Transcription

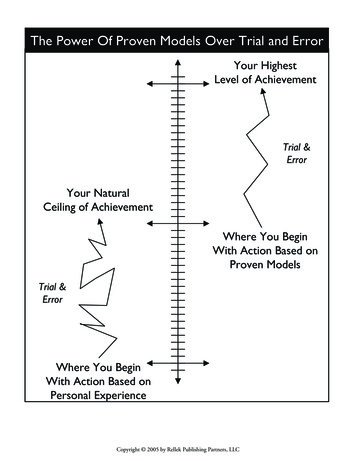

The Power Of Proven Models Over Trial and ErrorYour HighestLevel of AchievementTrial &ErrorYour NaturalCeiling of AchievementWhere You BeginWith Action Based onProven ModelsTrial &ErrorWhere You BeginWith Action Based onPersonal ExperienceCopyright 2005 by Rellek Publishing Partners, LLC

The 80:20 Rule20%80%80%20%ActionsResultsCopyright 2005 by Rellek Publishing Partners, LLC

ITERIACRCopyright 2005 by Rellek Publishing Partners, LLC

ITERIACRSRMTECopyright 2005 by Rellek Publishing Partners, LLC

CRSRMTEITERIAThe Dynamic Trio of Real Estate InvestingNETWORKCopyright 2005 by Rellek Publishing Partners, LLC

Criteria, Terms & NetworkYour CRITERIA identify potential dealsYour TERMS determine the real dealsYour NETWORK supports all your dealsCopyright 2005 by Rellek Publishing Partners, LLC

The Foundational Model of theMillionaire Real Estate right 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, LLCFiveInvestingMythsThreePersonalMythsMyth: All the Good Investments are Taken5{ Truth:Every Market has Its Share of Good Investments4{ Truth: In Successful Investing the Timing Finds YouMyth: Successful Investors are Able to Time the Market3{ Truth: Investing, by Definition, is Not RiskyMyth: Investing is Risky—I’ll Lose My MoneyMyth: The Best Investments Require Knowledge Most People Don’t Have2{ Truth: Your Best Investments Will Always Be in Areas You Can or Already Understand1{ Truth: Investing is Only as Complicated as You Make ItMyth: Investing is ComplicatedMyth: It Doesn’t Matter If I Want or Need It—I Just Can’t Do It3{ Truth: You Can’t Predict What You Can or Can’t Do Until You TryMyth: I Don’t Need or Want to Be Financially Wealthy—I’m Happy with What I Have2{ Truth:You Need to Open Your Eyes—You Do Need and Want to Be Financially Wealthy1{ Truth: Yes, You Do Need to Be an Investor—Your Job is Not Your Financial WealthMyth: I Don’t Need to Be an Investor—My Job Will Take Care of My Financial WealthThe Eight MythUnderstandingsBetween You and Financial Wealth

True Investors Win the Wealth Building GameNET WORTHTrue InvestorModest InvestorIncome EarnerTIMECopyright 2005 by Rellek Publishing Partners, LLC

True Investors Win the Cash Flow Game, Too!CASH FLOWTrue InvestorModest InvestorIncome EarnerTIMECopyright 2005 by Rellek Publishing Partners, LLC

Two Ways of Seeing Your ViewWhat’s “likely” for MeWhat’s “realistic” for MeWhat’s “conceivable” for MeWhat’s “imaginable” for MeCopyright 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, LLCMYTVs.AMYMYMYMY“ a little of a few things.”TAAreally need?What YouReally NeedTMMoneyAT do You YATime“A lot of everything or ”AWhat You ThinkYou NeedHow muchAbilityThe Gap Between What You Think You NeedAnd What You Really NeedTT

How the Multiplier Effect Works for Youx102 162 324 645 1255 250x10xMax Them All!58x10xMax One5 x5xHalf of Each42x4xDouble All Three4IPx4xDouble Two2 x4xDouble One2Mx2xSome of EachTxA10 Copyright 2005 by Rellek Publishing Partners, LLC1,000!

