Transcription

Internal Controls Over FinancialReporting Considerations forDeveloping and Implementing Bots

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsHow does RPA affect you?Companies are rapidly digitalizing parts of their business throughrobotic process automation (RPA). RPA uses computer-coded, rulesbased software robots (i.e., bots) to automate certain human tasks.RPA differs from artificial intelligence such as cognitive computing ormachine learning because it is unable to learn from data patternsand make judgments. In the simplest terms, a bot is a technologybased solution designed to replicate actions that a human wouldotherwise take to complete a computer-based task using the samesecurity settings as the user. Bots operate in the user interfacelayer, where they automate processes without compromising the2underlying information technology (IT) infrastructure. Bots followprescribed protocols and procedures with precision, allowingincreased compliance and cost efficiencies (see figure 1).RPA may be inexpensive to implement compared with otherautomation technologies and can quickly provide financial andnonfinancial benefits that affect the most common performancemeasures (see figure 2).

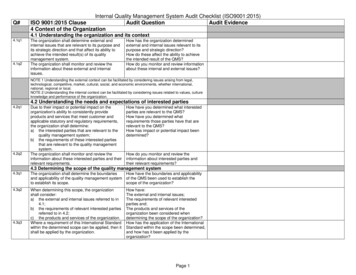

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsFigure 1. What RPA can doPull data from theInternetOpen, read, andcreate emailsObtain humaninput via emails/workflowLog in toenterprise appsMake calculationsMove files andfoldersExtract data fromdocumentsCopy/pasteCollect statisticsFill in formsRead/write to databasesFollow decision rulesFigure 2. RPA benefitsReduce turnaround timeReduce cost through automating activitiesand requiring fewer full-time equivalentsSpeed increaseReduce potentialfor unintentional orintentional human errorCost reductionIncrease quality byavoiding human errorQualityInternalcontrolRPA benefitsImprove executivedecision makingTalentDecisionmakingNonstop performance24/7OperationsBoost employeeengagement by shiftingpersonnel to moreinteresting tasksScalabilityIncreased capacity withoutlong buildup phase3

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsHow are companies using RPA?According to Deloitte’s 2017 RPA survey,1 market trends are indicatingnear-universal adoption of RPA in the next five years. Averagespending among companies surveyed was 1.5 million for RPApilots and upwards of 3 million for full-scale programs. This rapidincrease in market penetration and spending is contributing to theemergence of a broad ecosystem of RPA vendors and RPA solutionsgeared toward helping companies capitalize on automation. The useof process automation is at an unprecedented level, as companiescontinue to identify new ways to use RPA within their organizations.So where are we seeing the most use of automation? The DeloitteRobotics and Cognitive Automation Delivery Center has automatedhundreds of unique business processes and identified successfulbot deployments in the following areas (see figure 3).Figure 3. Use of automation6%8%4David Wright, Dupe Witherick, and Marina Gordeeva, The robots are ready. Are you?,Deloitte, 2018, itte-us-cons-global-rpa-survey.pdf.Internal auditTaxInformation technologyHuman resources25%1.%5% 2OperationalAccounting and finance54%

