Transcription

ANALYZING BANK PERFORMANCE

5-2Key Topics An Overview of the Balance Sheets and IncomeStatements of Banks The Balance Sheet or Report of Condition Asset Items Liability Items Components of the Income Statement: Revenuesand Expenses Stock Values and Profitability Ratios Measuring Credit, Liquidity, and Other Risks The UBPR and Comparing PerformanceMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-3Bank Financial Statements Report of Condition – Balance Sheet Report of Income – Income StatementMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

Key Items on Bank Financial StatementsMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-5Report of Condition The Balance Sheet of a Bank Showing itsAssets, Liabilities and Net Worth at a givenpoint in time May be viewed as a list of financial inputs(sources of funds) and outputs (uses offunds)McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

Report of Condition (Balance Sheet) for BB&T (Year-End2008 and 2009)McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-7C S L MA D NDB ECC Cash AssetsS Security HoldingsL LoansMA Miscellaneous AssetsMcGraw-Hill/IrwinBank Management and Financial Services, 7/eD DepositsNDB NondepositBorrowingsEC Equity Capital 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-8Cash Assets Account is Called Cash and Deposits Duefrom Bank Includes: Vault Cash Deposits with Other Banks (CorrespondentDeposits) Cash Items in Process of Collection Reserve Account with the Federal Reserve Sometimes Called Primary ReservesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-9Securities: The Liquid Portion Often Called Secondary Reserves Include: Short Term Government Securities Privately Issued Money Market Securities Interest Bearing Time Deposits Commercial PaperMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-10Investment Securities These are the Income Generating Portion ofSecurities Taxable Securities U.S. Government Notes Government Agency Securities Corporate Bonds Tax-Exempt Securities Municipal BondsMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-11Trading Account Assets Securities purchased to Provide Short-TermProfits from Short-Term Price Movements When the Bank Acts as a Securities Dealer Valued at Market – FASB 115McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-12Federal Funds Sold and ReverseRepurchase Agreements A Type of Loan Account Generally Overnight Loans Federal Funds Sold - Funds Come from theDeposits at the Federal Reserve Reverse Repurchase Agreements – BankTakes Temporary Title to Securities Ownedby BorrowerMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-13Loan Accounts The Major Asset Gross Loans – Sum of All Loans Allowance for Possible Loan Losses Contra Asset Account For Potential Future Loan Losses Net Loans Unearned Discount Income Nonperforming LoansMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-14Types of Loans Commercial and Industrial LoansConsumer Loans (Loans to Individuals)Real Estate LoansFinancial Institution LoansForeign LoansAgriculture Production LoansSecurity LoansLeasesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-15Allowance for Loan LossesBeginning ALL Provision for Loan Loss (Income Statement) Adjusted Allowance for Loan Losses- Actual Charge-Offs Recoveries from Previous Charge-Offs Ending Allowance for Loan LossesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-16Specific and General Reserves Specific Reserves Set Aside to Cover a Particular Loan Designate a Portion of ALL or Add More Reserves to ALL General Reserves Remaining ALL Determined by Management But Influencedby Taxes and Government Regulation Loans to Lesser Developed CountriesRequire Allocated Transfer ReservesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-17Miscellaneous Assets Bank Premises and Fixed Assets Other Real Estate Owned (OREO) Goodwill and Other IntangiblesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-18Deposit Accounts Non interest-Bearing Demand DepositsSavings DepositsNow AccountsMoney Market Deposit Accounts (MMDA)Time DepositsMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-19Nondeposit Borrowings Fed Funds Purchased Securities Sold Under Agreement toRepurchase (Repurchase Agreements) Acceptances Outstanding Eurocurrency Borrowings Subordinated Debt Limited Life Preferred Stock Other LiabilitiesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-20Equity Capital Preferred Stock Common Stock Common Stock OutstandingCapital SurplusRetained Earnings (Undivided Profits)Treasury StockContingency ReserveMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

The Composition of Bank Balance Sheets (Percentage Mix ofSources and Uses of Funds for (Year-End 2009)McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-22Off-Balance-Sheet Items Unused Commitments Standby Credit Agreements Derivative Contracts Futures Contracts Options Swaps OBS Transactions Exposure a Firm toCounterparty RisksMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

Examples of Off-Balance-Sheet Items Reported by FDICInsured BanksMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-24Possible Issues The Problem with Book-Value Accounting Original (historical, book-value) costAmortized costMarket-valueHeld-to-maturity and available-for-salesecurities Window Dressing Auditing Financial Statements Audit Committees Sarbanes-Oxley Accounting Standards ActMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-25Report of Income The Statement of Revenues, Expenses and Profitsfor a Bank Over a Period of Time Shows how much it has cost to acquire funds andto generate revenues from the uses of funds inReport of Conditions Shows the revenues (cash flow) generated byselling services to the public Shows net earnings after all costs are deductedfrom the sum of all revenuesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-26Income StatementNet Interest Income- Provision for Loan LossNet Income After PLL /- Net Noninterest IncomeNet Income Before TaxesTaxesNet Income- DividendsUndivided ProfitsMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