What’s Your Current Investment Potential?TMoneyMx xYour CurrentInvestment Potential TimexAxAbilityIPRate Each Area on a Scale of 1-10 andThen Multiply Them to Get You Current IPCopyright 2005 by Rellek Publishing Partners, LLC

A Penny Doubled for 30 DaysDay 1Day 2Day 3Day 4Day 5Day 6Day 7Day 8Day 9Day 10Day 11Day 12Day 13Day 14Day 15Day 16Day 17Day 18Day 19Day 20Day 21Day 22Day 23Day 24Day 25Day 26Day 27Day 28Day 29Day 30Total Invoice Daily 8,709.1210,737,418.23Copyright 2005 by Rellek Publishing Partners, LLC

The Seven Ways Millionaire Real Estate Investors Think1. Think Powered by a Big Why2. Think Big Goals, Big Models, and Big Habits3. Think Money Matters4. Think Net Worth5. Think Real Estate6. Think Value, Opportunity and Deals7. Think ActionCopyright 2005 by Rellek Publishing Partners, LLC

The Big WhyPersonal Financial Potential“I Want the Largest Life Possible”Why:Why:Why:Why:Why:Why:Why:Copyright 2005 by Rellek Publishing Partners, LLC

Big Goals and Big Models Build Big Habits 1,000,000 Models & Habits& Habits 500,000 Models 250,000 Models& Habits 175,000 Models- 500,000 Models& Habits- 250,000 Models& Habits- 175,000 ModelsTime& Habits& HabitsNet Worth- 5,000 Models& Habits& Habits 5,000 ModelsBigModelsBuild BigHabitsBadModelsBuildBadHabits- 1,000,000 Models & HabitsCopyright 2005 by Rellek Publishing Partners, LLC

Big Goals, Big Models & Big Habits1. Big Goals—The specific, measurable targets that fulfillyour Big Why.2. Big Models—The proven systems and strategies forreaching your Big Goals.3. Big Habits—The consistent actions and right choicesthat come from following Big Models.Copyright 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, LLCCashCapitalCash FlowCashConsumptionCapitalCash FlowShadow Wealth is built onCONSUMPTION and CASHMONEY WORKSfor you!ConsumptionYOU WORKfor money!Financial Wealth is build onCAPITAL and CASH FLOWThe Money Matrix

The Path of Passive Income:Where Does Your Money Come From?100%MONEY works for tUeGednarne100%75%meoInc50%25%0%25%50%YOU work for money100%The journey from earned income to unearned income doesn’thappen overnight—It is a progressive journey of intent and action.Copyright 2005 by Rellek Publishing Partners, LLC

A Financially Wealthy Money Matrix In ActionIncomeInCash FlowCashCapitalCopyright 2005 by Rellek Publishing Partners, LLCConsumptionOut

The Financially Poor Money Matrix In ActionIncomeInCash FlowCashCapitalCopyright 2005 by Rellek Publishing Partners, LLCConsumptionOut

The Impact of Real Estate Ownership on Net Worth1992199519982001Median Net Worth:Homeowner 122,300 120,200 143,800 171,700Median Net Worth:Renter 4,000 5,600 4,600 4,800The Real EstateDifference 118,300 114,600 139,200 166,900Copyright 2005 by Rellek Publishing Partners, LLC

Real Estate A Most “ABLE” Investment1.2.3.4.5.6.7.8.Accessible – Anyone can buy itAppreciable – Increases in value over timeLeverageable – Buy on margin & borrow against equityRentable – Cash Flow! Cash Flow! Cash Flow!Improvable – Sweat equityDeductible/Depreciable/Deferrable – Great tax benefitsStable – Slow to rise & slow to fallLiveable – Shelter in more ways than one .Copyright 2005 by Rellek Publishing Partners, LLC

Growth in U.S. Population & 0,00061%60%Yea19 r7219719 3719 4719 5719 6719 7719 8719 9819 0819 1819 2819 3819 4819 5819 6819 7819 8819 9919 0919 1919 2919 3919 4919 5919 6919 7919 8920 9020 0020 102-Us Population%HomeownersCopyright 2005 by Rellek Publishing Partners, LLC

