Transcription

Peru countrymining guideKPMG Global Mining InstituteFebruary 2016kpmg.com/miningamericas

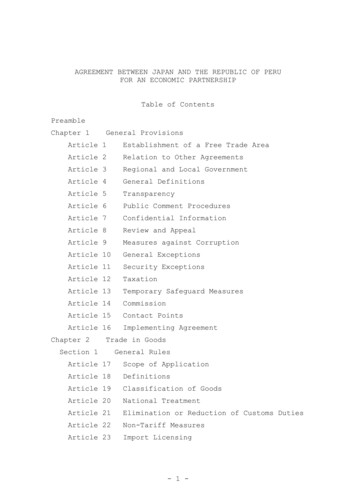

Table ofcontentsExecutive summaryCountry snapshotEIU (Economist Intelligence Unit) rankings:ease of doing businessType of governmentEconomy and fiscal policyFraser institute rankingsRegulatory environmentSustainability and environmentTaxationStability agreementsPower supplyInfrastructure developmentLabor relations and employmentInbound and outbound investmentKey commodities – production and reservesMajor mining companies in PeruFurther insight from KPMGKPMg global mining practiceMining centers 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.1345689111214182021222325272829

Peru Country mining guide1Executive summaryPeru is the world’s third largest producerof copper, after Chile and China, andholds the third-largest copper reserves.Peru is also the third largest producer ofsilver in the world, and the sixth largestproducer of gold. The country alsohas significant reserves of coal, ironore, silver, tin, sulfur and zinc. Mineralexports account for approximately60 percent of Peru’s total shipmentsabroad.Given its strong mining potential, Peruhas been attracting the world’s majormining companies to expand activitiesin the country. According to theMinistry of Energy and Mines (MINEM),copper production in Peru increasedby 64 percent from 113,700 tonnesin December 2014 to 186,450 tonnesin December 2015. The Mining andEnergy Minister, Rosa Ortiz, estimatedthat the increased production fromthe expansions of the Toromocho,Constancia and Cerro Verde mineswould enable the country to produce anestimated 2.5 million tonnes of copperin 2016. Foreign direct investment (FDI)has been entering the country, of whichthe Mining sector contributes over24 percent. As of October 2015, mininginvestment reached US 6.5 billionand is expected to reach US 7.5 billionby the end of 2015. Since investmentactivity in Peru has been driven bythe Private sector in recent years,the country is displaying a growingcommitment to become a good placefor doing business, ranking secondin the Latin American region in WorldBank’s Doing Business 2016.A long way to goPeru currently ranks in the middle ofWorld Bank’s ease of doing businessrankings. The Humala government iswilling to introduce more structuralreforms in the country to bolster theeconomic growth of Peru. Groundtransportation and electric powerinfrastructure is expensive and difficultto build due to the presence of theAndes Mountains and the Amazonjungle. The country’s environment issensitive with its citizens being evenmore sensitive toward protecting it.Peru3rdPeru is the world’sthird largest producerof copper and silverin the world6thThe sixth largestproducer of gold20thPeru is the 20th largestcountry in the worldand the third largestin South AmericaThe country ranked fifth in theEIU regional ranking, whichincluded 12 countries from theSouth American region. 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