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsAccounting and finance is the most common area of RPA deploymentby our clients. This business function is prime for automation for avariety of reasons, including: The need for a high degree of accuracy and consistencyBecause of these characteristics, a significant number of roles inback-office accounting and finance functions have the potential tobe automated. Table 1 below highlights specific processes withinthe accounting and finance function and the viability of automationwithin those processes (i.e., low, medium, high). Repetitive, manual nature of transaction processing Information gathered from fragmented systems Dependency on data entry, data manipulation, andreport generationTable 1. Viability of automation within back-office accounting and financeTransaction processingClose, consolidate, and reportAccounts receivableAccounts payableCash managementProject accountingClose the booksLegal and externalreportingMaintain customermaster dataMaintain suppliermaster dataPerform banking &cash mgmt. activitiesPerform projectaccountingPerform closingPerform legal andexternal reporting toregulatory bodiesManage customercredit exposureProcess invoicesManage foreignexchangeProcess invoicesPerform paymentsT&E processingMgmt. reportingConsolidationProcess paymentsPeriod-end processingand reportingGeneral accountingReceive & compilereimbursementrequestsPerform mgmt.reporting to internalstakeholdersPerform consolidationMaintain generalledger master dataAudit and documentexpense reportsPayrollPerform journalsAuthorize and processpaymentsMaintain employeemaster dataProcess intercompanytransactionsManage collectionsPeriod-end processingand reportingTax accountingManage payrollAuthorize and processpaymentsInventoryaccountingPerform taxaccountingPerform inventoryaccountingTransfer pricingFixed assetaccountingPeriod-end processingand reportingPerform fixed assetaccountingPeriod-end processingand reportingRPAHighMediumLowCommonly automated accounting and finance functions include: Order to cash and accounts receivable–– Creating and updating customermaster data–– Reviewing and approving customerorders against predefined credit limits–– Validation and posting of customerpayments Accounts payable–– Inputting invoices into an enterpriseresource planning (ERP) system–– Processing changes to purchase ordersand updating the ERP system–– Matching invoices against correspondingpurchase orders and receipts Financial closing and reporting process–– Journal entry validation–– Low-risk account reconciliations–– Generating reports and loading intoreporting/consolidation templates5

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsFinancial risk and controlconsiderations of RPASuccessful businesses continually work to identify solutionsthat create operational efficiencies. One trend over the past twodecades has been to offshore skilled and nonskilled work as aform of labor arbitrage to reduce costs. Enterprises are nowpivoting toward automation of certain business tasks (e.g., accountreconciliations, invoice processing, recalculations, source datamatching, threshold application) to further disrupt the humancapital leverage model. Specifically, RPA may replace or enhancecertain tasks previously performed by humans with bots that arecheaper, more efficient, and more reliable.Although RPA may reduce unintentional or intentional human errors,the implementation of bots presents new risks that businessesneed to understand and address. A key risk presented by the rapidadoption of bots is an organization’s failure to consider the effectsof these operational changes on its internal control over financialreporting (ICFR), specifically those controls over IT. Failure toadequately assess/identify and manage these new risks may erodeor limit the value created by this automation arbitrage. Bot-relatedrisks may increase when external third-party systems, websites, andcollaboration tools are involved.To realize the full benefits of automation, businesses should considerhow RPA affects risks in a number of categories (see figure 4).Figure 4. RPA areas of key echnology A single bot maybe equivalent tomultiple full-timeequivalents, resultingin concentration ofoperational risk. Improperimplementationor automation ofprocesses can result infinancial losses to theorganization. Bot-related errorscan affect validity andaccuracy of regulatoryreporting processes. The replacement orrepurposing of full-timeequivalents may havea negative impact onemployee morale. Changes to the ITplatform will nowaffect a new, criticalelement of theworkforce. The effects ofprocessing errorscan be magnified byhigh-paced bots andalgorithms. Bot-related errors canhave a negative impacton the integrity ofinternal and externalfinancial reports. Misalignment acrossgroups may lead togaps in roles andaccountability. Anomalous botactivity may have asevere impact on thefunctions of existing ITsystems. Failure to create nimbleoversight and controlmechanisms maylead to operationalinefficiency when botsor algorithms requirechanges. Poorly designedalgorithms may makecostly mistakes (e.g.,trading errors) or incurother financial costs.6 Bots and algorithmsmay inadvertentlyviolate laws. Lack of clear guidancefrom regulatorybodies regardingleading standardsfor automation andalgorithm design. Algorithms withoutproper controls mayinduce significantreputational risk. Communication andcoordination may benecessary among themanagement teamand with vendors andcustomers to ensurebot activity does notcreate the impressionof cyber events or otherissues that might createoperational or brand/reputation concerns. Powerful algorithmscan have anegative impacton other critical ITinfrastructure.Source: 2017 MIT SMR and Deloitte Digital business research

