Transcription

Handbook of Technical AnalysisFor Phil’s Stock WorldBy Pharmboy1

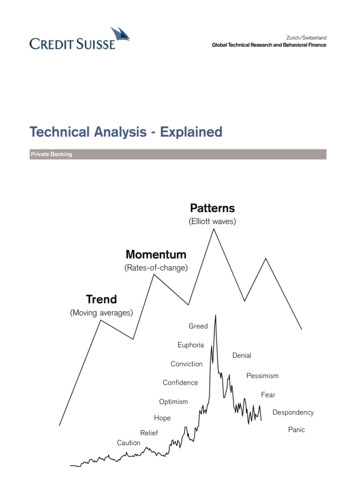

Table of ContentsTable of Contents 2Table of Figures 4Introduction 6Understanding Market Cycles: The Art of Market Timing 7Stages of a Market Cycle 8Phase Strategies 9Sentiment Cycle 10Dow’s Theory of Markets 12Fundamental vs. Technical Analysis 17Types of Technical Trading: Scalping, Day, Momentum, Swing, & Position Trading 19Scalping 19Day Trading 19Momentum Trading 19Swing Trading 21Position Trading 23Stock Charting Basics: How to Read & Understand Stock Charts 25Line Charts 26Bar Charts 28Candlestick Charts 29Trading Time Frames 29Using Moving Averages for Long and Short Trades 32Basic Technical Patterns: The Foundation of Common Pattern Identification 35Trends & Trend lines 36Support & Resistance 39Neutral Ranges 40Triangles: Symmetrical, Ascending, Descending 42Flags, Pennants and Wedges 44Double Tops & Bottoms 44Head & Shoulders 46Cup with a Handle 47Entry & Exit Points 49Low-Risk Trading 50Selling Short 50Candlestick Charts 51Summary: Combine Indicators to Support Trading Decisions 51Candlestick Charting I: Basic Patterns 54Doji 55Engulfing 55Harami 57Kicker 57Dark Cloud Cover 58Piercing 592

Shooting StarHammer & Hanging ManMorning StarEvening StarPlaying the Gap: Identifying and Trading GapsTypes of Gaps:Area GapsContinuation GapsBreakaway GapsExhaustion GapsStrategyWhen to Buy (Short) and Sell (Cover)How to Find Trading GapsConclusionHigh-Reliability Reversal SignalsBreakouts & BreakdownsBreakoutsBreakdownsHow to Trade Power SpikesReferences & Games59606062636363646565666666676874747680823

Table of FiguresFigure 1. Four stages of the market cycle. 7Figure 2a and b. Market stages of two companies. 7Figure 3. Market cycles of Potash (3a), Mosaic (3b) and CF Industries (3c). 9Figure 4. Range of a trader’s emotions. 10Figure 5. Candlestick chart with 50 and 200d MA. Below are the MACD and RSI. 12Figure 6. Primary and secondary movements of S&P 500 Spiders Index (SPY). 13Figure 7. Three phases of the market. 14Figure 8. STEC earnings announcement gaps. 14Figure 9. Divergence of XLF and XHB. 15Figure 10. SPY volume declines as price increases and vice versa. 16Figure 11. Market Trend (2003 – 2007). 16Figure 12. Technical analysis noted on the graph, Fundamental analysis income statement. 17Figure 13. TA and FA effectiveness in long and short term trading. 18Figure 14. Momentum trading of ENI. 21Figure 15. Swing trading Verizon. 23Figure 16. Position trader buying and selling in Petrohawk. 24Figure 17. SPWRA bar chart. 25Figure 18. SPWRA line chart. 28Figure 19. Bar chart. 28Figure 20. Candlestick chart. 29Figure 21. Cerner time frame chart. 30Figure 22. STEC volume analysis chart. 31Figure 23. 50 and 200d MA of Merck. 32Figure 24. Moving averages for Verizon. 33Figure 25. Four year DJIA bar chart. 34Figure 26. Typical up and down trends. 35Figure 27. Trend line drawn correctly. 36Figure 28. Trend line drawn incorrectly. 36Figure 29. Downtrend line of Caterpillar. 37Figure 30. Dryships chart showing trend lines and identifing breakdowns. 38Figure 31. Dryships chart continued. 39Figure 32. Support and resistance lines. 39Figure 33. Neutral trading ranges in Merck. 42Figure 34. Symmetrical triangle. 42Figure 35. Ascending triangle. 43Figure 36. Descending Triangle. 43Figure 37. Flags, pennents and wedges. 44Figure 38. Double top in GTE. 46Figure 39. Double bottom seen in chart of MEMC. 46Figure 40. Head and shoulders pattern in S&P 500. 47Figure 41. Cup with handle pattern. 49Figure 42. Chart showing the entry and exit points for STEC. 49Figure 43. Chart of the DIAs and its breakouts and consolidation pattern. 50Figure 44. Short selling CVX. 50Figure 45. Candlestick chart of MRK showing different signs. 51Figure 46. Different indicators to use when making trade decisions. 53Figure 47. Chandle sticks. 54Figure 48. Candlestick patterns. 544