Average Home Prices & Inflation (CPI)225 200,000200 175,000175 150,000150 125,000125 100,000100 75,00075 50,00050 25,00025 -0YEA19 R719 37419719 5719 67719719 8719 9819 0819 1819 2819 3819 4819 5819 6819 7819 8819 9919 0919 1919 2919 3919 4919 5919 69719919 8920 9020 001 225,000Average Home PriceConsumer Price IndexCopyright 2005 by Rellek Publishing Partners, LLC

The Power of Leverage on Rate of ReturnPrice PaidDown PaymentAppreciation (1 Year at 6.1%) 150,000 30,000 159,150Gain 9,150( 150,000 x 6.1%)Rate of Return on PriceRate of Return on Investment6.1%30.5%( 9,150 150,000)( 9,150 30,000)Copyright 2005 by Rellek Publishing Partners, LLC

Leverage – Pull Cash Out Without Selling the AssetPrice PaidDown PaymentOriginal LoanAppreciation (1 Year at 6.1%)Equity Gain 150,000 30,000 120,000 159,150 9,150Method 1: Borrow Against EquitySecondary Loan 9,150Cash Out 9,150Method 2: RefinanceNew LoanCash Out 129,150 9,150The tax free cash you take out on both is the same. The method you choosewill be dictated by the new monthly payment and terms each option offers.Copyright 2005 by Rellek Publishing Partners, LLC

19719 3719 47519719 6719 7719 8719 9819 0819 1819 2819 3819 4819 5819 6819 7819 8819 9919 0919 1919 2919 3919 4919 5919 6919 7919 8920 90020020 1020 203Percent ChangeThe Relative Stability of Real Estate40%30%20%10%0%-10%-20%-30%-40%YearAverage Home PriceNYSE IndexCopyright 2005 by Rellek Publishing Partners, LLC

6%8%10%12%14%16%18%Standard Deviation of Various Portfolio MixesAppears courtesy of Ibbotson Associates,CopyrightInc. It 2005is ,and theyLLCreserve all rights. Copyright 2005

Think Value, Opportunity & DealsKnowValueFindOpportunityMakeDealsCopyright 2005 by Rellek Publishing Partners, LLC

The Four Investment ProfilesINVESTOR Loves Opportunity Buys the Right Thing!COLLECTOR Loves Ownership Buys SomethingSPECULATOR Loves the Action Buys AnythingOBSERVER Loves Ideas Buys NothingCopyright 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, LLCLow RiskLow ReturnCOLLECTORCNo RiskIOBSERVEROMaximumReturnNo iskHigh RiskHigh ReturnSPECULATORSThe Straight and Narrow Path of Investing

The Five Models of the Millionaire Real Estate Investor1The Net Worth Model—A three-part model for identifying the2The Financial Model—A model for understanding the three ways3The Network Model—A model for building and organizing a4The Lead Generation Model—A model for determining your realbest investment vehicles for your goals; budgeting your moneyin order to have more to invest; and tracking your assets andliabilities to measure your progress towards financial wealth.wealth is built through real estate ownership: cash flow,appreciation and debt pay down.Network of investing relationships to mentor, advise and help you.estate investment Criteria and then systematically prospecting andmarketing for opportunities that match them.5The Acquisition Model—A model for creating Terms that willminimize your risk and maximize your profits when making realestate investment deals.Copyright 2005 by Rellek Publishing Partners, LLC

The Five Models—The Key Areas1 Learn the Pathof Money Budget forInvestments MakeInvestments &Track NetWorthNet WorthModel UnderstandThe TripleBenefits ofReal Estate:9 Cash Flow9 Appreciation9 Debt PayDown Establish YourCriteria Prospect &Market forReal orkModelLead GenerationModelAcquisitionModelCopyright 2005 by Rellek Publishing Partners, LLC Network forKnowledge,Leverage andLeads. Build YourInvestmentDream Team5 Master Termsfor MakingOffers &Closing Deals9 Buy & Sell9 Buy & Hold