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsIssues arising within any of these risks may lead to financial loss.For example, improper implementation or automation of the wrongprocesses (i.e., operational risks) may result in immediate financiallosses to an organization. Bot-related errors affecting the integrity ofcybersecurity programs or compliance with data privacy regulationsmay not only result in direct costs to the business, but also give riseto reputational concerns in the marketplace. Therefore, it is criticalfor organizations to assess how these changes inform their riskassessment, particularly those risks arising from IT, and whethermodifications to their existing standards, processes, and structures(i.e., control environment) are necessary. When exploring theadoption of RPA technologies, it is important to leverage the existingcontrol environment, when possible, and challenge those areasin which the governance construct may not adequately supportthese changes. Companies may consider controls in the followinglayers, in terms of the life cycle from ideation and creation of a bot toimplementation and monitoring (see figure 5).Figure 5. Entity-level controlsDevelopmentImplementationMonitoring1. Establish governance frameworkOwnership and responsibility for running and maintaining bots shouldbe defined. Organization should establish a policy to define parametersaround where robotics can and cannot be applied within the organization.The organization should train and appoint “bot managers” to oversee thework being conducted by bots and monitor the output the bots produce.7. Monitor and escalateCompliance processes shouldbe equipped with tools andtransparency to oversee andcontrol operational risksthrough monitoring of bots’audit-trail records.6. Detect and reportBots should be configuredto detect and report errorsand raise exceptions to botmanagers to be addressednear real time.5. Manage a changing environmentExtend existing change management models toaccount for the existence of bots and to trackthe impacts of internal or external changes thatcould affect the “bot” environment.2. Select tools and develop automationcoding/configurationBusinesses may select RPA tools anddevelop rules-based systems that mimichuman behavior to automate parts ofrepeatable processes (e.g., control checks,regulatory reporting).Risk-controlledroboticsenvironment3. Leverage existing controlsBusinesses should review the adequacyof existing controls and—to the extentpossible—leverage and enhanceexisting controls in the roboticsenvironment.4. User accessAccess management for bots shouldbe defined by system, services,applications, and user accounts.7

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsRPA may significantly change the way in which organizationsexecute day-to-day operations, certain areas of internal control,or both. At the 2017 AICPA Conference on Current SEC andPCAOB Developments, professionals in the SEC’s Office of theChief Accountant emphasized the importance of consideringPrinciple 9 of the COSO framework as part of maintainingeffective ICFR, particularly in a period of change, such as theimplementation of robotics and other new technologies.Focusing on Principle 9 will help companies prepare forimplementation, including establishing an appropriategovernance framework that will ensure a smooth transition tomanaging RPA throughout the business.An effective governance model establishes accountabilitythroughout the RPA life cycle, from ideation of the RPAstrategy, to design and testing of bot functionality and outputs,to implementation of the bot(s), and to monitoring of boteffectiveness. It is important to identify an executive sponsorwith the appropriate competency and authority to championand lead the project. Those charged with governance mayoutline and develop a corporate RPA charter that includes: Type of operating model (decentralized, centralized, federated) Standards and policies related to the selection, development,and use of bots within the organization, including successmeasurement criteria and key performance indicators Education and training programs to help management; businessowners, including those overseeing bot implementation (“botmanagers”); and the internal audit function develop a sufficientunderstanding of how bots affect risk assessment and thedetermination of which new or modified controls are necessary forautomation and monitoringThe “right size” operating model may consider factors, includingRPA capability maturity, availability of resources, the design of theunderlying IT infrastructure, and the commonality of RPA needs acrossthe organization. Companies with extensive RPA experience maydeploy a decentralized governance model allowing for more autonomywithin each business segment, whereas a centralized, federated,or hybrid of the two may be recommended for organizations thatare working to mature their RPA capabilities. Table 2 illustrates howthese factors may influence the selection of an operating model(decentralized, federated, and centralized).Table 2. Decentralized, federated, and centralized rea 1Gov.IntakeBuildOperateBusinessarea 2CentralizedCentralized RPA CoECentralized RPA CoEGovernanceGov.IntakeBuildOperateBusinessarea ssarea 4Business process areas own and managethe entirety of the process for governance,opportunity assessment, build, test and deploy,and operations with ad hoc coordinationbetween process owners.IntakeBuildOperateBusinessarea 1IntakeBuildOperateBusinessarea 2IntakeBuildBuildOperateOperateBusinessarea 3Businessarea 4Business areas with significant bot demandmanage their own opportunity assessment, build,test and deploy, and operations, while others withless demand or complex automation needs workwith the RPA Control Center.Businessarea 1Businessarea 2Businessarea 3Businessarea 4RPA Control Center owns and manages the entireprocess for automation, build, test and deploy,and operations for all business areas, withcoordination with business area process owners. RPA is a mature capability across manybusiness areas. RPA is a mature capability in one or morebusiness areas. RPA capabilities are not mature acrossbusiness areas. Many business areas have resources withthe requisite RPA skill set. Some business areas have resources withthe requisite RPA skill set. Availability of resources with requisite RPAskill sets is limited. RPA capabilities and tool needs arebusiness-specific with limited overlap. Some business areas have RPA tool needsthat are not applicable to others. Proliferation of RPA capabilities and toolsacross business areas is limited. Business area platforms and technologiesare siloed. Business area platforms and technologiesare siloed. Platforms and systems across businessareas are common.8