Figure 49.Figure 50.Figure 51.Figure 52.Figure 53.Figure 54.Figure 55.Figure 56.Figure 57.Figure 58.Figure 59.Figure 60.Figure 61.Figure 62.Figure 63.Figure 64.Figure 65.Figure 66.Figure 67.Figure 68.Figure 69.Figure 70.Figure 71.Figure 72.Figure 73.Figure 74.Figure 75.Figure 76.Figure 77.Figure 78.Figure 79.Figure 80.Doji patterns on STEC chart. 55Bullish and bearish engulfing patterns. 57Bullish and bearish haramis. 57Bullish kicker. 58Dark cloud cover. 58Piercing pattern. 59Shooting star pattern. 59Hammer and hanging man in STEC chart. 60Morning star pattern on Goldman Sachs. 62Evening Star in Merck chart. 62Area gap. 64Continuation gap. 64Breakaway gaps. 65Exhaustion gap. 65Signals for reversals. 68Evening star patterns of Sunpower and Verizon. 68Shooting star of Choice Hotels. 69Bearish engulfing on Verizon's chart. 70Bearish belt hold and examples. 70Failure of Bearish belt hold pattern. 73STEC chart showing a breakdown pattern. 74Merck chart patern on breakout pattern. 76Bank of America's high and tight flags. 76STEC breakdown. 77Arch Coal breakdown with island. 77Petrohawk double top pattern. 78LG Display chart with wedge and flags. 78Bucyrus slanted triple top. 79Head and shoulder example pattern and one of CNET. 79GTE’s double top head and shoulders. 80Example of power spikes. 80Power spikes. Error! Bookmark not defined.5

Introduction“Study as if you were going to live forever; live as if you were going to die tomorrow.”- Maria Mitchell“Get over the idea that only children should spend their time in study. Be a student so long asyou still have something to learn, and this will mean all your life.” Henry L. DohertyWelcome to Phil’s Stock World “Technical Trading 101” handbook! This handbook iscomprised of some simple methodologies in the art of Technical Analysis (henceforth referred toas TA). This handbook is not intended for novice traders.Technical analysis is the art of reading charts and deriving a decision to buy or sell solely on thechart. Financial statements do not need to be read, nor does the technician to need listen to aconference call. A chart speaks for itself. Technicians believe that past price patterns, tradingactions, and price-volume relationships, among other indicators, form an accurate basis of wherethe stock is likely to move to in the near-term. Since price patterns on a chart are formed byinvestors & traders past emotional responses to price movements, the patterns can be exploitedfor use in the future.Technical Analysis is not a crystal ball! Patterns can, and will fail, and will result in losses.However, if the trader focuses on highly reliable patterns (e.g., shooting star), combine severalindicators (e.g., MACD), and perfect entry and exit points, a technician will be way ahead of thegame.I begin this handbook as a macro view of the market and its cycles. The market cycles similar tothe seasons of the year, move in and out of favor for various reasons. Dow’s Theory of themarket discusses stock price movements that include, what is now called TA as well as someportion of sector rotation. By understanding fundamental analysis and using TA, a techniciancan use the information to make a strategic decision about trading a particular stock. Whentrading, the technician needs to decide what type of trade they are going to perform (e.g., scalp ormomentum trade) and how to use TA. Cha

Welcome to Phil’s Stock World “Technical Trading 101” handbook! This handbook is comprised of some simple methodologies in the art of Technical Analysis (henceforth referred to as TA). This handbook is not intended for novice traders. Technical analysis is the art of reading charts and deriving a decision to buy or sell solely on the chart. Financial statements do not need to be read .