The Path of MoneyTwo Kinds of Capital:HUMAN CAPITALYou Workfor MoneyCAPITAL ASSETSYour MoneyWorks for You1CASH FLOWFour Choices for Cash FlowSPEND IT%DONATE IT %HOLD IT %2INVEST IT %Two Basic Investment Choices3LENDLENDPASSIVE Money Markets CDs Bonds T-BillsTwo Basic PositionsOWN Stocks REITs MutualFunds“They Control It”OWNACTIVEOWNLEND4 OwnerFinancing PrivateLending Businesses Real Estate“You Control It”FINANCIAL RETURNS 5Copyright 2005 by Rellek Publishing Partners, LLC

How Consumers See Their BudgetConsumer’sPerceived BudgetConsumer’sBudgetConfuses Discretionary Spendingwith Required SpendingWhich is why they “just can’tafford to invest opyright 2005 by Rellek Publishing Partners, LLCDiscretionarySpending

How Millionaire Investors See Their BudgetMillionaireInvestor’s BudgetMillionaire Investor’sPerceived BudgetConsiders Investment Spendingto be Required Spending.Which is why they “always havemoney to ndingCopyright 2005 by Rellek Publishing Partners, LLCDiscretionarySpending

Millionaire Investors “Pays Themselves”First, Second and Last!The MillionaireInvestor’s BudgetThe Millionaire Investor’sBudget PrioritiesThey Invest Pre-TaxThey Invest Post-TaxThey Invest Anything Left opyright 2005 by Rellek Publishing Partners, LLCDiscretionarySpending

Financial Discretion is the Better Part of Financial Wealth-BuildingMillionaireInvestor’s SpendingWhat percentage of your earned income do you invest?Copyright 2005 by Rellek Publishing Partners, LLC

Sample Personal BudgetMonthly Income(1)Earned Income (2)Unearned Income Gross Monthly Income (1)Tithe % (2)Save % (3)(4)Invest % Tax % Net Spendable Income ExpensesCurrentRequiredDiscretionary(5)Housing % (6)Food % (7)Automobile % (8)Insurance % (9)Entertainment % (10)Clothing % (11)Medical % (12)Debt Service % (13)School/Child Care % (14)(15)Travel/Vacation % Misc. % Total Current Expenses Total Required Expenses Total Discretionary Expenses Budget AnalysisNet Spendable IncomeLess Required Expenses Total Surplus/Deficit Copyright 2005 by Rellek Publishing Partners, LLC

Tip: Use Nina’s Rule to Control Your Credit Card SpendingNext time you visit your bank, ask for a few of the protective sleeves theyprovide for ATM cards. Next, take a marker and write “I’m an Investor” onone side and “Remember Nina’s Rule” on the other. Then put all the plasticyou carry in one of these sleeves.The idea is to make you pause and think before you spend. It’s about yourfinancial posture and credit card debt is a serious problem for would-beinvestors. Here’s the facts: On average, consumers spend 112% more on a credit card purchase thanwhen using cash. (The Center for a New American Dream) Over 40% of US families spend more than they earn. (Federal ReserveBoard) An estimated 55%-60% of Americans carry credit card balances.(Massachusetts Public Interest Research Group) The average household with a credit card balance carries revolving debt ofnearly 10,000. (Federal Reserve Board)Copyright 2005 by Rellek Publishing Partners, LLC