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsDevelopmentphaseImplementationphaseFollowing the established process selection standards anddevelopment methods (from test to production) is essential forthe automation tool to achieve the desired outcome. After a bot isplaced into the production environment (i.e., the end-user stage inwhich robotics are put into operation), control activities are neededto mitigate the risks that the software bot is designed ineffectivelyor the designed automation does not continue to operate to achievethe identified objective. In these situations, it is helpful to analogizethe use of RPA technologies in the financial reporting process todesigning and implementing automated controls that support abusiness cycle. Testing the design of the automated control involvesa baselining process over the coding and configuration settingsbehind the automation (as applicable). This process helps confirmthat the design follows the business logic defined by the company,including the policies over the identification and reporting ofexceptions. Bots should be configured to detect and report errorsand raise exceptions to bot managers, addressing these issues inreal time. Once RPA development is final and baselining efforts arecompleted, general information technology controls (GITCs) willensure that the bots continue to operate as designed.Upon implementation, companies will need to contemplate theeffects of RPA on their IT risk assessment. The use of RPA presentsnew risks related to proper security of the access rights assignedto the bots and oversight of any changes to the technology toensure it continues to operate as designed. Thus, it is critical toobtain a comprehensive understanding of the elements of the ITinfrastructure (e.g., database, operating system, network) designedto support the automation technology and the GITCs over thoseelements, including controls over:1. Access security — Understanding user roles and system anddata access needs for bots interacting with core systems will preventunauthorized users from accessing RPA’s data processing rule setsand the connected data sources. It is important to prevent suchunauthorized access because it can be used to access confidentialdata and manipulate the bots and their automated tasks. Rolebased access controls enable organizations to restrict access andauthenticate users, thereby segregating automation-related dutiesamong employees. The ability to develop or manipulate the actionsof bots can be assigned on the basis of an employee’s position withinthe company. User access controls generally consist of (a) periodicreviews of user access rights and (b) authentication controls overuser identification.2. System change — We generally recommend that preparersfollow their existing change management program for softwaredevelopment life cycle–related activities. Change managementprocedures need to account for bots that use the applicationundergoing a change. A robust change management program alsoincludes a process for executing changes directly to the bots.3. Data center and network operations — Providing forthe integrity of the information that is processed, stored, orcommunicated by the relevant aspects of the IT infrastructure iscritical to maintaining effective ICFR related to bots. In addition,companies may need to evaluate third-party data privacy concernswhen a bot stores data in the cloud.9

