Transcription

8 February 2014FM 2014/133Greenland’s oil and mineral strategy 2014-2018AppendicesGovernment ofGreenlandFM 2014/133IASN-2013-093824February 2014

Contents:Appendix 1: Detailed description of Greenland's oil and gas strategy 2014-2018Appendix 2: Oil and gas taxation model (government take)Appendix 3: Detailed description of Greenland's mineral strategy 2014-2018Appendix 4: Mineral taxation model (government take)2

DETAILED CONTENTSAPPENDIX 1 OIL/GAS STRATEGY FOR 2014-2018. 81.1Knowledge – status and assessment of the current strategy . 81.2New licence strategy objectives . 101.2.1 Future licence policy . 131.2.2.1 Onshore Disco & Nuussuaq Peninsula . 141.2.2.2 Baffin Bay . 151.2.2.3 Davis Strait – Nuuk West – 63 -67 N . 161.2.2.4 Open door area South-West Greenland . 171.2.2.5 Open door area onshore Jameson Land . 181.2.2.6 Licence strategy 2014-2018. 181.3Environmental conditions in the proposed areas . 191.3.1 Baffin Bay . 191.3.2 Offshore areas in the Davis Strait west of Nuuk . 201.3.3 Onshore area of Jameson Land . 221.3.4 Onshore area of the Nuussuaq Peninsula . 231.3.5 Areas offshore South Greenland and South-West Greenland . 231.4Physical conditions in the proposed areas . 251.4.1 Baffin Bay . 271.4.2 Davis Strait . 281.4.3 South-West Greenland . 281.4.4 Jameson Land . 281.4.5 Nuussuaq Peninsula. 291.5Emergency response . 291.5.1 Oil spill response. 291.6Licence terms for the licensing round and the open door procedure . 311.7Licensing terms and conditions . 321.7.1 Prequalification of operators . 321.7.2 Special licence terms and licensing terms and conditions for onshore areas . 331.8Regulatory processing of licences and data . 341.9Marketing of the oil/gas potential . 351.10Oil/gas scenarios . 35APPENDIX 2 OIL AND GAS TAXATION MODEL (GOVERNMENT TAKE) . 373

2.1Benchmark analysis of oil and gas tax models (government take) . 372.1.1 Base case of exploitation of a field . 372.1.2 Tax rules. 372.2Comparison of effective tax and royalty rates etc. 382.3Government take levels of other countries . 392.3.1 Corporate tax . 392.3.2 Diversity over simplicity or vice versa . 402.3.3 Royalty – pros and cons . 402.3.4 Who has successfully increased taxes? . 402.3.5 State participation . 412.3.6 Export duty and withholding tax on dividend . 412.4Analysis of Greenland's government take model . 432.4.1 Corporate and withholding tax rates . 432.4.2 Royalty . 432.4.3 Other taxes . 432.4.4 Export taxes . 442.4.5 State participation . 442.4.6 Auctions . 442.4.7 Administration of control and collection of government take in Greenland . 452.5Alternative Greenland models for consideration . 452.5.1 Analysis of the different models . 472.5.2 Surplus royalty . 472.5.3 Effect of increased costs . 532.6Recommendation . 55APPENDIX 3 GREENLAND'S MINERAL STRATEGY 2014-18 . 583.1Knowledge – status and assessment . 583.2New focus areas . 603.2.1 Global perspective . 603.2.2 Iron alloy metals and base metals . 613.2.3 Critical minerals . 623.2.4 Gold . 643.2.5 Uranium . 643.3Special conditions for North Greenland north of 81 N . 653.4Small-scale licences . 663.5Marketing activities . 663.5.1 Scenarios for minerals . 673.6Licence policy and Greenland's minerals . 684

