Transcription

NALEPTHE LANDSCAPE FORIMPACT INVESTINGIN SOUTH ASIAUnderstanding the current status,trends, opportunities, and challengesin BANGLADESH, INDIA, MYANMAR,NEPAL, PAKISTAN, and SRI LANKAWITH SUPPORT FROM

ACKNOWLEDGMENTSThis project was funded with UK aid from the UK Government through theDepartment for International Development’s Impact Programme. The ImpactProgramme aims to catalyse the market for impact investment in sub-SaharanAfrica and South Asia. www.theimpactprogramme.org.ukThis report was made possible by the generous contributions of time and expertknowledge from many individuals and organizations. The GIIN Advisory Teamprovided invaluable insights, guidance, and support throughout the preparation ofthis report. In addition, we would like to thank all individuals that took part in theinterviews and surveys in each of the six countries of study. Through these interviewsand surveys, we obtained a wealth of experience, understanding, and data on impactinvesting activities in South Asia. We would also like to acknowledge the countryexperts who provided critical feedback on our preliminary findings. A full list of theinterviewees, survey respondents, and country experts can be found inthe Appendices.GIIN Advisory TeamAmit Bouri, Managing DirectorAbhilash Mudaliar, Manager, ResearchHannah Schiff, Senior Associate, ResearchMelody Meyer, Associate Director, CommunicationsKim Moynihan, Associate, CommunicationsDalberg Editorial TeamAdrien Couton, MumbaiLindsey Barone, MumbaiKira Intrator, MumbaiSneha Iyer, MumbaiFauzia Jamal, NairobiJyothi Vynatheya Oberoi, MumbaiRaahil Rai, Mumbaiii THE LANDSCAPE FOR IMPACT INVESTING IN SOUTH ASIA

LIST OF COMMON ACRONYMSADB Asian Development BankMDG Millennium Development GoalAIF Alternative Investment FundsMEB Myanmar Economic BankBoP Base of the PyramidMFI Microfinance InstitutionBRICS Brazil, Russia, India, China, South AfricaMFTB Myanmar Foreign Trade BankCA Chartered AccountancyMNC Multinational CorporationCIIE Centre for Innovation, Incubation andEntrepreneurshipMICB Myanmar Investment and Commercial BankCGTMSE Credit Guarantee Fund Trust for Micro &Small Enterprises (India)CSR Corporate Social ResponsibilityNABARD National Bank for Agriculture andRural DevelopmentNASE National Association of Social Enterprises (India)DFI Development Finance InstitutionNEDA National Enterprise Development Authority(Sri Lanka)DFID Department for International DevelopmentOPIC Overseas Private Investment CorporationFIL Foreign Investment LawPE Private EquityFDI Foreign Direct InvestmentPM Prime MinisterGAAR General Anti-Avoidance Rules (India)PPP Purchasing Power ParityGIZ Gesellschaft für Internationale Zusammenarbeit(German Agency for International Cooperation)RBI Reserve Bank of IndiaHDI Human Development IndexHNWI High Net-Worth IndividualHR Human ResourcesICT Information and Communication TechnologySEBI Securities and Exchange Board of IndiaSIB Social Impact BondSIDBI Small Industries Development Bank of IndiaSME Small or Medium EnterpriseIFC International Finance CorporationSMED Small and Medium Enterprise Development(Sri Lanka)IFI International Financial InstitutionSVF Social Venture FundIE Impact EnterpriseVC Venture CapitalIIC Impact Investors’ Council (India)WHO World Health OrganizationIMF International Monetary FundLP Limited PartnerLTTE Liberation Tigers of Tamil EelamNEPAL iii