2Peru Country mining guideThe Mining industry in Peru isprimarily regulated by mining lawsand regulations enacted by PeruvianCongress and the Executive branchof the government. The GeneralMining Law was approved in 1992and regulates nine different miningactivities. MINEM is the principal centralgovernment body in Peru with theauthority to regulate mining activitieswithin Peru. In Peru, nationals andforeigners are subject to the same set ofrules and regulations. The environmentalcertifications within the country aregranted in accordance with the impactthat the project is expected to haveon the environment. The governmentpassed a new law in July 2014 to boostinvestment in the Mining sector.A tax predictable regimeFinancially, it appears that Peru expectsthe Mining sector to contributegenerously to the national treasury.The three main taxes and fees imposedon mining companies are corporateincome tax, royalties and concessionrights. However, mining companies arealso required to pay a special mining taxand a special mining lien. In September2011, an additional charge was levied oncompanies with stability agreementsthat is aimed at increasing tax revenuesfrom mining companies. Taxationwill clearly be an issue for miningcompanies seeking to develop Peruvianprojects in the future.The recent spike in mining activity isputting pressure on Peru’s existinginfrastructure and increasing thedemand for new capacity. Thegovernment is responding bymaking infrastructure developmenta national priority. In May 2015, thegovernment announced plans tofinance US 1113 billion worth ofinfrastructure projects in partnershipwith private companies to reducethe infrastructure gap of betweenUS 85 billion and US 106 billion.Labor shortagesLabor is abundant and trainable in Peru,although there are shortages of highlyskilled workers in some fields due toa decline in the number of employeesoperating in the Mining industry.In February 2015, approximately190,819 people were employed in theindustry, a fall from 208,382 in 2013.In order to fill that gap, the sector isplanning to open some employmentopportunities to foreign professionalsand technicians. Peruvian law currentlystipulates that not more than 20 percentof a company’s total workforce can beforeigners. 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Peru Country mining guideCountry snapshotPeru1, 2GeographyThe Republic of Peru, commonly known as Peru, is the 20thlargest country in the world and the third largest in SouthAmerica, after Brazil and Argentina.—— Located in Western South America (10o00S, 76o00W),between Chile and Ecuador, the country spreads over1,285,216 square kilometersClimatePeru has three main climatic zones: the tropical Amazonjungle to the east; the arid coastal desert to the west; andthe Andes Mountains and high plateau in the middle of thecountry. The climate of the Andes Mountains varies fromtemperate to frigid.3PopulationWith an estimated population of 30.44 million (July 2015),Peru is the 44th most populated country in the world. Thecountry’s population is relatively young, with a median ageof 27.3 years.CurrencyThe official currency of Peru is the Sol (S/). Peru has hadfour main monetary systems since 1897. S/ is the currencyintroduced in 1991 when the country was experiencinghyperinflation.4Average exchange rate in 2015 was:—— S/ 3.1390 : US 1—— S/ 3.4805 : EUR1512345CIA: The World Factbook, Accessed on January 28, 2016Peru Country Profile, EIU, Accessed on January 28, 2016Peru Weather, Lonely PlanetPeruvian Money – Peruvian CurrencyOanda.com, Accessed on January 28, 2016 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.3

4Peru Country mining guideEIU (Economist Intelligence Unit)rankings: ease of doing businessPeru ranked48th among the82 countries coveredunder the EIUbusiness environmentranking for 2010–2014.The country rankedfifth in the regionalranking, whichincluded 12 countriesfrom the SouthAmerican region.Over 2015–2019, the businessenvironment is expected to improvedue to improvements in infrastructureand financing, according to EIUforecasts. Peru’s openness to foreigntrade is one of the favorable attributes ofthe country as a business location. Thecountry has secured multiple free-tradeagreements (FTAs) and has a stablemacroeconomic environment. Thebusiness-friendly approach that existedValue of Indexawithin the historical period (2010–2014)will remain in place irrespective of thegovernment that succeeds Mr. Humala(who himself took a highly orthodoxapproach).Peru’s infrastructure remains weak;however, it is expected to improvemarkedly over the long-term.Furthermore, the country’s labor marketis expected to remain the weakestaspect of the business environment.6Global RankbRegional 010–20142015–20196.096.42484855Note a. Out of tenNote b. Out of 82 countries.Note c. Out of 12 countries: Argentina, Brazil, Chile, Colombia, Costa Rica, Cuba, Dominican Republic, Ecuador,El Salvador, Mexico, Peru and Venezuela.Source: Economist Intelligence Unit6Peru Country Profile, EIU, Accessed on January 28, 2016 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Peru Country mining guideType of governmentPeru is a constitutionalrepublic. The presidentis directly elected for afive-year term and maynot be re-elected to asecond consecutiveterm. As the headof the state and thegovernment, thepresident appoints acouncil of ministers.78Peru’s Congress comprises130 members, and can be dissolvedonce during a presidential term. Peru’s25 regions and 1 province constituteits administrative divisions under civillaw. The provincial capitals have Courtsof first instance and the SupremeCourt is situated in Lima. The judgesof Supreme Court are proposed by theNational Council of the Judiciary orNational Judicial Council, nominatedby the president, and confirmed by theCongress.7, 8CIA: The World Factbook, Accessed on January 28, 2016Peru Country Profile, EIU, Accessed on January 28, 2016 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.5