Report of Income (Income Statement) for BB&T (2008 and2009)McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-28Net Interest Income Interest Income – Interest ExpensesInterest Income Interest and Fees on Loans Taxable Securities Revenue Tax-Exempt SecuritiesRevenue Other Interest IncomeMcGraw-Hill/IrwinBank Management and Financial Services, 7/eInterest Expenses Deposit Interest Costs Interest on Short-TermDebt Interest on Long-Term Debt 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-29Net Noninterest Income Noninterest Income – Noninterest ExpensesNoninterest IncomeNoninterest Expenses Fees Earned from FiduciaryActivities Service Charges on DepositAccounts Trading Account Gains andFees Additional NoninterestIncome Wages, Salaries, andEmployee Benefits Premises and EquipmentExpense Other Operating ExpensesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-30Fees Earned from Fiduciary Activities Fees for Managing Protecting a Customer’sProperty Fees for Record Keeping for CorporateSecurity Transactions and DispensingInterest and Dividend Payments Fees for Managing Corporate and IndividualPension and Retirement PlansMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-31Service Charges on Deposit Accounts Checking Account Maintenance FeesChecking Account Overdraft FeesFees for Writing Excessive ChecksSavings Account Overdraft FeesFess for Stopping Payment of ChecksMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-32Trading Account Gains and Fees Net Gains and Losses from Trading CashInstruments and Off Balance SheetDerivative Contracts That Have BeenRecognized During the Accounting PeriodMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

5-33Additional Noninterest Income Investment Banking, Advisory, Brokerageand Underwriting Venture Capital Revenue Net Servicing Fees Net Securitization Income Insurance Commission Fees and Income Net Gains (Losses) on Sales of Loans Net Gains (Losses) on ales of Real Estate Net Gains (Losses) on the Sales of OtherAssetsMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

The Composition of Bank Income Statements (Percentage ofTotal Assets Measured as of Year-End 2009)McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-35Key Profitability Ratios in BankingNet IncomeReturn on Equity Capital (ROE) Total Equity CapitalNet IncomeReturn on Assets (ROA) Total Assets(InterestincomeNet Interest Margin - Interestexpense) Net Interest Income Total AssetsTotal AssetsNoninterest revenue- PLLL- Noninterest expenses Net Noninterest IncomeNet Noninteres Companies, Inc., All RightsMcGraw-Hill/Irwin t Margin 2008 The McGraw-HillBank Management and Financial Services, 7/eReserved.Total AssetsTotal Assets

6-36Key Profitability Ratios in Banking (cont.)Total Operating Revenues Total Operating ExpensesNet Bank Operating Margin Total AssetsNet IncomeAfter TaxesEarnings Per Share (EPS) Common Equity Shares OutstandingTotal Interest Income Total Interest ExpenseEarnings Spread Total Earning AssetsTotal Interest Bearing LiabilityMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-37Breaking Down ROEROE Net Income/ Total Equity CapitalROA Net Income/Total AssetsxEquity Multiplier Total Assets/Equity CapitalAsset Utilization Net Profit Margin xNet Income/Total Operating Revenue Total Operating Revenue/Total AssetsMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-38ROE Depends On: Equity Multiplier Total assets/Total equity capital Leverage or Financing Policies: the choice ofsources of funds (debt or equity) Net Profit Margin Net income/Total operatingrevenue Effectiveness of Expense Management (costcontrol) Asset Utilization Total operating revenue/Totalassets Portfolio Management Policies (the mix and yieldon assets)McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

Components of Return on Equity (ROE) for All FDICInsured Institutions (1992-2009)McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-40Breakdown of ROAMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

Bank Performance ModelReturns toShareholdersROE NI / TEInterestRateComposition (mix)VolumeINCOMEFees and Serv ChargeNon InterestTrustOtherReturn to the BankROA NI / TARateInterestComposition (mix)VolumeEXPENSESOverheadSalaries and BenefitsOccupancyDegree of LeverageEM 1 / (TE / TA)McGraw-Hill/IrwinBank Management and Financial Services, 7/eProv. for LLOther 2008 The McGraw-Hill Companies, Inc., All RightsReserved.Taxes

