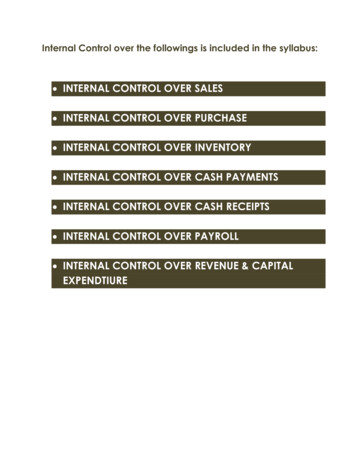

Transcription

INTERNALCONTROL OVERFINANCIALREPORTINGMarilyn Young, PhD, CPAProfessor of AccountingMassey Graduate School of BusinessBelmont Universitymarilyn.young@belmont.edu

BACKGROUND: THE FINANCIAL STATEMENTSThe Four Financial Statements Income Statement (also referred to as: Statement of Earnings,Statement of Income, or Statement of Operations) Statement of Changes in Stockholders’ Equity Balance Sheet Statement of Cash FlowsThe requirements for calculating and presenting the financialstatements are mandated by Generally Accepted AccountingPrinciples (GAAP), written by the Financial AccountingStandards Board (FASB).12/10/20202

BACKGROUND: THE FINANCIAL STATEMENTSFinancial Statements – Public view of company performance. Audience is investors and creditors. Each financial statement contributes unique information aboutfinancial performance. Collectively, the financial statements should provide investors andcreditors with enough information to rationally allocate funds in themarkets. Management is responsible for the amounts reported on the financialstatements and the system from which the financial statements areprepared. For publicly-traded companies the financial statements are subject toan audit by an independent accounting firm quarterly andannually.312/10/2020

BACKGROUND: THE FINANCIAL STATEMENTS The Securities and Exchange Commission (SEC) requires management tomake disclosures in the public financial statements to emphasize thatmanagement is responsible for the information on the financial statements andthe system that created the financial statements. A company’s Internal Control over Financial Reporting (ICFR) is a processdesigned to provide reasonable assurance regarding the reliability offinancial reporting and the preparation of financial statements for externalpurposes in accordance with generally accepted accounting principles(GAAP). Publicly-traded companies are required to create and maintain an internal controlsystem for financial reporting. An evaluation of Internal Control over Financial Reporting is an integral part of thequarterly/annual audit of the financial statements conducted by an independentaccounting firm.12/10/20204

INTERNAL CONTROLOVER FINANCIALREPORTING12/10/20205

INTERNAL CONTROL OVERFINANCIAL REPORTINGHistory: Foreign Corrupt Practices Act – motivated, in part, bymore that 400 corporations making over 300 million incorrupt payments to foreign government officials whilealso filing inaccurate corporate financial statements tohide the payments. Sarbanes-Oxley Act of 2002 – enacted to restoreconfidence in public financial reporting; mademanagement’s responsibility for financial statements12/10/20206and internal control more visible in public disclosures.

INTERNAL CONTROL OVERFINANCIAL REPORTINGThe Internal Control System is a set of policies andprocedures that:1. Pertain to the maintenance of records thataccurately and fairly reflect the transactions of thecompany.2. Provide reasonable assurance that transactions arerecorded as necessary to permit the preparation offinancial statements.3. Provide reasonable assurance regarding theprevention and timely detection of unauthorizedacquisition, use, or disposition of the company’sassets.12/10/20207

INTERNAL CONTROL OVERFINANCIAL REPORTING Control systems can provide reasonable, but notabsolute, assurance that financial statements arereliable and prepared in accordance with GAAP. Controls designed to generate reliable financialstatements are more likely to succeed if thecompany’s culture reflects the importance ofintegrity and ethical values and a commitment toreliable financial reporting.12/10/20208

INTERNAL CONTROLEXAMPLEAccounting Fraud in a Church12/10/20209

INTERNAL CONTROL OVERFINANCIAL REPORTINGOver a twenty-year period, the financial secretary of a local church stole 900,000 from her congregation. The church’s primary source of income iscontributions from the Sunday offering. Each Sunday volunteers serve asattendants to pass the contribution plates, and two deacons are responsible forplacing the cash and checks from the offering into a zippered bag and puttingthe bag into the office safe. Only the two deacons and the secretary know thecombination to the safe. During her tenure, the financial secretary wouldretrieve the offering from the safe each Monday. She was responsible forcounting the offering, recording the contributions in the accounting records,preparing a deposit slip and taking the funds to the bank. In counting thecontributions, the financial secretary also kept track of the donations ofindividual members for tax reporting purposes.12/10/202010

INTERNAL CONTROL OVERFINANCIAL REPORTINGThe financial secretary paid and recorded all of the bills of the church.The administrative assistant opened all the mail and bills wereforwarded directly to the financial secretary. When the financialsecretary received the bills, she carefully reviewed them to determineif they were appropriate. In addition, she maintained a list of“approved” suppliers to help ensure that purchases were made at thelowest price and that church members’ businesses were patronizedwhenever possible. When bills were paid, she determined the accountsin which each bill would be recorded and wrote and signed the checkfor the payment. According to church policy, if a bill exceeded 1,000,two signatures would be required on the check.12/10/202011