APPENDIX 4 MINERAL TAXATION MODEL (GOVERNMENT TAKE) . 714.1Benchmark analysis for mineral taxation models (government take) . 714.1.1 Base case of exploitation under an extraction licence . 714.1.2 Tax rules. 724.2Iron ore . 744.2.1 Base case of exploitation of iron ore . 744.2.2 Figure of government takes – iron ore . 744.2.3 Level of government takes – iron ore . 754.2.4 Corporate tax – iron ore . 754.2.5 Diversity over simplicity or vice versa – iron ore . 754.2.6 Royalty – pros and cons – iron ore . 764.2.7 Withholding tax on dividends and interest – iron ore . 764.2.8 Comparison of government takes – iron ore . 774.3Gold. 784.3.1 Base case of exploitation of gold . 784.3.2 Figure of government takes – gold . 784.3.3 Level of government takes – gold. 794.3.4 Corporate tax – gold . 794.3.5 Diversity over simplicity or vice versa – gold . 794.3.6 Royalty – pros and cons – gold . 794.3.7 Withholding tax on dividends and interest . 804.3.8 Comparison of government takes for gold . 804.4Copper . 814.4.1 Base case of exploitation of copper . 814.4.2 Figure of government takes for copper . 824.4.3 Level of government takes – copper . 824.4.4 Corporate tax – copper . 824.4.5 Diversity over simplicity or vice versa – copper . 824.4.6 Royalty – pros and cons – copper . 824.4.7 Withholding tax on dividends and interest – copper . 834.4.8 Comparison of government takes for copper . 834.5Rare earth elements . 844.5.1 Base case of exploitation of rare earth elements . 844.5.2 Figure of government takes – rare earth elements . 844.5.3 Level of government takes – rare earth elements . 854.5.4 Corporate tax – rare earth elements . 854.5.5 Diversity over simplicity or vice versa – rare earth elements. 854.5.6 Royalty – rare earth elements . 854.5.7 Withholding tax on dividends and interest – rare earth elements . 854.5.8 Comparison of government takes for rare earth elements . 864.6Gemstones. 874.6.1 Base case of exploitation of gemstones . 875

4.6.24.6.34.6.44.6.54.6.64.6.74.6.8Figure of government takes – gemstones . 87Level of government takes – gemstones . 88Corporate tax – gemstones . 88Diversity over simplicity or vice versa – gemstones . 88Royalty . 88Withholding tax on dividends and interest . 88Comparison of government takes for gemstones . 884.7Zinc . 894.7.1 Base case of exploitation of zinc. 894.7.2 Figure of government takes – zinc. 904.7.3 Level of government takes – zinc . 904.7.4 Corporate tax – zinc . 904.7.5 Diversity over simplicity or vice versa – zinc . 904.7.6 Royalty – pros and cons . 904.7.7 Withholding tax on dividends and interest . 904.7.8 Comparison of government takes for zinc . 914.8Uranium . 914.9Main observations and trends as well as changes under consideration . 914.9.1 Government take level . 914.9.2 Royalty . 924.9.3 Alternative Greenland models for consideration . 924.9.4 Iron ore, gold, copper and zinc . 924.9.5 Administration of control and collection of government take in Greenland . 934.10 Recommendations . 934.10.1Recommendations for future taxation of all metals and minerals, except for uranium, rare earthelements, copper, gold and gemstones . 934.10.2Recommendations for future taxation of gold and copper. 944.10.3Recommendations for future taxation of rare earth elements . 954.10.4Recommendations for future taxation of uranium . 954.10.5Recommendations for future taxation of gemstones. 956

Appendix 1Detailed description of Greenland's oil and gasstrategy 2014-2018Appendix 1 to proposal for Greenland's oil and mineral strategy 2014-20187

