Transcription

I N D EPEN D EN T P U B L I C AT I O N BYRACONTEUR.NETTRADINGSTRATEGIESLONDON JOIN05 SHOULD12THE SPAC BOOM?THE MYSTERIOUSAPPEAL OF CHARTISM17EVERYTHING YOU NEEDTO KNOW ABOUT NFTS#07322 7/ 0 4 / 2 0 2 1

RACONTEUR.NET#07322 7/ 0 4 / 2 0 2 1RACONTEUR.NETTRADINGSTRATEGIESTrading after COVIDDistributed inDISCLAIMER: Content in this publication shouldnot be used as financial advice – please ensureyou always seek the help of a qualifi ed investmentadviser or financial professionalA higher risk appetite, younger traders and bets made on the basisof social media sentiment were themes that characterised tradingat the height of the pandemicJoe McGrathContributorsFiona BondMarianne CurpheyRich McEachranJoe McGrathCharles Orton-JonesChris Stokel-WalkerRose StokesJonathan WeinbergJournalist writingacross business andfinance, she is the formercommodities editor atInteractive Investor.Award-winning financialwriter, blogger andcolumnist, and formerstaffer at The Guardianand The Times.Journalist covering tech,startups and innovation,writing for TheGuardian, The Telegraphand ProfessionalEngineering.An award-winningjournalist, he waseditor-at-large ofLondonlovesBusiness.com and editor ofEuroBusiness magazine.Financial journalistand editorial director ofRhotic Media, with workpublished in Bloomberg,Financial Times andDow Jones.Technology and culturejournalist and author,with bylines in TheNew York Times, TheGuardian and Wired.Lorem ipsumJournalist specialising inwomen’s rights, health andhuman interest features.Her work has appearedin The Guardian, TheEconomist and Vice.WINNER 2021Best ZeroCommissionBrokerPublishing managerJournalist, writer andmedia consultantspecialising intechnology, business,social impact, and thefuture of work and society.DesignAlex GibsonKellie JerrardColm McDermottSamuele MottaNita SaroglouJack WoolrichSean Wyatt-LivesleyManaging editorSarah VizardDeputy editorFrancesca CassidyIllustrationNita SaroglouAssociate editorPeter ArcherArt directorJoanna BirdHead of productionHannah SmallmanDesign directorTim WhitlockAlthough this publication is funded through advertising andsponsorship, all editorial is without bias and sponsored featuresare clearly labelled. For an upcoming schedule, partnershipinquiries or feedback, please call 44 (0)20 3877 3800 oremail info@raconteur.netRaconteur is a leading publisher of special-interest content andresearch. Its publications and articles cover a wide range of topics,including business, finance, sustainability, healthcare, lifestyle andtechnology. Raconteur special reports are published exclusively inThe Times and The Sunday Times as well as online at raconteur.netThe information contained in this publication has been obtainedfrom sources the Proprietors believe to be correct. However,no legal liability can be accepted for any errors. No part of thispublication may be reproduced without the prior consent of thePublisher. Raconteur Media@raconteur/raconteur.netraconteur.net03P O S T- C OV I D@raconteur london/trading-strategies-2021he coronavirus pandemiccaused some well documented and previouslyunimaginable consequences to thenation’s mental, physical and financial health.Yet, while daily news headlinesoften referenced those in financialhardship during the outbreak, therewere many in society who were ableto improve their disposable wealth.Figures released by YouGov at theend of March 2021 revealed thatalmost a third (32 per cent) of people in the UK had actually managed to grow their savings duringthe pandemic.However, the interest rates on savings accounts have remained lowand people are now exploring otherplaces to put their money, according to Simon Crookall, a formerbond trader who founded retail siteInvestEngine in 2019.“The surge in sign-ups to trading apps during the pandemic hasshown that people are prepared toput their money in the stock market even in a time of uncertainty,”he says. “For those who don’t needto keep this cash on hand, or plan tospend it, investment could certainlybe worth considering.”Given the low interest rate environment and the volatility in stocksthroughout the crisis, investorshave been keen to explore opportunities, according to experts at thevarious retail brokerages.“By causing significant fluctuations on the stock market, COVIDhas put investing on the public agenda,” says Anna-SophieHartvigsen, co-founder and partnerof Female Invest.