Sample Personal Balance SheetJanuary 1,January 1,Annual %CurrentYTD%Last YearThis YearIncreaseTotalIncreaseASSETSRetirement AccountsEquity InvestmentsBusinesses PrivateBusinesses PublicStocksBondsAnnuities 7,500.00 8,250.00 0.00 0.00 5,000.00 0.00 0.00 0.00 0.00 5,357.00 0.00 0.00Total Equity al PropertyReal Estate PersonalReal Estate InvestmentsNotes ReceivableOther Assets 5,000.00 2,500.00 100,000.00 0.00 500.00 155,000.00 71,400.00 0.00 0.00 5,357.00 3,000.00 100,000.00 0.00 500.00 163,000.00 83,500.00 0.00 0.00 341,900.00 363,607.00( 9,000.00)( 2,500.00)( 181,120.00)( 15,000.00) 0.00( 4,200.00)( 3,250.00)( 178,500.00)( 12,000.00) 0.00TOTAL ASSETS10.0% 9,000.00NANA7.1%NANA9.1% 0.00 0.00 5,897.00 0.00 0.00NANA10.1%NANA 5,897.00 2,750.00 100,000.00 0.00 525.00 171,500.00 98,120.00 0.00 0.0010.1%-8.3%0.0%NA5.0%5.2%17.5%NANA6.3% ILITIESCar LoansCredit Card DebtMortgage DebtSchool LoansOther DebtTOTAL LIABILITIESNET WORTH( 3,000.00)( 2,750.00)( 176,020.00)( 10,500.00) 0.00-28.6%-15.4%-1.4%-12.5%NA( 207,620.00) ( 197,950.00)-4.7% ( 192,270.00)-2.9% 134,280.00 165,657.0023.4% 195,522.0018.0% 45,000.00 1,260.004.7% 46,500.005.0% 1,480.003.3%17.5%ANNUAL CASH FLOW (EARNED) 43,000.00ANNUAL CASH FLOW (UNEARNED) 1,200.00-53.3%30.0%-1.4%-20.0%NACopyright 2005 by Rellek Publishing Partners, LLC

Sample Personal Balance SheetJanuary 1,January 1,Annual %CurrentYTD%Last YearThis YearIncreaseTotalIncreaseASSETSRetirement AccountsEquity InvestmentsBusinesses PrivateBusinesses PublicStocksBondsAnnuities % % %%%%% %%%%%Total Equity al PropertyReal Estate PersonalReal Estate InvestmentsNotes ReceivableOther Assets %%%%%%%%% %%%%%%%%% % % %%%%% %%%%%TOTAL LIABILITIES % %NET WORTH % %ANNUAL CASH FLOW (EARNED) ANNUAL CASH FLOW (UNEARNED) % % %%TOTAL ASSETSLIABILITIESCar LoansCredit Card DebtMortgage DebtSchool LoansOther DebtCopyright 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, LLC

Market Value Appreciation 180,000 170,000 169,900 160,000 150,000 147,800 140,000 139,000 130,000 128,400 120,000 115,800 110,000 109,900 103,700 100,000 95,500 90,000 89,300Copyright 2005 by Rellek Publishing Partners, 21991199019891988 80,000

Copyright 2005 by Rellek Publishing Partners, LLC

Financial Model: Your Total ReturnExample Property: Asking Price: 90,000 in 1988 Discount 20% ( 18,000) Purchase Price 72,000 Down Payment 20% ( 14,400) Mortgage Loan Amount 80% ( 57,600)30-YearMortgage15-YearMortgageTotal Equity Build Up(1988 – 2004) 128,506 171,840Total Net Cash Flow(1988 – 2004) 34,545 18,327Total Return 163,051 190,16717.6%18.8%Annual CompoundedRate of ReturnCopyright 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, 007Year 68,480 74,480 80,240 85,440 87,920 90,480 92,640 97,440 102,720 106,640 111,200 118,240 126,480 93,100 100,300 106,800 109,900 113,100 115,800 121,800 128,400 133,300 139,000 147,800 158,100 60,400 75,500 85,600 56,240PurchasePrice 70,300MedianPrice 17,088 17,584 18,096 18,528 19,488 20,544 21,328 22,240 23,648 25,296 16,048 14,896 13,696 12,080 11,248DownPayment 11,248 11,248 23,328 23,328 37,024 37,024 51,920 51,920 67,968 67,968 85,056 102,640 120,736 139,264 158,752 179,296 200,624 222,864 246,512 271,808 271,808 271,808 271,808 271,808 271,808TotalInvestment 73,816 77,509 160,663 168,702 267,027 280,390 392,180 411,809 537,740 564,657 705,066 855,757 1,017,351 1,189,868 1,377,322 1,581,089 1,800,201 2,036,267 2,293,391 2,574,200 2,703,060 2,838,378 2,980,477 3,129,696 3,286,391TotalMV 29,244 33,390 69,164 78,214 123,355 138,443 193,063 215,291 280,429 311,006 387,643 473,588 569,494 675,803 794,544 926,853 1,072,993 1,234,218 1,412,838 1,610,735 1,759,271 1,915,778 2,080,695 2,254,486 2,437,64230-Yr LoanCum. Equity 300 503 1,037 1,478 2,306 3,038 4,205 5,280 6,838 8,312 10,316 12,719 15,548 18,832 22,615 26,939 31,843 37,372 43,586 50,548 57,606 65,016 72,797 80,967 89,54530-Yr LoanAnnual CF 300 803 1,840 3,318 5,624 8,662 12,867 18,147 24,985 33,297 43,613 56,332 71,881 90,713 113,327 140,266 172,109 209,481 253,067 303,616 361,222 426,238 499,035 580,001 669,54730 -Yr LoanCum. CF 29,545 34,193 71,004 81,532 128,979 147,105 205,930 233,438 305,413 344,303 431,256 529,920 641,375 766,516 907,871 1,067,119 1,245,102 1,443,699 1,665,905 1,914,351 2,120,493 2,342,016 2,579,729 2,834,487 3,107,18930-Yr LoanTotal ROIMulti-Year Financial Model Detailed Overview: 15 Properties Over 25 Years

