Transcription

Elliot WaveTechnical AnalysisCourse - Part 1Surfing the Waves with Richard Tataruwww.orbex.com

Who is Orbex?Orbex is a global award-winning online forex broker, fully licensed and regulated by CySEC,specializing in the provision of access to the world’s biggest and most liquid financial markets. Orbex has a rich experience of ensuring superior customer service. Traders enjoy24/5 multilingual support, exceptional trading conditions, and a wealth of educationalmaterial.Since its founding in 2010, Orbex has focused on the quality of its services and technological advancement. As a part of our customer support program, we provide enhanced security of clients’ funds and high professionalism in confidential finance matters. Orbex understands the value of rapid decisions on fast-paced financial markets; therefore, we ensuresharp execution, sound market analysis, and extensive trading education.For our business partners, we have developed an outstanding Forex Affiliate Program,including personal business consultant, custom marketing campaigns, innovative affiliatedashboard, competitive commissions and leading reporting technology that provides fullcontrol over your business. Join Orbex and enjoy the new trading experience!About the AuthorRichard is passionate about technical analysiswith years of charting experience under his belt.When it comes to his insights and how he analyses the markets, he uses leading analysis tools. Inparticular, Elliott Wave Analysis is his forte, andhe dedicates the majority of his time to using andperfecting this analytical method. Richard usesElliott Waves in combination with Structures,Patterns, Divergences, and then spices things upwith Vibration Levels, Fibonacci measurements,Channeling, Break-outs or Flag formations.www.orbex.com1

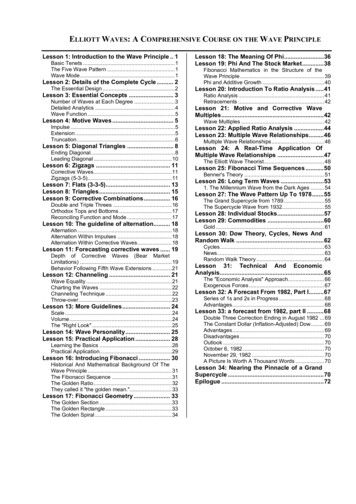

ELLIOTT WAVE PRINCIPLE – COURSE MODULE3AUTHOR’S THOUGHTS4INTRODUCTION TO ELLIOTT WAVE5R.N. ELLIOTT’S LEGACY7BASIC SEQUENCE & WAVE PATTERN8QUICK FACTS & GUIDELINES10Sit back and surf the waves, it’ll be worth your while!www.orbex.com2

ELLIOTT WAVE PRINCIPLE – COURSE MODULEThis course is delivered in a way that allows you to develop a whole new approach to trading or to perfect your current strategy. Besides the Elliott Wave Principle, it will also includeFibonacci Mathematical Measurements, Consolidation Areas, Points of Interest or Vibration Levels, Divergences (Differences in the Price Action), Types of Structure, and so muchmore.The course will be delivered in a series of EBooks to allow you to progress through thecourse at your own pace.Before we get started on the Elliot Wave Course and talk about how this Principle can beapplied to Forex & CFD trading, please be aware that that the following material has beenpublished for educational purposes only and should not be considered as immediateinvestment advice. Should you attempt to use any of the information provided, pleaseacknowledge the risks involved.www.orbex.com3

AUTHOR’S THOUGHTSThe Elliott Wave principle is acomplex way of analyzing theFinancial Markets. It revealshow trader sentiment works,how people behave and the mass psychology behind buying and selling the assets.Some believe that this method is in factone of the main laws of the universe and itcan be applied to almost every aspect ofour lives. Well, we’re not going to stretchit that far. Instead we’re going to discusshow this exercise in probability can helpan Elliottician to identify Market’s Structures and to anticipate the next most likelymarket movement, within the price actionon the charts of course.We are talking here, about a catalog withstructured patterns concerning the waycrowds diverge from extreme points ofpessimism to extreme points of optimism.It is a description of the steps humanbeings experience when they are part ofthe investment crowd. As you’ve probablyguessed; Price Action reflects the humanbuy/sell emotions, which appear on thecharts as patterns. The Elliott Wave Technique is a road-map with which tradersclassify patterns for their up-comingtrades. Many believe that the Market hasa pulse and a natural way of developingprice action. With this technique, Elliotticians are often one step ahead of thecrowd.In my personal opinion, this is by far themost reliable leading analysis tool that atrader can have in his/her arsenal and canbe a significant asset to you if appliedcorrectly.www.orbex.comThis technique however, is known to bevery subjective among traders. There aredifferent types of approaches and traderstend to begin using it, only to abandon thetechnique at a later stage as they may notfully understand the concept. Every traderis different in his/her trading style and hashis/her own set-ups, so it will be up to theindividual trader to adapt the concepttheir own trading strategy.The challenge that mostElliotticians face lies withinthe structure types, reading,mapping & labeling, hencethe reason for the subjectivity. This alsoaccounts for the reason why Wave Traderstend to have a main count and an alternate count acting as a back-up.If you are new to the Elliott Wave Strategy,it’s recommended to start with the basicsand to keep it simple in the beginning. Thisshould help you avoid any potential headaches. As your knowledge and hunger tolearn increases, you may choose to seehow far down the rabbit hole goes andexplore/apply more advanced techniques.Within this Module we will discuss thestructures of the Elliott Wave Concept; thetypes of waves, cycles, but most importantly how to start counting the right way andhow to apply the techniques onto yourcharts.This module will be split into two categories; a basic and an advanced approach.4