“As a result, people are joiningthe stock market at unprecedentedrates, hoping to get in at the righttime. This can be seen as an expression of an increased risk appetite,where investors are willing to gamble for short-term gains.”For many, the pandemic has redefined how they think about investing. The significant stimulus measures from governments around theworld shaped the performance ofequity markets. It meant a wholehost of individual sectors and stocksreturned double-digit returns in amatter of days, something investorspreviously waited months, or evenyears, to see before the pandemic.“The rapid bounce back fromCOVID lows inspired by significantstimulus and support reinforcedthe message that ‘bad news is oftengood news’ for the markets and thatChaiyapak Mankannan via ShutterstockI N D EPEN D EN T P U B L I C AT I O N BYTcorrections or dips are to be bought,”explains Charles White-Thomson,chief executive at Saxo Markets.Joshua Mahony, senior marketanalyst at IG Markets, acknowledges the opportunities market corrections have afforded during thepandemic, but explains that whilethe initial March-April capitulationin stocks and energy markets ledto some short-termist activity, thetrends since have been more drawnout, allowing traders to hold on topositions for longer.“Global lockdowns provided thebasis for huge tech gains, whichhave only recently started to losesome momentum,” he says.“Nevertheless, each trader willtake their own approach and whileone will see a trend and want to rideit for weeks at a time, another mayspot specific entry opportunitiesthat may last hours.”For younger consumers, the frustrations of slow income growth coupled with a long-term low interestrate environment is likely to meana greater willingness to explorewhat retail trading platforms haveto offer.In addition, substantial innovation in the retail trading market over the past decade has madeit easier to trade through apps, touse ewallet services and exploreSTOCK MARKET VALUE HAS SOARED DESPITE THE PANDEMICValue of MSCI World USD index 2018-20201,8842,3582,677201820192020MSCI 2021emerging asset classes such ascrypto currencies.“A lack of access to pedigree private investments has pushed younginvestors into high-risk assets wherethere's still upside growth potential,” says Josh Greenwald, chief riskofficer at Uphold.IG’s Mahoney agrees, explainingthat the market “collapse” witnessedduring the pandemic brought in anew crop of traders.“Huge interest from younger traders seeking to take advantage ofrock-bottom prices also brings a different risk-profile and investing attitude,” he says. “While the new generation of traders will often be moreopen to risk, that approach can perhaps shift as they move along theirjourney and take a more strategicapproach to trading and investing.”Some market observers at theFinancial Conduct Authority (FCA)will indeed be hoping this is thecase. In March 2021, the regulator issued a public notice warningthat young people were investing inhigh-risk products that may not besuitable for them.“We want to make sure weencourage the ability to save andinvest for lifetime events, particularly for younger generations, but itis imperative consumers do so withsavings and investment productsthat have a suitable level of risk fortheir needs,” says Sheldon Mills,executive director of consumersand competition at the FCA.“Investors need to be mindful oftheir overall risk appetite, diversifying their investments and onlyinvesting money they can afford tolose in high-risk products.”It is clear the shifting profile ofretail traders is of interest to the regulator, but their age profile isn’t theonly issue being monitored.The recent spike in previouslyout-of-favour stocks such as USretailer GameStop and tech firmBlackBerry led to the regulatorwarning traders about the dangers of high-risk trading basedon social media sentiment alone.Despite this, the media attentionthese events attracted fuelledinterest further. Since then a hostof companies have come forward towarn their own customers of trading without sufficient information.“This is a risky approach to investing,” says Crookall of InvestEngine.“We’d urge people tempted by suchopportunities to consider their ownsituation and build diversified, longterm portfolios. Many people needmore guidance on risk, rather thanjust diving headlong into what canbe very choppy waters.”