6Peru Country mining guideEconomy andfiscal policyMineral resources are found in themountainous and coastal areas ofPeru with the coastal waters provingexcellent fishing grounds. Peru isthe world’s third largest producer ofsilver and third largest producer ofcopper. High prices for Peru’s metalsand minerals exports persist in theinternational market, accounting formajor growth in the country’s economy.The exports of metals and mineralsaccount for approximately 60 percent ofthe country’s total exports. The Peruvianeconomy is vulnerable to fluctuationsin world prices, despite strongmacroeconomic performance, due todependence on minerals and metalsexports and imported foodstuffs.Peru has been one of the fastestgrowing economies in Latin Americaover the past decade. Backed byfavorable external environment, prudentmacroeconomic policies, and structuralreforms in different areas, the countryachieved an average GDP growth rateof 6.1 percent between 2005 and 2014.In 2010, the first year after the globaldownturn, Peru’s economy grew aremarkable 8.5 percent. Growth startedslowing down in 2014 due to adverseexternal conditions, prompting thecountry into a challenging phase as itwitnessed a corresponding declinein domestic confidence and fewerinvestments. The Fishing industry hasbeen affected by the adverse weatherconditions in the country.Peru has followed a steady path of fiscalconsolidation since it barely avoidedbankruptcy in 1998, by signing anagreement with the IMF. The economy’soverall stable and strong performance,among the Latin American counterparts,has allowed the government toincrease its revenues and, therefore,to balance the budget. Despite thefact that government consumption hasexpanded faster than the country’sGDP during 2004–2014, the Humalaadministration is committed to fiscalresponsibility while simultaneouslyaiming at promoting social developmentand productive public investment.In the first two quarters of 2015, theeconomy grew by 2.4 percent, whichincluded an expansion of 6.5 percentin the third quarter, led by strongdomestic demand. Peru’s GDP growthfor 2015 is forecast at 3 percent and2016 forecast at 4.7 percent by Peru’sFinance Minister Alonso Segura in 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Peru Country mining guide7the budget proposal submitted tothe government in September 2015.International Monetary Fund (IMF)projected the country’s 2015 growth atjust 2.4 percent, even worse than the3.8 percent growth forecast it issuedin April 2015. The country maintains itsleading position among the countries ofLatin America, even with a downwardrevision of its growth projections.projects that are expected to beginover 2015 and 2016. Additionally, thecountry is expected to implement acountercyclical fiscal policy to supportaggregate demand. Moreover, with theongoing application of structural reformswithin the country, the confidenceof private investors will be assured,ensuring continued investment in thecountry’s economy.Peru’s government aims tosimultaneously jump-start thestruggling Mining sector while alsoinvesting in other sectors to deter thecountry’s economy from commodityexports. On one hand, it is promotingnew mining projects that will increasecopper production. However, it isalso focusing on education andinfrastructure, while trying to cut redtape and bring more workers into theformal sector to increase productivity.According to the National Bureau forStatistics (INEI), 74.3 percent of thelabor force in 2014 was informal.EIU expects that Peru will remain anattractive destination with respect tothe business environment due to thecontinuity of its orthodox economicpolicies. The Humala government iswilling to introduce more structuralreforms in the country, which willbolster the growth of the economy.Despite the increase in funding onpublic education and healthcaresystems, they are expected to continueto underperform. During 2016–2020,investments and trade flows will remainstrong because of the bilateral freetrade agreements with Peru’s maintrading partners — the US, China,and the EU and regional initiativeswithin Latin America. EIU has forecastthe country’s economic growthduring 2016–2020 at an average of4.3 percent. 9,10,11,12,13,14According to the World Bank, theeconomy growth in Peru is expectedto progressively recover to an averagerate of 4 percent during 2016–2017,mainly driven by the large mining91011121314CIA: The World Factbook, Accessed on January 28, 2016Peru Country Profile, EIU, Accessed on January 28, 2016Peru shifts GDP forecast down, increases budget deficit, September 1, 2015Peru Overview, The World Bank, Accessed on January 28, 2016Peru’s Economic Woes Echo Latin America’s, October 9, 2015Peru Economic Outlook, FocusEconomics, January 19, 2016 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