Copyright 2005 by Rellek Publishing Partners, LLC 0 250,000 500,000 750,000 1,000,000 1,250,000 1,500,000 1,750,000 2,000,000 2,250,00019871986Market Value19941993199219911990Total Accumulated Equity 303,616 1,610,735 2,574,200199919971996Total Accumulated Cash Flow2000 2,500,0002001 2,750,0001998199519891988198519841983Multi-Year Financial Model Graphical Overview: 15 Properties Over 25 Years2002

Copyright 2005 by Rellek Publishing Partners, LLCCF60%Debt40%Equity 85,000/YearMedian Annual Net Cash FlowCFCash Flows 5.7%of Equity 3,700,000Median Market ValueCash Flows 2.3%of Market Value 1,500,000Median EquityMillionaire Real Estate Investor Financial Profile Overview

Copyright 2005 by Rellek Publishing Partners, LLCMasonsPlumbersPartnersReal erFlooring& REAL e Millionaire Real Estate Investor’s Work Network

Copyright 2005 by Rellek Publishing Partners, LLCINNERCIRCLEMILLIONAIREREAL ESTATEINVESTORConsultantsPartnersMentorsWork Network: Your Inner Circle

Copyright 2005 by Rellek Publishing Partners, LLIONAIREREAL ESTATEINVESTORReal EstateAgentsAccountantsContractorsInvestorsWork Network: Your Support Circle

Copyright 2005 by Rellek Publishing Partners, sersSERVICECIRCLEInspectorsCarpenterFlooring& echnicianMILLIONAIREREAL ESTATEINVESTORCourthouseClerksTitleCompaniesWork Network: Your Service Circle

Copyright 2005 by Rellek Publishing Partners, LLCBuild It “What would you do if youwere me?2. Qualify “Who do you know that Ishould know?”1. SeekTwo Questions to Start“Before You Need It”1Maintain It Review Your Net WorthWorksheet Share Your Plans & Goals3. And for Your Inner Circle, MeetThem every Month Gifts Three Times a Year Monthly Notes2. Mail Them Something OfInterest Every Month1. Call Them Every MonthThree Ways to Communicate“So You Have It”2Engage It3. Service Circle—As Needed2. Support Circle—Each Transaction1. Inner Circle—Each MonthThe Times of Engagement5. Refer Business to Your Network4. Don’t Short Change Anyone3. Don’t Talk Bad About Anyone2. Keep Your Word1. Do DealsFives Rules of Engagement“When You Need It”3The Work Network Development Model

Build Your Work Network With Two Questions1. Seek: “Who do you know that I should know?”2. Qualify: “What would you do if you were me?”Copyright 2005 by Rellek Publishing Partners, LLC

Maintain Your Work Relationships1. Call Them Every Month2. Mail Them Something of Value Every Month3. And, for Your Inner Circle, See Them Every MonthCopyright 2005 by Rellek Publishing Partners, LLC