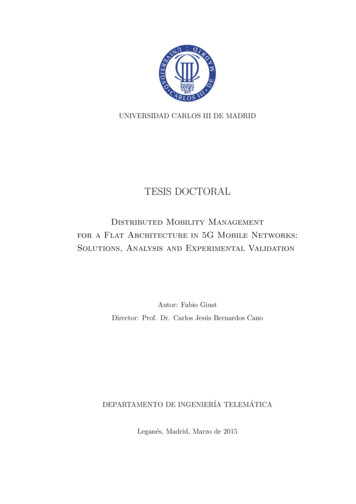

04T R A DING S T R AT EG IESRACONTEUR.NET05CazooCommercial featureIPOSJoining theSPAC boomThe UK is considering reforming the rulesregarding blank-cheque companies, whichcould entice fast-growth tech firms to listin London. But there are risks for investorsRich McEachranHow technology is makingtrading accessible to allAdvances in technology mean retail traders now have more choiceto trade financial products, but the most successful platforms willbe those that put the protection of their customers firstince the start of the coronavirus pandemic there hasbeen an unprecedentedboom in retail trading. What was oncea closed shop for anyone other thanprofessional traders is now accessibleto anyone with an internet connection.As lockdowns have left people withextra cash in their pockets, some havebeen turning to trading platforms totry their luck in the financial markets.The publicity around GameStop at thestart of the year has only increasedinterest in retail trading, with manynewcomers seeking to move beyondstocks and trade other products suchas contracts for difference (CFDs),derivative contracts that allow peopleto make short-term trades that hingeon the performance of a wide range ofunderlying assets.“In general, whenever finance is inthe news and whenever markets arevolatile, there is always more interestfrom new retail customers to trade,”says David Zruia, chief executive oftrading platform Plus500, which specialises in CFDs. “During the past yearwe’ve seen record numbers of customers trading everything which ispopular at the time. At the beginningof the pandemic when the oil pricedropped we saw more trading volumeson CFDs for oil and then later on we’veSseen a shift towards other CFD instruments, like shares.”This explosion in retail trading hasbeen unleashed because of technology. Retail customers can now simplypick up their smartphones and maketrades in a matter of seconds. In 2020,for example, Plus500’s trading platform saw its customer base increaseby 117 per cent to 434,000 activeusers, with more than 74 per cent ofall customer trades taking place onmobiles or tablets.“Over the last few years, but especially over the last 12 months, we haveseen that trading has become moreaccessible for retail customers,” saysZruia. “We’ve seen this with a numberof US-based operators and Plus500in Europe, which offer accessibilityfrom anywhere. And as the technology improves, it not only becomeseven more accessible, it also becomesfaster and easier to trade, so we andothertechnology-basedproviders can offer a better product to thepotential audience.”This backdrop has seen a rapidgrowth in the variety of retail tradingplatforms offering everything fromshare dealing to futures trading. Theseplatforms often make it easier for retailtraders to open accounts, for instanceby allowing customers to place smallerdeposits. Some platforms, such asPlus500, also enable traders to leverage their positions to potentiallyamplify returns, entailing higher risk,while also offering negative balanceprotection so customers can’t losemore than their initial deposit.“We have offered negative balanceprotection since our inception in2008, long before it became a regulatory requirement,” says Zruia. “Riskmanagement is very important to us;we do everything we can to protectand support our customers.”For instance, as part of that riskmanagement process, Plus500 didn’tallow its customers to take out CFDson GameStop stock from June 2020,which helped to protect them fromWe continue to enhanceand adopt new technologiesto improve our platform’susability for customersthe extreme moves in GameStop’sshare price in early-2021. In addition,Plus500 has introduced a number ofeducational tools on its platform tohelp customers understand the risksassociated with trading.For Zruia, advances in technologywill continue to democratise access tofinancial trading by reducing the barriers that have traditionally preventedwider adoption, such as high tradingcosts and fees.“We continue to enhance and adoptnew technologies to improve our platform’s usability for customers,” he says.