BASIC MODULEINTRODUCTION TO ELLIOTT WAVE PRINCIPLEAfter a brief introduction into the Wave Principle and what it can do. Let’s take a step backin time and assess why this trading technique intrigues so many people.Who was this man?Ralph Nelson Elliott was American accountant who, in the early 30’s, studied around 75years’ worth of stock market data. The data consisted mostly of indexes from annualdata, all the way down to 30 min charts. He discovered that the Stock Market did notmove randomly and chaotically as it was initially believed to, and that it followed naturallaws, which could be measured and predicted using the Fibonacci sequence (goldenratio). In short, Elliott identified that prices unfolded in specific patterns.twww.orbex.com5

Elliott developed this amazing analytical tool in the 1930’s. Then in 1938, he published histheory of market behavior in the book entitled ‘’The Wave Principle’’.Elliott was a genius. His inspiration came from understanding the ‘Dow Theory’ whichthen progressed to a point where he could measure and predict significant Stock Marketmovement. Elliott understood the mechanics of trends and counter-trends and saw thatCharles Dow (the founder of modern technical analysis) had indeed been correct with histheory. Elliott implemented his own thoughts and created a masterpiece, resulting in hisunbelievable and accurate predictions of the Stock Market Crash.DOW Growing recognitionApprehensionCautionShock & �s theory intrigued many, especially after the book with the same name, “The WavePrinciple” was published in 1978. In the book Robert Prechter and A.J. Frost rescue Elliott’sdiscovery from obscurity.So, you see, even after more than 80 years, this amazing theory and pattern is still beingused by hundreds of thousands of traders and investors worldwide.What, why and how?When setting goals, it is a must to ask these three questions. Thus far, we have covered the‘’what’’ in the Elliott Wave explanation. The ‘’why’’ is very simple: Wave Traders use this technique to trade better or more successfully and aim to generate a certain profit consistency. But“how”? That, my fellow traders, is the million-dollar question. The answer lies within the course.www.orbex.com6

R.N. ELLIOTT’S LEGACYAs previously discussed in the Author’s thoughts; Elliott believed that market cycles cameabout from investor reactions. The price action movements reflect investors buy or sellsentiment. Market cycles can be broken down into repetitive patterns which can then bebroken down into waves. These waves are what we will be identifying, counting andanalyzing in Elliot wave analysis.Wave 2canNEVERgoeb yondthe startofWave 1Before we begin learning about patterns in the concept, we must remember that thereare 3 commandments, stated by R.N Elliott that are imperative to the theory:Impulse Wave 3 can never be the shortest waveWave 2 can never retrace beyond the start of Wave 1Wave 4 can never cross into the same price area as Wave 1These rules, just like all rules in general, are bent sometimes, so don’t be afraid to thinkoutside the box and question everything.What I would suggest is that when one of these 3 rules are broken, then a review needsto be done for the wave count.With that being said, next we’re going to go over some important bullet-points to betreated as guidelines when using Wave Analysis.www.orbex.com7

BASIC SEQUENCE & WAVE PATTERNThere are 2 choices that one can make when applying the Elliot Wave theory to his/hercharts and when counting the waves, Simple and Advanced. The Simple technique impliescounting the waves normally (without any solid understanding) and the Advanced impliesgoing more technical and recognizing the Impulsive or Corrective structure type.We will start with the Simple Approach and then move towards the Advanced one andexpand our trading senses.53B1425A35C53355The Market has a law of its own and the progression unfolds in ‘’Waves’’, as R.N. Elliottcalled each Price Action Swing.www.orbex.com8