TABLE OF CONTENTSAbout this report. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Who is an impact investor?. . . . . . . . . . . . . . . . 2Country context. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3Overview. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3GDP growth and drivers of FDI. . . . . . . . . . 5Key constraints and opportunities in Nepal. 8Investing in Nepal: the supply side. . . . . . . . . . . . . 9The broad impact capital market in Nepal . . 9Active impact and impact-related investors in Nepal . 12Key trends in impact investing in Nepal . . 14Return expectations and exit possibilities. . 19Beyond the impact investing market. . . . . 20Challenges facing impact investors in Nepal. . 21Looking forward. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23Needs and opportunities: the demand side. . . . 24Overview of social enterprise ecosystem in Nepal . . 24Constraints to enterprise growth. . . . . . . . . . 25Enabling impact investing: the ecosystem. . . 29The macro investment climate. . . . . . . . . . . . 29Support for investors and enterprises . . . . 32Areas for further research. . . . . . . . . . . . . . . . . . . . . . . 34Annexes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35Annex 1—Interview participants. . . . . . . . . . . 35Annex 2—Survey respondents. . . . . . . . . . . . . 36Maps within the report are based on UN maps. Source: UN Cartographic SectionNEPAL 1

ABOUT THIS REPORTThe objective of this study is to develop an understanding of the status of the impactinvesting markets in six countries in South Asia—Bangladesh, India, Myanmar, Nepal,Pakistan, and Sri Lanka. The full report includes an introduction and a chapterfor each country. This research is intended to serve as a critical input to futureinvestments and engagement to build and grow these markets. The key themesexplored include the current status and trends in terms of the types of active investors,capital deployment, opportunities for and challenges to investing, the demandfor impact capital, challenges to accessing capital and opportunities for enterprisegrowth, and the vibrancy and scale of the supportive ecosystem for the industry.IntroductionIn recent years, impact investing has become prominent on the global stage as anapproach to deploying capital with social/environmental goals as well as financialreturn objectives. Deployed in both developing and developed markets, impactinvestments are made across a range of sectors and asset classes.South Asia is home to more than 1.6 billion people and has experienced dramaticeconomic growth over the last decade. However, this rapid growth, while changingsome economies dramatically, has been uneven between and within countries; about aquarter of the region’s population continues to live on less than USD 1.25 per day1 andlarge population segments lack access to quality social services, finance, energy, andinfrastructure as well as to affordable consumer products. The opportunity for impactthrough the deployment of capital into organizations and enterprises that increaseincomes, create jobs, and provide access to essential services is significant, and thestatus of the impact investing industries in these countries is worthy of attention.Who is an impact investor?Impact investments are “investments made in companies, organizations, and fundswith the intention to generate social and environmental impact alongside a financialreturn.”2The three key characteristics of an impact investor are as follows: Expectation of a financial return that can range from the return of capital to riskadjusted market-rate returns and that can be derived from investments in a rangeof asset classes.1Weighted average calculated with the latest country data (2010–2012) from World DevelopmentIndicators, The World Bank; Myanmar figures are not included in the weighted average. Myanmarfigures are not included in the weighted average as this indicator is not available for Myanmar.2For more details, refer to the GIIN website, www.thegiin.org.2 THE LANDSCAPE FOR IMPACT INVESTING IN SOUTH ASIA

Intent to generate a positive social and/or environmental impact throughinvestments. For example, investors may seek to use investments to increaseaccess to basic services or invest in solutions aimed at mitigating the negativeeffects of climate change. Commitment of the investor to measure the social/environmental performance ofthe underlying investments.This report focuses significantly on the impact investing landscape in each of thesix countries covered. Various terms may be used to refer to the impact investinglandscape, including “impact capital” and “impact funds,” depending on the context.For the sake of fluency, the modifier “impact” will be dropped when the context isclear.While the central goal of this study is to map the current landscape of the impactinvesting activity, there is also significant investment activity on the periphery ofimpact investing that is interesting to explore. In particular, we consider the followingtwo types of investment activity:a. Investments in businesses serving BoP populations by investors who may not haveexplicit impact intentionb. Investments where there is some intention to have social and/or environmentalimpact, but this impact is assumed to occur as a by-product and is not measured inany meaningful waySuch investment activity is also important for an analysis conducted to gain a betterunderstanding of the broader opportunity landscape for impact investing goingforward. When a section in the report focuses particularly on the investment activity inthis peripheral region, we will explicitly refer to these as “impact-related” investments,thereby clearly differentiating them from “impact investing.” (Please note that we areusing these labels purely for the ease of reference and do not intend the names toimply any subjective judgment on the nature of an investor’s investment activity orapproach.)COUNTRY CONTEXTOverviewNepal’s small population, low GDP per capita, and political instability aredeterrents to investments in the country, resulting in the country having thesecond smallest impact investing market by capital deployed among thecountries under study (slightly larger than Myanmar). Nepal, with a population of27.5 million and a GDP per capita of about USD 690 (at the current USD exchangerate),3 is passing through a momentous and a prolonged transition following a3World Development Indicators, The World Bank, 2013.NEPAL 3