“All the main elements of the platformwere developed by us so we’re not usingany third-party or licensed products,which improves the stability of the platform and reduces technical issues. Italso means we don’t have to pay fees tothird parties, so we can keep optimising the platform while at the same timereducing costs for our customers.”Innovation is not just about technology, but also bringing new tradingopportunities to customers. Plus500,for example, was not only the firstamong its competitors to offer anative mobile app for CFD trading, itwas also the first to offer bitcoin CFDs,says Zruia.As the fallout around GameStophighlighted, regulatory scrutiny onretail trading platforms is only goingto increase. Zruia says this is why itis doubly important to always treatyour customers fairly. Many of thenew regulations introduced in 2018 bythe European Securities and MarketsAuthority on trading CFDs, such asnegative balance protection and limitson the amount of leverage offered tocustomers, had already been adoptedby the platform much earlier.“The general purpose of regulation isto protect customers as much as possible, so we’re very supportive of this,”says Zruia. “Providers that are fairand honest with customers becomestronger and will continue to grow,and those that don’t play by the ruleswon’t last. Furthermore, this alignswith our objective to build a strongbond of trust with our customers.We’ve managed to do this primarilyby delivering a consistent level of service for our customers over the last12 months. And we remain highly cognisant of customer feedback to helpinform improvements in our product.”Developingproprietarytechnology also means companies likePlus500 are quickly able to ensuretheir trading platforms are compliant with new regulations.“We welcome new legislation; it isgood for our customers and good forour business. With any new legislation that is introduced, we are able toamend our system accordingly,” saysZruia. “This means we can adjust thetechnology and make changes veryfast to adhere to the new regulationswith as little impact on the customeras possible.”With the boom in retail tradingshowing no signs of slowing down,Zruia is now eyeing other opportunities for Plus500 beyond CFD trading.“We know that our customers whotrade CFDs with us trade other products on other platforms, so our plan isto become a one-stop shop and offerour customers a wider variety of products,” he says. “We’re currently workingon developing a separate share dealingplatform, which is going to be introduced very soon to the market acrossEurope, as well as in the UK. Besidesthis, we are looking at other trading andfinancial products as we aim to deliveron our vision of becoming a broader,multi-asset fintech group.”For more information please visitwww.plus500.comhen online used car dealerCazoo, the fastest UK firmto achieve unicorn status,announced it would be going public on the New York Stock Exchangevia a 7 billion merger with a special purpose acquisition company(SPAC), the news was considered ablow to the City of London.Cazoo isn’t the first UK companyto snub London in favour of NewYork. Electric vehicle firm Arrivalannounced it was going public via aSPAC last year and made its Nasdaqdebut on March 25. Meanwhile,diagnostictestmanufacturerLumiraDx is also set to float on theNasdaq in a 5 billion SPAC deal.The acronym SPAC has becomesynonymous with a frothy market. Essentially, SPACs are a typeof investment vehicle, blankcheque companies that list on stockexchanges and then hunt for privately owned businesses to take public. For the targets being acquired, itis an easier process than going downthe usual flotation route.There were 248 SPAC IPOs inAmerica in 2020, raising a collective 83.4 billion. So far in 2021, therehave already been 308 SPAC IPOs,which have raised 99.9 billion.Such is the froth surrounding SPACs, the US Securities andExchange Commission (SEC) isexploring options to crack downon the trend. Recent market jitters have seen some of the shinewear off and SPACs are no longerdelivering as high returns on dealannouncements as they were at thestart of the year.In stark contrast, SPACs have yet totake off in the UK. The main reasonfor this is because of their structure.