Data Protection Act 1998.For more information, please visit www.rcpsych.ac.uk/debt or www.malg.org.ukThe audiences for these Guidelines are: Creditors – that is any organisation to whoma consumer owes money. Unless otherwisespecified in these Guidelines, ’creditor’therefore includes original lenders, securedand unsecured, and third parties such as debtcollection agencies/companies, enforcementagents and any organisation (such as agovernment department or agency, localauthority, housing provider, or utility company)to which a consumer owes money. Debt advisers (free and fee-charging). Other organisations dealing with debtirrespective of whether they are regulatedby the FCA. Health and social care professionals.As a result, MALG and the Royal College ofPsychiatrists, with financial support from theMoney Advice Trust (MAT), developed a standardDebt and Mental Health Evidence Form (DMHEF).The DMHEF covers the following key areas byasking eight questions of the relevant healthand/or social care professional:1 What is your relationship with the personreporting the mental health problem?2 Does the person have a mental healthproblem?3 What is this mental health problem? If it hasa name or diagnosis, what is it?

10Money Advice Liaison GroupINTRODUCTIONRelationship with regulation,codes and trainingWhich mental health conditions arecovered by these Guidelines?Creditors and debt advice agencies operatewithin a highly regulated environment andcompliance with statute, case law, regulatoryrequirements and principles takes precedenceover these Guidelines. Nevertheless, theseGuidelines should help firms meet obligationsunder statute, regulations and their own tradeassociation codes of practice. These include theFCA’s Consumer Credit Sourcebook (CONC)6and other publications7, the Equality Act 2010,Insolvency Guidance, and the Tribunal Courts andEnforcement Act 2007.The term ‘mental health condition’ is used torefer to the range of mental health experiencesthat can limit a consumer’s ability to cope withday-to-day living. Being mentally healthy meanshaving the ability to adapt and cope with changeand to make the best of any situation you mayfind yourself in.In addition there are other useful sources ofdetailed help, good practice and guidance thatcan support these Guidelines including the BritishStandard 18477:2010 Inclusive Service Provision;Lending, debt collection and mental health– 12 Steps for Treating Potentially VulnerableCustomers Fairly 2nd edition Royal College ofPsychiatrists November 2014; and MALG BriefingNotes 3 and 4.Mental health conditions can be caused by, orresult from, a range of factors. There can be director underlying biological or organic, psychologicaland social causes.These Guidelines do not distinguish betweenmental health conditions resulting from differentfactors. In other words all mental healthconditions are regarded as being within thescope of these Guidelines, to the extent thattheir impact affects the consumer’s financial/debtmanagement skills.In particular, it is worth noting that biologicalor organic mental illnesses are covered by theGuidelines. These are conditions either caused by,or resulting from, disease of the central nervoussystem. For example, dementia8 and Parkinson’sdisease are both organic mental /CONC7For example the FCA’s April 2014 publication ‘Consumer Credit and consumers in vulnerable circumstances’and ‘FCA Occasional Paper No 8 Consumer Vulnerability, February 2015’8Note that this term includes Alzheimer’s and amnesiac disorders

Good Practice Awareness GuidelinesFurthermore, there are situations wherephysical health conditions can cause or resultin the development of mental disorders. Forexample, brain tumours or head injuries areneurological conditions that can cause psychosis,depression, mania and anxiety. Similarly,depression can be ‘caused’ by HIV or cancer(for example, following initial diagnosis, or thetrials of living with the condition).Problems arising from the use of harmful oraddictive substances are also relevant for theseGuidelines, and include the use of alcohol, illegalor street drugs, prescription and over-the-countermedicines, and volatile chemicals. People can alsodevelop behavioural addictions, such as gambling,to which these guidelines equally apply. Addictionscan result in mental and physical illnesses, as wellas wider social problems. The treatment of suchaddictions is undertaken by a range of health andsocial care professionals, including GPs, specialistsubstance misuse services, psychiatrists, andsocial care workers.Psychiatrists and other health or social careprofessionals provide care and treatment formental health conditions. In doing so, theyconsider the biological, psychological and socialfactors underpinning the condition, and devisean

4 Data protection procedures 16 5 referral mechanisms 19 6 procedures when creditors outsource debts 20 7 How much evidence is needed 22 . programme for recovery staff, enabling them to apply the practical steps in the Guideline