53B1425A35C53355Wave Sequence:In a Dominant Trend, progress ultimately takes the form of 5 Waves, which are labeled withnumbers; 1,2,3,4,5.Three of these swings, which are 1, 3 and 5, affect the overall direction in favor of the Dominant Trend. These Swings are known as Motive Waves or Impulses.Within the 5 Wave Sequence, the 3 Waves that unfold in favor of the Dominant Trend areseparated by 2 countertrend interruptions, which are labeled as 2 and 4. These Swingsrepresent a temporary interruption of the Impulse Waves, hence why they are calledCorrective Waves.Simply put, the Wave Principle states that; a Full Cycle is made up of 8 Swings. The Marketmoves with 5 Waves in the direction of the Main Trend with 3 Waves against it.Once the Impulsive Phase is complete, then the Trend Corrective Legs unfold and act as apull-back. Labeled A, B & C.Structures:Impulsive or Motive Waves come in 3 forms: Extensions, Ending and Leading Diagonals.Corrective Waves come in 5 forms: Zig-Zag, Flat, Triangle, Double & Triple Three.www.orbex.com9

Time for some fun facts!QUICK FACTS & GUIDELINESPrice Action moves in patterns and usually has the magic numbers set to 3 and 5.A Bullish or Bearish Elliott Cycle is formed out of 3 Impulsive Waves (1, 3 & 5), 2 Corrective Waves (2 & 4 which correct the impulsive 1 & 3) and then follows the Trend Correction legs - A, B & C.So, if you don’t want to complicate things, you can apply the basic theory, 12345-ABC, simpleright? BUT! It’s not that simple, if only it would be.If you aspire for greater accuracy levels, then the advanced technique would be of benefit.Impulsive or Corrective Waves are Fractal by nature meaning that they are usuallyformed from other Elliott Waves. So, you will find an Elliot Wave within a larger ElliotWave as each wave has ‘sub-waves’.Impulse Wave 3 is usually the strongest swing but sometimes 5 can be just as strong.Traders can take profit on the 3rd Impulsive Wave then after the 4th RetracementWave, they can get in again on the 5th Impulsive Wave. Or simply put, traders becameaccustomed to the Elliott method and this is why the 5th Wave tends to have a biggerimpact on the charts, especially in the commodities market.Most of the time, Impulse 3 contains an extension, which would imply Impulse 5 has thesame length as Impulse 1.Corrective Waves 2 & 4 can have 2 forms; Simple (3 moves) and Complex (5 moves). IfWave 2 is Simple, then Wave 4 will be Complex and vice versa, due to the Law of Alternation. Usually, corrective wave 2 unfolds with a Zig-Zag Structure.Sometimes, on rare occasions, the C Corrective Wave can transcend into Impulse Wave1.Wave C always unfolds with a 5 Wave Sequence.Wave B and Wave X always unfold with a 3 Wave Sequence and are known to be thecause of Market uncertainty, fake break-outs or even Structure change.ttwww.orbex.com10

ABC Correctives can provide a strong gain, depending on the size of the Impulsive Waves.This is because at the end of the 5th Wave, Divergences occur giving Traders the possibility to spot the difference in the price action.For example in an up-trend a new high would be created while the volumes woulddecrease, meaning that Bulls pushed the Market higher but they are not justifying acontinuation with enough liquidity, leaving room for Bears to take over.When the Market goes into a Correction, the correction itself would often end its firstswings inside the price territory of the previous Wave 4 of a lesser degree. This is validexclusively for a Wave 4 which would end in the territory of the previous Wave 4, withinthe main Impulse 3.www.orbex.com11

Risk warning: Forex, Commodities and CFDs (OTC Trading) are leveraged products thatcarry a substantial risk of loss up to your invested capital and may not be suitable foreveryone. Please ensure that you understand fully the risks involved and do not investmoney you cannot afford to lose. The information provided can under no circumstancesbe considered as a recommendation to engage in any trade. Orbex Limited All rightsreserved Our company is licensed by the Cyprus Securities & Exchange Commission (CySEC – License Number 124/10), which has been passported in the European Unionthrough the MiFID Directive.

Besides the Elliott Wave Principle, it will also include Fibonacci Mathematical Measurements, Consolidation Areas, Points of Interest or Vibra-tion Levels, Divergences (Differences in the Price Action), Types of Structure, and so much more. www.orbex.com 3. This technique however, is known to be very subjective among traders. There are different types of approaches and traders tend to begin .