“SPACs are structured differently inthe United States compared to the UK.With New York-listed SPACs, investors can redeem their shares if they’reunhappy with the target firm. That’scurrently not the case in London,where trading gets suspended onceWa merger is announced,” explainsNasser Khodri, head of capital markets at FIS.This investor lock-up means theappeal of doing a SPAC deal in Londonis not as attractive as it could be.The majority of companies thatchoose to go down the SPAC routeoperate in industries where they“need to move quickly to capitaliseon market opportunities”, according to James Allum, vice president and regional European headat Payoneer. The global paymentsprovider is set to merge with a SPAClisted on the Nasdaq, chaired bybanking entrepreneur Betsy Cohen,in a 3.3 billion deal.Allum explains that, unlikethe traditional flotation process,which only allows a company toshare data on historical performance, going public via a SPACenables the company to sharefuture revenue projections.To this end, SPACs can offer investors “an opportunity to share in thebenefits of accelerated growth”, hesays. But if trading gets suspendedonce a target has been announced,then it can weaken interest in thecompany being acquired as potential investors are temporarily prevented from buying shares.Despite concerns that the SPACmarket in America is showing thehallmarks of a bubble, Londonis actively looking at how it canrelax its rules regarding blankcheque companies. In March, LordHill published a report on the current rules, in which he describedthe lock-in as “a key deterrent forpotential investors''.According to the report, there is“a real danger the perception thatthe UK is not a viable location tolist a SPAC” could lead UK-basedfast-growing tech companies tolist on markets in the United Statesand European Union.Lord Hill urged the FinancialConduct Authority (FCA) to conduct areview into the rules to make listing inLondon more appealing. A final decision on any rule change is likely to bemade towards the end of the year.So what might any changes looklike? In layman’s terms, Khodri sayswe could expect to see the FCA provide US-style protections, whichmeans those investors unhappy witha target company can sell their position upon a merger announcement.“This is an improvement but,at the same time, doesn’t protectCazoo is one of anumber of UK firmsthat opted to gopublic in New Yorkvia a SPACIt’s unlikely that London cancatch up with Wall Street, butthere’s definitely a place for theUK in the long-term developmentof this marketretail investors from downsiderisk,” he adds, referring to the dropin a holding’s value that can happen between investing in a SPACpre-announcement and sellingpost-announcement.The risk associated with SPACs hasbeen prescient in recent months.Like so-called “meme” stocks – thinkGameStop – US SPACs have becomepopular with risk-hungry retailinvestors hoping for high returns onmerger announcements. They mayoften invest without doing theirdue diligence and reading a SPAC’sIPO prospectus available via theSEC’s website.Although investing in SPACs canbe risky, the benefits of relaxingLondon’s rules could outweigh anyconcerns. For one, it could helpattract tech unicorns that mightotherwise be lured elsewhere. Itcould also attract more impressiveSPAC boards of directors and serialSPAC sponsors who have experiencein the United States targeting bigname companies.EUROPE L AGS BEHIND THE US FOR SPAC IPOSBruce Garrow, co-head of corporate broking at Investec, believesthe "recommendations will certainly encourage the right management teams with the rightcredentials to think seriouslyabout London”.Of course, experience and pastperformance in doing SPAC dealsis no guarantee of future success. And there will be criticsin the City who believe that anyrule shake-up would be badnews and London shouldn’t bejumping on the SPAC bandwagon. However, Khodri atFIS suggets that if the rulechanges go ahead, they’llhelp boost London’s postBrexit profile.“It’s unlikely that Londoncan catch up withWall Street, but there’sdefinitely a place forthe UK in the longterm developmentof this market,”he concludes.Refinitiv 2021Number of SPAC IPOs completedUSEurope201520162017201820192020

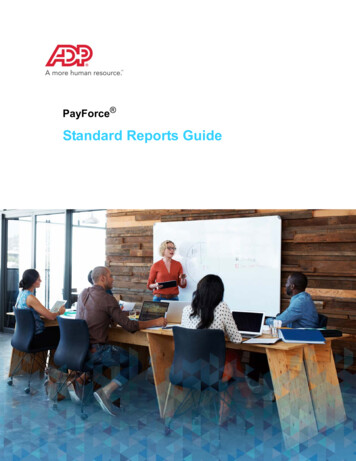