8Peru Country mining guideFraser institute rankings—— Size of government –expenditures, taxes andenterprises—— Legal structure and security ofproperty rights—— Access to sound moneyPeru ranked 52nd on Policy PerceptionIndex by the Fraser Institute‘s Survey ofMining Companies 2014. The countryhas slipped down in the rankings on theCurrent Mineral Potential index, witha ranking of 46 (of 122) in 2014 from arank of 22 (of 79) in 2010.Figure 1: Peru’s scores, Fraser Institute’s Survey of Mining Companies 2014Peru’s scores, fraser institute’s survey of mining companies60—— Freedom to trade 50.590.490.42200.440.450.40.30.2100—— Regulation of credit, labor 1220132014Policy perception index*Current mineral potential**0.10Current mineral potential and best practicesmineral potential score, on a scale of 1Among the 157 countries coveredin the Fraser Institute’s EconomicFreedom of the World 2015 Report,Peru ranked 41st, with a score of7.34 on a scale of 10. This annualpeer-reviewed report ranks 157countries around the world, basedon their policies that enable 42different economic measures in thefollowing areas:Survey of Mining Companies 201416Policy potential index score,on a scale of 100Economic freedom ofthe world 2015 report15Best practices mineral potential***Note *: The Policy Perception Index is a composite index that measures the effects on exploration of government policiesNote**: The Current Mineral Potential index is based on respondents’ answers to the question about whether or not ajurisdiction’s mineral potential under the current policy environment encourages or discourages exploration. It assumescurrent regulations and land use restrictions.Note***: The Best Practices Mineral Potential Index is based on respondents’ answers to the question about mineral potentialof jurisdictions, assuming their policies are based on “best practices.” It assumes no land use restrictions in place and theindustry “best practices”.1516Economic Freedom of the World 2015 Annual Report, Free the World, September 2015Survey of Mining Companies: 2014, Fraser Institute Annual 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Peru Country mining guide9Regulatory environmentPeru’s Mining industry is primarilyregulated by mining laws andregulations enacted by PeruvianCongress and the executive branch ofgovernment. The General Mining Lawwas approved in 1992, with the aimof attracting foreign investment in thesector. The law regulates nine differentmining activities: reconnaissance;prospecting; exploration; exploitation(mining); general labor; beneficiation;commercialization; mineraltransport and mineral storageoutside a mining facility.However, since 2000, anumber of countervailinglaws have been enactedthat focus on sustainabledevelopment.INGEMMET issues mining concessionsand keeps registers of all issued miningconcessions, as well as controlling thepayments of the Good Standing Feesand Penalties due every year. It alsoadministers the mining concessionscadaster and conducts geologicalsurveys.The General Directorate of Mining(DGM), a body of MINEM, grantsPrior Consultation Law, which definesthe public participation process thatmust be conducted before the approvalof a project that may have an impact onindigenous people.In Peru, nationals and foreigners aresubject to the same set of rules andregulations concerning the Miningindustry.The Ministry of Energy andMines (MINEM), a principalcentral government body inPeru, has the authority toregulate mining activitieswithin the Peruvian territory.The Ministry of Energyand Mines (MINEM), aprincipal central government bodyin Peru, has the authority to regulatemining activities within the Peruvianterritory. MINEM also grants miningconcessions to local or foreignindividuals or legal entities, througha specialized body called The Instituteof Geology, Mining and Metallurgy(INGEMMET).authorization to start exploration andexploitation projects. It also issuesconcessions for the following activitiesregulated under the General MiningLaw: general labor, beneficiation andmineral transport.One of the other laws that areapplicable to the Mining industry is theThe EnvironmentalAssessment and OversightAgency (OEFA), a body of theMinistry of the Environment,is in charge of auditingcompliance with environmentalregulation of all mining projectsand operations.The General Directorate ofMining Environmental Affairs(DGAAM), a body of MINEM,grants environmental certifications forthe Mining sector in Peru. As of July2015, the Environmental CertificationNational Service (SENACE), a body ofthe Ministry of the Environment, grantsenvironmental certifications for projectsthat require a Detailed EnvironmentalImpact Assessment (EIAd). 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