INTERNAL CONTROL OVERFINANCIAL REPORTING ROLESAND RESPONSIBILITIES12/10/202012

MANAGEMENT’SRESPONSIBILITIES Design, implementation and monitoring of internal controls. Annually assess the effectiveness of internal controls. Evaluate any change in the company’s internal controls thathas materially affected, or could likely materially affect,internal controls. Maintain documentation to provide reasonable support formanagement’s assessment. Provide quarterly and annual reporting of management’sassessment of internal controls. Keep the Audit Committee of the Board apprisedof the12/10/2020operation and effectiveness of controls.13

AUDIT FIRM’SRESPONSIBILITIES Obtain an understanding of each component of thecompany’s internal controls. Report timely to management and the AuditCommittee any deficiencies in internal controls. Conduct an audit of internal controls following atop-down, risk-based approach that considers thewhole financial reporting system with primaryattention given to controls over financial reportingareas most susceptible to material misstatement.12/10/202014

AUDIT COMMITTEE’SRESPONSIBILITIES Oversee management’s preparation of financialstatements and design and operation of controls. Oversee financial reporting under Sarbanes-Oxley. Review the assessment of financial reporting risks. Review management’s planned responses to theidentified financial reporting risks. Discuss with management control deficiencies andtheir potential impact on financial reporting and nature12/10/202015of remedial actions.

AUDIT COMMITTEE’SRESPONSIBILITIES Evaluate the quality of management’s financialreporting and related disclosures. Oversee and monitor activities in the InternalAudit Department including reports from internalaudit. Hire and oversee the external audit firm.12/10/202016

CATEGORIES OF INTERNALCONTROL DEFICIENCIES12/10/202017

INTERNAL CONTROL OVERFINANCIAL REPORTINGInternal Control Deficiencies –Under SEC Reporting Provisions, if a single materialweakness in the Internal Control System exists,then the Internal Controls are not effective.There are three categories for reporting internalcontrol weaknesses.12/10/202018

INTERNAL CONTROL OVERFINANCIAL REPORTINGCategories of Internal Control Deficiencies1) Material Weakness - A deficiency that createsa reasonable possibility that a materialmisstatement of the company’s financialstatements will not be prevented or detected ona timely basis.2) Significant Deficiency – a deficiency that is lesssevere, yet important enough to merit attentionby those responsible for oversight of thecompany’s financial reporting.12/10/202019

INTERNAL CONTROL OVERFINANCIAL REPORTINGCategories of Internal Control Deficiencies3) Deficiency – a deficiency where the design oroperation of a control does not allowmanagement or employees, in the normal courseof performing their assigned functions, toprevent or detect misstatements on a timelybasis.12/10/202020

INTERNAL CONTROL OVERFINANCIAL REPORTINGCritical Audit MattersA critical audit matter is defined as any matter arising fromthe audit of the financial statements that has beencommunicated or is required to be communicated to theaudit committee, and that relates to accounts ordisclosures that are material to the financial statements,and that involves especially challenging, subjective, orcomplex auditor judgments.12/10/202021

INTERNAL CONTROL OVERFINANCIAL REPORTINGCommon Internal Control Procedures:1)Personnel: Well-Defined Job Descriptions, BackgroundChecks, Mandatory Vacations, & Rotating Duties.2)Segregation of Duties: Operations, Custody of Assets,& Accounting.3)Prepare Budgets to Set Expectations and MeasureVariances Between Actual and Budgeted Results.4)Clear Credit Policies & Purchase Responsibilities.12/10/202022

INTERNAL CONTROL OVERFINANCIAL REPORTINGInternal Control Risks:1)Remote work environments from thepandemic2)Cybersecurity3)Oracle compared to Morgan Stanley12/10/202023

INTERNAL CONTROL OVERFINANCIAL REPORTINGRecent SEC Actions for Deficiencies in InternalControls over Financial Reporting:Grupo Simec S.A.B de C.V.Lifeway Foods Inc.Digital Turbines Inc.CytoDyn, Inc.Northwest Biotherapeutics, Inc.12/10/202024

INTERNAL CONTROL OVERFINANCIAL REPORTINGA good Internal Control System is hard tomaintain because:1)The company’s environment will changeover time.2)The company’s leadership and prioritieswill change over time.3)Employee roles will migrate over time.12/10/202025

FINANCIAL STATEMENTDISCLOSURES12/10/202026

REQUIRED DISCLOSURE – MANAGEMENT’SSTATEMENT ABOUT THE FINANCIALSTATEMENTSExcerpts from Nike Annual Report (Form 10-K, 7/24/2020)Management of NIKE, Inc. is responsible for the information andrepresentations contained in this report. The financial statements havebeen prepared in conformity with accounting principles generallyaccepted in the United States of America (“U.S. GAAP”) and includecertain amounts based on our best estimates and judgments. Otherfinancial information in this report is consistent with these financialstatements.12/10/202027