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsMonitoringphaseBe externalaudit readyDesigning mechanisms to monitor bot effectiveness is critical tocontrolling and sustaining these changes to the business. Effectiveoversight and monitoring programs are also paramount tomanagement’s ability to assess the effectiveness of bots supportingICFR and will thus enhance the ability to comply with Section 404(a)of the Sarbanes-Oxley Act of 2002. Therefore, companies may lookto a multilayered monitoring approach, including the followingcontrol activities:In addition to management’s annual assessment of the company’sICFR, it is important to keep external audit requirements in mind.Success in this area requires proactive communications withauditors throughout the journey to develop and implement RPA. Designing audit and compliance protocols to includeautomation components. Continuing the manual business control to validate successfulcompletion of the automated task. Reviewing the RPA platform(s) audit logs to verify the validityand appropriateness of each action performed by the bots.This also enables businesses to retrace and remediate issuesthat result from bot errors or malicious code. Performing an annual review of the automation algorithm(s)(i.e., reestablishing the baseline) to confirm alignment to thedefined business objective. Soliciting periodic feedback from both internal and externalaudit functions. Maintaining a comprehensive compliance checklist to meetregulatory requirements.Companies may consider reducing the number of monitoringactivities over time as their RPA capabilities mature and they sustainlong periods of bot effectiveness. For example, companies maydecide to remove the manual business control activity and solelyrely on automation as management becomes more confident in theoverall effectiveness of the RPA program.10Holding planning meetings and regular update discussions aboutthe ICFR implications are encouraged practices to help preparersand auditors align their thinking regarding risk assessment andthe identification of relevant controls. This will streamline the auditprocess and build auditors’ confidence in the effectiveness of thebots. Some additional topics to consider when preparing for externalaudits include:1. Those charged with internal compliance (e.g., internal auditfunction, IT compliance) should maintain an updated listing of botsand establish a protocol to confirm that updates to processes/controls are reflected in bot design, when necessary.2. Accounting procedures, process-flow diagrams, and internalcontrol documentation should clearly articulate where and how botsare used within the accounting and finance organization.3. Strong controls of bot design and operation do not mean acompany can neglect controls over inputs and outputs. Propercontrol frameworks should include controls of the entire transactioncycle, including source data, bot outputs, and points where humanintervention is required, such as investigating exceptions or makingjudgments. This is especially important when bots have a directimpact on financial reporting.4. Certain bots may be purely operational and only used on theperiphery of the financial reporting process, whereas other botsmay directly affect accounting and financial statement review controlactivities. Auditors will need to understand the nature and impactof bots employed by the accounting and finance organization sothey can focus their procedures on those most relevant to thefinancial statements.

Refocus your robotic process automation lens Internal control over financial reporting (ICFR) considerations for developing and implementing botsContact usIf you have any questions about the information in this publication, please contact us:Scott SzalonyPartner Audit & AssuranceDeloitte & Touche LLP 1 248 345 7963sszalony@deloitte.comKirti ParakhSenior Manager Audit & AssuranceDeloitte & Touche LLP 1 312 513 8006kirtiparakh@deloitte.comKyle SewellSenior Manager Audit & AssuranceDeloitte & Touche LLP 1 404 201 0759ksewell@deloitte.comStefan Elliot OzerSenior Manager Audit & AssuranceDeloitte & Touche LLP 1 203 423 4731sozer@deloitte.comEriko SatoSenior Manager Audit & AssuranceDeloitte & Touche LLP 1 212 653 6589erisato@deloitte.comJeffery Aughton assisted in the production of this publication.11

This publication contains general information only and Deloitte is not, by meansof this publication, rendering accounting, business, financial, investment, legal,tax, or other professional advice or services. This publication is not a substitutefor such professional advice or services, nor should it be used as a basis for anydecision or action that may affect your business. Before making any decision ortaking any action that may affect your business, you should consult a qualifiedprofessional adviser. Deloitte shall not be responsible for any loss sustained byany person who relies on this publication.About DeloitteDeloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UKprivate company limited by guarantee (“DTTL”), its network of member firms,and their related entities. DTTL and each of its member firms are legallyseparate and independent entities. DTTL (also referred to as “Deloitte Global”)does not provide services to clients. In the United States, Deloitte refers to oneor more of the US member firms of DTTL, their related entities that operateusing the “Deloitte” name in the United States, and their respective affiliates.Certain services may not be available to attest clients under the rules andregulations of public accounting. Please see www.deloitte.com/about to learnmore about our global network of member firms.Copyright 2018 Deloitte Development LLC. All rights reserved.

Financial closing and reporting process – Journal entry validation – Low-risk account reconciliations – Generating reports and loading into reporting/consolidation templates Table 1. Viability of automation within back-office accounting and finance. Figure 3. Use of automation. Account