10Peru Country mining guideThe environmental certifications formining projects in Peru are granted inaccordance with the significance ofthe project. Based on the significance,projects are classified into the followingthree categories:—— Category I: Projects that do notcause any significant negativeenvironmental impact. Suchprojects can be certified with theapproval of an EnvironmentalImpact Statement (DIA).—— Category II: Projects that causemoderate environmental impactsthat can be minimized or eliminatedby taking certain precautionarymeasures. These projects arecertified with the approval of asemi-detailed Environmental ImpactAssessment (EIAsd).—— Category III: Projects that producesignificant negative environmentalimpacts. Such projects requiredeeper analysis to review theimpacts and propose effectiveenvironment managementstrategies. The projects arecertified with the approval of aDetailed Environmental ImpactAssessment (EIAd).1718In July 2014, Peruvian governmentpassed a new law to boost investmentin the Mining sector. The law, signedby President Humala in July 2014,significantly reduces most fines forcompanies because of environmentaldamages, forces environmental studiesto be done in just 45 days, and allowsexploitation of fossil fuel and miningin any newly formed protected areas.Under the new law, the Ministryof Environment no longer has theauthority to set standards for air, soil,and water quantity.The Mining Occupational Health andSafety Regulations govern the healthand safety in the Mining industry.The regulations govern that theconcession holders and employers must:—— assume all costs related tooccupational health and safety;—— implement the occupational healthand safety management system;—— obtain and maintain all relatedpermits; and—— report all mandatory informationto the respective governmentagencies.17,18Peru Mining Law, International Comparative Legal Guides, August 24, 2015Peru slashes environmental protections to attract more mining investment, Mongabay News, July 23, 2014 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Peru Country mining guide11Sustainability and environmentHistorically, the Miningsector in Peru hasbeen associated withpollution.19 There havebeen instances ofmajor protests in thecountry against theindustrial pollutioncaused by the miningprojects, specificallythe Tia Maria miningproject. Most of theseprotests have led tosuspension of theprojects.20On October 31, 2012, Peru’scongressional committee on theeconomy approved the creation of anew oversight institution, known asSENACE (the national environmentalcertification service), within theMinistry of Environment. Theinstitution comprises representativesof six ministries and is chaired by theEnvironment Ministry has the principalfunction of reviewing and approvingenvironmental impact assessments(EIAs) for large-scale investmentprojects. Previously, the Ministryof Energy and Mines (MINEM) wasresponsible for both rewarding miningconcession agreements and approvingEIAs. July 2015 onwards, SENACEwas given the authority to grantenvironmental certifications for projectsthat require a Detailed EnvironmentalImpact Assessment (EIAd).Peru is a leading gold producing nationin the world and this has attributedfor rampant illegal gold mining in thecountry. Gold mining in Peru has beenresponsible for widespread mercurypollution, affecting the entire food1920212223chain, including the food ingested bythe people living in the country. Goldmining is also responsible for pollutingthe rivers when sediment is releasedinto the rivers, which affects the aquaticlife. Illegal mining in the country hasbeen held accountable for depletion offorest cover in the country.21 Accordingto the Monitoring the Andean AmazonMapping project, there was a “rapidincrease” in deforestation along theUpper Malinowski River from 2013 to2015, with 85 hectares of forest lostbecause of mining in the area. Thishas been predominant despite thestrict environmental regulations andagreements in the country.22As of June 2015, illegal operationswithin the Cajamarca region continue tooperate despite several administrativepenalties imposed on the mines locatedin the area. Most of illegal miningoperations within Peru continue asthey are located in isolated regionsand authorities encounter difficultiesand hence do not intervene in suchregions.23Capitalizing on sustainable development in mining, KPMG International, January 2012Peru’s mining protests suspended amid evidence of leadership’s corruption, June 16, 2015Gold mining ravages Peru, October 28, 2013Grim prospects for sustainable miners in Peru, September 21, 2015Illegal mining in Cajamarca continues despite penalties, June 16, 2015 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