REQUIRED DISCLOSURE – MANAGEMENT’SSTATEMENT ABOUT THE FINANCIALSTATEMENTSExcerpts from Nike Annual Report (Form 10-K, 7/24/2020)Our accounting systems include controls designed to reasonablyassure assets are safeguarded from unauthorized use or disposition andprovide for the preparation of financial statements in conformity withU.S. GAAP. These systems are supplemented by the selection andtraining of qualified financial personnel and an organizational structureproviding for appropriate segregation of duties.12/10/202028

REQUIRED DISCLOSURE – MANAGEMENT’SSTATEMENT ABOUT INTERNAL CONTROLSExcerpts from Nike Annual Report (Form 10-K, 7/24/2020)Management is responsible for establishing and maintaining adequateinternal control over financial reporting, as such term is defined in Rule13(a) - 15(f) and Rule 15(d) - 15(f) of the Securities Exchange Act of1934, as amended. Internal control over financial reporting is a processdesigned to provide reasonable assurance regarding the reliability offinancial reporting and the preparation of the financial statements forexternal purposes in accordance with generally accepted accountingprinciples in the United States of America.12/10/202029

REQUIRED DISCLOSURE – MANAGEMENT’SSTATEMENT ABOUT INTERNAL CONTROLSExcerpts from Nike Annual Report (Form 10-K, 7/24/2020)Because of its inherent limitations, internal control over financialreporting may not prevent or detect misstatements. Also, projections ofany evaluation of effectiveness to future periods are subject to the riskthat controls may become inadequate because of changes inconditions, or that the degree of compliance with the policies orprocedures may deteriorate.Under the supervision and with the participation of our Chief ExecutiveOfficer and Chief Financial Officer, our management conducted anevaluation of the effectiveness of our internal control over financialreporting Based on the results of our evaluation, our managementconcluded that our internal control over financial reporting waseffective as of May 31, 2020.12/10/202030

REQUIRED DISCLOSURE – AUDIT FIRM’SOPINION LETTERExcerpts from Nike Annual Report (Form 10-K, 7/24/2020)We have audited the accompanying consolidated balance sheets ofNIKE, Inc. and its subsidiaries (the “Company”) and the relatedconsolidated statements of income, of comprehensive income, ofshareholders' equity and of cash flows and the related notes.We alsohave audited the Company's internal control over financial reporting In our opinion, the consolidated financial statements referred to abovepresent fairly, in all material respects in conformity with accountingprinciples generally accepted in the United States of America. Also inour opinion, the Company maintained, in all material respects, effectiveinternal control over financial reporting.12/10/202031

CRITICAL AUDIT MATTERExcerpts from Nike Annual Report (Form 10-K, 7/24/2020)The critical audit matter communicated below is a matter arising fromthe current period audit and that (i) relates to accounts or disclosuresthat are material to the consolidated financial statements and (ii)involved especially challenging, subjective, or complex judgments.The communication of critical audit matters does not alter in any wayour opinion on the consolidated financial statements, taken as a whole,and we are not, by communicating the critical audit matter below,providing a separate opinion on the critical audit matter or on theaccounts or disclosures to which it relates.12/10/202032

CRITICAL AUDIT MATTERExcerpts from Nike Annual Report (Form 10-K, 7/24/2020)Accounting for Income Taxes[Nike] recorded income tax expense of 348 million for the year andhas net deferred tax assets of 732 million and total grossunrecognized tax benefits of 771 million. As disclosed bymanagement, the use of significant judgment and estimates, as well asthe interpretation and application of complex tax laws is required todetermine its provision for income taxes. The principal considerationsfor our determination that performing procedures relating to theaccounting for income taxes is a critical audit matter are the significantjudgment by management when assessing complex tax laws andregulations, including new temporary regulations and recent courtrulings, as it relates to determining the provision for income taxes andother tax positions. This in turn led to a high degree of auditorjudgment, subjectivity and effort in performing procedures 12/10/2020and33evaluating audit evidence

INTERNAL CONTROL OVERFINANCIAL REPORTINGAdditional Reading:“The FCPA’s Internal Controls Provision,” William J.Stuckwisch and Matthew J. Alexander, CriminalJustice, Fall 2013“Understanding Internal Control Over FinancialReporting” BDO Center for Corporate Governanceand Financial Reporting, June 2019Nike, Inc. Form 10-K (Annual Report), 202012/10/202034

statements are mandated by Generally Accepted Accounting Principles (GAAP), written by the Financial Accounting Standards Board (FASB). 12/10/2020 2. BACKGROUND: THE FINANCIAL STATEMENTS Financial Statements -Public view of company performance. Audience is investors and creditors.