06T R A DING S T R AT EG IESRACONTEUR.NETS TR ATEGYActivist investors: danger or opportunity?Surface via UnsplashThe GameStoptrading frenzy hasshown the impactactivist investors canhave but while somebelieve this willdemocratise finance,others are warningof the dangersMarianne Curpheyhere has been a surgein day-trading frenzies,fuelled by the actions ofso-called activist investors who usesocial media platforms and onlineforums to band together and betagainst companies and hedge funds.GameStop became the focus of atrading frenzy at the beginning of thisyear, surging to a valuation of 34 billion after the co-ordinated actions ofamateur investors via online tradingdiscussion groups like r/wallstreetbets, found on Reddit. The collectiveactions, plotted on online forums, candrive up stocks that hedge funds havebet against, aiming to punish the bigplayers in the stock market.TAt the centre of this wasRobinhood, the trading app thatbecame the vehicle for amateurinvestors to take on Wall Street andteach hedge funds a lesson in theGameStop debacle. However, whenRobinhood suspended trading onGameStop, retail investors wereoutraged, claiming the move hadprotected the hedge funds and institutional investors.While some herald activism asdemocratising finance, others warnthat online threads are leadingyoung and inexperienced investorsto make wild and risky bets, andput vast amounts of personal capital at risk.While activist investing is nothingnew, the GameStop incident is verydifferent to normal behaviour. “Thisis normally about buying shares inunderperforming companies andthen using shareholder influence toeffect change such as removing theboard or management, altering thestrategy or restructuring the businessGAMESTOP’S SHARE PRICE SURGE IN 2021Yahoo 2021Share price in US ilto improve profitability and shareholder returns,” says Jason Hollands,managing director of Bestinvest, theonline investment service.“This new phenomenon of private shareholders piling into a stocklike GameStop is very different. Theobjective is primarily to give a blackeye to other investors by mispricingthe shares. This upends the wholepurpose of investing, which shouldbe to allocate capital with companies that will make good use of itand return profits.”With people having more free timeto trade in stocks, alternatives formsof entertainment closed and government cash handouts widely available, companies such as Robinhoodhave seen a substantial increase inusers, says Maxim Manturov, headof investment research at FreedomFinance Europe.In America, equities have alwaysbeen seen as the place to invest. Now,people who are out of work are lookingfor alternative ways to create cash.“In the United States, people arecoming back to equity marketsto boost incomes that have beenreduced through the response to thepandemic,” says Stuart Lane, chiefexecutive of Trade Nation.“This is being encouraged by therecord highs being hit on the majorindices, plus fear of missing out.Also, for many people, trading is anexpression of individualism and anopportunity to take risks at a timewhen many feel their freedoms arebeing curtailed in other ways.”Anna-Sophie Hartvigsen, founderand partner of Female Invest, saysthat while activist investors maycause large fluctuations in individual stocks, they are unlikely toimpact the overall market. The bestway to guard against single-stockfluctuations is to diversify risk andinvest across different stocks andasset classes.“In many ways, the risk of activist investors is no different than anyother type of risk and therefore thesolution is the same,” she highlights.The frenzy over app-trading risksluring inexperienced investors intooverpriced and underachieving companies, says Hollands. It gives theimpression that “playing the stockmarket” is a get-rich-quick game builton short-term share price movements.“In reality, true investing is aboutbuying great companies for thelong term and not short-term speculating,” he says.Regulation has not yet stepped inbecause it will always lag behindinnovation, say Fiorenzo Manganielloand Nessim-Sariel Gaon, co-foundersof the LIAN Group.“Platforms like Reddit’s wallstreetbets provided the possibilityof rapidly sharing material information and an environment wherethe ‘little guys’ can join forcesagainst the institutional investors, squeezing out their shortpositions on companies like GME,AMC and BlackBerry,” according toManganiello and Gaon.