12Peru Country mining guideTaxationAs per World Bank’sDoing Business 2016report, Peru ranks 50globally in the rankingamong 189 economieson the ease of payingtaxes. Peru has madepaying taxes easier forcompanies by creatingan advanced onlineregistry with up-todate information onemployees.24The National Superintendence ofCustoms and Tax Administrations(SUNAT) is the main body responsiblefor collecting, and managing taxes paidto the central government. Municipalgovernments are responsible for levyingand collecting municipal taxes. Thethree main taxes and fees imposedon companies operating in the Miningsector include corporate income tax,royalties, and concession rights.Corporate income taxThe corporate income tax rate in Perufor the fiscal year 2015–2016 is 28percent. In mid-2014, Peru introduceda series of tax reforms, which aimto reduce the corporate income taxto 26 percent by 2019. The tax rateon dividends is 6.8 percent; and oninterest is 4.99 percent under specificconditions otherwise 30 percent.Mining companies pay the standardcorporate tax on income. In addition tothe corporate income tax, the miningcompanies pay royalties. 25, 262425262728RoyaltiesUnder the revised version of the2004 Mining Royalties Law, miningcompanies must pay on a quarterlybasis a royalty to the state forexploitation of resources based onoperating profit. Under the revisedfiscal system, the new royalty is appliedto operational profit of the miningcompanies – at a marginal-incrementrate, rising from one percent to12 percent, depending on operationalmargin, in 17 separate brackets. Thestate takes a percentage of the valueof the concentrates at prevailinginternational market prices.The law also defines the distributionof royalties to the provinces in thefollowing manner:—— Local governments of the districts inwhich the mining exploitation occursreceive 20 percent of royalties, ofwhich 50 percent goes to the localcommunities located near the mine.—— The government of the province inwhich mining takes place receives20 percent.27, 28Doing Business 2016 Peru, A World Bank Group Flagship ReportPeru reduces corporate income tax but raises dividends taxation, January 21, 2015Tax in Cross-Border Deals, Latin Lawyer, October 1, 2015Investment in Peru 2015, KPMGPeru Mining Law, International Comparative Legal Guides, August 24, 2015 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Peru Country mining guideConcession rightsConcession rights are granted bythe Peruvian government for mining,exploration, production, refining, andtransport of minerals by individualsor companies. The following benefitsare offered to companies undertakingmining activities:—— Foreign currency: The PeruvianConstitution establishes equalprotection for domestic andforeign investors who mayenter into agreements with thegovernment and guarantee freeaccess, possession, and disposalof foreign currency.—— Taxation exemption: Investors whoundertake large mining operationsmay enter into tax law stabilityagreements with the governmentfor periods of ten and fifteen years.Tax stability would include taxesknown as “impuestos.” No taxescreated subsequently to the date ofexecution of the stability agreementshall be applicable.293031Apart from these taxes, there are twoindustry-specific taxes levied on theMining sector by the central government:—— Special Mining Tax (SMT): A taxthat is applied as a marginal rate,from 2 percent to 8.4 percent, onoperational profit, also in successivebrackets for different operationalmargins.—— Special Mining Lien (SML): Miningcompanies that have taxationstability agreements previouslysigned with the government paythis contribution in the form of lienas the marginal rate rising from 4 to13.2 percent.SMT and SML charges are assessed bymultiplying an effective rate specificallyassessed for each charge by the“quarterly operational profits.”29, 30In September 2011, an additional chargewas levied on companies with stabilityagreements, which was known asSpecial Mining Contribution (SMC), withrates of 4–13.12 percent on quarterlynet operating profits.31Investment in Peru 2015, KPMGOverview of Peru’s Mining Industry, SES ProfessionalsPeru Mining Law, International Comparative Legal Guides, August 24, 2015 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.13

14Peru Country mining guideStabil

3 Peru Weather, Lonely Planet 4 Peruvian Money – Peruvian Currency 5 Oanda.com, Accessed on January 28, 2016 Peru Country mining guide 3 2015 KPMG International Cooperative (KPMG International). KPMG International provides no client services and is a Swiss entity with which the ind