The Five Rules of Engagement1. Do Deals2. Keep Your Word3. Don’t Talk Bad About Anyone4. Don’t Short Change Anyone5. Refer Business to Your Work NetworkCopyright 2005 by Rellek Publishing Partners, LLC

The Times of Engagement1. Inner Circle – Engage Them Each Month2. Support Circle– Engage Them Each Transaction3. Service Circle– Engage Them As NeededCopyright 2005 by Rellek Publishing Partners, LLC

1. WhatThe Lead Generation Model for Investment PropertiesHave Clear Criteria forthe Property you want toinvest in1.2.3.4.LocationTypeEconomicsCondition5. Construction6. Features7. Amenities1. Owners (Sellers) FSBOsMLS ListingsExpiredsBuilders/Developers AbsenteeLandlordsWholesalersOwners in an Area REO\Pre-ForeclosureHUD OfficialsAccountantsCourthouse ClerksAdministrative AssistantsInformation Providers2. Who2. Intermediaries (Gatekeepers) Bank Officers Loan Officers Attorneys Probate Bankruptcy Eviction REO Trustees DivorceIdentify the PeopleWho can connect you toProperties that meet yourCriteria3. Leads Network (Referrers) ResourcesAllied ResourcesAdvocateCore Advocates3. How1. Prospecting (Seek) Research Telephone Newspaper Face-to-Face Walking/Driving Area Public Postings Investment Clubs/Events(HUD, Foreclosure, etc) Community Events Multiple Listings Service Courthouse Proceedings Internet Probate Business Publications Foreclosure Paid Investor Prospect Estate/Tax SalesListings Bankruptcy/Evictions DivorceSystematically LeadGenerate for Propertiesand People2. Marketing (Attract)4.Which Separate Suspects fromProspects1.2.Business CardsDirect MailInternet/EmailFlyersTargeted Letters Newspaper AdsMagazine AdsSignsBillboardsQualify all SuspectsFocus only on ProspectsCopyright 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, LLCHave Clear Criteria for theProperty you want to invest in1.2.3.4.LocationTypeEconomicsCondition#1: What Am I Looking For?5. Construction6. Features7. Amenities

The Defining & Refining of Your CriteriaPropertyProspectsKnow YourCriteriaPeopleSuspectsCopyright 2005 by Rellek Publishing Partners, LLC

Two Kinds of Criteria1. Criteria for “What You’ll Consider”2. Criteria for “What You’ll Buy”Copyright 2005 by Rellek Publishing Partners, LLC

Your Real Estate Investment CriteriaWhat CriteriaWill I Consider?7. Amenities6. Features5. Construction4. Condition3. Economic2. TypeWhat CriteriaWill I Buy?Copyright 2005 by Rellek Publishing Partners, LLC1. Location

Zeroing In On A Great LocationGreat CountryGreat TownGreat CommunityGreat StreetGreat LotCopyright 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, LLCLiquidityAppreciationHassleCash FlowLow-EndPropertiesGreat DealsAveragePropertiesGood DealsBe In the Middle of the MarketHigh-EndPropertiesLowMediumHigh

The Millionaire Real Estate Investor’s Criteria Worksheet (1 of 2)1)LOCATION Country State/Province Taxes Rentals Laws Weather County/Parrish City/Town Taxes Services Neighborhood School District Crime Transportation Shopping/Recreation Street Traffic Size Lot Zoning Adjoining Lots Lot Size Trees Privacy Landscaping Orientation/View2)TYPE 3)Single Family Home Condo Town Home Mobile Home Zero Lot/GardenSmall Multi Family Duplex FourplexLarge RanchECONOMICS Price Range From ToDiscountCash FlowAppreciationCopyright 2005 by Rellek Publishing Partners, LLC % / Mo% /Yr