6-42Other Goals in BankingTotal Operating ExpensesOperating Efficiency Ratio Total Operating RevenuesNet Operating IncomeEmployee Productivity Ratio Number of Full Time-Equivalent EmployeesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-43Bank Risks Credit Risk Liquidity Risk Market Risk Interest Rate Risk Operational RiskMcGraw-Hill/IrwinBank Management and Financial Services, 7/e Legal andCompliance Risk Reputation Risk Strategic Risk Capital Risk 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-44Credit RiskThe Probability that Some of the Financial Firm’sAssets Will Decline in Value and Perhaps BecomeWorthlessCredit Risk Measures Nonperforming Loans/Total LoansNet Charge-Offs/Total LoansProvision for Loan Losses/Total LoansProvision for Loan Losses/Equity CapitalAllowance for Loan Losses/Total LoansAllowance for Loan Losses/Equity CapitalNonperforming Loans/Equity CapitalMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-45Liquidity RiskProbability the Financial Firm Will Not HaveSufficient Cash and Borrowing Capacity to MeetDeposit Withdrawals and Other Cash NeedsLiquidity Risk Measures Purchased Funds/Total AssetsNet Loans/Total AssetsCash and Due from Banks/Total AssetsCash and Government Securities/Total AssetsMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-46Market Risk: Comprises Price Riskand Interest Rate RiskProbability of the Market Value of the FinancialFirm’s Investment Portfolio Declining in Value Dueto a Change in Interest RatesMarket Risk Measures Book-Value of Assets/ Market Value of AssetsBook-Value of Equity/ Market Value of EquityBook-Value of Bonds/Market Value of BondsMarket Value of Preferred Stock and Common StockMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-47Interest Rate RiskThe Danger that Shifting Interest Rates MayAdversely Affect a Bank’s Net Income, the Value ofits Assets or EquityInterest Rate Risk Measures Interest Sensitive Assets/Interest SensitiveLiabilitiesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-48Capital RiskProbability of the Value of the Bank’s AssetsDeclining Below the Level of its Total Liabilities.The Probability of the Bank’s Long Run SurvivalCapital Risk Measures Stock Price/Earnings Per ShareEquity Capital/Total AssetsPurchased Funds/Total LiabilitiesEquity Capital/Risk AssetsMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-49Off-Balance-Sheet RiskThe Volatility in Income and Market Value of BankEquity that May Arise from Unanticipated Lossesdue to OBS Activities (activities that do not have abalance sheet reporting impact until a transactionis affected)Operational RiskUncertainty Regarding a Financial Firm’s EarningsDue to Failures in Computer Systems, Errors,Misconduct by Employees, Floods, LighteningStrikes and Similar Events or Risk of Loss Due toUnexpected Operating ExpensesMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

6-50Legal and Compliance RiskRisk of Earnings Resulting from Actions Taken bythe Legal System. This can Include UnenforceableContracts, Lawsuits or Adverse Judgments.Compliance Risk Includes Violations of Rules andRegulationsReputation RiskThis is Risk Due to Negative Publicity that canDissuade Customers from Using the Services of theFinancial Firm. It is the Risk Associated with PublicOpinion.McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

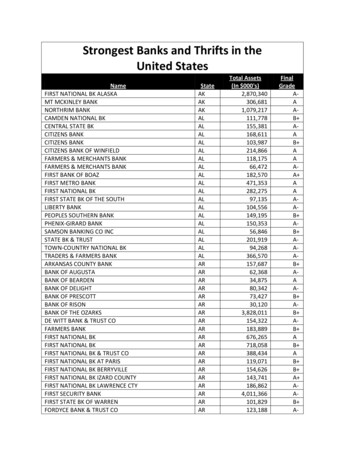

6-51Performance Indicators Related tothe Size of a Firm, 2007McGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

Appendix: Using Financial Ratios and Other AnalyticalTools to Track Financial-Firm Performance – The UBPRand BHCPR Compared to other financial institutions, more information isavailable about banks than any other type of financial firm Through the cooperative effort of four federal banking agencies –the Federal Reserve System, the Federal Deposit InsuranceCorporation, the Office of Thrift Supervision, and the Office of theComptroller of the Currency – the Uniform Bank PerformanceReport (UBPR) and the Bank Holding Company PerformanceReport (BHCPR) provide key information for financial analysts The UBPR, which is sent quarterly to all federally supervisedbanks, reports each bank’s assets, liabilities, capital, revenues, andexpenses, and the BHCPR is similar for BHCs Web link for UBPR and BHCPR: www.ffiec.govMcGraw-Hill/IrwinBank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All RightsReserved.

McGraw-Hill/Irwin Bank Management and Financial Services, 7/e 2008 The McGraw-Hill Companies, Inc., All Rights Reserved