APPENDIX 1 Oil/gas strategy for 2014-20181.1 Knowledge – status and assessment of the current strategyA central element of the current strategy has been the preparation and launch of oil/gas licensingrounds. Licensing rounds have typically been carried out at intervals of about two years since2002 in theform of acombinationWhat is a licensing round?of licensingrounds andIn the dossier, the Government of Greenland describes the licence”open doorterms, the licence blocks available, the application date, the selectionprocedures”.criteria, etc.The regularlaunch ofAfter the application date, the applications are then evaluated at thelicensingsame time. If there are two or more applicants for the same licencerounds andblock, the applications will be evaluated on the selection criteria.open doorprocedureshas resultedin a number ofexclusivelicenceshaving being granted for oil/gas exploration and exploitation activities in Greenland. Below followsa brief summary:What is an open door procedure?In an open door procedure, theGovernment of Greenland designatesan open door area which will be openfor ongoing licensing. In the dossier,the Government describes the licenceterms, the open door areas available,the selection criteria, etc.Applications are considered in theorder received.The licensing rounds in 2002 and 2004resulted in the Canadian explorationcompany Encana being granted twoexploration and exploitation licences,referred to as the Lady Franklin andAtammik blocks offshore to the west ofNuuk. The licenses have subsequentlybeen assigned to Cairn Energy(Capricorn Greenland Exploration A/S).The licensing rounds in the DiscoNuussuaq region in 2006 and 2007resulted in some of the world's biggestoil companies being granted a total ofseven exploration and exploitationlicenses. The licence holders aredistributed over the following licences:Sigguk and Eqqua (Cairn Energy,Nunaoil), Puilasoq (DONG, ExxonMobil,Chevron, Nunaoil), Orsivik (ExxonMobil,Husky, Nunaoil), Kangerluk and Ikermiut(Husky, Nunaoil) and Naternaq (PAResources, Nunaoil).8

In 2008, Cairn Energy and Nunaoil were granted four exploration and exploitation licences in theopen door area off South-West Greenland, called Kingittoq, Saqqamiut, Sallit andUummannarsuaq (Cairn Energy, Nunaoil).In 2010, a licensing round was carried out in the Greenlandic part of Baffin Bay. The Bureau ofMinerals and Petroleum received 17 applications for exploration and exploitation licences andfollowing a thorough evaluation of the applications based on the selection criteria specified in thedossier a total of seven exclusive licences for oil and gas exploration and exploitation weregranted to the following oil companies: Qamut (ConocoPhillips, DONG, Nunaoil), Anu and Napu(Shell, Statoil, GDF SUEZ, Nunaoil), Pitu, Napariaq and Ingoraq (Cairn Energy, Nunaoil) and Tooq(Mærsk Oil, Nunaoil). Statoil and Tullow have subsequently become parties to the Pitu and Tooqlicences, respectively.In 2012 and 2013, a two-phase licensing round was carried out in the Greenland Sea in NorthEast Greenland. The licensing round consists of a pre-round and an ordinary round. It isanticipated that between five and seven new licences will be granted in this region. As a result, anextensive data collection effort will be conducted in this area in the next years.As in connection with earlier licensing rounds, a number of in-depth studies have been made priorto the launch of this licensing round, including a strategic environmental impact assessment of thearea, an assessment of its geological potential, a benchmark analysis of fiscal terms as well as icestudies. The preparatory work follows e.g. from the hydrocarbon strategy 2009.The strategic environmental impact assessment of the Greenland Sea has contributed, amongother things, to determining the areas to be made available for exploration activities – and theareas which will not be available to the industry. SEIAs are also used to determine the factors inthe environment and nature which the companies must take particular care to provide for in theirplanning and operations in the areas.From a geological perspective, the area is one of the most interesting areas in Greenland asregards its oil/gas potential. In a report from 2008, the USGS estimated that the area may hold31bn barrels of undiscovered oil/gas resources (middle estimate). This estimate is obviouslysubject to high uncertainty, and any finds which are made may turn out to deviate substantially.When the coming years’ prospecting programmes have been completed, it will most likely bepossible to say whether oil/gas occurs in commercially viable quantities and, if so, the size of suchquantities.The first phase of the licensing round in the waters off North-East Greenland (the pre-round) wasthe result of the preferential position of the so-called KANUMAS companies under the so-calledKANUMAS agreements (from 1989 and 2009). It is thus a requirement in the pre-round that theoperator in the group of applicants must be one of the KANUMAS companies (StatoilHydro, BP,ExxonMobil, ChevronTexaco, Shell, Japan Oil, Gas and Metals National Corporation) or asubsidiary of one of these companies.On the final application date, the Government of Greenland received eleven applications foroil/gas exploration and exploitation licences. The applications came from three different groups ofapplicants who competed for the most coveted licence blocks. The applications received wereevaluated on the basis of the selection criteria specified in the dossier. Based on an overallassessment, the Government of Greenland decided to grant four exclusive oil/gas exploration andexploitation licences. The licences were granted to the following oil companies: Statoil,ConocoPhillips and Nunaoil, Block 6 (”Avinngaq”), ENI, BP, DONG and NUNAOIL, Block 89