The Millionaire Real Estate Investor’s Criteria Worksheet (2of 2)4)CONDITION5)CONSTRUCTION Roof Walls (Exterior) Foundation Plumbing Water/Waste Wiring Insulation Heating/ACFEATURES Age/Year Built Beds Baths Living Dining Stories Square Feet Ceilingsft. Parking/Garage Kitchen Closets/Storage Appliances (Gas/Electric) Floor Plan (Open, In-law) Patio/Deck Basement Attic Lighting Walls (Interior) Laundry Room6) Needs No RepairNeeds Minor CosmeticNeeds Major CosmeticNeeds StructuralNeeds Demolition7)AMENITIES Office Play/Exercise Room Security System Furniture/Furnishings Sprinkler System Workshop/Studio In-Law Suite Fireplace(s) Pool Hot Tub Ceiling Fans Window Treatments Satellite Dish Internet (Broadband) Sidewalk Energy Efficient Features Other: Copyright 2005 by Rellek Publishing Partners, LLC

#2: Who Can Help Me Find It?1. Owners (Sellers) FSBOsMLS ListingsExpiredsBuilders/Developers AbsenteeLandlordsWholesalersOwners in an Area REO\Pre-ForeclosureHUD OfficialsAccountantsCourthouse ClerksAdministrative AssistantsInformation Providers2. Intermediaries (Gatekeepers)Identify the PeopleWho can connect you toProperties that meet yourCriteria Bank Officers Loan Officers Attorneys Probate Bankruptcy Eviction REO Trustees Divorce3. Leads Network (Referrers) ResourcesAllied ResourcesAdvocateCore AdvocatesCopyright 2005 by Rellek Publishing Partners, LLC

#3: How Will I Find the Property or People Connected to It?1. Prospecting (Seek)Systematically LeadGenerate for Propertiesand People Research Telephone Newspaper Face-to-Face Walking/Driving Area Public Postings Investment Clubs/Events(HUD, Foreclosure, etc) Community Events Multiple Listings Service Courthouse Proceedings Internet Probate Business Publications Foreclosure Paid Investor Prospect Estate/Tax SalesListings Bankruptcy/Evictions Divorce2. Marketing (Attract) Business CardsDirect MailInternet/EmailFlyersTargeted LettersCopyright 2005 by Rellek Publishing Partners, LLC Newspaper AdsMagazine AdsSignsBillboards

Copyright 2005 by Rellek Publishing Partners, LLCMarketingProspecting &MarketingProspecting &MarketingLEADSNETWORK(Met)TARGETEDGENERAL PUBLIC(Haven’t Met)GENERAL PUBLIC(Haven’t Met)Generating Leads and Moving People Into Your Network Circles

Copyright 2005 by Rellek Publishing Partners, LLCOtherTargeted MarketingInternet/Database ResearchFor Sale By OwnersForeclosure ListingsNewspaper & AdsDriving/WalkingReal Estate Agents/MLSNetworking2%3%4%5%7%9%10%28%32%How Millionaire Real Estate Investors Find Opportunity

The Lead Generation Database ModelHaven’t MetMetTargeted ListCreatedContact MadeContact ManagementDatabase1) Categorize By Area By Property Type2) Contact Prospecting Marketing1) Categorize Work Network Leads Network2) Contact Prospecting MarketingLEADSCopyright 2005 by Rellek Publishing Partners, LLCConvertHaven’t Metcontacts intoMet contacts.

Copyright 2005 by Rellek Publishing Partners, LLCLeadsNetworkThe Goal is to move to greater and greater concentricity—You wantto have a common center for your work and lead generation ng Your Work Network With Your Leads Network

Millionaire Real Estate Investor Preferred Databases43%MS Outlook19%Top ProducerACTOtherNone12%12%14%Copyright 2005 by Rellek Publishing Partners, LLC

Copyright 2005 by Rellek Publishing Partners, ELL-PLACED&ABSOLUTELYWILL send youLeadsABSOLUTELYWILL send youLeadsCAN &PROBABLYWILL send youLeadsMIGHT sendyou LeadsA Closer Look at the Circles of Your Leads Network

Prospecting for Leads1. Telephone2. Face-to-Face Walking/Driving Area Seminars & Investment Clubs Community Events Courthouse Proceedings Probate Foreclosure Estat

The Seven Ways Millionaire Real Estate Investors Think 1. Think Powered by a Big Why 2. Think Big Goals, Big Models, and Big Habits 3. Think Money Matters 4. Think Net Worth 5. Think Real Estate 6. Think Value, Opportunity and Deals 7. Think Action