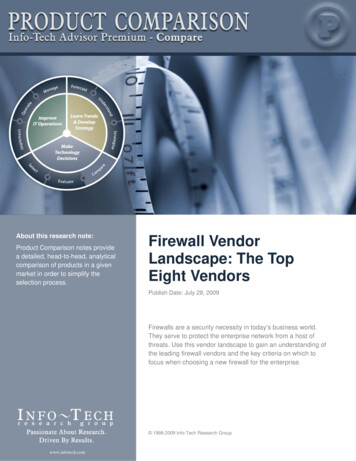

10-year-long violent conflict that ended in 2006. Since monarchy was abolished in2008, there have been numerous attempts to draft a new constitution (Figure 1).Following a year of multiple delays, elections were held in 2013 to elect the secondConstitutional Assembly. The Maoist party lost its majority, and the new governmentis now committed to delivering a new constitution by 2015.FIGURE 1: TIMELINE OF KEY EVENTS IN NEPAL’S POLITICAL HISTORY20062008King relinquishes sovereign power;House of Representatives takescontrolNepal united as singlecountry; monarchyestablished1700s2012House of Representativesofficially abolishes monarchyElections held to electConstitutional Assembly taskedwith drafting new constitution;Maoist party wins majority20082014First Constitutional Assemblydissolved due to inability todraft new constitution bydeadlineStrife arises between partiesand multiple Prime Ministersousted; delay in drafting of newconstitution20082011Following a year of multiple delays,elections held to elect secondConstitutional Assembly; Maoistparty loses majority2013Source: BBC Nepal profile http://www.bbc.com/news/world-south-asia-12511455 The implications of this for investors are numerous: Nepal’s political instability has brought about low investor confidence. Investorswill only feel confident in a politically stable environment and a governmentthat will hold for a reasonable length of time (e.g., five years). Further, Nepal’spolicy and regulatory environment is uncertain, highlighted by the lack of aconstitution. However, there is a general belief among domestic investors that therecently sworn in Second Constitutional Assembly will have a new constitutionwithin a year, as promised, leading to tempered optimism within the investmentcommunity. On the positive side, diminished Maoist power has created space for more privatesector activity and a more supportive agenda for policy reform, again creatingoptimism among investors. This has also meant decreased labor volatility. In the early 2000s, labor strikes wereparalyzing the country, but have since reduced in frequency and severity.4 THE LANDSCAPE FOR IMPACT INVESTING IN SOUTH ASIASecond ConstitutionalAssembly sworn in andpromises new constitutionwithin a year

GDP growth and drivers of FDINepal has seen steady GDP growth at about 6% per annum since 2004 and isexpected to continue this trend through 2016, but its GDP remains the lowestamong the countries under study. Nepal’s total GDP in 2013 was only 42 billion(PPP, international dollars),4 as seen in Figure 2. At 6% per annum from 2014 to 2016,the forecast growth is also one of the lowest in the region.FIGURE 2: GDP OF NEPAL (PPP, INTERNATIONAL DOLLAR, BILLIONS): CHANGE OVER TIME AND 2013 COMPARISONWITH THE REST OF THE REGIONGDP OF NEPAL(PPP, CURRENT INTERNATIONAL DOLLAR, BILLIONS, 2013)GDP, BY COUNTRY(PPP, CURRENT INTERNATIONAL DOLLAR,

adjusted market-rate returns and that can be derived from investments in a range of asset classes. 1 Weighted average calculated with the latest country data (2010–2012) from World Development Indicators, The World Bank; Myanmar figures are not included in the weighted average. Myanmar figures are not included in the weighted average as this indicator is not available for Myanmar. 2 For more .