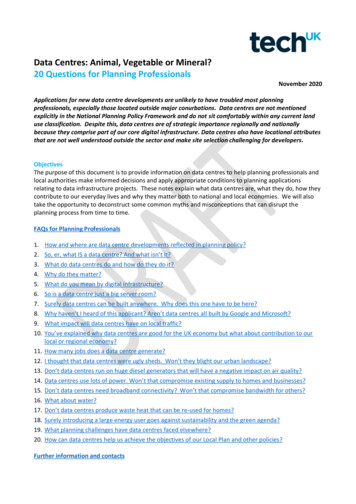

(”Amaroq”) and Chevron, GreenPex, Shell and NUNAOIL, Block 9 (”Umimmak”) and Block 14(”Nerleq”).On the final application date for the second round, the Government of Greenland had receivedthree applications for oil/gas exploration and exploitation licences and the applications came fromtwo different groups of applicants. The evaluation process was still in progress at the time ofdrafting of this strategy (at the end of December 2013).The Government of Greenland believes that the current licence strategy has resulted in asatisfactory number of licences. Thanks to the strategy, the interest of the foreign mineralresources companies in carrying out exploration activities in Greenland has successfully been builtup and maintained.Oil exploration activities are characterised by substantial investments and not least substantialexploration risks. A key element in the planning of an oil/gas licence strategy is thus to maintain acontinuously high level of exploration activity in different regions of Greenland.The reason for this is that it is impossible to predict in advance which region will first lead to thedesired breakthrough in the oil activities. It may thus be expected that not all existing licence areaswill lead to commercial finds.In step with the geological knowledge about the subsoil improving, it may thus be expected thatexploration activities in some licence areas will be intensified. At the same time, it must beexpected that other licence areas will be relinquished if the geological parameters are notconsidered promising enough when viewed against the expected cost level of initiating additionalexploration activities.One example of this natural development is Cairn Energy's exploratory drillings in 2010 and 2011.Based on the initial geophysical exploration results, the company found that the potential in someof the licence areas was so promising that the company wished to intensify the exploration bycarrying out exploratory drillings. A total of eight drillings were completed in 2010 and 2011. Thewells were drilled in different sedimentary basins offshore West Greenland and in several of theseCairn Energy found small quantities of oil and gas which were not big enough for commercialexploitation though. Cairn Energy's drillings in 2010 and 2011 ran into a total of around DKK 6bn.The map in Figure 1 provides a status of exclusive licences for exploration and exploitation ofoil/gas in Greenland currently granted.1.2 New licence strategy objectivesIn the Government of Greenland's opinion, the oil/gas licence strategy pursued so far hasdelivered on its objective of creating and sustaining industry interest in oil exploration inGreenland. The Government of Greenland’s objective is to carry on its efforts to attract investorsin oil exploration activities in Greenland. The Government of Greenland’s objective is to have oilexploration activities in different regions of Greenland. The current licence level is regarded assatisfactory. In order to maintain the current level of activity, it is necessary to make new licenceareas available at regular intervals in order to compensate for the licence blocks which will berelinquished over time.As described in the next section, the geological assessment is that the following areas will be ofparticular interest: Onshore areas of Disco and the Nuussuaq Peninsula10

Onshore area of Jameson LandAreas offshore South Greenland and South-West GreenlandOffshore areas in Baffin BayOffshore areas in the Davis Strait west of Nuuk11

Figure 1: Exclusive hydrocarbon exploration and exploitation licences, active as at 31 December 2013.12

1.2.1Future licence policyWithin the next five-year period, the goal is to conduct licensing rounds at intervals of approx. two orthree yea

8 February 2014 FM 2014/133 _ FM 2014/133 IASN-2013-093824 Greenland’s oil