“While this has all been great funfor some of the market participants,there is considerable risk and lossesborne by the investors who joined the‘hype train’ late and endured considerable losses in the process. Many ofthem could trade with leverage, getting exposed to additional risk.”Indeed, “meme stock” stories, likethe GameStop saga, merely act asexamples of how easily inexperiencedinvestors can be pulled into making potentially damaging financialdecisions, says Edgar de Picciotto,co-founder at ikigai, a premium banking and wealth management fintech.Ben Hobson, markets editor atStockopedia, says hedge fundsand deep-pocketed investors havealways taken big stakes in troubledcompanies so they can influenceboard-level decisions.He says the risk isn’t so muchabout activism but more to do withthe age-old stock market problem ofThis phenomenon ofprivate shareholderspiling into a stockupends the purposeof investing 25.10BlackBerry's share price hit anine-year high in January 2021 afterinvestors on Reddit began investingin the companyYahoo 2021investors herding together to createbubble-like conditions.“Soaring price momentum instocks, where the only appeal is avocal community of investors buyinginto them, is hugely risky. Without agood quality business or attractivevaluation, things can get very volatilevery quickly,” says Hobson.Seth Ward, co-founder and chiefexecutive at Pynk, says investors, particularly large ones, have never beforehad to answer for their actions.“It’s almost impossible to hidewhat you do today. And the consequences of business decisions havenever been more apparent,” he says.His advice is to keep applyingstandard, best practice, long-terminvestment strategies. For example,diversification will give good protection against one or two shares moving out of sync with the fundamentals for a period of time.Also, keeping an eye on investment subreddits might help in moreways than one; it’s an importantpart of the market and might offersome fresh perspective, which israrely a bad idea. “Don’t over leverage; don’t invest more than you canafford to lose,” says Ward.Social media chat rooms are beginning to resemble the squawk boxeson fast-paced trading floors, saysMichael Kamerman, chief executiveof online trading venue Skilling.“What started out as a combinationof vast numbers of remote workerslooking to take up trading with moretime on their hands, coupled withgreater volatility in financial marketsand the rise of digital brokerages, hasevolved into a retail trader mindsetrevolution,” he says.Yet, if anything, prices moving toextremes in both directions createsa more fertile environment for fundamental active management, saysKasim Zafar, chief investment strategist at EQ Investors.“The biggest lesson from this sort ofthing is that investing is a serious business. It requires skill, care and due diligence. If any of these are lacking, oneruns the risk of being a ‘punter’ ratherthan an investor,” he says.Samuel Leach, chief executive ofSamuel & Co Trading, says marketsare efficient and, if people find a wayto ‘beat the system’, this tends toonly last for a short time before themarket adapts and removes sucharbitrage opportunity.“This puts more risk on the retailinvestors who are putting their lifesavings into these stocks in thehope that the rally will continue,”he says. “With investing, it is a zerosum game, therefore for you to win,someone else must lose.”07

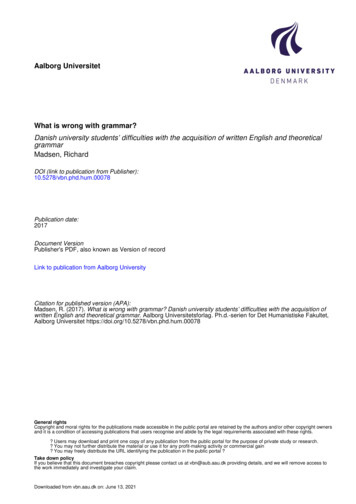

08T R A DING S T R AT EG IESRACONTEUR.NET09Commercial featureTHE PRICE OF SOME COMMODITIES IS ON THE RISEWorldBank 2021Price in US dollars9k8k7k6kCopper per metric ton5kPlatinum per troy ounceIron ore per dry metric ton4k3k2k1kJaiFotomania via Shutterstock0COMMODITIESAre commoditieson the cusp of anew supercycle?A recent surge in commodity prices has led somebanks to declare the start of a new ‘supercycle’but there are questions over whether theconditions are there for multi-year growthFiona Bondollowing the devastatingimpact of the coronavirus pandemic on financial markets around the world, therecent surge in commodity pricesappears to suggest growing investorconfidence for the future.Oil prices have jumped

commodities editor at Interactive Investor. Jonathan Weinberg Journalist, writer and media consultant specialising in technology, business, social impact, and the future of work and society. Rose Stokes Journalist specialising in women’s rights, health and human interest features. Her w